Best Auto Insurance for Grubhub Drivers in 2026 (Your Guide to the Top 10 Companies)

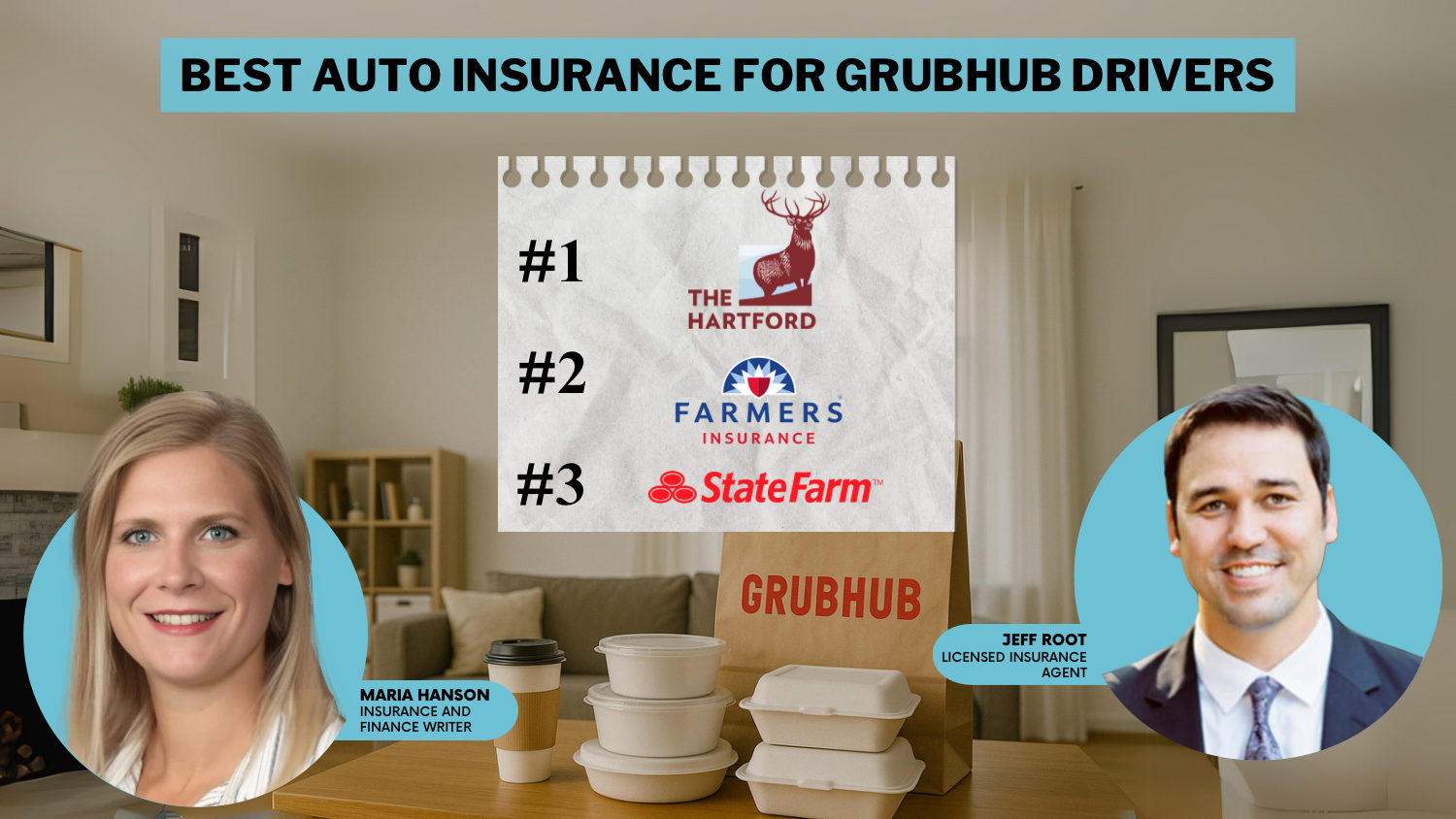

Get the best auto insurance for Grubhub drivers with The Hartford, Farmers, and State Farm, offering rates up to 25% discounts, making them top picks. These insurers stand out for their comprehensive coverage options and competitive rates, ensuring Grubhub drivers get the protection they need at affordable prices.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated April 2025

765 reviews

765 reviewsCompany Facts

Full Coverage for Grubhub Drivers

A.M. Best

Complaint Level

Pros & Cons

765 reviews

765 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Grubhub Drivers

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Grubhub Drivers

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsDiscover the best auto insurance for Grubhub drivers with the top providers, including The Hartford, Farmers, and State Farm, offering discounts up to 25%. The Hartford offers top-notch service and comprehensive coverage, making it a prime choice. Compare quotes to find the right coverage for you.

You need liability coverage to meet Grubhub’s auto insurance requirements. You’ll also need rideshare auto insurance on top of your personal policy — fortunately, you can add coverage from top companies such as Allstate for as low as $2 monthly.

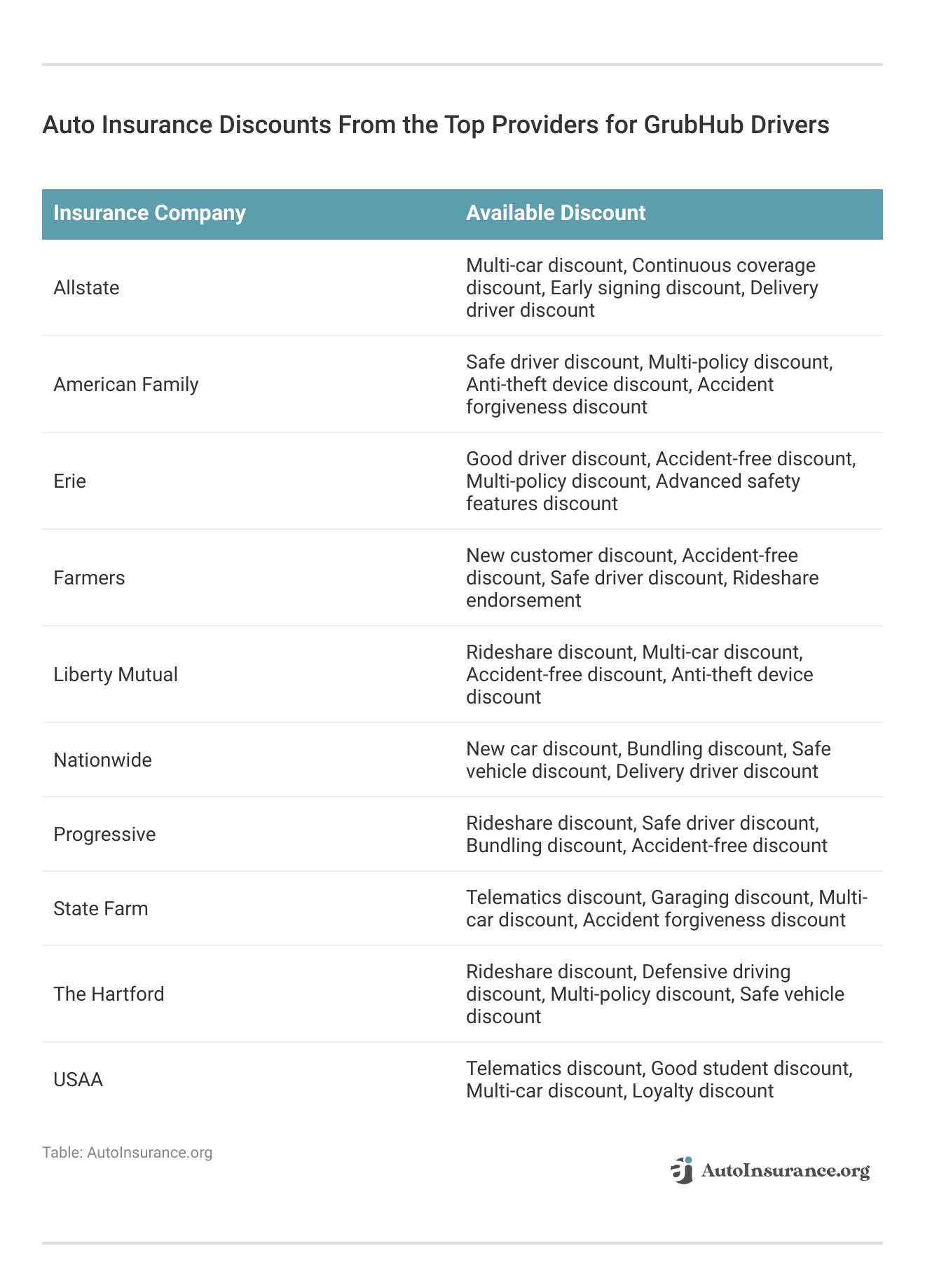

Our Top 10 Company Picks: Best Auto Insurance for Grubhub Drivers

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Rideshare Coverage The Hartford

#2 23% A Rideshare Endorsement Farmers

#3 22% B Agent Network State Farm

#4 20% A+ Comprehensive Coverage Allstate

#5 18% A Flexible Policies Liberty Mutual

#6 16% A+ Discount Variety Nationwide

#7 14% A++ Military Benefits USAA

#8 12% A+ Competitive Rates Erie

#9 10% A Discount Options American Family

#10 10% A+ Rideshare Program Progressive

Continue reading to learn about meeting Grubhub driver insurance requirements and finding cheap rates. Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- The Hartford tops for Grubhub , great service and coverage

- Grubhub drivers need liability coverage

- Compare quotes for best rates, up to 25% discounts

#1 – The Hartford: Top Overall Pick

Pros

- Excellent Customer Service: Renowned for exceptional customer support.

- Comprehensive Coverage Options: Offers a wide range of coverage choices.

- Specializes in Drivers Insurance: Tailored solutions for drivers. Learn more in our The Hartford auto insurance review.

Cons

- Higher Cost: Can be more expensive compared to competitors.

- Limited Availability: Not available in all states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Rideshare Endorsement

Pros

- Customizable Coverage Options: Allows for personalized coverage.

- Good Customer Service Ratings: High ratings for customer service.

- Wide Range of Products: They offer various insurance products.

Cons

- Higher Premiums in Some Regions: Pricing may be higher in certain areas. Check their rates in our Farmers auto insurance review.

- Limited Discounts: Fewer discount opportunities.

#3 – State Farm: Best for Agent Network

Pros

- Largest Auto Insurer: Largest insurer in the U.S.

- Extensive Agent Network: As mentioned in our State Farm auto insurance review, they have a wide availability of local agents.

- Numerous Discounts: Offers a variety of discounts.

Cons

- Higher Rates for Some Drivers: Premiums may be higher for certain demographics.

- Limited Digital Services: Digital and mobile services are not as advanced.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Innovative Tools like Drivewise: Offers innovative tools to monitor driving behavior.

- Wide Range of Coverage Options: Comprehensive selection of coverage.

- Strong Financial Strength: High financial stability ratings. Check out our Allstate auto insurance review to know more details.

Cons

- Expensive for Young Drivers: Higher premiums for younger drivers.

- Mixed Customer Service Reviews: Some customers report inconsistent service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Flexible Policies

Pros

- Multiple Policy Discounts: Discounts for bundling multiple policies.

- Good Selection of Coverage Options: Offers a wide array of coverage options.

- 24/7 Claims Service: As mentioned in our Liberty Mutual auto insurance review, they have round-the-clock claims assistance.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for certain demographics.

- Limited Availability in Rural Areas: Not widely available in rural locations.

#6 – Nationwide: Best for Discount Variety

Pros

- Vanishing Deductible Program: Deductible reduction program.

- Highly-Rated Customer Service: Strong reputation for customer support. For more information, read our Nationwide auto insurance review.

- Variety of Discounts: Offers numerous discount options.

Cons

- Limited Availability: Not available in all regions.

- Higher Premiums for Young Drivers: Increased rates for younger drivers.

#7 – USAA: Best for Military Benefits

Pros

- Top-Rated Customer Service: Consistently high customer service ratings.

- Competitive Rates: Offers competitive pricing.

- Exclusive to Military Members: Specialized coverage for military members.

Cons

- Limited to Military Personnel: As mentioned in our USAA auto insurance review, they are only available to military personnel and their families.

- Not Available to General Public: Not accessible to non-military individuals.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Competitive Rates

Pros

- Highly-Rated Customer Service: Strong reputation for customer support.

- Competitive Pricing: Offers competitive rates. Learn more about their rates in our Erie auto insurance review.

- Comprehensive Coverage: Broad range of coverage options.

Cons

- Limited Availability: Not available nationwide.

- Fewer Digital Services: Less advanced digital tools compared to competitors

#9 – American Family: Best for Discount Options

Pros

- Personalized Customer Service: Known for personalized customer service.

- Good Discounts: Offers a variety of discounts. More information about their discounts in our American Family auto insurance review.

- Bundle Discounts: Discounts for bundling multiple policies.

Cons

- Limited Availability: Not available in all states.

- Higher Premiums for Some Drivers: Premiums may be higher for certain demographics.

#10 – Progressive: Best for Rideshare Program

Pros

- Name Your Price Tool: Unique tool to customize policy premiums.

- Wide Range of Discounts: Offers many discount opportunities.

- Strong Online Presence: Advanced digital and mobile services.

Cons

- Mixed Customer Service Reviews: Some customers report inconsistent service. Learn more in our Progressive auto insurance review.

- Higher Rates for Some Drivers: Premiums may be higher for certain demographics.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Grubhub Auto Insurance for Drivers

While Grubhub employment requires its drivers to carry car insurance, the company doesn’t provide auto insurance coverage. Some delivery companies offer their employees commercial auto insurance coverage when they’re on the job, but Grubhub insurance requirements dictate that employees must find coverage independently.

You must meet the following requirements to work for the company:

- Be 19 years of age or older

- Have a valid U.S. driver’s license

- Have a vehicle or bicycle (in certain areas)

- Carry auto insurance

- Have an up-to-date smartphone

Grubhub car requirements and additional requirements are not very stringent.

Scott W. Johnson

LICENSED INSURANCE AGENT

Grubhub drivers should compare quotes and consider full coverage options for optimal protection, despite higher rates.

But while Grubhub vehicle requirements are not demanding, you will still need to figure out the right auto insurance coverage on your own.

Grubhub Driver Auto Insurance Requirements

Requirements for Grubhub include carrying your state’s minimum auto insurance requirements. While it’s wise to carry additional coverage to ensure you have protection for yourself and your vehicle, this is not something the company requires.

The liability coverage you need to purchase will depend on where you live. Each state has individual requirements for both property damage and bodily injury liability. The table below shows the different requirements in each state.

Liability Auto Insurance Requirements by State

| State | Coverages | Limits |

|---|---|---|

| Alabama | Bodily injury & property damage liablity | 25/50/25 |

| Alaska | Bodily injury & property damage liablity | 50/100/25 |

| Arizona | Bodily injury & property damage liablity | 15/30/10 |

| Arkansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| California | Bodily injury & property damage liablity | 15/30/5 |

| Colorado | Bodily injury & property damage liablity | 25/50/15 |

| Connecticut | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Delaware | Bodily injury, property damage liablity, & personal injury protection | 25/50/10 |

| Florida | Property damage liablity, & personal injury protection | 10/20/10 |

| Georgia | Bodily injury & property damage liablity | 25/50/25 |

| Hawaii | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Idaho | Bodily injury & property damage liablity | 25/50/15 |

| Illinois | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Indiana | Bodily injury & property damage liablity | 25/50/25 |

| Iowa | Bodily injury & property damage liablity | 20/40/15 |

| Kansas | Bodily injury, property damage liablity, & personal injury protection | 25/50/25 |

| Kentucky | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Louisiana | Bodily injury & property damage liablity | 15/30/25 |

| Maine | Bodily injury, property damage liablity, uninsured motorist/underinsured motorist, & MedPay | 50/100/25 |

| Maryland | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/15 |

| Massachusetts | Bodily injury, property damage liablity, & personal injury protection | 20/40/5 |

| Michigan | Bodily injury, property damage liablity, & personal injury protection | 20/40/10 |

| Minnesota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 30/60/10 |

| Mississippi | Bodily injury & property damage liablity | 25/50/25 |

| Missouri | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/25 |

| Montana | Bodily injury & property damage liablity | 25/50/20 |

| Nebraska | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Nevada | Bodily injury & property damage liablity | 25/50/20 |

| New Hampshire | Financial responsibility (None required) | 25/50/25 |

| New Jersey | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 15/30/5 |

| New Mexico | Bodily injury & property damage liablity | 25/50/10 |

| New York | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/10 |

| North Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 30/60/25 |

| North Dakota | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/25 |

| Ohio | Bodily injury & property damage liablity | 25/50/25 |

| Oklahoma | Bodily injury & property damage liablity | 25/50/25 |

| Oregon | Bodily injury, property damage liablity, personal injury protection, & uninsured motorist/underinsured motorist | 25/50/20 |

| Pennsylvania | Bodily injury, property damage liablity, & personal injury protection | 15/30/5 |

| Rhode Island | Bodily injury & property damage liablity | 25/50/25 |

| South Carolina | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| South Dakota | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Tennessee | Bodily injury & property damage liablity | 25/50/15 |

| Texas | Bodily injury, property damage liablity, & personal injury protection | 30/60/25 |

| Utah | Bodily injury, property damage liablity, & personal injury protection | 25/65/15 |

| Vermont | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/10 |

| Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/20 |

| Washington | Bodily injury & property damage liablity | 25/50/10 |

| Washington, D.C. | Bodily injury, property damage liablity, & Uninsured Motorist | 25/50/10 |

| West Virginia | Bodily injury, property damage liablity, & uninsured motorist/underinsured motorist | 25/50/25 |

| Wisconsin | Bodily injury, property damage liablity, uninsured motorist, & MedPay | 25/50/10 |

| Wyoming | Bodily injury & property damage liablity | 25/50/20 |

Some states require additional coverage, such as personal injury protection (PIP), medical payments (MedPay), and uninsured motorist (UM) coverage.

Grubhub Auto Insurance Cost

The amount of money you pay for auto insurance as a Grubhub driver will depend on many different factors, including the following:

- Age

- Gender

- Marital status

- Car make and model

- ZIP code

- Occupation

- Driving record

- Credit history

- Level of coverage

If you only carry liability coverage, your insurance rates will be lower than those associated with a full coverage policy that includes collision and comprehensive coverage. But the extra protection may be worth the investment.

The only way you will know how much you will end up paying for coverage is to shop online and compare quotes from several companies near you. Below, you can compare rideshare insurance costs from the best auto insurance companies:

Monthly Rideshare Auto Insurance Rates by Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$32 $83

$76 $198

$43 $114

$96 $248

$42 $110

$63 $164

$56 $150

$38 $101

$47 $123

$32 $84

Of course, the Grubhub rideshare insurance rates above get added on top of your existing policy rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Grubhub Rideshare Auto Insurance Coverage

As a Grubhub driver, you may want to consider a commercial insurance policy. But a commercial policy may not be worth the cost if you don’t work full time.

Commercial Auto Insurance Monthly Rates by Vehicle Type

Car Type Minimum Coverage Full Coverage

Car $50 $200

Semi $667 $1,042

Cargo/Delivery Van $275 $517

Limo $333 $500

Cab $417 $833

Grubhub delivery drivers could pay as much as $200 monthly for commercial insurance. But if you only work for Grubhub part-time, you may want to consider purchasing rideshare insurance or adding a rideshare plan to your insurance policy.

Rideshare auto insurance coverage offers additional protection when you’re working as a delivery driver. Your personal insurance policy will cover you if you’re in an accident or if your car is otherwise damaged while you’re making a delivery.

Grubhub Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$62 $166

$32 $83

$76 $198

$96 $248

$63 $164

$56 $150

$47 $123

$61 $161

$32 $84

If you don’t purchase rideshare coverage, there’s a chance your insurance will not cover you if you’re in an accident while working for Grubhub. Most policies have exclusions when driving your car for work purposes, so you must notify your insurance company that you work for Grubhub and ensure you’re covered.

How to Get Cheap Grubhub Auto Insurance

The best way to find cheap auto insurance as a Grubhub driver is to shop online and compare quotes from insurance providers in your area. Unless you compare rates from different companies, you’ll never know how much you will pay for coverage.

As you shop for coverage, ask companies whether you qualify for discounts that would help you save on your monthly or annual rates. And be sure to ask whether you will be covered as a Grubhub driver with a personal policy or if you need rideshare coverage or commercial coverage to maintain proper protection.

Find the Best Grubhub Auto Insurance Coverage Today

You’ll need to carry a Grubhub rideshare insurance policy to be a delivery driver for the company. Grubhub only requires that you carry your state’s requirements for liability insurance, but you should consider purchasing additional coverage.

Read more: Cheapest Liability-Only Auto Insurance

Anyone working for Grubhub full time may need commercial coverage, but you should consider purchasing rideshare insurance if you only work for the company part-time. Shop for coverage with several companies in your area to determine which insurer will offer you the coverage you need as a Grubhub driver at a rate that works with your budget.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Frequently Asked Questions

Does Grubhub have insurance for drivers?

No, Grubhub doesn’t provide auto insurance coverage for its drivers. Drivers are required to find coverage independently. Read more about finding cheap delivery driver auto insurance rates.

Does Grubhub require insurance?

GrubHub drivers must carry their state’s minimum liability insurance. However, you should consider add-on coverages depending on individual needs and state requirements.

Does Grubhub require proof of insurance?

GrubHub driver insurance requirements say you must be age 19 with 2+ years of driving experience, a driver’s license, and auto insurance. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Do I need rideshare insurance to drive for Grubhub?

While Grubhub doesn’t require rideshare insurance, you should consider purchasing it or adding a rideshare plan to your existing policy. Rideshare coverage provides additional protection while you’re working as a delivery driver.

Can I find cheap car insurance as a Grubhub driver?

Yes, it is possible to find affordable car insurance as a Grubhub driver. The best way to find cheap insurance is to shop around, compare quotes from different companies, and inquire about any available auto insurance discounts.

What auto insurance coverage do I need as a Grubhub driver?

As a Grubhub driver, you need at least the minimum liability coverage required by your state. Additionally, considering rideshare insurance is advisable to ensure you are adequately covered while working.

What factors should I consider when choosing auto insurance as a Grubhub driver?

Key factors to consider include coverage options (such as liability, comprehensive, and rideshare insurance), cost, customer service, and the insurer’s reputation for handling claims.

How much does Grubhub car insurance cost?

The cost of car insurance for Grubhub drivers varies depending on several factors, including coverage options, location, driving history, and the insurance provider. It is recommended to shop online and compare quotes from different companies to find the cheapest auto insurance.

Do I need rideshare insurance if I drive for Grubhub part-time?

Yes, even if you drive for Grubhub part-time, you should consider rideshare insurance. Personal auto insurance policies typically exclude coverage when you’re using your vehicle for business purposes, which includes food delivery.

Can I use my personal auto insurance for Grubhub deliveries?

While you can use your personal auto insurance, it’s recommended to add rideshare coverage to ensure you are fully protected during deliveries, as personal policies may exclude business use.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.