Best Bradenton, Florida Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Bradenton, Florida auto insurance includes State Farm, USAA, and AAA, with State Farm providing the lowest rate at $47per month. These top companies excel in affordability, coverage, and customer service. For the best car insurance in Bradenton, these options offer outstanding value and reliability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Bradenton FL

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Bradenton FL

A.M. Best

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Bradenton FL

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

The best Bradenton, Florida auto insurance providers are State Farm, USAA, and AAA, with State Farm offering the lowest rates at $47 per month and numerous discounts.

USAA provides excellent savings for military members, while AAA notably stands out with its user-friendly online app.

Our Top 10 Company Picks: Best Bradenton, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Many Discounts State Farm

#2 10% A++ Military Savings USAA

#3 18% A Online App AAA

#4 12% A+ Add-on Coverages Allstate

#5 14% A+ Usage Discount Nationwide

#6 17% A+ 24/7 Support Erie

#7 11% A Local Agents Farmers

#8 16% A+ Innovative Programs Progressive

#9 19% A++ Accident Forgiveness Travelers

#10 13% A++ Custom Plan Geico

These top choices offer a range of benefits tailored to different needs, ensuring you find the best coverage at the most competitive prices.

Get the car insurance at the best price — enter your ZIP code above to shop for right coverage from the top insurers.

- State Farm provides the best Bradenton, Florida auto insurance with extensive discount options.

- Tailored policies meet the unique needs of Bradenton drivers, covering specific local risks.

- Comprehensive coverage ensures protection against a range of common driving issues.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm showcases its extensive discount opportunities in Bradenton, which significantly reduce premiums and highlight its commitment to affordability, as shown in our State Farm review.

- Local Agent Support: Bradenton drivers benefit from personalized service and support through State Farm’s local agents.

- Comprehensive Coverage Options: State Farm offers a range of coverage options tailored to different needs in Bradenton.

Cons

- Higher Rates for Certain Drivers: Some drivers in Bradenton may face higher rates with State Farm, particularly those with poor credit.

- Limited Discount Options: Compared to other providers, State Farm may offer fewer discount opportunities for Bradenton residents.

#2 – USAA: Best for Military Savings

Pros

- High Customer Satisfaction: Bradenton policyholders frequently report high satisfaction with USAA’s customer service.

- Exclusive Military Savings: USAA offers remarkable savings for military members in Bradenton, highlighting its commitment to supporting those in the armed forces. detailed in our USAA review.

- Comprehensive Coverage: USAA offers extensive coverage options at competitive rates for Bradenton drivers.

Cons

- Limited Eligibility: USAA’s coverage is restricted to military members and their families, limiting availability in Bradenton.

- Fewer Local Offices: Bradenton residents may find fewer in-person service options with USAA.

#3 – AAA: Best for Online App

Pros

- Competitive Rates: Offers competitive rates for car insurance, especially with multiple policies in Bradenton.

- Added Benefits: Offers extra member benefits, including roadside assistance and travel discounts, for Bradenton members.

- User-Friendly Online App: AAA offers a user-friendly online app that boosts customer convenience and showcases innovative technology for managing auto insurance in Bradenton., highlighted in our AAA review.

Cons

- Membership Fees: AAA’s membership fees can add to the overall cost of car insurance in Bradenton.

- Limited Coverage Options: May offer fewer coverage options compared to other leading insurers in Bradenton.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate offers flexible add-on coverages, demonstrating their ability to meet diverse needs in Bradenton, as reviewed in our Allstate review.

- Innovative Tools: Allstate’s Drivewise app helps Bradenton drivers save on premiums based on driving behavior.

- Strong Financial Stability: Provides reliable coverage with strong financial backing in Bradenton.

Cons

- Higher Premiums: Some Bradenton drivers may experience higher premiums compared to other insurers.

- Lower Customer Satisfaction: Allstate’s customer service ratings in Bradenton may fall short compared to some of its competitors.

#5 – Nationwide: Best for Usage Discount

Pros

- Tailored Coverage Reviews: The On Your Side® Review ensures that Bradenton drivers get the best coverage.

- Usage Discount: Nationwide showcases its usage-based discount programs in Bradenton, offering a cost-effective option for drivers who demonstrate safe driving habits, as outlined in our Nationwide review.

- Strong Stability: Nationwide’s financial stability supports reliable claim payouts for Bradenton Drivers.

Cons

- Higher Rates for Some Drivers: Rates may be higher for certain Bradenton drivers with less-than-perfect driving records.

- Fewer Local Agents: Limited local agent presence in Bradenton compared to some competitors.

#6 – Erie: Best for 24/7 Support

Pros

- Competitive Pricing: Erie offers competitive pricing for Bradenton drivers seeking affordable auto insurance.

- First Accident Forgiveness: Helps maintain rates after an initial at-fault accident for Bradenton drivers.

- 24/7 Support: Erie shows its dedication to customer service in Bradenton with 24/7 support, ensuring reliable assistance whenever needed, as featured in our Erie review.

Cons

- Limited Availability: Erie operates only in certain regions, limiting its availability in Bradenton.

- Fewer Digital Tools: Offers fewer online tools compared to larger insurers in Bradenton.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Local Agent Assistance: Farmers showcases its network of local agents in Bradenton, delivering personalized service tailored to the specific needs of residents in your area, as emphasized in our Farmers review.

- Customizable Coverage: Farmers provides flexible coverage options to meet various needs in Bradenton.

- Accident Forgiveness: Helps maintain lower rates in Bradenton after an at-fault accident.

Cons

- Higher Premiums: Some Bradenton drivers may find Farmers’ premiums to be higher compared to other insurers.

- Mixed Customer Service: Customer service experiences in Bradenton may vary, with some reports indicating lower ratings.

#8 – Progressive: Best for Innovative Programs

Pros

- Competitive Rates: Provides budget-friendly options for Bradenton drivers, especially those with varied driving records.

- Innovative Programs: In Bradenton, Progressive’s Snapshot program shows its commitment to using technology for customer benefits, as discussed in our Progressive review.

- Wide Range of Coverage: In Bradenton Progressive offer a variety of coverage options to meet diverse driver needs.

Cons

- Higher Rates for Some: Rates may be higher for drivers with less-than-ideal records in Bradenton.

- Inconsistent Customer Service: Customer service experiences can be inconsistent for Bradenton policyholders.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Multi-Policy Discounts: Travelers offers savings for bundling multiple policies, benefiting Bradenton drivers.

- Strong Financial Stability: Reliable claims support and financial stability in Bradenton.

- Accident Forgiveness: Travelers offers accident forgiveness programs, demonstrating their commitment to protecting Bradenton drivers who experience mishaps, as described in our Travelers review.

Cons

- Limited Local Agents: Fewer local agents available in Bradenton for personalized service.

- Claims Processing: Some Bradenton customers report slower claims processing times.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Custom Plans

Pros

- Affordable Rates: Known for offering some of the lowest rates in Bradenton, Florida.

- Custom Plan: Geico offers customizable plans in Bradenton, showcasing its flexibility and dedication to tailoring coverage to meet individual needs, as illustrated in our Geico review.

- Multiple Discounts: Provides various discounts for good drivers and military members in Bradenton.

Cons

- Limited Local Support: Fewer local agents in Bradenton may lead to less personalized service.

- Mixed Customer Satisfaction: Customer satisfaction ratings can vary in Bradenton.

Minimum Auto Insurance in Bradenton, Florida

Best Bradenton, Florida Auto Insurance Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $50 | $102 |

| Allstate | $44 | $96 |

| Erie | $52 | $107 |

| Farmers | $49 | $101 |

| Geico | $52 | $105 |

| Nationwide | $54 | $109 |

| Progressive | $46 | $98 |

| State Farm | $47 | $99 |

| Travelers | $51 | $103 |

| USAA | $52 | $104 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Bradenton, Florida Auto Insurance by Age, Gender, and Marital Status

Age, gender, and marital status significantly influence the best Bradenton, Florida auto insurance rates.

Best Bradenton, Florida Auto Insurance by Driving Record

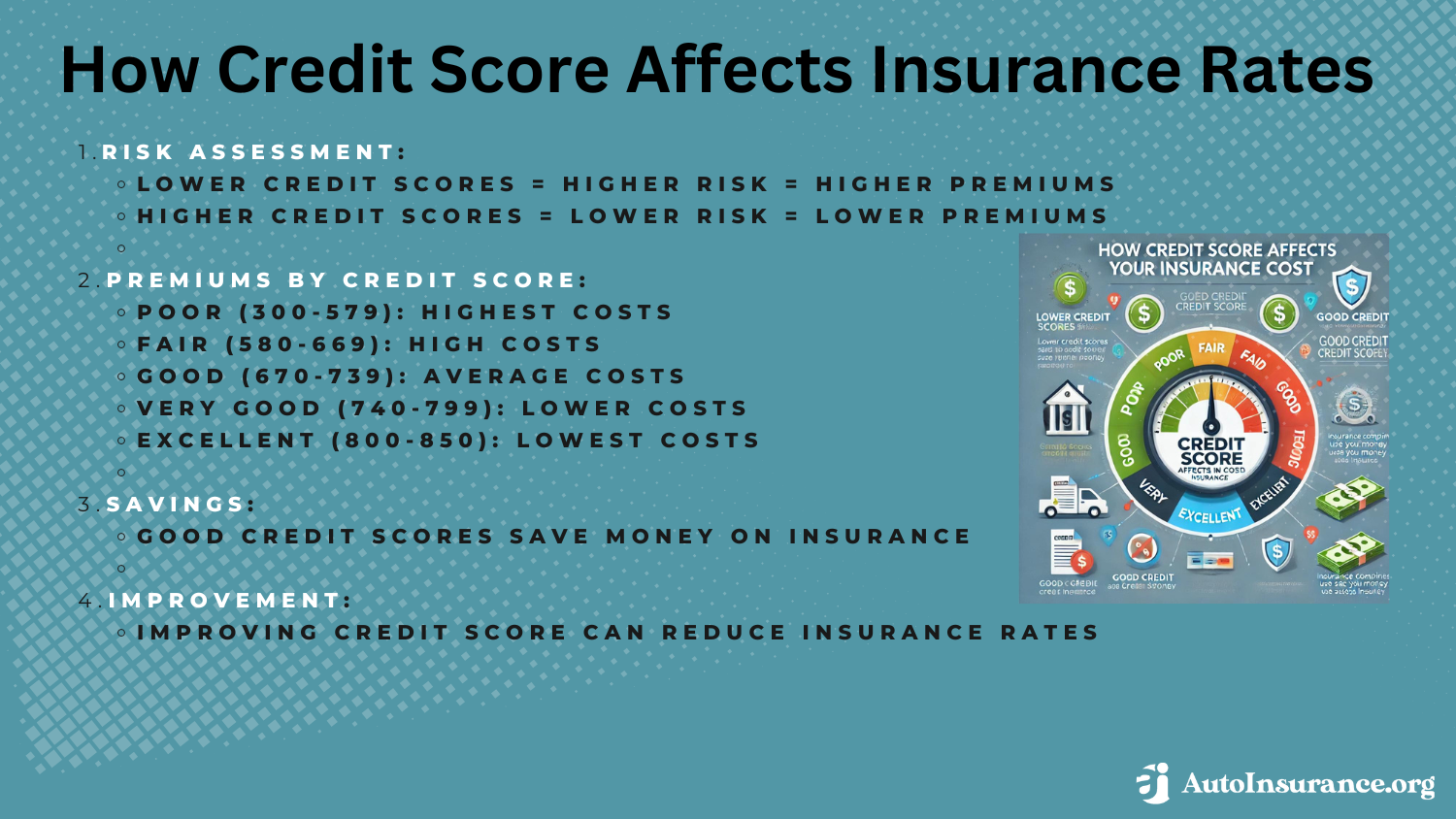

Best Bradenton, Florida Auto Insurance by Credit History

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Bradenton, Florida Auto Insurance Rates by ZIP Code

Auto insurance rates in Bradenton, Florida, vary by ZIP code. Compare the annual costs for the best Bradenton, Florida auto insurance by ZIP code to understand how location impacts your car insurance rates.

Auto insurance rates in Bradenton, Florida, can vary significantly by ZIP code, making it essential to compare options to find the best coverage for your area.

Different ZIP codes can lead to significant differences in premiums due to factors like local risk levels and traffic conditions. Analyzing these variations helps in finding the most cost-effective coverage for your area.

Best Bradenton, Florida Auto Insurance Rates by Commute

Best Auto Insurance in Bradenton, Florida

State Farm stands out as the best choice for auto insurance in Bradenton, Florida, thanks to its competitive rates and comprehensive coverage options.

As the top pick for the best Bradenton, Florida auto insurance, State Farm offers exceptional value through a wide range of discounts and reliable customer service.

Their extensive network and tailored policies ensure that drivers in Bradenton receive both affordability and quality protection. Explore State Farm’s offerings to secure the most comprehensive and cost-effective coverage available.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What affects auto insurance rates in Bradenton, Florida?

In Bradenton, Florida, auto insurance rates are affected by local auto theft rates, commute lengths, and traffic conditions. For the best Bradenton, Florida auto insurance, higher auto theft rates and longer commutes can raise premiums, while heavy traffic can increase rates due to accident risks.

State Farm offers the best Bradenton, Florida auto insurance with its unbeatable rates and extensive coverage options.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Understanding these influences can help you find the best insurance options. For additional details, explore our comprehensive resource titled “Factors That Affect Auto Insurance Rates”

Compare Best Bradenton, Florida Auto Insurance Quotes

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Frequently Asked Questions

What is the best auto insurance company in Florida?

State Farm is often considered the best auto insurance company in Florida, offering competitive rates, extensive coverage options, and excellent customer service, making it a top pick for many residents.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Who has the lowest car insurance rates in Florida?

Geico typically offers the lowest car insurance rates in Florida, providing affordable options that cater to various drivers’ needs while maintaining good coverage.

What is the best Bradenton, Florida auto insurance for seniors?

For seniors in Bradenton, Florida, State Farm offers the best auto insurance with tailored discounts and coverage plans that meet the unique needs of older drivers.

For detailed information, refer to our comprehensive report titled “Best Auto Insurance For Seniors in Florida”

What are the top 10 insurance companies in Florida?

The top 10 insurance companies in Florida include State Farm, USAA, AAA, Allstate, Nationwide, Erie, Farmers, Progressive, Travelers, and Geico, with each offering various benefits depending on your needs.

What is Florida’s minimum auto insurance requirement?

Florida’s minimum auto insurance requirements include $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) coverage.

Is Geico leaving Florida?

No, Geico is not leaving Florida. The company continues to operate and provide auto insurance services throughout the state, offering competitive rates and various coverage options to meet the needs of Florida drivers.

For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance Companies Pulling Out of Florida”

At what age does your car insurance go down in Florida?

Car insurance rates in Florida typically decrease when drivers reach the age of 25, provided they have maintained a clean driving record.

Which insurance company has the highest customer satisfaction in Florida?

USAA generally receives the highest customer satisfaction ratings in Florida, particularly among military families, due to its exceptional service and coverage.

What is full coverage auto insurance in Florida?

Full coverage auto insurance in Florida includes liability, collision, and comprehensive coverage, offering broad protection against various types of damage and accidents.

Why is Florida insurance so expensive?

Florida’s insurance rates are high due to factors like high auto theft rates, severe weather risks, and the state’s no-fault insurance laws, which drive up costs for insurers.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.