Best Nissan Versa Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

The top picks for the best Nissan Versa auto insurance are State Farm, Geico, and Progressive, with rates starting at just $70 per month. These providers deliver excellent coverage, competitive premiums, and notable discounts, ensuring great value for Nissan Versa car insurance. Compare quotes today.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated March 2025

Company Facts

Full Coverage for Nissan Versa

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissan Versa

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Nissan Versa

A.M. Best

Complaint Level

Pros & Cons

The best Nissan Versa auto insurance providers are State Farm, Geico, and Progressive, with rates starting as low as $70 per month. For those comparing to Nissan Sentra insurance costs, these top choices offer competitive premiums and excellent coverage options. State Farm stands out overall for its value and comprehensive benefits.

The article explains why auto insurance rates vary so much, highlighting factors such as location, driver age, and vehicle type. Understanding these variables can help Nissan Versa owners better navigate their insurance options and find the most cost-effective coverage tailored to their needs.

Our Top 10 Company Picks: Best Nissan Versa Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 15% A++ Competitive Rates Geico

#3 10% A+ Innovative Discount Progressive

#4 10% A++ Military Benefits USAA

#5 10% A+ Comprehensive Coverage Allstate

#6 12% A Customizable Policies Liberty Mutual

#7 20% A+ Vanishing Deductible Nationwide

#8 8% A++ IntelliDrive Discounts Travelers

#9 10% A+ Personalized Service Farmers

#10 15% A+ Customer Satisfaction Amica

Use our free comparison tool above to see what auto insurance quotes look like in your area.

- Find the best Nissan Versa auto insurance with rates

- Compare coverage and discounts for optimal Nissan Versa insurance value

- State Farm offers the best overall coverage and rates

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: As mentioned in our State Farm auto insurance review, State Farm offers a competitive annual rate of $150 for Nissan Versa insurance, which is lower than the industry average. This cost-effectiveness can be particularly beneficial for budget-conscious drivers seeking comprehensive coverage without overspending.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options for Nissan Versa owners, including comprehensive and collision coverage, which can provide extensive protection against various types of damage. This allows drivers to customize their insurance policy according to their specific needs and preferences.

- Discount Opportunities: State Farm provides various discounts, including safe driver discounts and multi-policy savings. These discounts can significantly reduce the overall cost of insurance for your Nissan Versa, making it an affordable option for both new and experienced drivers.

Cons

- Limited Coverage Options: While State Farm offers competitive rates, their coverage options may be less comprehensive compared to some competitors. For Nissan Versa owners looking for extensive coverage, additional endorsements might be necessary to fully protect their vehicle.

- Variable Premiums by Region: The cost of insurance with State Farm can vary significantly depending on your location. This means that while $150 is the average rate, some Nissan Versa drivers might experience higher premiums based on their geographical area, potentially impacting affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: As mentioned in our Geico auto insurance review, the company offers one of the lowest average rates for Nissan Versa insurance at $145 per year. This can be advantageous for those looking to minimize their insurance expenses while maintaining adequate coverage.

- Extensive Online Tools: Geico provides a range of online tools and resources, including a user-friendly website and mobile app. These tools allow Nissan Versa owners to easily manage their policies, file claims, and access customer support.

- Discounts for Safe Vehicles: Geico offers discounts for vehicles with advanced safety features, which is beneficial for Nissan Versa owners. If your Versa is equipped with features like anti-lock brakes and stability control, you might qualify for additional savings.

Cons

- Limited Local Agent Availability: Geico primarily operates online, which means there may be limited access to local agents for personalized assistance. This could be a drawback for Nissan Versa owners who prefer face-to-face interactions for managing their insurance.

- Mixed Customer Reviews: Some customers report mixed experiences with Geico’s claims process and customer service. Although Geico generally has a good reputation for Nissan Versa owners, there are occasional complaints about the handling of claims and responsiveness.

#3 – Progressive: Best for Innovative Discount

Pros

- Customizable Coverage Options: Progressive offers a variety of customizable coverage options for Nissan Versa owners. This flexibility allows you to tailor your policy to meet specific needs, such as higher liability limits or additional comprehensive coverage.

- Snapshot Program: Progressive’s Snapshot program can help reduce premiums based on your driving habits. If you are a safe driver with a clean record, you may qualify for significant discounts on your Nissan Versa insurance.

- Broad Range of Discounts: As mention in Progressive auto insurance review, Progressive provides numerous discounts, including those for bundling policies and having anti-theft devices. These discounts can help lower the cost of insurance while ensuring your Nissan Versa is well-protected.

Cons

- Higher Average Premiums: While Progressive offers flexible coverage options for your Nissan Versa, their average premium of $155 is slightly higher than some competitors. This might make it less appealing for budget-conscious drivers seeking the lowest possible rates.

- Complex Policy Structure: Progressive’s wide range of coverage options and discounts can sometimes lead to a confusing policy structure. Nissan Versa owners might find it challenging to navigate and understand all available options and discounts.

#4 – USAA: Best for Military Benefits

Pros

- Lowest Average Rates: As outlined in USAA auto insurance review, the company offers the lowest average annual rate of $140 for Nissan Versa insurance, making it an excellent choice for those seeking cost-effective coverage without compromising on quality.

- Exceptional Customer Service: USAA is renowned for its outstanding customer service and satisfaction ratings. Nissan Versa owners can expect efficient claims handling and personalized support from a company known for its commitment to serving military families and their affiliates.

- Generous Discounts: USAA provides a variety of discounts, including those for safe driving and bundling multiple policies. These discounts can further lower the cost of insurance for your Nissan Versa, providing added financial benefits.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families. This limited eligibility might exclude potential Nissan Versa owners who do not meet the requirements for membership.

- Less Accessible for Non-Members: For those who are not eligible for USAA coverage, finding comparable rates and service from other insurers might be necessary for your Nissan Versa. This could involve additional research and comparisons to find a suitable alternative.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options for Nissan Versa owners, including optional add-ons like roadside assistance and rental car coverage. This ensures that you can fully protect your vehicle according to your preferences.

- Strong Reputation for Claims Handling: Allstate is known for its reliable claims processing and customer support. This can be beneficial for Nissan Versa owners who value a straightforward and efficient claims experience.

- Discounts for Safe Driving: Allstate offers several discounts for safe driving behaviors and vehicle safety features. If your Nissan Versa is equipped with advanced safety technologies, you may be eligible for additional savings on your policy. Learn more about their discounts in our Allstate auto insurance review.

Cons

- Higher Average Premiums: Allstate’s average annual premium of $160 is on the higher side compared to some competitors. This might be a drawback for those looking for more budget-friendly insurance options for their Nissan Versa.

- Mixed Customer Reviews: Some Nissan Versa customers have reported mixed experiences with Allstate’s customer service and claims handling. While generally reliable, there are occasional complaints about service and support, which could affect overall satisfaction.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Extensive Coverage Options: Liberty Mutual offers a variety of coverage options for Nissan Versa owners, including unique features such as new car replacement and accident forgiveness. These options can provide enhanced protection and peace of mind.

- Customization Opportunities: As mentioned in our Liberty Mutual auto insurance review, the company allows for significant customization of insurance policies, enabling Nissan Versa owners to adjust coverage levels and add endorsements based on their specific needs.

- Discounts for Safety Features: Liberty Mutual provides discounts for vehicles equipped with advanced safety features. This can be advantageous for Nissan Versa owners with additional safety technologies, helping to reduce overall insurance costs.

Cons

- Higher Premiums: With an average premium of $165, Liberty Mutual is one of the more expensive options for Nissan Versa insurance. This could be a deterrent for those seeking lower-cost insurance solutions.

- Inconsistent Customer Service: Liberty Mutual has received mixed reviews regarding customer service and claims processing. Some Nissan Versa owners may experience delays or issues with claims, impacting their overall satisfaction with the insurer.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Competitive Coverage Options: Nationwide offers competitive coverage options for Nissan Versa owners, including comprehensive and collision coverage. This ensures that you have robust protection for your vehicle against various types of damage.

- Discounts for Bundling: Nationwide provides substantial discounts for bundling auto insurance with other policies, such as home or renters insurance. This can help Nissan Versa owners save on overall insurance costs while enjoying comprehensive coverage.

- Strong Financial Stability: Nationwide is known for its strong financial stability and reliability, which can provide peace of mind to Nissan Versa owners knowing that their insurer is well-positioned to handle claims and provide support. For more information, read our Nationwide auto insurance review.

Cons

- Higher Average Premiums: Nationwide’s average premium of $158 is higher than some other insurers. This could be a disadvantage for budget-conscious Nissan Versa owners looking for more affordable insurance options.

- Limited Discounts for Safety Features: While Nationwide offers bundling discounts, it may not provide as many discounts for safety features compared to other insurers. This might mean fewer opportunities for savings based on your Nissan Versa’s safety technologies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for IntelliDrive Discounts

Pros

- Flexible Coverage Options: Travelers offers a range of flexible coverage options for Nissan Versa owners, allowing you to tailor your policy to your specific needs and preferences. This flexibility can help ensure you get the coverage that best fits your situation.

- Discounts for Safe Driving: Travelers provides discounts for safe driving behaviors and the installation of safety features in your vehicle. If your Nissan Versa is equipped with advanced safety technologies, you may benefit from lower premiums.

- Strong Reputation: As outlined in our Travelers auto insurance review, Travelers has a solid reputation for customer service and claims handling. This can be beneficial for Nissan Versa owners who prioritize a reliable and supportive insurance experience.

Cons

- Moderate Premiums: With an average premium of $152, Travelers is not the cheapest option available for Nissan Versa insurance. This might be a consideration for those seeking lower-cost insurance alternatives.

- Mixed Customer Service Reviews: While generally reputable, Travelers has received mixed reviews from customers regarding service and claims processing. Some Nissan Versa owners may encounter issues that impact their overall satisfaction with the insurer.

#9 – Farmers: Best for Personalized Service

Pros

- Comprehensive Coverage Options: Farmers offers a variety of comprehensive coverage options for Nissan Versa owners, including customizable add-ons like roadside assistance and rental car coverage. This ensures you can protect your vehicle in multiple scenarios.

- Discounts for Safe Vehicles: Farmers provides discounts for vehicles with advanced safety features and anti-theft systems. If your Nissan Versa is equipped with these technologies, you might benefit from lower insurance rates. Check out this page Farmers auto insurance review to know more details.

- Strong Local Presence: Farmers has a robust network of local agents, providing personalized service and support. This can be advantageous for Nissan Versa owners who prefer in-person interactions and tailored insurance solutions.

Cons

- Higher Average Premiums: Farmers’ average annual premium of $157 is higher compared to some competitors. This may be a drawback for those seeking more affordable insurance options for their Nissan Versa.

- Inconsistent Customer Service: Some customers report mixed experiences with Farmers’ customer service and claims handling. This inconsistency could affect Nissan Versa owners’ overall satisfaction with the insurer.

#10 – Amica: Best for Customer Satisfaction

Pros

- Affordable Rates: Amica offers competitive rates for Nissan Versa insurance, averaging $148 per year. This affordability makes it a good option for those seeking cost-effective coverage without sacrificing quality.

- Excellent Customer Service: Amica is known for its high level of customer service and satisfaction. Nissan Versa owners can expect responsive support and efficient claims processing from a company with a strong reputation for customer care.

- Discounts for Safe Driving: As mentioned in Amica auto insurance review, Amica offers various discounts for safe driving behaviors and the installation of safety features. These discounts can help reduce the cost of insurance for your Nissan Versa while promoting safer driving habits.

Cons

- Limited Coverage Options: While Amica offers competitive rates, their coverage options may be more limited compared to some larger insurers. Nissan Versa owners seeking extensive or specialized coverage might find Amica’s offerings less comprehensive.

- Regional Availability: Amica’s availability may be limited in certain regions. Nissan Versa owners in areas where Amica does not operate might need to explore other insurance providers to find suitable coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nissan Versa Insurance Cost

Understanding the insurance costs for a Nissan Versa is crucial for budgeting and finding the best coverage options. The table below compares monthly rates for minimum and full coverage car insurance from various providers.

Nissan Versa Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $83 $160

Amica $76 $148

Farmers $81 $157

Geico $75 $145

Liberty Mutual $85 $165

Nationwide $82 $158

Progressive $80 $155

State Farm $78 $150

Travelers $79 $152

USAA $70 $140

Comparing these auto insurance rates helps in choosing the right insurance provider and coverage level for your Nissan Versa.

For Nissan Versa owners, State Farm offers peace of mind through robust policy options tailored to meet diverse needs.Justin Wright Licensed Insurance Agent

To further assist in your decision-making, here is a breakdown of insurance rates for different scenarios such as high deductibles, low deductibles, and rates for high-risk and teen drivers.

Nissan Versa Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $114 |

| Discount Rate | $67 |

| High Deductibles | $99 |

| High Risk Driver | $244 |

| Low Deductibles | $144 |

| Teen Driver | $418 |

By comparing insurance rates from multiple providers and considering various scenarios, Nissan Versa owners can find the best coverage options to suit their needs and budget. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Are Nissan Versas Expensive to Insure

When you get auto insurance for a Nissan Versa, it’s helpful to compare it with other similar sedans. The chart below details how Nissan Versa insurance rates compare to other models like the Nissan Sentra, MINI Hardtop 4 Door, and Ford Focus.

Nissan Versa Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Focus | $20 | $45 | $33 | $111 |

| Hyundai Sonata | $25 | $44 | $35 | $119 |

| MINI Hardtop 4 Door | $25 | $47 | $33 | $118 |

| Nissan Sentra | $21 | $48 | $33 | $114 |

| Nissan Versa | $23 | $47 | $31 | $114 |

| Toyota Camry | $25 | $48 | $33 | $118 |

| Volkswagen Passat | $28 | $50 | $33 | $123 |

By examining these rates, you can see how the Nissan Versa compares to other sedans in terms of insurance costs. This comparison can help you make an informed decision when choosing the best insurance for your vehicle.

What Impacts the Cost of Nissan Versa Insurance

Understanding the factors that influence the monthly car insurance rates of Nissan Versa insurance can help you make informed decisions and find the best rates.

Key elements that impact insurance premiums include the age of the vehicle, driver age, location, clean driving record, and safety ratings.

Age of the Vehicle

The age of your Nissan Versa plays a significant role in determining your insurance premiums. Older models generally cost less to insure compared to newer models due to their lower market value and repair costs.

Nissan Versa Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Versa | $25 | $49 | $32 | $116 |

| 2023 Nissan Versa | $24 | $48 | $32 | $115 |

| 2022 Nissan Versa | $24 | $48 | $32 | $114 |

| 2021 Nissan Versa | $23 | $47 | $31 | $114 |

| 2020 Nissan Versa | $23 | $47 | $31 | $114 |

| 2019 Nissan Versa | $22 | $45 | $33 | $113 |

| 2018 Nissan Versa | $21 | $45 | $33 | $112 |

| 2017 Nissan Versa | $21 | $44 | $35 | $112 |

| 2016 Nissan Versa | $20 | $42 | $36 | $111 |

| 2015 Nissan Versa | $19 | $40 | $37 | $109 |

| 2014 Nissan Versa | $18 | $38 | $38 | $107 |

| 2013 Nissan Versa | $17 | $35 | $38 | $104 |

| 2012 Nissan Versa | $17 | $32 | $38 | $100 |

| 2011 Nissan Versa | $16 | $29 | $38 | $96 |

| 2010 Nissan Versa | $15 | $27 | $39 | $94 |

By considering the age of your vehicle, you can better understand how it impacts your insurance rates and potentially opt for an older model to save on premiums.

Driver Age

Driver age can have a significant impact on Nissan Versa auto insurance rates. Younger drivers tend to pay more for insurance compared to older, more experienced drivers due to their higher risk profile.

Nissan Versa Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $418 |

| Age: 18 | $372 |

| Age: 20 | $259 |

| Age: 30 | $119 |

| Age: 40 | $123 |

| Age: 45 | $115 |

| Age: 50 | $104 |

| Age: 60 | $102 |

Understanding how age affects insurance rates can help young drivers find ways to reduce their premiums, such as taking defensive driving courses or maintaining a clean driving record.

Driver Location

Where you live can have a large impact on Nissan Versa insurance rates. For example, drivers in Houston may pay $84 a month more than drivers in Columbus.

Nissan Versa Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $151 |

| Columbus, OH | $95 |

| Houston, TX | $179 |

| Indianapolis, IN | $97 |

| Jacksonville, FL | $166 |

| Los Angeles, CA | $196 |

| New York, NY | $181 |

| Philadelphia, PA | $153 |

| Phoenix, AZ | $133 |

| Seattle, WA | $111 |

By understanding the impact of location on insurance costs, you can better anticipate your premiums and explore ways to mitigate these costs, such as moving to areas with lower rates.

Your Driving Record

Your driving record can have an impact on the cost of Nissan Versa auto insurance. Drivers with clean records tend to pay less than those with violations or accidents, as insurers view them as lower risk.

Nissan Versa Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $418 | $460 | $523 | $681 |

| Age: 18 | $372 | $409 | $465 | $614 |

| Age: 20 | $259 | $282 | $336 | $484 |

| Age: 30 | $119 | $130 | $154 | $283 |

| Age: 40 | $114 | $124 | $146 | $271 |

| Age: 45 | $110 | $120 | $142 | $264 |

| Age: 50 | $104 | $113 | $134 | $255 |

| Age: 60 | $102 | $111 | $131 | $249 |

Maintaining a clean driving record is crucial for keeping insurance costs low. Avoiding violations and accidents can lead to significant savings on your premiums.

Safety Ratings

Your Nissan Versa auto insurance rates are tied to the safety ratings of the Nissan Versa. Vehicles with higher safety ratings are generally cheaper to insure because they are less likely to result in severe injuries during an accident.

Nissan Versa Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Not Tested |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Not Tested |

| Head restraints and seats | Not Tested |

By driving a vehicle with high safety ratings, you can benefit from lower insurance premiums and increased protection for you and your passengers.

Crash Test Ratings

Good Nissan Versa crash test ratings mean the vehicle is safer, which could mean cheaper Nissan Versa auto insurance rates. These ratings assess the vehicle’s performance in various crash scenarios and help insurers determine the risk associated with the vehicle.

Nissan Versa Crash Test Rating

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Versa 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Nissan Versa 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Nissan Versa 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Nissan Versa 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Nissan Versa 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Nissan Versa Note SR 5 HB FWD | N/R | N/R | N/R | N/R |

| 2019 Nissan Versa Note 5 HB FWD | N/R | N/R | N/R | 4 stars |

| 2019 Nissan Versa 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2018 Nissan Versa Note 5 HB FWD | N/R | 3 stars | N/R | 4 stars |

| 2018 Nissan Versa 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Nissan Versa Note 5 HB FWD | N/R | 3 stars | N/R | 4 stars |

| 2017 Nissan Versa 4 DR FWD | N/R | 4 stars | N/R | 4 stars |

| 2016 Nissan Versa Note 5 HB FWD | 4 stars | 3 stars | 5 stars | 4 stars |

| 2016 Nissan Versa 4 DR FWD | 4 stars | 4 stars | 4 stars | 4 stars |

These crash test ratings provide valuable insights into the safety performance of the Nissan Versa, which can influence your insurance costs.

Nissan Versa Safety Features

The more safety features you have on your Nissan Versa, the more likely it is that you can earn a discount. Key safety features include:

- Air Bags: Driver, passenger, front head, rear head, front side, and rear side air bags.

- Braking Systems: 4-wheel ABS, front disc/rear drum brakes, and brake assist.

- Stability and Traction: Electronic stability control and traction control.

- Lighting and Visibility: Daytime running lights.

- Safety Warnings: Lane departure warning and child safety locks.

These features enhance the overall safety of the vehicle and can lead to lower insurance premiums by reducing the risk of accidents and injuries.

Loss Probability

The Nissan Versa’s insurance loss probability varies for each form of coverage. The lower percentage means lower Nissan Versa auto insurance rates; higher percentages mean higher Nissan Versa auto insurance rates.

Nissan Versa Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | 38% |

| Collision | 16% |

| Comprehensive | -8% |

| Medical Payment | 103% |

| Personal Injury | 90% |

| Property Damage | 10% |

By understanding the insurance loss probability rates, you can gain insights into how likely your vehicle is to be involved in claims, which can help you choose the right coverage and manage your insurance costs effectively.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5 Ways to Save on Nissan Versa Insurance

There are many ways that you can save on Nissan Versa auto insurance to get the best value possible. Below are five scenarios you can explore to help keep your Nissan Versa auto insurance rates low.

- Save money on young driver Nissan Versa insurance rates by mentioning grades or gpa.

- Apply for your full, unrestricted license as soon as you’re eligible.

- Use a service like Turo to rent out your Nissan Versa.

- Consider applying for multiple vehicle auto insurance discounts, if you have any other vehicles.

- If you’re a young driver living at home, add yourself to your parents’ plan.

Whether it’s through academic achievements, early licensure, leveraging rental services, adding yourself to a family plan, or proactively searching for better rates, taking these steps can help you secure the most cost-effective insurance for your Nissan Versa.

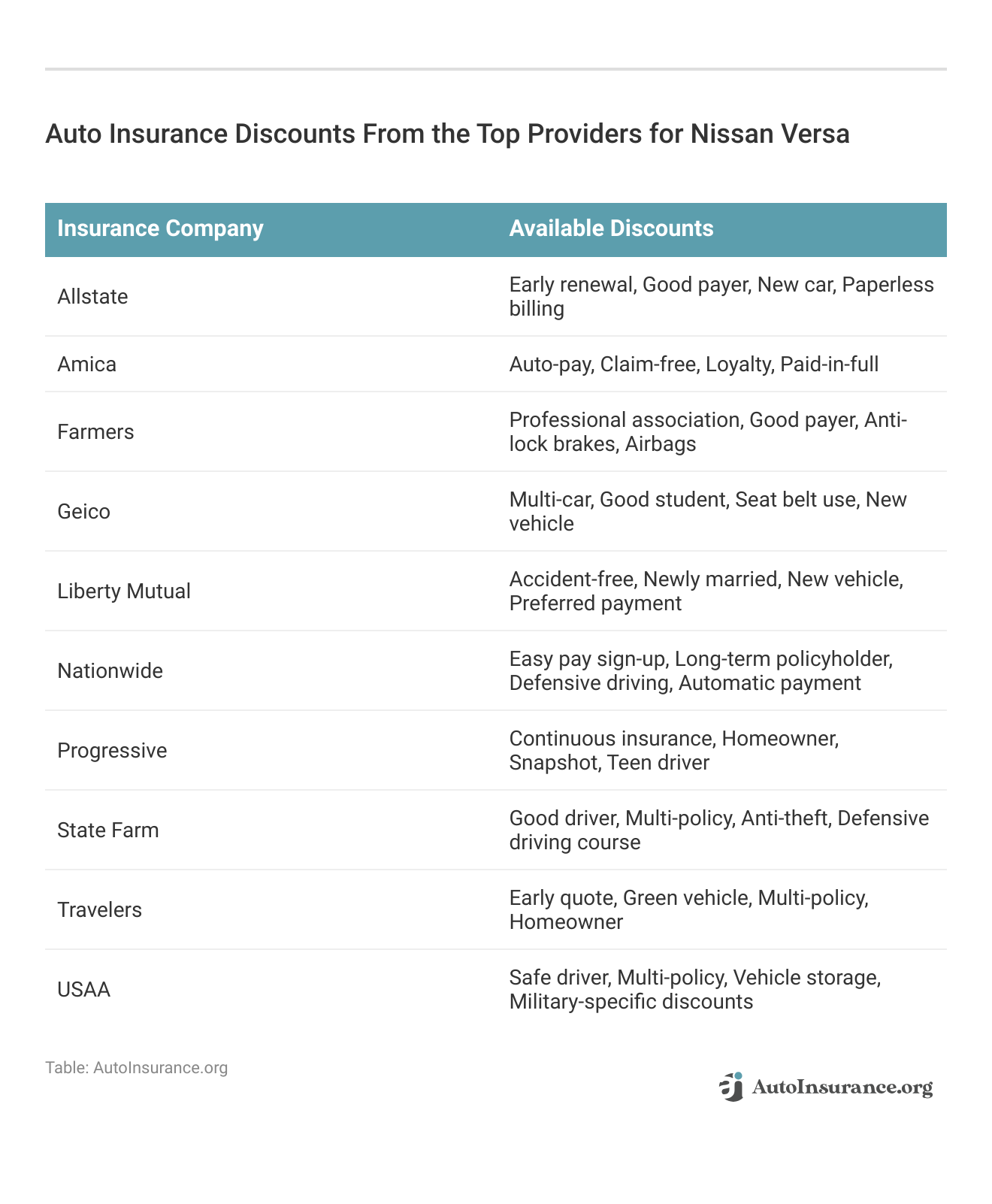

These discounts from top insurance providers for Nissan Versa offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Nissan Versa Insurance Companies

Who is the best auto insurance companies for Nissan Versa insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Nissan Versa auto insurance coverage (ordered by market share).

Top 10 Nissan Versa Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20.0 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

The companies listed above are some of the top providers in the industry, offering competitive rates and extensive coverage. By comparing quotes and evaluating your specific needs, you can find the best insurance provider to suit your requirements and ensure optimal protection for your Nissan Versa.

Many of these companies offer discounts for security systems and other safety features that the Nissan Versa offers. You can start comparing quotes for Nissan Versa auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

What factors can affect the cost of auto insurance for a Nissan Versa?

Several factors can influence the cost of auto insurance for a Nissan Versa. These factors include your driving history, age, location, the model and year of your Versa, your insurance deductible, coverage limits, and any optional add-ons you choose, such as comprehensive or collision coverage.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Is Nissan Versa considered an expensive vehicle to insure?

The cost of insuring a Nissan Versa is generally affordable compared to some higher-end or luxury vehicles. However, insurance rates can vary depending on various factors, such as the specific model, your location, and your personal driving profile. It’s recommended to obtain quotes from different insurance providers to determine the best rate for your specific situation.

Are there any specific safety features of the Nissan Versa that could lower insurance costs?

Yes, the safety features of the Nissan Versa can potentially help lower your insurance costs. The Versa typically comes equipped with safety features such as anti-lock brakes, stability control, traction control, airbags, and possibly advanced driver assistance systems. More information is available in our article titled “At-Fault Accident.”

Should I consider purchasing additional coverage for my Nissan Versa?

The decision to purchase additional coverage for your Nissan Versa depends on your individual circumstances and preferences. While liability insurance is typically required by law, you may want to consider optional coverages such as comprehensive and collision coverage to provide extra protection for your vehicle. These coverages can help pay for damages to your Versa caused by accidents, theft, vandalism, or natural disasters.

Can I get discounts on insurance for my Nissan Versa?

Yes, you may be eligible for various auto insurance discounts on your Nissan Versa auto insurance. Insurance companies often offer discounts for factors such as bundling multiple policies, having a good driving record, being a safe driver, completing defensive driving courses, having certain safety features installed in your vehicle, and being a member of certain professional organizations or alumni associations.

Is it possible to transfer my current insurance policy to a new Nissan Versa?

Yes, it is typically possible to transfer your current insurance policy to a new Nissan Versa. However, it’s important to inform your insurance provider about the change in your vehicle to ensure that you have the appropriate coverage for your new Versa. The insurance premiums may also change based on the new vehicle’s specifications and other factors.

Can I choose any insurance provider for my Nissan Versa?

Yes, you have the freedom to choose any insurance provider for your Nissan Versa. It’s recommended to research and compare quotes from multiple insurance companies to find the best coverage options and rates for your specific needs. Consider factors such as the company’s reputation, customer service, coverage options, and discounts available to make an informed decision.

What are some ways to reduce my Nissan Versa insurance premiums?

There are several strategies to reduce your Nissan Versa insurance premiums. These include maintaining a clean driving record, bundling your auto insurance with other policies, increasing your deductibles, taking advantage of discounts for safety features, and completing a defensive driving course. Access comprehensive insights into our guide titled, “Understanding Auto Insurance Premiums.”

How does the usage of my Nissan Versa affect insurance costs?

The way you use your Nissan Versa can impact your insurance premiums. Vehicles used for daily commuting or business purposes may have higher insurance costs compared to those used for occasional driving or leisure. Informing your insurer about your usage patterns can help ensure you have the appropriate coverage and potentially lower your premiums.

How can I find the best insurance coverage for my Nissan Versa as a first-time car owner?

As a first-time car owner, finding the best insurance coverage for your Nissan Versa involves researching different providers, understanding your coverage needs, and comparing multiple quotes. Look for providers that offer good customer service, competitive rates, and discounts for new drivers.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.