Florida Minimum Auto Insurance Requirements in 2026 (FL Coverage Guide)

Florida minimum auto insurance requirements include $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL). Florida minimum auto insurance rates start at $21/mo. However, rates for auto insurance in Florida can vary based on the insurance provider, location, and driving history.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated March 2025

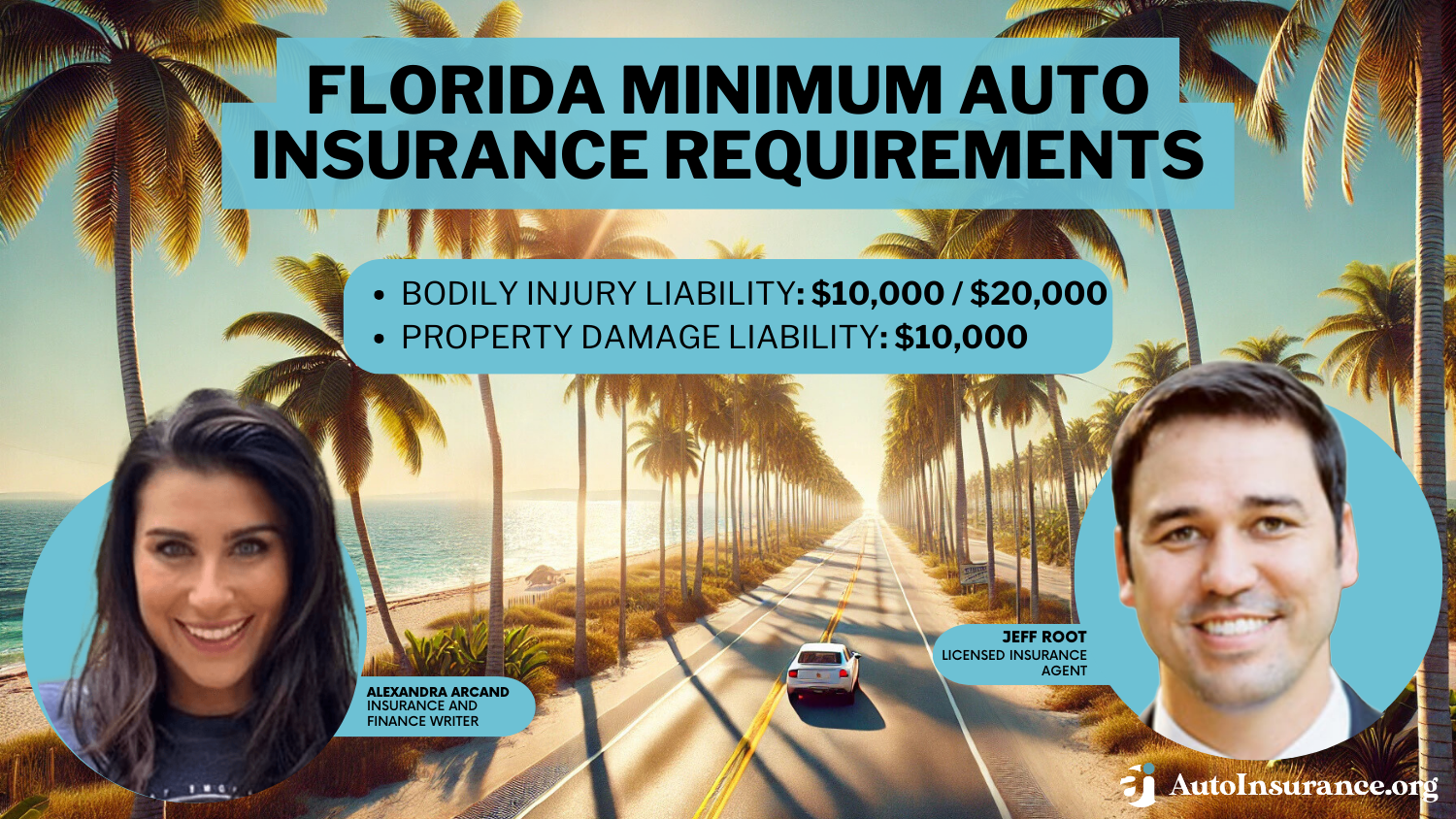

Florida minimum auto insurance requirements offer crucial protection for drivers, covering unexpected incidents on the road. Rates start at about $16 per month, and liability minimums are set at 10/20/10.

Auto insurance laws in Florida require every vehicle to have a valid policy, even if it’s inoperable. Proof of insurance from a licensed insurance company is required before registering a vehicle in Florida. You must surrender your license plate before canceling Florida insurance.

Florida Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $10,000 per person / $20,000 per accident |

| Property Damage Liability | $10,000 per accident |

Every driver in Florida must carry $10,000 in personal injury protection (PIP) and property damage liability (PDL) insurance. Bodily injury liability isn’t required unless you’re a high-risk driver with a history of accidents or DUIs.

Keep reading for Florida car insurance coverage recommendations and auto insurance rates from the most popular local companies. Enter your ZIP code to compare free quotes from top Florida auto insurance companies side-by-side.

- Florida liability insurance requirements are 10/20/10

- Florida minimum auto insurance rates start at $21per month

- Consider additional options to enhance protection beyond state minimums

Florida Minimum Coverage Requirements & What They Cover

Does Florida require car insurance? Yes, you must carry a minimum of $10,000 in coverage in both PIP and PDL to meet Florida minimum car insurance requirements:

- Personal Injury Protection (PIP)

- Property Damage Liability (PDL)

You may just want to get basic auto insurance in Florida if you don’t drive often and want to save money. But be aware that the Florida minimum insurance requirements are much lower than other states.

Liability Auto Insurance Requirements by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury & property damage liablity | 25/50/25 |

| Alaska | Bodily injury & property damage liablity | 50/100/25 |

| Arizona | Bodily injury & property damage liablity | 15/30/10 |

| Arkansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| California | Bodily injury & property damage liablity | 15/30/5 |

| Colorado | Bodily injury & property damage liablity | 25/50/15 |

| Connecticut | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Delaware | Bodily injury, property damage liablity, & personal injury protection | 25/50/10 |

| Florida | Property damage liablity, & personal injury protection | 10/20/10 |

| Georgia | Bodily injury & property damage liablity | 25/50/25 |

| Hawaii | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Idaho | Bodily injury & property damage liablity | 25/50/15 |

| Illinois | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Indiana | Bodily injury & property damage liablity | 25/50/25 |

| Iowa | Bodily injury & property damage liablity | 20/40/15 |

| Kansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| Kentucky | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury & property damage liablity | 15/30/25 |

| Maine | Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, & MedPay | 50/100/25 |

| Maryland | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury, property damage liablity, & personal injury protection | 20/40/5 |

| Michigan | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Minnesota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury & property damage liablity | 25/50/25 |

| Missouri | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/25 |

| Montana | Bodily injury & property damage liablity | 25/50/20 |

| Nebraska | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Nevada | Bodily injury & property damage liablity | 25/50/20 |

| New Hampshire | Financial responsibility (None required) | 25/50/25 |

| New Jersey | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury & property damage liablity | 25/50/10 |

| New York | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Ohio | Bodily injury & property damage liablity | 25/50/25 |

| Oklahoma | Bodily injury & property damage liablity | 25/50/25 |

| Oregon | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury, property damage liablity, & personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury & property damage liablity | 25/50/25 |

| South Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| South Dakota | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Tennessee | Bodily injury & property damage liablity | 25/50/15 |

| Texas | Bodily injury, property damage liablity, & personal injury protection | 30/60/25 |

| Utah | Bodily injury, property damage liablity, & personal injury protection | 25/65/15 |

| Vermont | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/10 |

| Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Washington | Bodily injury & property damage liablity | 25/50/10 |

| Washington, D.C. | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/10 |

| West Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury, property damage liablity, uninsured motorist, & MedPay | 25/50/10 |

| Wyoming | Bodily injury & property damage liablity | 25/50/20 |

If you have a history of car accidents, chances are you’ll have higher minimum requirements. The most common is the bodily injury liability (BIL) requirement in Florida.

You might see Florida liability requirements written as 10/20/10. This includes the BIL requirements. The 10/20/10 insurance in Florida refers to:

- $10,000 in BIL per driver

- $20,000 in BIL per accident

- $10,000 in PDL

When would you be required to have bodily injury liability insurance in Florida? Remember, the law only requires BIL for high-risk drivers. Otherwise, you carry 10/10 minimums for the $10,000 in PIP and PDL limits you must have.

Florida car insurance laws require continuous coverage. Even if your vehicle is inoperable, you must have an up-to-date insurance policy until you surrender the license plate.Travis Thompson Licensed Insurance Agent

Some drivers can opt out of coverage and choose to be self-insured instead. You must apply and qualify for self-insurance through the Department of Highway Safety and Motor Vehicles.

Read More: Best Property Damage Liability (PDL) Auto Insurance Companies

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Florida

Local traffic and weather risks impact Florida car insurance rates, and the level of coverage you carry significantly influences premium prices. For instance, Florida car lease insurance requirements often have higher limits, which raises rates.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

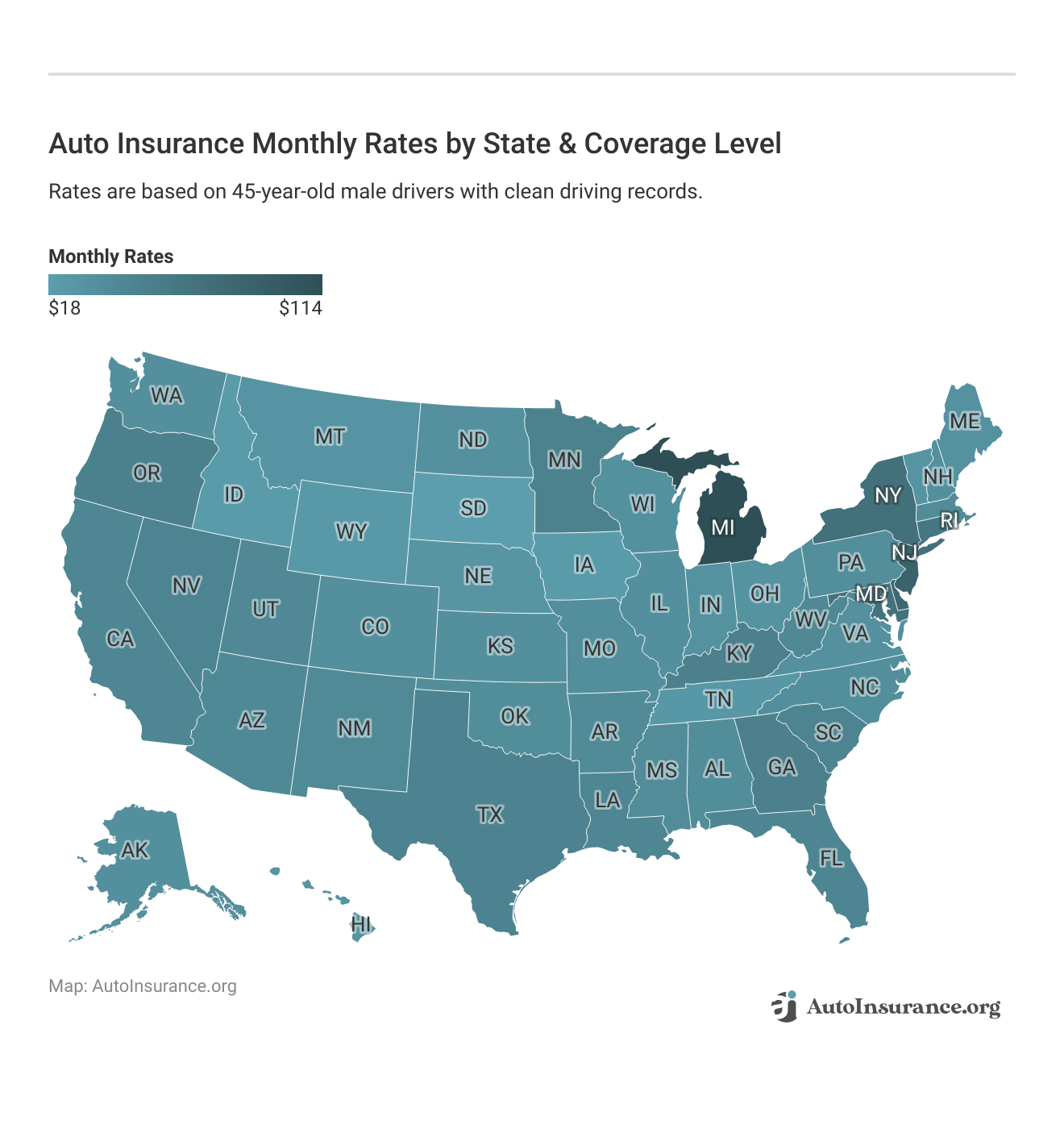

18,157 reviewsBuying only the Florida state minimum auto insurance limits is cheaper than full coverage but won’t provide as much protection. Full coverage includes the 10/10 PIP and PDL minimums plus comprehensive and collision insurance. Interact with the table below to see how Florida insurance costs differ from other states:

To explore how different providers, like USAA, handle these factors, check out our USAA auto insurance review. Scroll down to see how prices for minimum and full coverage auto insurance vary in Florida by company, age, and city.

Read More: Cheapest Car Insurance in Florida

Florida Auto Insurance Rates by Company

Geico and State Farm are the cheapest providers for Florida minimum insurance. USAA is the cheapest for military families.

Florida Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$82 $245

$102 $304

$40 $119

$72 $216

$55 $165

$46 $138

$69 $205

$44 $132

$75 $223

$21 $63

If you’re looking for a Florida auto insurance guide and recommendations, check out the best Florida auto insurance.

Florida Auto Insurance Rates by Age and Gender

Florida teen auto insurance is the most expensive, especially when you carry the recommended full coverage over the minimum requirements.

Monthly Florida Auto Insurance Rates by Age, Gender and Coverage Level

Age & Gender Minimum Coverage Full Coverage

Female (Age 16) $287 $1,001

Male (Age 16) $334 $747

Female (Age 20) $222 $616

Male (Age 20) $286 $756

Female (Age 30) $68 $78

Male (Age 30) $73 $218

Female (Age 40) $58 $156

Male (Age 40) $59 $260

Female (Age 50) $64 $192

Male (Age 50) $64 $190

Female (Age 60) $58 $202

Male (Age 60) $59 $199

Female (Age 70) $63 $202

Male (Age 70) $62 $199

Fortunately, rates start to get cheaper when Florida drivers turn 20. Teens can also lower their rates in the meantime by taking driver’s ed classes and earning good student auto insurance discounts.

Florida Auto Insurance Rates by City

Auto insurance costs in Florida vary widely by city. Click on your city below to compare local rates or enter your ZIP code to get real-time auto insurance quotes.

Monthly Auto Insurance Rates for Minimum Coverage in Florida by City

| City | Rates |

|---|---|

| Brandon | $88 |

| Cape Coral | $62 |

| Clearwater | $75 |

| Coral Springs | $88 |

| Davie | $83 |

| Fort Lauderdale | $84 |

| Gainesville | $55 |

| Hialeah | $115 |

| Hollywood | $88 |

| Jacksonville | $69 |

| Lakeland | $67 |

| Lehigh Acres | $67 |

| Miami | $99 |

| Miami Gardens | $95 |

| Miramar | $85 |

| Orlando | $74 |

| Palm Bay | $64 |

| Pembroke Pines | $81 |

| Pompano Beach | $89 |

| Port St. Lucie | $69 |

| Spring Hill | $71 |

| St. Petersburg | $78 |

| Tallahassee | $56 |

| Tampa | $93 |

| West Palm Beach | $96 |

Coastal cities like Miami, Fort Lauderdale, and Tampa have some of the highest rates due to the increased risk of weather events. Learn more about auto insurance companies pulling out of Florida and how it affects your coverage.

Penalties for Driving Without Insurance in FL

What happens if auto insurance lapses in Florida? Driving without car insurance can result in several penalties, including fines:

- Fines: Fines range from $150 to $500, depending on the number of offenses.

- Reinstatement Fees: The fee is $150 for the first offense, $250 for the second, and $500 for subsequent offenses within three years.

- License Suspension: Your driver’s license, vehicle registration, and license plates will be suspended until you provide proof of insurance.

The DMV will not provide a provisional license for insurance-related infractions, but it may require you to file an SR-22 auto insurance form. And once your license is reinstated, your insurance premiums are likely to increase due to the lapse in coverage.

Read More: How to Manage Your Auto Insurance Policy

Additional Coverage Options in Florida

While Florida’s minimum auto insurance requirements may seem sufficient, they often leave drivers exposed to significant financial risks. To enhance your protection, consider these coverage options:

- Comprehensive and Collision Insurance: This type of coverage protects your vehicle from damage due to accidents, theft, or natural disasters. Comprehensive insurance covers non-collision incidents, while collision insurance pays for damages resulting from accidents.

- Bodily Injury Liability (BIL): Although not required for all drivers, carrying BIL can help cover medical expenses and legal costs if you are found responsible for injuries in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who lacks adequate insurance. It can help cover medical bills and damages that exceed the at-fault driver’s policy limits.

- Medical Payments Coverage (MedPay): MedPay can help cover medical expenses for you and your passengers, regardless of fault, making it a valuable addition to your policy.

Exploring these options can provide peace of mind and greater financial security while on the road. Choosing the cheapest companies for your auto insurance can significantly reduce your overall costs, but it’s essential to balance affordability with adequate coverage.

By comparing quotes from various companies, you can find a policy that fits your budget without sacrificing necessary coverage, ensuring you’re well protected against unexpected incidents.

Understanding Florida Auto Insurance

What is the minimum auto insurance required in Florida? Individual drivers must carry personal injury protection (PIP) to pay for their medical costs after an accident.

The PIP car insurance requirements in Florida are designed to cover 80% of these costs, while the other required policies cover damages you cause in a collision.

Here is a complete list of Florida minimum requirements for auto insurance:

- PIP Insurance: Covers a portion of medical bills and emergency treatment for you and your passengers if you suffer an injury in the crash

- PDL Insurance: Pays for property damage you cause in an auto accident or collision. Does not protect your personal vehicle.

- BIL Insurance: Covers medical bills for any injury you cause to other drivers and passengers in a collision.

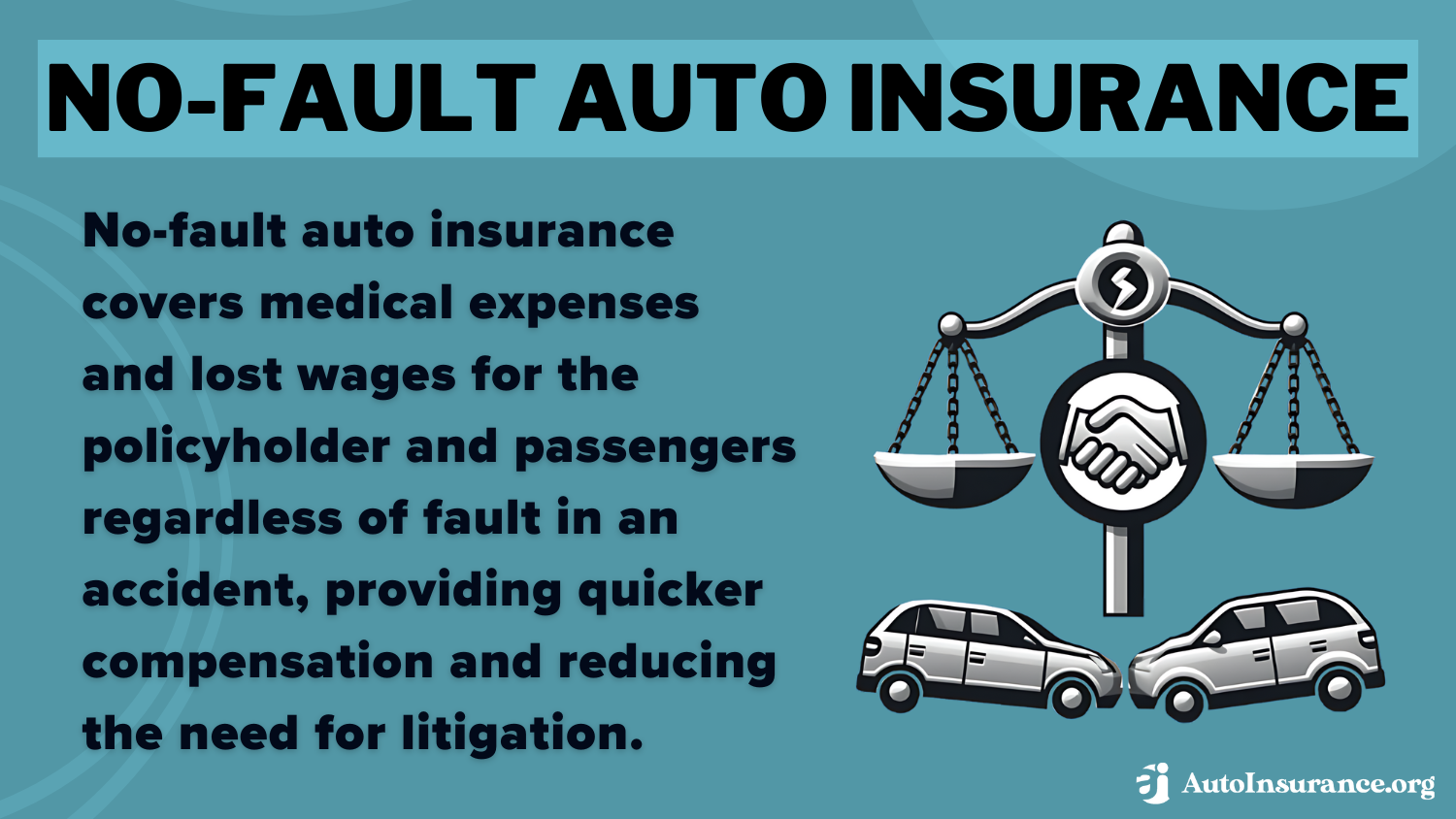

Florida is a no-fault insurance state. This means each driver is responsible for their own injuries and property damage no matter who or what caused the collision.

However, if injuries are severe and medical expenses exceed PIP limits, the injured driver may still pursue legal action against the at-fault driver.

Read more: Cheap No-Fault Auto Insurance

Full Coverage vs. Minimum Florida Auto Insurance

The minimum Florida auto insurance coverage protects you from out-of-pocket costs for damage you cause, but it doesn’t cover your vehicle. The recommended car insurance coverage in Florida is comprehensive and collision auto insurance.

Minimum insurance requirements for a financed car in Florida will often include comprehensive and collision coverage, also known as a full coverage policy.Leslie Kasperowicz Former Farmers Insurance CSR

Taxis and leased vehicles also require full coverage, and you need higher policy limits — 125/250/50 compared to the 10/10 state minimum for car insurance in Florida. Use our guide to find the best auto insurance for leased vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

FL Auto Insurance Laws: New in the State

Current Florida law requires 10/10 in personal injury and property damage protection, although state representatives have tried to pass different legislation aimed at overhauling auto insurance requirements in Florida.

Most recently, SB54 tried to eliminate the no-fault system and replace PIP and PDL insurance in Florida with traditional 25/50/10 liability limits.

Florida car insurance premiums expected to rise again in 2024 https://t.co/BNdzUJP1Jo

— WPTV (@WPTV) February 29, 2024

If the bill had passed, the new Florida car insurance laws would have also included a mandatory $5,000 in medical payments coverage (MedPay). However, Governor DeSantis vetoed the new law in 2022 worrying it would increase Florida required auto insurance costs and lead to more uninsured drivers.

Essential Insights on FL Auto Insurance Requirements

What is the minimum auto insurance coverage in Florida? Florida minimum auto insurance requirements are low — only $10,000 in PIP insurance and property damage liability.

Drivers with high-risk auto insurance may need to carry additional bodily injury liability, but the policy still won’t pay to repair your own vehicle.

The opportunity always exists for you to take a step back, analyze your current policy, and assess if it meets your needs. If you want to go beyond the Florida basic insurance requirements and find better coverage, compare Florida auto insurance rates by ZIP code to see policies from multiple local companies.

Frequently Asked Questions

What is the minimum amount of car insurance allowed in Florida?

The minimum auto insurance in Florida is $10,000 in personal injury protection (PIP) and property damage liability (PDL) insurance.

Do Florida car insurance minimums provide sufficient coverage?

Florida minimum auto insurance limits may not provide adequate coverage in more severe accidents. It is advisable to consider higher coverage limits to protect your assets and provide better financial protection.

Can I rely solely on the minimum auto insurance coverage in Florida?

While meeting the minimum car insurance requirements in Florida is legally necessary, it may not provide sufficient coverage for all situations. Additional coverage options, such as bodily injury liability, full coverage, and uninsured motorist protection (UM/UIM) are worth considering to enhance your financial protection.

Do you have to have full coverage on a car in Florida?

What is full coverage in Florida? Full coverage (which includes comprehensive and collision auto insurance) is not legally required by Florida insurance laws but may be required by lenders if you finance or lease your vehicle.

What are the potential consequences of not meeting Florida insurance requirements?

Failure to have the state minimum insurance in Florida can result in penalties, such as fines, suspension of your driver’s license, and registration revocation for your vehicle.

What is the recommended auto insurance coverage in Florida?

While you only need $10,000 in PDL and PIP insurance in Florida, it’s recommended to have higher limits such as:

- $100,000/$300,000 for bodily injury liability

- $50,000 for property damage liability

- Uninsured/underinsured motorist coverage

- Comprehensive and collision coverage

Is auto insurance mandatory in Florida?

Minimum car insurance coverage in Florida is mandatory. Enter your ZIP code to find an affordable policy today.

What auto coverage is 10/10 in Florida?

The “10/10” coverage refers to the minimum $10,000 policy limit for PDL and PIP car insurance in Florida.

What minimum auto insurance is required in Florida?

PIP and PDL insurance are the minimum insurance required in Florida. State law requires additional bodily injury liability (BIL) auto insurance for high-risk drivers.

Do I need 100/300 auto insurance in Florida?

The 100/300 in insurance refers to higher limits of liability, such as $100,000 per person and $300,000 per accident for bodily injury. While not required by law, these limits are recommended for better protection.

Can you have a car without insurance in Florida?

Why is Florida car insurance so expensive?

How much is car insurance in Florida?

How does car insurance work in Florida?

Who has the cheapest car insurance in Florida?

What are Florida’s DUI insurance requirements?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.