Best Acura TL Auto Insurance in 2025 (Find the Top 10 Companies Here)

Discover why State Farm, Progressive, and Allstate are the top picks for the best Acura TL auto insurance, offering competitive rates starting at just $85 per month. These providers excel in delivering extensive coverage options, superior customer service, and exceptional value for Acura TL owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

Company Facts

Full Coverage for Acura TL

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Acura TL

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Acura TL

A.M. Best

Complaint Level

Pros & Cons

The top picks for the best Acura TL auto insurance are State Farm, Progressive, and Allstate, renowned for their exceptional coverage and customer satisfaction.

These companies stand out in the competitive market with robust policy options that cater specifically to the needs of Acura TL owners. See more details in our guide titled “Best Auto Insurance Companies.”

Our Top 10 Company Picks: Best Acura TL Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 12% A+ Competitive Rates Progressive

#3 10% A+ Comprehensive Coverage Allstate

#4 25% A++ Affordable Rates Geico

#5 40% A++ Military Members USAA

#6 20% A+ Vanishing Deductible Nationwide

#7 10% A+ Personalized Coverage Farmers

#8 12% A Accident Forgiveness Liberty Mutual

#9 15% A++ Financial Strength Travelers

#10 10% A Customer Service American Family

They are lauded for their comprehensive support and claims handling, ensuring drivers receive the best possible service. By choosing any of these providers, Acura TL owners can enjoy peace of mind knowing they are well-protected on and off the road. Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers a 17% discount for bundling multiple insurance policies, which can include coverage for an Acura TL, potentially reducing overall insurance costs.

- High Low-Mileage Discount: Owners of an Acura TL who drive less can benefit significantly from State Farm’s discounts for low-mileage usage. Discover insights in our guide titled, State Farm auto insurance review.

- Wide Coverage: State Farm provides diverse coverage options that cater to the specific needs of Acura TL owners, from collision coverage to comprehensive plans.

Cons

- Limited Multi-Policy Discount: Compared to competitors, State Farm’s 17% multi-policy discount may not be as substantial for Acura TL owners looking to combine various types of insurance.

- Premium Costs: Despite available discounts, the cost of insuring an Acura TL with State Farm may still be higher compared to other insurers, especially at higher coverage levels.

#2 – Progressive: Best for Competitive Rates

Pros

- Customizable Policies: Progressive allows Acura TL owners to customize their policies extensively, ensuring a perfect fit for their coverage needs and budget.

- Loyalty Rewards: Progressive offers loyalty rewards that can benefit Acura TL owners who maintain their policies without claims. Delve into our evaluation of Progressive auto insurance review.

- Competitive Rates: With an A+ rating from A.M. Best, Progressive offers competitive rates that are often lower than competitors, making it an economical choice for insuring an Acura TL.

Cons

- Average Multi-Policy Discount: Progressive’s 12% discount for bundling policies is average and may not offer the most savings for Acura TL owners compared to other insurers with higher discounts.

- Variable Customer Service: Some customers have reported inconsistent service experiences, which might affect Acura TL owners during claims or policy management.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Options: Allstate excels in offering comprehensive coverage options that protect Acura TLs against a wide range of incidents and accidents.

- New Car Replacement: For newer Acura TL models, Allstate offers new car replacement insurance, which can be a significant benefit in case of total loss.

- Deductible Rewards: Allstate provides deductible rewards that reduce the deductible amount for Acura TL owners each year without a claim. Access comprehensive insights into our guide titled Allstate auto insurance review.

Cons

- Higher Premiums: Despite its comprehensive coverage, Allstate’s premiums tend to be higher, particularly for luxury vehicles like the Acura TL.

- Less Competitive Multi-Policy Discount: At a 10% discount, Allstate’s multi-policy offer might be less attractive to Acura TL owners seeking to maximize savings through bundling.

#4 – Geico: Best for Affordable Rates

Pros

- High Multi-Policy Discount: Geico offers a substantial 25% discount for multi-policy bundles, which can significantly reduce the cost of insuring an Acura TL.

- Low Base Premiums: Known for affordable rates, Geico offers some of the lowest premiums, making it a cost-effective choice for Acura TL owners. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

- Strong Financial Stability: With an A++ rating from A.M. Best, Geico ensures reliability and capability in handling claims for high-value vehicles like the Acura TL.

Cons

- Basic Coverage Options: While affordable, Geico’s coverage options are sometimes more basic compared to others, which might not meet all the specific needs of Acura TL owners.

- Automated Customer Service: Geico heavily relies on digital and automated customer service solutions, which may not satisfy Acura TL owners who prefer personalized service.

#5 – USAA: Best for Military Members

Pros

- Exceptional Discounts for Military: USAA offers up to 40% discount for multi-policy bundles, providing significant savings for military members who own an Acura TL.

- Tailored Services for Military Needs: USAA tailors its services and coverages to fit the lifestyles of military families, which can benefit Acura TL owners in active service.

- Top-Rated Customer Service: USAA consistently receives high marks for customer service and claims satisfaction, which ensures a smooth experience for Acura TL owners. Unlock details in our guide titled, USAA auto insurance review.

Cons

- Exclusive Membership: USAA’s services are only available to military members, veterans, and their families, which limits access for other Acura TL owners.

- Limited Physical Presence: USAA primarily operates online and through phone, which might not appeal to Acura TL owners who prefer in-person service interactions.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible that decreases each year without a claim, beneficial for Acura TL owners maintaining a clean driving record.

- Wide Range of Coverage Options: Nationwide provides a variety of coverage choices that can be tailored to protect an Acura TL comprehensively. Read up on the Nationwide auto insurance review for more information.

- Accident Forgiveness: Nationwide includes accident forgiveness policies, which can prevent premium spikes after an initial at-fault accident involving an Acura TL.

Cons

- Average Multi-Policy Discount: With a 20% discount, Nationwide’s multi-policy savings are good but may not compete with the highest discounts offered by others.

- Mixed Customer Reviews: Nationwide has received mixed reviews regarding customer service, which might concern Acura TL owners looking for consistent support.

#7 – Farmers: Best for Personalized Coverage

Pros

- Customized Insurance Options: Farmers allows extensive customization of policies, which benefits Acura TL owners by enabling them to tailor coverage specifics to their needs.

- Potential for Lower Deductibles: Farmers offers decreasing deductibles for each year without a claim, which can significantly benefit Acura TL owners over time.

- Dedicated Agents: Farmers employs dedicated agents who provide personalized services, enhancing the insurance experience for Acura TL owners. More information is available about this provider in our Farmers auto insurance review.

Cons

- Higher Cost: Farmers’ premiums tend to be on the higher side, especially for luxury vehicles like the Acura TL.

- Limited Discounts: The 10% multi-policy discount offered by Farmers may not be as competitive, potentially making it a less attractive option for Acura TL owners looking to bundle insurance.

#8 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness from the start of the policy, which can prevent rate increases for Acura TL owners after their first accident.

- Customizable Policies: Extensive customization options are available, allowing Acura TL owners to modify their coverage as needed. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- RightTrack Discount: Liberty Mutual’s RightTrack program offers a discount based on driving behavior, which can reward Acura TL owners who are safe drivers.

Cons

- Variable Premiums: Premiums at Liberty Mutual can vary significantly, which might result in higher-than-expected costs for insuring an Acura TL.

- Average Customer Service: Customer service ratings for Liberty Mutual are average, which might not meet the expectations of Acura TL owners used to a high level of service.

#9 – Travelers: Best for Financial Strength

Pros

- High Financial Stability: With an A++ rating from A.M. Best, Travelers is highly capable of handling claims, assuring Acura TL owners. See more details in our guide titled, “Travelers Auto Insurance Review.”

- IntelliDrive Program: Travelers offers a telematics-based discount program that can reduce premiums for safe driving, appealing to conscientious Acura TL owners.

- Broad Coverage Options: The company provides a wide array of insurance options, including gap insurance, which is beneficial for financing or leasing Acura TLs.

Cons

- Higher Rates for High-Risk Drivers: Acura TL owners with past traffic violations or accidents may face significantly higher rates at Travelers.

- 15% Multi-Policy Discount: While competitive, Travelers’ 15% discount for bundling policies might not be the most attractive for Acura TL owners compared to other options with higher discounts.

#10 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: American Family is known for its strong customer service, providing a supportive experience for Acura TL owners.

- MyAmFam App: The innovative app offers easy policy management and claims filing, enhancing convenience for Acura TL owners. See more details in our guide titled, “American Family Auto Insurance Review.”

- Flexibility in Coverage: American Family offers flexible coverage options, including coverage for custom parts and equipment, which can benefit Acura TL owners with modified vehicles.

Cons

- Higher Premiums for Certain Coverage: Insuring an Acura TL with American Family might be costly, especially for comprehensive or full coverage options.

- Limited Discounts: With only a 10% multi-policy discount, American Family might not provide the most savings for Acura TL owners seeking to combine multiple insurance products.

Acura TL Insurance Rates by Coverage Level

Acura TL Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $105 $235

American Family $94 $218

Farmers $97 $222

Geico $90 $215

Liberty Mutual $102 $232

Nationwide $98 $225

Progressive $100 $230

State Farm $95 $220

Travelers $99 $228

USAA $85 $210

The table below illustrates the monthly rates offered by leading insurance companies for the Acura TL. For minimum coverage, USAA offers the most competitive rate at $85, making it an attractive option for those seeking basic protection at a lower cost.

On the higher end, full coverage from USAA remains the most affordable at $210, ideal for Acura TL owners looking for extensive protection. Other providers like Allstate and Liberty Mutual offer full coverage at higher rates of $235 and $232, respectively, reflecting more comprehensive benefits and added features.

This range in pricing showcases the variety available in the market, allowing Acura TL owners to tailor their insurance according to their coverage needs and financial preferences.

Read more: What are the recommended auto insurance coverage levels?

Are Acura TLs Expensive to Insure

Comparing insurance costs is crucial for understanding how Acura TLs stack up against other luxury vehicles in terms of insurance expenses. The following chart provides a detailed comparison of insurance rates for the Acura TL and similar luxury cars, including comprehensive, collision, and liability coverage.

Acura TL Auto Insurance Monthly Rates vs. Other Luxury Cars by Coverage Type| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Acura TLX | $28 | $57 | $33 | $131 |

| Audi S8 | $55 | $114 | $33 | $215 |

| Lexus IS 300 | $30 | $57 | $33 | $133 |

| Mercedes-Benz CLS 550 | $36 | $79 | $33 | $162 |

| Mercedes-Benz E300 | $33 | $62 | $28 | $134 |

| Porsche Panamera | $43 | $87 | $33 | $177 |

This comparison illustrates that while Acura TLs are reasonably priced for insurance relative to other luxury vehicles, proactive measures can still be taken to secure even lower rates.

Exploring various online options will help Acura TL owners find the most cost-effective insurance solutions. For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

What Impacts the Cost of Acura TL Insurance

The Acura TL trim and model you choose can impact the total price you will pay for Acura TL insurance coverage.

Age of the Vehicle

The cost of insuring an Acura TL can vary significantly depending on the age of the vehicle. Generally, newer models come with higher insurance premiums due to their increased value and replacement costs.

Acura TL Auto Insurance Monthly Rates by Model Year & Coverage Type| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Acura TL | $29 | $55 | $40 | $137 |

| 2023 Acura TL | $28 | $53 | $40 | $134 |

| 2022 Acura TL | $27 | $51 | $40 | $131 |

| 2021 Acura TL | $26 | $49 | $39 | $128 |

| 2020 Acura TL | $25 | $47 | $39 | $125 |

| 2019 Acura TL | $24 | $45 | $39 | $122 |

| 2018 Acura TL | $23 | $43 | $39 | $118 |

| 2017 Acura TL | $23 | $41 | $38 | $115 |

| 2016 Acura TL | $22 | $40 | $38 | $114 |

| 2015 Acura TL | $22 | $42 | $38 | $114 |

| 2014 Acura TL | $22 | $42 | $38 | $114 |

| 2013 Acura TL | $21 | $39 | $38 | $111 |

| 2012 Acura TL | $20 | $35 | $38 | $107 |

| 2011 Acura TL | $19 | $32 | $38 | $103 |

| 2010 Acura TL | $18 | $30 | $39 | $100 |

As shown, insurance rates for the Acura TL decrease as the vehicle ages, with the cost for comprehensive, collision, and liability coverage all adjusting downward. This trend highlights the importance of considering the model year when budgeting for the insurance expenses of an Acura TL.

Driver Age

Driver age can have a significant impact on Acura TL auto insurance rates. For instance, a 30-year-old driver may pay $60 more each year for Acura TL auto insurance than a 40-year-old driver.

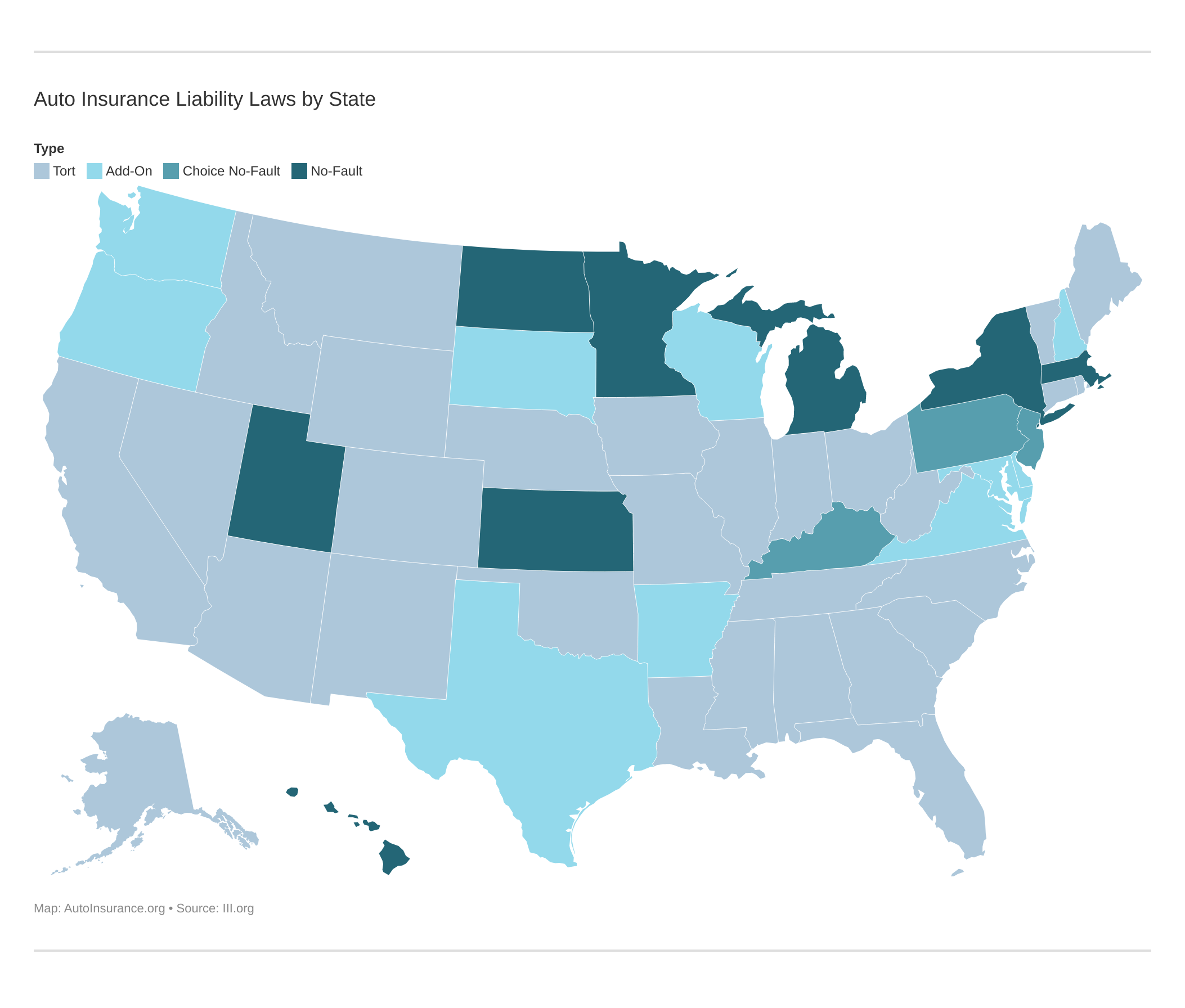

Driver Location

Where you live can have a large impact on Acura TL insurance rates. For example, drivers in Los Angeles may pay approximately $63 a month more than drivers in Phoenix.

Your Driving Record

Your driving record can have an impact on the cost of Acura TL auto insurance. Teens and drivers in their 20s see the highest jump in their Acura TL insurance rates with violations on their driving record.

Acura TL Safety Ratings

The safety ratings of your Acura TL play a crucial role in determining your auto insurance rates. Below, you’ll find a detailed breakdown of how the Acura TL fares in various crash safety tests.

Acura TL Safety Ratings| Test Type | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Understanding these safety ratings is vital as they not only reflect the vehicle’s ability to protect its occupants but also influence the cost of insuring your Acura TL.

High ratings in these tests can lead to more favorable insurance premiums, reflecting the reduced risk associated with insuring a safer vehicle.

Acura TL Crash Test Ratings

The crash test ratings of your Acura TL significantly influence your insurance premiums. Here is a comprehensive overview of the Acura TL’s performance in safety evaluations across different model years.

Acura TL Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Acura TLX 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Acura TLX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Acura TLX 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Acura TLX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Acura TLX 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Acura TLX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Acura TLX 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Acura TLX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Acura TLX 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Acura TLX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

As demonstrated by the consistently high ratings across multiple categories and years, the Acura TL’s robust safety performance not only ensures occupant protection but also contributes to potentially lower insurance costs due to reduced risk factors.

Acura TL Safety Features

The safety features equipped in the 2020 Acura TL enhance the vehicle’s security and contribute to potentially lower insurance costs. Here’s a comprehensive list of what this model offers to protect passengers and reduce risk.

Acura TL Safety Features| Safety Feature | Description |

|---|---|

| Driver Air Bag | Provides frontal impact protection for the driver. |

| Passenger Air Bag | Offers frontal impact protection for the front passenger. |

| Front Head Air Bag | Protects front occupants during side collisions. |

| Rear Head Air Bag | Offers head protection for rear occupants in side impacts. |

| Front Side Air Bag | Protects front occupants from side impacts. |

| 4-Wheel ABS | Prevents wheel lock during braking for better control. |

| 4-Wheel Disc Brakes | Provides superior braking performance. |

| Brake Assist | Enhances braking power in emergency situations. |

| Electronic Stability Control | Improves car's stability by detecting and reducing skidding. |

| Daytime Running Lights | Increases vehicle visibility during the day. |

| Child Safety Locks | Prevents children from opening the doors from inside. |

With its extensive array of safety features, the 2020 Acura TL is designed to ensure maximum protection for its occupants and minimize potential hazards.

These safety enhancements not only provide peace of mind but can also favorably impact the cost of your auto insurance premiums.

Acura TL Insurance Loss Probability

The insurance loss probability of your Acura TL directly impacts your auto insurance rates, with lower percentages indicating more favorable rates. Below is a summary of how the Acura TL performs across various coverage categories.

Acura TL Car Insurance Loss Probability| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | -10% |

| Property Damage | -25% |

| Comprehensive | -3% |

| Personal Injury | -7% |

| Medical Payment | -26% |

| Bodily Injury | -23% |

These loss rate percentages provide key insights into the financial risk insurers associate with Acura TL for different types of claims. Better understanding these figures can help you gauge potential insurance costs, as lower loss rates typically result in lower insurance premiums. Learn more in our complete “Types of Auto Insurance.”

Ways to Save on Acura TL Insurance

Reducing your Acura TL insurance costs can be straightforward if you implement a few strategic tips. Here are some effective ways to potentially lower your premiums and make your coverage more affordable.

- Add a more experienced driver to your Acura TL policy.

- Never drink and drive your Acura TL.

- Ask about Acura TL discounts if you were listed on someone else’s policy.

- Work with a direct insurer instead of an insurance broker for your Acura TL.

- Pay your bills on time — especially Acura TL payments and insurance.

By following these practical tips, you can take proactive steps to minimize the expenses associated with insuring your Acura TL.

With State Farm, Acura TL owners enjoy peace of mind through extensive coverage and reliable support.Chris Abrams Licensed Insurance Agent

Staying informed and making smart choices can lead to significant savings on your auto insurance. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Top Acura TL Insurance Companies

The best auto insurance companies for Acura TL insurance rates will offer competitive rates, and discounts, and account for the Acura TL’s safety features. The following list of auto insurance companies outlines which companies hold the highest market share.

Top Acura TL Auto Insurance Companies by Market Share| Rank | Insurance Company | Premium Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Liberty Mutual | $39.2 million | 5.4% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

This list of top insurers for the Acura TL demonstrates which companies are most prevalent in the market, reflecting their ability to meet the specific needs of Acura TL owners through competitive pricing and comprehensive coverage options. When choosing an insurer, consider these leaders who have proven their dominance and reliability in the marketplace.

You can start comparing quotes for Acura TL insurance rates from some of the best auto insurance companies by using our free online tool below.

Frequently Asked Questions

Why do I need auto insurance for my Acura TL?

Auto insurance is necessary for your Acura TL because it provides financial protection in case of accidents, theft, or other unforeseen events. It helps cover the cost of repairs, medical expenses, and potential liabilities, ensuring you’re financially protected.

For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

What types of auto insurance coverage are available for my Acura TL?

Several types of auto insurance coverage are available for your Acura TL, including:

- Liability Coverage: This covers bodily injury and property damage to others if you’re at fault in an accident.

- Collision Coverage: Pays for repairs or replacement if your Acura TL is damaged in a collision.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if you’re in an accident with a driver who doesn’t have enough insurance or any insurance.

When choosing auto insurance for your Acura TL, you have access to a variety of coverage types, ensuring that all aspects of your driving experience are protected.

Will the cost of auto insurance for my Acura TL be higher compared to other vehicles?

The cost of auto insurance for your Acura TL can vary based on several factors, including the model year, trim level, safety features, your driving history, location, and insurance provider. While luxury vehicles like the Acura TL may have slightly higher insurance rates due to their value and repair costs, it’s important to compare quotes from different insurers to find the most competitive rates for your specific Acura TL model.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Are there any discounts available for Acura TL auto insurance?

Many insurance companies offer discounts that could help lower the cost of Acura TL auto insurance. These discounts may include:

- Safe driver discounts for maintaining a clean driving record.

- Multi-vehicle discounts if you insure multiple vehicles with the same company.

- Bundling discounts for combining your auto insurance with other policies, such as home insurance.

- Anti-theft device discounts if your Acura TL has security features.

- Good student discounts for young drivers who maintain good grades.

To reduce the cost of Acura TL auto insurance, take advantage of available discounts such as safe driver, multi-vehicle, bundling, anti-theft device, and good student discounts offered by many insurers.

What should I do if I’m involved in an accident with my Acura TL?

If you’re involved in an accident with your Acura TL, follow these steps:

- Ensure your safety and the safety of others involved by moving to a safe location, if possible.

- Call emergency services if needed and provide any necessary medical assistance.

- Exchange information with the other party involved, including contact details, insurance information, and vehicle information.

- Take photos of the accident scene and any damages to your Acura TL.

- Contact your insurance provider as soon as possible to report the accident and initiate the claims process.

Cooperate fully with your insurance company and provide any necessary documentation or information they require.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

Is insuring an Acura TL expensive due to its reliability?

The Acura TL is known for its reliability, with a RepairPal rating of 4.0 out of 5.0. Its low ownership costs and minimal repair issues typically lead to more affordable insurance premiums compared to less reliable luxury cars.

Does the luxury status of the Acura TL affect its insurance costs?

Yes, the Acura TL’s classification as a luxury sedan can impact its insurance costs. Luxury vehicles often carry higher insurance rates due to their value, performance specifications, and the cost of repairs and parts.

How does the Acura TL’s resale value influence its insurance?

The Acura TL’s moderate resale value can affect insurance premiums. Vehicles that retain their value well are often cheaper to insure because they pose a lower risk in terms of replacement or repair costs.

What is the typical maintenance cost for an Acura TL, and how does it impact insurance?

The Acura TL’s maintenance costs are lower than average at approximately $41.75 per month. Lower maintenance costs can contribute to lower insurance claims for mechanical failures, potentially reducing insurance premiums.

To find out more, explore our guide titled, “Cheap Acura Auto Insurance.”

How does Acura’s overall reliability compare to Lexus in terms of insurance?

Lexus is rated higher in reliability by J.D. Power compared to Acura. This higher reliability can lead to lower insurance rates for Lexus due to fewer claims for breakdowns and repairs, which insurers factor into their risk assessments.

Why did the discontinuation of the Acura TL affect its insurance rates?

How does the Acura TL’s market history in Japan influence insurance?

Which Acura model is the most economical to insure?

Does the engine size of the Acura TL affect its insurance costs?

Is using premium fuel in an Acura TL recommended for insurance purposes?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.