21st Century vs. Farmers Auto Insurance in 2026 (Side-by-Side Review)

When choosing between 21st Century vs. Farmers auto insurance, 21st Century offers better rates at $64 per month for minimum coverage. Farmers costs more at $76 per month, but it has more discounts and policy options. 21st Century auto insurance is only available in California, while Farmers is a national insurer.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated August 2025

344 reviews

344 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

344 reviews

344 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsUnlock savings on 21st Century vs. Farmers auto insurance. Both companies appeal to cost-conscious drivers who need reliable coverage.

21st Century vs. Farmers Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 3.6 | 4.3 |

| Business Reviews | 3.0 | 4.0 |

| Claim Processing | 3.0 | 3.3 |

| Company Reputation | 3.0 | 4.5 |

| Coverage Availability | 4.6 | 5.0 |

| Coverage Value | 3.2 | 4.1 |

| Customer Satisfaction | 4.0 | 2.0 |

| Digital Experience | 3.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.3 |

| Plan Personalization | 3.0 | 4.5 |

| Policy Options | 2.8 | 5.0 |

| Savings Potential | 4.3 | 4.5 |

| 21st Century Review | Farmers Review |

Farmers is actually the parent company of 21st Century. 21st Century Insurance Company only sells auto insurance in California, sometimes under the Toggle brand, but all policies are underwritten by Farmers Insurance Group. Learn more in our 21st Century auto insurance review.

Farmers policyholders using the Signal app automatically earn a 5% discount when they enroll and save up to 15% at renewal based on driving habits.

- 21st Century and Farmers auto insurance rewards safe drivers

- The Farmers Signal app gives 15% off for logging safe mileage

- 21st Century does not file SR-22 in California

21st Century auto insurance is competitive in California, but if you live in any other state, consider Farmers car insurance. Find affordable auto insurance near you by using our free quote comparison tool.

How 21st Century vs. Farmers Auto Insurance Rates Compare

This table shows how age and gender change the monthly costs between 21st Century and Farmers auto insurance. Teen drivers pay the most, with monthly rates of $304 with 21st Century and $452 with Farmers.

21st Century vs. Farmers Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $304 | $452 |

| 16-Year-Old Male | $304 | $452 |

| 30-Year-Old Female | $70 | $87 |

| 30-Year-Old Male | $73 | $91 |

| 45-Year-Old Female | $64 | $76 |

| 45-Year-Old Male | $64 | $76 |

| 60-Year-Old Female | $59 | $68 |

| 60-Year-Old Male | $61 | $72 |

As drivers age, their insurance rates tend to decrease significantly. Overall, 21st Century gives lower premiums in all categories to California drivers, while Farmers is one of the more expensive national providers.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $159 |

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $50 | $150 | |

| $47 | $123 | |

| $53 | $141 |

For full coverage, State Farm offers the lowest rate at $123, while Liberty is the highest at $248. 21st Century remains competitive with rates of $64 for minimum coverage and $159 for full coverage, outpacing Farmers, which offers $76 for minimum coverage and $198 for full coverage auto insurance.

Choosing wisely means finding a balance between the amount you pay for insurance and the type of protection you truly need, while also taking into account your driving history. With a clean record, 21st Century gives a $64 monthly rate, which is $12 cheaper per month than Farmers.

21st Century vs. Farmers Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $64 | $76 |

| One Accident | $91 | $109 |

| One DUI | $110 | $105 |

| One Ticket | $74 | $95 |

However, if you were involved in an accident or received a ticket, 21st Century still beats Farmers by up to $18 a month. Farmers has cheap auto insurance after a DUI at $105 per month compared to 21st Century’s $110 a month, which is the only time it’s slightly more affordable.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Coverage Options With 21st Century vs. Farmers Auto Insurance

For the most part, 21st Century and Farmers offer the same types of auto insurance. This includes liability, comprehensive, collision, uninsured motorist, and medical payments coverage. Farmers vs. 21st Century also offers accident forgiveness, gap insurance, rental reimbursement, and original equipment and custom parts coverage.

However, due to California state laws, Farmers includes more flexibility and additional features with its wider policy packages available in other states:

- Usage-Based Auto Insurance (UBI): Track driving behaviors with Farmers Signal and save up to 15% a year. Learn how it works in our Farmers Signal review.

- Rideshare Auto Insurance: If you work for Uber, Lyft, or another type of rideshare or delivery service, Farmers will cover the gaps in your company’s policy.

- Personal Umbrella Policy: Drivers can add this to increase their liability policy limits to cover increased medical bills and legal fees.

In California, many UBI discounts are not available due to the state’s strict digital privacy laws. While you can still use its features to track driving habits, California drivers will not see any UBI savings from 21st Century or Farmers.

Both insurance companies provide drivers with the basic coverage they need. However, Farmers offers additional features that might attract those who want more sophisticated protection options.

21st Century vs. Farmers Auto Insurance Discounts

If you arrange discounts smartly, Farmers gives bigger savings for good drivers (30%) and those with accident-free histories (20%).

21st Century vs. Farmers Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Accident-Free | 15% | 20% |

| Anti-Theft | 15% | 10% |

| Auto-Pay | 5% | 5% |

| Bundling | 20% | 20% |

| Defensive Driving | 10% | 10% |

| Good Driver | 20% | 30% |

| Good Student | 15% | 15% |

| Low Mileage | 10% | 10% |

| Multi-Car | 25% | 20% |

| Paperless | 3% | 3% |

| Pay-in-Full | 10% | 10% |

| Safe Driver | 20% | 20% |

However, the 21st Century is better if you have multiple cars because they offer a 25% discount. Both companies share a similar approach to bundling services, rewarding defensive driving, and requiring full payment upfront.

Both reward paperless billing, but only 21st Century stacks it with early renewal. Notably, this combo boosts savings uniquely.Kristen Gryglik Licensed Insurance Agent

Compare, mix, and match options that suit your lifestyle and driving habits. Find out which insurer delivers the best auto insurance discounts tailored to your driving habits.

21st Century vs. Farmers Customer Reviews and Ratings

Here is how Farmers vs. 21st Century insurance customer service compares. 21st Century has a strong financial rating of A from A.M Best, but also has a NAIC score of 2.85, which indicates a higher number of complaints.

Insurance Business Ratings & Consumer Reviews: 21st Century vs. Farmers

| Agency |  | |

|---|---|---|

| Score: 865 / 1,000 Above Avg. Satisfaction | Score: 706 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 72/100 Avg. Customer Satisfaction | Score: 82/100 High Customer Satisfaction |

|

| Score: 2.85 More Complaints Than Avg. | Score: 1.32 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

Farmers auto insurance reviews are better, with an 82/100 rating from Consumer Reports, and has fewer complaints at 1.32, also with stable financial support. J.D. Power ranks them below 21st Century in terms of satisfaction, however.

Comment

byu/SignalBad5523 from discussion

innys_cs

This Reddit post shares a user’s story about switching from Geico to Farmers for home and auto insurance because the rates were cheaper.

However, even with good prices, the user feels annoyed by the provider’s old-fashioned ways of communication. Compare more in our Farmers vs. Geico auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How 21st Century vs. Farmers Auto Insurance Stacks Up

21st Century is a strong provider in California, offering affordable rates and competitive discounts. However, as a smaller company, it lacks some of the policy features that larger companies, such as Farmers, can offer.

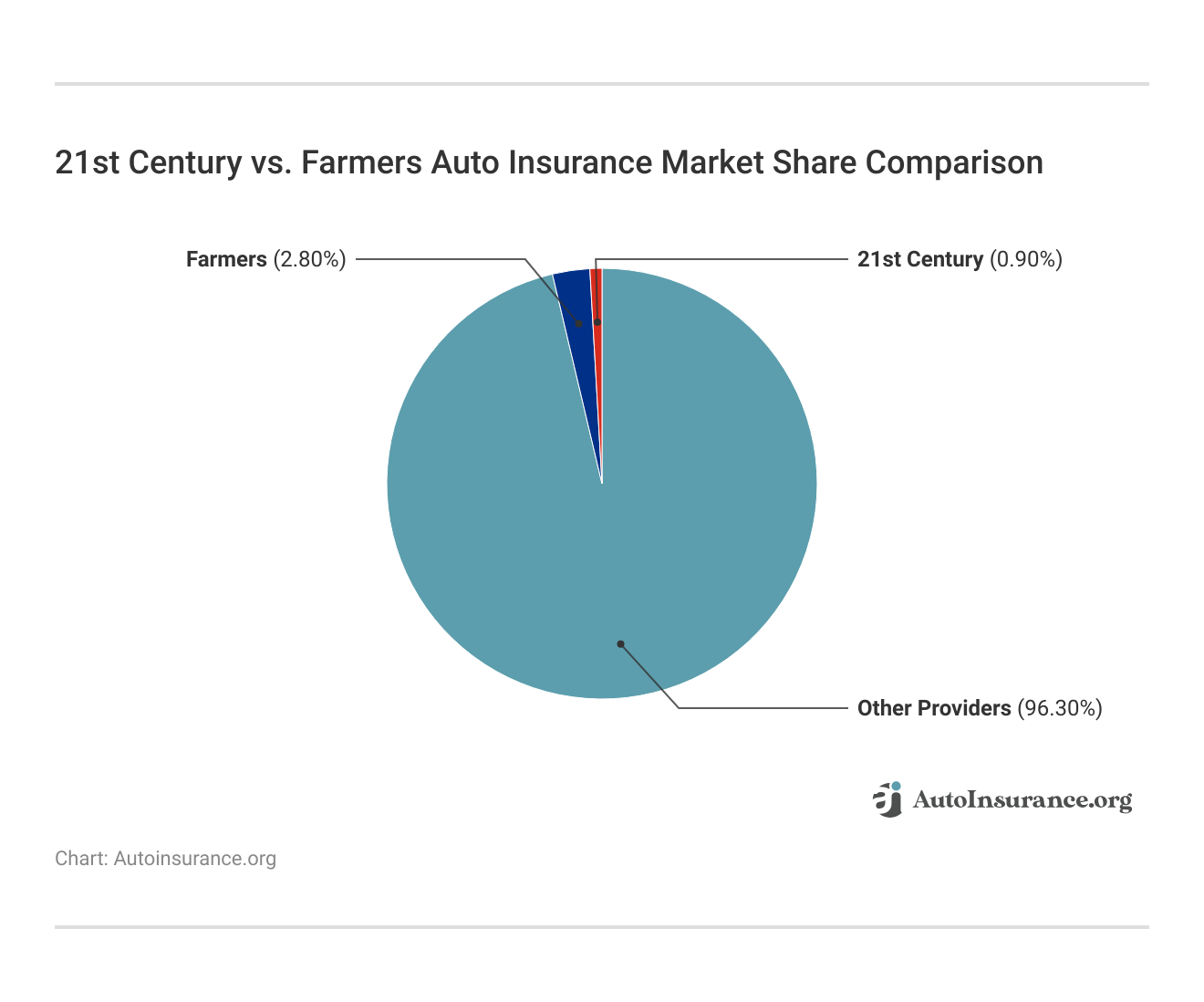

Farmers hold 2.80% of the auto insurance market, which is three times more than 21st Century’s small share of 0.90%. The data shows not only a difference in numbers, but also a power balance where both companies, especially 21st Century, act as small players in a very crowded market. That’s why it’s always important to compare car insurance rates from at least two or more companies before you buy auto insurance online.

Farmers offers an advantage to drivers seeking more detailed policy features, such as Signal-based safe driving rewards and options for better bundling. It offers a 30% discount for good drivers and a 20% discount for those with accident-free records.

Farmers supports usage-based insurance in more states than 21st Century. As such, it’s easier to unlock telematics discounts with a Farmers policy.Brandon Frady Licensed Insurance Producer

On the other hand, 21st Century provides lower base rates across almost all age groups and has notable savings with its 25% multi-vehicle discount. While 21st Century insurance might be attractive to families with several cars and a limited budget, Farmers could better suit those who are tech-savvy. Compare auto insurance quotes by entering your ZIP code to find the best company near you.

Frequently Asked Questions

Who owns 21st Century Insurance?

21st Century Insurance is owned by Farmers Insurance Group, which was acquired by Zurich Insurance Group in 1998 and later absorbed 21st Century from AIG in 2009. Discover how Zurich’s financial strength affects your options in our Zurich auto insurance review.

What can you expect from 21st Century automobile insurance?

You can expect low monthly premiums starting around $64, plus basic coverage options ideal for budget-conscious drivers.

How can you obtain a 21st Century insurance quote quickly?

You can receive a 21st Century insurance quote online within minutes by visiting the company website. If you want to see quotes from all the companies in your area, enter your ZIP code.

Where do you access the 21st Century insurance login page?

You can log into your 21st Century insurance company account at www.21st.com using your policy number or registered email.

How does the 21st Century insurance agency support your policy needs?

The 21st Insurance Agency helps you manage auto, home, and bundled policies with tools for quick quotes and service access. Compare policy savings and discover which providers offer the best options for bundling home and auto insurance.

What does 21st Century Centennial Insurance offer you as a policyholder?

21st Century Centennial Insurance offers you essential auto coverage with financial backing under the Farmers Insurance Group.

How can you reach 21st Century insurance customer service?

You can contact 21st Century insurance customer service by calling their main support line at 1-877-401-8181 during business hours.

What is the 21st Century insurance claims phone number?

You can reach the 21st Century insurance phone number for insurance claims by calling 1-888-244-6163 to file or check claim updates.

Is 21st Century homeowners insurance right for you?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

How does Toggle 21st Century Insurance relate to auto coverage?

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

21st Century Insurance is owned by Farmers Insurance Group, which was acquired by Zurich Insurance Group in 1998 and later absorbed 21st Century from AIG in 2009. Discover how Zurich’s financial strength affects your options in our Zurich auto insurance review.

You can expect low monthly premiums starting around $64, plus basic coverage options ideal for budget-conscious drivers.

How can you obtain a 21st Century insurance quote quickly?

You can receive a 21st Century insurance quote online within minutes by visiting the company website. If you want to see quotes from all the companies in your area, enter your ZIP code.

Where do you access the 21st Century insurance login page?

You can log into your 21st Century insurance company account at www.21st.com using your policy number or registered email.

How does the 21st Century insurance agency support your policy needs?

The 21st Insurance Agency helps you manage auto, home, and bundled policies with tools for quick quotes and service access. Compare policy savings and discover which providers offer the best options for bundling home and auto insurance.

What does 21st Century Centennial Insurance offer you as a policyholder?

21st Century Centennial Insurance offers you essential auto coverage with financial backing under the Farmers Insurance Group.

How can you reach 21st Century insurance customer service?

You can contact 21st Century insurance customer service by calling their main support line at 1-877-401-8181 during business hours.

What is the 21st Century insurance claims phone number?

You can reach the 21st Century insurance phone number for insurance claims by calling 1-888-244-6163 to file or check claim updates.

Is 21st Century homeowners insurance right for you?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

How does Toggle 21st Century Insurance relate to auto coverage?

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

You can receive a 21st Century insurance quote online within minutes by visiting the company website. If you want to see quotes from all the companies in your area, enter your ZIP code.

You can log into your 21st Century insurance company account at www.21st.com using your policy number or registered email.

How does the 21st Century insurance agency support your policy needs?

The 21st Insurance Agency helps you manage auto, home, and bundled policies with tools for quick quotes and service access. Compare policy savings and discover which providers offer the best options for bundling home and auto insurance.

What does 21st Century Centennial Insurance offer you as a policyholder?

21st Century Centennial Insurance offers you essential auto coverage with financial backing under the Farmers Insurance Group.

How can you reach 21st Century insurance customer service?

You can contact 21st Century insurance customer service by calling their main support line at 1-877-401-8181 during business hours.

What is the 21st Century insurance claims phone number?

You can reach the 21st Century insurance phone number for insurance claims by calling 1-888-244-6163 to file or check claim updates.

Is 21st Century homeowners insurance right for you?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

How does Toggle 21st Century Insurance relate to auto coverage?

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

The 21st Insurance Agency helps you manage auto, home, and bundled policies with tools for quick quotes and service access. Compare policy savings and discover which providers offer the best options for bundling home and auto insurance.

21st Century Centennial Insurance offers you essential auto coverage with financial backing under the Farmers Insurance Group.

How can you reach 21st Century insurance customer service?

You can contact 21st Century insurance customer service by calling their main support line at 1-877-401-8181 during business hours.

What is the 21st Century insurance claims phone number?

You can reach the 21st Century insurance phone number for insurance claims by calling 1-888-244-6163 to file or check claim updates.

Is 21st Century homeowners insurance right for you?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

How does Toggle 21st Century Insurance relate to auto coverage?

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

You can contact 21st Century insurance customer service by calling their main support line at 1-877-401-8181 during business hours.

You can reach the 21st Century insurance phone number for insurance claims by calling 1-888-244-6163 to file or check claim updates.

Is 21st Century homeowners insurance right for you?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

How does Toggle 21st Century Insurance relate to auto coverage?

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

21st Century home insurance is ideal for auto policyholders seeking basic home coverage, offering potential multi-policy discounts. Find out why to get multiple auto insurance quotes when comparing 21st Century and Farmers for better savings.

Toggle is a renters insurance brand under Farmers Insurance, not directly part of 21st Century. Both are connected through their ownership by Farmers Insurance Group.

What can you expect from 21st Century Farmers Insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Farmers Mutual insurance the same as Farmers insurance?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.