Cheap Gap Insurance in Arizona (Big Savings With These 10 Companies in 2026)

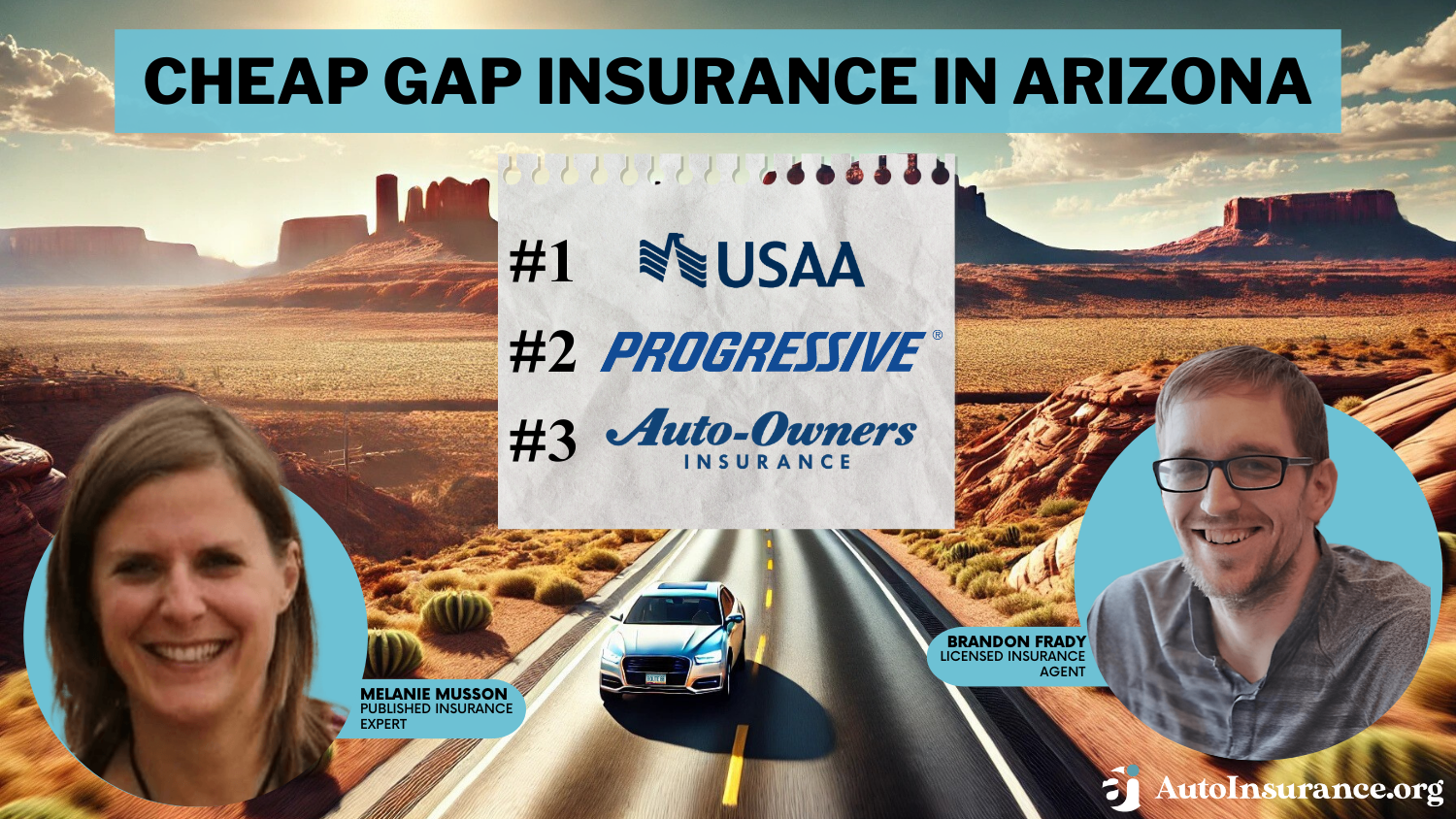

USAA, Progressive, and Auto-Owners are the top picks for cheap gap insurance in Arizona, starting at $33 per month. USAA offers military gap coverage, Progressive provides loan/lease payoff, and Auto-Owners includes new car replacement. Gap insurance in Arizona covers loan balances after a total loss.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2025

6,590 reviews

6,590 reviewsCompany Facts

Gap Insurance in Arizona

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Gap Insurance in Arizona

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 563 reviews

563 reviewsCompany Facts

Gap Insurance in Arizona

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviewsUSAA, Progressive, and Auto-Owners are the top providers of cheap gap insurance in Arizona, offering top-rated gap protection for drivers.

Our Top 10 Companies: Cheap Gap Insurance in Arizona

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $33 | A++ | Military Focus | USAA | |

| #2 | $44 | A+ | Flexible Coverage | Progressive | |

| #3 | $58 | A++ | Affordable Rates | Auto-Owners | |

| #4 | $60 | A | Young Drivers | American Family | |

| #5 | $61 | A+ | Vanishing Deductible | Nationwide |

| #6 | $70 | A | Insurance Discounts | Farmers | |

| #7 | $88 | A | High-Risk Drivers | The General | |

| #8 | $93 | A | Comprehensive Options | Liberty Mutual | |

| #9 | $94 | A+ | High-Mileage Savings | Allstate | |

| #10 | $94 | B | Local Presence | State Farm |

USAA leads with military-exclusive gap insurance, providing unique benefits for service members. See which of the cheapest auto insurance companies offer top savings.

- USAA is the top pick for cheap gap insurance in Arizona for the military

- Gap insurance covers loan balances if a vehicle is totaled in a claim

- Arizona drivers can save on gap insurance by comparing multiple quotes

Progressive offers loan/lease payoff coverage, which is best for financed vehicles. Auto-Owners does really well with new car replacement and assures additional safety for more recent cars.

Enter your ZIP code above to explore which companies have cheap gap insurance in Arizona.

Arizona Gap Insurance Cost Summary & Comparison

USAA offers the lowest rate for Arizona gap insurance, starting at $33 a month, and it’s also the best pick for military members.

Gap Insurance Monthly Rates in Arizona by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $94 | |

| $60 | |

| $58 | |

| $70 | |

| $93 |

| $61 |

| $44 | |

| $94 | |

| $88 | |

| $33 |

Progressive follows at $44 monthly, providing budget-friendly loan/lease payoff coverage. Auto-Owners ranks third at $58 monthly, featuring new car replacement for added financial protection.

Multiple factors combine to determine your overall gap insurance costs, making it crucial to consider them when shopping for coverage.

- Vehicle Type: The make, model, and age of your car significantly influence your gap insurance rates, with newer, more expensive vehicles typically costing more to insure.

- Driving Record: A clean driving history can lower your premiums, while accidents or traffic violations may lead to higher rates for gap insurance in Arizona.

- Coverage Level: Opting for full coverage instead of minimum coverage increases your monthly premiums but provides more comprehensive protection.

By understanding what affects your Arizona insurance rates, you can find the most cost-effective policy for your needs.

Read More: Cheap Full-Coverage Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Practical Tips for Reducing Gap Insurance Costs in Arizona

To reduce your gap insurance costs in Arizona, focus on discounts, safe driving, and making informed coverage choices.

Gap insurance prevents out-of-pocket costs after a total loss. For example, USAA’s military plans offer top savings.Kristen Gryglik Licensed Insurance Agent

Additionally, consider raising your auto insurance deductible to lower monthly premiums, but ensure you can cover the out-of-pocket expense in case of a claim.

For instance, enrolling in a defensive driving course can not only enhance your driving skills but also earn you a discount from many insurers on this list.

If you’re buying Arizona gap insurance for a new car, many providers also offer new vehicle auto insurance discounts. Some companies have make, model, and age limits on new vehicles, so check with your insurer to see if your car qualifies.

The Leading Gap Insurance Providers in Arizona

Finding cheap gap insurance in Arizona requires comparing companies to secure the top rates and coverage options.

USAA stands out for military-exclusive benefits, while Progressive offers affordable loan/lease payoff protection, and Auto-Owners provides new car replacements.

#1 – USAA: Top Overall Pick

Pros

- Exclusive Arizona Discounts: USAA offers exclusive cheap gap insurance rates for Arizona military members and their families.

- High Customer Satisfaction: Arizona policyholders praise USAA for its excellent customer service and ease of handling claims. Get detailed insights in our complete USAA auto insurance review.

- Comprehensive Coverage: USAA gap insurance options are specifically tailored to meet the needs of Arizona’s military community.

Cons

- Eligibility Restrictions: Only Arizona military members and their families qualify for USAA gap insurance, limiting access for non-military residents.

- Limited Physical Locations: Arizona customers may face challenges accessing in-person support due to fewer USAA branches in the state.

#2 – Progressive: Cheapest Flexible Policies

Pros

- Flexible Coverage: Progressive gap insurance can be tailored to the needs and budgets of all types of Arizona drivers.

- Robust Online Tools: Arizona drivers benefit from Progressive’s advanced online tools, making it easy to manage gap insurance policies and compare rates.

- Wide Range of Discounts: Progressive provides various discount options for Arizona drivers, helping reduce the overall cost of gap insurance. Find out more in our Progressive Insurance review.

Cons

- Mixed Customer Reviews: Some customers have reported inconsistencies in customer service experiences, particularly when handling Arizona gap insurance claims.

- Rate Increases at Renewal: Some drivers report Arizona gap insurance rate increases at renewal when nothing in their driving history has changed.

#3 – Auto-Owners: Cheapest for Affordable Rates

Pros

- Affordable Arizona Rates: Auto-Owners consistently offers some of the lowest Arizona gap insurance premiums, making it a top pick for budget-conscious drivers.

- Superior Financial Strength: With an A++ rating from A.M. Best, Auto-Owners is one of the most reliable Arizona gap insurance companies. Get full ratings in our Auto-Owners review.

- Competitive Discounts: Auto-Owners offers big discounts on gap insurance in Arizona for safe drivers, policy bundling, and usage-based savings.

Cons

- Limited Availability: As a regional company, Auto-Owners gap insurance may not be available in other states if you decide to move away from Arizona.

- Fewer Policy Add-Ons: You might not see as many comprehensive gap insurance options as you would with larger Arizona auto insurance companies.

#4 – American Family: Cheapest for Young Drivers

Pros

- Tailored Arizona Coverage: American Family focuses on providing affordable gap insurance policies for Arizona families with teen drivers.

- Exceptional Customer Service: Arizona policyholders consistently praise AmFam for its responsive and family-oriented customer service. Get full ratings in our AmFam Insurance review.

- Comprehensive Coverage Options: American Family offers a range of gap insurance policies that cater to various scenarios faced by Arizona drivers.

Cons

- Limited Availability: American Family’s services may be less accessible in certain parts of Arizona, limiting the convenience of in-person support.

- Premium Costs: Arizona drivers might find American Family gap insurance premiums higher, particularly for comprehensive coverage.

#5 – Nationwide: Cheapest With Vanishing Deductible

Pros

- Vanishing Deductible Rewards: Nationwide will reduce the full coverage deductible on Arizona gap insurance every year drivers go without filing a claim.

- Discount Variety: Arizona drivers benefit from a broad range of discounts, helping to reduce overall gap insurance costs. Compare rates and discounts in our Nationwide review.

- Reputation for Reliability: Nationwide’s strong A.M. Best rating reassures Arizona drivers of dependable gap insurance coverage.

Cons

- Service Variability: Some customers report inconsistent experiences with Nationwide’s customer service, particularly concerning AZ gap insurance claims.

- Complex Policy Options: Arizona drivers might find Nationwide’s array of gap insurance options overwhelming, requiring careful consideration to choose the right coverage.

#6 – Farmers: Cheapest for Insurance Discounts

Pros

- Long List of Discounts: Farmers offers more gap insurance discounts than any Arizona company on this list.

- Strong Local Presence: With a significant number of agents in Arizona, Farmers provides personalized service and support. Read more in our complete Farmers auto insurance review.

- Financial Strength: Farmers’ excellent A.M. Best rating ensures reliable gap insurance coverage for Arizona residents.

Cons

- Higher Premiums: Arizona drivers may find Farmers gap insurance rates slightly higher compared to other providers, despite the customization options.

- Varied Customer Service Experiences: Arizona drivers report inconsistent experiences with Farmers gap insurance customer service in different cities.

#7 – The General: Cheapest for High-Risk Drivers

Pros

- Competitive Arizona Rates: The General offers affordable high-risk auto insurance options for gap coverage in Arizona, often lower than competitors. Compare rates in our review of The General.

- Simple Online Process: Arizona drivers appreciate The General’s straightforward online process for obtaining gap insurance quotes and coverage.

- Accessible Coverage: The General provides gap insurance options that are accessible to a broad range of Arizona drivers, regardless of their driving history.

Cons

- Limited Coverage Options: Arizona drivers may find The General gap insurance policies less comprehensive and with fewer customization options than their competitors.

- Mixed Customer Reviews: Some customers report varying experiences with The General’s customer service and Arizona gap insurance claims handling.

#8 – Liberty Mutual: Cheapest Comprehensive Protection

Pros

- Extensive Arizona Coverage: Liberty Mutual offers comprehensive gap insurance policies that cover a broad spectrum of needs for Arizona drivers.

- Strong Claims Process: Arizona customers frequently commend Liberty Mutual for its efficient claims process, especially for gap insurance.

- Financial Stability: Liberty Mutual’s high A.M. Best rating ensures reliable coverage for Arizona policyholders. Get further details in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Arizona drivers may find Liberty Mutual gap insurance rates on the higher end compared to other providers.

- Discount Availability: Liberty Mutual offers fewer discounts on gap insurance in Arizona, potentially resulting in higher overall costs.

#9 – Allstate: Cheapest for High-Mileage Drivers

Pros

- Pay-As-You-Go Discounts: Allstate Milewise Unlimited helps higher-mileage drivers get cheaper gap insurance rates in Arizona. Learn how in our Milewise review.

- Strong Claims Support: Arizona customers frequently commend Allstate for its efficient claims process, particularly in handling gap insurance claims.

- Superior Financial Stability: Allstate’s high A.M. Best rating assures Arizona drivers of reliable and consistent coverage.

Cons

- Premium Costs: Arizona drivers may find Allstate’s gap insurance premiums higher compared to other providers if they don’t qualify for discounts.

- More Complaints Than Average: Despite strong claims service, Allstate has twice as many complaints from customers as other Arizona gap insurance companies.

#10 – State Farm: Cheapest for Local Agents

Pros

- Arizona-Focused Coverage: State Farm provides highly customizable gap insurance options for Arizona drivers, allowing them to tailor coverage to specific needs.

- Strong Local Presence: With numerous agents across Arizona, State Farm offers easy access to personalized service and support. Explore our review of State Farm auto insurance.

- Superior Customer Service: State Farm is among the top five Arizona insurance companies for gap insurance claims handling and customer service satisfaction.

Cons

- Discount Limitations: Available discounts for gap insurance in Arizona may not be as extensive as those offered by competitors, affecting overall cost savings.

- Low Financial Rating: Other Arizona gap insurance companies have higher A.M. Best ratings and more trustworthy service.

Get an Affordable AZ Gap Insurance Policy Today

Choosing the right insurer ensures financial protection if your vehicle is totaled. Arizona drivers can lower costs by bundling policies, maintaining a clean record, and comparing multiple quotes.

Learn More: Cheap Auto Insurance for a Bad Driving Record

Each of these companies excels in key areas, ensuring that Arizona residents can find affordable gap insurance to meet their specific needs. Enter your ZIP code to compare top gap insurance providers in AZ today for free.

Frequently Asked Questions

Who normally has the cheapest gap insurance in Arizona?

USAA and Progressive typically have cheap AZ gap insurance starting at $33 monthly. Discover where to buy auto insurance online for the best coverage options.

Is it illegal not to have auto insurance in Arizona?

Yes, it is illegal to drive without car insurance in Arizona, and maintaining gap insurance in Arizona is important for protecting your financial investment.

Who has the lowest gap insurance rates in Arizona?

USAA offers the cheapest gap insurance, but you can enter your ZIP code to compare the best gap insurance quotes in Arizona for free.

How is Arizona gap insurance calculated?

Gap insurance in Arizona is calculated based on the amount left due on your auto loan or lease when your vehicle is written off as a total loss after a claim.

What does gap insurance in Arizona cover?

Arizona gap insurance covers the difference between your car’s value at the time of total loss and the remaining balance on your loan or lease.

How many claims can you make on Arizona gap insurance?

You can typically make only one Arizona gap insurance claim, as it is designed to cover the difference between your car’s value and the remaining loan balance after a total loss.

Is Arizona gap insurance the same as regular insurance?

No, gap insurance in Arizona is not the same as regular insurance; it specifically covers the difference between your car’s actual cash value and the remaining balance on your loan or lease.

Does State Farm offer gap insurance?

Yes, you can get gap coverage through State Farm. It’s called Payoff Protector and is only available if you finance through State Farm Bank.

What is the minimum car insurance required for gap coverage in Arizona?

The minimum auto insurance required in Arizona includes liability coverage of $25,000 per person, $50,000 per accident for bodily injury, and $15,000 for property damage.

What is the cost of State Farm gap insurance?

State Farm doesn’t charge extra for Payoff Protector, but you must finance your vehicle through State Farm Bank to receive this coverage.

Where can you find the best gap insurance deals?

How can you qualify for an Arizona auto insurance reduction?

How do I file a gap insurance claim in Arizona?

Where can you get asset protection gap insurance in Peoria, AZ?

Which companies are the best gap auto insurance providers?

Will gap insurance in Arizona cover a blown engine?

Who offers gap insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.