Best Auto Insurance for Limousines in 2026 (Your Guide to the Top 10 Companies)

Progressive, State Farm, and Geico offer the best auto insurance for limousines. At Progressive, the average limo insurance cost for minimum coverage is $54/mo. The best limo companies on our list all offer auto insurance discounts, personalized coverages, and other perks for limousine owners.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Limousines

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Limousines

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Limousines

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsLimo drivers will find the best auto insurance for limousines at Progressive, State Farm, and Geico.

All individuals are required to have auto insurance in case they are involved in an accident; however, it is critical to have proper insurance coverage if you drive a limousine. The companies with the best auto insurance for luxury cars like limousines will ensure that your passengers, employees, and limousines are taken care of if there is an accident.

Our Top 10 Company Picks: Best Auto Insurance for Limousines

| Company | Rank | Multi-Car Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 14% | A+ | Tight Budgets | Progressive | |

| #2 | 12% | A++ | Business Owners | State Farm | |

| #3 | 15% | A++ | Affordable Rates | Geico | |

| #4 | 13% | A+ | Drivewise Programs | Allstate | |

| #5 | 15% | A | Various Discounts | Farmers | |

| #6 | 14% | A+ | Widespread Availability | Nationwide |

| #7 | 19% | A | Multi-Policy Discounts | Liberty Mutual |

| #8 | 15% | A | Claims Service | American Family | |

| #9 | 13% | A++ | Coverage Options | Travelers | |

| #10 | 16% | A+ | Exclusive Benefits | The Hartford |

Check out this guide to finding the cheapest auto insurance for limousines and then be sure to enter your ZIP code in our free online quote tool for free quotes!

- Progressive has the best limo auto insurance

- Shopping for limo quotes will help you find the best deal on limo insurance

- Limo insurance will take care of passengers, employees, and limos after accidents

#1 – Progressive: Top Pick Overall

Pros

- Tight Budgets: Drivers with a tight budget for limousine insurance can use Progressive’s Name Your Price tool.

- Network of Repair Shops: Progressive’s repair shop network helps limo owners with hassle-free repairs.

- Loyalty Rewards: Maintaining a limousine car insurance policy at Progressive can earn customers loyalty rewards.

Cons

- Commercial Discounts: Discounts for commercial limo insurance may not be as extensive.

- Rate Increases: Progressive may not be as affordable after claims. Find out more in our Progressive auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Business Owners

Pros

- Business Owners: State Farm has great commercial limo car insurance for business owners.

- Financial Strength: State Farm’s A.M. Best rating is high, which you can learn more about in our State Farm insurance review.

- Agency Network: A local agent can directly assist limo owners with their limo auto insurance policy.

Cons

- Commercial Discounts: State Farm may have more limited options for commercial vehicle discounts.

- Rates for Risky Drivers: Having poor drivers on your limo policy may drive rates up.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico’s limousine insurance quotes are competitive. Read our Geico review for more details on rates.

- Claims Processing: Geico has relatively quick processing of claims.

- Financial Stability: Geico is one of the highest-rated limo insurance companies for financial strength.

Cons

- Commercial Discounts: There may be fewer commercial vehicle discounts than discounts for limo insurance for personal use.

- Upgraded Limo Coverages: Specialized limousines, such as those with modifications, may have fewer insurance options at Geico.

#4 – Allstate: Best for Drivewise Programs

Pros

- Drivewise Programs: If you have a personal limo insurance policy, you could save with the Drivewise discount programs at Allstate.

- Claims Satisfaction Guarantee: Unsatisfied limo owners may receive reward credits towards their next policy period.

- Customizable Coverages: Limo owners can adjust coverage as needed. Learn about Allstate’s coverage in our Allstate review.

Cons

- Claim Reviews: Claims handling has some complaints.

- Higher Rates: Allstate’s average rates are higher than the national average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Various Discounts

Pros

- Various Discounts: You may be able to save on your limousine insurance costs with Farmers’ discount options.

- On Your Side Review: Limo drivers can get help each year with their limousine insurance rates and coverages.

- Coverage Options: Farmers has commercial vehicle insurance that can be tailored to limousines.

Cons

- Higher Rates: Some limo drivers may see higher-than-average rates at Farmers. Learn more about rates in our Farmers review.

- Limited Online Functions: Some changes to limo insurance policies will have to be done through an agent.

#6 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: Nationwide’s commercial insurance is available in most states.

- Payment Plans: Nationwide’s payment plans are flexible. Learn more about the company in our Nationwide review.

- Adjustable Deductibles: You can change your limo insurance cost per month by adjusting your deductibles.

Cons

- Luxury Rates: Nationwide’s rates can be less economical for luxury limos.

- Mixed Reviews: Customer service and claims handling have some negative ratings.

#7 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Limo owners may purchase more than one insurance type for a discount.

- 24/7 Assistance: Liberty Mutual offers assistance round the clock. Learn more in our review of Liberty Mutual.

- Adjustable Deductibles: Adjust your limo deductibles as needed at Liberty Mutual.

Cons

- High-Risk Rates: Liberty Mutual isn’t affordable for most high-risk drivers.

- Customer Service: Some customers have complained about trouble reaching an agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Claims Service

Pros

- Claims Service: Customers rated American Family’s customer service for claims highly.

- Costco Members: You can purchase American Family insurance through Costco and get exclusive deals.

- Coverage Options: Choose from coverages like roadside assistance. Read our American Family review to learn more.

Cons

- Limited Availability: Certain states don’t offer insurance.

- Commercial Discounts: American Family’s commercial discounts may be more limited.

#9 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers has plenty of commercial coverage options for limos.

- Bundling Policies: Purchase more than just auto insurance for a discount.

- Online Tools: File claims online or change your policy. Read more in our review of Travelers.

Cons

- Higher Rates: Travelers’ rates may be more expensive.

- Local Support: There are fewer local agents available at Travelers.

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: AARP members can get exclusive benefits

- Customer Ratings: Most ratings are positive. Read more in The Hartford auto insurance review.

- Risk Management: The Hartford offers resources to customers to help them with risk management.

Cons

- Young Driver Rates: Older drivers will have the most affordable rates.

- Limited Online Tools: Some policy changes can’t be done online at The Hartford.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Auto Insurance for Limousines

What kind of insurance do you need for a limo? Limousine auto insurance falls under commercial auto insurance. Most major insurers offer commercial policies, so they would be able to provide you with commercial auto insurance for limousines.

Here are some of the different types of limo auto insurance coverage:

- Collision Auto Insurance and Comprehensive Auto Insurance: Collision coverage covers the cost if there is an accident. Comprehensive coverage will cover damage that occurs as a result of theft, fire, vandalism, and several other types of damages.

- Underinsured Motorist (UIM)/Uninsured Motorist (UM) Coverage: This provides coverage if you are involved in an accident in which the other driver was at fault, and they did not have adequate coverage to pay the cost. There are many states that require this type of coverage of limousines.

- Personal Injury Protection (PIP) Insurance: This type of insurance covers the cost if there is an accident and injuries occur. This will cover part of funeral expenses, medical costs, rehabilitation bills, and lost wages at work. If a pedestrian is injured, this type of coverage will pay their expenses, and it does not matter whose fault the accident was.

- Employment Practices Liability: If a limousine company is accused of things such as sexual harassment, wrongful termination, or discrimination, this type of insurance will protect the business.

- Bodily Injury Liability (BIL) Auto Insurance and Property Damage Liability (PDL) Auto Insurance: These types of insurance are usually not required; however, it is a good idea for limousine drivers to purchase it. They will cover victims if property damage or injuries occur if the limousine driver is at fault. This will cover legal fees if the limousine company is sued.

If you need commercial insurance on your limo, it is recommended to carry high amounts of coverage to protect yourself against financial losses.

Finding Limousine Coverage

There are companies that specialize in limousine insurance; therefore, they will be well-qualified to provide excellent coverage for your limousine.

You should enter your ZIP code into the free quote tool on this page to compare free limo insurance quotes and then also do research at places like the National Limo Association to see which limousine insurance company will offer you the best auto insurance for limousines.

The top auto insurance companies that provide the best commercial car insurance policies include Progressive, State Farm, and Geico, which writes great limousine and commercial auto insurance policies in the U.S.Tracey L. Wells Licensed Insurance Agent & Agency Owner

There are many agencies like Progressive that will provide free quotes, so you will know exactly what you are paying for insurance.

However, you want to research a company before you ask for their services, as you want to make sure that the company has a good reputation with no complaints.

Read more: Where can I find unbiased reviews of auto insurance companies?

How to Save Money on Limousine Insurance

Is limo insurance expensive? Yes, limo insurance cost is expensive compared to standard auto insurance. It can typically range from $416-$833 a month for each limousine.

How much does automobile insurance cost? Standard personal auto insurance averages $52 a month for minimum coverage and $167 a month for full coverage.

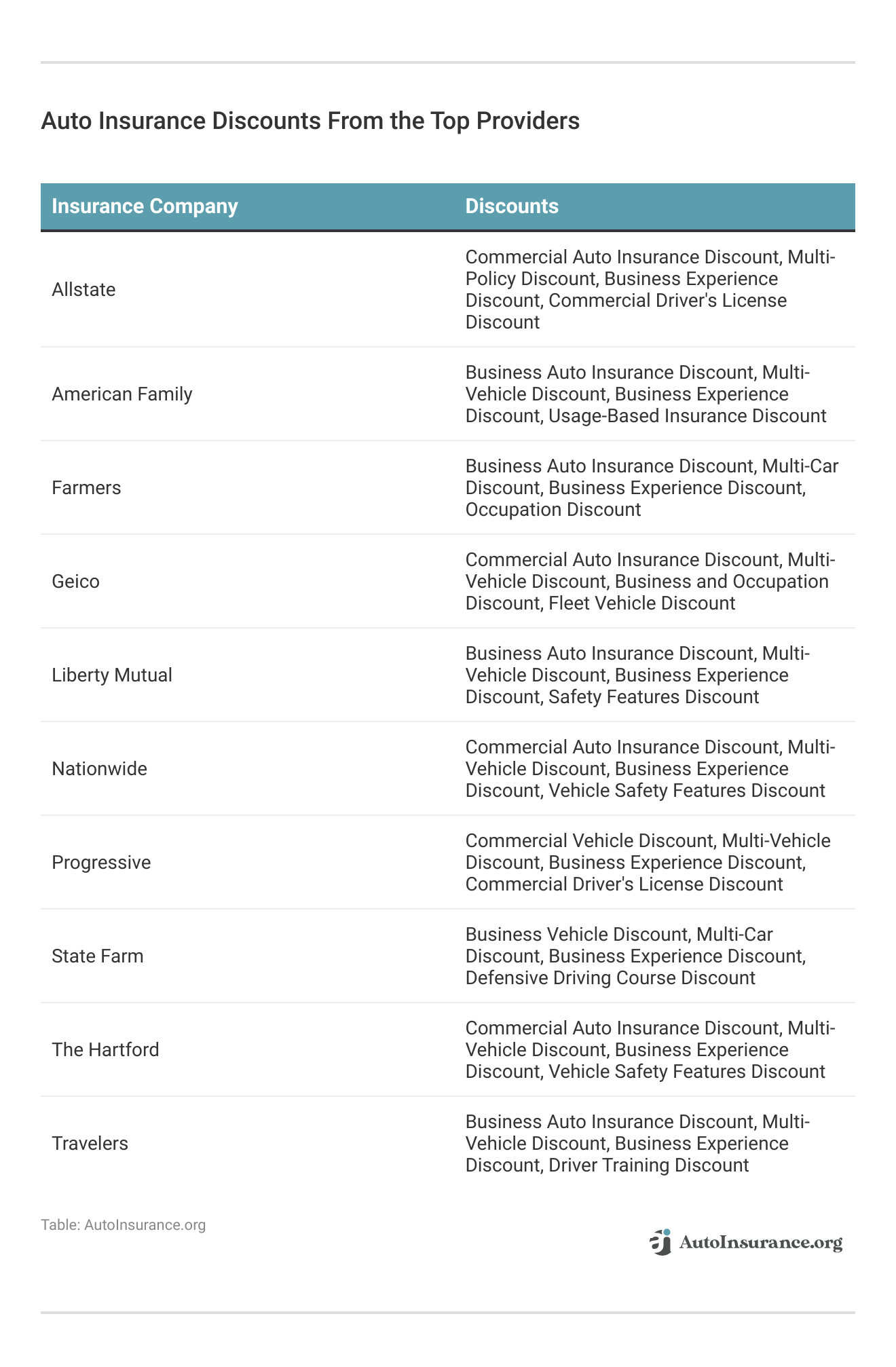

However, some companies offer discounts on services, so you need to ask about available auto insurance discounts for your limousine company. You might receive a discount for having airbags, anti-lock brakes, and other safety features.

There are several other ways that you can also find the cheapest auto insurance for limousines:

- Check your credit score. Your credit can affect your insurance premiums, so you need to order a copy of your credit report to clear up any inaccuracies. Learn more in our article, How Credit Scores Affect Auto Insurance Rates.

- Hire qualified employees. If you hire drivers who have been through adequate training and have a good driving record, you can get cheaper limousine insurance.

You need to keep in mind that some insurance companies will not insure older vehicles or vehicles that are not certified. Be sure to shop around and compare car insurance quotes from many different companies before buying a limo insurance policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Know Your Needs on Auto Insurance for Limousines

Before you can begin to search online and compare limo insurance quotes, you should know exactly what your business needs and what type of coverage you should obtain.

It might be helpful to write down all aspects of your company and analyze the type of insurance coverage that you need.

If you are the sole proprietor of the limousine, then your coverage needs could be different than the ones with many limousines.

Sole proprietors are in charge of everything, including maintenance, so you need to have complete coverage in order to not be stuck with huge bills. Comprehensive coverage is also a good idea, as limousines are often the victims of theft or vandalism.

Get an idea of how much full versus minimum coverage costs at the best limo companies in the table below.

Limousine Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $190 |

| American Family | $55 | $147 |

| Farmers | $68 | $180 |

| Geico | $35 | $93 |

| The Hartford | $70 | $143 |

| Liberty Mutual | $83 | $215 |

| Nationwide | $57 | $150 |

| Progressive | $54 | $146 |

| State Farm | $42 | $111 |

| Travelers | $43 | $180 |

If your company includes many drivers, you should make sure you have adequate coverage and meet the limo insurance requirements of your state. Your employees should have proper training, and their records need to be clean.

Learn more: How Auto Insurance Companies Check Driving Records

The age and vehicle model should also be taken into consideration when choosing the proper coverage. If you own a garage, you should also make sure your policy covers the cost if there is a fire. An experienced insurance agent can help you know which the best policy is for you.

Auto Insurance for Limousines: The Bottom Line

Having proper limousine insurance coverage is crucial, as it can save your company from financial disaster. While the best business auto insurance does cost a little more than car insurance; however, it is worth it to prevent many problems in the future. Therefore, research your options to find the best deal for your company.

For free limousine auto insurance quotes online, try our comparison tool.

Frequently Asked Questions

Can I add additional coverage to my limousine insurance policy?

Yes, depending on your needs, you can often add additional coverage options to your limousine insurance policy. Examples include comprehensive coverage for theft or vandalism, roadside assistance, and rental reimbursement. Discuss your requirements with the insurance provider to explore available options (read more: How much car insurance do I need?).

Why is having proper limousine insurance coverage important?

Having proper limousine insurance coverage is crucial to protect your company from financial disaster. Adequate insurance coverage ensures that your passengers, employees, and vehicles are protected in case of accidents or incidents. It provides peace of mind and safeguards your business from potential liabilities and costly legal claims.

How can I save money on limousine insurance?

To find cheaper limousine insurance, you can consider the following steps:

- Check your credit score and clear up any inaccuracies that may affect your premiums.

- Hire qualified employees with good driving records and proper training.

- Inquire about available discounts for your limousine company, such as discounts for safety features like airbags and anti-lock brakes.

- Shop around and compare quotes from multiple insurance companies before purchasing a policy.

Are there any age restrictions for limousine drivers?

Age restrictions for limousine drivers may vary by state and insurance company. Some insurers may have minimum age requirements for drivers due to the increased responsibility of driving a larger vehicle. It’s important to check with your insurance provider for any specific age restrictions.

Can I add additional drivers to my limousine insurance policy?

Yes, you can usually add additional drivers to your limousine insurance policy. However, insurance companies may have certain criteria and requirements for additional drivers, such as minimum age, driving record, and licensing. Discuss with your insurance provider to ensure compliance with their guidelines.

How much is limo insurance in New Jersey?

The average rate for auto insurance for limousines in New Jersey is $450 a month (learn more: New Jersey Auto Insurance).

Is there a difference in insurance rates based on the type of limousine?

Yes, insurance rates can vary based on the type of limousine you own. Factors such as the vehicle’s value, passenger capacity, weight, and safety features can influence insurance premiums. It’s important to provide accurate information about your specific limousine when obtaining insurance quotes.

How much is limo insurance?

The cost of limo insurance depends on what coverages you carry, your driving record, your choice of company, and more. Use our free tool to find cheap limousine insurance.

What kind of insurance do you need for a limo?

If you use your limo for business rather than personal use, then you will need commercial auto insurance that meets the limo insurance requirements in your state (learn more: Minimum Auto Insurance Requirements by State).

What is the best limo insurance company?

Progressive has the best limo insurance for most drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.