Best Honda CR-V Auto Insurance in 2025 (Compare the Top 10 Companies)

State Farm, USAA, and Progressive are top choices for the best Honda CR-V auto insurance, with rates as low as $32 per month for minimum coverage. Get savings from this providers with policy discounts, and benefit from CR-V’s safety features like airbags and stability control for lower premiums.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated April 2025

Company Facts

Full Coverage for Honda CR-V

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Honda CR-V

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Honda CR-V

A.M. Best

Complaint Level

Pros & Cons

The best Honda CR-V auto insurance are State Farm, USAA, and Progressive, offering competitive rates starting at $32 per month. State Farm stands out as the top overall pick due to its excellent customer service and robust coverage options.

By leveraging the Honda CR-V’s safety features and comparing these providers, you can ensure you get the best insurance deal tailored to your needs. See more details in our guide titled “Best Auto Insurance Companies.”

Our Top 10 Company Picks: Best Honda CR-V Auto Insurance

Company Rank Multi-Vehicle

DiscountA.M. Best Best For Jump to Pros/Cons

#1 16% B Many Discounts State Farm

#2 12% A++ Military Savings USAA

#3 10% A+ Cheap Rates Progressive

#4 7% A++ Student Savings Geico

#5 10% A++ Accident Forgiveness Travelers

#6 10% A Online Convenience American Family

#7 20% A Local Agents Farmers

#8 7% A Customizable Polices Liberty Mutual

#9 15% A+ Add-on Coverages Allstate

#10 14% A+ Usage Discount Nationwide

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Honda CR-V insurance rates are quite a bit cheaper than the average vehicle

- State Farm, USAA, and Progressive are top choices for auto insurance

- Benefit from CR-V’s safety features like airbags and stability control

#1 – State Farm: Best for Top Overall Pick

Pros

- Affordable Premiums: State Farm offers Honda CR-V owners an attractive monthly rate of $125, which is one of the lower options available, making it a cost-effective choice for budget-conscious drivers.

- Comprehensive Coverage Options: State Farm auto insurance review highlights the wide range of coverage options for Honda CR-V owners, including liability, collision, and comprehensive coverage, ensuring all aspects of your vehicle are protected.

- User-Friendly Mobile App: State Farm’s mobile app provides Honda CR-V owners with convenient access to policy management, claims tracking, and customer support, enhancing the overall user experience.

Cons

- Limited Discounts for Safe Drivers: While State Farm offers competitive rates, their discounts for safe driving are not as extensive as some other insurers, which might limit savings for Honda CR-V owners with clean driving records.

- Higher Rates for Younger Drivers: Younger Honda CR-V drivers may find State Farm’s premiums higher compared to older drivers, making it a less appealing option for young or inexperienced drivers.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Membership Benefits: As mentioned in our USAA auto insurance review, USAA provides Honda CR-V owners with exclusive benefits and discounts, available only to military members and their families, enhancing the value of their insurance policies.

- High Customer Satisfaction: Known for high customer satisfaction, USAA offers Honda CR-V owners exceptional service and support, ensuring their insurance needs are met efficiently and effectively.

- Comprehensive Coverage at Competitive Rates: USAA offers extensive coverage options for Honda CR-V owners at a competitive rate of $153 per month, ensuring robust protection without breaking the bank.

Cons

- Restricted Eligibility: USAA is only available to military members and their families, limiting access for the general public, including many Honda CR-V owners who do not meet this criteria.

- Limited Physical Locations: USAA has fewer physical branches compared to other insurers, which might inconvenience Honda CR-V owners who prefer in-person interactions for their insurance needs.

#3 – Progressive: Best for Cheap Rates

Pros

- Snapshot Program for Savings: Progressive’s Snapshot program allows Honda CR-V owners to potentially lower their insurance costs by monitoring their driving habits and rewarding safe driving behaviors.

- Diverse Coverage Options: Progressive offers a wide range of coverage options, including gap insurance and rideshare coverage, which can be particularly beneficial for Honda CR-V owners with unique insurance needs.

- Strong Online Tools and Resources: As mention in Progressive auto insurance review, Progressive provides robust online tools and resources, allowing Honda CR-V owners to easily manage their policies, file claims, and access support online.

Cons

- Higher Monthly Premiums: At $185 per month, Progressive’s insurance rates for Honda CR-V owners are higher than several competitors, which may deter cost-sensitive drivers.

- Mixed Customer Service Reviews: Progressive has received mixed reviews regarding its customer service, which might be a concern for Honda CR-V owners who prioritize reliable and prompt support.

#4 – Geico: Best for Student Savings

Pros

- Lowest Monthly Premiums: Geico offers Honda CR-V owners the lowest monthly premium at $95, making it an extremely budget-friendly option for those seeking affordable insurance.

- Good Driver Discounts: Geico provides significant discounts for good drivers, which can further reduce insurance costs for Honda CR-V owners who maintain a clean driving record.

- User-Friendly Online Experience: Geico auto insurance review highlights Geico’s website and mobile app offer an easy-to-use interface, allowing Honda CR-V owners to manage their policies, file claims, and access support conveniently online.

Cons

- Limited Coverage Options: While Geico offers basic coverage at a low cost, Honda CR-V owners might find their coverage options somewhat limited compared to other insurers with more comprehensive packages.

- Average Customer Service: Geico’s customer service is rated as average, which might be a drawback for Honda CR-V owners who value high-quality, personalized support.

#5 – Travelers: Best for Accident Forgiveness

Pros

- Comprehensive Policy Options: Travelers offers a wide range of policy options for Honda CR-V owners, including liability, collision, and comprehensive coverage, ensuring robust protection for various needs.

- Discounts for Hybrid Vehicles: Honda CR-V owners with hybrid models can benefit from additional discounts, making Travelers a cost-effective choice for eco-conscious drivers.

- Strong Financial Stability: As outlined in our Travelers auto insurance review, with a solid A.M. Best rating, Travelers ensures financial stability and reliability, providing Honda CR-V owners with confidence in their insurance coverage.

Cons

- Higher Rates for High-Risk Drivers: Travelers may charge higher premiums for Honda CR-V owners with less-than-perfect driving records, making it less attractive for high-risk drivers.

- Limited Availability of Local Agents: Travelers has fewer local agents compared to some competitors, which might be inconvenient for Honda CR-V owners who prefer face-to-face interactions for managing their insurance.

#6 – American Family: Best for Online Convenience

Pros

- Comprehensive Coverage Options: American Family offers extensive coverage options for Honda CR-V owners, including liability, collision, and comprehensive coverage, ensuring all aspects of the vehicle are protected.

- Good Student Discounts: Honda CR-V owners with students in their household can benefit from American Family’s good student discounts, helping to lower overall insurance costs. (Read More: American Family Auto Insurance Review).

- Accident Forgiveness Program: American Family’s accident forgiveness program helps Honda CR-V owners avoid rate increases after their first at-fault accident, providing peace of mind and financial protection.

Cons

- Higher Rates for Urban Areas: Honda CR-V owners living in urban areas may find American Family’s insurance rates higher compared to those living in rural or suburban locations.

- Limited Online Tools: American Family’s online tools and resources are less comprehensive compared to some competitors, which might be a drawback for Honda CR-V owners who prefer managing their policies online.

#7 – Farmers: Best for Local Agents

Pros

- Customizable Coverage Options: Farmers offers highly customizable coverage options for Honda CR-V owners, allowing them to tailor their insurance policies to meet specific needs and preferences.

- Excellent Claims Service: Farmers is known for its efficient and reliable claims service, ensuring Honda CR-V owners receive prompt assistance and support when filing claims.

- Safe Driver Discounts: Farmers provides substantial discounts for safe drivers, helping Honda CR-V owners with clean driving records to lower their insurance premiums. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums for Younger Drivers: Honda CR-V owners who are younger may face higher premiums with Farmers, making it less appealing for younger or inexperienced drivers.

- Limited Availability of Discounts: While Farmers offers various discounts, the availability of these discounts might be more limited compared to other insurers, reducing potential savings for Honda CR-V owners.

#8 – Liberty Mutual: Best for Customizable Polices

Pros

- Comprehensive Coverage Options: Liberty Mutual provides a wide range of comprehensive coverage options for Honda CR-V owners, including liability, collision, and comprehensive coverage, ensuring robust protection.

- Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program helps Honda CR-V owners avoid rate increases after their first at-fault accident, providing financial protection and peace of mind.

- Better Car Replacement: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers a better car replacement program, allowing Honda CR-V owners to replace their totaled car with a newer model, enhancing value and security.

Cons

- High Premiums: At $254 per month, Liberty Mutual’s premiums are significantly higher compared to other insurers, which may deter cost-sensitive Honda CR-V owners.

- Mixed Customer Service Reviews: Liberty Mutual has received mixed reviews regarding its customer service, which might be a concern for Honda CR-V owners who prioritize reliable and prompt support.

#9 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage options for Honda CR-V owners, including liability, collision, and comprehensive coverage, ensuring robust protection for all aspects of the vehicle.

- New Car Replacement Program: Allstate’s new car replacement program provides Honda CR-V owners with a new car of the same make and model if their car is totaled within the first two model years.

- Good Driver Discounts: Allstate offers significant discounts for good drivers, helping Honda CR-V owners with clean driving records to reduce their insurance premiums. Learn more about their discounts in our Allstate auto insurance review.

Cons

- Higher Premiums: At $186 per month, Allstate’s premiums are higher than some competitors, which may deter Honda CR-V owners seeking more affordable insurance options.

- Mixed Customer Service Reviews: Allstate has received mixed reviews regarding its customer service, which might be a concern for Honda CR-V owners who value high-quality support and assistance.

#10 – Nationwide: Best for Usage Discount

Pros

- Vanishing Deductible Program: Nationwide’s vanishing deductible program allows Honda CR-V owners to reduce their deductible by $100 for each year of safe driving, up to $500, offering potential savings.

- Comprehensive Coverage Options: Nationwide offers a wide range of coverage options, including liability, collision, and comprehensive coverage, ensuring robust protection for Honda CR-V owners.

- Strong Financial Stability: With a solid A.M. Best rating, Nationwide ensures financial stability and reliability, providing Honda CR-V owners with confidence in their insurance coverage. For more information, read our Nationwide auto insurance review.

Cons

- Limited Availability of Local Agents: Nationwide has fewer local agents compared to some competitors, which might be inconvenient for Honda CR-V owners who prefer face-to-face interactions for managing their insurance.

- Higher Rates for High-Risk Drivers: Honda CR-V owners with high-risk driving records may find Nationwide’s premiums higher compared to those with clean records, making it less attractive for high-risk drivers.

Honda CR-V Insurance Cost

Comparing insurance rates for a Honda CR-V can help you find the best deal for your coverage needs. The table below highlights the monthly rates for both minimum and full coverage from various providers.

Honda CR-V Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $141

$32 $84

Reviewing these rates can assist you in choosing the most cost-effective insurance provider for your Honda CR-V. By comparing options, you can ensure you’re getting the best coverage at the best price.

Understanding the range of insurance rates for a Honda CR-V can help you make informed decisions about your coverage options. Whether you’re looking for discounts or managing high deductibles, knowing these figures ensures you can find the best policy for your needs.

Read More: What are the recommended auto insurance coverage levels?

Honda CR-V Rates Comparison

The chart below details how Honda CR-V insurance rates compare to other crossovers like the Mazda CX-5, Toyota C-HR, and Ford EcoSport.

Honda CR-V Auto Insurance Monthly Rates vs. Other Vehicles| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Honda CR-V | $23 | $34 | $26 | $95 |

| Mazda CX-5 | $27 | $44 | $31 | $115 |

| Toyota C-HR | $21 | $38 | $22 | $90 |

| Ford EcoSport | $23 | $42 | $31 | $109 |

| Nissan Rogue | $22 | $43 | $37 | $117 |

| Cadillac XT4 | $30 | $55 | $26 | $123 |

| Mazda CX-3 | $26 | $42 | $31 | $112 |

Comparing insurance rates for the Honda CR-V with other crossovers shows it to be a competitively priced option. By exploring different providers, you can find the most affordable insurance rates for your Honda CR-V. There are a few things you can do to find the cheapest Honda auto insurance rates online.

Factors Influencing the Cost of Honda CR-V Insurance

The cost of Honda CR-V insurance is influenced by several factors, including the vehicle’s trim and model, age, driver age, location, and driving record. Higher-end trims may offer features that reduce premiums, while newer models typically incur higher rates due to their greater value.

Younger drivers face higher costs due to inexperience, whereas older drivers often enjoy lower premiums. Additionally, living in urban areas can lead to increased insurance rates compared to rural locations.

A clean driving record is crucial for securing the best rates, as insurers reward safe driving with lower premiums. Understanding these elements can help you find the most cost-effective insurance for your Honda CR-V.

Age of the Vehicle

The average Honda CR-V car insurance rates are higher for newer models. For example, car insurance for a 2020 Honda CR-V is significantly more expensive than for a 2010 Honda CR-V, reflecting the impact of the vehicle’s age on insurance costs.

Honda CR-V Auto Insurance Monthly Rates by Coverage Type| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Honda CR-V | $23 | $34 | $26 | $95 |

| 2023 Honda CR-V | $22 | $33 | $28 | $94 |

| 2022 Honda CR-V | $21 | $32 | $28 | $93 |

| 2021 Honda CR-V | $21 | $32 | $30 | $93 |

| 2020 Honda CR-V | $20 | $30 | $30 | $92 |

| 2019 Honda CR-V | $19 | $29 | $31 | $91 |

| 2018 Honda CR-V | $18 | $27 | $32 | $89 |

| 2017 Honda CR-V | $17 | $26 | $32 | $87 |

Insurance rates for the Honda CR-V tend to decrease as the vehicle ages, with notable savings for older models. By considering the model year, you can better manage your insurance costs while enjoying the reliability of the Honda CR-V.

Driver Age

Driver age can have a significant impact on Honda CR-V auto insurance rates. For instance, a 30-year-old driver may pay $50 more for Honda CR-V auto insurance than a 40-year-old driver.

Honda CR-V Auto Insurance Monthly Rates by Age| Age | Rates |

|---|---|

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Driver age significantly impacts Honda CR-V auto insurance rates, with younger drivers paying more. For example, an 18-year-old may pay $350 monthly, while a 60-year-old pays just $130.

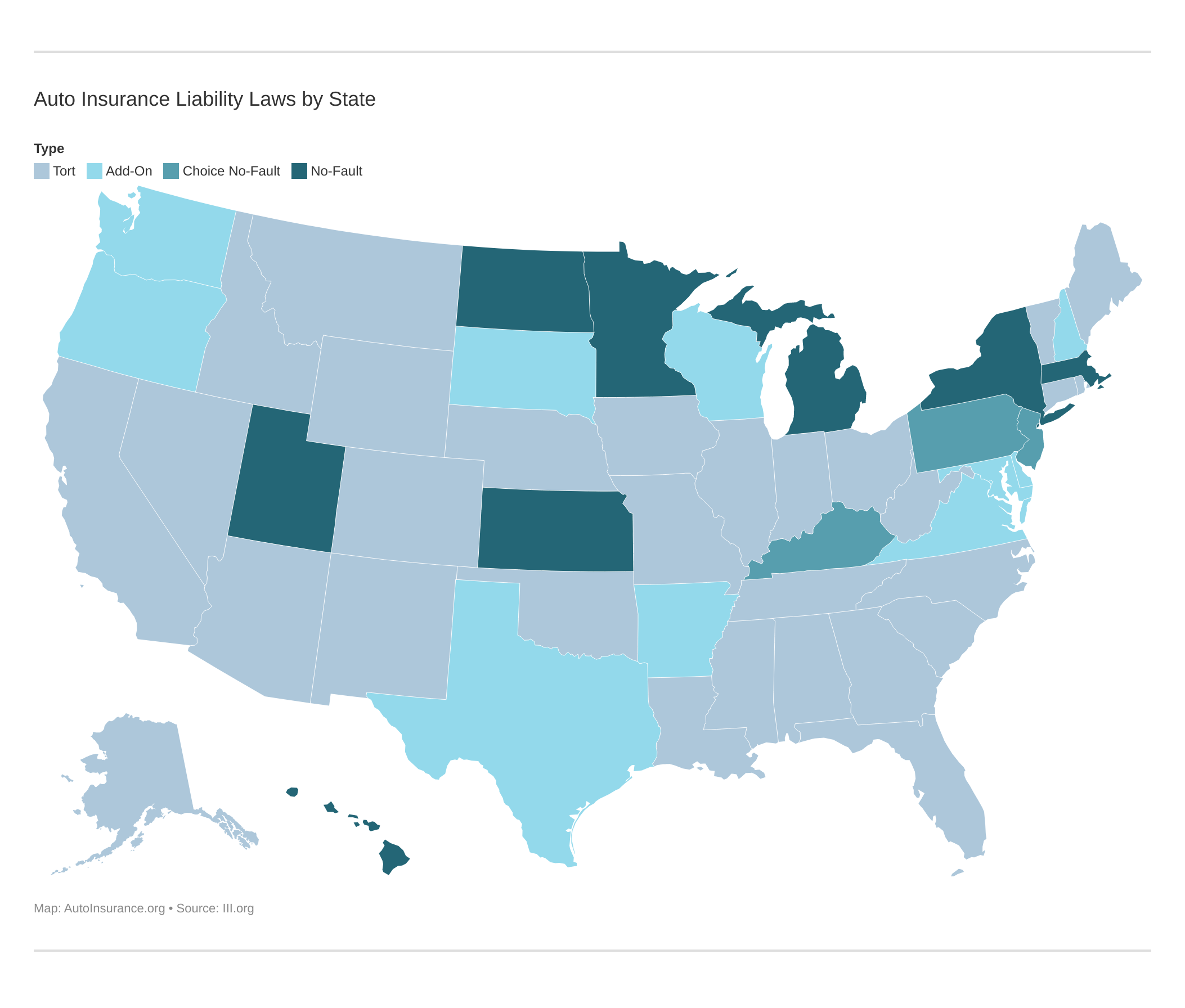

Driver Location

Where you live can have a large impact on Honda CR-V insurance rates. For example, drivers in New York may pay more than drivers in Seattle.

Honda CR-V Auto Insurance Monthly Rates by City| City | Rates |

|---|---|

| Chicago, IL | $230 |

| Columbus, OH | $210 |

| Houston, TX | $250 |

| Indianapolis, IN | $220 |

| Jacksonville, FL | $240 |

| Los Angeles, CA | $280 |

| New York, NY | $300 |

| Philadelphia, PA | $260 |

| Phoenix, AZ | $220 |

| Seattle, WA | $215 |

Your location greatly affects Honda CR-V insurance rates, with urban areas generally costing more. For instance, drivers in New York pay up to $300 monthly, while those in Seattle pay around $215.

Your Driving Record

Your driving record can have an impact on the cost of Honda CR-V car insurance. Teens and drivers in their 20’s see the highest jump in their Honda CR-V car insurance with violations on their driving record.

Honda CR-V Auto Insurance Monthly Rates by Age & Driving History| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $350 | $450 | $560 | $400 |

| Age: 20 | $320 | $410 | $510 | $370 |

| Age: 30 | $190 | $240 | $300 | $210 |

| Age: 40 | $160 | $200 | $250 | $180 |

| Age: 50 | $140 | $180 | $220 | $160 |

| Age: 60 | $130 | $170 | $210 | $150 |

Your driving history significantly impacts Honda CR-V insurance rates, with violations leading to higher premiums. For example, an 18-year-old with a DUI may face rates up to $560, compared to $350 with a clean record.

Safety Ratings

Your Honda CR-V auto insurance rates are influenced by the Honda CR-V’s safety ratings. See the breakdown below:

Honda CR-V Safety Ratings| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Honda CR-V’s top safety ratings contribute to lower auto insurance premiums due to its excellent crash test performance. Its strong safety features, including high ratings in all key areas, help reduce insurance costs.

Crash Test Ratings

Good Honda CR-V crash test ratings can lower your Honda CR-V auto insurance rates. See Honda CR-V crash test results below:

Honda CR-V Crash Test Ratings| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Honda CR-V SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Honda CR-V SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Honda CR-V HYBRID SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Honda CR-V SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Honda CR-V SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Honda CR-V SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Honda CR-V SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Honda CR-V SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Honda CR-V SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Honda CR-V SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

The Honda CR-V’s consistently high crash test ratings contribute to lower insurance rates by demonstrating superior safety performance. Its strong overall scores across various test categories reflect its reliable safety features, which insurers reward with reduced premiums.

Honda CR-V Safety Features

The more safety features you have on your Honda CR-V, the more likely it is that you can earn a discount. The Honda CR-V’s safety features include:

- Comprehensive Airbag System: Driver Air bag, passenger air bag, front head air bag, rear head air bag, front side air bag

- Advanced Braking Systems: 4-wheel abs, 4-wheel disc brakes, brake assist

- Stability and Traction Control: Electronic stability control, traction control

- Safety and Visibility Features: Daytime running lights, child safety locks

- Lane Safety Technology: Lane departure warning, lane keeping assist

With these comprehensive safety features, the Honda CR-V not only ensures a safer driving experience but also offers potential savings on your insurance. Investing in a vehicle with advanced safety systems can significantly reduce your insurance premiums.

Loss Probability

The lower percentage means lower Honda CR-V car insurance rates; higher percentages mean higher Honda CR-V auto insurance rates. Insurance loss probability on the Honda CR-V fluctuates between each type of coverage. Learn more in our complete “Types of Auto Insurance.”

Honda CR-V Auto Insurance Loss Probability| Coverage | Loss |

|---|---|

| Collision | -32% |

| Property Damage | -19% |

| Comprehensive | -42% |

| Personal Injury | -7% |

| Medical Payment | -14% |

| Bodily Injury | -23% |

The Honda CR-V’s lower loss probabilities across various coverage types indicate it is a cost-effective choice for insurance. Its strong performance in minimizing losses can help drivers secure better rates.

Honda CR-V Finance and Insurance Cost

When financing a Honda CR-V, most lenders will require your carry higher Honda CR-V coverage options including comprehensive coverage, so be sure to shop around and compare Honda CR-V car insurance rates from the best companies using our free tool below.

Financing a Honda CR-V often means higher insurance costs due to the requirement for comprehensive coverage.Jeff Root LICENSED INSURANCE AGENT

To find the most cost-effective options, utilize our comparison tool to evaluate quotes from top insurance providers and ensure you get the best deal for your needs.

Ways to Save on Honda CR-V Insurance

There are many ways that you can save on Honda CR-V car insurance. Below are five actions you can take to find cheap Honda CR-V auto insurance rates.

- Ask for a Honda CR-V discount if you have college degree or higher.

- Understand that your insurer can change your Honda CR-V auto insurance rates mid-term for other reasons.

- Don’t skimp on Honda CR-V liability coverage.

- Provide your Honda CR-V vin when requesting Honda CR-V auto insurance quotes.

- Consider using a tracking device on your Honda CR-V.

These discounts below can significantly impact rates by offering savings based on factors helping to lower monthly premiums.

These discounts from top insurance providers Honda CR-V offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road. Learn more in our guide titled, “How to Lower Your Auto Insurance Rates.”

Top Honda CR-V Insurance Companies

Who is the best auto insurance companies for Honda CR-V insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Honda CR-V auto insurance coverage (ordered by market share).

Top 10 Honda CR-V Auto Insurance Providers by Market Share| Rank | Insurance Company | Volume | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.30% |

| #2 | Geico | $46,106,971 | 6.60% |

| #3 | Progressive | $39,222,879 | 5.60% |

| #4 | Liberty Mutual | $35,600,051 | 5.10% |

| #5 | Allstate | $35,025,903 | 5.00% |

| #6 | Travelers | $28,016,966 | 4.00% |

| #7 | USAA | $23,483,080 | 3.30% |

| #8 | Chubb | $23,388,385 | 3.30% |

| #9 | Farmers | $20,643,559 | 2.90% |

| #10 | Nationwide | $18,442,145 | 2.60% |

Many of these companies offer discounts for security systems and other safety features that the Honda CR-V offers. Start comparing Honda CR-V auto insurance quotes for free by using our free online comparison tool.

Frequently Asked Questions

What are the average insurance rates for a Honda CR-V?

Average Honda CR-V insurance rates can vary based on several factors, including your driving record, location, and the specific model of your CR-V. It’s best to compare quotes from multiple insurance companies to find the most competitive rate for your situation.

Are Honda CR-Vs expensive to insure?

Generally, Honda CR-Vs are not considered expensive to insure compared to other vehicles. Their good safety ratings and features can contribute to lower insurance premiums. However, individual rates will depend on factors like driving history and coverage choices.

Read More: Is Honda’s safety rating on small SUVs better than Subaru’s?

What factors impact the cost of Honda CR-V insurance?

Several factors influence the cost of Honda CR-V insurance, including the vehicle’s trim and model, the driver’s age and driving record, location, and coverage options chosen. Additional features and safety technologies in the vehicle can also affect insurance costs.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code (below/above).

What are the safety ratings of the Honda CR-V?

The Honda CR-V has strong safety ratings, which can positively influence insurance rates. It has received favorable crash test results and comes equipped with advanced safety features that can help reduce the likelihood of accidents and injuries.

How can I save on Honda CR-V insurance?

How to lower your auto insurance rates, consider bundling your insurance policies, maintaining a clean driving record, opting for higher deductibles, and installing safety features in your vehicle. Additionally, comparing quotes from multiple insurance companies can help you find the best rates.

Do insurance rates vary by location?

Yes, insurance rates for a Honda CR-V can vary significantly based on your location. Urban areas often have higher rates compared to rural areas due to factors like traffic density and accident rates.

What discounts are available for Honda CR-V insurance?

Insurance providers offer various discounts for Honda CR-V insurance, including safe driver discounts, multi-policy discounts, and discounts for safety features such as anti-lock brakes, airbags, and stability control.

How does the age of the vehicle affect insurance rates?

The age of the Honda CR-V impacts insurance rates, with newer models generally costing more to insure than older models. This is due to the higher replacement costs and value of newer vehicles. Learn more in our article titled, “How Vehicle Year Affects Auto Insurance Rates“.

Can my driving record influence Honda CR-V insurance rates?

Yes, a clean driving record can help you secure lower insurance rates for your Honda CR-V. Conversely, traffic violations and accidents can increase your premiums.

Are there special insurance considerations for young drivers?

Young drivers typically face higher insurance rates due to their lack of driving experience. However, they can benefit from discounts such as good student discounts and those for completing driver education courses.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.