Best Pay-As-You-Go Auto Insurance in Maryland (Top 10 Companies Ranked for 2026)

The best pay-as-you-go auto insurance in Maryland starts at $30/month. Allstate, Root, and Geico are the top MD insurance companies for pay-as-you-go plans. Root has the cheapest Maryland insurance rates, but Allstate offers both low-mileage and safe driver usage-based policies to help Maryland drivers save money.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated December 2024

11,640 reviews

11,640 reviewsCompany Facts

Full Coverage in Maryland

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews

Company Facts

Full Coverage in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Maryland

A.M. Best

Complaint Level

Pros & Cons

The best pay-as-you-go auto insurance in Maryland comes from Allstate, Root, and Geico. These providers offer competitive rates starting at $30/month and cheap usage-based insurance (UBI) for safe and low-mileage drivers.

Allstate is the best pay-as-you-go (PAYG) auto insurance company in Maryland because it offers two types of UBI, with special savings for high-mileage drivers who wouldn’t qualify for programs with other companies.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Maryland

Company Rank Safe Driver Discount Bundling Discount Best For Jump to Pros/Cons

#1 22% 25% Infrequent Drivers Allstate

#2 30% 10% Roadside Assistance Root

#3 25% 25% Affordable Rates Geico

#4 10% 20% Bundling Discounts Nationwide

#5 25% 25% Accident Forgiveness Liberty Mutual

#6 30% 15% Mobile App Metromile

#7 30% 10% UBI Discount Progressive

#8 30% 17% Customer Service State Farm

#9 40% 15% Diminishing Deductible Safeco

#10 25% 13% Specialized Coverage Travelers

Safe drivers in Maryland qualify for big discounts with Root, Metromile, and Progressive. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Allstate, Root, and Geico have the best pay-as-you-go auto insurance in Maryland

- Root has the cheapest pay-as-you-go insurance for $30/month

- Maryland drivers might have to meet mileage requirements for PAYG insurance

#1 – Allstate: Top Pick Overall

Pros

- Customizable UBI: Allstate Drivewise tracks safe driving habits for a discount, while Allstate Milewise tracks monthly mileage to set Maryland pay-as-you-go insurance rates.

- Discounts: Numerous discounts on PAYG insurance in Maryland, including early signing and multi-policy discounts.

- Financial Stability: Rated highly for financial strength and capable of paying Maryland pay-as-you-go insurance claims. Find more information in our review of Allstate insurance.

Cons

- Higher Premiums: MD pay-as-you-go premiums may be higher than some competitors, especially for fully customized policies.

- Complex Discount Structure: Some discounts may have complicated eligibility criteria, making it harder to qualify.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

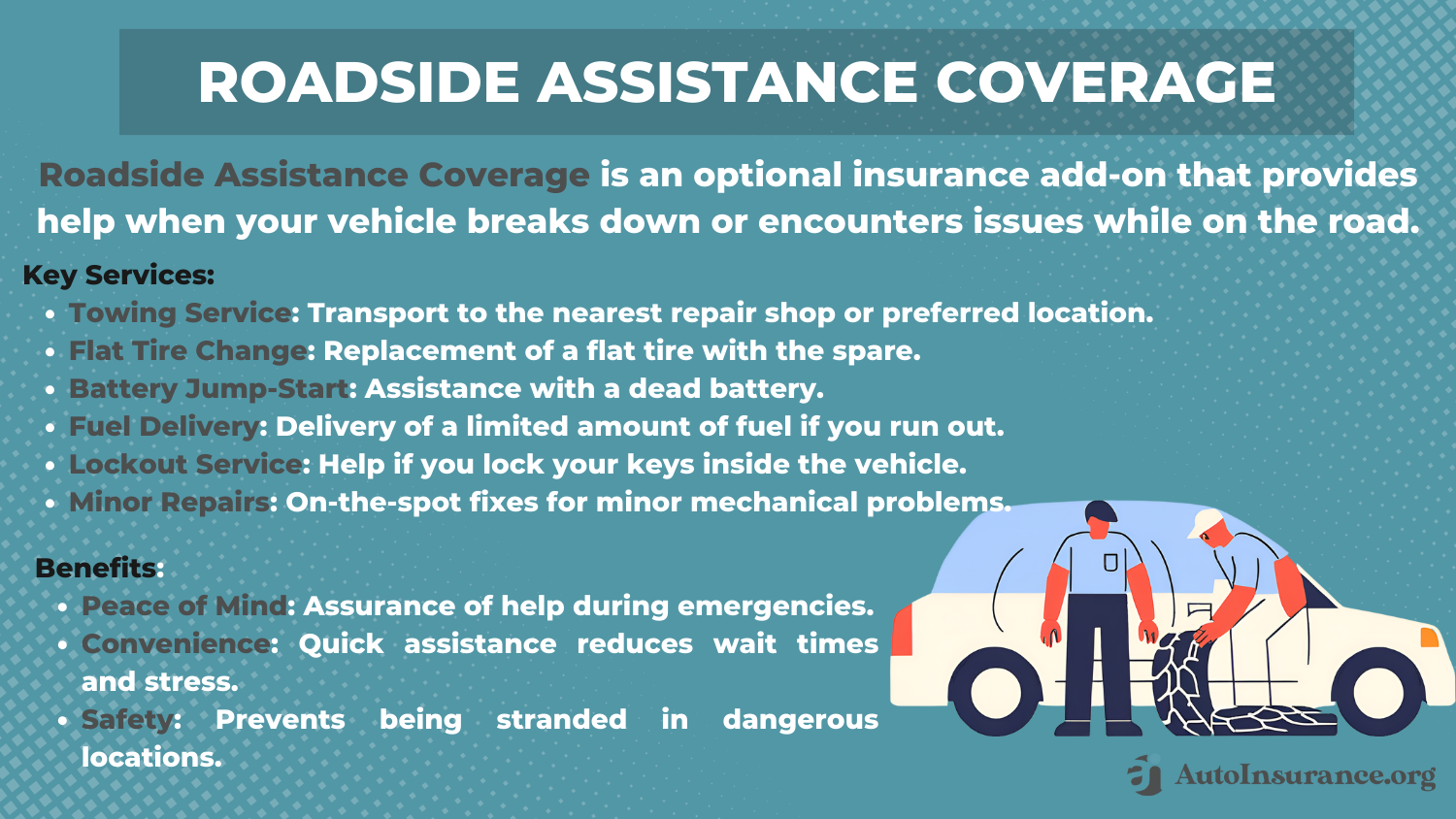

#2 – Root: Best for Roadside Assistance

Pros

- Roadside Assistance: Root offers comprehensive roadside assistance, making it a top choice for the best pay-as-you-go auto insurance in Maryland with minimum coverage starting at $30.

- Affordable Rates: Root is known for its competitive rates in Maryland, with minimum coverage costing $30 and full coverage at $98.

- User-Friendly App: The Root app provides a seamless user experience for Maryland pay-as-you-go drivers. Explore Root’s customer satisfaction ratings in our Root auto insurance review.

Cons

- Limited Availability: Root’s pay-as-you-go insurance is not available in all areas of Maryland.

- Strict Eligibility: Root’s underwriting criteria can be stringent, making it harder for some drivers to qualify.

#3 – Geico: Best For Low Rates

Pros

- Low Rates: Geico offers some of the lowest rates for pay-as-you-go auto insurance in Maryland. Minimum coverage starts at $38/month. Compare rates in our Geico auto insurance company review.

- Wide Range of Discounts: Geico provides numerous discounts for Maryland pay-as-you-go insurance, including multi-policy and safe driver discounts.

- Strong Financial Ratings: Geico’s A++ rating ensures financial stability and reliability when paying Maryland pay-as-you-go insurance claims.

Cons

- Customer Service Variability: Some customers report inconsistent experiences with Geico’s customer service in Maryland.

- Limited UBI Options: Geico’s usage-based insurance options are not as extensive as some competitors in Maryland.

#4 – Nationwide: Best for Multi-Policy Options

Pros

- Diverse UBI Options: Nationwide SmartRide tracks and rewards safe driving habits, while SmartMiles tracks monthly mileage to set Maryland pay-as-you-go insurance rates.

- Discounts: Nationwide has the biggest pay-as-you-go insurance discount in Maryland of up to 40%.

- Financial Stability: High financial strength ratings mean Nationwide is capable of paying MD pay-as-you-go insurance claims.

Cons

- Higher Premiums: Base rates for Maryland pay-as-you-go insurance are higher than other companies. Compare costs in our Nationwide SmartMiles review and Nationwide SmartRide App review.

- Low Customer Satisfaction: Nationwide ranks lowest for customer support when compared to other Maryland pay-as-you-go insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Affordable Rates: Known for offering affordable rates and various discounts on pay-as-you-go auto insurance in Maryland. To see monthly premiums, read our Liberty Mutual review.

- Accident Forgiveness: Accident and claim-free drivers in Maryland won’t see their pay-as-you-go insurance rates increase after their first accident.

- UBI Discounts: Liberty Mutual RightTrack helps drivers save 25% with pay-as-you-go insurance in Maryland. See how much you can save in our RightTrack review.

Cons

- Customer Service Variability: Some reports of inconsistent customer service experiences among pay-as-you-go drivers in Maryland.

- Discount Eligibility: Some MD pay-as-you-go insurance discounts may have stringent eligibility criteria.

#6 – Metromile: Best Mobile App

Pros

- Innovative Mobile App: Metromile’s mobile app is highly rated, offering excellent functionality for Maryland pay-as-you-go insurance customers.

- Affordable Rates: Known for its competitive pricing, Metromile’s minimum coverage starts at $35 in Maryland. Learn more about pay-as-you-go insurance in our Metromile auto insurance review.

- Data-Driven Pricing: Metromile’s use of real-time data to calculate Maryland pay-as-you-go insurance rates ensures fair and accurate pricing.

Cons

- Limited Availability: Metromile’s services are not available throughout all areas of Maryland.

- Customer Support: Some users have reported issues with Metromile’s customer support responsiveness in Maryland.

#7 – Progressive: Best UBI Discounts

Pros

- Substantial UBI Discounts: Progressive offers significant discounts for usage-based insurance in Maryland, with minimum coverage starting at $43.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with lower Maryland pay-as-you-go insurance rates. Our Progressive Snapshot review goes over this in detail.

- Comprehensive Coverage Options: Progressive provides a wide range of coverage options, making it a flexible choice for Maryland pay-as-you-go insurance.

Cons

- Higher Base Rates: Progressive’s initial rates can be higher compared to other Maryland pay-as-you-go insurance providers.

- Complex Discount Structure: Some customers find Progressive’s discount structure confusing and hard to navigate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best Customer Service

Pros

- Excellent Customer Service: State Farm is renowned for its superior customer service in Maryland, providing reliable support for pay-as-you-go insurance customers. Find out more in our State Farm company review.

- Financial Stability: State Farm’s high financial ratings ensure it can handle claims efficiently for Maryland pay-as-you-go insurance.

- Comprehensive Coverage Options: Offering a variety of coverage choices, State Farm is a versatile option for Maryland pay-as-you-go insurance with minimum coverage at $39.

Cons

- Higher Premiums: State Farm’s pay-as-you-go insurance premiums in Maryland can be higher before applying discounts.

- Limited Discount Options: Fewer discounts compared to some other Maryland pay-as-you-go insurance providers.

#9 – Safeco: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Significant discounts for bundling multiple policies with pay-as-you-go auto insurance in Maryland.

- Strong Financial Stability: High ratings for financial strength make Safeco a reliable pay-as-you-go insurance company in Maryland. Compare rates in our Safeco auto insurance review.

- Customer Service: Generally positive customer service experiences from pay-as-you-go drivers in Maryland.

Cons

- Limited Discount Options: Fewer discount options compared to other Maryland pay-as-you-go companies.

- Higher Initial Rates: Initial Maryland pay-as-you-go car insurance rates may be higher before applying discounts.

#10 – Travelers: Best for Specialized Policies

Pros

- Specialized Coverage Options: Travelers offers unique and specialized coverage options, making it a top pick for pay-as-you-go auto insurance in Maryland.

- Strong Financial Ratings: With an A++ rating, Travelers is highly reliable for handling Maryland pay-as-you-go insurance claims.

- Competitive Rates: Travelers offers competitive rates in Maryland, with minimum coverage starting at $41. Read our full review of Travelers insurance for more information.

Cons

- Customer Service Variability: Some Maryland customers report mixed experiences with Travelers’ customer service.

- Complex Policy Options: Travelers’ specialized coverage options can be overwhelming and complex for some Maryland pay-as-you-go insurance customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Maryland Pay-As-You-Go Auto Insurance Rates

For minimum coverage, Root offers the most affordable option at $30/month, while Safeco charges the highest at $45/month.

Maryland Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $38 | $120 |

| Geico | $38 | $115 |

| Liberty Mutual | $39 | $115 |

| Metromile | $35 | $105 |

| Nationwide | $42 | $130 |

| Proogressive | $43 | $120 |

| Root | $30 | $98 |

| Safeco | $45 | $130 |

| State Farm | $39 | $115 |

| Travelers | $41 | $120 |

Root and Metromile are the cheapest for full coverage auto insurance, but not everyone in Maryland will qualify for coverage. Geico, State Farm, and Liberty Mutual are the cheapest Maryland auto insurance companies for most drivers.

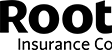

When considering pay-as-you-go auto insurance in Maryland, it’s essential to compare how these programs work and the range of rates for coverage and mileage.

Allstate and many Maryland insurers offer flexible payment plans with their usage-based and pay-as-you-go insurance plans, making it easier to manage the cost of coverage. Regularly updating your coverage can also ensure that you are always adequately protected as your needs change over time.

Maryland Pay-As-You-Go Insurance Coverage Options

When selecting pay-as-you-go auto insurance, you must meet Maryland auto insurance requirements. State law requires liability insurance and uninsured/underinsured motorist protection (UM/UIM):

- Liability Coverage: This is the minimum requirement in Maryland, covering bodily injury liability and property damage to others in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

You can also add these coverages to your Maryland pay-as-you-go auto insurance policies, especially if you’re renting or leasing a vehicle:

- Collision Coverage: Collision coverage pays for damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage covers non-collision-related damages such as theft, vandalism, and natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of who is at fault.

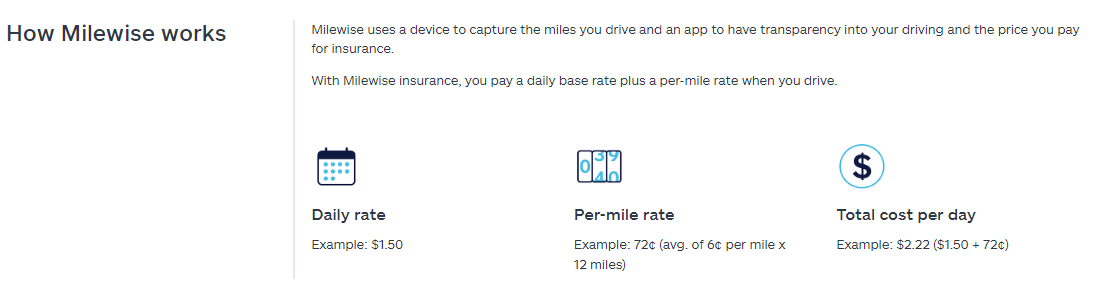

- Roadside Assistance: Roadside assistance provides help for emergencies like towing, flat tires, and battery issues.

The best pay-as-you-go auto insurance companies in Maryland will provide roadside assistance for free, including Allstate and Root Insurance.

Pay-as-you-go coverage options can be tailored to fit individual needs, ensuring that you’re adequately protected without paying for unnecessary extras. Choosing the right combination can enhance your financial security and peace of mind on the road. Additionally, these flexible plans allow you to adjust your coverage as your circumstances change, offering you the freedom to pay only for what you need.

This approach can also provide significant savings over time, especially for drivers who don’t use their vehicles frequently. Ultimately, pay-as-you-go insurance empowers you to take control of your coverage while keeping costs manageable.

Pay-As-You-Go Auto Insurance Discounts in Maryland

On top of UBI savings, Maryland insurance companies offer a variety of discounts to help policyholders save money. By taking advantage of these discounts, Maryland drivers can lower their insurance costs while still enjoying comprehensive coverage.

For instance, drivers with a clean driving record can benefit from safe driver discounts. Full-time students with good grades may also benefit from good student auto insurance discounts, which result in reduced premiums.

Paying your premium in full upfront often results in a discount, and Maryland drivers save money by bundling insurance policies, such as home or renters insurance, with multi-policy discounts.

Have you heard of Drivewise? It’s located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don’t. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

Additionally, installing approved anti-theft devices in your vehicle can lower your insurance costs, as most pay-as-you-go auto insurance companies in Maryland have anti-theft device discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Free Pay-As-You-Go Auto Insurance Quotes in Maryland

In summary, the best pay-as-you-go auto insurance providers in Maryland are Allstate, Root, and Geico. However, obtaining and comparing cheap online auto insurance quotes will help you find the most competitive rates quickly.

Enter essential information, including your ZIP code, vehicle details, and driving history, to receive a personalized auto insurance quote online.Daniel Walker Licensed Auto Insurance Agent

By comparing quotes and evaluating different providers, Maryland drivers can find the best pay-as-you-go car insurance for their budget and coverage requirements. Additionally, taking advantage of available discounts can further reduce Maryland insurance costs.

Find the best pay-as-you-go auto insurance company in your city by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is the recommended auto insurance coverage in Maryland?

Recommended car insurance coverage in Maryland is liability insurance. Maryland mandates minimum liability limits of $30,000 per person, $60,000 per accident for bodily injury, and $15,000 per accident for property damage.

What is the average auto insurance cost in Maryland?

The average cost of car insurance in Maryland is about $137 per month, totaling around $1,640 annually. However, your actual monthly auto insurance premium might vary depending on the coverage you select. Enter your ZIP code below to find out if you can get a better deal.

Why is Maryland car insurance so high?

Maryland’s insurance regulations impose higher minimum liability limits of 30/60/15 compared to other states. This elevated requirement often leads insurance companies to increase their rates across the state.

What is the cheapest full coverage insurance in Maryland?

In general, Geico is the cheapest for full coverage auto insurance in Maryland. Root is the cheapest full coverage pay-as-you-go insurance.

Does the state of Maryland offer auto insurance?

The Maryland Automobile Insurance Fund (MAIF) offers auto insurance coverage to Maryland residents who have been denied by two other insurance providers or had their policy canceled by one.

What is the fee for not having car insurance in Maryland?

If someone is found guilty of driving without auto insurance, they will incur a fine of $150 for the first 30 days the insurance has lapsed, with an additional $7 for each day beyond that period. The maximum fine that can be imposed is $2,500.

How much do most pay for auto insurance in the U.S.?

On a national level, the average cost of full-coverage car insurance is $223 per month.

Is insurance cheaper in D.C. or Maryland?

The typical insurance monthly premium amounts to $150 in Washington, DC, $133 in Maryland, and $84 in Virginia. The average premium across the nation is $110.

Which category of MD auto insurance is best?

Comprehensive auto insurance offers the most extensive coverage available. This type of policy is ideal for those seeking maximum reassurance or those who own a new or high-value vehicle. Comprehensive insurance generally includes coverage for damage to other people’s vehicles or property.

Is pay-as-you-drive insurance in Maryland worth it?

Pay-as-you-go policies work best for Maryland drivers who don’t drive often, making it an affordable way to maintain car insurance for people who work from home, have short commutes, avoid night driving, and are overall safe drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.