American Family vs. Mercury Auto Insurance in 2026 (Side-by-Side Review)

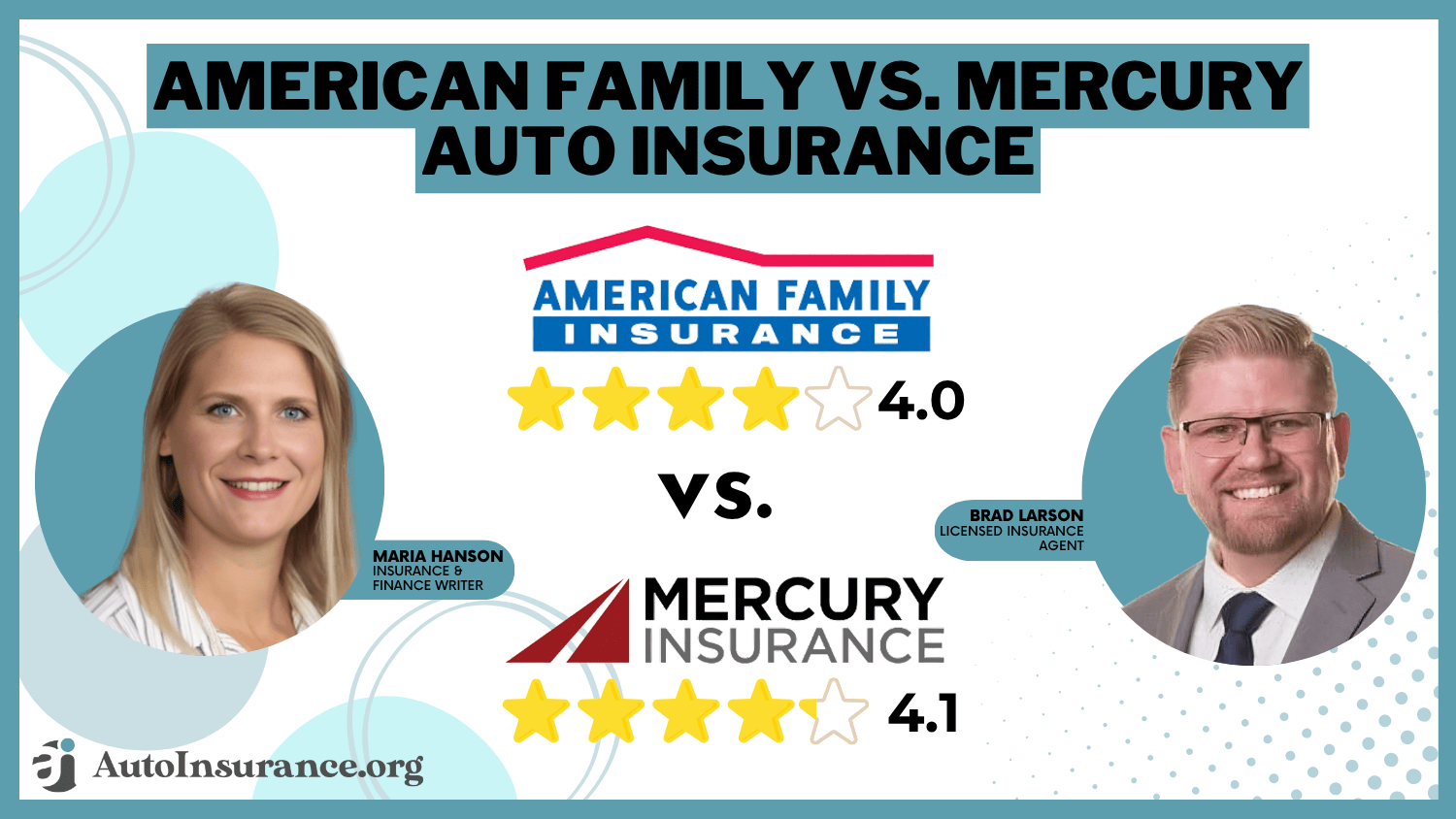

When comparing American Family vs. Mercury auto insurance, Mercury Insurance has lower average rates, starting at $39 per month. However, American Family Insurance offers a few more discounts, like a 20% multi-car discount. Both companies are good choices and well-rated by A.M. Best, with an A financial rating.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 675 reviews

675 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

675 reviews

675 reviewsWhen comparing American Family vs. Mercury auto insurance, Mercury scores slightly higher because it has cheaper auto insurance on average for drivers, especially if customers are shopping for cheap auto insurance for a bad driving record.

American Family vs. Mercury Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.0 | 4.1 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.8 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 3.9 | 3.1 |

| Coverage Value | 4.0 | 4.1 |

| Customer Satisfaction | 2.0 | 1.9 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.3 |

| Plan Personalization | 4.5 | 4.0 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 4.2 | 4.6 |

| American Family Review | Mercury Review |

However, American Family is available in 19 states, compared to Mercury’s 11 states, so American Family is more widely available. Both companies are good options for drivers looking for a reputable company, but Mercury will be more affordable.

- Both companies have fewer customer complaints than average on the NAIC

- Both companies offer up to 25% off with good driver discounts

- American Family has more coverage options, like new car replacement

To help you choose between Mercury Insurance and American Family Insurance, we cover both companies’ rates, discounts, coverages, and much more. Need to find an affordable auto insurance provider today? Compare rates with our free quote tool.

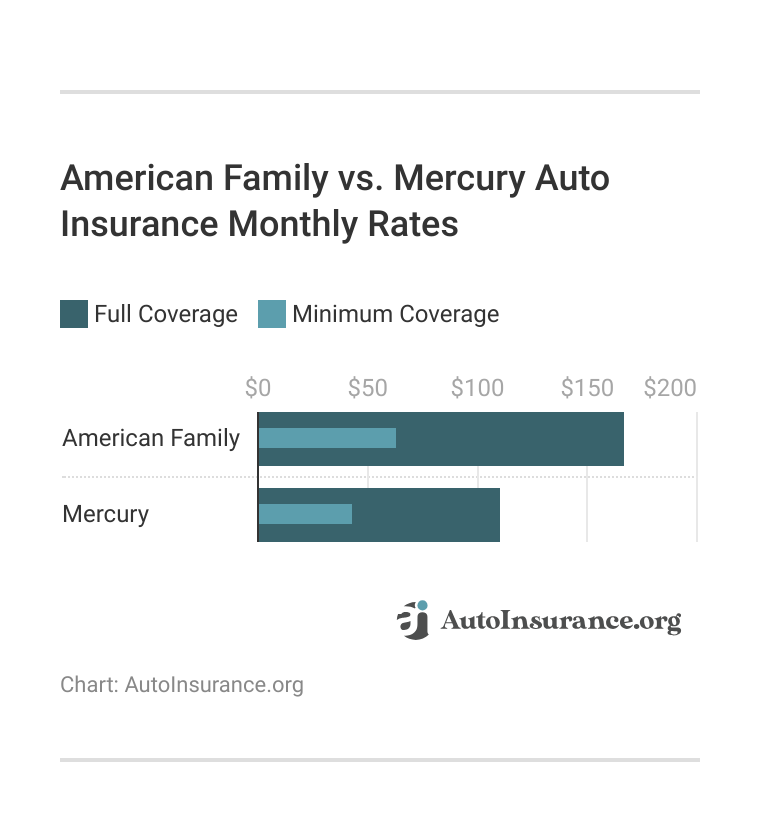

Compare American Family vs. Mercury Auto Insurance Rates

Price is often the leading factor behind customers’ decisions about an auto insurance provider, so we want to take an in-depth look at the price differences between Mercury vs. American Family car insurance.

Full coverage will be the most expensive option at both companies, as it provides the best protection to customers.

For most drivers, the higher cost of full coverage will be worth it, as it usually more than pays itself off in a covered claim.

If you have a lease on your car, your lender will require you to have full coverage in your contract.Dani Best Licensed Insurance Producer

Age will also play a role in how much you pay at Mercury and American Family. Below, see how rates differ by age between the two companies.

American Family vs. Mercury Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $230 | $213 |

| 16-Year-Old Male | $296 | $227 |

| 30-Year-Old Female | $62 | $47 |

| 30-Year-Old Male | $73 | $49 |

| 45-Year-Old Female | $62 | $43 |

| 45-Year-Old Male | $62 | $42 |

| 60-Year-Old Female | $57 | $39 |

| 60-Year-Old Male | $58 | $40 |

Mercury Insurance is consistently cheaper on average than American Family for all ages, including teens and young drivers.

Mercury and American Family also consider a customer’s driving record when calculating rates, not just age (Learn More: Factors That Affect Auto Insurance Rates).

American Family vs. Mercury Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $62 | $42 |

| One Accident | $94 | $62 |

| One DUI | $104 | $70 |

| One Ticket | $73 | $52 |

If your driving record isn’t perfect, Mercury will still be cheaper than American Family on average for auto insurance policies.

If your driving record is bad, we recommend shopping around to determine who has the best rate, such as comparing rates at Mercury Insurance vs. AAA or Mercury Insurance vs. Travelers. Take a look at the table below to see how Mercury and American Family compare to other competitors.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $166 |

| $42 | $110 | |

| $87 | $228 | |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $61 | $161 |

| $53 | $141 | |

| $32 | $84 |

Both Mercury and American Family are cheaper than other competitors like Allstate, Farmers, and Liberty Mutual.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family and Mercury Auto Insurance Coverage Options

When looking at the coverage options that American Family Mutual Insurance Company and Mercury Insurance Services offer, American Family has a few more add-ons than Mercury.

Optional Auto Insurance Coverages With American Family and Mercury

| Coverage |  | |

|---|---|---|

| Roadside Assistance | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Accident Forgiveness | ✅ | ❌ |

| Gap Insurance | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| Custom Equipment | ✅ | ✅ |

| Pet Injury Protection | ✅ | ❌ |

However, both companies offer great coverage that can be added to an existing policy, such as guaranteed auto protection (gap) insurance for leased vehicles.

Customers can also get custom equipment coverage, roadside assistance, and much more at American Family and Mercury.

Auto Insurance Discounts at American Family and Mercury

Both auto insurance companies offer several ways to save on auto insurance policies. Take a look at the best auto insurance discounts offered by Mercury and American Family Insurance.

American Family vs. Mercury Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Anti-Theft | 25% | 12% |

| Auto-Pay | 4% | ❌ |

| Bundling | 25% | 20% |

| Defensive Driving | 5% | ❌ |

| Good Driver | 25% | 25% |

| Good Student | 20% | 15% |

| Loyalty | 18% | 10% |

| Multi-Car | 20% | ❌ |

| New Vehicle | 15% | ❌ |

| Paperless | 4% | ❌ |

| Pay-in-Full | 20% | ❌ |

| Safe Driver | 18% | 8% |

Mercury has fewer discounts than American Family, which could be because its rates are already fairly low before discounts are applied.

When choosing between companies, make sure to calculate the final rate after discounts. One may have a bigger discount, but it still costs more.Daniel Walker Licensed Insurance Agent

However, both Mercury and American Family have good driver programs that offer discounts for safe driving habits after a tracking period. Mercury’s program is called MercuryGo, and American Family’s is MyAmFamDrive. American Family also offers low-mileage auto insurance with MilesMyWay. Both are tracked by the AmFam insurance apps.

Your insurance card at the touch of a button! Learn about @amfam‘s handy #mobile app: http://t.co/jj2mwquauv pic.twitter.com/0EvdbjYaPq

— American Family Insurance (@amfam) October 15, 2014

MilesMyWay is meant for drivers who travel under 8,000 miles annually, and you will have to take a picture of your odometer twice a year to prove you aren’t driving more to earn the 25% discount.

Read More: How to Lower Your Auto Insurance Rates

American Family vs. Mercury Insurance Reviews & Ratings

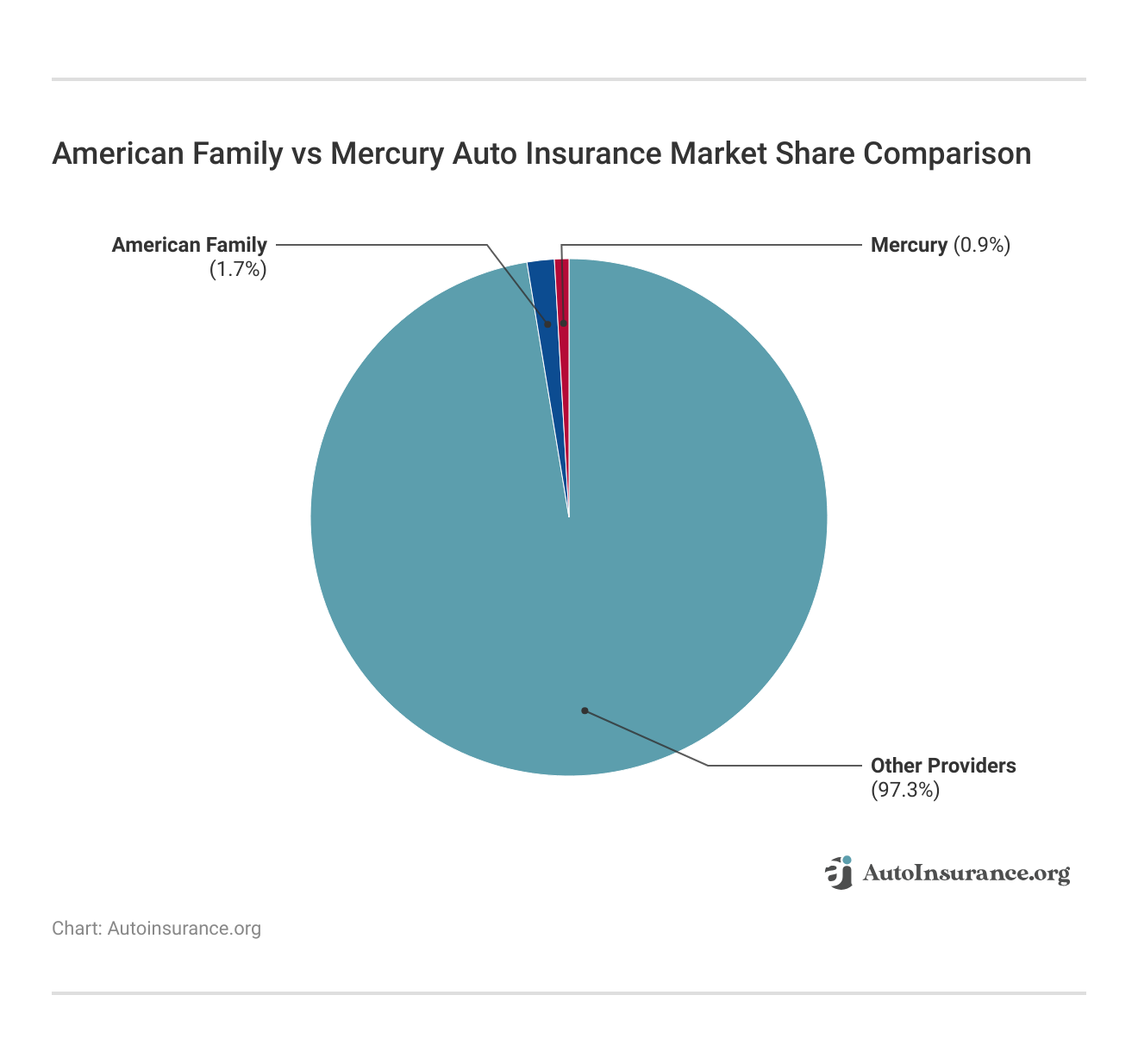

Both American Family and Mercury have plenty of customer reviews and business ratings, as they are both reputable companies. American Family may have a few more reviews than Mercury, as it has a larger market share and serves more customers, but you can find plenty of feedback for both companies online.

You can find customer feedback on Google, Yelp, Reddit, and more. For example, take a look at the Reddit thread below discussing American Family’s rate increases.

American family insurance decided to raise 75% of my insurance without accident or parking violations – living in Marysville WA

byu/Intangibles8480 inWashington

Rate increases at companies are common, but there are multiple customer complaints about prices at American Family going up despite being customers with no accidents or tickets for years. As for Mercury Insurance, customers say that they had issues with the claims department, even though they liked Mercury’s cheap rates.

Does anyone have any experience with Mercury Car Insurance?

byu/GibsonMaestro inAskLosAngeles

Customer reviews can provide insight into a company’s issues, but they are just one part of the picture. Business ratings will give further insight into a company’s reputation, financial management, and more, helping you answer questions like “Is Mercury reputable?”

Insurance Business Ratings & Consumer Reviews: American Family vs. Mercury

| Agency |  | |

|---|---|---|

| Score: 692 / 1,000 Below Avg. Satisfaction | Score: 663 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A- Good Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 70/100 Positive Claims Handling |

|

| Score: 0.26 Fewer Complaints Than Avg. | Score: 0.84 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

When comparing ratings across the board, American Family has slightly better ratings than Mercury for financial strength, complaints, and more. Although they both have fewer complaints than average and good business practice scores, Mercury Insurance and AmFam scored below average for claims satisfaction at J.D. Power.

Read More: Auto Insurance Companies With the Best Customer Service

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of American Family and Mercury Auto Insurance

Both American Family and Mercury are great companies, but Mercury Insurance is the more economical choice for those looking to save on car insurance.

- Affordable Rates: Mercury auto insurance rates start at $39 per month for good drivers.

- Strong A.M. Best Rating: Mercury has an A rating from A.M. Best for financial stability.

- Good Driver Discount: Customers can join MercuryGo for a usage-based insurance discount.

Mercury Insurance offers affordable auto insurance rates for safe and high-risk drivers, and it has fewer complaints from the NAIC.

However, its claims satisfaction is below average, with fewer discounts than AmFam and many other competitors. Other downsides to choosing Mercury are:

- Availability: Mercury auto insurance is only available for purchase in 11 states.

- Fewer Discounts: Mercury Insurance doesn’t offer as many discounts as American Family.

When comparing American Family vs. Mercury auto insurance reviews, AmFam may have higher rates, but it has better discounts, add-ons, and deals for teens and Costco members.

- Costco Discount: AmFam Connect offers discounted car insurance policies for Costco members (Read More: CONNECT Auto Insurance Review).

- Add-On Coverages: American Family has great coverage options, like roadside assistance and new car replacement insurance.

- Strong BBB Rating: The Better Business Bureau gave American Family an A+ for business practices.

American Family Insurance is also an excellent provider for high-risk drivers who have points on their licenses after a speeding ticket or DUI.

Unfortunately, like Mercury Insurance, American Family auto insurance is not available everywhere, and discount availability can vary based on where you live. Other limitations to AmFam Insurance include:

- Availability: American Family is only available for purchase in 19 states.

- Claim Satisfaction: J.D. Power only gave American Family a score of 692 / 1,000 (below average) for customer claim satisfaction.

Both companies have below-average customer complaints recorded on the NAIC and are financially stable according to A.M. Best. The downside is that American Family is only available in 19 states, and Mercury is only available in 11 states.

If neither company is available in your state for purchase, you can still find great auto insurance. Enter your ZIP in our free quote tool to find affordable coverage near you.

Frequently Asked Questions

Is Mercury auto insurance a good company?

Wondering is Mercury auto insurance any good? The A.M. Best Mercury insurance rating is an A, which means it has great financial standing. Mercury is a reputable company to purchase auto insurance from.

Is American Family Insurance any good?

Is American Family good for auto insurance? Yes, American Family has an A rating from A.M. Best and an A+ from the Better Business Bureau. Auto insurance rates start at $57 per month at AmFam.

Why is American Family Insurance so expensive?

American Family rates start at $57 per month, which isn’t the most expensive in the auto insurance market. If you find that your rates are high, it could be due to your driving record, age, or location (Learn More: Why do auto insurance rates vary so much?).

What is the American Family Insurance controversy?

There have been several controversies or lawsuits against American Family, which is typical of any large company. One of the latest ones was a data breach in 2023, which temporarily shut down American Family’s operations.

Does American Family Insurance pay claims well?

American Family has a score of 692/1,000 (below average) for claims satisfaction at J.D. Power. Therefore, not all customers are happy with claims at American Family.

Is Geico or Mercury auto insurance better?

Geico and Mercury are both good choices, but Geico is available in every state, whereas Mercury is only available in 11 states. Learn more in our Geico vs. Mercury auto insurance review.

What company owns American Family Insurance?

American Family’s parent organization is AmFam Holdings, Inc.

Who owns Mercury Insurance?

Mercury auto insurance is owned by Mercury General Corporation.

How much does Mercury insurance go up after an accident?

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family Insurance better than State Farm?

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

Wondering is Mercury auto insurance any good? The A.M. Best Mercury insurance rating is an A, which means it has great financial standing. Mercury is a reputable company to purchase auto insurance from.

Is American Family good for auto insurance? Yes, American Family has an A rating from A.M. Best and an A+ from the Better Business Bureau. Auto insurance rates start at $57 per month at AmFam.

Why is American Family Insurance so expensive?

American Family rates start at $57 per month, which isn’t the most expensive in the auto insurance market. If you find that your rates are high, it could be due to your driving record, age, or location (Learn More: Why do auto insurance rates vary so much?).

What is the American Family Insurance controversy?

There have been several controversies or lawsuits against American Family, which is typical of any large company. One of the latest ones was a data breach in 2023, which temporarily shut down American Family’s operations.

Does American Family Insurance pay claims well?

American Family has a score of 692/1,000 (below average) for claims satisfaction at J.D. Power. Therefore, not all customers are happy with claims at American Family.

Is Geico or Mercury auto insurance better?

Geico and Mercury are both good choices, but Geico is available in every state, whereas Mercury is only available in 11 states. Learn more in our Geico vs. Mercury auto insurance review.

What company owns American Family Insurance?

American Family’s parent organization is AmFam Holdings, Inc.

Who owns Mercury Insurance?

Mercury auto insurance is owned by Mercury General Corporation.

How much does Mercury insurance go up after an accident?

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family Insurance better than State Farm?

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

American Family rates start at $57 per month, which isn’t the most expensive in the auto insurance market. If you find that your rates are high, it could be due to your driving record, age, or location (Learn More: Why do auto insurance rates vary so much?).

There have been several controversies or lawsuits against American Family, which is typical of any large company. One of the latest ones was a data breach in 2023, which temporarily shut down American Family’s operations.

Does American Family Insurance pay claims well?

American Family has a score of 692/1,000 (below average) for claims satisfaction at J.D. Power. Therefore, not all customers are happy with claims at American Family.

Is Geico or Mercury auto insurance better?

Geico and Mercury are both good choices, but Geico is available in every state, whereas Mercury is only available in 11 states. Learn more in our Geico vs. Mercury auto insurance review.

What company owns American Family Insurance?

American Family’s parent organization is AmFam Holdings, Inc.

Who owns Mercury Insurance?

Mercury auto insurance is owned by Mercury General Corporation.

How much does Mercury insurance go up after an accident?

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family Insurance better than State Farm?

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

American Family has a score of 692/1,000 (below average) for claims satisfaction at J.D. Power. Therefore, not all customers are happy with claims at American Family.

Geico and Mercury are both good choices, but Geico is available in every state, whereas Mercury is only available in 11 states. Learn more in our Geico vs. Mercury auto insurance review.

What company owns American Family Insurance?

American Family’s parent organization is AmFam Holdings, Inc.

Who owns Mercury Insurance?

Mercury auto insurance is owned by Mercury General Corporation.

How much does Mercury insurance go up after an accident?

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family Insurance better than State Farm?

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

American Family’s parent organization is AmFam Holdings, Inc.

Mercury auto insurance is owned by Mercury General Corporation.

How much does Mercury insurance go up after an accident?

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is American Family Insurance better than State Farm?

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

If you have a clean driving record, Mercury rates start at $39 per month. However, rates jump to an average of $62 per month after one accident. Shopping around at other companies may help you find a lower rate. Enter your ZIP in our free quote tool to find the best deal on auto insurance after an accident.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Both companies are good choices. However, State Farm is available in every state, so it might be a better choice for people who move frequently. You can read more about the two companies in our American Family vs. State Farm auto insurance review.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.