Best Hyundai Sonata Auto Insurance in 2026 (Find the Top 10 Companies Here)

Explore the best Hyundai Sonata auto insurance with top providers like Geico, State Farm, and Progressive, offering rates from $43 per month. The average insurance cost for a Hyundai Sonata makes these companies standout options for car insurance for Hyundai Sonata, offering excellent coverage and value.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Updated April 2025

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Hyundai Sonata

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Hyundai Sonata

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews

Company Facts

Full Coverage for Hyundai Sonata

A.M. Best

Complaint Level

Pros & Cons

For the best Hyundai Sonata auto insurance, Geico, State Farm, and Progressive offer rates starting at just $43 per month. If you’re asking why Hyundai Sonatas are so expensive to insure, these top companies provide the most competitive coverage options. Find the best blend of cost and protection with these leading providers.

In addition to highlighting the best Hyundai Sonata auto insurance, the article explores who are the reputable auto insurance companies. It provides insights into top-rated providers like Geico, State Farm, and Progressive, helping you understand their strengths and how they compare for insurance on Hyundai Sonatas.

Our Top 10 Company Picks: Best Hyundai Sonata Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Affordable Rates Geico

#2 17% B Customer Service State Farm

#3 10% A+ Innovative Discount Progressive

#4 10% A+ Comprehensive Coverage Allstate

#5 15% A+ Customer Satisfaction Amica

#6 25% A++ Military Benefits USAA

#7 10% A+ Personalized Service Farmers

#8 12% A Customizable Policies Liberty Mutual

#9 8% A++ IntelliDrive Discounts Travelers

#10 20% A+ Vanishing Deductible Nationwide

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

- Geico offers the best rates for Hyundai Sonata insurance

- Discover top companies for Hyundai Sonata coverage

- Learn why Hyundai Sonatas are costly to insure

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: As mentioned in our Geico auto insurance review, the company offers competitive rates for Hyundai Sonata auto insurance, with an average monthly cost of $150, making it an economical choice for full coverage.

- Robust Online Tools: Geico’s user-friendly online platform allows Hyundai Sonata owners to easily manage policies, file claims, and access customer support, enhancing the overall customer experience.

- Discounts for Safety Features: Geico provides substantial discounts for Hyundai Sonatas equipped with advanced safety features like anti-lock brakes and electronic stability control, helping reduce insurance premiums further.

Cons

- Inconsistent Customer Service: While Geico offers affordable rates, their customer service can be inconsistent, potentially causing frustration for Hyundai Sonata owners needing prompt assistance.

- Higher Rates Post-Accident: Geico’s rates tend to increase significantly after an accident, which may not be ideal for Hyundai Sonata drivers with previous violations or claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Excellent Customer Service: As mentioned in our State Farm auto insurance review, State Farm is renowned for its superior customer service, offering Hyundai Sonata owners reliable support and assistance throughout their insurance experience.

- Wide Range of Discounts: With State Farm, Hyundai Sonata drivers can benefit from a variety of discounts, including those for safe driving, multiple policies, and vehicle safety features, reducing overall insurance costs.

- Flexible Coverage Options: State Farm offers a variety of coverage options tailored to meet the specific needs of Hyundai Sonata owners, providing comprehensive protection.

Cons

- Higher Premiums for Younger Drivers: State Farm tends to charge higher premiums for younger Hyundai Sonata drivers, making it less affordable for those under 25.

- Limited Online Tools: Compared to some competitors, State Farm’s online tools and mobile app features may be less robust, which can be inconvenient for tech-savvy Hyundai Sonata owners.

#3 – Progressive: Best for Innovative Discount

Pros

- Flexible Coverage Options: As mention in Progressive auto insurance review, Progressive offers a variety of customizable coverage options for Hyundai Sonata insurance, allowing drivers to tailor their policies to their specific needs and budget.

- Snapshot Program: Progressive’s Snapshot program rewards safe Hyundai Sonata drivers with discounts based on their driving habits, potentially lowering insurance costs.

- Competitive Rates: With an average monthly rate of $148, Progressive provides affordable insurance options for Hyundai Sonata owners seeking comprehensive coverage.

Cons

- Higher Rates After Claims: Progressive’s rates can increase significantly after filing a claim, which may be a drawback for Hyundai Sonata drivers who have had accidents.

- Moderate Complaint Levels: Progressive has a higher number of customer complaints compared to some competitors, which might be a concern for Hyundai Sonata owners prioritizing customer satisfaction.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Allstate offers extensive coverage options for Hyundai Sonata insurance, ensuring that drivers have access to robust protection against various risks.

- Useful Online Resources: Allstate provides a wealth of online resources and tools, helping Hyundai Sonata owners manage their policies and understand their insurance needs effectively.

- Strong Customer Support: Allstate is known for its responsive and helpful customer support, providing Hyundai Sonata drivers with reliable assistance when needed.

Cons

- Higher Average Rates: At $160 per month, Allstate’s average rates for Hyundai Sonata insurance are higher than many competitors, making it less cost-effective for budget-conscious drivers.

- Potential for Rate Increases: Allstate’s rates can increase following an accident or claim, which may be a concern for Hyundai Sonata owners looking to maintain affordable insurance premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Amica: Best for Customer Satisfaction

Pros

- Exceptional Customer Service: Amica is praised for its outstanding customer service, offering Hyundai Sonata owners personalized and responsive support.

- Dividend Policies: Amica provides dividend policies that return a portion of premiums to Hyundai Sonata policyholders, potentially reducing overall insurance costs.

- Competitive Rates: As mentioned in our Amica auto insurance review, With an average monthly rate of $155, Amica offers competitive pricing for comprehensive Hyundai Sonata insurance coverage.

Cons

- Limited Availability: Amica is not available in all states, which can limit access for some Hyundai Sonata owners looking for its insurance policies.

- Higher Premiums for Young Drivers: Like many insurers, Amica charges higher premiums for younger Hyundai Sonata drivers, which might be a drawback for this demographic.

#6 – USAA: Best for Military Benefits

Pros

- Best Rates for Military Families: USAA offers the lowest average rate of $140 per month for Hyundai Sonata insurance, providing exceptional value for military families.

- Top-notch Customer Service: As outlined in USAA auto insurance review, the company is renowned for its excellent customer service, ensuring Hyundai Sonata owners receive prompt and helpful assistance.

- Wide Range of Discounts: USAA offers numerous discounts, including those for safe driving, multi-policy, and vehicle safety features, significantly reducing insurance costs for Hyundai Sonata drivers.

Cons

- Restricted to Military Families: USAA’s services are only available to military members, veterans, and their families, limiting access for non-military Hyundai Sonata owners.

- Moderate Online Tools: While USAA offers solid customer service for Hyundai Sonata drivers, its online tools and mobile app may not be as comprehensive as those of some competitors, which could be a drawback for tech-savvy users.

#7 – Farmers: Best for Personalized Service

Pros

- Good Customer Support: Farmers is known for its reliable customer support, providing Hyundai Sonata owners with responsive and helpful service when managing their policies.

- Customizable Policies: Farmers offers a variety of customizable insurance options, allowing Hyundai Sonata drivers to tailor their coverage to meet their specific needs and budget.

- Multi-policy Discounts: Farmers provides significant discounts for Hyundai Sonata owners who bundle their auto insurance with other policies, such as home or life insurance. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher-than-Average Premiums: With an average monthly rate of $157, Farmers’ insurance premiums for Hyundai Sonata are higher than some competitors, which might be a concern for cost-conscious drivers.

- Rate Increases Post-Accident: Farmers’ rates tend to increase after an accident or claim, which may be a drawback for Hyundai Sonata owners seeking stable premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Multiple Discounts: Liberty Mutual offers a range of discounts for Hyundai Sonata insurance, including for safety features, multi-policy, and good driving records, helping to lower overall costs.

- Good Mobile App: Liberty Mutual’s mobile app is highly rated, providing Hyundai Sonata owners with convenient access to policy management, claims filing, and customer support.

- Comprehensive Coverage: As mentioned in our Liberty Mutual auto insurance review, the company offers extensive coverage options, ensuring that Hyundai Sonata drivers have robust protection against various risks.

Cons

- Higher Premiums: With an average monthly rate of $165, Liberty Mutual’s premiums for Hyundai Sonata insurance are among the highest, which may not be ideal for budget-conscious drivers.

- Variable Rates: Liberty Mutual’s rates can vary significantly based on location and driving history, which can lead to inconsistent pricing for Hyundai Sonata owners.

#9 – Travelers: Best for IntelliDrive Discounts

Pros

- Strong Financial Stability: Travelers has strong financial ratings, ensuring that Hyundai Sonata policyholders can trust in the company’s ability to pay out claims efficiently and reliably.

- Variety of Coverage Options: Travelers offers a wide range of coverage options, allowing Hyundai Sonata owners to customize their policies to fit their specific needs.

- Good Customer Service: As outlined in our Travelers auto insurance review, Travelers is known for its responsive and reliable customer service, providing Hyundai Sonata drivers with support when they need it.

Cons

- Higher Average Rates: At $162 per month, Travelers’ insurance premiums for Hyundai Sonata are higher than many competitors, making it less affordable for some drivers.

- Moderate Complaint Levels: Travelers has a moderate level of customer complaints compared to other companies, which might be a concern for Hyundai Sonata owners prioritizing customer satisfaction.

#10 – Nationwide: Best for Vanishing Deductible

Pros

- Strong Financial Stability: Nationwide’s strong financial ratings ensure that Hyundai Sonata policyholders can rely on the company’s ability to handle claims efficiently.

- Wide Range of Discounts: Nationwide offers numerous discounts for Hyundai Sonata insurance, including for safe driving, multi-policy, and vehicle safety features, helping to reduce costs.

- Customizable Coverage Options: Nationwide provides a variety of coverage options, allowing Hyundai Sonata owners to tailor their policies to their specific needs and budget. For more information, read our Nationwide auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Nationwide tends to charge higher premiums for high-risk Hyundai Sonata drivers, which might be a drawback for those with previous violations or accidents.

- Limited Availability in Some Areas: Nationwide’s insurance policies may not be available in all regions, which can restrict access for some Hyundai Sonata owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hyundai Sonata Auto Insurance Rates

The table below compares monthly rates for minimum and full coverage car insurance for a Hyundai Sonata from various providers.

Hyundai Sonata Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$87 $228

$65 $215

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $141

$32 $84

Choosing the right insurance provider for your Hyundai Sonata can significantly impact your monthly costs. Review the rates above to find the best balance of coverage and affordability for your needs.

Hyundai Sonata Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $119 |

| Discount Rate | $70 |

| High Deductibles | $102 |

| High Risk Driver | $253 |

| Low Deductibles | $150 |

| Teen Driver | $434 |

Understanding how factors like deductibles and driver risk affect Hyundai Sonata insurance rates can help you make informed decisions. Use this comparison to find the best rate tailored to your specific situation.

Read More: What is a good deductible for auto insurance?

Why Hyundai Sonatas Insurance are Expensive

The chart below details how Hyundai Sonata insurance rates compare to other sedans like the Ford Fusion, Hyundai Elantra, and Subaru Impreza.

Hyundai Sonata Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Focus | $20 | $45 | $33 | $111 |

| Ford Fusion | $28 | $52 | $31 | $124 |

| Hyundai Elantra | $23 | $47 | $31 | $114 |

| Hyundai Sonata | $25 | $44 | $35 | $119 |

| Mazda 3 | $26 | $47 | $31 | $117 |

| Subaru Impreza | $27 | $45 | $33 | $118 |

| Subaru WRX | $27 | $47 | $28 | $113 |

However, there are a few things you can do to find the cheapest Hyundai Sonata insurance rates online, which we go over in the next few sections.

Read More: Cheap Subaru Auto Insurance

Factors that Influence Hyundai Sonata Insurance Cost

The Hyundai Sonata trim and model you choose will affect the total price you will pay for Hyundai Sonata insurance coverage. Newer models or higher trims with advanced features and higher market values typically cost more to insure due to the increased repair or replacement costs.

Models with more powerful engines or additional luxury features might also attract higher insurance premiums.Michelle Robbins LICENSED INSURANCE AGENT

The specific safety features and crash ratings of the particular Hyundai Sonata model can also influence insurance costs, as vehicles with better safety ratings may qualify for lower premiums. Lastly, the overall theft rates and loss history associated with the specific trim and model can further impact the insurance rates, with models more prone to theft generally costing more to insure.

Read More: How to Lower Your Auto Insurance Rates

Age of the Vehicle

The average Hyundai Sonata car insurance rates are higher for newer models. For example, car insurance rates for a 2020 Hyundai Sonata are $119 per month, while 2010 Hyundai Sonata rates are $100 per month, a difference of $19 per month.

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Hyundai Sonata | $27 | $49 | $32 | $126 |

| 2023 Hyundai Sonata | $26 | $48 | $33 | $124 |

| 2022 Hyundai Sonata | $26 | $47 | $34 | $123 |

| 2021 Hyundai Sonata | $25 | $46 | $34 | $122 |

| 2020 Hyundai Sonata | $24 | $44 | $35 | $119 |

| 2019 Hyundai Sonata | $23 | $43 | $37 | $118 |

| 2018 Hyundai Sonata | $22 | $42 | $38 | $117 |

| 2017 Hyundai Sonata | $22 | $41 | $39 | $117 |

| 2016 Hyundai Sonata | $21 | $40 | $40 | $116 |

| 2015 Hyundai Sonata | $20 | $38 | $42 | $115 |

| 2014 Hyundai Sonata | $19 | $35 | $42 | $112 |

| 2013 Hyundai Sonata | $18 | $33 | $43 | $109 |

| 2012 Hyundai Sonata | $18 | $30 | $43 | $106 |

| 2011 Hyundai Sonata | $16 | $28 | $43 | $102 |

| 2010 Hyundai Sonata | $16 | $26 | $44 | $100 |

Insurance rates for the Hyundai Sonata generally increase with the age of the vehicle, reflecting the cost of coverage for newer models. For instance, the monthly insurance cost for a 2020 Hyundai Sonata is $119, compared to $100 for a 2010 model, highlighting a difference of $19 per month.

Driver Age

Driver age can have a significant effect on the cost of Hyundai Sonata car insurance. For example, a 20-year-old driver could pay around $145 more each month for their Hyundai Sonata car insurance than a 30-year-old driver.

Hyundai Sonata Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $808 |

| Age: 18 | $656 |

| Age: 20 | $225 |

| Age: 30 | $191 |

| Age: 40 | $178 |

| Age: 45 | $165 |

| Age: 50 | $157 |

| Age: 60 | $152 |

Driver age significantly influences Hyundai Sonata insurance rates, with younger drivers typically paying more. Review the rates above to see how age impacts your premium and find the best option for your age group.

Driver Location

Where you live can have a large impact on Hyundai Sonata insurance rates. For example, drivers in New York may pay $73 more per month than drivers in Seattle.

Hyundai Sonata Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $157 |

| Columbus, OH | $99 |

| Houston, TX | $186 |

| Indianapolis, IN | $101 |

| Jacksonville, FL | $172 |

| Los Angeles, CA | $203 |

| New York, NY | $188 |

| Philadelphia, PA | $159 |

| Phoenix, AZ | $138 |

| Seattle, WA | $115 |

Insurance rates for a Hyundai Sonata vary significantly by location, with drivers in major cities often paying higher premiums. Use the rates provided to understand how your city affects your insurance costs and find the best coverage for your area.

Your Driving Record

Your driving record can have an impact on the cost of Hyundai Sonata auto insurance. Teens and drivers in their 20’s see the highest jump in their Hyundai Sonata auto insurance rates with violations on their driving record.

Hyundai Sonata Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $434 | $507 | $610 | $745 |

| Age: 18 | $358 | $414 | $498 | $610 |

| Age: 20 | $269 | $293 | $345 | $425 |

| Age: 30 | $124 | $135 | $159 | $195 |

| Age: 40 | $119 | $129 | $151 | $185 |

| Age: 45 | $115 | $124 | $145 | $178 |

| Age: 50 | $108 | $118 | $137 | $168 |

| Age: 60 | $106 | $115 | $133 | $163 |

Your driving record can significantly affect Hyundai Sonata insurance rates, with violations and accidents leading to higher premiums. Review the impact of driving history on insurance costs to ensure you maintain a clean record and manage your rates effectively.

Safety Ratings

Your Hyundai Sonata auto insurance rates are tied to the Hyundai Sonata’s safety ratings. See the breakdown below:

Hyundai Sonata Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Hyundai Sonata’s excellent safety ratings can positively influence your auto insurance rates. Vehicles with top safety scores often qualify for lower premiums, reflecting the reduced risk they pose to insurers.

Crash Test Ratings

If the Hyundai Sonata crash test ratings are good, you could have lower Hyundai Sonata car insurance rates. See Hyundai Sonata crash test results below:

Hyundai Sonata Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Hyundai Sonata HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Hyundai Sonata HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Hyundai Sonata HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Hyundai Sonata HEV 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Hyundai Sonata HEV 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Hyundai Sonata 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2019 Hyundai Sonata Plug-in Hybrid 4 DR FWD | N/R | N/R | N/R | N/R |

| 2019 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Hyundai Sonata Plug-in Hybrid 4 DR FWD | N/R | N/R | N/R | N/R |

| 2018 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Sonata Plug-in Hybrid 4 DR FWD | N/R | N/R | N/R | N/R |

| 2017 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Sonata Plug-in Hybrid 4 DR FWD | N/R | N/R | N/R | N/R |

| 2016 Hyundai Sonata Hybrid 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Hyundai Sonata 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

The Hyundai Sonata’s consistently high crash test ratings across multiple years can lead to lower insurance premiums due to reduced risk. Ensuring your vehicle has top safety scores can be a strategic way to save on insurance costs.

Hyundai Sonata Safety Features

Most drivers don’t realize that not only do Hyundai Sonata safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Hyundai Sonata auto insurance rates. The Hyundai Sonata’s safety features include:

- Comprehensive Air Bag System: Includes driver, passenger, front head, rear head, front side, and rear side air bags.

- Advanced Braking and Stability: Features 4-wheel ABS, 4-wheel disc brakes, brake assist, and electronic stability control.

- Enhanced Visibility and Control: Equipped with daytime running lights, traction control, lane departure warning, and lane-keeping assist.

- Safety and Security: Includes child safety locks for rear seats and robust safety technology to enhance driver and passenger protection.

- Accident Prevention Features: Incorporates lane-keeping assist and electronic stability control to help prevent accidents and improve driving stability.

The Hyundai Sonata’s comprehensive safety features, including advanced airbag systems and electronic stability controls, ensure robust protection for all passengers. These technologies enhance both safety and driving confidence, making the Sonata a reliable choice for those prioritizing security on the road.

Loss Probability

Another contributing factor that plays a direct role in Hyundai Sonata insurance rates is the loss probability for each type of coverage.

Hyundai Sonata Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Bodily Injury | 10% |

| Collision | 29% |

| Comprehensive | 1% |

| Medical Payment | 49% |

| Personal Injury | 38% |

| Property Damage | -12% |

The Hyundai Sonata’s insurance rates are influenced by varying loss probabilities across different coverage types. Understanding these rates can help you make informed decisions about your insurance coverage to better manage potential costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hyundai Sonata Finance and Insurance Cost

If you are financing a Hyundai Sonata, you will pay more if you purchase Hyundai Sonata car insurance at the dealership, so be sure to shop around and compare Hyundai Sonata car insurance quotes from the best companies using our free tool below.

Ways to Save on Hyundai Sonata Insurance

There are several ways you can save even more on your Hyundai Sonata car insurance rates. Take a look at the following five tips:

- Don’t assume your Hyundai Sonata is cheaper to insure than another vehicle.

- Ask about a student away from home discount.

- Take advantage of referral fees.

- Compare insurance companies after moving.

- Renew your Hyundai Sonata insurance coverage to avoid lapses.

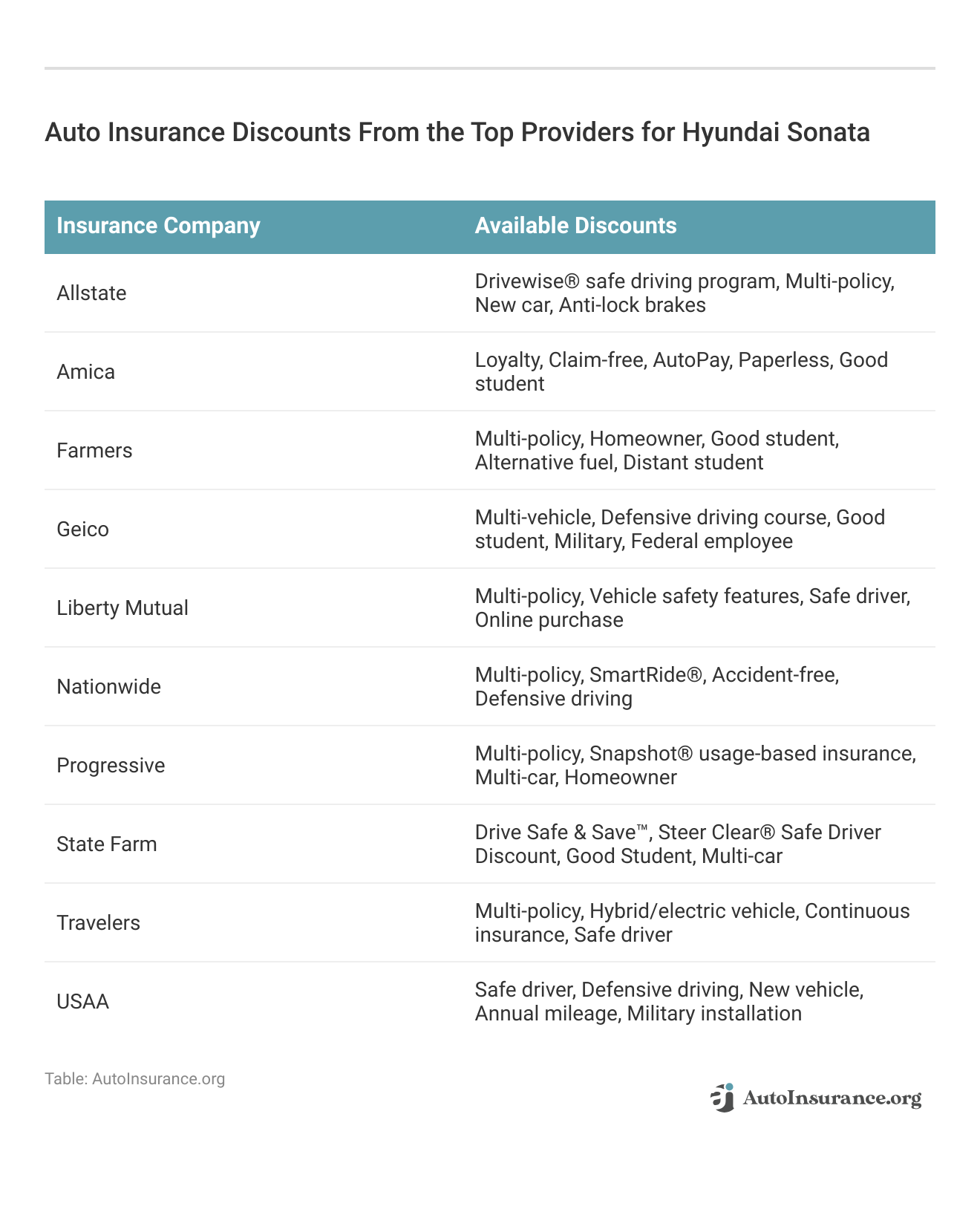

Make sure you also check auto insurance discounts at your company to see if there are any additional ones you can qualify for.

These discounts from top insurance providers for Hyundai Sonata offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Be sure to explore all available auto insurance discounts offered by your insurance company, including the good driver auto insurance discount. Many top insurers provide valuable opportunities for Hyundai Sonata owners to save money through various discounts.

These discounts can include savings for safe driving records, bundling multiple policies, or completing defensive driving courses. By taking advantage of these discounts, you can maintain comprehensive coverage and enhance safety on the road while potentially lowering your insurance premiums.

Top Hyundai Sonata Insurance Companies

Who is the top car insurance company for Hyundai Sonata insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Hyundai Sonata auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Hyundai Sonata offers.

Top 10 Hyundai Sonata Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

When choosing the best insurance company for your Hyundai Sonata, consider providers with significant market share like State Farm and Geico, which offer competitive rates and discounts for the Sonata’s safety features. Comparing options from top insurers can help you find the best coverage for your needs.

Read More: Largest Auto Insurance Companies in the U.S

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Hyundai Sonata Insurance Quotes Online

Start comparing Hyundai Sonata auto insurance quotes for free using our online comparison tool. This easy-to-use platform allows you to quickly gather and evaluate quotes from multiple insurers, ensuring you find the most competitive rates for your Hyundai Sonata.

How to compare auto insurance? Input your vehicle details and coverage preferences to receive tailored quotes that reflect your specific needs. Comparing quotes will help you identify the best coverage options and potential savings for your Hyundai Sonata, so you can make an informed decision about your auto insurance.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

Will modifications or aftermarket additions to my Hyundai Sonata affect my insurance?

Yes, modifications or aftermarket additions to your Hyundai Sonata can potentially affect your insurance. Certain modifications, such as engine upgrades, suspension modifications, or changes to the vehicle’s appearance, may increase the risk associated with your car and lead to higher insurance premiums.

It’s crucial to inform your insurance provider about any modifications made to your Sonata to ensure that you have adequate coverage. For more information, read our article titled “How do insurance companies determine car value?”

What factors can affect the insurance premium for a Hyundai Sonata?

Several factors can influence the insurance premium for a Hyundai Sonata, including the driver’s age, driving history, location, coverage options selected, the model year of the vehicle, safety features installed, and the cost of repairs and replacement parts for the Sonata.

What role does the Hyundai Sonata’s model year play in insurance premiums?

The model year of your Hyundai Sonata significantly impacts insurance premiums. Newer models typically cost more to insure due to higher repair or replacement costs. Conversely, older models might have lower premiums but may lack some modern safety features.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Can I customize my Hyundai Sonata insurance coverage?

Yes, you can customize your Hyundai Sonata insurance coverage based on your needs. Insurance providers offer various coverage options and additional endorsements that allow you to tailor your policy. You can choose the coverage limits, deductibles, and additional features that suit your requirements and budget.

Read More: Can my auto insurance policies overlap?

Are there any specific safety features on the Hyundai Sonata that can lower insurance premiums?

Yes, certain safety features on the Hyundai Sonata can potentially lower insurance premiums. Common safety features that may lead to discounts include anti-lock brakes, airbags, electronic stability control, lane departure warning, adaptive cruise control, and automatic emergency braking. Insurance providers often consider vehicles with these features to be less risky and may offer discounts accordingly.

What unique discounts does Progressive offer for Hyundai Sonata owners?

Progressive offers innovative discounts like the Snapshot program, which rewards safe driving habits. This program can help Hyundai Sonata owners reduce their premiums based on their actual driving behavior, making Progressive a valuable option for those seeking the best auto insurance.

Is car insurance mandatory for a Hyundai Sonata?

Yes, car insurance is mandatory for a Hyundai Sonata, as it is for any other vehicle on the road. In most jurisdictions, drivers are required to have at least liability insurance to cover damages or injuries caused to others in an accident. Additional coverage options, such as collision or comprehensive coverage, may also be available and can provide additional protection for your Sonata.

What makes Geico a top choice for Hyundai Sonata auto insurance?

Geico stands out for its competitive rates starting at $80 per month and its reputation for excellent customer service. Their extensive network of repair shops and user-friendly digital tools make them a strong contender for the best Hyundai Sonata auto insurance.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

How does financing a Hyundai Sonata affect my auto insurance requirements?

When financing a Hyundai Sonata, lenders typically require full coverage insurance, which includes both collision and comprehensive coverage. This protects the lender’s investment by covering repairs or replacement costs in the event of an accident or other incidents. Ensure you meet these requirements to avoid any potential issues with your loan.

Is full coverage necessary for a Hyundai Sonata, and what does it include?

Full coverage for a Hyundai Sonata generally includes liability, collision, and comprehensive insurance. While not legally required in all states, it provides extensive protection against a wide range of risks, such as accidents, theft, and natural disasters. This coverage is often recommended for newer or financed vehicles to ensure adequate financial protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.