9 Best Auto Insurance Companies That Insure Cars With Salvage and Rebuilt Titles (2026)

Progressive, Nationwide, and Kemper are the best auto insurance companies that take salvage titles. You can buy Progressive comprehensive insurance when your car doesn't qualify for full coverage, but Nationwide has the best insurance for salvage titles at $164/mo with usage-based and pay-per-mile discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated June 2025

675 reviews

675 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

675 reviews

675 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

Our Top 9 Picks: Best Auto Insurance Companies That Insure Rebuilt Titles

Company Rank Usage-Based Discount Rebuilt Coverage Best For Jump to Pros/Cons

#1 50% Yes Discounts Available Mercury

#2 40% Yes Usage-Based Nationwide

#3 40% No Infrequent Drivers Allstate

#4 30% Yes Customer Service State Farm

#5 30% Yes Military Members USAA

#6 30% Yes Safe Drivers Root

#7 25% Yes Cheap Rates Geico

#8 20% Yes Qualifying Coverage Progressive

#9 10% Yes High-Risk Drivers Kemper

Progressive has the best insurance for rebuilt titles. It offers liability and comprehensive auto insurance even if you don’t qualify for full coverage. Find the best auto insurance companies that take salvage titles by entering your ZIP code above to compare quotes.

- Salvage cars can only receive a rebuilt title after getting repaired and passing a state inspection

- Insurance companies will not issue a policy for a salvage title vehicle that has not received a rebuilt title

- Progressive and Nationwide offer the best full coverage insurance, while Kemper has the most affordable high-risk car insurance for rebuilt salvage titles

#1 – Progressive: Top Pick Overall

Pros:

- National availability: Coverage in all 50 states

- Full coverage policies: Full coverage available pending a vehicle inspection

- More coverage options: Comprehensive policies for vehicles that don’t qualify for full coverage

- Usage-based savings: Annual savings of $231 with Progressive Snapshot in 49 states (Learn More: Progressive Snapshot Review)

Cons:

- Limited discounts: UBI participation discounts for new customers only

- No pay-as-you-go insurance: Progressive doesn’t offer pay-per-mile auto insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Biggest Usage-Based Discounts on Rebuilt Titles

Pros:

- Pay-as-you-go savings: Lower rates with Nationwide SmartMiles

- Usage-based savings: Learn how to save 40% in our Nationwide SmartRide Review

- Wide UBI availability: SmartMiles and SmartRide available in 44 states

- Few customer complaints: Receives half the number of complaints than other providers

Cons:

- No full coverage: Only offers liability policies unless damage was cosmetic

- Poor claims satisfaction: Scores below average in most regions for claims service

#3 – Kemper: Best for High-Risk Drivers

Pros:

- SR-22 filings: Kemper will file SR-22 insurance for drivers who need it

- Full coverage policies: Full coverage available pending a vehicle inspection

- Policy add-ons: Diminishing deductibles and accident forgiveness

Cons:

- Expensive: Insuring high-risk drivers leads to higher-than-average rates. Compare free quotes in our Kemper car insurance review.

- No UBI savings: Kemper does not offer UBI or pay-per-mile auto insurance

#4 – State Farm: Best for Customer Satisfaction

Pros:

- Usage-based savings: 30% discount with State Farm Drive Safe & Save in 47 states

- Full coverage policies: Full coverage available pending a vehicle inspection

- High customer satisfaction: Top 5 in J.D. Power’s annual customer and claim satisfaction surveys. Read more in our full review of State Farm’s auto insurance.

Cons:

- Not in every state: Not writing new auto policies in RI or MA

- No pay-as-you-go insurance: State Farm doesn’t offer pay-per-mile auto insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros:

- National availability: Coverage in all 50 states

- Full coverage policies: Full coverage available pending a vehicle inspection

- Usage-based savings: 30% discount with USAA SafePilot

- High customer satisfaction: Consistently scores highest in customer and claims satisfaction

Cons:

- Exclusive: Only available to active military, veterans, and their families. Learn if you qualify in our USAA auto insurance review.

- Limited UBI availability: SafePilot only in 37 states

#6 – Geico: Cheapest Auto Insurance Rates for Salvage Titles

Pros:

- National availability: Coverage in all 50 states

- Cheap rates: Lowest average rates for most drivers

- Full coverage policies: Full coverage available pending a vehicle inspection

- Usage-based savings: 25% discount with Geico DriveEasy

Cons:

- No pay-as-you-go insurance: Geico doesn’t offer pay-per-mile auto insurance

- Limited UBI availability: DriveEasy only available in 33 states. Use our Geico DriveEasy review to find it in your state.

#7 – Root: Best for Accident-Free Drivers

Pros:

- Low rates: Drivers without tickets or accidents get the lowest rates

- Full coverage policies: Full coverage available pending a vehicle inspection

- Usage-based savings: Up to 30% discount for good driving habits. See what discounts are available in our Root auto insurance review.

- Policy perks: Roadside assistance included in every policy

Cons:

- Not in every state: Coverage only in 34 states

- No high-risk coverage: Drivers with accidents or claims history won’t qualify

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Infrequent Drivers

Pros:

- Pay-as-you-go savings: Allstate Milewise pay-per-mile policies capped at 250 miles

- High-mileage discounts: Milewise Unlimited gives higher-mileage drivers a chance to save

- Usage-based savings: 40% discount with Allstate Drivewise. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons:

- Limited UBI availability: Milewise and Drivewise only available in 21 states.

- No full coverage: Only offers liability policies on rebuilt salvage titles

#9 – Mercury: Best for Discounts

Pros:

- Full coverage policies: Full coverage available pending a vehicle inspection

- Pay-as-you-go savings: Lower rates with RealDrive pay-per-mile policies

- Usage-based savings: Save up to 50% with MercuryGO UBI

Cons:

- Not in every state: Only available in AZ, CA, FL, GA, IL, NJ, NV, OK, TX, VA

- Poor claims satisfaction: One of the lowest-ranking companies for claims satisfaction. See what customers have to say about policy options and claims satisfaction in our Mercury auto insurance review.

The Difference Between Salvage Titles vs. Rebuilt Titles

You might hear the terms salvage and rebuilt title used interchangeably, but they aren’t the same. You can’t drive a car with a salvage title on a public road nor insure it, but you can legally drive and insure a repaired salvage car with a rebuilt title.

What does salvage mean? A salvage title is given to a vehicle after an insurance company has declared it totaled (i.e., the cost to repair the car compared to its value means it isn’t worth fixing). If you want salvage title insurance, you’ll need to get it repaired and inspected. Once your vehicle passes inspection, you can apply for a rebuilt title through the local DMV.

Insurance companies declare a car totaled when it reaches a specific damage threshold. Every company is different, but most report cars totaled when the cost of repairing damage reaches 75% to 90% of its total value.Zach Fagiano Licensed Insurance Broker

Typically, after the insurance company declares a total loss, you’ll receive a payout equal to the value of your car before the accident, less your deductible. At that point, the vehicle is typically issued a salvage title by the local motor vehicle department.

An easy way to tell which type of title your car has is by the color of the title’s paper:

- Green titles are clean.

- Blue titles are salvaged.

- Orange titles are rebuilt.

A salvage car is street-legal again when it receives a rebuilt title, but there is a permanent record of the previous salvage title which can impact your auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Rebuilt Salvage Title Auto Insurance

Most insurers will not write a policy on a salvage title vehicle until it has undergone repairs and received a rebuilt title. Here are the steps you need to take to get a rebuilt title:

- Repair the vehicle: First, your car will need to be repaired back to a road-worthy condition. Make sure that these repairs are done according to the standards set by your state’s DMV.

- Document the repairs: Collect all receipts for work done, take before-and-after photos of the work, and make a list of all the parts used or changed during the repair process. Most states will ask for this information when inspecting for a rebuilt title.

- Pass the state inspection: Schedule a rebuilt vehicle inspection with your state’s DMV or licensed inspection provider. The official performing the inspection will review the vehicle, your documentation, and verify that the repairs meet the state’s standards before granting an approval.

- Apply for and obtain a rebuilt title: If you pass your inspection, you will typically need to submit an application with the state department in order to get a rebuilt title. Along with this application, you will most likely need to pay an application fee, submit the record of your inspection, and provide any supporting documentation of your repairs.

Once you have a rebuilt title, then you can get insured. Most providers will ask for additional documentation on a vehicle with a rebuilt title. When talking with an insurer, be prepared by having the documentation below:

- Certified mechanic’s statement: This proves your rebuilt vehicle has passed an inspection for safety and roadworthiness

- Photos of your vehicle: This provides a record of the current state of your car so that if you file a claim (after buying full coverage), companies can more accurately determine the value of the claim and differentiate between old and new damage

- Proof your vehicle was rebuilt: You can most easily achieve this by providing the original repair estimate, as it will include a list of the damages and repairs completed to rebuild your vehicle

- Rebuilt title: have your rebuilt title from the state ready for insurers.

When you speak to the insurance company, have this documentation ready to get the most accurate salvage title auto insurance quotes.

How Much Salvage Title Auto Insurance Costs

The first step in getting affordable rebuilt title auto insurance is to shop around. What insurance companies cover rebuilt titles on salvage cars? Start here and compare multiple providers to get the best rates based on your driving history and location.

This table shows the average rebuilt salvage title car insurance rates for liability and full coverage policies:

Best Auto Insurance Providers That Insure Rebuilt Titles: Monthly Auto Insurance Rates

Rank Company Full Coverage Minimum Coverage

1 $150 $56

2 $164 $63

3 $178 $67

4 $123 $47

5 $84 $32

6 $114 $43

7 $61 $23

8 $228 $87

9 $110 $42

Root and Mercury have the lowest salvage auto insurance rates for rebuilt titles but availability is limited. Allstate is also more affordable than its competitors, but it only provides liability coverage on rebuilt salvage titles.

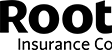

Nationwide has affordable salvage title auto insurance rates, but you could save even more by signing up for SmartMiles pay-as-you-go auto insurance. Nationwide tracks mileage with SmartMiles to calculate a lower rate.

Read More: Nationwide SmartMiles Review

Compare auto insurance quotes online to find the best auto insurance companies that accept salvage titles near you.

The Bottom Line on The Best Auto Insurance Companies That Take Salvage Titles

If you’ve successfully obtained a rebuilt title on your salvage car, you will be able to buy auto insurance coverage. Most companies only offer liability on rebuilt salvage titles, but Progressive, Nationwide, and Kemper have the best insurance for a salvage title with full coverage options.

These companies require an inspection and expect documentation that proves your vehicle has been repaired, but you can still get affordable rates through usage-based and pay-per-mile discount programs. Progressive is the best auto insurance company that takes salvage titles because it is the only provider that will still offer comprehensive insurance when you don’t meet full coverage qualifications.

Use our free quote comparison tool below to see what rates you’ll get from car insurance companies that take salvage titles in your area.

Frequently Asked Questions

What car insurance companies cover salvage titles?

Insurance companies do not write policies for salvage cars unless it has a rebuilt title. Progressive and Nationwide have the best insurance for a salvage title that is repaired and earns a rebuilt title after inspection.

What is the salvage value of a car?

The salvage value of your vehicle is the amount you received from your insurance company after it totaled the car, minus your deductible.

How do I negotiate salvage value?

Bring proof of your vehicle’s value to counter the insurer’s offer. Kelley Blue Book and local dealerships can help you determine the actual value of your salvaged car.

How do I register a car with a salvage title?

You cannot legally register a car with a salvage title in any state. If you want to register your totaled vehicle, get it repaired to pass inspection and get a rebuilt title. You can register and insure a rebuilt title as long as it passes your state’s inspection criteria.

Will having a salvage or rebuilt title affect the resale value of my vehicle?

Yes, having a salvage or rebuilt title will generally impact the resale value of your vehicle.

Can I remove the salvage or rebuilt title designation from my vehicle?

The ability to remove the salvage or rebuilt title designation depends on state laws and regulations.

Do I need to disclose the salvage or rebuilt title when obtaining insurance quotes?

Yes, it’s important to disclose the salvage or rebuilt title status of your vehicle when getting quotes or you could lose coverage and face insurance fraud charges.

Can I switch insurance companies if I have a salvage or rebuilt title vehicle?

Yes, you can switch insurers, but not all companies provide coverage for salvage or rebuilt title vehicles.

Will insuring a rebuilt title vehicle be more expensive than insuring a vehicle with a clean title?

Yes, insurance rates for rebuilt title vehicles are often higher due to the increased risk.

Will USAA insure a salvage title?

No insurance company will cover a salvage vehicle, but USAA will provide full coverage to rebuilt salvage titles that pass inspection.

Are salvage title vehicles eligible for full coverage auto insurance?

Why should you avoid salvage titles?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.