Best Auto Insurance for Domino’s Pizza Delivery Drivers in 2026 (Top 10 Companies Ranked)

Progressive, State Farm, and Allstate offer the best auto insurance for Domino’s pizza delivery drivers, starting at just $47 monthly. These providers are renowned for their comprehensive coverage options and competitive pricing, making them the top choices for delivery drivers seeking reliable insurance coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated March 2025

Company Facts

Delivery Full Coverage

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Delivery Full Coverage

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Delivery Full Coverage

A.M. Best

Complaint Level

Pros & Cons

The top picks for the best auto insurance for Domino’s pizza delivery drivers are Progressive, State Farm, and Allstate.

These companies stand out due to their robust coverage options tailored specifically to the needs of delivery drivers. Learn more in our guide titled “Best Business Auto Insurance.”

Our Top 10 Company Picks: Best Auto Insurance for Domino's Pizza Delivery Drivers

Company Rank Association Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Safe-Driving Discounts Progressive

#2 13% B Customer Service State Farm

#3 12% A+ Online Tools Allstate

#4 11% A+ Financial Strength Nationwide

#5 10% A Bundling Policies Farmers

#6 10% A Customizable Policies Liberty Mutual

#7 9% A++ Specialized Coverage Travelers

#8 9% A+ Customized Policies The Hartford

#9 8% A++ Competitive Rates Geico

#10 8% A Local Agents American Family

Understanding that the job can be unpredictable, they offer policies that provide both protection and peace of mind while on the road. Choosing the right insurance is crucial for ensuring you’re covered in all delivery scenarios, making these providers ideal for Domino’s drivers.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code above into our comparison tool today.

- State Farm is the top pick for Domino’s Pizza delivery drivers

- Coverage options are tailored for the unpredictable nature of delivery driving

- Policies focus on providing comprehensive protection while on the job

#1 – Progressive: Top Overall Pick

Pros

- Significant Association Discounts: Progressive offers up to 15% off for qualifying members.

- A+ Rating by A.M. Best: Indicates strong financial health and claim-paying ability. Delve into our evaluation of Progressive auto insurance review.

- Focus on Safe-Driving Incentives: Progressive rewards drivers for safe driving practices.

Cons

- Higher Rates for Riskier Drivers: Premiums may increase significantly for drivers with poor driving records.

- Complex Claim Process: Some customers report a more complicated claim submission process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Customer Service Excellence: Known for outstanding client support and agent availability.

- Wide Range of Discounts: Offers various discounts including for low-mileage drivers.

- B+ Rating by A.M. Best: Good financial stability to back insurance claims. Discover insights in our guide titled State Farm auto insurance review.

Cons

- Higher Premiums: Can be more expensive compared to other insurers, especially without discounts.

- Limited Multi-Policy Discount: Less competitive discounts for bundling compared to others.

#3 – Allstate: Best for Online Tools

Pros

- Advanced Online Tools: Offers robust online resources for policy management.

- Strong Financial Rating: A+ rated by A.M. Best, ensuring reliability. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Discounts for Association Members: Provides discounts for various affiliations.

Cons

- Premium Cost: Generally higher premiums without qualifying discounts.

- Less Personalized Agent Interaction: More focus on digital tools can limit direct support.

#4 – Nationwide: Besty for Financial Strength

Pros

- Exceptional Financial Strength: A+ rating by A.M. Best signifies excellent financial health.

- Tailored Insurance Solutions: Offers products that can be customized to specific needs.

- Stable Discount Offers: Consistent discount rates for members. Read up on the Nationwide auto insurance review for more information.

Cons

- Higher Pricing Tiers: Tends to be pricier, reflecting its comprehensive service and coverage options.

- Less Focus on Innovation: A more traditional approach may not appeal to tech-savvy customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Bundling Policies

Pros

- Attractive Bundling Options: Offers significant savings when combining multiple policies.

- A Rating by A.M. Best: A strong financial backbone supports its insurance commitments.

- Extensive Policy Choices: Wide range of policies that cater to diverse needs. More information is available about this provider in our Farmers auto insurance review.

Cons

- Variable Customer Service: Service quality can vary significantly from one agent to another.

- Higher Costs Without Bundles: Premiums may be higher unless multiple policies are bundled.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Coverage: Policies can be tailored very specifically to individual needs.

- Strong A Rating by A.M. Best: Good financial stability and reliability. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Broad Range of Products: Wide selection of insurance products and services.

Cons

- Premium Pricing: Customization options can lead to higher costs.

- Complex Policies: Extensive customization might complicate the selection process for some users.

#7 – Travelers: Best for Specialized Coverage

Pros

- Specialized Coverage Options: Offers unique and specific insurance solutions. See more details in our guide titled Travelers auto insurance review.

- Top-Notch Financial Rating (A++ by A.M. Best): Reflects exceptional financial strength.

- Innovative Insurance Products: Continuously develops new offerings to meet client needs.

Cons

- Pricing Above Average: Specialized services come at a higher cost.

- Limited Discount Availability: Fewer discounts compared to other major insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Personalized Policies

Pros

- Tailored for Drivers Over 80: Customized policies to fit the needs of older drivers.

- Strong A+ Financial Rating: Ensures reliability and ability to pay claims. Learn more in our complete The Hartford auto insurance review.

- Focused on Senior Benefits: Provides benefits and services that appeal to senior drivers.

Cons

- Niche Market Focus: Limited appeal for younger demographics.

- Higher Costs for Non-Seniors: Non-seniors may find better rates elsewhere.

#9 – Geico: Best for Competitive Rates

Pros

- Highly Competitive Pricing: Known for offering some of the lowest rates in the industry.

- Superior Financial Strength (A++): A high rating ensures dependability and claim support.

- Wide Acceptance: Popular across various demographics due to affordability. Learn more by reading our guide titled Geico auto insurance review.

Cons

- Basic Coverage Options: While affordable, options may lack depth compared to others.

- Automated Service Model: Heavy reliance on online and automated services can deter those preferring personal touch.

#10 – American Family: Best for Local Agents

Pros

- Strong Local Agent Support: Extensive network of agents providing personalized service.

- Solid A Financial Rating: Good stability and financial backing. See more details in our guide titled American Family auto insurance review.

- Focus on Community and Local Services: Emphasizes local understanding and tailored solutions.

Cons

- Limited Availability: Not available in all states, which might limit options for some drivers.

- Potentially Higher Rates: Sometimes higher rates are due to the local agent model.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

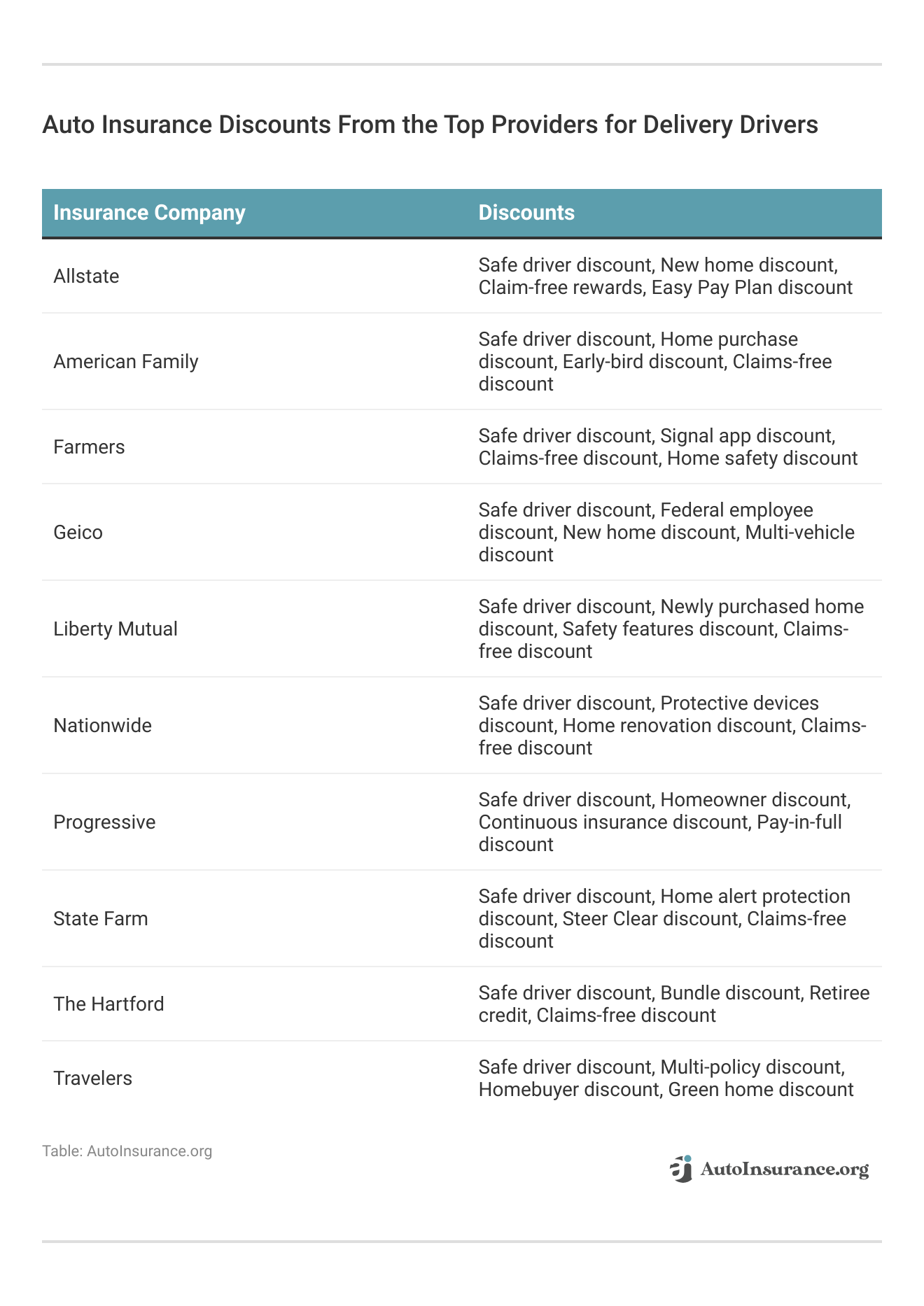

Auto Insurance Monthly Rates for Delivery Drivers

Understanding the specific monthly rates for auto insurance can help delivery drivers make an informed decision when choosing their provider. The table below highlights both the minimum and full coverage options across several insurance companies.

Domino’s Pizza Delivery Driver Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$61 $161

$53 $141

In the table, the monthly rates for minimum coverage start as low as $60, available from Geico, Nationwide, and Progressive. For full coverage, the rates show more variance, ranging from $180 at Geico, the most affordable, to $220 at Liberty Mutual and State Farm, which are on the higher end.

This variation in pricing reflects the differing levels of protection and additional features offered by each insurance company, catering to the unique needs and budgets of delivery drivers.

Such information is crucial for drivers seeking to balance cost with the comprehensiveness of coverage. Discover insights in our guide titled “What are the recommended auto insurance coverage levels?”

What Is Domino’s Pizza Auto Insurance

There is no such thing as Domino’s insurance for Domino’s employees. While some companies offer their delivery personnel commercial coverage when actively delivering food or other goods, Domino’s doesn’t have this option. Instead, Domino’s delivery drivers and other employees must purchase their insurance policies to ensure they can legally drive.

In all states, drivers must carry at least their state’s minimum levels of liability insurance (For more information, read our “Cheapest Liability-Only Auto Insurance”). Similarly, Domino’s employees must have a valid U.S. driver’s license and carry at least liability coverage to drive for the company.

What Kind of Car Insurance Do Domino’s Drivers Need

Domino’s doesn’t specify what kind of car insurance drivers need to work for the company on its website. But legally, anyone driving for Domino’s must have at least a liability car insurance policy. The amount of liability you must have will depend on where you live, and each state requires a different amount of liability coverage.

The table below shows the car insurance coverage requirements for bodily injury liability per person, bodily injury liability per accident, and property damage liability in each state. Access comprehensive insights into our guide titled “Minimum Auto Insurance Requirements by State.”

Liability Auto Insurance Requirements by State

State Coverages Limits

Alabama Bodily injury & property damage liablity 25/50/25

Alaska Bodily injury & property damage liablity 50/100/25

Arizona Bodily injury & property damage liablity 15/30/10

Arkansas Bodily injury, property damage liablity, & personal injury protection 25/50/25

California Bodily injury & property damage liablity 15/30/5

Colorado Bodily injury & property damage liablity 25/50/15

Connecticut Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Delaware Bodily injury, property damage liablity, & personal injury protection 25/50/10

Florida Property damage liablity, & personal injury protection 10/20/10

Georgia Bodily injury & property damage liablity 25/50/25

Hawaii Bodily injury, property damage liablity, & personal injury protection 20/40/10

Idaho Bodily injury & property damage liablity 25/50/15

Illinois Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Indiana Bodily injury & property damage liablity 25/50/25

Iowa Bodily injury & property damage liablity 20/40/15

Kansas Bodily injury, property damage liablity, & personal injury protection 25/50/25

Kentucky Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/25

Louisiana Bodily injury & property damage liablity 15/30/25

Maine Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, & MedPay 50/100/25

Maryland Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 30/60/15

Massachusetts Bodily injury, property damage liablity, & personal injury protection 20/40/5

Michigan Bodily injury, property damage liablity, & personal injury protection 20/40/10

Minnesota Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 30/60/10

Mississippi Bodily injury & property damage liablity 25/50/25

Missouri Bodily injury, property damage liablity, & Uninsured Motorist 25/50/25

Montana Bodily injury & property damage liablity 25/50/20

Nebraska Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Nevada Bodily injury & property damage liablity 25/50/20

New Hampshire Financial responsibility (None required)

25/50/25

New Jersey Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 15/30/5

New Mexico Bodily injury & property damage liablity 25/50/10

New York Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/10

North Carolina Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 30/60/25

North Dakota Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/25

Ohio Bodily injury & property damage liablity 25/50/25

Oklahoma Bodily injury & property damage liablity 25/50/25

Oregon Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist 25/50/20

Pennsylvania Bodily injury, property damage liablity, & personal injury protection 15/30/5

Rhode Island Bodily injury & property damage liablity 25/50/25

South Carolina Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

South Dakota Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Tennessee Bodily injury & property damage liablity 25/50/15

Texas Bodily injury, property damage liablity, & personal injury protection 30/60/25

Utah Bodily injury, property damage liablity, & personal injury protection 25/65/15

Vermont Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/10

Virginia Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/20

Washington Bodily injury & property damage liablity 25/50/10

Washington, D.C. Bodily injury, property damage liablity, & Uninsured Motorist 25/50/10

West Virginia Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist 25/50/25

Wisconsin Bodily injury, property damage liablity, uninsured motorist, & MedPay 25/50/10

Wyoming Bodily injury & property damage liablity 25/50/20

While insurance companies will often ensure that you carry the right amounts of liability coverage, it’s your responsibility as a driver to ensure you have the coverage you need before working for Domino’s or simply driving from one place to another.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Is Domino’s Insurance

The amount you’ll pay as a Domino’s delivery driver will depend on several different factors, such as:

- Age

- Gender

- Car Make and Model

- ZIP Code

- Coverage Types

- Credit Score

If you choose a full coverage policy with collision and comprehensive insurance, you’ll pay more than you would for a liability-only policy. See more details in our guide titled “Factors That Affect Auto Insurance Rates.”

The table below shows the average annual rates for each state in terms of liability, collision, comprehensive coverage, and full coverage policies.

Auto Insurance Monthly Rates by State & Coverage Type

State Liability Collision Comprehensive Full Coverage

Alabama $35 $27 $13 $75

Alaska $47 $30 $12 $89

Arizona $45 $23 $16 $84

Arkansas $34 $27 $16 $78

California $42 $34 $8 $84

Colorado $45 $24 $15 $85

Connecticut $57 $31 $11 $99

Delaware $67 $27 $10 $104

Florida $74 $24 $10 $108

Georgia $50 $28 $13 $91

Hawaii $39 $26 $9 $73

Idaho $31 $19 $10 $59

Illinois $38 $26 $11 $75

Indiana $33 $21 $10 $64

Iowa $26 $19 $16 $60

Kansas $30 $22 $20 $73

Kentucky $45 $23 $12 $80

Louisiana $68 $35 $18 $121

Maine $29 $22 $8 $60

Maryland $53 $30 $13 $95

Massachusetts $51 $33 $11 $95

Michigan $68 $35 $13 $116

Minnesota $38 $20 $15 $73

Mississippi $39 $27 $18 $84

Missouri $36 $23 $15 $75

Montana $33 $22 $19 $74

Nebraska $31 $20 $19 $71

Nevada $60 $26 $10 $95

New Hampshire $34 $25 $9 $68

New Jersey $75 $32 $11 $117

New Mexico $43 $23 $15 $80

New York $69 $33 $14 $115

North Carolina $30 $25 $11 $65

North Dakota $25 $21 $20 $65

Ohio $34 $23 $10 $67

Oklahoma $39 $27 $19 $85

Oregon $51 $19 $8 $78

Pennsylvania $42 $28 $12 $82

Rhode Island $66 $35 $11 $111

South Carolina $46 $22 $15 $84

South Dakota $26 $18 $22 $65

Tennessee $36 $26 $12 $74

Texas $46 $32 $17 $95

Utah $43 $22 $9 $74

Vermont $30 $25 $11 $66

Virginia $36 $24 $12 $72

Washington $51 $22 $9 $82

Washington, D.C. $55 $39 $19 $114

West Virginia $42 $28 $17 $87

Wisconsin $32 $19 $12 $62

Wyoming $28 $23 $21 $73

As you can see, if you purchase a liability policy, you’ll pay less than if you add collision or comprehensive coverage or buy a full coverage policy including them all. However, a liability policy will only cover damages to other people or their vehicles.

Collision coverage will protect your vehicle if you’re in an accident, even if you’re at fault. Comprehensive coverage protects your car from damage due to theft, vandalism, inclement weather, and other non-accident-related instances.

While collision and comprehensive coverage are extremely helpful in protecting your vehicle, your insurance company may require you to purchase additional coverage if you use your vehicle for business purposes.

Do Domino’s Drivers Need Commercial Coverage

If you drive for Domino’s, you may be interested in purchasing a commercial car insurance policy. However, whether you need that much coverage will depend on how often you drive for the company. Delve into our evaluation of “Best Commercial Auto Insurance Companies.”

Anyone who works full-time or close to full-time as a delivery driver should consider purchasing a commercial auto insurance policy. These policies can be pricey, costing up to $2,000 annually, but they offer higher levels of protection for individuals who use their vehicles for business use.

Choosing Progressive means securing top-tier insurance that meets the unique needs of delivery drivers.Jeffrey Manola Licensed Insurance Agent

However, if you’re a part-time delivery driver, you may not have to purchase a commercial policy. Instead, your insurance company may add business-use coverage to your policy. Many insurance companies consider a business-use add-on to suffice for drivers who use their cars for work purposes for 20 hours a week or less. Therefore, a business-use add-on may be perfect if you fit this description.

Business-use coverage will increase your car insurance rates. Still, you won’t pay nearly as much as you would for commercial coverage, and you’ll ensure that your claim gets approved if you’re ever in an accident while delivering food for Domino’s.

The Bottom Line: Domino’s Pizza Auto Insurance

If you drive for Domino’s, you need car insurance. You should consider carrying more than a simple liability policy, as it wouldn’t cover you or your vehicle if you’re at fault in an accident. You can purchase a full coverage policy for your vehicle, protecting you if you’re in an accident or your car incurs non-accident-related damage.

Learn more: What is auto insurance?

However, you should speak with a representative from your insurance company to ensure you’re covered if you get in an accident while making deliveries for Domino’s. If a personal auto insurance policy isn’t enough to cover you, you should consider purchasing a commercial policy or adding a business-use add-on to your policy. The one that works for you will likely depend on how much time you spend making deliveries.

Finding affordable insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

What is Domino’s Pizza Auto Insurance?

Domino’s car insurance is the coverage that Domino’s Pizza provides to its delivery drivers under their employment contract. This insurance is designed to safeguard the drivers during their delivery duties.

For additional details, explore our comprehensive resource titled “Best Delivery Driver Auto Insurance.”

What does Domino’s Pizza Auto Insurance cover?

The coverage offered by Domino’s Pizza Auto Insurance can differ based on the policy details and the legal requirements of the area. Typically, it provides liability coverage that safeguards the Domino delivery driver if they are involved in an accident during a delivery. In some cases, it might also cover damage to the driver’s vehicle.

Do all Domino’s Pizza delivery drivers have auto insurance through the company?

Yes, Domino’s Pizza requires all their delivery drivers to have auto insurance coverage. The insurance coverage is typically provided through the company, ensuring that the drivers have appropriate insurance while performing their delivery duties.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Do Domino’s Pizza delivery drivers need their own personal auto insurance?

While Domino’s Pizza provides auto insurance coverage for their delivery drivers, drivers may still need to maintain their own personal auto insurance policy. Personal auto insurance typically covers personal use of the vehicle, and Domino’s Pizza Auto Insurance is specific to the driver’s employment with the company.

Are there any requirements or qualifications for Domino’s Pizza Auto Insurance?

The specific requirements and qualifications for Domino’s Pizza Auto Insurance may vary depending on the jurisdiction and the insurance policy. Generally, drivers need to meet certain criteria set by the insurance provider.

For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

What are the key aspects of Domino’s terms and conditions?

Domino’s terms and conditions outline the rules and guidelines for using their services, including delivery policies, order cancellations, and customer responsibilities.

Does Domino’s insure their drivers?

Yes, Domino’s insures their drivers, requiring them to carry liability insurance as a minimum to cover any incidents while delivering.

What does the Domino’s driver insurance policy include?

The Domino’s driver insurance policy typically includes liability coverage to protect against claims from accidents occurring during deliveries.

What are Domino’s delivery car requirements?

Domino’s delivery car requirements include having a valid driver’s license, a clean driving record, and a properly insured vehicle.

To learn more, explore our comprehensive resource on “Do points affect auto insurance rates?“

Where can I find cheap pizza delivery insurance?

Cheap pizza delivery insurance can be found by comparing quotes from insurance providers that offer special commercial or business-use policies for delivery drivers.

What is Domino’s delivery insurance?

What happens if I have a car accident while delivering pizza?

Why is commercial auto insurance important for delivery drivers?

What is the difference between a commercial driver and a regular driver?

How much does delivery driver insurance cost?

Do Domino’s delivery drivers use their own cars?

Do I need commercial auto insurance to deliver pizza?

Does Domino’s provide a car for delivery?

What is Domino’s pizza driver pay rate?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.