Best Orangeburg, South Carolina Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Geico, and Allstate are the best Orangeburg, South Carolina auto insurance providers, with rates beginning at $49 per month. These companies stand out for their competitive premiums, comprehensive coverage, and high customer satisfaction, making them the preferred choice for drivers in Orangeburg.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated October 2024

Company Facts

Full Coverage in Orangeburg SC

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Orangeburg SC

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Orangeburg SC

A.M. Best

Complaint Level

Pros & Cons

Orangeburg, South Carolina auto insurance requires 25/50/25 coverage. To find affordable options, look for auto insurance discounts and compare rates from different providers.

Our Top 10 Company Picks: Best Orangeburg, South Carolina Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 18% B Multiple Discounts State Farm

![]()

#2 17% A++ Affordable Rates Geico

![]()

#3 16% A+ Comprehensive Coverage Allstate

#4 14% A+ Online Tools Progressive

#5 22% A++ Customer Service USAA

#6 21% A+ Financial Stability Nationwide

#7 16% A Car Replacement Liberty Mutual

#8 12% A+ Rental Reimbursement Farmers

#9 10% A++ Accident Forgiveness Travelers

#10 20% A++ Roadside Assistance Chubb

Enter your ZIP code above for free quotes and potential savings for your vehicle in Orangeburg, South Carolina.

- Secure top rates starting at $49 per month with State Farm, the top overall choice

- Explore the best auto insurance options in Orangeburg, tailored to your needs

- Find affordable coverage that fits your unique requirements across Orangeburg

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options that are among the best for Orangeburg, South Carolina auto insurance, including rental car coverage and roadside assistance.

- Strong Local Presence: With a robust network of local agents in Orangeburg, South Carolina, State Farm provides personalized service that stands out in the best Orangeburg, South Carolina auto insurance market.

- High Customer Satisfaction: State Farm consistently receives high ratings for customer service and claims handling, making it a top choice in the best Orangeburg, South Carolina auto insurance sector. Wondering about their level of customer service? Find out in our State Farm company review.

Cons

- Higher Premiums for Some Drivers: Premiums may be higher for drivers with poor credit or high-risk profiles, which can be a downside in the quest for the best Orangeburg, South Carolina auto insurance.

- Limited Online Tools: The online tools offered by State Farm are less advanced compared to some competitors, which might hinder those seeking the best Orangeburg, South Carolina auto insurance experience online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is renowned for offering some of the most competitive premiums in the best Orangeburg, South Carolina auto insurance market, starting as low as $49 per month. Learn more in our Geico review.

- Extensive Discounts: Offers a variety of discounts, such as those for federal employees and good drivers, enhancing its position as a top choice for affordable Orangeburg, South Carolina auto insurance.

- Strong Financial Stability: With high financial ratings (A++), Geico ensures reliable claims handling and long-term stability, key factors in choosing the best Orangeburg, South Carolina auto insurance.

Cons

- Limited Local Agent Interaction: Geico’s primarily online or phone-based operations might not suit those preferring in-person interactions, which can be a drawback for the best Orangeburg, South Carolina auto insurance.

- Potential Coverage Gaps: Some customers report limited coverage options compared to traditional insurers, potentially affecting its standing in the best Orangeburg, South Carolina auto insurance market.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers extensive features like accident forgiveness and new car replacement, making it a strong contender in the best Orangeburg, South Carolina auto insurance market. Read more about this provider in our Allstate auto insurance review.

- Robust Online Tools: Excellent digital tools and a mobile app for managing your policy and claims contribute to its reputation for the best Orangeburg, South Carolina auto insurance.

- Good Customer Service: High customer satisfaction ratings for service and claims support make Allstate a standout option in the best Orangeburg, South Carolina auto insurance sector.

Cons

- Higher Rates for Some Drivers: Premiums can be higher, particularly for drivers with less-than-perfect records, which might detract from Allstate’s appeal as the best Orangeburg, South Carolina auto insurance provider.

- Complex Policy Options: The extensive array of options can be overwhelming, potentially complicating the process of finding the best Orangeburg, South Carolina auto insurance for some customers.

#4 – Progressive: Best for Online Tools

Pros

- Competitive Rates: Progressive offers competitive premiums and flexible coverage options, including usage-based insurance programs, which are ideal for those seeking the best Orangeburg, South Carolina auto insurance.

- Innovative Online Tools: Tools like Name Your Price® and Snapshot® enhance user control over their policies and driving habits, making Progressive a leading choice in the best Orangeburg, South Carolina auto insurance market.

- Flexible Coverage Options: Provides a wide range of coverage options to cater to various needs, positioning it as one of the best providers of Orangeburg, South Carolina auto insurance.

Cons

- Variable Coverage Quality: Some customers report inconsistencies in coverage quality, which may impact its reputation in the best Orangeburg, South Carolina auto insurance market. Our complete Progressive review goes over this in more detail.

- Additional Fees: Progressive may have extra fees or higher rates for certain types of coverage, which could be a drawback for those seeking the most affordable Orangeburg, South Carolina auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Customer Service

Pros

- Excellent Customer Service: USAA receives high marks for customer satisfaction and claims support, making it a top choice for the best Orangeburg, South Carolina auto insurance among military families. See how USAA’s rates compare to other insurance providers in our USAA auto insurance review.

- Comprehensive Coverage: Provides robust coverage options including rental car coverage and roadside assistance, which is ideal for those seeking the best Orangeburg, South Carolina auto insurance.

- Strong Financial Stability: High financial ratings (A++) ensure reliable claims handling and long-term stability, crucial for finding the best Orangeburg, South Carolina auto insurance.

Cons

- Limited Eligibility: USAA is only available to military members and their families, which excludes many from accessing what might be the best Orangeburg, South Carolina auto insurance.

- Higher Rates for Non-Military: For those not eligible for USAA, rates may not be as competitive, which can limit its appeal for the best Orangeburg, South Carolina auto insurance.

#6 – Nationwide: Best for Financial Stability

Pros

- Financial Stability: Nationwide’s strong financial ratings (A+) ensure reliability in claims payment and long-term stability, making it a solid option for the best Orangeburg, South Carolina auto insurance. Explore more add-on options in our Nationwide auto insurance review.

- Discounts: Offers various discounts, including for multi-policy holders and safe drivers, which can help reduce costs in the best Orangeburg, South Carolina auto insurance market.

- User-Friendly Online Tools: Provides a solid online platform for managing policies and claims, enhancing its position among the best Orangeburg, South Carolina auto insurance providers.

Cons

- Higher Rates for Some Drivers: Premiums may be higher for drivers with poor credit or high-risk profiles, potentially affecting its standing as the best Orangeburg, South Carolina auto insurance.

- Customer Service Variability: Experiences with customer service can vary, which might impact its reputation in the best Orangeburg, South Carolina auto insurance market.

#7 – Liberty Mutual: Best for Car Replacement

Pros

- Unique Coverage Options: Liberty Mutual provides features like new car replacement and better car replacement, making it a competitive option in the best Orangeburg, South Carolina auto insurance market.

- Strong Financial Ratings: High financial stability ratings ensure reliable claims handling and long-term stability, crucial for the best Orangeburg, South Carolina auto insurance.

- Good Mobile App: Well-rated mobile app for managing policies and claims, enhancing the overall experience in the best Orangeburg, South Carolina auto insurance market. To see monthly premiums and honest rankings, read our Liberty Mutual review.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, which might be a drawback for those seeking the best Orangeburg, South Carolina auto insurance at lower costs.

- Customer Service Issues: Some customers report problems with claims processing and customer service, which can impact its standing in the best Orangeburg, South Carolina auto insurance market.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Rental Reimbursement

Pros

- Strong Local Presence: With numerous local agents, Farmers offers personalized service that can be valuable for those seeking the best Orangeburg, South Carolina auto insurance.

- Discounts: Offers various discounts, including multi-policy and safety feature discounts, which can enhance its appeal as a top choice for Orangeburg, South Carolina auto insurance. Take a look at our Farmers insurance company review to learn more.

- Good Customer Service: Generally positive reviews for customer service and support contribute to its reputation as a leading provider of the best Orangeburg, South Carolina auto insurance.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for high-risk drivers, which might make it less competitive in the best Orangeburg, South Carolina auto insurance market.

- Inconsistent Customer Service: Service quality can vary by location, potentially impacting its overall reputation in the best Orangeburg, South Carolina auto insurance market.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Numerous Discounts: Provides several discounts, such as for safe drivers and bundling policies, which can help lower premiums in the best Orangeburg, South Carolina auto insurance market.

- Strong Financial Ratings: High financial stability ratings (A++) ensure reliable claims handling and long-term stability, crucial for the best Orangeburg, South Carolina auto insurance. For more information, read our Travelers company review.

- Good Online Tools: Offers a user-friendly website and mobile app for managing policies and claims, enhancing its appeal as a top provider in the best Orangeburg, South Carolina auto insurance market.

Cons

- Higher Premiums for Some Drivers: Rates may be higher for drivers with poor credit or high-risk profiles, which could impact its standing as the best Orangeburg, South Carolina auto insurance.

- Inconsistent Customer Service: Some customers report issues with customer service and claims handling, affecting its reputation in the best Orangeburg, South Carolina auto insurance sector.

#10 – Chubb: Best for Roadside Assistance

Pros

- Comprehensive Coverage Options: Chubb offers an extensive range of coverage options, including higher limits for property damage and liability, making it a strong contender for the best Orangeburg, South Carolina auto insurance.

- Personalized Service: Provides tailored insurance solutions and dedicated agents, ensuring a customized approach to the best Orangeburg, South Carolina auto insurance. Read more through our Chubb auto insurance review.

- High Financial Strength: With top financial ratings (A++), Chubb ensures reliability and stability, crucial factors for securing the best Orangeburg, South Carolina auto insurance.

Cons

- Higher Premiums: Chubb’s premium rates may be higher compared to some competitors, which can be a disadvantage for those seeking the most affordable best Orangeburg, South Carolina auto insurance.

- Limited Availability: Chubb’s coverage options may not be available in all areas, which could limit its accessibility for some residents looking for the best Orangeburg, South Carolina auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Basic Auto Insurance Coverage Level in Orangeburg, South Carolina

When seeking the best auto insurance coverage in Orangeburg, South Carolina, it’s essential to understand the required coverage levels and options available.

Orangeburg, South Carolina Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $58 $140

Chubb $50 $127

Farmers $57 $140

Geico $52 $130

Liberty Mutual $60 $145

Nationwide $54 $138

Progressive $53 $132

State Farm $55 $135

Travelers $55 $135

USAA $49 $125

South Carolina mandates a minimum liability coverage of 25/50/25, which means $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage.

However, to ensure comprehensive protection, consider higher coverage limits and optional add-ons such as collision, comprehensive, and uninsured and underinsured motorist coverage.

These enhancements can provide greater financial security and peace of mind in various scenarios, from accidents to theft or natural disasters.

Tailoring your coverage to meet both legal requirements and personal needs will help you find the best auto insurance coverage in Orangeburg.

Cheap Orangeburg, South Carolina Auto Insurance Rates By ZIP Code

Auto insurance rates in Orangeburg, South Carolina, can vary significantly depending on the zip code.

For example, comparing auto insurance rates by ZIP code in Orangeburg reveals that premiums may be higher in areas with higher traffic congestion or crime rates.

By evaluating how different ZIP codes affect insurance costs, residents can understand the impact of local factors on their premiums. This insight helps Orangeburg drivers make more informed choices and find the best auto insurance rates based on their specific location. Enter your ZIP code now to begin.

Credit Score Affecting Orangeburg, South Carolina Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Most Affordable Companies for Orangeburg, South Carolina Auto Insurance

Frequently Asked Questions

What should I do if I’m involved in an auto accident in Orangeburg, South Carolina?

Ensure safety, exchange information, document the scene, report to your insurance company, and seek medical attention if needed.

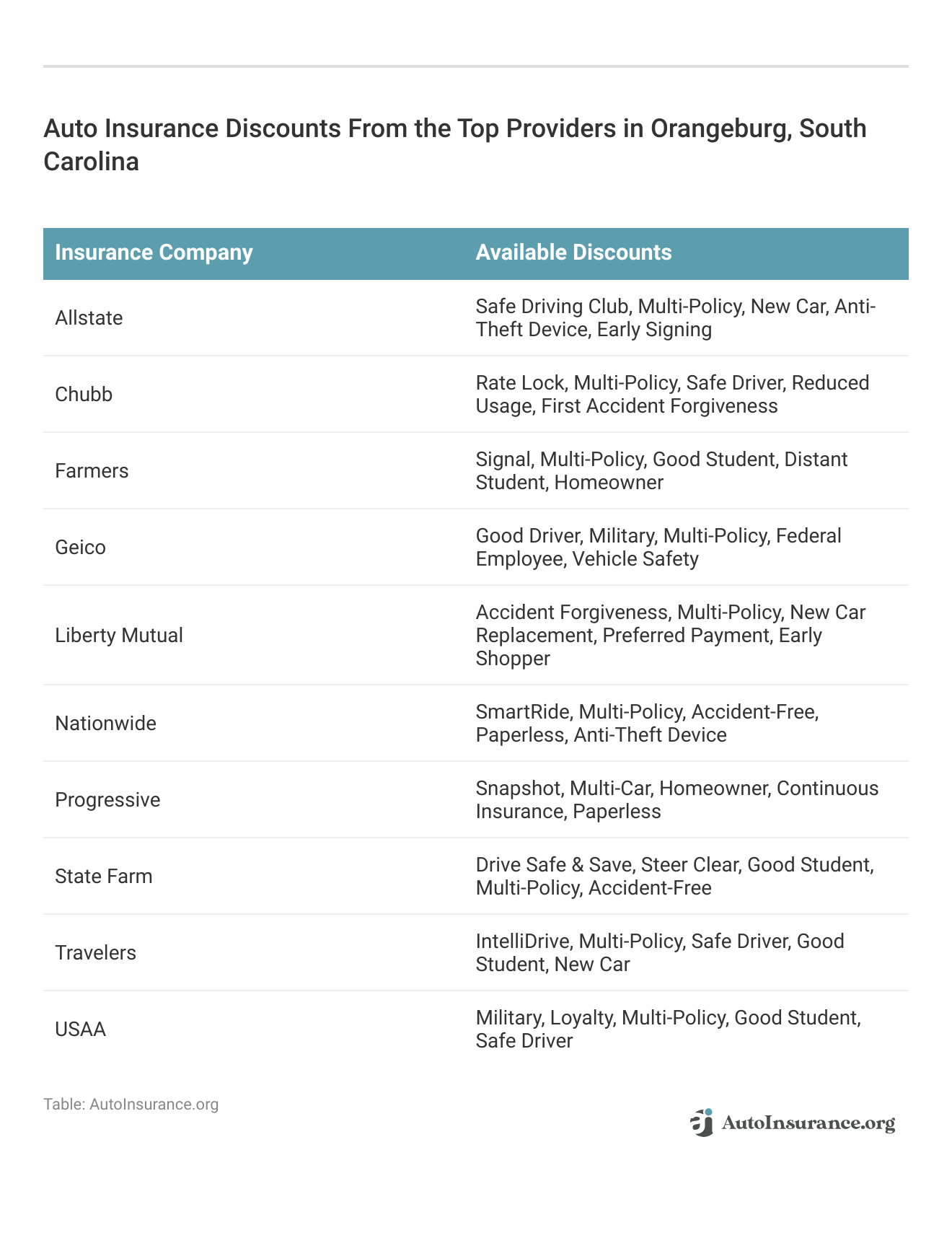

Are there any discounts available for auto insurance in Orangeburg, South Carolina?

Yes, common discounts include safe driver, multi-policy, good student, low mileage, and safety feature discounts. Enter your ZIP code now to begin.

Can I get auto insurance coverage for rental cars in Orangeburg, South Carolina?

When considering auto insurance, it’s important to understand whether your policy includes auto insurance covering rental cars.

To ensure you’re adequately protected, inquire with your insurance provider to confirm if rental cars are covered under your current plan.

Additionally, checking with your credit card company can also be beneficial, as many credit cards offer rental car coverage that could complement your auto insurance.

What factors are considered when determining auto insurance rates in Orangeburg, South Carolina?

Factors include age, gender, driving record, credit history, location, vehicle type, mileage, coverage level, and underwriting criteria.

How can I lower my auto insurance rates in Orangeburg, South Carolina?

Maintain a clean driving record, take defensive driving courses, choose a higher deductible, bundle policies, and compare quotes. Enter your ZIP code now to begin.

Can I bundle my auto insurance with other types of insurance?

Yes, bundling policies can lead to savings on overall insurance costs.

For families, finding the best auto insurance for families often involves looking for discounts that come from combining car insurance with other types of coverage, such as home or life insurance.

This bundling can reduce premiums and provide a more comprehensive protection package, making it a valuable option for family insurance needs.

Which company offers the best Orangeburg, South Carolina auto insurance for affordable rates?

Geico is known for offering competitive premiums and numerous discounts, making it a top choice for affordable auto insurance in Orangeburg, South Carolina. State Farm also provides competitive rates and discounts for various driver profiles.

What is the minimum required auto insurance coverage in Orangeburg, South Carolina?

South Carolina mandates a minimum liability coverage of 25/50/25, which includes $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage.

It’s advisable to consider higher coverage limits for better protection. Enter your ZIP code now to begin.

How does credit score impact auto insurance rates in Orangeburg, South Carolina?

Which provider is recognized for comprehensive coverage in Orangeburg, South Carolina?

Allstate is noted for its extensive coverage options, including accident forgiveness and new car replacement, making it a strong contender for comprehensive auto insurance in Orangeburg, South Carolina.

Chubb also offers comprehensive coverage with high limits and personalized service.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.