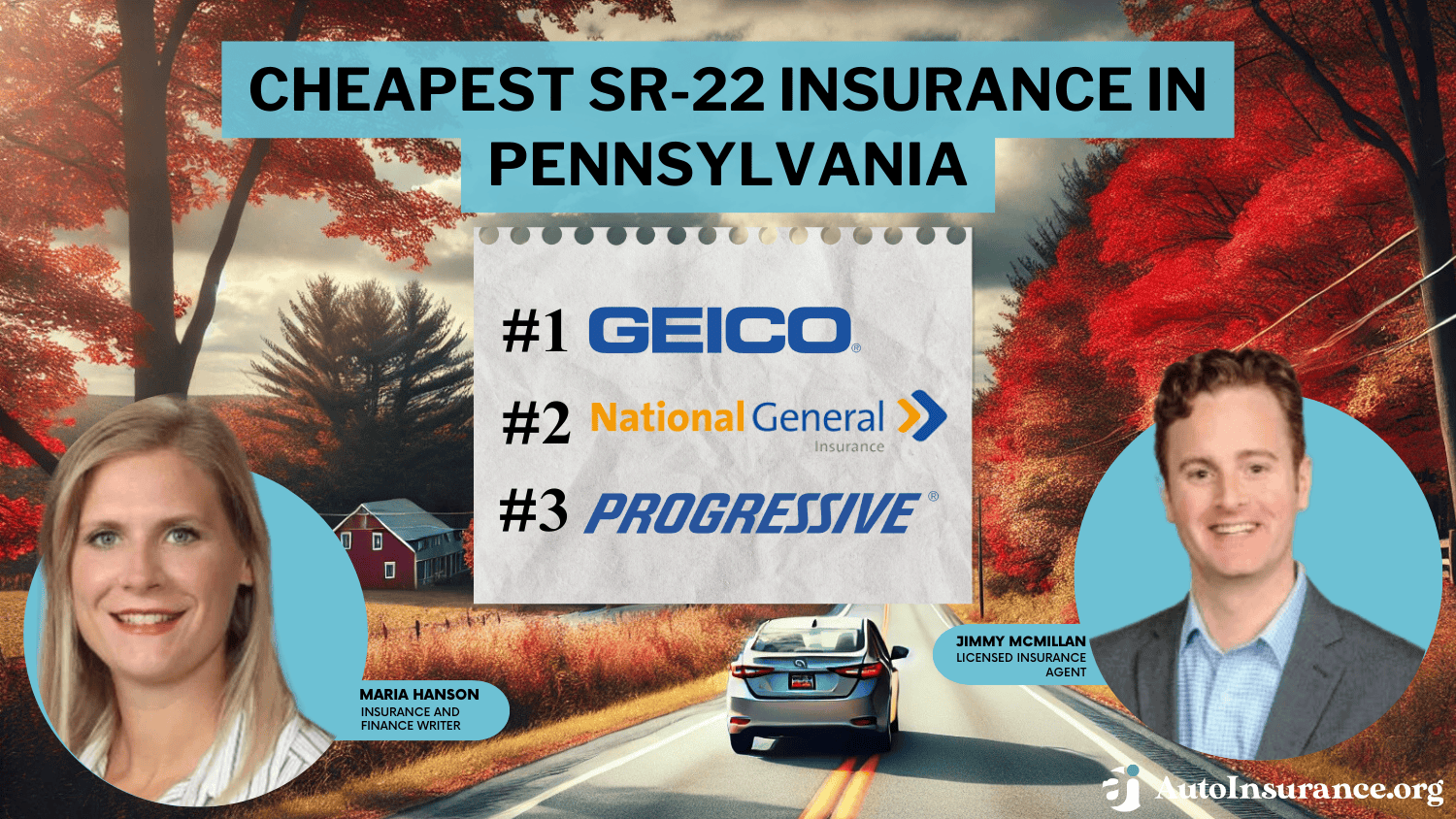

Cheapest SR-22 Insurance in Pennsylvania for 2026 (Save With These 10 Companies)

The cheapest SR-22 insurance in Pennsylvania comes from Geico, National General, and Progressive, offering cheap starting rates of $58 per month. These Pennsylvania auto insurance companies specialize in high-risk coverage and stand out with competitive rates and "A+" A.M. Best ratings.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated February 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for SR-22 in Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 437 reviews

437 reviewsCompany Facts

Min. Coverage for SR-22 in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

437 reviews

437 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for SR-22 in Pennsylvania

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsGeico, National General, and Progressive offer the cheapest SR-22 insurance in Pennsylvania, starting at just $58 per month.

If you’re a driver in Pennsylvania who needs cheap SR-22 insurance, use this guide to compare reputable auto insurance companies known for offering competitive rates and specialized Pennsylvania SR-22 coverage.

Learn how to compare auto insurance quotes, explore available discounts, and discover the best strategies to secure affordable Pennsylvania SR-22 insurance.

Our Top 10 Company Picks: Cheapest SR-22 Insurance in Pennsylvania

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $58 | A++ | Competitive Rates | Geico | |

| #2 | $61 | A+ | Specialized Coverage | National General | |

| #3 | $63 | A+ | Flexible Options | Progressive | |

| #4 | $64 | B | Extensive Discounts | State Farm | |

| #5 | $66 | A+ | New Cars | Allstate | |

| #6 | $68 | A | Member Benefits | AAA |

| #7 | $70 | A+ | Low-Mileage | Nationwide |

| #8 | $72 | A+ | High-Risk Focus | Dairyland | |

| #9 | $73 | A | Senior Drivers | The General | |

| #10 | $75 | A | Customizable Policies | Liberty Mutual |

Explore local auto insurance options by entering your ZIP code into our free comparison tool today.

- The average cost of SR-22 insurance in Pennsylvania is $58/month

- Geico, National General, and Progressive have the best PA SR-22 rates

- Maximize savings with multi-policy and safe driver discounts

#1 – Geico: Top Pick Overall

Pros

- Lowest Rate Guarantee: As mentioned in the Geico auto insurance review, it has tailored Pennsylvania SR-22 coverage options for various needs.

- Military Advantage: Geico offers special SR-22 rates and discounts for Pennsylvania service members.

- Safety Focused: The company has an SR-22 premium reduction for defensive driving completion in Washington.

Cons

- Limited Locations: Geico has fewer places you can visit in Pennsylvania if you need help with SR-22 insurance.

- Tough Criteria: Geico has a complicated process for getting military discounts on SR-22 insurance in Pennsylvania.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – National General: Cheapest Specialized Coverage

Pros

- High-Risk Focus: National General’s SR-22 coverage in Pennsylvania is designed for drivers who have a bit of a risky driving history.

- Mileage Benefits: Pennsylvania drivers can enjoy SR-22 discounts for low-mileage driving (Read More: National General Auto Insurance Review).

- Homeowner Rewards: Pennsylvania SR-22 premiums may be reduced for property owners.

Cons

- Coverage Gaps: In certain areas of Pennsylvania, there are limited options for SR-22 policies, making it challenging to find affordable coverage.

- Fewer Discount: In Washington, National General provides fewer SR-22 discount programs than other states.

#3 – Progressive: Cheapest Flexible Options

Pros

- Payment Variety: Progressive provides multiple SR-22 premium payment plans for Pennsylvania drivers.

- Online Savings: Drivers can earn discounts for buying Progressive SR-22 insurance policies online.

- Continuous Coverage: The company has one of the best customer loyalty auto insurance discounts for long-term Pennsylvania SR-22 insurance holders.

Cons

- Rate Increases: SR-22 insurance full coverage in Pennsylvania can cost up to $135 monthly.

- Complex Terms: The company has an intricate qualification rule for SR-22 flexible payment options for Pennsylvania policyholders.

#4 – State Farm: Cheapest With Discounts

Pros

- Multiple Savings: Our State Farm auto insurance discounts page highlights six different SR-22 discount programs for Pennsylvania drivers.

- Safe Driver Focus: Pennsylvania SR-22 rates may drop for drivers with accident-free records.

- Vehicle Safety: Pennsylvania SR-22 premiums may be lower for cars equipped with security features.

Cons

- Direct Agent Requirement: In Pennsylvania, people must speak directly with an insurance agent to file an SR-22. This process may be inconvenient for some policyholders.

- Limited Online Features: State Farm’s SR-22 policies have few online services. Pennsylvania drivers find it hard to handle their insurance online.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Cheapest for New Vehicles

Pros

- Early Registration: Pennsylvania drivers with an SR-22 can lower their insurance rates by registering ahead of time.

- New Vehicle Benefits: Pennsylvania drivers with newer cars may be eligible for special SR-22 rates because newer vehicles have better safety features.

- Multi-Policy Value: Significant savings on Pennsylvania SR-22 premiums are available when bundling with home or other insurance policies (Read More: How to Save Money by Bundling Insurance Policies).

Cons

- Higher Premiums: For high-risk drivers in Pennsylvania, SR-22 minimum coverage premiums start at $66 monthly.

- Technology Requirements: To qualify for SR-22 discounts in Pennsylvania, Allstate requires using its digital features and tools.

#6 – AAA: Cheapest With Membership

Pros

- Membership Perks: Our AAA auto insurance review covers the company’s exclusive Pennsylvania SR-22 discounts for AAA members.

- Loyalty Rewards: AAA’s long-term SR-22 policyholders in Pennsylvania can qualify for premium discounts.

- Safety Incentives: Policyholders in Pennsylvania can avail of SR-22 discounts for anti-theft device installation.

Cons

- Membership Cost: AAA charges extra membership fees for access to Pennsylvania SR-22 insurance coverage.

- Limited Non-Member Options: In AAA, non-members face limited SR-22 coverage options in Pennsylvania.

#7 – Nationwide: Cheapest With Low-Mileage

Pros

- SmartMiles Program: The company’s SmartMiles program offers cheaper than the average pay-per-mile SR-22 premiums for Pennsylvania drivers.

- Accident Forgiveness: Nationwide provides first-incident protection for Pennsylvania SR-22 policyholders.

- Safety Course Benefits: Policyholders who completed a defensive driving course in Pennsylvania can get SR-22 insurance discounts (Read More: How to Get a Defensive Driver Auto Insurance Discount).

Cons

- Mileage Requirements: In Pennsylvania, drivers can earn SmartMiles SR-22 discounts by staying under 11,000 miles annually.

- Regional Variations: Nationwide’s SR-22 services can differ depending on where you are in Pennsylvania.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Dairyland: Best High-Risk Focus

Pros

- Risk Acceptance: Pennsylvania drivers with complicated driving records can obtain special SR 22 insurance with Dairyland.

- Payment Flexibility: The company provides multiple SR-22 premium payment options for Pennsylvania drivers.

- Safety Rewards: Our Dairyland auto insurance review covers Pennsylvania SR-22 discounts for completing defensive driving courses.

Cons

- Coverage Cost: Dairyland in Pennsylvania has a higher SR-22 full coverage rate at $145/month than other insurers in the state.

- Limited Availability: The company’s SR-22 insurance support is limited to specific service areas in Pennsylvania.

#9 – The General: Cheapest for Senior Drivers

Pros

- Senior Benefits: In Pennsylvania, special rates are available on SR-22 auto insurance for seniors.

- Safety Incentives: The General gives discounts on SR-22 insurance for cars in Pennsylvania that come with safety features.

- Billing Options: The company has flexible SR-22 premium structures for Pennsylvania policyholders.

Cons

- Basic Features: The General’s SR-22 coverage in Pennsylvania has a few add-on choices and is limited.

- Service Restrictions: The company offers limited SR-22 support and fewer agents in rural Pennsylvania, making personalized assistance harder to access.

#10 – Liberty Mutual: Cheapest Customizable Policies

Pros

- Policy Flexibility: Pennsylvania SR-22 coverage options are customizable to suit different driving needs and risk profiles.

- Online Discounts: Save on Pennsylvania SR-22 premiums with discounts for enrolling through digital platforms.

- Military Benefits: Our Liberty Mutual auto insurance review compares special SR-22 rates for Pennsylvania service members.

Cons

- Premium Rates: Pennsylvania SR-22 minimum coverage starts at $75 monthly, reflecting higher costs than other states.

- Complex Customization: The process for modifying Pennsylvania SR-22 policies with Liberty Mutual is detailed and may require professional assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting the Best Pennsylvania SR-22 Insurance Rates

Filing SR-22 proves you meet Pennsylvania minimum auto insurance requirements, but to get the best price, it’s important to compare quotes from different providers.

While minimum SR-22 coverage in Pennsylvania meets legal requirements, full coverage includes collision and comprehensive protection.Jeff Root LICENSED INSURANCE AGENT

If you’re wondering who has the cheapest auto insurance in PA? Below is a comparison of monthly premiums from the major SR-22 insurance companies. Geico has the best SR-22 insurance rates in Pennsylvania, starting at $58/month, nearly $20 less than the most expensive company, Liberty Mutual.

Pennsylvania SR-22 Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $68 | $142 |

| $66 | $139 | |

| $72 | $145 | |

| $58 | $129 | |

| $75 | $150 |

| $61 | $134 | |

| $70 | $143 |

| $63 | $135 | |

| $64 | $137 | |

| $73 | $148 |

You can use this chart to determine what company has the cheapest SR-22 in Pennsylvania. Picking the right insurance company can help you save money on premiums while ensuring you meet Pennsylvania’s minimum required car insurance coverage.

Read More: How to Get SR-22 Insurance From Geico

Understanding SR-22 Insurance Risk Factors in Pennsylvania

If you need cheap high-risk auto insurance in Pennsylvania after an SR-22, knowing what types of claims are common can help you avoid significant impacts on your already high premiums.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

SR-22 drivers should be particularly cautious of rear-end collisions and single-vehicle accidents, as these incidents makeup 55% of claims and could lead to even higher premiums or policy cancellations.

5 Most Common Auto Insurance Claims in Pennsylvania

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collisions | 30% | $3,500 |

| Single-Vehicle Accidents | 25% | $4,200 |

| Side-Impact Collisions | 20% | $3,800 |

| Parking Lot Incidents | 15% | $1,500 |

| Weather-Related Damage | 10% | $5,000 |

SR-22 insurance rates vary significantly by location in Pennsylvania. SR-22 drivers in Philadelphia and Pittsburgh should expect higher premiums due to increased accident rates, while those in smaller cities like Erie might find more affordable options.

Pennsylvania Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Allentown | 5,000 | 4,200 |

| Erie | 4,200 | 3,600 |

| Harrisburg | 3,800 | 3,200 |

| Philadelphia | 12,000 | 10,800 |

| Pittsburgh | 8,500 | 7,300 |

These factors explain why even the cheapest companies, like Geico and National General, adjust their rates based on location and driving conditions.

Unlock Savings With SR-22 Insurance Discounts

When looking for affordable SR-22 insurance in Pennsylvania, it’s important to take advantage of available car insurance discounts.

Pennsylvania SR-22 Auto Insurance Discounts and Savings Amounts by Provider

| Discount Name | Savings | Participating Providers |

|---|---|---|

| Safe Driver | 25% | Geico, Nationwide, USAA |

| Multi-Policy | 20% | Allstate, State Farm, Progressive |

| Good Student | 15% | Liberty Mutual, Travelers, Farmers |

| Anti-Theft Device | 10% | Erie, The Hartford, Geico |

| Paperless Billing | 10% | Progressive, Nationwide, USAA |

Many top insurance providers offer discounts unrelated to driving record, such as multi-policy auto insurance discounts and multi-car discounts, to help reduce premiums.

Below, we’ve outlined the best discounts offered by leading insurance companies in Pennsylvania to make it easier for you to save.

Auto Insurance Discounts From the Top Providers for SR-22 in Pennsylvania

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Vehicle Safety, Loyalty, Low Mileage, Anti-Theft Device |

| Multi-Policy, New Car, Anti-Theft Device, Good Student, Safe Driver, Full-Pay, Early Signing | |

| Multi-Policy, Homeowner, Defensive Driving, Paid-in-Full, Vehicle Safety | |

| Multi-Policy, Safe Driver, Good Student, Military, Anti-Theft Device, Defensive Driving | |

| Multi-Policy, Multi-Vehicle, Good Student, New Car, Homeowner, Online Purchase, Paperless Billing, Military |

| Multi-Vehicle, Good Student, Homeowner, Low Mileage, Paid-in-Full | |

| Multi-Policy, Safe Driver, Defensive Driving, Anti-Theft Device, Accident-Free, SmartRide (Usage-Based) |

| Multi-Policy, Multi-Vehicle, Safe Driver, Homeowner, Continuous Insurance, Sign-Up Online, Paperless Billing | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving, Accident-Free, Anti-Theft Device, Vehicle Safety | |

| Safe Driver, Defensive Driving, Vehicle Safety, Paid-in-Full, Homeowner, Senior |

Choosing the right provider and utilizing discounts, you can reduce your SR-22 insurance costs significantly. Compare the options above and find the best savings for your specific situation.

Read More: Which car insurance companies have the biggest multi-car discounts?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest SR-22 Insurance Companies in Pennsylvania

Geico, National General, and Progressive stand out with the cheapest SR-22 insurance in Pennsylvania. Geico SR-22 insurance costs start at $58/month.

Geico offers competitive rates, National General provides specialized coverage for high-risk drivers, and Progressive excels with flexible options for customizable policies.

In Pennsylvania, opt for higher coverage limits to protect yourself from traffic, theft, and winter hazards, as these elements can raise the likelihood of expensive accidents or claims.Michelle Robbins LICENSED INSURANCE AGENT

Understanding how to compare auto insurance will help you find the best option, ensuring that you acquire an economically feasible policy that is tailored to the SR-22 requirements in Pennsylvania.

Pennsylvania Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | B+ | Urban areas experience heavy traffic, increasing accident risks |

| Vehicle Theft Rate | B+ | Below national average, but urban hotspots raise concerns |

| Average Claim Size | B | Claims are moderately sized, averaging $3,800 |

| Weather-Related Risk | B | Risk is moderate due to frequent snow and ice in winter months |

| Uninsured Drivers Rate | B | Slightly above average, with approximately 14% of drivers uninsured |

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

Who has the cheapest SR-22 insurance?

Geico offers the cheapest SR-22 insurance in Pennsylvania, starting at $58 per month, followed by National General at $61/month and Progressive at $63/month. These providers specialize in affordable high-risk auto insurance.

Does PA require SR-22 insurance?

Pennsylvania typically does not require SR-22 insurance filings except for certain offenses. Instead, the state enforces financial responsibility through penalties like fines and license suspensions for uninsured drivers. If you need minimum coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

What is the simplest way to lower your SR-22 auto insurance premium?

Bundling policies, maintaining a clean driving record, and exploring discounts such as safe driving and multi-policy savings can significantly reduce your premium. Shopping around with providers like Geico and Progressive can also yield cost savings.

What is the state minimum car insurance in PA?

Pennsylvania requires minimum coverage of $15,000 per person and $30,000 per accident for bodily injury liability, $5,000 for property damage liability, and $5,000 for medical benefits.

Does USAA have SR-22?

Yes, USAA offers SR-22 insurance for eligible members, including active-duty military, veterans, and their families, with competitive rates and exceptional customer service.

Read More: Best Auto Insurance for Military Families and Veterans

What is the cheapest car insurance in PA?

Minimum liability insurance is generally the cheapest option. However, it provides limited coverage and may not cover all costs in an accident.

What does SR-22 mean for motorcycle insurance?

An SR-22 for motorcycle insurance proves you carry the state-required liability coverage. It’s often needed after severe violations like DUIs or driving without insurance.

Read more: Best Motorcycle Insurance Discounts

Who is cheaper for SR-22 insurance, Geico or Progressive?

Geico tends to offer lower rates for many drivers, but Progressive provides competitive rates for high-risk policies, including SR-22 insurance. Comparing quotes can help determine the cheaper option for your needs. Use our free comparison tool to see what auto insurance quotes look like in your area.

What happens if you drive without insurance in PA?

Driving without insurance in Pennsylvania can result in severe penalties, including a $300 fine, suspension of your vehicle registration and driver’s license for three months, and additional restoration fees. Repeated offenses may lead to harsher consequences.

Does PA have a grace period for car insurance?

Pennsylvania does not offer a state-mandated grace period for car insurance. If your coverage lapses, penalties such as fines, license suspension, and vehicle registration suspension can apply. Some insurers may provide a brief grace period, but this varies by provider.

How long do you have to get insurance after buying a used car in PA?

Do you need comprehensive insurance in PA?

Who pays for car damage in a no-fault state in Pennsylvania?

Do I need full coverage on a financed car in PA?

At what age is SR-22 car insurance cheapest?

Can I get cheap car insurance in PA with no down payment?

How much is car insurance in PA for a 22-year-old?

What happens if you get caught driving a car without interlock in PA?

How long does it take to get DUI paperwork in the mail in PA?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.