Best Jeep Wrangler Auto Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, Allstate, and USAA are the top providers of the best Jeep auto insurance, with rates starting as low as $32 per month. State Farm offers comprehensive coverage for Jeeps, while Allstate has affordable roadside assistance that can help during off-roading. Compare quotes to get cheaper insurance for Jeeps.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Jeep Wrangler Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsCompany Facts

Jeep Wrangler Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 6,589 reviews

6,589 reviewsCompany Facts

Jeep Wrangler Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

State Farm, Allstate, and USAA are the top providers for the best Jeep Wrangler auto insurance, with rates as low as $32 per month. For those seeking affordable insurance on a Jeep Wrangler, State Farm stands out as the top pick overall. Compare quotes to find the best rates for your needs.

Find out how much insurance for a Jeep Wrangler can vary and how vehicle year affects auto insurance rates. Our guide delves into these topics, offering insights into cost differences and tips for securing the best coverage based on your Jeep Wrangler’s age and other factors.

Our Top 10 Company Picks: Best Jeep Wrangler Auto Insurance

Company Rank Multi-Vehicle

DiscountA.M. Best Best For Jump to Pros/Cons

#1 12% B Many Discounts State Farm

#2 15% A+ Add-on Coverages Allstate

#3 10% A++ Military Savings USAA

#4 18% A+ Online Convenience Progressive

#5 14% A++ Accident Forgiveness Travelers

#6 9% A Local Agents AAA

#7 17% A++ Cheap Rates Geico

#8 11% A Local Agents Farmers

#9 13% A Customizable Polices Liberty Mutual

#10 16% A+ Usage Discount Nationwide

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Jeep auto insurance rates typically hover around the national average

- Jeep owners often benefit from roadside assistance, especially if they go off-roading

- Progressive and State Farm offers cheap Jeep insurance

#1 – State Farm: Top Pick Overall

Pros

- Personalized Service: As mentioned in our State Farm auto insurance review, State Farm offers tailored insurance plans specifically for Jeep Wranglers, with local agents providing personalized support to address your individual coverage needs. This ensures that Jeep Wrangler owners receive customized service.

- Flexible Coverage Options: Their insurance policies include comprehensive and collision coverage, essential for protecting your Jeep Wrangler against a range of risks. State Farm’s flexibility allows for adaptation to different driving scenarios.

- Local Presence: With a vast network of local agents, State Farm provides convenient access to face-to-face consultations and support, making it easier for Jeep Wrangler owners to manage their insurance and address any concerns.

Cons

- Higher Rates for Younger Drivers: Younger Jeep Wrangler owners may face higher premiums due to increased risk profiles, making State Farm potentially more expensive for this demographic.

- Limited Discounts for New Policyholders: New customers might not immediately benefit from the full range of discounts available, which can impact the affordability of insurance for those just starting with State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Coverage: Allstate offers extensive coverage options including roadside assistance and rental car coverage, ideal for Jeep Wrangler owners who require additional support, especially for off-road adventures.

- Discount Opportunities: A variety of discounts, such as multi-policy and safe driver discounts, are available, helping to lower insurance costs for Jeep Wrangler owners while maintaining robust coverage.

- Strong Reputation: Allstate is known for its solid financial stability and extensive experience in the insurance industry, providing reliable coverage and support for Jeep Wrangler owners. Learn more about their discounts in our Allstate auto insurance review.

Cons

- Higher Premiums: Compared to some competitors, Allstate’s rates are relatively high, which could be a disadvantage for Jeep Wrangler owners looking for more affordable insurance options.

- Mixed Customer Service Reviews: Customer feedback on Allstate’s service is varied, with some users reporting less satisfactory experiences, potentially impacting the overall insurance experience for Jeep Wrangler owners.

#3 – USAA: Best for Military Savings

Pros

- Military Discounts: As outlined in USAA auto insurance review, the company offers substantial discounts for active and retired military members, making it a highly cost-effective option for Jeep Wrangler owners who are part of the military community.

- Excellent Customer Satisfaction: USAA is renowned for its exceptional customer service and efficient claims handling, ensuring Jeep Wrangler owners receive reliable support and swift resolution of claims.

- Comprehensive Coverage: USAA provides extensive coverage options tailored for Jeep Wranglers, including protection for off-road activities and high-value repairs, making it suitable for adventurous drivers.

Cons

- Eligibility Restrictions: Insurance coverage is limited to military members and their families, excluding non-military Jeep Wrangler owners from accessing USAA’s competitive rates and benefits.

- Higher Premiums for Non-Military: For qualifying members, premiums can still be on the higher end compared to some other providers, which might not appeal to those looking for more budget-friendly insurance options.

#4 – Progressive: Best for Online Convenience

Pros

- Innovative Digital Tools: Progressive provides advanced digital tools and apps, such as usage-based insurance, which allows Jeep Wrangler owners to potentially reduce their premiums based on their driving habits.

- Competitive Pricing: Known for its low rates, Progressive offers affordable insurance for Jeep Wranglers, making it an attractive option for those seeking budget-friendly coverage without compromising essential protection.

- Wide Range of Discounts: As mentioned in Progressive auto insurance review, Progressive offers numerous discounts, including those for safe driving and bundling policies, which can further reduce the cost of insurance for Jeep Wrangler owners.

Cons

- Potential for Rate Increases: Rates may increase upon renewal, which can be a concern for Jeep Wrangler owners who are looking for stable and predictable insurance costs over time.

- Customer Service Variability: Progressive’s customer service has received mixed reviews, which could affect the satisfaction of Jeep Wrangler owners who prioritize reliable and consistent support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers an accident forgiveness program that prevents your first accident from increasing your premium, which benefits Jeep Wrangler owners who are at risk of occasional incidents.

- Comprehensive Coverage Options: The company provides a wide array of coverage options, including protection for off-road use, which is advantageous for Jeep Wrangler owners who use their vehicles for adventurous activities.

- Strong Financial Stability: As outlined in our Travelers auto insurance review, Travelers is known for its solid financial standing and reliability, ensuring that Jeep Wrangler owners can count on the company to fulfill its coverage commitments.

Cons

- Higher Premiums: Travelers’ rates are on the higher side compared to some competitors, which may not be ideal for Jeep Wrangler owners seeking more cost-effective insurance solutions.

- Complex Policy Details: Some customers find Travelers’ policy details and coverage options to be complex, which could make it challenging for Jeep Wrangler owners to fully understand and manage their insurance coverage.

#6 – AAA: Best for Local Agents

Pros

- Roadside Assistance: AAA provides exceptional roadside assistance coverage, which is beneficial for Jeep Wrangler owners who frequently drive off-road and may need support during emergencies.

- Member Discounts: AAA members can access various discounts on insurance premiums, which can make AAA’s coverage more affordable for Jeep Wrangler owners who are already AAA members. Learn more about their rates in our AAA auto insurance review.

- Comprehensive Coverage: Offers extensive insurance coverage options, including protection for off-road usage, which is ideal for Jeep Wrangler owners who use their vehicles for diverse driving conditions.

Cons

- Moderate Premiums: While not the highest, AAA’s premiums are higher than some competitors, which might be a consideration for Jeep Wrangler owners looking for the most economical insurance options.

- Availability: AAA’s insurance services may not be available in all regions, which could limit access for Jeep Wrangler owners in areas where AAA does not operate.

#7 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico offers competitive rates for Jeep Wrangler insurance, making it a viable option for those seeking lower-cost coverage while still maintaining comprehensive protection.

- User-Friendly Online Tools: As outlined in our Geico auto insurance review, Geico provides easy-to-use online tools and mobile apps, allowing Jeep Wrangler owners to manage their policies, file claims, and access support conveniently.

- Wide Range of Discounts: Offers numerous discounts, including those for safe driving, vehicle safety features, and bundling policies, which can help reduce the cost of insurance for Jeep Wrangler owners.

Cons

- Customer Service Challenges: Geico’s customer service has received mixed reviews, with some users reporting difficulties in resolving issues, which may affect the overall satisfaction of Jeep Wrangler owners.

- Limited Coverage Options: Geico may have fewer specialized coverage options compared to some competitors, which could be a disadvantage for Jeep Wrangler owners seeking specific protections, such as off-road coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Extensive Discount Options: Farmers offers a wide variety of discounts, including those for bundling policies and safe driving, which can help reduce the cost of insurance for Jeep Wrangler owners despite higher base rates.

- Comprehensive Coverage: Provides broad coverage options, including protection for off-road use and custom parts, which is beneficial for Jeep Wrangler owners who require extensive coverage for their vehicles.

- Strong Customer Service: Farmers is known for providing good customer service and support, ensuring that Jeep Wrangler owners receive attentive and helpful assistance when needed. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums: Farmers’ insurance rates are among the highest, which may not be ideal for budget-conscious Jeep Wrangler owners seeking more affordable options.

- Potential for High Deductibles: Some Farmers policies may have higher deductibles, which could result in higher out-of-pocket costs for Jeep Wrangler owners in the event of a claim.

#9 – Liberty Mutual: Best for Customizable Polices

Pros

- Unique Coverage Options: Liberty Mutual offers specialized coverage options, including enhancements for high-risk activities and off-road usage, which is ideal for Jeep Wrangler owners with adventurous driving needs.

- Accident Forgiveness: Provides an accident forgiveness program that helps keep premiums stable after your first accident, benefiting Jeep Wrangler owners who might experience occasional incidents.

- Wide Range of Discounts: As mentioned in our Liberty Mutual auto insurance review, offers various discounts, such as those for safety features and bundling, which can help lower insurance costs for Jeep Wrangler owners.

Cons

- Higher Premiums: Liberty Mutual’s rates are higher compared to some competitors, which might not be the most cost-effective option for Jeep Wrangler owners looking to save on insurance premiums.

- Complex Policy Options: The variety of coverage options can be overwhelming, making it challenging for Jeep Wrangler owners to navigate and select the best policy for their needs.

#10 – Nationwide: Best for Usage Discount

Pros

- UBI Savings: Nationwide offers usage-based insurance programs that can reward safe driving habits, potentially lowering premiums for Jeep Wrangler owners who demonstrate responsible driving.

- Comprehensive Coverage: Provides extensive coverage options, including for off-road use, which is suitable for Jeep Wrangler owners who need protection for diverse driving conditions.

- Discount Opportunities: Nationwide offers various discounts, including those for safety features and multi-policy bundling, which can help reduce the cost of insurance for Jeep Wrangler owners. For more information, read our Nationwide auto insurance review.

Cons

- Higher Initial Rates: Nationwide’s initial premiums may be higher compared to some competitors, which could be a concern for Jeep Wrangler owners looking for immediate savings.

- Mixed Customer Feedback: Some customers report mixed experiences with Nationwide’s customer service, which may affect overall satisfaction for Jeep Wrangler owners seeking reliable support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeep Wrangler Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Jeep Wrangler from various providers.

Jeep Wrangler Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$65 $122

$87 $228

$76 $198

$43 $114

$95 $248

$62 $164

$59 $150

$47 $123

$53 $141

$32 $84

When evaluating Jeep Wrangler auto insurance, consider both minimum and full coverage rates to find the most cost-effective option. Providers like Progressive and Nationwide offer competitive rates, making them strong choices for budget-conscious drivers.

Jeep Wrangler Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $105 |

| Discount Rate | $62 |

| High Deductibles | $90 |

| High Risk Driver | $223 |

| Low Deductibles | $132 |

| Teen Driver | $383 |

When comparing insurance rates for Jeep Wranglers, it’s crucial to weigh the impact of discounts, deductibles, and driver risk factors on overall costs.

Opting for policies with lower premiums and comprehensive coverage can provide the best value for your insurance needs.

Read More: Does the car a teen drives affect auto insurance rates?

Jeep Wranglers Expensive Insurance Explained

The chart below details how Jeep Wrangler insurance rates compare to other SUVs like the Subaru Forester, Jeep Cherokee, and Jeep Compass.

Jeep Wrangler Similar Vehicles Auto Insurance Monthly Rates by Coverage Level

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi Q3 | $29 | $57 | $33 | $132 |

| GMC Terrain | $27 | $47 | $26 | $111 |

| Jeep Cherokee | $29 | $52 | $39 | $137 |

| Jeep Compass | $25 | $42 | $31 | $110 |

| Mercedes-Benz GLA 250 | $31 | $60 | $38 | $143 |

| Subaru Forester | $29 | $43 | $28 | $111 |

Jeep Wrangler insurance rates are generally competitive compared to other SUVs, often coming in lower than models like the Jeep Cherokee and Mercedes-Benz GLA 250. While not the cheapest, the Wrangler’s insurance costs are reasonable given its off-road capabilities and unique features.

Read More: Cheap GMC Auto Insurance

Factors That Impact Jeep Wrangler Insurance Cost

The Jeep Wrangler trim and model significantly impact insurance premiums due to factors like vehicle value, repair costs, and safety features. Higher trims and newer models often come with advanced technology and premium materials, leading to increased insurance costs.

Wranglers with high-end features or advanced driver assistance systems generally incur higher repair costs, which can raise premiums.Michelle Robbins LICENSED INSURANCE AGENT

Conversely, older or base models tend to have lower insurance costs because of their reduced value and simpler repair needs. Trims with enhanced off-road capabilities, like the Rubicon, may also be more expensive to insure due to increased risk and potential for damage.

Understanding these factors can help you select the most cost-effective coverage based on your Jeep Wrangler’s trim and model.

Read More: What is the difference between car make and car model?

Age of the Vehicle

The average Jeep Wrangler auto insurance rates are higher for newer models. For example, auto insurance rates for a 2020 Jeep Wrangler are significantly higher compared to those for a 2010 Jeep Wrangler, reflecting the increased value and repair costs associated with newer vehicles.

Jeep Wrangler Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Jeep Wrangler | $32 | $44 | $30 | $115 |

| 2023 Jeep Wrangler | $31 | $43 | $29 | $113 |

| 2022 Jeep Wrangler | $30 | $42 | $28 | $111 |

| 2021 Jeep Wrangler | $29 | $41 | $28 | $110 |

| 2020 Jeep Wrangler | $28 | $39 | $26 | $105 |

| 2019 Jeep Wrangler | $27 | $38 | $28 | $103 |

| 2018 Jeep Wrangler | $26 | $37 | $28 | $102 |

| 2017 Jeep Wrangler | $25 | $36 | $30 | $102 |

| 2016 Jeep Wrangler | $24 | $35 | $30 | $100 |

| 2015 Jeep Wrangler | $23 | $34 | $31 | $99 |

| 2014 Jeep Wrangler | $22 | $31 | $32 | $96 |

| 2013 Jeep Wrangler | $21 | $29 | $32 | $94 |

| 2012 Jeep Wrangler | $20 | $26 | $33 | $90 |

| 2011 Jeep Wrangler | $19 | $24 | $33 | $87 |

| 2010 Jeep Wrangler | $18 | $23 | $33 | $85 |

Insurance rates for the Jeep Wrangler tend to increase with newer models due to their higher value and repair costs. Older models, like the 2010 Jeep Wrangler, generally offer more affordable premiums, reflecting their lower overall value and simpler repair needs.

Driver Age

Driver age can have a significant effect on the cost of Jeep Wrangler auto insurance. Younger drivers, such as those in their twenties, typically face higher premiums compared to more experienced drivers in their thirties due to increased risk factors and statistical data.

Jeep Wrangler Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 18 | $656 |

| Age: 20 | $206 |

| Age: 30 | $191 |

| Age: 40 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Jeep Wrangler insurance rates are significantly higher for teen drivers compared to more experienced age groups, reflecting the increased risk associated with younger drivers. Premiums generally decrease as drivers age, with the most affordable rates typically available to those in their fifties and sixties.

Driver Location

Where you live can have a significant impact on Jeep Wrangler insurance rates. For instance, drivers in high-risk areas or large cities often face higher premiums compared to those in smaller towns or regions with lower accident rates.

Jeep Wrangler Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $179 |

| New York, NY | $165 |

| Houston, TX | $164 |

| Jacksonville, FL | $152 |

| Philadelphia, PA | $140 |

| Chicago, IL | $138 |

| Phoenix, AZ | $121 |

| Seattle, WA | $102 |

| Indianapolis, IN | $89 |

| Columbus, OH | $87 |

Jeep Wrangler insurance rates vary widely across U.S. cities, with higher premiums typically found in major metropolitan areas like Los Angeles and New York. Conversely, smaller cities and less densely populated areas often offer more affordable rates for Jeep Wrangler owners.

Your Driving Record

Your driving record can have an impact on the cost of Jeep Wrangler auto insurance. Teens and drivers in their 20’s see the highest jump in their Jeep Wrangler auto insurance rates with violations on their driving record.

Jeep Wrangler Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $383 | $442 | $575 | $423 |

| Age: 20 | $237 | $287 | $425 | $273 |

| Age: 30 | $109 | $149 | $215 | $135 |

| Age: 40 | $105 | $142 | $205 | $130 |

| Age: 50 | $95 | $128 | $188 | $115 |

| Age: 60 | $94 | $125 | $185 | $113 |

A clean driving record can help keep Jeep Wrangler insurance costs manageable, while violations and accidents lead to significantly higher premiums, especially for younger drivers. The impact of these violations tends to diminish with age, resulting in lower rates for more experienced drivers.

Safety Ratings

The Jeep Wrangler’s safety ratings will affect your Jeep Wrangler auto insurance rates. Higher safety ratings generally result in lower insurance premiums due to reduced risk. See the chart below:

Jeep Wrangler Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Marginal |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Jeep Wrangler’s safety ratings can significantly influence your insurance premiums. Vehicles with better safety scores are often rewarded with lower insurance costs.

Crash Test Ratings

Jeep Wrangler crash test ratings can impact your auto insurance costs, with higher ratings potentially leading to lower premiums. Review the detailed ratings below to understand how different models have performed in safety tests.

Jeep Wrangler Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Jeep Wrangler Unlimited SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2024 Jeep Wrangler SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2023 Jeep Wrangler Unlimited SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2023 Jeep Wrangler SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2022 Jeep Wrangler Unlimited SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2022 Jeep Wrangler SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2021 Jeep Wrangler Unlimited SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2021 Jeep Wrangler SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2020 Jeep Wrangler Unlimited SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2020 Jeep Wrangler Unlimited DIESEL SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2020 Jeep Wrangler SUV 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2019 Jeep Wrangler Unlimited 4 DR 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2019 Jeep Wrangler 2 DR 4WD | 4 stars | 4 stars | 3 stars | 3 stars |

| 2018 Jeep Wrangler Unlimited JK 4 DR 4WD Early release | 3 stars | 3 stars | 3 stars | 3 stars |

| 2018 Jeep Wrangler Unlimited 4 DR 4WD Later Release | 4 stars | 4 stars | 3 stars | 3 stars |

| 2018 Jeep Wrangler JK 2 DR 4WD Early release | 3 stars | 3 stars | 3 stars | 3 stars |

| 2018 Jeep Wrangler 2 DR 4WD Later Release | 4 stars | 4 stars | 3 stars | 3 stars |

| 2017 Jeep Wrangler Unlimited 4 DR 4WD | 3 stars | 3 stars | 3 stars | 3 stars |

| 2017 Jeep Wrangler 2 DR 4WD | 3 stars | 3 stars | 3 stars | 3 stars |

| 2016 Jeep Wrangler 4DR 4WD | 3 stars | 3 stars | 3 stars | 3 stars |

| 2016 Jeep Wrangler 2DR 4WD | 3 stars | 3 stars | 3 stars | 3 stars |

The Jeep Wrangler’s crash test ratings highlight its varying performance across different models and years. Understanding these ratings can help you assess the potential impact on your insurance premiums based on vehicle safety.

Jeep Wrangler Safety Features

The Jeep Wrangler safety features can help lower insurance costs. According to AutoBlog, the 2020 Jeep Wrangler has the following safety features:

- Airbags: Includes driver, passenger, and front side airbags.

- Brakes: Equipped with 4-wheel ABS, 4-wheel disc brakes, and brake assist.

- Stability and Control: Features electronic stability control, traction control, and a rollover protection system.

- Safety Enhancements: Comes with front tow hooks and additional safety measures.

- Advanced Safety: Incorporates modern safety technologies for enhanced protection.

The Jeep Wrangler’s comprehensive safety features can contribute to lower insurance premiums by reducing overall risk. Investing in a model with these advanced safety technologies can provide both protection and potential savings on your insurance.

Loss Probability

The Jeep Wrangler’s insurance loss probability varies for each form of coverage. The lower percentage means lower Jeep Wrangler auto insurance rates; higher percentages mean higher Jeep Wrangler auto insurance rates.

Jeep Wrangler Auto Insurance Loss Probability

| Type | Loss |

|---|---|

| Bodily Injury | 2% |

| Collision | -46% |

| Comprehensive | -29% |

| Medical Payment | -48% |

| Personal Injury | -43% |

| Property Damage | 34% |

The loss probability for different insurance coverage categories can significantly influence Jeep Wrangler insurance rates. Lower loss rates generally result in reduced premiums, while higher rates may increase overall insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeep Wrangler Finance and Insurance Cost

If you are financing a Jeep Wrangler, you will pay more if you purchase Jeep Wrangler auto insurance at the dealership, so be sure to shop around and compare Jeep Wrangler auto insurance quotes from the best companies using our free tool below.

Read More: How to Get Multiple Auto Insurance Quotes

Ways to Save on Jeep Wrangler Insurance

Save more on your Jeep Wrangler auto insurance rates. Take a look at the following five strategies that will get you the best Jeep Wrangler auto insurance rates possible.

- Check reviews and state complaints before you choose an insurer.

- Wait six years for accidents to disappear from your record.

- Reduce your coverage on an older Jeep Wrangler.

- Take advantage of referral fees.

- Don’t assume your Jeep Wrangler is cheaper to insure than another vehicle.

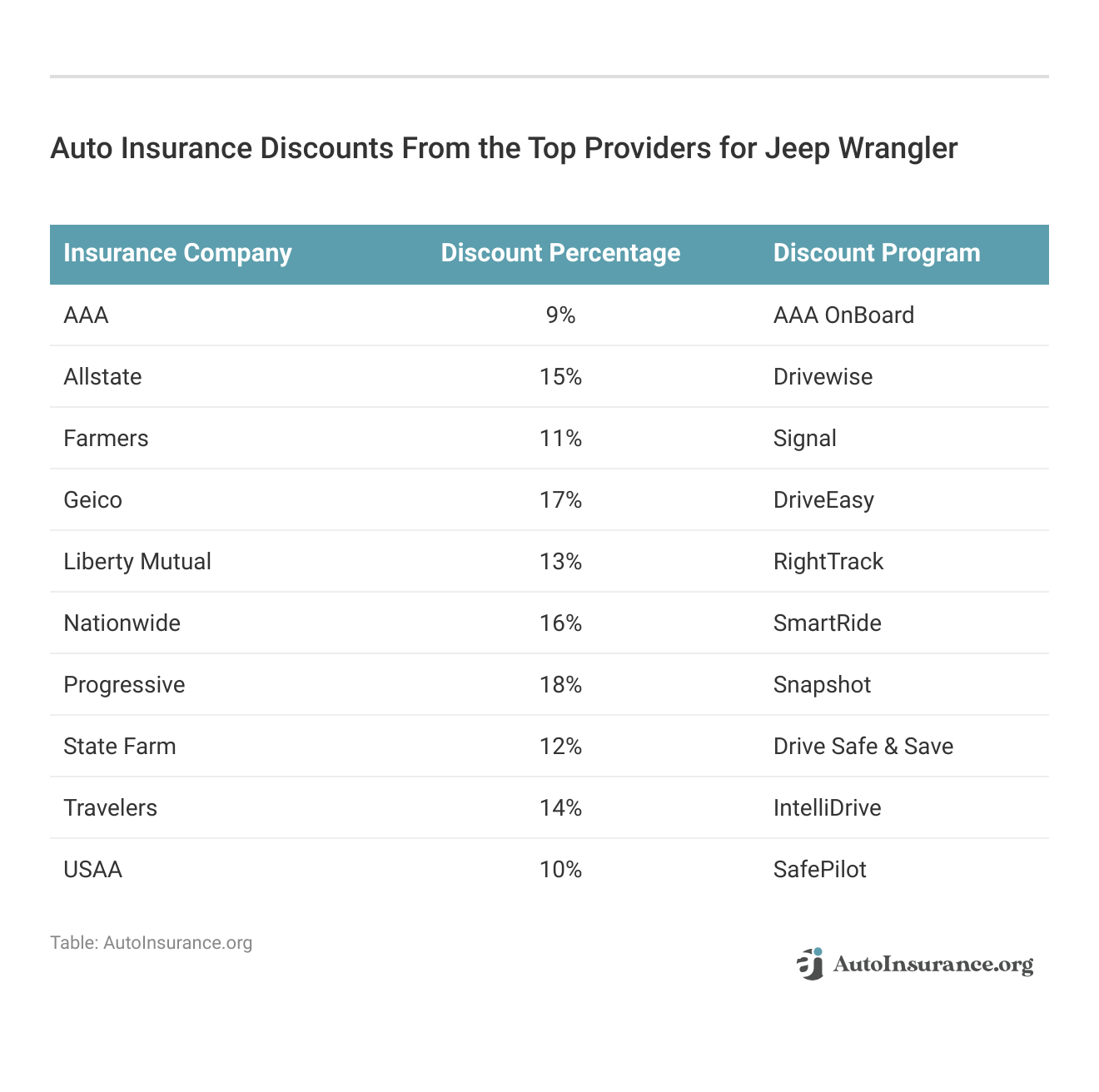

Discover the variety of car insurance discounts offered by top providers for Jeep Wrangler to help you save on your premiums.

These discounts from top insurance providers for Jeep Wrangler offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Read More: State Farm Auto Insurance Discounts

Top Jeep Wrangler Insurance Companies

Who is the top auto insurance company for Jeep Wrangler insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Jeep Wrangler auto insurance coverage (ordered by market share). Many of these companies offer cheap Jeep auto insurance and discounts for security systems and other safety features that the Jeep Wrangler offers.

Top Jeep Wrangler Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9% |

| #2 | Geico | $46.1 million | 6% |

| #3 | Progressive | $39.2 million | 5% |

| #4 | Liberty Mutual | $35.6 million | 5% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3% |

| #8 | Chubb | $23.3 million | 3% |

| #9 | Farmers | $20.6 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

When selecting an auto insurance provider for your Jeep Wrangler, consider market share and the available discounts for safety features. Top companies like State Farm and Geico offer competitive rates and substantial coverage options for Jeep Wrangler owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Free Jeep Wrangler Insurance Quotes Online

Start comparing Jeep Wrangler auto insurance quotes for free using our convenient online comparison tool. This tool helps you evaluate coverage options from various providers, ensuring you find the best policy for your needs. By comparing quotes, you can discover which offers the most comprehensive coverage at competitive rates.

Explore options from the cheapest auto insurance companies to find deals tailored to your Jeep Wrangler’s trim and model. Save time and money by leveraging our comparison tool to make informed decisions about your auto insurance.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

How much is insurance for a Jeep Wrangler?

The cost of Jeep Wrangler auto insurance can vary based on several factors, including your location, driving history, age, coverage options, and the specific model and trim of your Jeep Wrangler. It’s recommended to request quotes from different insurance providers to get an accurate idea of the cost.

Is auto insurance mandatory for Jeep Wrangler owners?

Yes, auto insurance is generally mandatory for all vehicle owners, including Jeep Wrangler owners. The specific requirements may vary depending on your country or state, but liability insurance coverage is typically required at the minimum. For more information, read our article titled “When did auto insurance become mandatory?”

What type of insurance coverage do I need for my Jeep Wrangler?

While the specific coverage needs may vary based on your personal circumstances, it’s generally recommended to have at least liability insurance, which covers damages or injuries you may cause to others. Additionally, comprehensive and collision coverage are common options that can help protect your Jeep Wrangler from theft, vandalism, accidents, and other types of damage.

Are Jeep Wranglers expensive to insure compared to other vehicles?

The insurance rates for Jeep Wranglers can vary depending on factors such as the model, trim, and safety features. Generally, Jeep Wranglers may have slightly higher insurance rates compared to some other vehicles due to factors like their off-road capabilities and potential for higher repair costs. However, it’s always advisable to compare insurance quotes from different providers to find the best rates for your specific situation.

Is medical payments coverage required by law?

No, MedPay is not required by law in most states. However, it is an optional coverage that you can add to your auto insurance policy. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Are there any discounts available for Jeep Wrangler auto insurance?

Many insurance providers offer discounts that may be applicable to Jeep Wrangler owners. Common discounts include safe driver discounts, multi-policy insurance discounts (if you have multiple insurance policies with the same provider), and vehicle safety feature discounts (such as anti-theft devices or advanced safety systems). It’s recommended to inquire about available discounts when obtaining insurance quotes.

Are modifications to my Jeep Wrangler covered by auto insurance?

Modifications made to your Jeep Wrangler, such as lift kits, aftermarket parts, or performance enhancements, may not be automatically covered by standard auto insurance policies. It’s essential to inform your insurance provider about any modifications and discuss the coverage options available to adequately protect your modified Jeep Wrangler.

Can I get specialized insurance for off-roading with my Jeep Wrangler?

Yes, some insurance companies offer specialized insurance coverage specifically designed for off-roading vehicles like the Jeep Wrangler. These policies may provide additional coverage for off-road accidents, trail damage, and towing expenses. If you plan to use your Jeep Wrangler for off-roading activities, it’s recommended to inquire about specialized insurance options.

What steps can I take to lower my Jeep Wrangler insurance premiums?

There are several steps you can take to potentially lower your Jeep Wrangler insurance premiums. These include maintaining a clean driving record, bundling multiple policies with the same provider, increasing your deductibles, taking advantage of available discounts, installing anti-theft devices, and considering usage-based insurance programs that reward safe driving habits.

Are Jeeps expensive to Insure?

Jeep insurance cost can be higher due to their off-road capabilities and potential repair costs. However, compared to luxury vehicles, Jeep insurance rates are often competitive. To get the best deal, compare quotes and consider safety features and available discounts.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.