8 Best Pay-As-You-Go Auto Insurance Companies in 2026 (Top Providers Ranked)

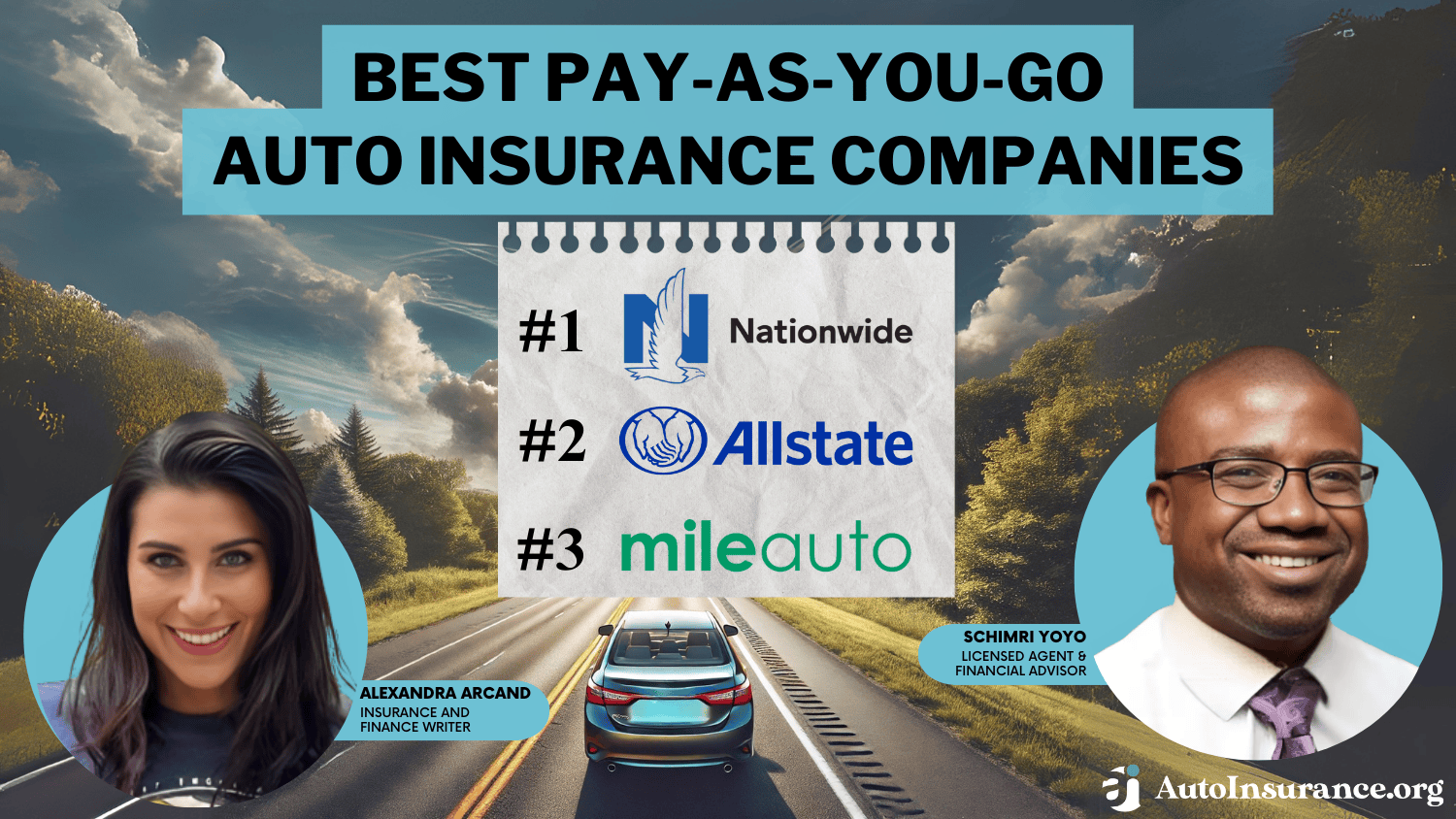

Nationwide, Allstate, and Mile Auto are the best pay-as-you-go insurance companies, offering wide availability and safe driving discounts of up to 40%. If you put 10,000 miles or fewer on your car each year, you may be able to find rates as low as $23 per month with pay-as-you-go car insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2025

3,071 reviews

3,071 reviewsCompany Facts

PAYG Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,640 reviews

11,640 reviewsCompany Facts

PAYG Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 12 reviews

12 reviewsCompany Facts

PAYG Full Coverage

A.M. Best

Complaint Level

Pros & Cons

12 reviews

12 reviewsThe best pay-as-you-go auto insurance companies are Nationwide, Allstate, and Mile Auto. These companies offer the most affordable rates, the best coverage options, and are available in more states than other providers.

Our Top 8 Picks: Best Pay-As-You-Go Auto Insurance Companies

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 40% | A+ | Widespread Availability | Nationwide |

| #2 | 25% | A+ | High-Mileage Savings | Allstate | |

| #3 | 30% | A | Data Privacy | MileAuto | |

| #4 | 52% | A+ | Roadside Assistance | Root | |

| #5 | 40% | A- | Mobile App | Metromile | |

| #6 | 25% | B+ | Short-Term Coverage | Hugo | |

| #7 | 30% | A+ | Safe-Driving Discounts | Progressive | |

| #8 | 40% | A | Military Savings | Noblr |

If you don’t drive often, pay-as-you-go car insurance companies offer low-mileage discounts that can help you find significant savings. Most companies require drivers to install a tracking device to qualify for low-mileage rates, but you can find less intrusive programs with companies like Metromile.

- Pay-as-you-go insurance is best for those who drive less than 8,000 miles per year

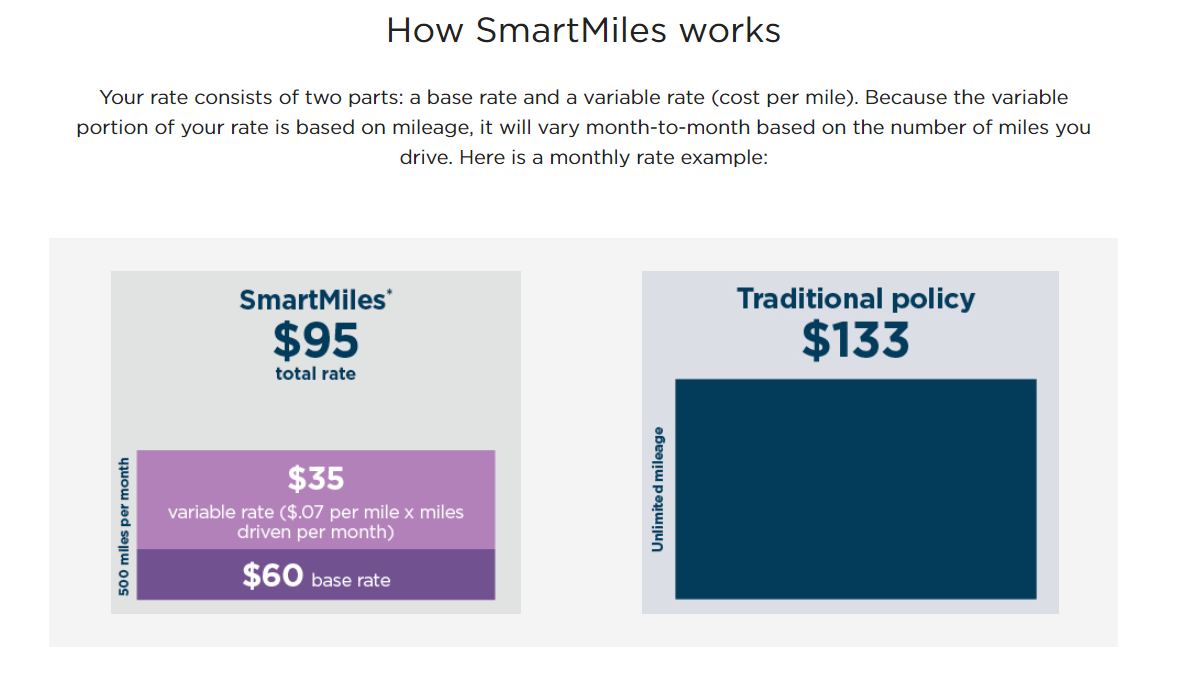

- The Nationwide SmartMiles program is available in most states

- Allstate Milewise has cheap pay-as-you-go car insurance for higher-mileage drivers

You can explore the best pay-as-you-go auto insurance companies below to figure out which is the best for your needs. When you have an idea of which option is the best pay-as-you-go car insurance for you, enter your ZIP code into our free tool to see personalized quotes.

Understanding Pay-As-You-Go Auto Insurance

Pay-as-you-go insurance, also known as pay-per-mile auto insurance, is a flexible and cost-effective option that allows policyholders to pay premiums based on the actual miles driven, making it ideal for occasional drivers or those with low annual mileage.

Before you read the details of pay-as-you-go insurance, check out the rates below to see how much you might pay.

Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level

| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $60–$80 | N/A | |

| $62 | $164 | |

| $71 | $136 | |

| $63 | $164 |

| $107 | $221 | |

| $50 | $150 | |

| $23 | $61 |

Pay-as-you-go car insurance companies have gained popularity because they offer the best auto insurance for infrequent drivers. There are now many pay-as-you-go insurance companies, each with unique features and pricing structures. These companies often utilize telematics devices that automatically track your mileage. The most popular option is through your phone, but you can also find plug-in devices for your car.

For those seeking pay-as-you-go full coverage car insurance, it’s essential to compare rates and coverage options from multiple providers. While some companies may offer comprehensive coverage at competitive rates, others may specialize in basic coverage for minimal driving needs.

When looking for the best pay-as-you-go insurance, consider factors such as pricing transparency, customer service reputation, and coverage flexibility.

So, how does pay-as-you-go auto insurance work? It mind seem complicated, but the way your rates are calculated is actually simple.

To determine how much you pay for coverage, pay-as-you-go companies will assign you two rates. The first is a flat fee you pay every month, whether you drive zero miles or a thousand. The second is your per-mile rate, which is usually just a few cents. So if your base cost is $50 monthly, your per-mile charge is $.04, and you travel 300 miles, you would spend $62 that month.

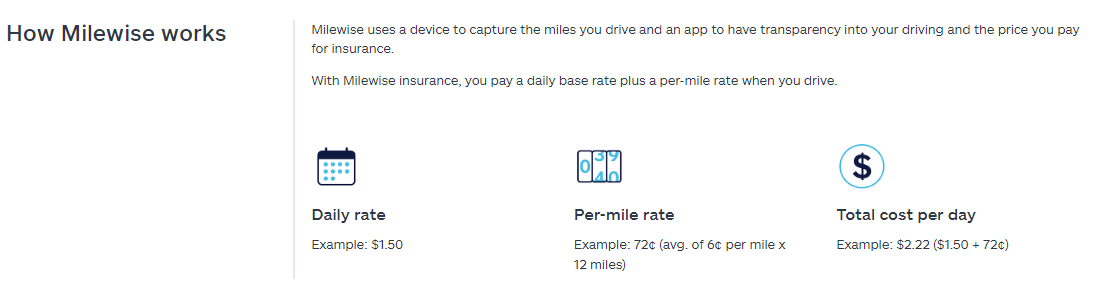

Milewise charges by the day, with a flat rate of $1.50 plus $.06 per mile, which adds up to the cheapest pay-as-you-go auto insurance rates in more states than Metromile.

Many people refer to this type of coverage as “prepaid car insurance” because users only pay for the extra miles they drive after the set base cost. Insurance companies track mileage through a device installed in the car or through self-reporting. The plug-in device communicates with the mobile app on your phone so drivers can see how rates change with each trip.

Some insurance companies like Hugo offer short-term coverage, but most pay-per-mile providers sell traditional policies.Daniel Walker Licensed Auto Insurance Agent

Local pay-as-you-go auto insurance companies will also offer uninsured/underinsured motorist (UM/UIM) and personal injury protection (PIP) to meet state laws, but you won’t always find additional coverages like rideshare insurance or roadside assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pay-As-You-Go Auto Insurance Rates

Drivers don’t have to worry about the typical factors that affect auto insurance rates with pay-as-you-go insurance, as premiums depend solely on the miles driven. Pay-as-you-go or pay-by-the-day car insurance rates change month by month based on how much you drive.

However, that doesn’t mean you can’t get an estimate of how much you might pay. To get an idea of how much pay-as-you-go insurance might cost you, check out the rates below.

Pay-As-You-Go Auto Insurance Rates by Age & Gender

| Age & Gender | Rates |

|---|---|

| 16-Year-Old Female | $292 |

| 16-Year-Old Male | $323 |

| 25-Year-Old Female | $73 |

| 25-Year-Old Male | $76 |

| 35-Year-Old Female | $67 |

| 35-Year-Old Male | $68 |

| 45-Year-Old Female | $62 |

| 45-Year-Old Male | $61 |

| 65-Year-Old Female | $62 |

| 65-Year-Old Male | $63 |

Although mileage is the most important factor in premiums, your base rate is affected by many factors. For example, younger drivers will typically pay more for pay-per-mile insurance than more experienced drivers, even if they drive the same number of miles.

Experts recommend avoiding temporary pay-by-the-day auto insurance because interrupted coverage can negatively affect your premiums.Justin Wright Licensed Insurance Agent

Another important factor to consider is your driving record. Drivers with at-fault accidents, speeding tickets, and DUIs will pay higher rates for insurance than drivers with a clean record. To see the difference your driving record can make, check out the rates below.

Other important factors include what type of vehicle you drive and where you live. For example, pay-as-you-go car insurance in Georgia typically costs less than it does in Florida. To get the cheapest car insurance with pay-as-you-go payment options, you can enter your ZIP code into our free comparison tool.

The Difference: Usage-Based Insurance vs. Pay-As-You-Go Insurance

Usage-based auto insurance (UBI) and pay-per-mile coverage are similar in many ways. Both provide state minimum and full coverage policies, and both often require plug-in devices to track driving behavior to determine rates.

The biggest difference between the two is the pay-as-you-go feature. Only pay-per-mile coverage allows drivers to pay rates solely based on miles driven, sometimes per trip, while UBI relies on safe driving habits to generate a discount.

Usage-based insurance companies also still charge a monthly or annual rate based on demographics like age and gender.

Pay-As-You-Go Auto Insurance for Teens and Seniors

Finding the right car insurance can be particularly challenging for young drivers and seniors. It can be very difficult to find affordable pay-as-you-go insurance for young drivers and the best car insurance for seniors. Teens’ and seniors’ insurance needs often differ from those of other age groups.

For young drivers, pay-as-you-go insurance is an excellent opportunity for savings. Due to new drivers having less experience and higher accident rates, they unfortunately can’t avoid paying higher rates than other drivers.

Pay-as-you-go car insurance for young drivers is a flexible, cost-effective option. Pay-as-you-go young driver insurance can be the affordable option that teens (and their parents) are desperately searching for.

This type of insurance allows policyholders to pay premiums based on their actual mileage, which can be beneficial for those who drive less frequently or only short distances, often the case for senior drivers. It helps young drivers and seniors alike manage their insurance costs while maintaining the coverage they need.

Read More: Cheap Auto Insurance for Drivers Over 80

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pay-As-You-Go Auto Insurance by Location

Navigating car insurance options in specific regions involves exploring tailored solutions. Pay-as-you-go car insurance in Texas and pay-per-mile car insurance in California have become how money-conscious drivers shop for their auto insurance coverage. These customized pay-as-you-go options cater to drivers’ needs and offer more flexible, cost-effective coverage than traditional auto insurance models.

Pay-per-mile car insurance in Florida has been very successful. It is designed to meet the unique requirements of drivers in the Sunshine State, aligning premiums with actual driver usage patterns.

Pay-as-you-go car insurance in Florida is growing in popularity as it provides an alternative to conventional insurance plans, allowing policyholders to pay premiums based on their actual mileage.

Enjoying the new normal of working from home?🏡Don’t keep paying the same rates as when you were commuting! At https://t.co/27f1xf131D, we can help you understand usage-based auto insurance so you can save big while teleworking!💲Learn more here👉: https://t.co/Giu8rLtTaE pic.twitter.com/DGagWIWS9m

— AutoInsurance.org (@AutoInsurance) April 21, 2023

If you are considering your insurance options in Florida, it’s important to review specific Hugo Insurance Florida reviews (and other pay-per-mile coverage options) to make an informed decision about which provider and level of coverage you choose.

Drivers seeking affordable car insurance in PA, MD, and SC have reported this mileage-based, prepaid auto insurance as the most affordable option in their area, emphasizing its value and affordability.

Read More: Auto Insurance Rates by State

Ultimately, selecting the right insurance coverage requires careful consideration of regional regulations, individual needs, and budgetary constraints. Pay-as-you-go has repeatedly been a winner.

Pros and Cons of Pay-As-You-Go Auto Insurance

Many pay-as-you-go auto insurance companies are new, not verified by A.M. Best or the Better Business Bureau, and don’t operate in many states. However, many drivers are using these companies to find an insurance policy that better suits their lifestyle.

Like all things in life, there are pros and cons to pay-as-you-go insurance. When you get a pay-per-mile insurance policy, you can expect the following benefits:

- Lower Rates: Since you only pay for the miles you drive, low-mileage drivers can find the cheapest auto insurance companies with much less effort than with a traditional policy.

- More Flexibility: Some companies offering pay-as-you-go car insurance, like Hugo, offer short-term policies. Others may let you prepay for car insurance rather than having you wait for a monthly bill.

- Promotes Less Driving: Pay-per-mile insurance offers great encouragement if you’re trying to reduce your time behind the wheel.

You’ll also need to be aware of the drawbacks of pay-as-you-go insurance before you sign up. These include:

- Possible Penalties: Some companies penalize drivers for exceeding a certain number of miles in a single drive, and you might need to notify your company before going on a road trip.

- Limited Coverage: Most pay-as-you-go policies don’t have many customization options. If you want to save with a low-mileage policy, you’ll likely only get the basic types of auto insurance.

- Budgeting Issues: If you’re the sort of person who likes to know the exact total of your monthly bill in advance, a pay-per-mile policy might not be right for you.

If you’re unsure if the low-mileage car insurance is right for you, ask your provider about a test drive. It can offer you a reduced rate for a limited amount of time so that you can try out the service.

8 Best Pay-As-You-Go Auto Insurance Companies

Ready to see the best companies with a pay-per-mile auto insurance option? The companies listed below are our top picks, but make sure to read carefully. Some companies are best for drivers looking for pay-by-day car insurance, while others are add-ons to traditional policies.

#1 – Nationwide: Top Pick Overall

Pros

- Availability: Nationwide’s SmartMiles is available in 44 states, more than any other pay-as-you-go insurance company.

- Low Daily Mileage Cap: Nationwide caps the daily miles you’re charged for at 250 miles per day, making long drives and road trips more affordable.

- Safe Driving Rewards: By being a safe driver, you can earn an additional 10% off your Nationwide policy after your first renewal period.

Cons

- Not in Every State: Nationwide’s pay-per-mile program is not available in Alaska, Hawaii, Louisiana, North Carolina, New York, and Oklahoma.

- Better Usage-Based Rates: You likely save more by signing up for Nationwide’s UBI program, SmartRide. Learn how to save more money in our Nationwide SmartRide review.

#2 – Allstate: Cheapest for High-Mileage Drivers

Pros

- Affordable Mileage Cap: With Allstate’s Milewise program, the maximum miles you’ll be charged for in a single day are 250. Learn more in our Allstate auto insurance review.

- Affordable Rates: Allstate offers the cheapest pay-as-you-go car insurance, and the Milewise Unlimited program offers savings to higher-mileage drivers.

- Unique Perks: Drivers can earn Allstate Rewards points for their good driving habits. Simply sign up for the program to get started.

Cons

- Limited Availability: Milewise by Allstate is only available in 21 states. If you don’t qualify, you can always try Allstate’s UBI program.

- Rate Increases: Bad driving habits can increase your Allstate rates in some states, even if you’re signed up for a low-mileage policy.

#3 – Mile Auto: Best for Privacy Concerns

Pros

- No Data Tracking: Mile Auto does not use a plug-in device to track your driving habits or location. If you’re uncomfortable being tracked, Mile Auto might be your best choice.

- Cheap Rates: With competitive rates, Mile Auto may be your cheapest option for pay-as-you-go insurance. See how much you might pay in our Mile Auto insurance review.

- Coverage Options: Unlike some pay-per-mile companies, Mile Auto offers policy customization options like roadside assistance and rental car reimbursement.

Cons

- Limited Availability: Mile Auto is only available in 11 states, making it impossible for most Americans to sign up for a policy.

- No Mileage Caps: Mile Auto does not cap the number of miles you can be charged for in a day or month. If you like the occasional road trip, you’ll get charged for every mile with Mile Auto.

#4 – Root: Best for Roadside Assistance

Pros

- Free Roadside Assistance: Root offers roadside assistance in every insurance policy it sells. To learn more, check out our Root auto insurance review.

- Customization Options: You can add rental car and rideshare reimbursement coverage to your policy as needed.

- Additional Discounts: Many pay-as-you-go insurance companies don’t offer discounts, but you may qualify for additional savings with Root.

Cons

- Not Available Everywhere: Root is currently available in just 34 states.

- No High-Risk Drivers: To qualify for a Root policy, you have to have a clean driving record. Root does not cover high-risk drivers to help keep costs low.

#5 – Metromile: Best Mobile App

Pros

- Pay-As-You-Go Pioneer: Metromile was one of the first insurance companies exclusively designed for low-mileage drivers.

- Hi-Tech Perks: Take advantage of one of the best pay-as-you-go car insurance apps with Metromile. It offers features that go beyond trip management.

- Growth Potential: Metromiles’ recent merger with Lemonade could expand coverage options in the future.

Cons

- Limited Availability: Metromile is currently only available in Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Use our Metromile auto insurance review to find coverage near you.

- Requires Mobile Phone: If you want to sign up for a Metromile policy, you’ll need access to a mobile phone. Metromile’s plug-in device always requires cell phone service to track mileage.

#6 – Hugo: Best for Short-Term Coverage

Pros

- Flexible Premiums: There are multiple payment options for your Hugo pay-as-you-go car insurance, including prepaid car insurance and payment plans. You can learn more in our Hugo auto insurance review.

- Short-Term Coverage: Finding car insurance similar to Hugo can be difficult, as it’s one of the only providers offering short-term coverage. You can purchase Hugo prepaid insurance for as short as three days.

- Immediate Coverage: Get same-day pay-as-you-go car insurance with no deposit from Hugo. All you have to do is sign up online.

Cons

- Limited Availability: Hugo only sells insurance in 13 states. There are other pay-as-you-go insurance like Hugo, so keep searching if it’s unavailable in your state.

- Standard Coverage: You won’t be able to customize your policy with Hugo, as options are limited to liability, collision, and comprehensive insurance. You’ll need Hugo insurance alternatives if you need more coverage.

#7 – Progressive: Biggest Discounts for Safe Drivers

Pros

- Safe Driver Rewards: Your safe driving habits can lead to substantial discounts with Progressive. See our Progressive auto insurance discounts to learn more.

- Quick Sign-Up: Progressive focuses on innovative ways to bring you car insurance. One of the ways it does so is by making it easy to buy a policy through the mobile pay-as-you-go insurance app.

- No Long-Term Tracking: Progressive doesn’t track you forever. After your initial testing period is complete, Progressive stops tracking driving habits.

Cons

- Rate Increases: Progressive automatically tracks driving habits along with your mileage, which can increase rates.

- Limited Discounts: The initial participation discount is only available to new customers. Customers with a traditional Progressive policy will not receive the initial discount.

#8 – Noblr: Best for Military Families

Pros

- Coverage Options: Noblr offers car insurance options, including rental car reimbursement and roadside assistance coverage.

- Convenient Mobile App: Noblr offers a convenient mobile app that offers real-time feedback on driving habits.

- Savings Account: Drivers have the potential to earn money back with the Noblr subscriber savings account.

Cons

- Not in Every State: Noblr may be USAA’s pay-per-mile option, but it is much more limited in availability. See which states are covered in our Noblr auto insurance review.

- Exclusive for Military Drivers: Like USAA, Noblr is only available to military members and their immediate families.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Pay-As-You-Go Auto Insurance Companies Today

Nationwide SmartMiles is available in more states, allowing more drivers to get cheap pay-as-you-go auto insurance. However, if you live in a state where Mile Auto, Metromile, or Hugo Insurance is available, you will get cheaper, more flexible coverage. Further, Mile Auto is the only company on this list that does not use a tracking device for drivers concerned about data breaches.

Pay-per-mile insurance may not be the best option for everyone, but it is worth considering if you don’t drive frequently, especially when Allstate Milewise offers an unlimited policy. You may also want to look at Allstate Milewise and Progressive Snapshot for good driver auto insurance discounts to help lower rates for higher-mileage drivers.

The best way to find cheap pay-per-mile car insurance companies is to compare auto insurance quotes online and make sure you choose a policy that best fits your needs. Enter your ZIP code to get started on quote comparison.

Frequently Asked Questions

How much is pay-as-you-go car insurance?

The cost of pay-per-mile insurance varies depending on several factors, including your driving habits, mileage, location, vehicle type, and insurance provider. Generally, policyholders pay a base rate, often referred to as a “base premium,” along with a per-mile charge.

Whether you get daily pay auto insurance, or standard pay-as-you-go coverage, you can find rates as low as $23 per month for minimum coverage. For full coverage, rates start at $61 per month. Keep in mind that only low-mileage drivers will see low rates, though. If you’re a frequent driver but you keep your driving record clean, it might be easier to find cheap usage-based auto insurance instead of a pay-as-you-go policy.

Is pay-per-mile auto insurance cheaper?

When it comes to auto insurance, pay-as-you-go can be cheaper, depending on how much you drive. Pay-per-mile car insurance is best for people who don’t drive frequently, and it can save them money. However, it may not be as cost-effective for those who drive more often.

How do auto insurance companies check mileage?

Insurance companies may use various methods to track your mileage, including odometer readings, global positioning systems (GPS), and plug-in devices.

What happens if you exceed your annual mileage?

Some pay-per-mile insurance plans have penalties for exceeding your annual mileage limit. In contrast, others allow you to buy additional miles at a predetermined cost. Therefore, it’s important to keep track of how many miles you drive so you don’t end up paying more than expected.

What is the best pay-as-you-go auto insurance company?

While there are many great pay-as-you-go and pay-by-day insurance companies, the best are Nationwide, Allstate, and Mile Auto. However, the best company for you depends on your needs. For example, if you want temporary coverage, pay-as-you-go insurance like Hugo policies may be a better fit. If you want to buy auto insurance online instantly, Progressive is a great option.

To find the best car insurance with pay-by-the-day policies or a mileage-tracking pay-as-you-go plan, enter your ZIP code into our free comparison tool to see rates in your area.

Does Hugo Insurance offer full coverage auto insurance?

Yes, Hugo offers full coverage auto insurance. Hugo pay-as-you-go insurance policies can include liability, collision, and comprehensive coverage. You may also be able to add things like uninsured/underinsured motorist, medical payments, and rental car reimbursement coverage.

Does Hugo Insurance cover Georgia?

If you’re looking for pay-as-you-go car insurance in Georgia with no deposit, you’re not the only one. “Pay-as-you-go car insurance in Georgia” is a top search these days. Georgia is one of the 13 states where Hugo sells car insurance, which means you can sign up for its daily pay car insurance.

Are there other companies with auto insurance like Hugo?

Hugo is one of the newer players in the pay-as-you-go insurance market, so it doesn’t offer daily pay insurance nationwide yet. However, its car insurance with daily pay is a popular idea, so drivers throughout the country are starting to look for companies like Hugo Insurance with temporary auto insurance.

Luckily, there are many companies like Hugo insurance pay-as-you-go. In fact, every state has pay-as-you-go insurance providers for you to choose from. Most modern companies also have apps like Hugo Insurance, so you can get the best service possible. Companies like Progressive, Root, and Metromile are excellent Hugo alternatives if you’re looking for pay-per-day insurance.

Who should get pay-as-you-go auto insurance?

Pay-as-you-go car insurance is a good choice for people who don’t drive very often. Those who work from home or take public transportation, students in college, and drivers with another car idling at home could all save money with pay-per-mile insurance.

What is the best pay-as-you-go car insurance in Florida?

Metromile, Root, and Progressive offer the best Florida pay-as-you-go auto insurance. These companies make it easy to get pay-as-you-go car insurance with no deposit, offer affordable rates, and have dependable mileage-tracking apps.

Is pay-per-mile car insurance worth it?

Is Allstate Milewise a good option for pay-as-you-go auto insurance?

Can I get car insurance discounts with pay-per-mile auto insurance?

What is the best pay-as-you-go car insurance in California?

Is my privacy compromised with pay-as-you-go auto insurance?

Can you combine pay-per-mile and usage-based insurance savings?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.