Insurance.com Review for 2026 (Accurate Quote Tool?)

Comparing auto insurance quotes is simple with Insurance.com, which works with 85+ companies to deliver accurate and expert-reviewed rates. Insurance.com auto insurance reviews are mostly positive, and our Insurance.com rating is 4.6/5. Check out this Insurance.com review to see how users rate the platform.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated April 2025

This in-depth Insurance.com review breaks down how the site helps drivers compare auto insurance quotes and see rates from 85+ providers in one spot.

Insurance.com Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.6 |

| Customer Support | 4.5 |

| Discount Clarity | 4.4 |

| Ease of Use | 4.7 |

| Educational Resources | 4.6 |

| Provider Network | 4.5 |

| Quote Accuracy | 4.6 |

| Quote Speed | 4.7 |

| Savings Potential | 4.5 |

With a 4.6/5 platform score, Insurance.com stands out for its simple quote process and expert-reviewed content, but its lower Trustpilot and BBB ratings show room for improvement. It still offers an easy way to get an instant auto insurance quote comparison online, especially for drivers who want a quick snapshot of available rates.

By contrast, AutoInsurance.org helps users save up to 40%, delivers quotes in under two minutes, and offers 25% more coverage options per request. With $540 in average yearly savings and a 98% satisfaction score, it leads in speed, value, and coverage variety.

- The Insurance.com rating is 4.6/5

- Insurance.com pulls rates from more than 85 insurers

- Insurance.com reviews show a 2.9 Trustpilot score and a C- from the BBB

If you’re searching for a smarter way to shop for insurance, AutoInsurance.org gives you faster access to more trusted providers. Just enter your ZIP code to start comparing.

What Sets Insurance.com Apart

Since being acquired by QuinStreet, Inc., in 2010 for $35.6 million, Insurance.com has operated as a subsidiary focused on providing consumers with transparent insurance rate information and tools.

Insurance.com Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | Yes |

| Average Quote Time | 3-15 minutes |

| Insurance Types Compared | Auto, home, renters, life, health |

| Providers Compared | 50+ insurers, including major national providers |

| Shares Contact Info | Yes; information may be shared with partner agencies |

| Customer Support | Online resources and tools; limited direct support |

| Platform Focus | Insurance comparison and advice |

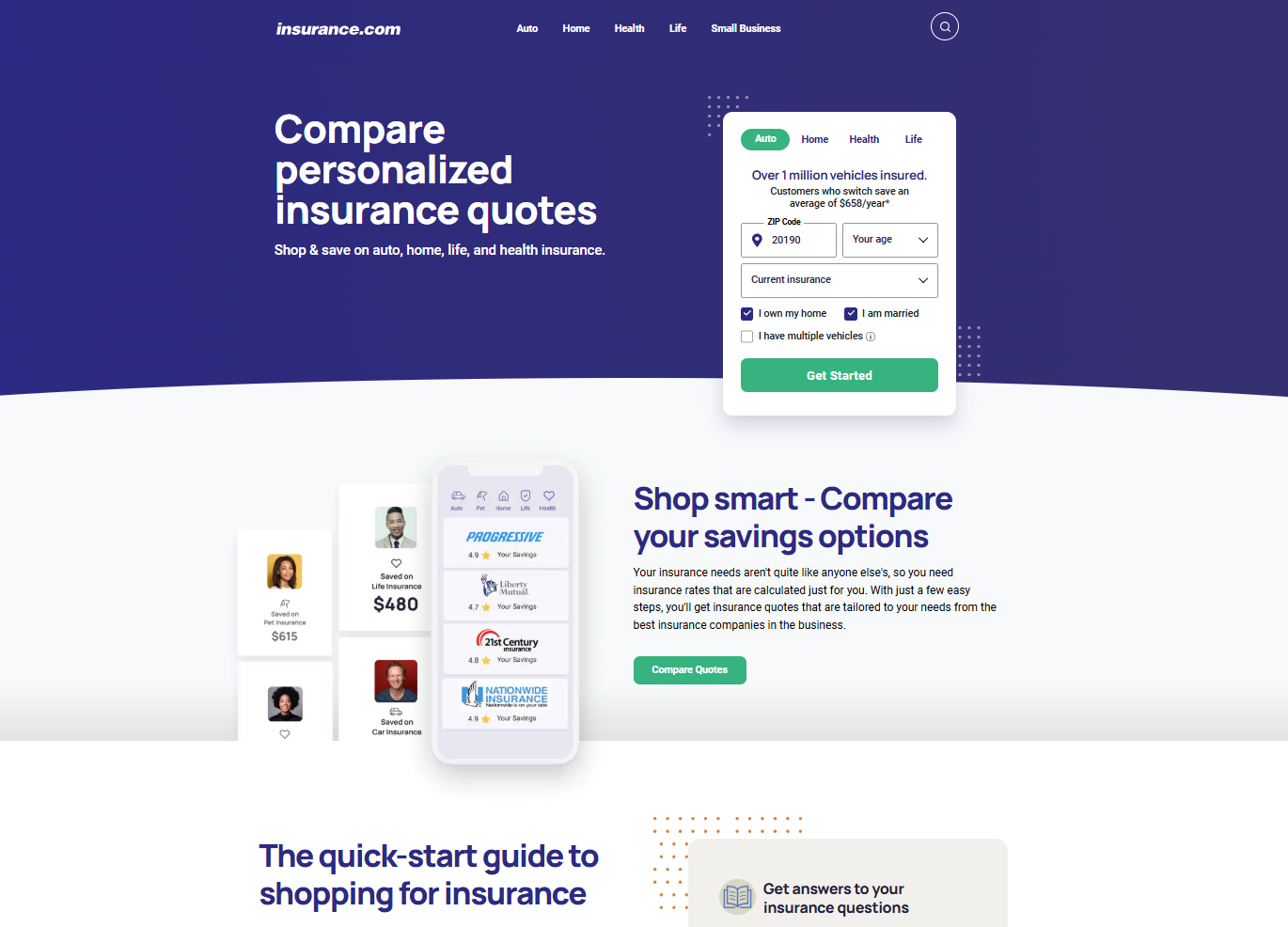

With over two decades in the space, it has built a reputation around data-backed guidance and practical resources. If you’re looking to compare personalized insurance quotes.

Insurance.com’s platform is built to make comparison shopping easy, especially for people who don’t want to deal with multiple calls or websites. It leverages advanced technology and partnerships to give users up-to-date pricing from trusted carriers.

It’s essential to keep in mind that Insurance.com is less an operator than a tool. It’s not processing claims or writing policies. It simply pulls quotes and steers you to the insurer that best meets your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

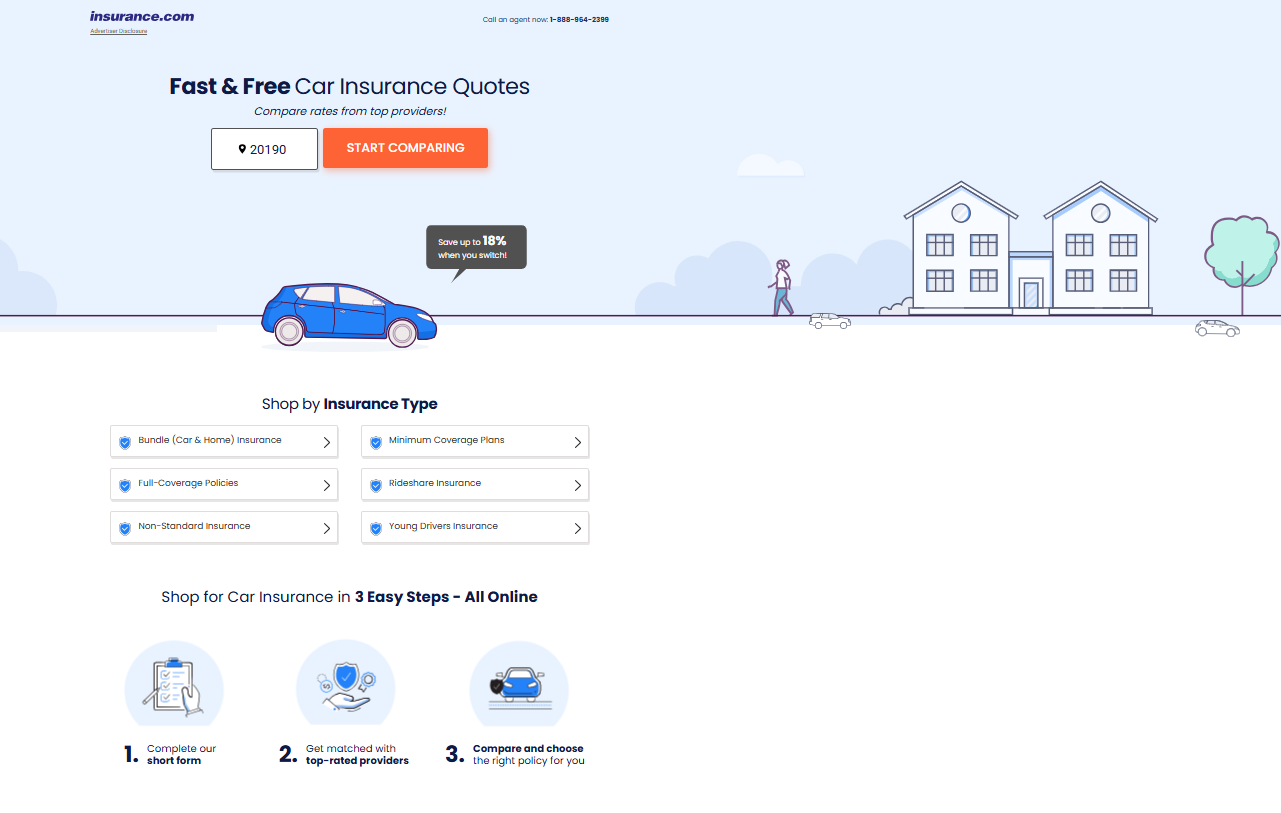

What You Need to Get Started With Insurance.com

Insurance.com isn’t a direct insurance provider. Instead, it serves as a comparison platform that helps you shop smarter by pulling quotes from the best auto insurance companies all in one place. Here’s exactly how Insurance.com’s quote tool works and what you’ll need to complete it.

It all starts with your ZIP code. Since auto insurance premiums vary by state, even down to your ZIP code, entering it makes sure you’re only shown options that actually fit your location. Once you enter your ZIP code and hit “Start Comparing,” you’ll go through a quick form that asks for the basics to get your quotes ready. Here’s what you’ll need to have on hand:

- Your full name, date of birth, and address

- Basic details about your car (year, make, model)

- How the vehicle is used (personal, business, commute, etc.)

- Your current insurance status

- Driving history, including any past accidents or tickets

The form takes just a few minutes to fill out, and you only need to do it once to access a wide range of options. After you’ve entered your info, Insurance.com pulls real-time quotes from multiple insurers. You’ll see different coverage options, monthly rates, and provider details — all organized side by side, so it’s easy to compare what each one offers.

Insurance.com helps you compare real quotes side by side, so you can quickly see which coverage fits your needs and budget without having to visit multiple sites.Kristen Gryglik Licensed Insurance Agent

Insurance.com doesn’t sell policies directly, but it makes it easier to find the right one. Its tools allow you to calculate and compare the rates for your coverage without pressure, and it doesn’t favor one insurer over another. When you find a rate and coverage that fit your needs, you can click through to choose an auto insurance policy and finalize your purchase directly with the insurer.

A Smarter Alternative to Insurance.com

If you’re looking for a faster, more efficient way to compare insurance quotes, AutoInsurance.org is a strong alternative to Insurance.com. It delivers quick results in under two minutes, helps users save an average of $540 per year on full coverage, and connects drivers with over 60 top-rated insurers. That’s more provider access than most platforms, including Insurance.com.

Users also see 40% more in potential savings and 25% more coverage options per request, backed by a 98% customer satisfaction rate. With this level of performance, AutoInsurance.org makes it easy to find the cheapest auto insurance companies without the hassle of jumping between multiple sites.

Compare Auto Insurance Tools Side by Side

When you stack Insurance.com against Insurify and NerdWallet, it holds its own in a few key areas but does fall short in others. It delivers solid average annual savings of $300 and an 88% customer satisfaction rate, which is respectable, but not quite as impressive as Insurify’s 94% satisfaction and $420 in savings. Insurance.com’s quote speed is decent at 3 minutes, but again, Insurify is faster at just 2 minutes.

Insurance.com vs. Insurify vs. NerdWallet: Compare Top Insurance Sites

| Feature | |||

|---|---|---|---|

| Savings Potential | 20% | 30% | 20% |

| Annual Savings | $300 | $420 | $300 |

| Fastest Quote Time | 3 minutes | 2 minutes | 5 minutes |

| Providers Compared | 50+ | 120+ | 700+ |

| Customer Satisfaction | 88% | 94% | 89% |

Where Insurance.com really lags is in provider access; it pulls quotes from over 50 companies, while NerdWallet connects users to more than 700. Still, if you’re trying to figure out where to compare auto insurance rates without getting inundated, Insurance.com is pretty no-nonsense. It’s quick, very easy to use, and does the job without any unnecessary frills.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance.com Customer Ratings & Third-Party Reviews

Insurance.com has a C- rating from the Better Business Bureau and a 2.9 out of 5 on Trustpilot, but that’s based on just two reviews. A C- rating the BBB isn’t ideal as it usually points to some customer service issues or unresolved complaints. As for the Trustpilot score, 2.9 isn’t the worst, but it’s not exactly a strong vote of confidence either, especially with so few reviews to go on.

Insurance.com vs. Insurify vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | |||

|---|---|---|---|

| NA | 3.4 / 5 141 reviews | 4.8 / 5 115k+ reviews |

|

| C- | A+ | A+ | |

| NA | 3.8 / 5 130+ reviews | NA | |

| NA | 3.4 / 5 141 reviews | 3.7 / 5 2k+ reviews |

|

| 2.9 / 5 2 reviews | 4.7 / 5 2,000+ reviews | 1.5 / 5 10+ reviews |

The low number of ratings does raise a flag since it could mean that users don’t typically interact directly with Insurance.com post-quote, or they just don’t think of reviewing a comparison platform the same way they would an actual insurer.

Still, if you’re the type of consumer who wants a flawless user experience from start to finish—or who relies heavily on reviews—these ratings are worth noting before you dive in, especially if you’re trying to figure out how to check if an auto insurance company is legitimate before sharing your information.

Insurance.com vs. Insurify

When comparing Insurance.com to Insurify, the biggest difference shows up in user experience and customer satisfaction. Insurify reviews clearly come out ahead in terms of mobile access and reviews. It’s available on both the App Store and Google Play with a 3.4/5 rating on each, while Insurance.com doesn’t offer an app at all.

Insurance.com vs. Insurify: Third-Party Customer Ratings

| Reviewer | ||

|---|---|---|

| X | 3.4 / 5.0 (141 reviews) | |

| C- | A+ | |

| X | 3.8 / 5.0 (130+ reviews) | |

| X | 3.4 / 5.0 (141 reviews) | |

| 2.9 / 5.0 (2 reviews) | 4.7 / 5.0 (2k+ reviews) | |

| X | 4.1 / 5.0 (70+ reviews) |

Insurify also earns strong marks with a 4.7/5 on Trustpilot (from over 2,000 users), 4.1/5 on WalletHub, and an A+ rating from the BBB. In contrast, Insurance.com has a 2.9/5 on Trustpilot from just two users and a C- with the BBB. Insurance.com still offers value with in-depth content, rate calculators, and side-by-side comparisons that can be useful if you want to dive into the details of a policy, not just find the lowest price.

Insurance.com vs. NerdWallet

When you stack Insurance.com against NerdWallet insurance reviews, the difference in user experience is pretty clear. NerdWallet has built a strong reputation for user satisfaction, including a 4.8 out of 5 on the App Store and 4.5 on Google Play, not to mention an A+ BBB rating and strong showings on PCMag and Trustpilot.

Insurance.com vs. NerdWallet: Third-Party Customer Ratings

| Reviewer | ||

|---|---|---|

| X | 4.8 / 5.0 (115k+ reviews) | |

| C- | A+ | |

| X | 4.5 / 5.0 (29.9k reviews) | |

| X | 4.0 / 5.0 | |

| 2.9 / 5.0 (2 reviews) | 3.7 / 5.0 (2k+ reviews) | |

| X | 1.5 / 5.0 (10+ reviews) |

Insurance.com, on the other hand, doesn’t have much of a presence on app stores and holds a C- with the BBB, along with a lower Trustpilot rating. If you’re looking for a more polished, highly-rated tool that users consistently trust for both ease and reliability, NerdWallet clearly leads the way.

Pros and Cons of Using Insurance.com

If you’re thinking about where to compare auto insurance rates, before using Insurance.com, it helps to know what you’re getting into before clicking around. Insurance.com is a long-standing comparison site that makes it easy to view rates from top insurers, offering a fast quote process and a few handy tools to help guide your decisions.

| Pros/Cons | |

|---|---|

| ✅ Pros | • Compares rates from top insurers. • Fast, easy quote process. • Offers useful insurance tools and guides. |

| ❌ Cons | • Redirects to partner sites for quotes. • Shares contact info with partners. • Limited customer service options. |

It’s also a good starting point if you’re learning how to evaluate auto insurance quotes, thanks to its side-by-side comparisons and helpful breakdowns. But while it has its perks, it’s not without trade-offs.

- Side-by-Side Quotes: The best things about Insurance.com are how easily it lays out rates from different companies in one spot. Enter your ZIP code, answer a few questions, and get a clean snapshot.

- Helpful Tools and Guides: Their coverage calculators, rate breakdowns, and educational content actually help you make informed decisions. It’s built for regular drivers, not insurance experts.

- Expert-Reviewed Content: Unlike some quote sites that just push sales, Insurance.com backs its info with licensed professionals. That means what you read is usually accurate and based on current data.

The platform has been around for over two decades, and while it offers some real conveniences, it’s not perfect. Here’s a quick, honest rundown of the not-so-good features:

- Can’t Finalize Your Policy: Although the site compares rates, you’ll have to navigate over to your insurance site to buy an actual policy. It’s an additional step that can seem a bit cumbersome.

- Mixed User Experiences: Some users report smooth comparisons, others say they didn’t get as many quotes as expected, or found the interface a bit dated; your results may vary.

AutoInsurance.org gives you free, no-email-required quotes—no strings attached. Think you’re already getting the lowest rate? Run a quick comparison and see if you can cut up to 40% off your current premium.

How Insurance.com Helps You Compare Auto Insurance Quickly

If you’re not sure how to evaluate auto insurance quotes, our Insurance.com auto insurance review found it’s a no-frills way to compare real-time auto insurance quotes from multiple providers in one place.

It doesn’t sell policies directly, and it isn’t as polished or highly rated as competitors like Insurify or NerdWallet, but it does the job when it comes to basic comparison shopping. If you prefer to do your own research and don’t mind a bare-bones interface without all the bells and whistles, it can help you narrow your choices.

AutoInsurance.org gives you quick, free quotes without requiring your email—no spam, no hassle. Already have a rate in mind? Use the tool to compare and see if you could save up to 40% more on coverage.

Frequently Asked Questions

Is Insurance.com legit for comparing quotes?

Yes, Insurance.com is a legitimate source for comparing insurance quotes. It partners with reputable national and regional insurers and uses secure tools to deliver side-by-side rate comparisons.

Is there a better alternative to Insurance.com for comparing quotes?

How do you explain an insurance company like Insurance.com?

Insurance.com is not an insurance carrier. It is a licensed insurance marketplace that allows users to compare online auto insurance companies with multiple quotes through affiliated providers.

What is an insurance company example that’s like Insurance.com?

A comparable example to Insurance.com is Insure.com, which also provides insurance comparison tools. Is Insure.com legit? Both are part of QuinStreet’s portfolio, and they don’t sell insurance directly but connect users to licensed insurers for auto, home, and other coverage types.

What is the benefit of using Insurance.com?

The biggest benefit is convenience and cost savings. Insurance.com lets you compare quotes from multiple insurers in one place, often in under five minutes. If you want to compare insurance rates right now, enter your ZIP code.

Which is the best company for insurance quotes on Insurance.com?

According to Insurance.com’s data, Erie Insurance is ranked as the top pick for auto insurance quotes, with a 4.7 out of 5 score in customer satisfaction, claims handling, and affordability. Learn more in our Erie auto insurance review.

Who owns the Insurance.com company?

Insurance.com is owned by QuinStreet, Inc., a publicly traded digital marketing company based in Foster City, California. QuinStreet also owns other consumer-focused insurance websites, including Insure.com and CarInsurance.com, and partners with dozens of top-tier insurance providers.

What is the main function of Insurance.com in insurance shopping?

Insurance.com’s main function is to simplify the insurance shopping process. It offers users customized rate comparisons, insurer reviews, discount information, and educational tools. It doesn’t issue policies, but it connects users to licensed agents or the insurer’s quoting system to purchase coverage.

What insurance company makes the most money on Insurance.com?

While Insurance.com doesn’t publish revenue by carrier, large insurers like State Farm, Progressive, and Allstate auto insurance tend to dominate listings due to their advertising budgets and national reach. However, smaller companies like Erie and Auto-Owners often offer cheaper rates and higher satisfaction scores.

How important is the Insurance.com company when comparing quotes?

If you’re looking for a trustworthy tool to compare quotes, check out Insurance.com. It works with more than 70 carriers and evaluates rates at 34,000+ ZIP codes. It offers price comparisons as well as complaint ratios, A.M. Best ratings, and customer satisfaction scores to help consumers make informed decisions.

How does Insurance.com work for auto insurance quotes?

You enter your ZIP code and basic driving details on Insurance.com, and the site uses that data to pull quotes from its partner insurers. You can compare rates, adjust coverage levels, and in some cases, complete the purchase online. The quotes are tailored using factors like driving record, credit score, and vehicle details.

How do insurance companies help drivers through platforms like Insurance.com?

What are Good2GoInsurance.com reviews and ratings like?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.