Best Auto Insurance for Drivers with Dementia in 2026 (10 Expert Favorites)

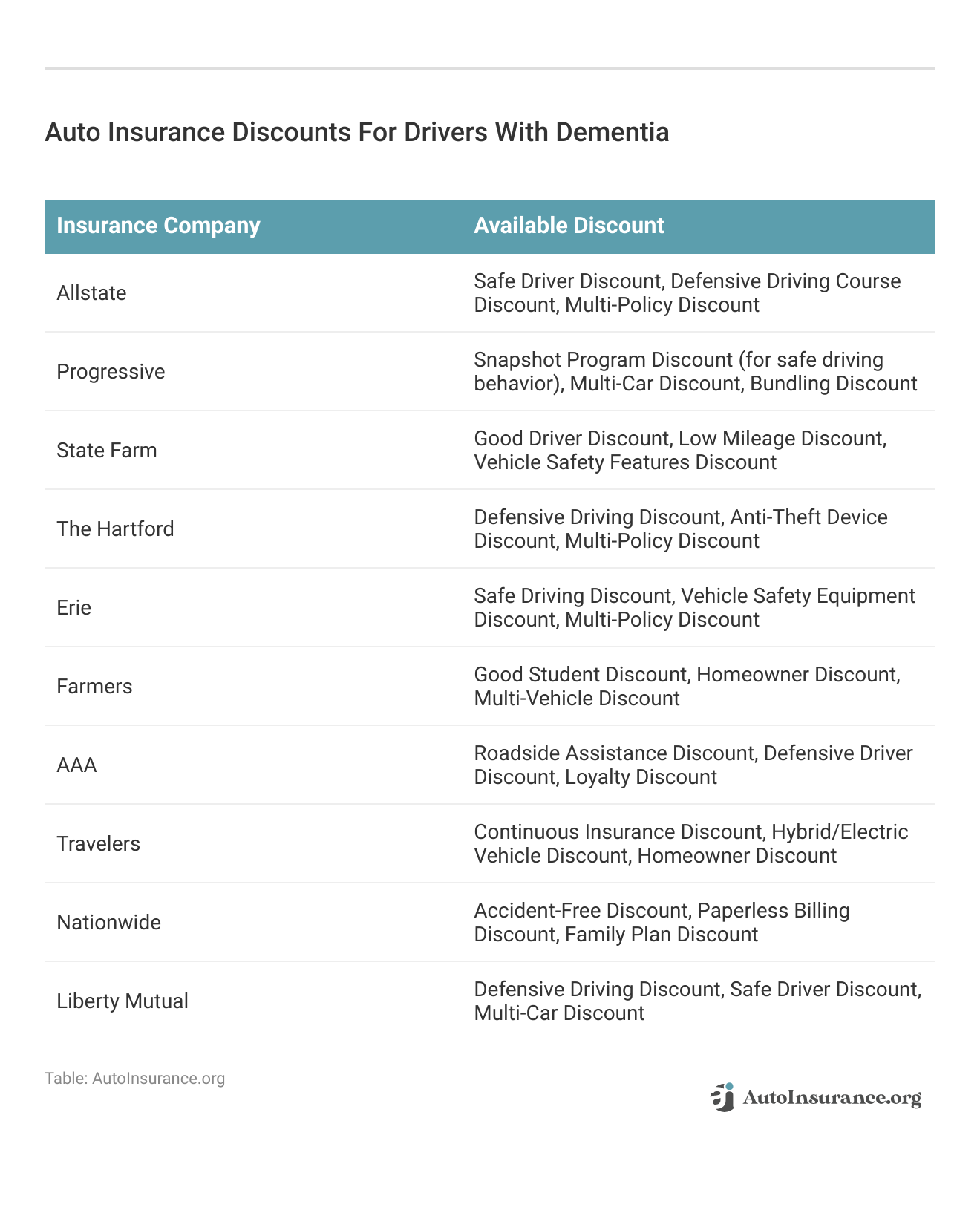

Allstate, Progressive, and State Farm provide the best auto insurance for drivers with dementia priced for as low as $33 only per month. We'll assist you in comparing insurance costs for cars among leading providers, helping you secure the optimal coverage and prime discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated January 2025

11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Drivers With Dementia

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

Company Facts

Full Coverage for Drivers With Dementia

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Drivers With Dementia

A.M. Best

Complaint Level

Pros & Cons

- State Farm presents competitive pricing starting from $33 per month

- Leading insurance companies offer potential savings for those with dementia

- Discounts guarantee the best auto insurance for drivers coping with dementia

#1 – Allstate: Top Overall Pick

Pros

- Discount Opportunities: Allstate offers personalized discount options for individuals.

- Financial Security: Allstate benefits from the backing of a financially secure corporation.

- Outstanding Customer Support: Allstate is celebrated for its quick and readily available assistance.

Cons

- Coverage Restrictions: Some supplementary policy features may not fully cater to individual needs. Refer to our Allstate auto insurance review for assistance.

- Claims Processing: Individuals may face delays or difficulties in the claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Qualifying Coverage

Pros

- Tailored Policies: In our Progressive auto insurance review, personalized coverage options are tailored to suit individual vehicles.

- Competitive Rates: Progressive offers cost-effective pricing.

- Discount Options: Progressive provides various opportunities for price reductions, including those specifically geared towards automobiles.

Cons

- Claims Processing: Individuals may encounter delays or complexities in the claims procedure.

- Restricted Discount Selection: Progressive may not provide as wide a range of discounts as some competitors.

#3 – State Farm: Best for High-Risk Drivers

Pros

- Discount Options: State Farm offers a range of discount opportunities.

- Financial Security: State Farm benefits from the backing of a financially stable corporation.

- Outstanding Customer Care: State Farm is acclaimed for its attentive and user-friendly service.

Cons

- Coverage Limitations: Certain driving requirements may not qualify for policy add-ons. Learn more in our State Farm auto insurance review.

- Claims Handling: Individuals may face delays or complications when handling claims.

#4 – The Hartford: Best for Coverage Options

Pros

- Cutting-Edge Coverage Choices: The Hartford offers innovative coverage options like Accident Forgiveness and Deductible Rewards, enhancing policy value.

- Accessible Technology: Through user-friendly mobile apps and online tools, The Hartford simplifies policy and claims management for customers.

- Solid Financial Security: The Hartford’s strong financial foundation guarantees policyholders a dependable and secure insurance partner.

Cons

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Erie: Best for Filing Claims

Pros

- Affordable Premiums: Our Erie auto insurance review highlights cost-effective rates that suit various budgets.

- Flexible Coverage Choices: Erie offers customizable policies to meet individual needs.

- Discount Opportunities: Erie provides a range of discounts, including ones specifically designed for automobiles.

Cons

- Sparse Local Agent Presence: Erie primarily operates through online and phone channels, with limited physical locations.

- Coverage Restrictions: Certain policy add-ons may not adequately address the requirements of classic car owners.

#6 – Farmers: Best for Safety Discounts

Pros

- Tailored Protection: Farmers, as highlighted in our Farmers auto insurance review, customizes coverage to suit individuals’ needs.

- Budget-Friendly Rates: Farmers offers economical car insurance options.

- Discount Opportunities: Farmers presents a variety of discounts, including those specifically for car insurance.

Cons

- Restricted Accessibility: Farmers primarily operates through local agents, which may be inaccessible in certain regions.

- Coverage Constraints: Certain additional coverage options may not fully satisfy requirements.

#7 – AAA: Best for Roadside Assistance

Pros

- Tailored Plans: AAA offers customized coverage options for automobiles.

- Competitive Rates: AAA provides cost-effective pricing. Begin your affordability journey with our AAA auto insurance review.

- Discount Options: AAA offers various discounts, including those tailored for automobiles.

Cons

- Limited Local Agent Availability: AAA mainly functions through local agents, which may not be universally accessible.

- Coverage Limitations: Some policy enhancements may not fully meet the needs of automobiles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Low-Mileage Drivers

Pros

- Affordable Premiums: Our Travelers auto insurance review highlights competitive rates that are friendly to various budgets.

- Flexible Coverage Choices: Travelers offers customizable policies to suit individual needs.

- Discount Opportunities: Travelers provides various discounts, including those designed specifically for automobiles.

Cons

- Sparse Local Agent Network: Travelers primarily operates online and over the phone, with limited physical agent presence.

- Coverage Restrictions: Some policy add-ons may not completely address the needs of automobiles.

#9 – Nationwide: Best for Accident Forgiveness

Pros

- Extensive Array of Coverage Choices: Nationwide presents a wide selection of coverage options, enabling customers to customize policies according to their requirements.

- Safe Driving Incentive: The Vanishing Deductible program incentivizes safe driving by gradually decreasing deductibles over time.

- Member Savings: Nationwide offers discounts for various affiliations and memberships, improving affordability for specific groups.

Cons

- Mixed Customer Satisfaction: Customer satisfaction ratings differ, as outlined in our Nationwide insurance review, with some customers reporting average experiences.

- Variable Premiums: Premiums may fluctuate depending on location and individual profiles, potentially affecting overall affordability.

#10 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Personalized Plans: Liberty Mutual provides tailored coverage options for car insurance.

- Competitive Rates: Liberty Mutual offers cost-effective pricing.

- Outstanding Customer Care: Liberty Mutual is highly regarded for its responsive and user-friendly service.

Cons

- Membership Restrictions: Liberty Mutual membership is exclusive to military members, veterans, and their families.

- Limited Accessibility: Liberty Mutual’s availability may vary depending on location. For more information, refer to our Liberty Mutual auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating Driving Skills

No Special Dementia Insurance Policies

Raising Coverage on the Policy

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Collision vs. Comprehensive

Frequently Asked Questions

Can a person with dementia still get auto insurance?

Yes, a person with dementia can still obtain auto insurance as long as they meet the requirements set by their local DMV and pass a driving evaluation to determine their competency.

Should a person with dementia consider increasing their insurance coverage?

It is advisable for someone with dementia to consider maximizing their insurance coverage to ensure adequate financial protection in case of any accidents or incidents. Saving money should not be the main priority in this case. To start comparing, kindly enter your ZIP code.

Do people with dementia need to purchase special insurance policies?

How does a person with dementia determine the best level of coverage?

It may be helpful to discuss the situation with an insurance company or a financial planner to determine the appropriate level of coverage based on individual needs and circumstances. Enter your ZIP code for more details.

Should a person with dementia consider raising their coverage limits?

It is recommended to consider purchasing coverage limits higher than the minimum required by the state. Being underinsured could leave the driver financially vulnerable in the event of a serious accident.

What are some recommended insurance providers for drivers with dementia?

What factors should individuals with dementia consider when selecting their auto insurance coverage?

Individuals with dementia should consider factors such as collision and comprehensive coverage options, the minimum auto insurance requirement, and the potential risks associated with underinsurance. Enter your ZIP code now.

What are the potential risks associated with opting for minimum auto insurance coverage, particularly for individuals with dementia?

Opting for minimum auto insurance coverage may leave drivers with dementia drastically underinsured, potentially leading to legal and financial complications in the event of an accident.

How can comparison shopping help drivers with dementia find more affordable insurance rates while ensuring sufficient coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.