Nationwide vs. Progressive Auto Insurance in 2026 (Head-to-Head Review)

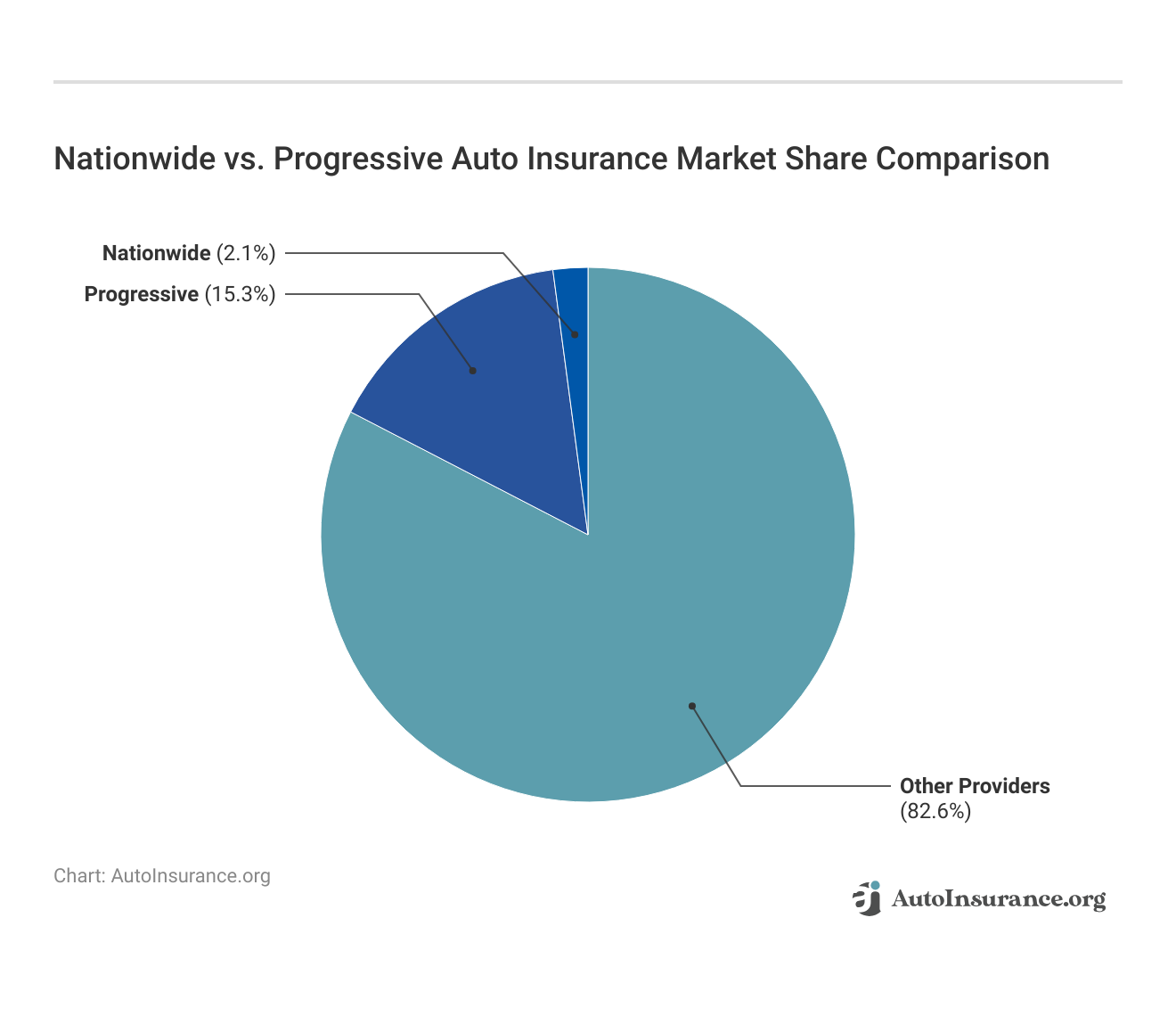

Nationwide vs. Progressive auto insurance shows that Progressive provides lower rates starting at $39/month, while Nationwide averages $44 per month and offers extensive coverage and bundling discounts. This comparison highlights the differences in coverage and overall value for customers seeking auto insurance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated June 2025

3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsNationwide vs. Progressive auto insurance has cheaper quotes starting at $39 per month with discounts for safe drivers; however, Nationwide shines on bundling, averaging at $44 per month.

Progressive auto insurance is ideal for savings and flexibility, while Nationwide Mutual Insurance Company excels in customer service and policy variety. Read on for more insights into the cheapest auto insurance companies.

Nationwide vs. Progressive Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.5 | 4.4 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 3.5 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.4 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.7 | 5.0 |

| Savings Potential | 4.6 | 4.5 |

| Nationwide Review | Progressive Review |

Nationwide auto insurance is ideal for family groups and has programs for young drivers who have selected Progressive insurance. Don’t miss comparing a few insurance quotes as you try to pick the best fit.

Discover affordable Nationwide vs. Progressive auto insurance and compare quotes by entering your ZIP code.

- Progressive’s rates start at $39 for drivers with clean records

- Nationwide offers 25% off for bundling home and auto insurance

- Progressive’s Snapshot can give discounts of up to 30% for safe driving

Nationwide Car Insurance Is Cheaper Than Progressive

Nationwide auto insurance averages $44 monthly, cheaper than Progressive’s $39. However, rates vary based on age, driving record, and credit score. Keep reading our Nationwide vs. Progressive review to see how each factor influences your rate.

Nationwide vs. Progressive: The Cheapest Company by Age, Gender, and Marital Status

The cheapest company for you will depend on these personal factors. Let’s look at the monthly Progressive Nationwide auto quotes by age, gender, and marital status.

Nationwide vs. Progressive Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $411 | $801 |

| Age: 16 Male | $476 | $814 |

| Age: 30 Female | $124 | $131 |

| Age: 30 Male | $136 | $136 |

| Age: 45 Female | $113 | $112 |

| Age: 45 Male | $115 | $105 |

| Age: 60 Female | $99 | $92 |

| Age: 60 Male | $104 | $95 |

Although Nationwide has more affordable vehicle insurance than the national average, Progressive insurance is cheaper for married drivers and single 25-year-old drivers.

However, parents can find cheaper rates for teen drivers at Nationwide. Remember that some rates will vary because some states have outlawed gender-based car insurance discrepancies.

Nationwide vs. Progressive: The Cheapest Company by Driving Record

Nationwide auto insurance reviews reveal that Nationwide insurance costs are cheaper by driving record, but certain infractions could make them more expensive than Progressive car insurance costs.

Let’s compare Progressive insurance rates with Nationwide’s to see which is cheaper by driving record.

Nationwide vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $115 | $105 |

| Not-At-Fault Accident | $161 | $186 |

| Speeding Ticket | $137 | $140 |

| DUI/DWI | $237 | $140 |

Nationwide has cheaper car insurance than Progressive, but Progressive offers cheap car insurance for DUI-convicted drivers. The best way to secure cheap car insurance is to maintain a clean driving record. A speeding ticket has minimal effect, but multiple violations can increase your rates by hundreds of dollars.

Nationwide vs. Progressive: The Cheapest Company by Credit Score

Nationwide and Progressive offer lower car insurance rates for those with good credit histories. Let’s compare the auto insurance options from Nationwide and Progressive based on credit scores.

Monthly Auto Insurance Rates for Nationwide vs. Progressive by Credit Score

| Credit Score |  | |

|---|---|---|

| Good Credit (670-739) | $244 | $302 |

| Fair Credit (580-669) | $271 | $330 |

| Poor Credit (300-579) | $340 | $395 |

Good credit produces the most affordable rates. Fair and poor credit generate much higher rates. Although both companies have monthly rates under $400, Nationwide is still cheaper. Remember to purchase Nationwide or Progressive commercial auto insurance if you are a food delivery driver.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide vs. Progressive: Auto Insurance Coverage Options

You’ve seen how much it costs. But what do Nationwide and Progressive offer with their auto insurance? Nationwide has more coverage options, but that does not make Progressive a lousy company. Companies often make up for a lack of coverage with other insurance products.

Progressive is famous for offering relatively low premiums, primarily because of its usage-based programs, Snapshot, which provide discounts based on good driving behavior. Competitive pricing and easy-to-use online tools contribute to popularity among frugal drivers.

Why is progressive so cheap?!

byu/BatHistorical8081 inInsurance

Both Progressive and Nationwide provide roadside assistance for auto insurance policyholders. However, Progressive offers so many other types of insurance that you can bundle significantly few other policies with this one. You might be thinking: Can you have two auto insurance policies? They can help you maximize your coverage and save money.

However, both companies also have pet insurance. If pet insurance is essential for one’s family, compare Progressive pet insurance rates to Nationwide pet insurance to see which company has better coverage.

Progressive vs. Nationwide Auto Insurance Discounts

Car insurance discounts are among the best ways to lower your rates significantly. Most auto insurance companies offer many of the same deals, such as good student and multi-policy discounts. Let’s match up Progressive and Nationwide car insurance discounts below.

Nationwide vs. Progressive Auto Insurance Discounts by Savings Potential

| Discount |  | |

|---|---|---|

| Multi-Policy | 10% | 17% |

| Safe Driver | 10% | 10% |

| Good Student | 5% | 8% |

| Low Mileage | 7% | Varies |

| Paperless Billing | 4% | 5% |

| Defensive Driving Course | 7% | 10% |

| Accident-Free | N/A | 15% |

| Anti-Theft Device | 5% | 10% |

| Defensive Driving | 10% | 5% |

Progressive has more discount opportunities, but you must consider which discounts you are personally eligible for. Any anti-theft or safety features on your vehicle can save you money.

If you’re insuring your teen or young adult child, you can save money through a student discount. When you get your Progressive or Nationwide auto insurance quotes, ask about discounts not listed on the companies’ websites.

Nationwide vs. Progressive: A Comparison of Third-Party Ratings

Before you make a decision, you should know about Nationwide and Progressive auto insurance ratings. But why are ratings important? Third-party ratings can reassure you about a company’s financial standing.

Progressive's $39 rate is ideal for budget-focused drivers, while Nationwide's $44 rate offers value through extensive bundling discounts and reliable customer service.Justin Wright Licensed Insurance Agent

Let’s see how Nationwide and Progressive auto insurance ratings from the financial strength and credit rating agencies. Although Nationwide’s car insurance rating and Progressive’s rating from A.M. Best are the same, Progressive car insurance has better ratings overall. The Progressive app ratings are much better than Nationwide’s app ratings.

Insurance Business Ratings & Consumer Reviews: Nationwide vs. Progressive

| Agency |  | |

|---|---|---|

| Score: 855 / 1,000 Above Avg. Satisfaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 72/100 Avg. Customer Feedback |

|

| Score: 0.78 Fewer Complaints | Score: 1.11 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A+ Superior Financial Strength |

Customers of Nationwide and Progressive can access their insurance records, locate ID cards, and pay bills through their Nationwide or Progressive logins. Reading about how auto insurance companies check driving records is essential, as it affects your insurance rates.

Both companies rated about average under J.D. Power’s 2020 Auto Insurance Claims Study, but Nationwide Insurance ranks higher than Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide Pros & Cons

Pros

- Comprehensive Bundling Options: Nationwide offers shallow bundled house and auto insurance, thus making it one of the cheapest for families.

- Excellent Customer Service: Clients give great ratings about Nationwide customer care because it is always helpful, responsive, and friendly when filing claims or asking questions

- Substantial Discounts for Young Drivers: Nationwide offers customized discounts for young drivers to reduce their expenses even more while traveling.

Cons

- Higher Average Rates: Nationwide’s average monthly rates are slightly higher than some of its competitors, which might not attract a tight-budgeted driver.

- Limited Availability in Some Regions: Nationwide isn’t available in all states, making it unavailable to some customers. See more in our “Nationwide Auto Insurance Review.“

Progressive Pros & Cons

Pros

- Competitive Pricing: Progressive quotes start at $39, making it one of the most affordable options for drivers with clean records. Explore our “Progressive Auto Insurance Review” for more details.

- Snapshot Program Discounts: Their snapshot program rewards safe driving behavior and even gives up to 30 percent discount to ensure responsible driving and additional savings.

- Easy Online Quote Process: The website is accessible, offering customers ease in comparing prices and identifying which coverage to meet their demands.

Cons

- Mixed Customer Service Reviews: Progressive’s customer service could be better for several customers, creating frustration in the claims process.

- Complex Policy Options: Due to Progressive having so many policy options and add-ons, customers might get confused about making the best selection for the appropriate plan to meet their requirements.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Recap: Nationwide vs. Progressive Auto Insurance

Nationwide and Progressive are great companies, but Nationwide has more affordable insurance rates on average. However, discounts and certain personal factors can significantly lower your Progressive monthly rates.

Teens and young adults can benefit from significant savings with Nationwide, so it’s worth checking out. Additionally, read the “State Auto Insurance Review” to explore Progressive’s car insurance discounts and bundling for the best insights into potential savings.

For affordable auto rates, enter your ZIP code to compare multiple auto insurance companies in your area.

Frequently Asked Questions

What are the main differences in coverage between Progressive vs. Nationwide?

The primary difference in coverage is that Nationwide offers more extensive options for bundling home, renters, and life insurance policies. At the same time, Progressive is well-known for customizable policies with affordable starting rates, especially for safe drivers. Progressive appeals to budget-conscious drivers, whereas Nationwide provides additional perks for multi-policy holders.

How does a Nationwide car insurance review rate their claims process and customer service?

Nationwide receives generally positive marks for customer service and claims handling. People comment on responsive support and how easy claims are to file. However, claims experience is very geographically dependent. Overall, satisfaction is higher in those who bundle policies or use Nationwide’s preferred repair shops.

What do Progressive auto insurance reviews say about their rates for different driver profiles?

Progressive receives positive reviews for competitive rates for safe drivers and clean records, though rates may be higher for drivers with incidents. The Snapshot program offers discounts based on safe driving habits, providing flexibility to adjust rates for auto insurance for different types of drivers.

How do policies and rates compare between Progressive vs. Mercury?

Mercury is much cheaper, especially for clients without blemishes on their records. Progressive, however, offers more conveniences and user-friendliness, like mobile applications to manage policies or fill claims. Even though Mercury would suffice for a budget-driven driver, Progressive’s discounts and digital amenities appeal to the tech-inclined customer.

Which offers better coverage options, USAA vs Nationwide?

USAA is known for its comprehensive coverage and competitive rate options for military members and their families. While offering broad coverage, Nationwide is best suited for civilians seeking customizable policies and bundling options. USAA often has lower rates but limited eligibility, while Nationwide is available to all drivers.

What are the top pros and cons of Progressive vs Amica auto insurance?

Progressive provides discounts for safe drivers but may increase rates after past incidents. On the other hand, Amica excels in customer service and claims support, earning high ratings in the Amica auto insurance review despite having fewer discounts available.

How can drivers find accurate Progressive auto quotes?

To get the most accurate Progressive auto quotes, drivers should enter detailed information about their driving record, vehicle type, mileage, and location. Progressive’s website and mobile app offers real-time quote adjustments and Snapshot users can further adjust rates by tracking safe driving habits. Get free quotes for the cheapest auto insurance by filling in your ZIP code here.

Which company is better for young drivers, Progressive vs State Farm?

State Farm is often more affordable for young drivers, providing competitive rates and student discounts. Progressive, however, offers the Snapshot program for additional savings, though young drivers with clean records may find lower rates with State Farm. Both have flexible options, but State Farm’s discounts make it a popular choice for young drivers.

Is Progressive good insurance for high-risk drivers?

Progressive is a solid choice for high-risk drivers, offering SR-22 filings and flexible options for those with past violations. Premiums may be higher, but Progressive’s Snapshot program helps make cheap SR-22 auto insurance more accessible.

Which has more affordable options, Progressive vs The General?

The General typically offers more affordable rates for high-risk drivers or those with poor credit, while Progressive provides more discounts and flexibility for safe driving. The General’s policies are designed for budget-conscious drivers, but Progressive’s broader offerings and customer support attract a more comprehensive range of drivers.

How does customer satisfaction differ between Nationwide vs. Erie?

Which provides better deals for safe drivers, Nationwide vs Root car insurance?

Which company offers more extensive coverage, Liberty Mutual vs. Progressive?

What are some Progressive insurance similar companies that drivers might consider?

Are premiums more affordable with Nationwide vs. Geico?

Which is more competitive for comprehensive policies, State Farm vs. Progressive?

How do safe driving discounts compare for Root vs. Nationwide?

Is Progressive good for multi-vehicle coverage?

How do claims and rates compare in Amica vs Progressive auto insurance?

Are Nationwide and Progressive the same company, or do they operate differently?

Which has better reviews for customer satisfaction, Progressive vs. Erie?

Why is Progressive so cheap for specific drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.