Best Auto Insurance After a DUI in Georgia (See the Top 10 Companies for 2026)

The best auto insurance after a DUI in Georgia includes Allstate, Farmers, and Geico, with rates starting at $83 per month. These high-risk insurance companies focus on customer service, discounts, and DUI recovery. Drivers can use Allstate and Farmers DUI resources to improve driving habits and lower rates.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

Company Facts

Full Coverage After a DUI in Georgia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Georgia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage After a DUI in Georgia

A.M. Best

Complaint Level

Pros & Cons

These companies provide high-risk auto insurance and exceptional customer service. They are notable for their personalized DUI plans, which cater to individual circumstances and SR-22 insurance requirements.

Our Top 10 Company Picks: Best Auto Insurance in Georgia After a DUI

Company Rank Multi-Car Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Customer Service Allstate

#2 18% A Personalized Policies Farmers

#3 20% A++ Cost Savings Geico

#4 14% A++ Youth Discounts Auto-Owners

#5 17% A+ Dividend Payments Amica

#6 12% A Local Agents Safeco

#7 16% A Member Discounts AAA

#8 19% A+ Driver Improvement Erie

#9 13% B DUI Support State Farm

#10 18% A+ Flexible Payments Dairyland

This guide will help you compare the best auto insurance in Georgia after a DUI, ensuring you find the right coverage that balances cost, service, and benefits.

Ready to shop around for the best high-risk car insurance company? Enter your ZIP code and see which one offers the coverage you need.

- Allstate offers top auto insurance in Georgia after a DUI starting at $83/month

- Erie has the cheapest DUI insurance rates for $42/month

- Geico DriveEasy can help lower auto insurance rates after a DUI

#1 – Allstate: Top Overall Pick

Pros

- DUI Educational Resources: Provides educational resources specifically for drivers seeking auto insurance in Georgia after a DUI.

- Quick Claim Processing: According to our Allstate auto insurance review, the company excels in fast claim processing for auto insurance in Georgia after a DUI.

- DUI Risk Assessment Tools: Offers tools to help assess and manage DUI-related risks in Georgia.

Cons

- Limited DUI Discounts: Fewer discounts available for DUI drivers in Georgia.

- Lengthy Application Process: The application process for auto insurance in Georgia after a DUI can be lengthy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Personalized DUI Plans

Pros

- Personalized DUI Coverage: Tailors auto insurance policies to individual needs in Georgia after a DUI.

- Strong Community Presence: Active community presence supporting DUI prevention programs in Georgia.

- DUI Rehabilitation Support: Based on our Farmers auto insurance review, the provider offers support for DUI rehabilitation efforts in Georgia.

Cons

- Higher Deductibles: Higher deductibles for auto insurance in Georgia after a DUI.

- Inconsistent Rates: Auto insurance rates can vary significantly for DUI drivers in Georgia.

#3 – Geico: Best for Affordable DUI Rates

Pros

- DUI Educational Discounts: Offers discounts for completing DUI educational programs in Georgia.

- Innovative DUI Tracking: As per our Geico DriveEasy review, the insurer tracks driving to help lower DUI insurance rates.

- Comprehensive Online Resources: Extensive online resources for managing auto insurance in Georgia after a DUI.

Cons

- Customer Service Delays: Longer wait times for customer service for DUI-related queries in Georgia.

- Limited Local Agents: Fewer local agents specializing in DUI cases in Georgia.

#4 – Auto-Owners: Young Driver Discounts

Pros

- DUI Recovery Programs: Supports DUI recovery programs as part of auto insurance in Georgia.

- DUI Legal Assistance: In line with our Auto-Owners auto insurance review, the company offers legal assistance resources for DUI cases in Georgia.

- Young Driver Discounts: Drivers under 25 with DUIs are high-risk, but good student and Teen Driver Monitoring discounts help young drivers save 20%.

Cons

- Higher Initial Costs: Initial costs for auto insurance in Georgia after a DUI can be high.

- Limited Online Interaction: Fewer options for managing DUI policies online in Georgia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Amica: Best for Dividend Payments

Pros

- Comprehensive DUI Education: Provides comprehensive education on DUI consequences and prevention in Georgia.

- DUI Policy Transparency: Transparent policies specifically for auto insurance in Georgia after a DUI. Read our Amica auto insurance review to learn more.

- Policy Dividends: Even high-risk drivers will receive dividend payments for any unused premium payments every year they renew their policy.

Cons

- Eligibility Limitations: Strict eligibility criteria for auto insurance in Georgia after a DUI.

- Higher Renewal Rates: Renewal rates for DUI policies can be high in Georgia.

#6 – Safeco: Best for Local Agents

Pros

- DUI Driver Programs: Offers programs to improve driving skills after a DUI in Georgia.

- DUI Specialized Agents: In our Safeco auto insurance review, you will find they provide access to agents specializing in DUI cases in Georgia.

- Flexible Coverage Options: Provides flexible coverage options tailored to DUI drivers in Georgia.

Cons

- Rate Increases Over Time: Rates may increase over time for auto insurance in Georgia after a DUI.

- Less Competitive Discounts: Fewer competitive discounts for DUI drivers in Georgia.

#7 – AAA: Best for Member Benefits

Pros

- DUI Educational Workshops: Offers workshops for DUI education and prevention in Georgia.

- Exclusive DUI Discounts: With our AAA auto insurance review, it’s clear that exclusive discounts are available for members with a DUI in Georgia.

- Extensive DUI Resources: Comprehensive resources for managing auto insurance in Georgia after a DUI.

Cons

- Higher Membership Fees: Higher membership fees for DUI-related auto insurance benefits in Georgia.

- Limited DUI Policy Flexibility: Less flexibility in DUI policy options for Georgia drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Erie: Best for Driver Improvement

Pros

- DUI Driver Improvement Programs: Offers programs to help improve driving after a DUI in Georgia.

- Customized DUI Coverage: According to our Erie auto insurance review, the company tailors coverage specifically for DUI drivers in Georgia.

- Proactive DUI Monitoring: Monitors driving habits proactively after a DUI in Georgia.

Cons

- Restricted Discounts: Discounts for auto insurance in Georgia after a DUI are more limited.

- Higher Premiums: Higher premiums for repeat DUI offenders in Georgia.

#9 – State Farm: Best for Dedicated DUI Support

Pros

- DUI Support Line: Provides a dedicated support line for auto insurance in Georgia after a DUI.

- Innovative DUI Solutions: Uses innovative solutions to help manage DUI risks in Georgia.

- DUI Policy Discounts: In our State Farm auto insurance review, we highlight specific discounts offered for DUI policies in Georgia.

Cons

- Strict DUI Coverage Limits: Strict limits on DUI coverage in Georgia.

- Premium Increases Post-DUI: Significant increases in premiums after a DUI in Georgia.

#10 – Dairyland: Best for Flexible Payments

Pros

- DUI Financial Assistance: Following our Dairyland auto insurance review, the insurer offers financial assistance programs for DUI drivers in Georgia.

- DUI Coverage Plans: Provides specialized coverage plans for auto insurance in Georgia after a DUI.

- Flexible DUI Payment Options: Flexible payment options tailored to DUI drivers in Georgia.

Cons

- Higher Coverage Costs: Coverage costs can be higher for auto insurance in Georgia after a DUI.

- Mixed Customer Feedback: Mixed reviews on customer service for DUI policyholders in Georgia.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rate Increases in Georgia After a DUI

For drivers in Georgia with a DUI, insurance rates will be high. Costs vary significantly by provider and coverage level, with comprehensive and full coverage policies costing more than basic liability coverage.

DUI Auto Insurance Monthly Rates in Georgia by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $57 | $148 |

| Allstate | $83 | $207 |

| Amica Mutual | $86 | $283 |

| Auto-Owners | $51 | $130 |

| Dairyland | $148 | $410 |

| Erie | $42 | $107 |

| Farmers | $83 | $208 |

| Geico | $96 | $238 |

| Safeco | $47 | $122 |

| State Farm | $47 | $117 |

The monthly rates for minimum coverage range from $42 with Erie to $148 with Dairyland. For full coverage, Erie again offers the lowest rate at $107, while Dairyland is the most expensive at $410.

Allstate is top-rated at 95% for delivering affordable, comprehensive coverage and personalized discounts to Georgia drivers with a DUI.Michelle Robbins Licensed Insurance Agent

Other notable options include Auto-Owners with rates of $51 for minimum and $130 for full coverage, and State Farm with $47 for minimum and $117 for full coverage.

Personal factors, such as age, gender, and marital status, along with the vehicle’s make, model, and age, further influence Georgia insurance rates after a DUI.

This is an important consideration, as living in areas with higher rates of accidents or theft can increase premiums. Understanding the full scope of your coverage, including theft protection, is crucial when selecting a policy, especially in high-risk situations.

Read More: How Auto Insurance Companies Check Driving Records

How to Save Money on DUI Auto Insurance in Georgia

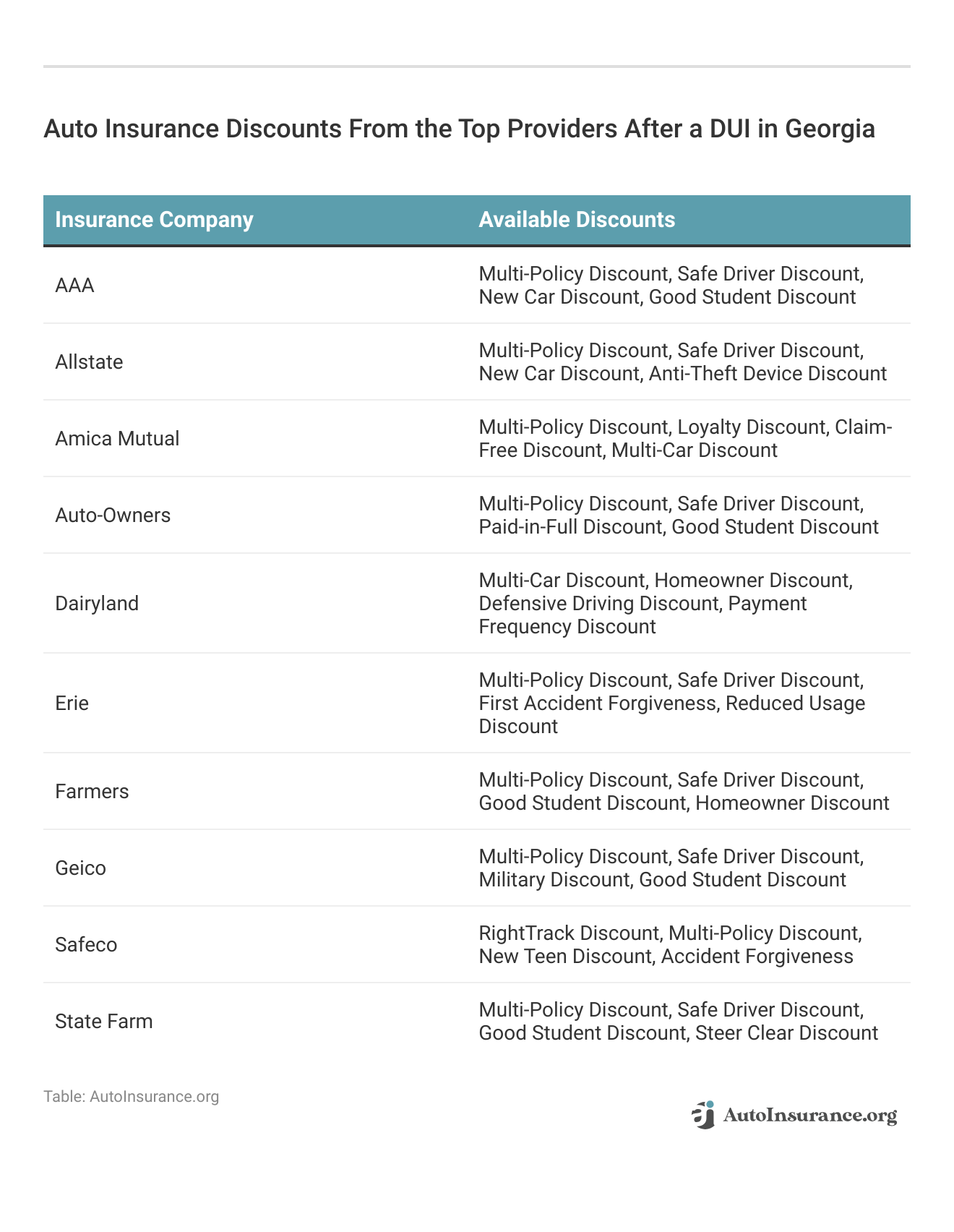

After a DUI, you can still qualify for auto insurance discounts that aren’t based on your driving record. The availability of discounts and the driver’s eligibility for them can offset the higher DUI insurance costs.

Many insurance providers offer various discounts for paying bills on time or online. Additionally, policyholders can benefit from bundling multiple insurance policies, such as auto and home, which often leads to substantial savings.

Rest assured that discounts for safe driving can be achieved even after a DUI through usage-based auto insurance like Geico DriveEasy. Discounts for completing defensive driving courses also help save money on car insurance.

Membership-based benefits, including loyalty rewards and discounts for long-term customers, can also contribute to savings. So can maintaining continuous insurance coverage without lapses.Luke Williams Insurance and Finance Writer

Some companies also provide discounts for installing safety features and anti-theft devices in vehicles, further lowering costs.

Tips to Get Cheaper Auto Insurance Rates after a DUI

Navigating how much DUI auto insurance costs in Georgia can be challenging. After all, it isn’t one of the best states for affordable DUI insurance. But implementing smart strategies can help you save money. Along with discounts, here are some effective tips to reduce high-risk car insurance rates:

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premium, though it means paying more out-of-pocket in the event of a claim.

- Maintain a Clean Driving Record: Avoid further traffic violations or accidents to demonstrate improved driving behavior and potentially reduce rates over time.

- Complete a Defensive Driving Course: Enroll in an approved defensive driving or DUI driver improvement course to show commitment to safer driving, which may result in discounts.

- Install Safety Features: Equip your vehicle with safety and anti-theft devices to lower the risk of claims and potentially reduce premiums.

- Review Coverage Needs: Regularly review and adjust your coverage to ensure you are not paying for unnecessary extras.

Finally, always shop around for free auto insurance quotes before you buy. Comparing quotes from multiple insurance providers will help you find the best rates and coverage options.

Taking proactive steps to improve your driving record and seeking out discounts can significantly reduce your premiums, making it easier to maintain the coverage you need.

Get the Right Georgia Auto Insurance Company After a DUI

Here are some practical tips to help you choose the right auto insurance company after a DUI. Pick a company that can file SR-22 insurance in Georgia if you need it. By following these tips, you can find the right auto insurance policy that meets your needs after a DUI.:

- Consider Customer Service: Research customer service ratings and reviews to find a provider known for responsive and helpful service.

- Look for Specialized DUI Programs: Seek out insurance companies that offer programs tailored to DUI drivers, which may include additional support and resources.

- Compare Policy Options: Examine the details of different policies, including limits, exclusions, and add-ons, to ensure you get comprehensive protection.

- Ask About Discounts: Inquire about potential discounts for which you may be eligible, such as those for safe driving courses or bundling policies.

- Review Complaint Records: Check the complaint records of insurance providers to identify any red flags related to their service or claims process.

Take the time to research and compare options to ensure you get the best coverage and support.

Consult with an insurance agent or broker who can provide expert guidance and help you navigate your options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Auto Insurance in Georgia After a DUI

Each case highlights the importance of evaluating insurance providers based on factors such as coverage options, discounts, and affordability, aiming to find the best fit for each individual’s needs. These are only fictional case studies based on real-world scenarios.

- Case Study #1 – Securing Comprehensive Coverage: John in Atlanta got a DUI and needs affordable insurance for his 2018 Honda Accord. He chose Allstate for its coverage and discounts. By installing anti-theft devices and completing a DUI improvement program, he secured significant discounts.

- Case Study #2 – Personalized DUI Plans: Lisa, a teacher in Savannah, got a DUI last year. She drives a 2020 Toyota Camry and chose Farmers for their specialized DUI plans. Farmers provided personalized coverage for DUI incidents and a discount for participating in their DUI improvement program

- Case Study #3 – Affordable DUI Rates: Mike, a mechanic in Augusta, got a DUI six months ago. He drives a 2015 Ford F-150 and chose Geico for affordable DUI rates and easy online sign-up process. By bundling auto and home insurance, Mike saved money while getting full coverage.

Whether it’s securing comprehensive coverage, finding personalized DUI plans, or obtaining affordable rates, these examples highlight the importance of informed decision-making in managing auto insurance after a DUI.

data-media-max-width=”560″>

Learn the ways auto liability coverage may help if you get in a car accident: https://t.co/CysocGN2X5#dolvininsurance #allstate #jimdolvin #covington #georgia pic.twitter.com/UvPzqdWqyc

— Jim Dolvin (@jimdolvin) September 18, 2020

By understanding your options and leveraging available discounts, you can ensure the best possible outcome for your insurance needs post-DUI.

Bottom Line on DUI Auto Insurance in Georgia

Allstate, Farmers, and Geico have the best auto insurance in Georgia after a DUI. These top providers excel in offering specialized plans and discounts tailored to DUI drivers.

Allstate offers the best tailored coverage and discounts for Georgia drivers with a DUI, ensuring comprehensive and affordable insurance.Brandon Frady Licensed Insurance Producer

When selecting auto insurance in Georgia after a DUI, several critical factors must be considered. First, the availability of specialized plans tailored to DUI drivers is essential, ensuring that coverage meets specific needs. Programs focused on DUI driver improvement can improve your driving record, reducing insurance costs over time.

Affordable DUI car insurance rates are also crucial for budget-conscious individuals. Discounts for safe driving and participation in improvement programs can help lower premiums. Read our Geico DriveEasy review to learn how to save money with driver improvement programs.

Comparing multiple quotes ensures you find the most suitable coverage for your needs. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What is the best auto insurance after a DUI in Georgia?

The best auto insurance companies for high-risk drivers in Georgia with a DUI are Allstate, Farmers, and Geico. Car insurance for a DUI in Georgia depends on various factors such as individual driving history and specific needs.

How much is car insurance after a DUI in Florida?

After a DUI in Florida, car insurance rates can increase significantly, often by 50-80%. The exact amount depends on the insurance provider and your overall driving record. It’s important to compare quotes from different companies to find the best rate.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Does a DUI fall off your record in Georgia?

In Georgia, a DUI does not fall off your record automatically. A DUI conviction stays on your criminal record permanently, although it may be less visible to employers and insurers after 10 years.

How long does a DUI stay on your background check in Georgia?

A DUI remains on your background check in Georgia indefinitely. This can affect various aspects of your life, including employment opportunities and insurance rates, as it indicates a history of high-risk behavior.

How long does a DUI stay on your insurance in Georgia?

A DUI stays on your insurance record in Georgia for about three years. During this period, your auto insurance premiums will likely be higher due to the increased risk profile associated with a DUI conviction.

How many points is a DUI in GA?

In Georgia, a DUI does not result in points being added to your driving record. Instead, it leads to an automatic license suspension and other severe penalties, including fines and potential jail time.

What do you do after a DUI in Georgia?

After a DUI in Georgia, it’s crucial to comply with all legal requirements, such as attending court-mandated programs and paying fines. Additionally, you should shop around for the best auto insurance in Georgia after a DUI to ensure you get the most favorable rates possible.

What happens after your first DUI in Georgia?

After your first DUI in Georgia, you can face various penalties including fines, potential jail time, community service, and a possible suspension of your driver’s license. Additionally, your car insurance premiums will likely increase significantly. Compare quotes from insurance companies for impaired drivers to find affordable coverage.

What is the 3-hour rule for DUI in Georgia?

The 3-hour rule for DUI in Georgia states that a chemical test (breath, blood, or urine) must be conducted within three hours of the time of driving to be considered valid evidence in court.

What is a DUI Less Safe driver in Georgia?

A DUI Less Safe driver in Georgia is a charge applied when a driver is considered impaired to the extent that they are less safe to drive, even if their blood alcohol concentration (BAC) is below the legal limit of 0.08%.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.