Cheap Auto Insurance for Single Moms in 2026 (Save With These 8 Companies!)

Cheap auto insurance for single moms starts at $50 per month. State Farm, Progressive, and Allstate offer the best value through minimum liability coverage, usage-based discounts, and bundling options, making them top choices for car insurance for low-income single mothers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated September 2025

18,157 reviews

18,157 reviewsCompany Facts

Single Mom Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Single Mom Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 11,640 reviews

11,640 reviewsCompany Facts

Single Mom Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsThe top pick overall for cheap auto insurance for single moms is State Farm. Progressive and Allstate also offer competitive rates for single moms, starting at just $50 per month.

Our Top 8 Company Picks: Cheap Auto Insurance for Single Moms

| Company | Rank | Monthly Rates | Low Mileage | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $50 | 30% | Cheap Rates | State Farm | |

| #2 | $55 | 30% | Budgeting Tools | Progressive | |

| #3 | $60 | 30% | Usage-Based Discount | Allstate | |

| #4 | $65 | 40% | Roadside Assistance | Nationwide | |

| #5 | $70 | 30% | Accident Forgiveness | Erie |

| #6 | $75 | 10% | 24/7 Support | Farmers | |

| #7 | $80 | 30% | Customizable Coverage | Liberty Mutual |

| #8 | $85 | 20% | Loyalty Discounts | American Family |

The cheapest auto insurance companies in the U.S. offer affordable car insurance for single parents, with benefits like roadside assistance or budgeting tools tailored for single moms.

These companies offer low-cost coverage, great service, and discounts for bundling, safe driving, and defensive courses. This guide helps single moms find affordable insurance quotes.

- State Farm is the top pick for cheap auto insurance, with rates starting at $50/mo

- Single moms can save more with bundling, safe driver, and usage-based discounts

- Affordable coverage options help meet the needs of low-income single mothers

To find the best car insurance for low-income single mothers, enter your ZIP code and compare single-mother auto insurance rates with the top auto insurance companies.

Cheapest Auto Insurance Rates for Single Moms

Single moms can secure minimum coverage from just $50 a month and full coverage from $98 a month, with State Farm offering the lowest rates.

Auto Insurance Monthly Rates for Single Mothers by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $115 | |

| $85 | $150 |

| $70 | $135 |

| $75 | $130 | |

| $80 | $145 |

| $65 | $120 | |

| $55 | $105 | |

| $50 | $98 |

Other affordable options include Progressive, Nationwide, and Allstate. Comparing quotes helps single parents find the best balance of coverage and cost.

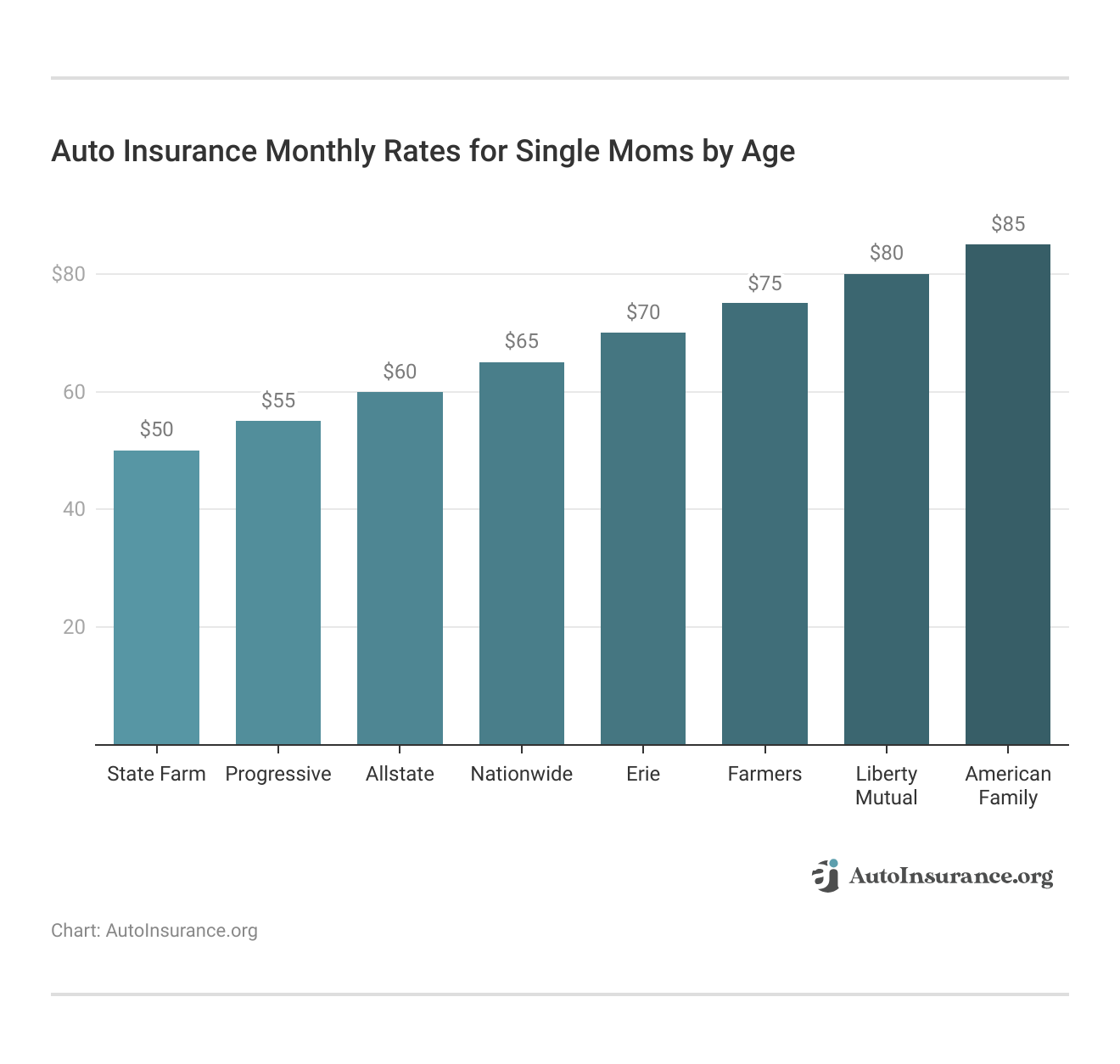

Auto insurance premiums for single moms vary by age and provider, with younger drivers generally paying more. At age 25, the average monthly premium is around $80 across most insurers. By age 30, premiums drop to approximately $65 and continue to decrease slightly through ages 40 and 45.

State Farm offers the lowest rates across all age groups, making it ideal for car insurance for single-mother households. Liberty Mutual and Farmers are pricier, while Progressive, Allstate, and American Family offer midrange rates with modest decreases as age increases. Rates generally improve after age 30.

Single moms don’t pay more by default, but missed updates can raise rates. For example, reporting low mileage can help lower your premiums.Justin Wright Licensed Insurance Agent

Liberty Mutual and Farmers also offer big savings of over $505 when bundling, making them attractive options for those seeking cheap car insurance for single mothers. State Farm and Geico remain budget-friendly as well, with minimal increases for teen coverage, an important factor for single moms managing family expenses.

Cost for Single Moms to Add a Teen to Their Policy

Teen full coverage auto insurance rates vary by provider, and single moms can save by adding a teen to their policy.

Teen Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $318 | $740 | |

| $253 | $591 |

| $387 | $897 | |

| $153 | $362 | |

| $398 | $893 |

| $239 | $552 | |

| $400 | $944 | |

| $178 | $405 | |

| $443 | $1,056 | |

| $125 | $289 |

USAA offers low rates at $170 a month, while American Family gives the biggest discount, $509 down to $180. It helps to know where to compare auto insurance rates to find the best deal.

Even high-cost insurers like Progressive and Travelers offer $240+ in savings when teens are added. For those seeking car insurance for single parents, adding a teen can cut costs by over half, making it a smart financial move.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Auto Insurance Rates for Single Mothers

Single moms may not pay more for car insurance just for their status, but several personal and situational factors can impact their rates. Knowing what affects your premium can help you make smart, cost-saving coverage choices.

- Marital Status: Single moms may get low rates, but married couples often pay less since they file fewer claims, leading insurers to offer them better quotes.

- Driving Record: A clean driving record helps single moms get cheaper insurance, while tickets or accidents can raise rates significantly.

- Vehicle: High-end or sports cars cost more to insure, while older, safer vehicles can lower your premiums. Learn more about insurance for older cars and top coverage by vehicle type.

- Location: Auto insurance rates differ by ZIP code depending on claims frequencies, crime, traffic, and weather. People who reside in a high-risk zone pay more in premiums.

- Credit Score: Auto insurers use credit scores to gauge financial responsibility; higher scores often mean timely payments and safer driving, leading to lower rates.

Single moms can maximize the chances of affordable insurance by knowing the top 7 factors that affect auto insurance rates, such as marital status, driving history, vehicle type, location, and credit score. Single moms can take proactive steps to lower their premiums and make informed decisions that lead to greater financial stability.

Whether it’s choosing a safer car, improving your credit, or maintaining a clean record, every decision counts when finding affordable and reliable car insurance for single moms.

Top Auto Insurance Discounts for Single Moms

Most of the top insurers offer discounts to help single moms lower their auto insurance costs. Common discounts include bundling multiple policies, maintaining a clean driving record, taking a defensive driving course, and qualifying as a safe driver.

Taking advantage of the best auto insurance discounts can significantly lower premiums, with total potential savings varying by provider. Choosing cheap cars for single moms can further reduce rates, as insurers offer lower premiums for safe, affordable vehicles.

Top Auto Insurance Discounts Available to Single Moms

| Company | Low Mileage | Bundling | Defensive Driving | Safe Driver |

|---|---|---|---|---|

| 30% | 25% | 10% | 18% | |

| 20% | 25% | 10% | 18% |

| 30% | 25% | 20% | 15% |

| 10% | 20% | 10% | 20% | |

| 30% | 25% | 10% | 20% |

| 40% | 20% | 10% | 10% | |

| 30% | 10% | 31% | 10% | |

| 30% | 17% | 15% | 8% |

Nationwide offers the highest good driver discount at 40%, while Progressive leads with a 31% defensive driving discount, ideal for single moms focused on safe habits. Allstate, American Family, Erie, and Liberty Mutual provide up to 25% off for bundling policies, helping families save more.

Consider raising your deductible if you have emergency savings, as this can lower your monthly premium without reducing essential coverage.Daniel S. Young Insurance Content Managing Editor

Farmers and Erie offer well-rounded discounts across categories, and even though State Farm’s discounts are smaller, it remains a solid choice with strong service. By stacking multiple discounts, single moms can cut auto insurance costs by 20–40%, making it crucial to compare providers and ask about available savings.

Best Single-Mother Auto Insurance Coverage Types

If you want to save the most money, you could stick with getting the minimum amount of insurance required by your state. Usually, the minimum third-party liability insurance includes bodily injury or property damage.

If you want to increase the level of protection for you and your children, consider the following elective coverages.

- Personal Injury Protection: Personal injury protection (PIP) auto insurance pays for your and your children’s medical expenses and recovery costs after an accident.

- Collision: Collision auto insurance covers damages to your car after a collision.

- Comprehensive: Comprehensive auto insurance covers damages from fires, storms, theft, and other non-collision incidents.

- Rental Car Reimbursement: Rental car reimbursement coverage helps pay for the cost of a rental car if your car gets totaled.

- Roadside Assistance: Roadside assistance coverage provides battery jumps, tow services, gas refilling, and tire replacement for those unfortunate emergencies.

Even though your monthly rates will increase, having these extra safety nets included in your single mom insurance policy could save you from having to pay a large sum out of pocket.

It’s especially important for single mothers who rely on one car to commute to work and care for their children.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Cheap Rates: Single moms can get minimum coverage with State Farm for as low as $50 a month on average. Learn more about their rates in our State Farm auto insurance review.

- Discount Variety for Families: Offers up to 17% in multi-policy discounts, ideal for single moms, and programs for getting cars for single mothers.

- High Customer Satisfaction: Ranked #1 in overall customer satisfaction among large insurers by J.D. Power, offering single moms peace of mind in claims processing.

Cons

- Fewer Digital Budgeting Features: Lacks the robust financial tracking tools Progressive offers, which may be useful for budgeting single-income households.

- Limited Online Claims Features: The mobile app lacks robust features, which can be a drawback for busy users managing auto insurance for single mothers on the go.

#2 – Progressive: Best for Budgeting Tools

Pros

- Mobile App Budget Integration: Progressive’s app, rated 4.7/5 on the App Store, includes cost tracking, policy management, and claims status.

- Snapshot Savings: Single moms can save up to $146 per year with usage-based discounts for safe, low-mileage driving. See our Progressive auto insurance review for more information.

- Online Comparison Feature: This feature offers in-app quotes from competitors for single mothers who want to make smarter purchases without switching internet connections and making phone calls.

Cons

- Higher Base Premiums: Without discounts, single mom car insurance can cost 12–15% more than similar coverage from providers like State Farm, making discounts crucial for affordability.

- Coverage Add-ons Can Be Costly: Optional coverages like roadside assistance or rental reimbursement often cost more than bundled competitors.

#3 – Allstate: Best for Usage-Based Discount

Pros

- Rewards Safe Driving Habits: Allstate’s Drivewise program offers up to 40% savings for safe driving—ideal for single moms who typically drive carefully with kids onboard.

- Custom Alerts for Teen Drivers: Drivewise tracks teen driving, key for single moms, since adding a teen can raise premiums by up to 132%, making safe-driving discounts essential.

- Incentives for Low-Mileage Drivers: Single moms with short commutes can save 20–30% with low-mileage telematics, making car insurance for single mothers more affordable.

Cons

- May Penalize Night Driving: Moms with late-shift jobs may get lower scores due to increased risk during night driving, reducing their eligible discount.

- Mixed Customer Ratings: Allstate has some mixed customer claim ratings. Learn more about their ratings in our Allstate auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Roadside Assistance

Pros

- Affordable Peace of Mind: For just $22 per year, Nationwide’s Basic Plan includes towing, battery jumpstart, and lockout services—valuable for single moms managing emergencies alone.

- 24/7 Nationwide Coverage: Services are available 24/7 across the U.S., which is especially important for single moms who may drive long distances or commute during nonstandard hours.

- Multiple discounts: Nationwide offers discounts like good driver and multi-policy savings. Find the complete list of discounts in our Nationwide auto insurance review.

Cons

- Doesn’t Include All Services in Basic Plan: Services like trip interruption and rental car reimbursement are only available in the Plus Plan, requiring an upgrade.

- Vehicle-Based, Not Driver-Based: Coverage is linked to the insured vehicle, so single moms driving another car in an emergency won’t be covered.

#5 – Erie: Best for Accident Forgiveness

Pros

- First-At-Fault Forgiveness: Erie forgives your first accident after three years, helping busy single moms avoid premium hikes.

- Competitive Premiums: Erie’s rates are up to 25% lower, offering budget-friendly coverage for single moms, which you can learn more about in our Erie auto insurance review.

- Reduced Deductibles Over Time: Erie reduces your deductible by $100 for each consecutive claims-free year (up to $500), a major win for responsible single moms focused on safety.

Cons

- Limited State Availability: Erie is only available in 12 states and D.C., excluding large markets like California and Texas, limiting options for many single moms nationwide.

- No Mobile App Claims Filing: Unlike competitors, Erie doesn’t allow accident claims through a mobile app, a downside for tech-savvy single moms seeking on-the-go service.

#6 – Farmers: Best for 24/7 Support

Pros

- Always-On Support for Emergencies: Farmers provides 24/7 claims and customer service, offering peace of mind to single moms who may face late-night breakdowns or post-work accidents.

- Customized Alert Systems: Their mobile alerts provide claim updates and policy reminders—key features when searching for the cheapest car insurance for a single mom.

- Extensive Agent Network: With 48,000+ agents, Farmers offers accessible support, ideal for single moms needing personalized guidance. Discover our Farmers auto insurance review for more information.

Cons

- Usage-Based Discounts Require Monitoring: The Signal program rewards safe driving but requires phone-based tracking, which some single moms may find intrusive or technically demanding.

- Limited Discount Stacking: Farmers offers many discounts, but limits how many can be combined, a drawback for those seeking affordable single-parent car insurance and trying to maximize savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Tailored Policies for Single Moms: Liberty Mutual offers customizable coverage, roadside help, and car insurance assistance for single moms.

- 24/7 Customer Support Access: Having round-the-clock service helps single moms manage claims or get help during non-working hours when juggling parenting responsibilities.

- Convenient Mobile App: The Liberty Mutual app allows single moms to customize policies, file claims, and access ID cards from their phones. Check our Liberty Mutual auto insurance review for more details.

Cons

- Higher Rates in High-Risk ZIP Codes: Single moms in high-risk areas may pay more, but they can reduce costs with car insurance programs.

- Limited Local Agent Availability: Liberty Mutual emphasizes online tools, which may be a con for single moms who prefer in-person guidance from a local agent.

#8 – American Family: Best for Loyalty Discounts

Pros

- Generous Loyalty Rewards for Single Moms: American Family offers multi-year discount tiers—ideal for single moms seeking long-term budget stability.

- MyAmFam App with Family Tools: The app offers payment reminders, policy management, and claims tracking—great for busy single moms. See our American Family auto insurance review for more.

- Teen Safe Driver Program: American Family’s free telematics-based teen driver tool helps single moms monitor teen behavior and qualify for up to 30% in safe-driving discounts.

Cons

- Higher Premiums Without Loyalty: New single mom customers without multi-policy or loyalty history may face higher-than-average starting rates.

- Limited Roadside and Customization Options: Add-ons like roadside assistance are not as robust or customizable as competitors’, which may limit protection for single moms who depend on one vehicle.

Find Cheap Auto Insurance for Single Moms Today

Cheap auto insurance for single moms is available with top providers like State Farm, Progressive, and Allstate, offering minimum coverage from just $50 a month.

Single mothers can shop around and compare quotes from several insurers and determine which policy will provide them with coverage that is affordable for their budget. Finding cheap auto insurance for single moms shouldn’t be difficult. After reading this article, we hope you feel empowered to explore your options and find a policy that is perfect for single parents.

Just insert your ZIP code into our free quote comparison tool to compare single-mother car insurance rates from various companies in one place.

Frequently Asked Questions

Are there government programs that offer free cars for single moms in Georgia?

Yes, while the federal government doesn’t directly give away free cars, state-level initiatives and nonprofit organizations in Georgia often provide transportation assistance to single moms through car donation or low-cost vehicle programs.

How can I find nonprofit organizations offering car insurance help for single moms?

Look for local community service agencies, women’s shelters, or single-parent support nonprofits. Many offer referrals, transportation grants, or discounted rates through partnerships with insurers.

Get cheap auto insurance coverage for single moms today with our quote comparison tool.

Are there government programs that help with cheap auto insurance for low-income families?

Yes, some states offer government assistance programs for low-income drivers, such as California’s Low Cost Auto Insurance Program (CLCA), which is available to qualifying residents. Check with your state’s Department of Insurance to explore similar assistance options tailored to low-income individuals.

Can life insurance for single moms cover childcare and education expenses?

Yes, the payout from a life insurance policy can be used by beneficiaries for any purpose, including childcare, tuition, and everyday living costs.

Are there free car assistance programs for single mothers in the U.S.?

Yes, several organizations, such as 1-800-Charity Cars, Working Cars for Working Families, and some local churches, offer free or low-cost car assistance for single mothers based on eligibility.

How to get cheap car insurance after a recent accident?

Cheap auto insurance for a bad driving record is achievable by choosing insurers with accident forgiveness, improving your driving habits, raising your deductible, and cutting unnecessary coverages.

Are there good cars for single moms with limited budgets?

Yes, budget-friendly options include the Hyundai Elantra, Kia Soul, and Toyota Corolla. These models are known for affordability, reliability, and low maintenance costs, making them good cars for single moms seeking value.

Who is eligible for auto grants for single moms?

Eligibility often depends on income level, employment status, family size, and residency. Most programs require proof of financial hardship and that the applicant is the primary caregiver for a child.

Can I get full coverage with low-income car insurance?

Most low-income car insurance plans offer minimum liability auto insurance coverage only. However, you may still find affordable full coverage options by comparing quotes and applying discounts like safe driver or bundling policies.

Who qualifies for free car programs for single moms?

Eligibility typically includes being a single mother, demonstrating financial need, having a valid driver’s license, and showing proof of employment or enrollment in school. Each program has its own specific requirements.

Are there government programs that help single mothers get a car?

Does the best insurance for single moms include roadside assistance?

Can I finance cars for single moms near me with bad credit?

Are electric vehicles practical for single moms?

Can car assistance for single moms include help with buying a vehicle?

Is there financial help with a car for single mothers who need repairs?

Are there any state or local programs that help with purchasing cars for single moms in Colorado?

Do car programs for single moms only offer free vehicles?

Which states have the highest single-mom household rate, and how does this impact local insurance offerings?

Are there online resources for single moms to help with getting a car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.