Best Fort Myers, Florida Auto Insurance in 2026 (Find the Top 10 Companies Here)

For the best Fort Myers, Florida auto insurance, State Farm, Geico, and Progressive lead the way with competitive rates starting as low as $64/month. These top providers offer excellent coverage options and discounts, ensuring Fort Myers residents can find affordable and reliable insurance to suit their needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Fort Myers FL

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Fort Myers FL

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage in Fort Myers FL

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsState Farm, Geico, and Progressive stand out as the top choices for the best auto insurance in Fort Myers, Florida, with rates starting as low as $64 per month.

Among these options, State Farm stands out with its competitive rates and comprehensive coverage, making it the top choice overall.

Geico and Progressive also offer great value, especially for those seeking affordability and flexible coverage. Each provider delivers unique benefits, catering to various needs and preferences.

Our Top 10 Company Picks: Best Fort Myers, Florida Auto Insurance

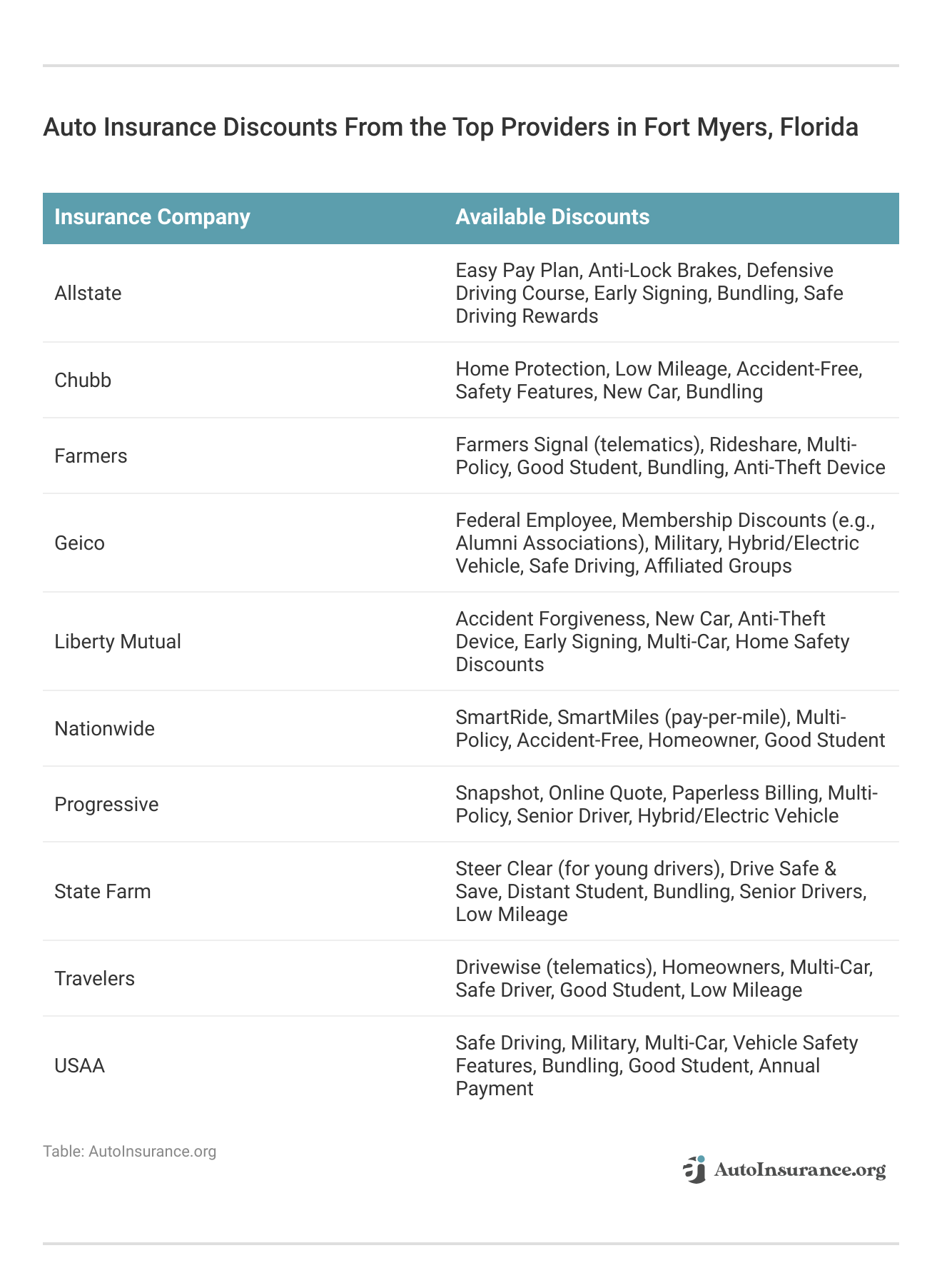

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agent | State Farm | |

| #2 | 16% | A++ | Low Premiums | Geico | |

| #3 | 13% | A+ | Competitive Rates | Progressive | |

| #4 | 11% | A+ | Accident Forgiveness | Allstate | |

| #5 | 14% | A | Flexible Coverage | Liberty Mutual |

| #6 | 21% | A+ | Roadside Assistance | Nationwide |

| #7 | 22% | A++ | Claims Handling | USAA | |

| #8 | 10% | A+ | Roadside Assistance | Farmers | |

| #9 | 8% | A++ | Extensive Options | Chubb | |

| #10 | 9% | A++ | Standard Coverage | Travelers |

Explore your options to secure the most cost-effective and reliable insurance for your needs. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm, Geico, and Progressive offer the best auto insurance in Fort Myers

- State Farm leads with competitive rates and comprehensive coverage options

- Geico and Progressive provide excellent value with affordable premiums

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates for Various Driver Profiles: State Farm offers highly competitive premiums for Fort Myers, Florida drivers, especially for those with clean driving records or who qualify for multiple discounts. Their policies tend to be more affordable compared to many competitors, making them a popular choice for a broad range of drivers in Fort Myers.

- Efficient Claims Handling: State Farm is known for its reliable claims process, with fast, fair, and efficient claim resolution. Fort Myers, Florida drivers benefit from the company’s strong reputation for customer satisfaction in dealing with accidents and other issues that arise in the area, as highlighted in our State Farm auto insurance review.

- Wide Range of Discounts: In Fort Myers, Florida, State Farm provides a variety of savings, such as those for careful drivers, multi-policy holders, deserving students, and drivers of cars with safety features. For many residents, these savings might result in a major decrease in the cost of their premiums.

Cons

- Limited Specialized Coverage: Although State Farm offers comprehensive coverage options for standard vehicles in Fort Myers, Florida, they may not be the best choice for residents who need more specialized coverage, such as insurance for exotic or vintage vehicles or additional protections like rideshare coverage.

- Complex Discount Eligibility: State Farm’s discount programs in Fort Myers, Florida can be complex, making it challenging for some drivers to determine if they qualify and which discounts they might be eligible for.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Premiums Across All Tiers

Pros

- Affordable Premiums Across All Tiers: Geico is well-known for offering some of the most affordable auto insurance rates in Fort Myers, Florida. This applies particularly to drivers with clean records, but even high-risk drivers can often find more competitive pricing through Geico than with other insurers, as highlighted in our Geico auto insurance review.

- Highly Rated Mobile App: Geico’s mobile app is one of the most user-friendly and robust in the industry. Fort Myers, Florida residents can manage their policies, access ID cards, report claims, and request roadside assistance all from their phones, making the entire insurance process more convenient.

- Strong Digital Experience: Geico’s digital-first approach makes it easy for Fort Myers residents to handle all aspects of their insurance online, from getting a quote to managing claims. This is ideal for tech-savvy consumers in Fort Myers who prefer self-service options.

Cons

- Limited Agent Availability: Geico primarily operates online and over the phone, so Fort Myers drivers who prefer face-to-face interactions may be disappointed by the limited availability of local agents.

- Personalized Service Trade-Off: While Geico excels in providing digital and phone-based service, some Fort Myers residents may find that this approach lacks the personal touch that comes from working with a dedicated local agent.

#3 – Progressive: Best for Snapshot Program for Safe Drivers

Pros

- Snapshot Program for Safe Drivers: Progressive’s Snapshot program allows Fort Myers, Florida drivers to receive personalized rates based on their driving habits. By tracking safe driving behaviors, cautious drivers can earn significant discounts, making Progressive particularly appealing to drivers who prioritize road safety.

- Online Quote Tools: Progressive’s online tools are some of the most advanced in the industry, allowing Fort Myers residents to easily compare quotes, customize coverage, and even bundle auto insurance with home or renters insurance. This ease of use is a key advantage for consumers who prefer to manage everything online.

- Bundling Discounts: Fort Myers, Florida residents can save money by bundling Progressive’s auto insurance with home, renters, or even boat insurance. This bundling option allows for simplified billing and can result in significant savings on premiums.

Cons

- Mixed Customer Service Feedback: While many Fort Myers customers are satisfied with Progressive’s service, others report frustrations with claims processing, particularly during busy periods or after significant weather events like hurricanes. Delays in processing could be an issue for drivers who need swift resolution.

- Premium Increases After Claims: Fort Myers drivers may experience premium increases after making a claim, even if the claim wasn’t their fault. Progressive has been known to raise rates more sharply than other insurers in these situations, as noted in our Progressive auto insurance review.

#4 – Allstate: Best for Wide Range of Coverage Options

Pros

- Wide Range of Coverage Options: Allstate offers flexible policy options, allowing Fort Myers, Florida drivers to customize their coverage to meet their needs. This includes standard protections like liability and collision, as well as add-ons such as roadside assistance, rental reimbursement, and new car replacement coverage, as highlighted in our Allstate auto insurance review.

- Claim Satisfaction Guarantee: Allstate offers a unique Claim Satisfaction Guarantee, ensuring that Fort Myers, Florida residents receive high-quality service during the claims process. If customers aren’t satisfied, they may receive a credit toward their policy, offering peace of mind during stressful times.

- Drivewise Program: Allstate’s Drivewise program allows Fort Myers drivers to earn discounts by demonstrating safe driving habits. The program tracks driving behavior and rewards cautious drivers with cashback and reduced premiums, making it a great option for those who prioritize safe driving.

Cons

- Higher Premiums for Some Drivers: Allstate is known to have higher premiums compared to some competitors, especially for drivers in Fort Myers who don’t qualify for significant discounts or have less-than-perfect driving records. This can make it less appealing to those on a budget.

- Limited Discount Availability: While Allstate offers various discounts, Fort Myers residents may find that they’re not as extensive or easy to qualify for compared to competitors like Geico or Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Flexible Coverage Options: Liberty Mutual offers an extensive range of customizable coverage options, allowing Fort Myers drivers to tailor their policies to fit their specific needs. Options include accident forgiveness, new car replacement, better car replacement, and more, catering to drivers looking for comprehensive protection, as mentioned in our Liberty Mutual auto insurance review.

- Superior Online and Mobile Tools: Liberty Mutual provides a robust online platform and mobile app that allows Fort Myers drivers to manage their policies, pay bills, and file claims quickly and easily. The convenience and ease of use are a significant advantage for those who prefer managing their insurance digitally.

- Roadside Assistance Add-On: Liberty Mutual offers optional roadside assistance that covers towing, lockout services, and more. This add-on can be particularly beneficial for Fort Myers drivers who want extra peace of mind while on the road.

Cons

- Potential for Rate Increases: Some Fort Myers, Florida customers report that Liberty Mutual’s rates can increase over time, especially after the initial policy period ends. This could be a drawback for drivers seeking long-term premium stability.

- Mixed Claims Processing Reviews: Although Liberty Mutual generally offers good service, some Fort Myers residents have expressed concerns about slow claims processing and a lack of clear communication during the claims process. This could be an issue for drivers who prioritize fast resolutions.

#6 – Nationwide: Best for On Your Side Review

Pros

- On Your Side Review: Nationwide offers regular policy reviews through their On Your Side Review program, ensuring that Fort Myers residents are always receiving the right coverage at the best possible price. This proactive approach to policy management helps customers avoid overpaying for unnecessary coverage.

- Diverse Policy Options: Nationwide offers a variety of policy options, allowing Fort Myers drivers to customize their coverage to meet their needs. From standard liability and collision to unique options like accident forgiveness and gap insurance, Nationwide provides flexibility in coverage.

- Usage-Based Insurance with SmartRide: Nationwide’s SmartRide program rewards Fort Myers drivers for safe driving habits by offering discounts based on monitored driving behavior. This program can lead to significant savings for drivers who exhibit caution behind the wheel.

Cons

- Higher Premiums for High-Risk Drivers: Nationwide tends to charge higher premiums for Fort Myers, Florida drivers with poor driving records or those who are classified as high-risk. This can make it less appealing for those with blemishes on their driving history, according to Nationwide auto insurance review.

- Fewer Discounts Compared to Competitors: Although Nationwide offers some attractive discounts, Fort Myers drivers may find that they have fewer opportunities to save compared to insurers like Geico or Progressive, particularly when it comes to bundling options or specialty discounts.

#7 – USAA: Best for Exceptional Service for Military Families

Pros

- Exceptional Service for Military Families: USAA is highly regarded in Fort Myers, Florida for its specialized support tailored to military members, veterans, and their families, including exclusive benefits and a deep understanding of their unique needs, as highlighted in our USAA auto insurance review.

- Competitive Rates: USAA often offers some of the lowest premiums in Fort Myers, Florida due to its membership-based model, which facilitates competitive pricing and better risk management.

- Comprehensive Coverage Options: USAA provides an extensive array of coverage options in Fort Myers, Florida, including specialized features like rental reimbursement, new car replacement, and military discounts.

Cons

- Limited Availability: USAA’s services are restricted to military personnel and their families in Fort Myers, Florida, excluding a significant portion of potential customers and limiting its accessibility.

- Fewer Local Agents: As an insurer primarily operating online and over the phone, USAA offers limited opportunities for face-to-face interactions with agents in Fort Myers, Florida, which can be a drawback for those who prefer in-person consultations.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Farmers provides a wide range of coverage options in Fort Myers, Florida, including specialized policies for high-risk and rideshare drivers, ensuring tailored insurance solutions, as noted in our Farmers auto insurance review.

- Flexible Discounts: Farmers offers various discounts in Fort Myers, Florida, such as those for safe driving, bundling policies, and insuring multiple vehicles, which can significantly reduce overall insurance costs.

- Customizable Policies: Farmers allows significant policy customization in Fort Myers, Florida, enabling drivers to adjust coverage limits and options to meet their specific needs, including additional protection add-ons.

Cons

- Higher Premiums for High-Risk Drivers: Farmers may charge higher premiums in Fort Myers, Florida, for drivers with poor driving records or those classified as high-risk, which might be less appealing for those with a history of accidents or violations.

- Mixed Customer Service Reviews: Customer experiences with Farmers in Fort Myers, Florida can vary, with some reporting delays or inconsistencies in claims processing and support, potentially affecting overall satisfaction.

#9 – Chubb: Best for High-Value Coverage Options

Pros

- High-Value Coverage Options: Chubb is renowned in Fort Myers, Florida for providing high-value coverage, particularly for luxury and high-net-worth vehicles, with extensive protection and additional benefits.

- Comprehensive Policy Benefits: Chubb offers policies with exceptional benefits in Fort Myers, Florida, including worldwide coverage, high limits for personal property, and enhanced protection features.

- Loss Prevention Services: Chubb offers proactive loss prevention services in Fort Myers, Florida, helping clients mitigate risks before they lead to claims. These services include home and auto safety assessments, enhancing overall protection for policyholders.

Cons

- Higher Premiums: The comprehensive coverage and high limits offered by Chubb often come with higher premiums in Fort Myers, Florida, which might be a drawback for budget-conscious drivers, as noted in our Chubb auto insurance review.

- Limited Discounts: Chubb tends to offer fewer discounts compared to other insurers in Fort Myers, Florida, potentially reducing savings opportunities for those who benefit from multiple discount options.

#10 – Travelers: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Travelers offers a broad range of coverage options and add-ons in Fort Myers, Florida, including accident forgiveness, new car replacement, and gap insurance, meeting diverse needs, according to Travelers auto insurance review.

- Competitive Rates: Travelers provides competitive pricing in Fort Myers, Florida, often appealing to drivers seeking affordable yet extensive coverage options, designed to be cost-effective while maintaining high protection levels.

- User-Friendly Digital Tools: Travelers features robust digital tools in Fort Myers, Florida, including a well-designed mobile app and online platform, making it easy to manage policies, file claims, and access information.

Cons

- Premium Increases After Claims: Travelers may increase premiums in Fort Myers, Florida following a claim, even if it wasn’t the driver’s fault, which can be a concern for avoiding potential rate hikes.

- Varied Customer Service Experiences: Some customers in Fort Myers, Florida report inconsistent experiences with Travelers’ customer service, which might affect overall satisfaction, particularly in claims processing and support quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Required Auto Insurance Coverage in Fort Myers, Florida

In Fort Myers, Florida, minimum auto insurance is the lowest level of coverage required by law for drivers to legally operate a vehicle. Florida law mandates that drivers carry specific amounts of insurance to cover costs related to accidents, injuries, or damages they may cause.

Fort Myers, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $74 | $163 |

| Chubb | $77 | $175 |

| Farmers | $73 | $160 |

| Geico | $66 | $152 |

| Liberty Mutual | $76 | $174 |

| Nationwide | $71 | $151 |

| Progressive | $72 | $160 |

| State Farm | $70 | $158 |

| Travelers | $72 | $165 |

| USAA | $64 | $144 |

Personal Injury Protection (PIP) is required, providing coverage for medical expenses, lost wages, and other costs regardless of fault, with a minimum of $10,000. Additionally, drivers must have at least $10,000 in Property Damage Liability (PDL) insurance, which covers damage to others’ property if they are at fault in an accident.

While these are the only mandatory coverages, drivers can opt for additional insurance such as Bodily Injury Liability (BIL) or Uninsured/Underinsured Motorist coverage for added protection. Meeting these insurance requirements is essential for legal driving and avoiding penalties, but many drivers choose higher coverage limits to ensure broader financial protection.

Cheap Fort Myers, Florida Auto Insurance by Age, Gender, and Marital Status

This refers to the varying auto insurance rates available to residents of Fort Myers based on their age, gender, and marital status. Insurance providers often use these demographic factors to assess risk and determine premiums. Younger drivers, for example, typically face higher rates due to perceived inexperience, while older drivers might benefit from lower premiums.

Fort Myers, Florida Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $321 | $303 | $277 | $280 | $1,083 | $1,163 | $316 | $319 |

| Geico | $232 | $233 | $217 | $217 | $416 | $528 | $256 | $262 |

| Liberty Mutual | $267 | $267 | $245 | $245 | $559 | $858 | $267 | $361 |

| Nationwide | $216 | $213 | $193 | $199 | $515 | $632 | $237 | $246 |

| Progressive | $288 | $272 | $248 | $265 | $814 | $892 | $348 | $335 |

| State Farm | $148 | $148 | $134 | $134 | $416 | $529 | $164 | $134 |

| USAA | $404 | $468 | $146 | $158 | $117 | $115 | $109 | $108 |

Gender can also influence rates, as statistical trends show differences in driving behaviors between men and women. Marital status is another factor, with married individuals often receiving discounts due to the perceived stability and lower risk associated with married life.

In Fort Myers, finding cheap auto insurance involves comparing rates across providers while considering how age, gender, and marital status impact the cost of coverage.

Cheap Fort Myers, Florida Auto Insurance for Teen Drivers

It might be difficult to get inexpensive teen vehicle insurance in Fort Myers, Florida, because young drivers frequently have higher premiums because of their inexperience and greater risk factors. Finding an affordable coverage in the complex insurance market necessitates diligent comparison shopping and knowledge of the variables affecting premiums.

Fort Myers, Florida Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $321 | $303 |

| Geico | $232 | $233 |

| Liberty Mutual | $267 | $267 |

| Nationwide | $216 | $213 |

| Progressive | $288 | $272 |

| State Farm | $148 | $148 |

| USAA | $404 | $468 |

It’s important to compare the different annual adolescent auto insurance rates offered in Fort Myers, Florida, in order to assist you get a better idea of what you might expect to pay. You can determine which insurance companies in the area give the most affordable teen driver policies by looking over their rates, which will help you make a more well-informed choice when choosing a policy.

Cheap Fort Myers, Florida Auto Insurance for Seniors

The cost of senior auto insurance in Fort Myers, Florida, can vary greatly depending on a number of variables, including driving record, kind of vehicle, and kind of coverage chosen. Compared to younger, less experienced drivers, elder drivers may qualify for lower premiums because they often have years of driving expertise.

Fort Myers, Florida Senior Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $316 | $319 |

| Geico | $256 | $262 |

| Liberty Mutual | $267 | $361 |

| Nationwide | $237 | $246 |

| Progressive | $348 | $335 |

| State Farm | $164 | $134 |

| USAA | $109 | $108 |

But, as drivers get older, health issues that can affect their ability to drive might cause insurance prices to go up. Senior drivers should investigate a variety of insurance choices, such as those that provide savings for low annual miles, defensive driving classes, or safe driving records.

Examining the yearly average rates for senior drivers in Fort Myers can give seniors insight into the pricing environment and a clearer idea of what to anticipate.

Cheap Fort Myers, Florida Auto Insurance By Driving Record

Cheap Fort Myers, Florida auto insurance by driving record refers to affordable car insurance options tailored to individuals in Fort Myers with varying driving histories.

Insurers often adjust rates based on a driver’s past behavior on the road, including factors such as the number of accidents, traffic violations, and overall driving record. Discover our comprehensive guide to “How Auto Insurance Companies Check Driving Records” for additional insights.

Fort Myers, Florida Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $438 | $526 | $581 | $486 |

| Geico | $207 | $263 | $390 | $321 |

| Liberty Mutual | $277 | $359 | $520 | $378 |

| Nationwide | $262 | $287 | $386 | $290 |

| Progressive | $342 | $505 | $425 | $459 |

| State Farm | $211 | $251 | $231 | $231 |

| USAA | $159 | $196 | $291 | $166 |

Generally speaking, drivers with spotless records pay less in premiums; however, individuals with a history of infractions or accidents may pay more. People should check insurance quotes from several companies, take into account possible discounts for safe driving, and look for policies that fit their unique driving demands and driving history in order to get the best offers.

Cheap Fort Myers, Florida Auto Insurance Rates After a DUI

Finding cheap vehicle insurance in Fort Myers, Florida, following a DUI conviction can be especially difficult because of the higher risk involved in insuring a driver with such an offense. A DUI conviction usually results in noticeably higher premiums. Finding an insurance at a reasonable price is doable, though, if you’re prepared to put in the time to compare quotes from several insurers.

Fort Myers, Florida DUI Auto Insurance Rates

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $581 |

| Geico | $390 |

| Liberty Mutual | $520 |

| Nationwide | $386 |

| Progressive | $425 |

| State Farm | $231 |

| USAA | $291 |

Because different insurance companies evaluate drivers with a DUI on their record differently, some may provide more affordable rates than others. It’s critical to carefully examine the annual rates for DUI vehicle insurance in Fort Myers, Florida in order to receive the greatest bargain, taking into consideration elements like coverage levels, discounts, and the insurer’s track record of handling claims.

Cheap Fort Myers, Florida Auto Insurance By Credit History

Cheap Fort Myers, Florida auto insurance by credit history pertains to affordable insurance rates offered to drivers in Fort Myers based on their credit scores. For further details, check out our in-depth “How Credit Scores Affect Auto Insurance Rates” article.

Insurance companies often use credit history as a factor in determining premiums, with the assumption that individuals with better credit scores are less likely to file claims.

Fort Myers, Florida Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $364 | $449 | $710 |

| Geico | $197 | $261 | $428 |

| Liberty Mutual | $295 | $363 | $493 |

| Nationwide | $254 | $281 | $384 |

| Progressive | $334 | $401 | $563 |

| State Farm | $170 | $207 | $316 |

| USAA | $118 | $162 | $329 |

Therefore, drivers with strong credit histories may qualify for lower rates compared to those with poor credit. To secure the best rates, individuals should maintain a good credit score, review their credit reports for errors, and compare quotes from various insurers that consider credit history in their pricing models.

Save on Auto Insurance in Fort Myers, FL: ZIP Code-Based Rates

Your ZIP code has a significant impact on how much your cheap auto insurance rates in Fort Myers, Florida cost because of the complex interactions between local factors and insurance requirements. Learn more by visiting our detailed “Minimum Auto Insurance Requirements by State” section.

Fort Myers, Florida Auto Insurance Monthly Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 33901 | $261 |

| 33907 | $256 |

| 33908 | $256 |

| 33912 | $261 |

| 33913 | $262 |

| 33916 | $262 |

| 33965 | $257 |

| 33966 | $262 |

| 33967 | $257 |

| 33971 | $268 |

When setting rates, insurers carefully consider a variety of criteria specific to each ZIP code, including as population density, traffic patterns, crime data, and even local weather occurrences.

As a result, the cost of auto insurance might differ significantly between neighborhoods. It’s critical to compare prices across ZIP codes in order to get the best bargain, as your particular area might have a significant impact on your overall insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fort Myers Auto Insurance: Cheap Rates by Commute Length

In Fort Myers, Florida, the cost of auto insurance can swing dramatically based on the particulars of your daily commute. Insurance companies delve into the depths of your driving patterns, analyzing both the distance and the frequency of your journeys to gauge risk and establish your premium.

Fort Myers, Florida Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $494 | $522 |

| Geico | $294 | $297 |

| Liberty Mutual | $371 | $396 |

| Nationwide | $306 | $306 |

| Progressive | $433 | $433 |

| State Farm | $223 | $239 |

| USAA | $201 | $205 |

If you’re clocking in lengthy commutes or frequent trips, you might find yourself facing steeper rates, driven by the heightened risk of accidents and vehicle wear. Read our extensive guide on “How Much Coverage You Need” for more knowledge.

On the flip side, if your drive is short or sporadic, you could potentially snag a lower premium. Grasping the intricate relationship between your commute and your insurance rate can be key to uncovering budget-friendly options.

Budget-Friendly Fort Myers Auto Insurance: Rates by Coverage

In Fort Myers, Florida, the cost of auto insurance dances to the tune of the coverage level you select. Opt for the bare-bones approach—just liability insurance—and you might find yourself with a pleasantly light premium. It’s the cheapest route but leaves you exposed if something goes awry.

On the flip side, if you’re leaning towards a safety net that includes comprehensive and collision coverage, be prepared for your rates to climb. Expand your understanding with our thorough “Comparing Auto Insurance” overview.

These higher tiers offer a cushier cushion against a broader spectrum of risks and damages, but at a price. Balancing the scales between minimal and maximum coverage is essential for aligning your budget with your desired level of protection.

Best By Category: Cheapest Auto Insurance in Fort Myers, Florida

When searching for the cheapest auto insurance in Fort Myers, Florida, it’s crucial to assess options by specific categories to pinpoint the most cost-effective solutions.

This involves evaluating insurance providers based on various factors such as age, driving record, credit history, and coverage level. Explore our detailed analysis on “How to Evaluate Auto Insurance Quotes” for additional information.

Cheapest Fort Myers, Florida Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| One Accident | USAA |

| One DUI | State Farm |

| One Ticket | USAA |

By comparing rates across these categories, you can identify the best deals for different scenarios, ensuring you get the most affordable insurance tailored to your unique situation. This approach helps in finding the most economical policy that meets your needs without overspending.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Fort Myers, Florida Auto Insurance Companies

When diving into the realm of the most cost-effective auto insurance providers in Fort Myers, Florida, we’re talking about those insurers who flaunt the lowest premium rates for coverage.

These companies, masters of budget-friendly policies, shine by offering competitive pricing without skimping on necessary protections. Get more insights by reading our expert “Where can I compare online auto insurance companies?” advice.

To pinpoint these champions of affordability, we analyze factors like base rates, the array of discounts available, and the intricacies of their pricing strategies. Essentially, this exploration uncovers which insurance giants manage to deliver top-notch coverage at a bargain, ensuring you don’t pay more than you need to for reliable auto protection.

Key Factors Influencing Auto Insurance Rates in Fort Myers, Florida

Auto insurance rates in Fort Myers, Florida can swing dramatically based on a myriad of local influences, setting it apart from other cities. The interplay of traffic congestion, vehicle theft rates, and commute times in Fort Myers plays a crucial role in determining these costs. Continue reading our full “Factors That Affect Auto Insurance Rates” guide for extra tips.

Fort Myers Auto Theft

Fort Myers is not immune to the rising trend in auto theft, with the FBI’s annual data revealing a startling 257 reported thefts. Because insurers are having to pay out more claims, this rise in car theft directly correlates to rising insurance costs.

Fort Myers Commute Time

Commute times also contribute significantly to insurance costs. Fort Myers drivers face an average commute of 27.2 minutes, a factor that often correlates with elevated insurance expenses due to the higher risk associated with longer driving times.

Fort Myers Traffic

Traffic congestion further impacts rates. Fort Myers, with its 521st position globally in terms of traffic congestion according to Inrix, reflects a city where insurance costs are influenced by the frequency and severity of traffic delays. Each of these elements intertwines to shape the unique auto insurance landscape in Fort Myers.

Compare Fort Myers, Florida Auto Insurance Quotes

In order to find the most affordable coverage, researching quotes for car insurance in Fort Myers, Florida, requires weighing a number of different considerations. This procedure entails examining the several coverage options that each provider provides, such as comprehensive, collision, and liability insurance, in addition to extras like emergency assistance and rental car coverage.

Premiums can differ widely depending on factors like driving history, vehicle type, and personal demographics, so it’s crucial to review the monthly or annual costs associated with each quote. For more information, explore our informative “How to Compare Auto Insurance Quotes” page.

State Farm's extensive network of local agents and competitive rates make it a top choice for Fort Myers drivers looking for personalized service and affordability.Michelle Robbins Licensed Insurance Agent

Every policy should have its deductible taken into account in addition to the premiums, since a higher deductible frequently translates into a lower premium but necessitates greater out-of-pocket costs in the event of a claim. Discounts for safe driving or combining many policies, for example, might also affect the total cost.

It’s critical to assess how well insurance firms handle claims and provide customer service since, in times of trouble, competent assistance can go a long way. Lastly, take into account the insurance providers’ financial stability, as a solid business is more likely to honor its policy commitments and pay claims.

By carefully comparing these elements, drivers in Fort Myers can select an auto insurance policy that offers the best balance of coverage, cost, and customer service. Before you buy Fort Myers, Florida auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code below to get free Fort Myers, Florida auto insurance quotes.

Frequently Asked Questions

What are the lowest auto insurance rates in Fort Myers, Florida?

State Farm and Geico often give the lowest vehicle insurance prices in Fort Myers, Florida. These organizations constantly offer affordable prices because to their wide networks and rapid claim processing.

Which company has the highest customer satisfaction in Fort Myers, Florida insurance?

In Fort Myers, Florida, USAA consistently ranks highest in customer satisfaction. Their exceptional customer service and tailored coverage options contribute to their strong reputation.

What are the reasons for high insurance rates in Fort Myers, Florida?

High insurance rates in Fort Myers, Florida, are primarily due to the area’s susceptibility to natural disasters, such as hurricanes. Additionally, high population density and traffic congestion contribute to increased insurance costs.

Discover our comprehensive guide to “Where to Compare Auto Insurance Rates” for additional insights.

Are there insurance companies pulling out of Fort Myers, Florida?

Due to the high risk brought about by natural catastrophes, certain insurance providers, especially certain smaller regional insurance companies, have scaled back or pulled out of the Fort Myers market.

Which insurance companies have the most complaints in Fort Myers, Florida?

In Fort Myers, Florida, companies such as Liberty Mutual and Travelers have reported a higher volume of customer complaints compared to others. Common issues include claim processing delays and customer service concerns.

What is the best auto insurance in Fort Myers, Florida?

The best auto insurance in Fort Myers, Florida, is often considered to be State Farm due to its competitive rates, broad coverage options, and strong customer service.

For further details, check out our in-depth “How to Ask an Auto Insurance Company for Quotes” article.

Who offers the best auto insurance rates for seniors in Fort Myers, Florida?

For seniors in Fort Myers, Florida, USAA offers some of the best auto insurance rates. Their specialized programs for seniors and competitive pricing make them a top choice.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Is State Farm pulling out of Fort Myers, Florida?

No, State Farm is not pulling out of Fort Myers, Florida. They continue to offer their services in the area and remain a prominent insurer.

Who is the largest insurer in Fort Myers, Florida?

State Farm is the throughout the process insurance in Fort Myers, Florida, thanks to its sizable share of the market and a diverse variety of insurance offerings.

Learn more by visiting our detailed “What does standard auto insurance cover?” section.

What are the best tips for saving on car insurance in Fort Myers, Florida?

To save money on vehicle insurance in Fort Myers, Florida, try bundling policies, keeping a perfect driving record, taking advantage of available safety feature discounts, and comparing rates from multiple insurance companies.

What is the average car insurance cost in Fort Myers, Florida?

What is the monthly car insurance average in Fort Myers, Florida?

What is the most basic car insurance in Fort Myers, Florida?

What are the minimum car insurance requirements in Fort Myers, Florida?

Which is the cheapest car insurance company in Fort Myers, Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.