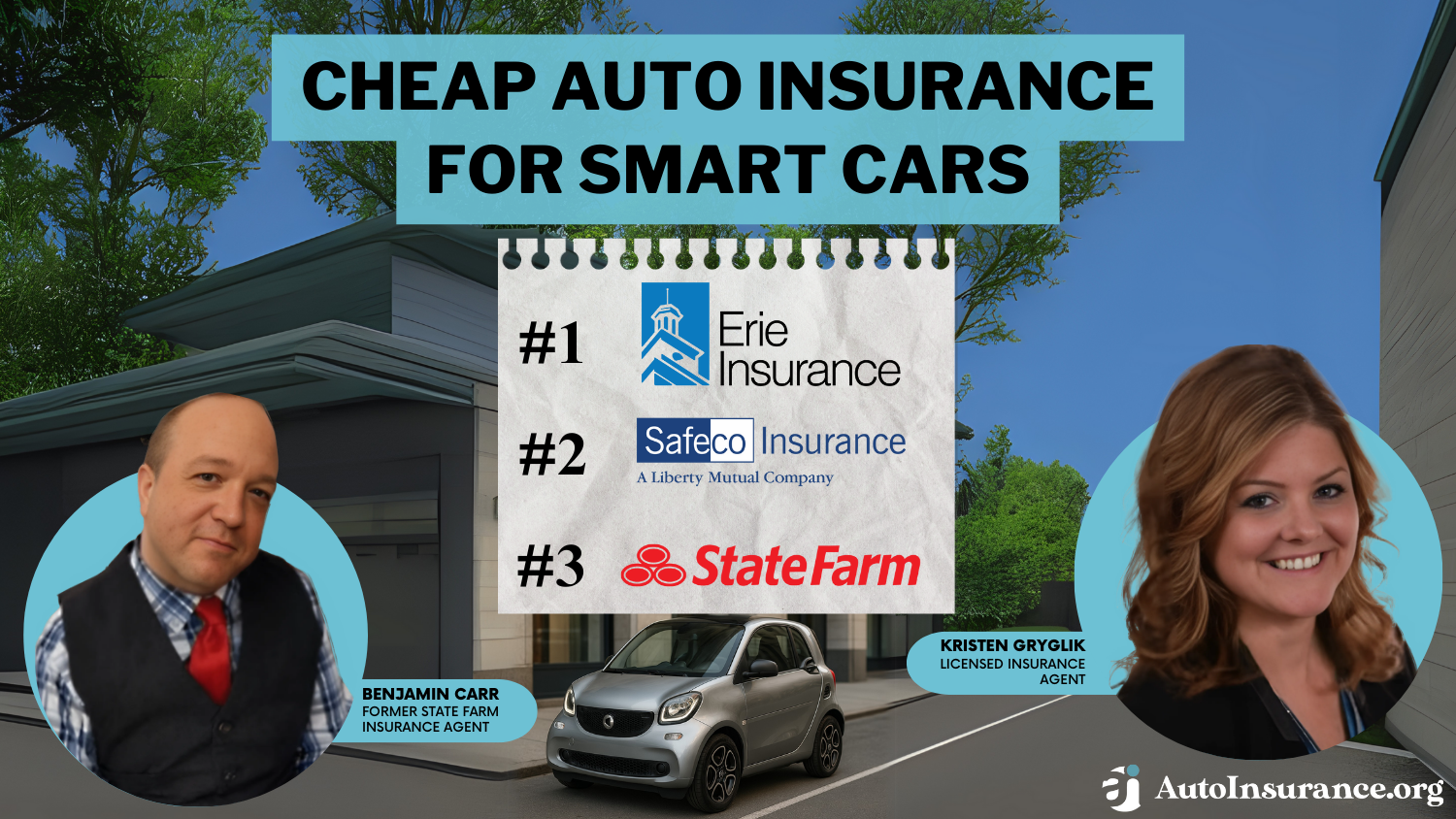

Cheap Auto Insurance for Smart Cars in 2025 (Your Guide to the Top 10 Providers)

The top picks for cheap auto insurance for smart cars are Erie, Safeco, and State Farm, with rates starting at $40/mo, ensuring affordability, compliance with state laws, and protection. Below, you can compare discounts, coverages, and the cost of insurance on smart cars from top providers near you.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated June 2025

Company Facts

Min. Coverage for Smart Cars

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Smart Cars

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Smart Cars

A.M. Best

Complaint Level

Pros & Cons

Erie, Safeco, and State Farm are the top providers of cheap auto insurance for smart cars.

Smart car insurance premiums remain low thanks to their affordability and impressive safety ratings. With rates under $100, top providers options offer financial security and peace of mind for smart car owners, ensuring they meet state requirements without breaking the bank.

Our Top 10 Company Picks: Cheap Auto Insurance for Smart Cars

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A+ Customer Service Erie

#2 $27 A++ Extensive Discounts Safeco

#3 $33 B Coverage Options State Farm

#4 $37 A+ Budgeting Tools Travelers

#5 $39 A Loyalty Discounts Progressive

#6 $43 A+ Accident Forgiveness American Family

#7 $44 A Customizable Policies Nationwide

#8 $53 A Customizable Policies Farmers

#9 $61 A+ Customized Policies Allstate

#10 $68 A 24/7 Support Liberty Mutual

We’ll explore the factors influencing smart car insurance costs and find the right types of auto insurance coverage for your needs.

Compare smart car insurance costs from leading insurers by entering your ZIP code above.

- Erie Insurance, Safeco and State Farm offer cheap smart car auto insurance

- Ensure you get access to cheap auto insurance for smart cars by comparing quotes

- Consider discounts to get even further savings on your smart car auto insurance

#1 – Erie Insurance: Top Overall Pick

Pros

- Superior Financial Strength: Erie has been in business for over 90 years and is rated highly by AM Best.

- Lots of Discounts: Erie offers many ways to save money on smart car insurance costs, like discounts for having multiple policies or driving safely. Check out our review of Erie auto insurance to review available discounts.

- High Quality Customer Service: Many customers say Erie handles claims quickly and has helpful staff.

Cons

- Limited Availability: Erie only operates in 12 states, mostly in the Northeast and Midwest.

- Higher Prices for Risky Drivers: Erie might charge more if you’ve had accidents or tickets in the past.

#2 – Safeco: Best for Extra Features

Pros

- Multiple Perks Available: As an incentive to being a policyholder, Safeco offers a few different perks, including Accident forgiveness, diminishing deductible and claims-free cash back.

- Divers Add-On Options: Beyond basic auto insurance coverage for smart cars, Safeco offers multiple add-ons for even further protection.

- Safeco RightTrack Program: Enrolling in Safeco’s RightTrack program saves drivers up to 25% on insurance by tracking driving habits. You can learn more about this UBI program in our Safeco auto insurance review.

Cons

- Limited Discount Options: Compared to other auto insurance providers, Safeco only offers a handful of discount options to drivers.

- Online Quotes Unavailable: To get a quote from Safeco, you have to work with an agent.

#3 – State Farm: Best for Mobile App

Pros

- Favorable Reputation: State Farm auto insurance stands out for its top ratings in customer service, claims processing and coverage quality.

- User-Friendly Mobile App: The State Farm app makes tasks like filing claims, making payments, and policy tracking simple and convenient.

- Variety of Coverage Options: State Farm offers insurance tailored to your needs, from state minimums to full coverage. A full list of coverage options is available in our State Farm Auto Insurance Review.

- Personal Price Plan: Customers can quickly and easily customize coverage to ensure an affordable price that aligns with their budget.

Cons

- Lack of Add-Ons: State Farm doesn’t offer new vehicle replacement, vanishing deductibles or accident forgiveness.

- High Rates for Drivers with Poor Credit: Smart car drivers with poor will likely see high rates.

#4 – Travelers: Best for Accident Forgiveness

Pros

- Responsible Driver Program: Travelers’ Responsible Driver plan prevents rate hikes following your first accident or traffic offense, offering potential long-term advantages for smart car drivers despite the additional expense.

- Diverse Coverage Options: Travelers provides basic insurance along with additional options like gap and rental coverage. Additional details on coverage options are available in our Travelers auto insurance review.

- Multiple Discount Options: Travelers offers discounts for safe driving, bundling policies, owning hybrid/electric cars and more.

- Accident Forgiveness: If eligible, your rate stays stable after the first accident.

Cons

- Varied Customer Feedback: While many customers are happy, some complain about the claims process and quality of the customer service.

- Possible Rate Increase: If drivers perform poorly on the app while enrolled in Travelers IntelliDrive, this could result in higher rates.

#5 – Progressive: Best for Budget-Friendly Coverage

Pros

- Budget-Friendly Options: Use Progressive’s Name Your Price tool to find coverage for your smart car within your monthly budget.

- Drive Safe, Save More: Progressive offers Snapshot, a program where safe drivers can save money.

- Affordable Rates for Risky Drivers: Progressive provides low rates for high-risk drivers seeking savings.

- Loyalty Rewards: Enjoy increasing discounts based on how long you’ve been a Progressive policyholder. Explore more discounts in our Progressive auto insurance review.

Cons

- Significant Rate Hikes After Accidents: Progressive may impose large rate increases following at-fault accidents.

- Snapshot Risk: Participation in Snapshot could lead to rate increases if driving habits aren’t safe.

#6 – American Family: Best for Bundling

Pros

- Bundle and Save: Get discounts by combining your auto policy with other American Family products.

- KnowYourDrive program: Safe drivers can earn up to 30% off with American Family’s KnowYourDrive program.

- Great Customer Service: American Family is known for its top-notch customer service.

Cons

- Coverage Not Available Nationwide: American Family operates in only 19 states. Take a look at our review of American Family auto insurance to see if coverage is available in your area.

- Limited Online Tools: American Family relies more on agents and lacks some online features found with other insurers.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- On Your Side Review: Nationwide offers annual evaluations through their On Your Side review to ensure you’re not overpaying for coverage.

- Vanishing Deductible: Reduce your deductible by $100 each year with Nationwide’s Vanishing Deductible program. Explore other available add-ons in our review of Nationwide auto insurance.

- Pay-Per Mile: Drivers who don’t get behind the wheel often may benefits from the pay-per mile coverage option.

- Highly rated: Nationwide holds an A+ (superior) financial strength rating from A.M. Best.

Cons

- Limited Availability: Nationwide doesn’t offer coverage in every state.

- High Accident Rates: If you have an accident on your driving record, premiums can be high.

#8 – Farmers: Best for Customizable Coverage

Pros

- Signal App: Smart cars drivers can utilize the Signal app to join their UBI program and save up to 20% on your insurance.

- Wide Array of Discounts: Farmers boasts an impressive selection of 23 discounts, catering to nearly every driver’s needs.

- Extensive Coverage Options: Farmers offers various optional coverages like customized equipment insurance, enhancing your protection.

Cons

- Customer Retention Challenges: Despite its comprehensive coverage, Farmers faces difficulties retaining customers. See what customers are saying in our Farmers auto insurance review.

- Coverage Not Available in Certain States: Farmer’s auto insurance coverage is not available in Alaska, Hawaii, Delaware, New Hampshire, Maine, Rhode Island, West Virginia, Vermont, and Washington D.C.

#9 – Allstate: Best for UBI Discount

Pros

- Customizable Coverage: Allstate offers numerous options for tailoring your coverage. Read our review on Allstate auto insurance to learn about available coverage options.

- Drivewise: By using Drivewise, you could save up to 40% on your insurance.

- Extensive Agent Network: Allstate boasts one of the nation’s largest networks of local agents, ensuring easy access to assistance.

Cons

- Higher Rates: Allstate’s premiums tend to be pricier compared to competitors.

- Subpar Customer Ratings: Despite its size, Allstate receives below-average ratings in customer reviews.

#10 – Liberty Mutual: Alternative Energy Discount

Pros

- Unique Coverage Options: Liberty Mutual offers a variety of ways to customize your coverage, including better car replacement and original parts replacement. We explore coverage options in our Liberty Mutual auto insurance review.

- Excellent Discounts: Liberty Mutual offers 17 ways to save on your insurance, including a hard-to-find alternative energy discount.

- Easy-to-Use Website: Many customers praise Liberty Mutual for making it easy and convenient to manage their policies online.

- Wide Availability: Liberty Mutual offers auto insurance in every state and Washington, D.C.

Cons

- Average Customer Service: Liberty Mutual’s customer reviews are mixed, with some complaining about their experiences with representatives.

- Expensive for High-Risk Drivers: Coverage for high-risk drivers is likely find cheaper with another company.

Consider factors like coverage options, customer service and discounts when selecting your insurer. Making the right choice ensures you get the best protection at an affordable price, tailored to your needs.Daniel Walker Licensed Auto Insurance Agent

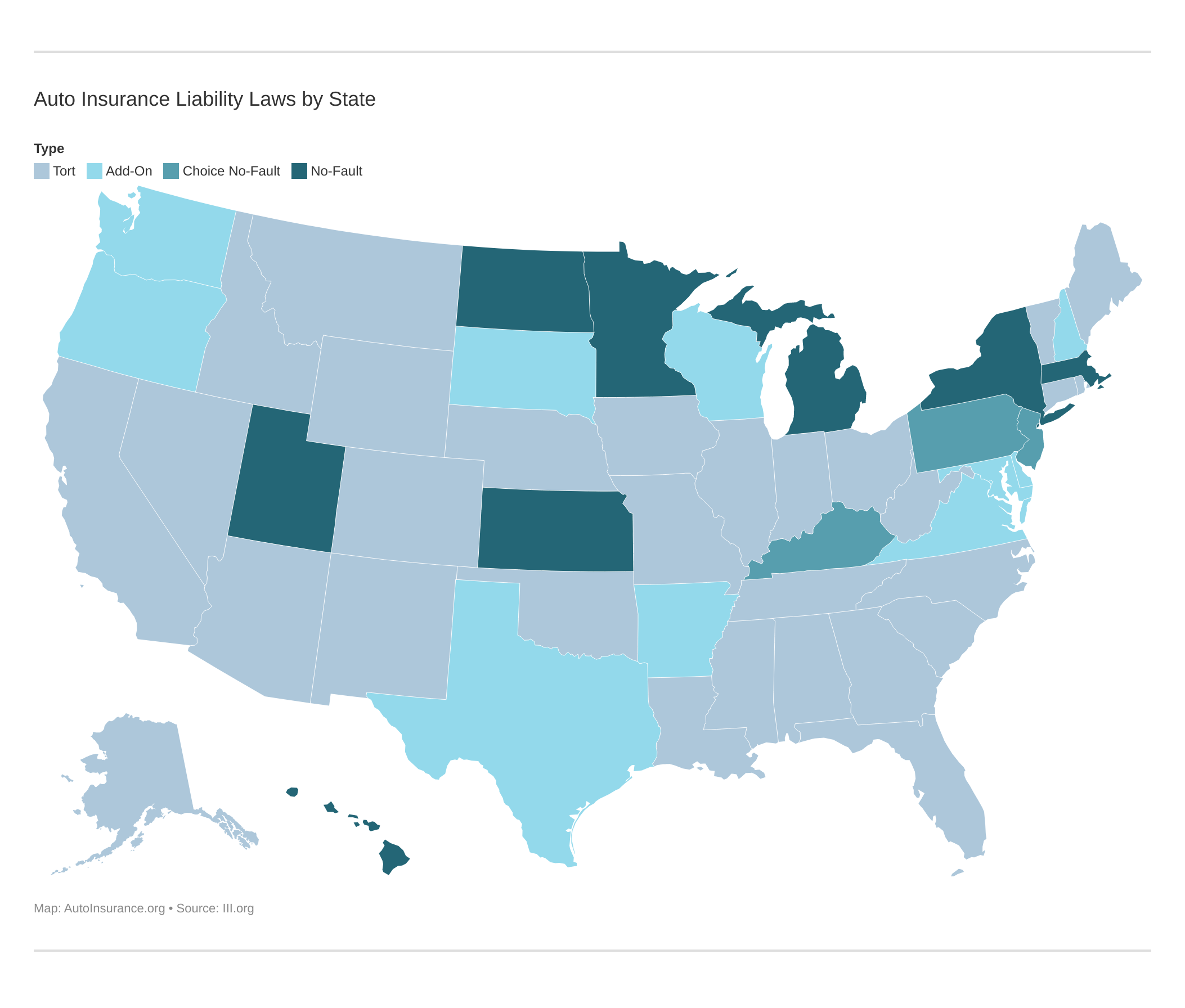

Best Smart Car Auto Insurance Options

In all states, drivers are required to take financial responsibility for damages they cause to others while driving a car, and this includes driving a Smart car. To ensure compliance with this law, many states require drivers to purchase liability auto insurance. Liability coverage pays for car repairs, medical bills, and other accident-related expenses if you are at fault.

Liability car insurance does not pay for any of your own vehicle’s repair bills or for your own other accident-related expenses.

Collision insurance can be purchased as optional coverage to pay for your expenses if you are involved in an accident. If you want even more coverage for weather-related damage, fire, theft, and other types of damaging events, you will need to purchase comprehensive insurance.

There are other optional types of auto insurance coverage to consider when buying a car insurance policy for your Smart car. For example, towing coverage pays for any towing expenses you incur as a result of a breakdown or accident up to the limits of your coverage.

Rental car insurance may pay for you to rent a car when your own vehicle is being repaired up to a certain dollar limit or for a specified number of days per claim.

You can also buy coverage for personal property losses, personal injury losses, and more. Your insurance agent or representative can help you to learn more about the different types of coverage available for your Smart car.

Determining How Smart Car Features Affect Insurance Costs

Many factors determine the cost of your auto insurance policy. Take a look at the table below to see what factors impact your Smart insurance costs:

Factors That Affect Usage-Based Auto Insurance Discounts| Factor | Rate Impact |

|---|---|

| Accidents Near Home | Most accidents occur close to home, potentially raising rates. |

| Cellphone Use While Driving | Significantly increases accident risk, which affects rates. |

| Driving Behavior | Rushed driving increases accident risk and potentially rates, while relaxed driving lowers risk. |

| Driving in High-Risk Areas | Frequenting accident-prone or vandalism-prone areas raises rates. |

| Hard Braking Events | Indicates risky driving, which can increase rates. |

| Job & Commuting Mode | Lower rates for public transit users compared to daily car commuters. |

| Mileage | Higher mileage increases rates; lower mileage decreases them. |

| Rush Hour Accidents | Higher risk during rush hour may increase rates. |

| Time of Day (3–6 p.m.) | Higher accident risk during peak commute times may affect rates. |

| Vehicle Usage Classification | Pleasure" use lowers rates; "business" or "commuter" use increases them. |

In addition to these factors, car insurance rates are also determined by the vehicle you drive. Some of the features of a Smart car make this a very affordable vehicle to insure, and these features include:

- The power of the engine

- The repair and replacement cost

- Safety ratings

A Smart car generally has a much smaller and less powerful engine than many other vehicles on the market. It also is an affordable vehicle to repair or replace, and it has exceptional safety ratings.

As you can see, there are many factors related to the Smart car that make it very affordable to insure, but you understandably still want to find the best coverage available to save money and enjoy maximum protection from your car insurance policy. By focusing your attention on a few important factors when buying car insurance, you can make a better overall decision for your coverage needs.

Finding Top Smart Car Auto Insurance Companies

Most auto insurance providers offer Smart car coverage, and this gives you a great range of providers to purchase your coverage from. Usually, Erie Insurance and Safeco Insurance offer the cheapest rates for Smart cars of all the top providers.

Read More:

However, not all providers have the same level of financial strength or the same consumer satisfaction ratings. These factors can impact your regular interactions with your provider as well as how easy the claims process is if you need to file a claim.

Therefore, it is wise to begin looking for the best car insurance companies by researching their financial strength online. A great resource to use is the A.M. Best website. Through this website, you can easily search for providers that you want to get a quote from and determine their financial strength.

Consumer Reports and online reviews are also available to help you determine which providers have a solid reputation. You can learn more about billing practices, claims processes, and more by reading various online reviews and reports.

Determining How Much Smart Car Insurance Coverage You Need

Before you request quotes for your Smart car insurance, you need to determine how much car insurance you need to buy. As a starting point, look at state minumum auto insurance requirements. Your lender may also have coverage requirements for you to meet. These should be considered minimum insurance requirements, and you may consider increasing your coverage limits or buying optional coverage.

Any expenses that you incur through liability or other factors are your responsibility. If your coverage limits are too low or your coverage type does not pay for the expenses, you must pay the expenses out of your own funds.

Many serious accidents can cost tens of thousands of dollars or more, and minimum coverage limits may not pay for the full amount of the expenses.

Increasing coverage limits and buying optional coverage types can decrease your out-of-pocket expenses if you're involved in an accident.Kristen Gryglik Licensed Insurance Agent

Your insurance agent or provider can provide you with recommendations for coverage. Because the minimum requirements vary by state and lender, your agent will need to review your specific factors to determine if buying optional insurance makes sense for you.

Smart Car Insurance: Money-Saving Discounts

While Smart cars are affordable to insure, you understandably want to keep your premium as low as possible. One option to do so is to take full advantage of discounts offered by some providers. A few of the more common auto insurance discounts that you may find with top companies include good student, good driver, anti-theft, and multi-vehicle discounts.

Read More:

- How to Get a Good Student Auto Insurance Discount

- How to Get a Good Driver Auto Insurance Discount

- How to Get an Anti-Theft Auto Insurance Discount

- How to Get a Multi-Vehicle Auto Insurance Discount

These discounts can make your cheap Smart car auto insurance rates even lower.

More About Finding Cheap Smart Car Auto Insurance Rates

Whether you are thinking about buying a Smart car or you are ready to buy insurance for your new Smart car, you can see that this is an affordable vehicle to insure. Auto insurance rates vary, but you can easily request quotes today to identify the best deal overall for Smart insurance.

Get started on comparing your options for cheap auto insurance for smart cars by entering your ZIP code below.

Frequently Asked Questions

How much is the insurance for a smart car?

Smart car insurance is inexpensive, with top providers offering coverage for less than $100.

Is insurance more expensive on a smart car?

Compared to other types of vehicles, smart cars are less expensive to insure.

Are smart cars hard to insure?

Insuring smart cars is generally straightforward, with rates influenced by factors like the vehicle’s safety features and repair costs.

Does credit score affect car insurance for a smart car?

Yes, credit score is one of many factors that affect auto insurance rates. Similar to other vehicle types, it can impact car insurance rates for smart cars by causing lower premiums for higher scores and higher premiums for lower scores.

Is a smart car cheap to run?

Yes, smart cars generally have low overall costs, which include insurance expenses, owing to their compact size, fuel efficiency and reduced maintenance needs relative to larger vehicles.

Who has the absolute cheapest auto insurance for a smart car?

Erie Insurance offers the cheapest auto insurance for a smart car, with rates starting as low as $22.

What is a disadvantage of a Smart car?

One of the most significant cons of a Smart car is its limited space and cargo capacity.

Why was Smart car discontinued?

Smart cars stopped being produced in the United States after 2019 due to low sales.

What are the pros and cons of a Smart Car?

Smart cars are cheap to insure and offer compact size and excellent fuel efficiency, making parking easy and appealing to eco-conscious drivers. However, they have limited space for passengers and cargo, and may lack power for certain driving situations, despite their urban convenience.

What factors affect smart car insurance costs?

Smart car auto insurance costs are influenced by factors such as driving history, location, age, credit score and the selected coverage options and auto insurance deductibles.

Check out smart car insurance costs from top providers by entering your zip code.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.