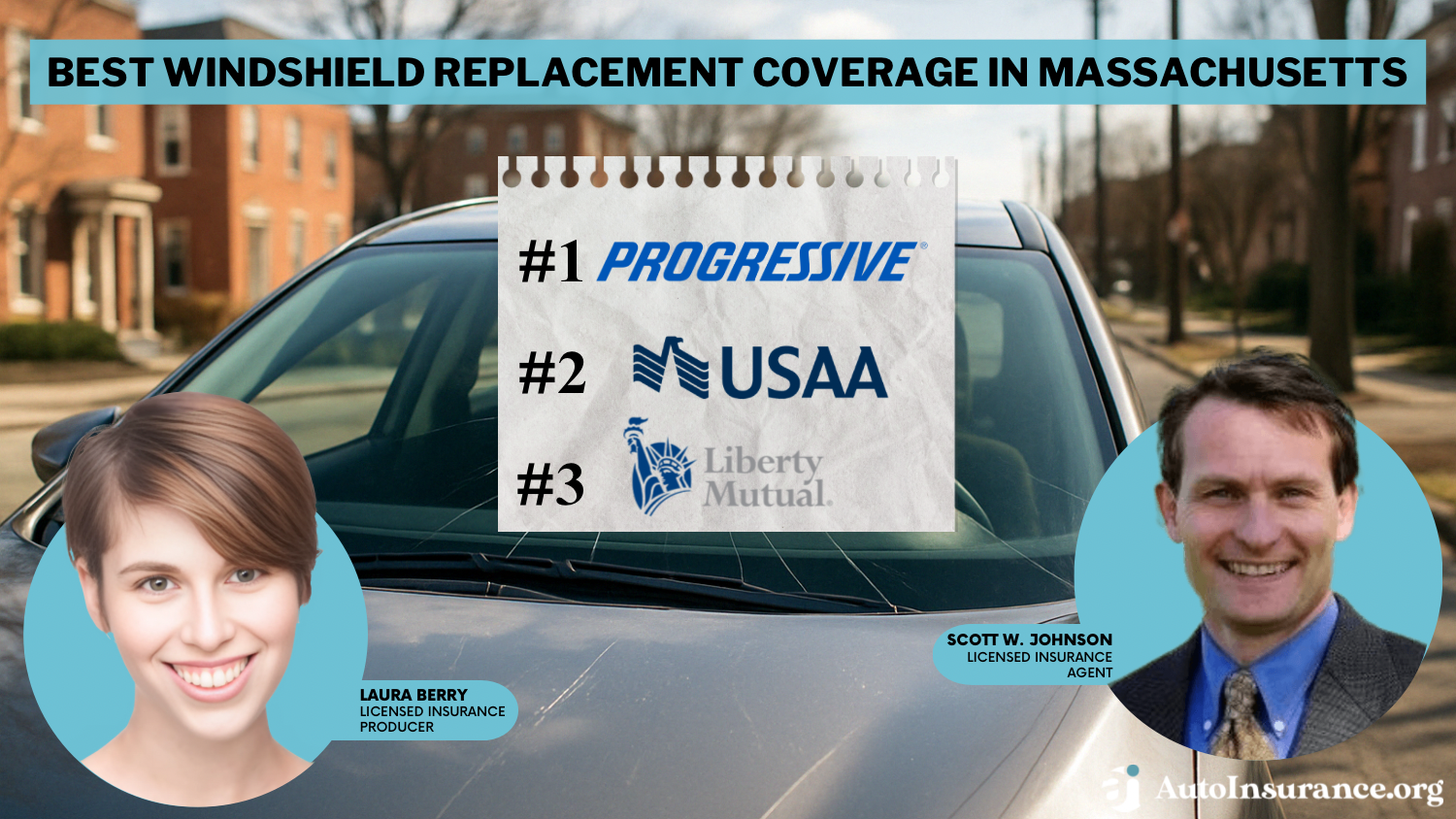

Best Windshield Replacement Coverage in Massachusetts (Top 10 Companies in 2026)

Progressive, USAA, and Liberty Mutual provide the best windshield replacement coverage in Massachusetts, beginning at just $70 monthly. Our goal is to assist you in comparing quotes from these insurers, ensuring you obtain the best coverage and customized discounts suited to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated April 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage Windshield Replacement in Massachusetts

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage Windshield Replacement in Massachusetts

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage Windshield Replacement in Massachusetts

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews- Progressive offers budget-friendly rates starting at $136 per month

- Top insurance companies provide a variety of options for windshield replacements

- Numerous discounts are available for windshield replacement coverage

#1 – Progressive: Top Overall Pick

Pros

- Comprehensive Coverage Options: Progressive offers a wide range of coverage options beyond just windshield replacement, providing customers with flexibility to tailor their policies according to their needs.

- User-Friendly Technology: In our Progressive auto insurance review, Progressive’s mobile app and online tools make it easy for customers to manage their policies, file claims, and access resources conveniently.

- Competitive Rates: Progressive is known for offering competitive rates, making it an attractive option for cost-conscious customers seeking value in their insurance coverage.

Cons

- Limited Availability: Progressive’s coverage may not be available in all areas, potentially limiting options for customers in certain regions.

- Mixed Customer Service Reviews: While Progressive offers extensive online resources, some customers have reported mixed experiences with their customer service, particularly in handling complex claims or inquiries.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Exceptional Customer Service: USAA consistently receives high ratings for its customer service, providing personalized assistance and support to its members. Read more through our USAA auto insurance review.

- Exclusive Membership Benefits: USAA offers a range of financial products and services beyond insurance, including banking and investment options, exclusively to its members.

- Strong Financial Stability: USAA’s strong financial stability and reliability provide peace of mind to customers, knowing that their insurance provider is well-equipped to handle claims and payouts.

Cons

- Membership Limitations: USAA membership is restricted to military personnel, veterans, and their families, limiting eligibility for those outside of these groups.

- Limited Physical Presence: USAA primarily operates online and through phone-based services, which may be less convenient for customers who prefer in-person interactions or local agents.

#3 – Liberty Mutual: Best for Flexible Options

Pros

- Customizable Coverage Options: Liberty Mutual offers a variety of coverage options and discounts, allowing customers to tailor their policies to fit their specific needs and budget.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance, providing potential savings for customers who consolidate their coverage.

- Strong Financial Standing: Liberty Mutual is a financially stable insurance provider with a long history, instilling confidence in customers regarding the company’s ability to fulfill its obligations. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Pricing Transparency: Some customers have reported challenges in understanding Liberty Mutual’s pricing structure and policies, leading to confusion or dissatisfaction.

- Claims Process Length: In some cases, customers have experienced delays or extended wait times during the claims process with Liberty Mutual, which may impact satisfaction levels.

#4 – Allstate: Best for Comprehensive Plans

Pros

- Wide Range of Coverage Options: Allstate offers a variety of coverage options, including comprehensive plans that provide extensive protection for drivers and their vehicles.

- Innovative Technology: Allstate’s mobile app and online tools provide customers with convenient ways to manage their policies, file claims, and access support resources.

- Local Agent Network: Allstate has a vast network of local agents who can provide personalized assistance and guidance to customers, offering a human touch to the insurance experience.

Cons

- Premium Costs: Allstate’s premiums may be higher compared to some other providers, potentially making it less affordable for budget-conscious customers. Use our Allstate auto insurance review as your guide.

- Claims Satisfaction: While Allstate generally provides efficient claims processing, some customers have reported issues with claim denials or disputes, leading to dissatisfaction with the claims experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Trusted Provider

Pros

- Trusted Provider: State Farm is one of the largest and most reputable insurance companies in the United States, known for its reliability and financial stability.

- Personalized Service: State Farm agents offer personalized service and assistance to customers, helping them find the right coverage options and discounts to suit their individual needs.

- Comprehensive Coverage: State Farm offers a wide range of coverage options, including comprehensive plans that provide extensive protection for drivers, vehicles, and property.

Cons

- Limited Discounts: State Farm may offer fewer discounts compared to some other providers, potentially limiting opportunities for customers to save on their premiums.

- Claims Process Complexity: Some customers have reported challenges navigating the claims process with State Farm, citing issues with documentation requirements or communication delays. Find out more in our State Farm auto insurance review.

#6 – Amica: Best for Personalized Service

Pros

- Exceptional Customer Service: Amica Mutual consistently receives high ratings for its customer service, providing responsive support and assistance to policyholders.

- Financial Stability: Amica Mutual is a financially stable insurance provider with a long history of reliability and strong financial performance.

- Discount Opportunities: Amica Mutual offers various discounts, including loyalty discounts for long-term customers and bundling discounts for combining multiple policies.

Cons

- Limited Availability: Amica Mutual may have limited availability in certain regions, potentially restricting options for customers outside of its service area. Read more through our Amica auto insurance review.

- Online Service Limitations: While Amica Mutual offers online account management tools, some customers have reported limitations in functionality or ease of use compared to other providers’ platforms.

#7 – Nationwide: Best for Nationwide Coverage

Pros

- Wide Range of Coverage Options: Nationwide offers a diverse selection of coverage options, including specialized plans for various types of vehicles and drivers.

- Member Benefits: Nationwide offers membership benefits and discounts through its affinity programs, providing additional value to policyholders. Read more through our Nationwide auto insurance review.

- Strong Financial Stability: Nationwide is a financially stable insurance provider with a solid reputation for reliability and claims handling.

Cons

- Limited Local Agents: Nationwide’s local agent network may be less extensive compared to some other providers, potentially affecting accessibility for customers who prefer in-person assistance.

- Claims Process Efficiency: While Nationwide generally provides efficient claims processing, some customers have reported occasional delays or communication issues during the claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Our Travelers auto insurance review reveals that Travelers offers competitive rates and discounts, making it an attractive option for customers seeking affordable coverage.

- Flexible Coverage Options: Travelers provides flexible coverage options, allowing customers to customize their policies to meet their specific needs and budget.

- Strong Financial Standing: Travelers is a financially stable insurance provider with a solid track record of financial strength and stability.

Cons

- Limited Availability: Travelers’ coverage may not be available in all areas, potentially limiting options for customers in certain regions.

- Customer Service Reviews: While Travelers offers online and phone-based support, some customers have reported mixed experiences with customer service, particularly in handling complex inquiries or issues.

#9 – Farmers: Best for Customizable Policies

Pros

- Extensive Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, offers a wide range of coverage options, including specialized plans for different types of vehicles and drivers.

- Discount Opportunities: Farmers provides various discounts, including multi-policy discounts and safe driver discounts, helping customers save on their premiums.

- Local Agent Network: Farmers has a vast network of local agents who can provide personalized assistance and guidance to customers, offering a human touch to the insurance experience.

Cons

- Premium Costs: Farmers’ premiums may be higher compared to some other providers, potentially making it less affordable for budget-conscious customers.

- Claims Process Length: Some customers have reported delays or extended wait times during the claims process with Farmers, which may impact satisfaction levels.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers extensive roadside assistance coverage as part of its insurance policies, providing peace of mind to drivers in case of emergencies. Read more through our AAA auto insurance review.

- Member Benefits: AAA members can access a range of additional benefits and discounts beyond insurance, including travel services and discounts on various products and services.

- Local Presence: AAA has a strong local presence with numerous branches and service centers, making it convenient for customers to access support and assistance.

Cons

- Membership Costs: AAA membership fees may add to the overall cost of insurance, potentially making it less competitive compared to providers that do not require membership.

- Claims Process Complexity: Some customers have reported challenges navigating the claims process with AAA, citing issues with documentation requirements or communication delays.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Massachusetts Windshield Replacement Insurance Requirements

Purchasing a Comprehensive Policy for Glass Coverage in Massachusetts

Choosing Your Own Glass Repair Shop

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Massachusetts Windshield Replacement Insurance: The Bottom Line

Frequently Asked Questions

Does auto insurance in Massachusetts cover windshield replacement?

Yes, auto insurance in Massachusetts often covers windshield replacement under certain conditions. Comprehensive coverage, which is an optional coverage, typically includes windshield replacement as part of its coverage. However, it’s important to review your specific policy to understand the terms, conditions, and deductible associated with windshield replacement.

What is comprehensive coverage in auto insurance?

Comprehensive coverage is an optional coverage in auto insurance that helps protect your vehicle against damage that is not caused by a collision with another vehicle. It typically covers incidents such as theft, vandalism, fire, falling objects, and certain types of natural disasters. In many cases, comprehensive coverage also includes windshield replacement if the damage is due to non-collision incidents. Enter your ZIP code now to begin.

Do I need comprehensive coverage to have windshield replacement coverage in Massachusetts?

Yes, in most cases, you need to have comprehensive coverage in your auto insurance policy to have windshield replacement coverage in Massachusetts. Comprehensive coverage is the specific coverage that typically includes windshield replacement for non-collision damage. If you only have liability auto insurance coverage or a basic policy, it may not include windshield replacement coverage.

What factors should I consider when making a windshield replacement claim in Massachusetts?

When making a windshield replacement claim in Massachusetts, consider the following factors:

- Deductible: Check your policy to see if you have a deductible for comprehensive coverage. You will usually be responsible for paying this amount before the insurance coverage kicks in.

- Repair or Replacement: Determine if the damage to your windshield requires repair or full replacement. Insurance coverage may vary depending on the severity of the damage.

- Preferred Providers: Check if your insurance company has a list of preferred providers for windshield replacement. Using a preferred provider may simplify the claims process and ensure quality service.

- Claim Process: Contact your insurance company to initiate the claim. They will guide you through the necessary steps, which may involve providing documentation, photos, or arranging an inspection.

- Coverage Limits: Review your policy to understand any limits or exclusions that may apply to windshield replacement coverage. Ensure that the cost of the replacement falls within the coverage limits.

Use above information for your windshield replacement claim.

Will filing a windshield replacement claim affect my insurance rates in Massachusetts?

Filing a windshield replacement claim in Massachusetts does not typically affect your insurance rates. Windshield replacement claims are often considered “no-fault” claims and may not result in premium increases. However, it’s advisable to check with your insurance provider to understand their specific policies and any potential impacts on your rates. Enter your ZIP code now.

Are there any limitations or exclusions to windshield replacement coverage in Massachusetts?

What are the legal requirements for windshield replacement coverage in Massachusetts?

The legal requirements for windshield replacement coverage in Massachusetts include offering glass replacement coverage with a $0 or $100 deductible, making windshield repairs more affordable. Although not mandatory, this coverage is beneficial as windshield replacements can be costly, and compliance ensures drivers can promptly address windshield damage, reducing the risk of further issues.

How do Massachusetts insurance companies typically offer glass replacement coverage?

Massachusetts insurance companies typically offer glass replacement coverage as part of comprehensive auto insurance policies. This coverage can be purchased with a collision or liability policy or as a standalone policy. The state mandates OEM glass for newer, low-mileage vehicles, while older vehicles can use aftermarket or used glass, though there may be additional costs for OEM glass. Enter your ZIP code now to start.

What factors should drivers consider when making a windshield replacement claim in Massachusetts?

When making a windshield replacement claim in any types of auto insurance in Massachusetts, drivers should consider factors such as whether their insurance policy includes comprehensive coverage, the deductible amount, and whether they can choose their own repair shop. Additionally, drivers should be aware of any limitations or exclusions to their coverage and how filing a claim may impact their insurance rates.

What are some limitations or exclusions to windshield replacement coverage in Massachusetts?

Some limitations or exclusions to windshield replacement coverage in Massachusetts may include restrictions on the number of claims allowed within a specific time frame, limitations on the type of damage covered, and requirements for using preferred repair facilities. It’s essential for drivers to review their policy documentation or contact their insurance provider to understand any specific limitations or exclusions that may apply to their coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.