Best Windshield Replacement Coverage in Louisiana (Top 10 Companies in 2026)

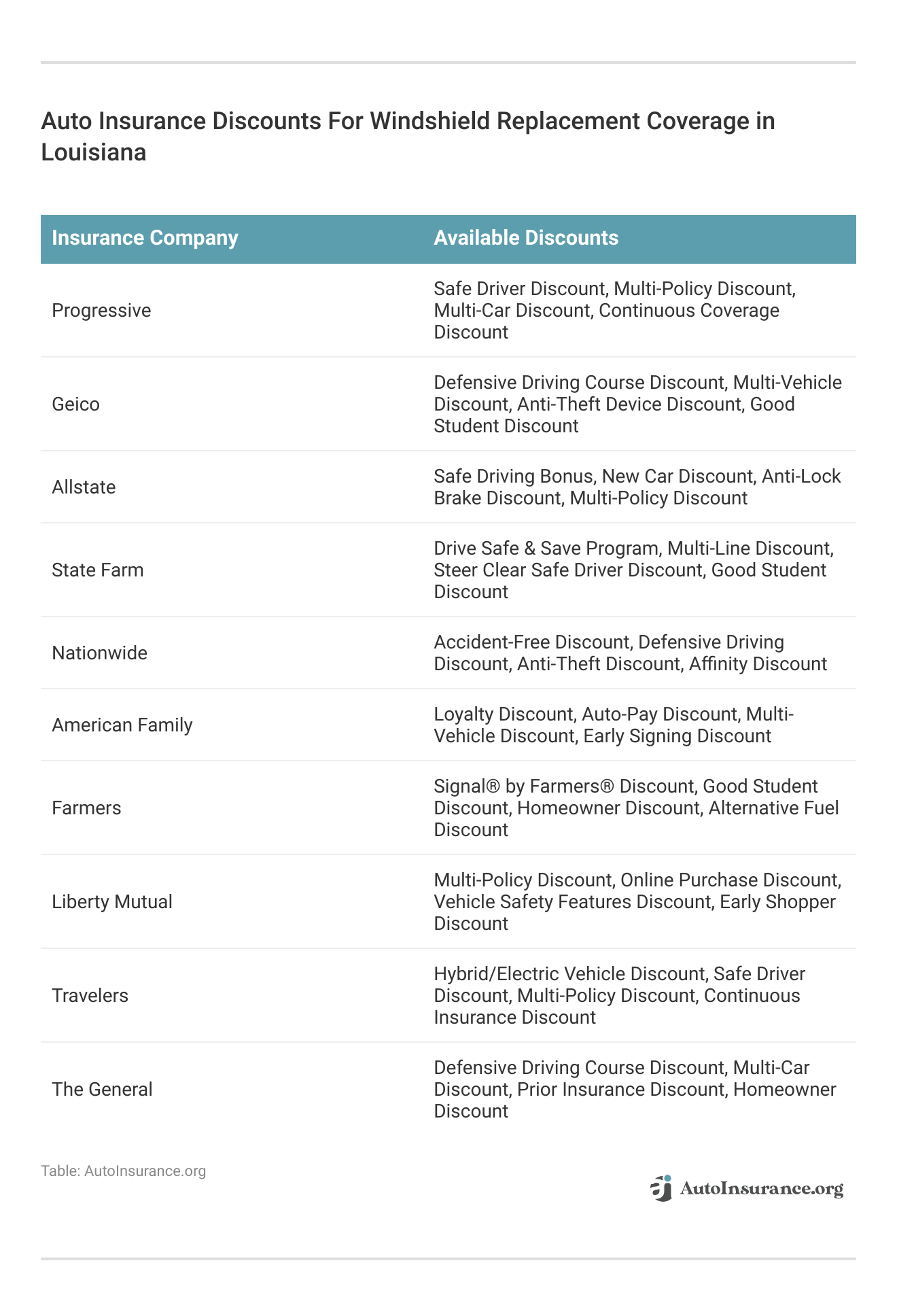

Progressive, Geico, and Allstate provide the best windshield replacement coverage in Louisiana, with monthly premiums beginning at a budget-friendly $50. Our goal is to assist you in comparing quotes from these providers, ensuring you find the best coverage and personalized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated October 2024

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage Windshield Replacement in Louisiana

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Louisiana

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage Windshield Replacement in Louisiana

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews- Progressive provides affordable rates beginning at $50 per month

- Major insurance companies offer various options for windshield replacements

- Many discounts are available for windshield replacement coverage

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: In our Progressive auto insurance review, Progressive offers competitive rates for windshield replacement coverage, starting as low as $50 per month, making it budget-friendly for many drivers.

- Extensive Coverage Options: Progressive provides extensive coverage options tailored to fit specific driving requirements, ensuring that customers can find a plan that meets their needs.

- User-Friendly Claims Process: Progressive’s claims process is known for being straightforward and user-friendly, making it easy for customers to file claims and get their windshields repaired or replaced quickly.

Cons

- Customer Service Challenges: Some customers have reported challenges with Progressive’s customer service, including long wait times and difficulty reaching representatives, which can be frustrating when trying to resolve issues.

- Limited Availability: Progressive may not be available in all areas, so drivers in certain regions may not have access to their coverage options, limiting choice for some consumers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Easy Process

Pros

- Ease of Process: Geico is known for its simple and streamlined insurance processes, including filing claims for windshield replacement, which can save customers time and hassle. Read more through our Geico auto insurance review.

- Financial Stability: Geico is backed by strong financial stability, providing customers with confidence that their claims will be paid promptly and reliably.

- Discount Opportunities: Geico offers various discount opportunities for policyholders, which can help drivers save money on their premiums, including discounts for safe driving and multiple policies.

Cons

- Limited Local Agents: Geico primarily operates online and over the phone, which means customers may have limited access to in-person support from local agents, which some drivers prefer for personalized assistance.

- Potential for Rate Increases: While Geico initially offers competitive rates, some customers have reported experiencing rate increases over time, which can lead to higher premiums in the long run.

#3 – Allstate: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options, including comprehensive windshield replacement coverage, allowing customers to customize their policies to suit their individual needs. Read more through our Allstate auto insurance review.

- Strong Reputation: Allstate has a strong reputation for reliability and customer service, with many customers praising the company’s responsiveness and support during the claims process.

- Innovative Features: Allstate offers innovative features such as Drivewise, which rewards safe driving habits with discounts, providing additional value to policyholders.

Cons

- Higher Premiums: Some customers may find that Allstate’s premiums are higher compared to other insurers, which can be a drawback for budget-conscious drivers.

- Limited Discounts: While Allstate offers some discounts, such as those for safe driving, it may not have as many discount opportunities as some other insurers, potentially limiting savings for customers.

#4 – State Farm: Best for Trusted Service

Pros

- Trusted Service: State Farm is known for its long-standing reputation and commitment to customer satisfaction, providing drivers with peace of mind knowing they are insured by a reputable company.

- Local Agents: State Farm has a vast network of local agents who can provide personalized assistance and guidance, making it easy for customers to get help when they need it.

- Claims Satisfaction: State Farm consistently ranks high in customer satisfaction surveys for its claims process, with many policyholders reporting positive experiences and efficient resolutions. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Premiums: Some drivers may find that State Farm’s premiums are higher compared to other insurers, particularly for certain coverage options or demographic groups.

- Limited Online Features: While State Farm has made strides in improving its online and mobile platforms, some customers may find that its digital offerings are not as robust or user-friendly as those of other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Nationwide Coverage

Pros

- Nationwide Coverage: As the name suggests, Nationwide offers coverage across the nation, providing drivers with access to insurance products and services in various regions. Read more through our Nationwide auto insurance review.

- Bundle Discounts: Nationwide offers discounts for bundling multiple insurance policies, such as auto and home insurance, which can result in significant savings for customers.

- 24/7 Claims Support: Nationwide provides 24/7 claims support, allowing customers to file claims and get assistance at any time, day or night, which can be invaluable in emergencies.

Cons

- Mixed Customer Reviews: Nationwide has received mixed reviews from customers regarding its customer service and claims handling, with some policyholders reporting dissatisfaction with their experiences.

- Limited Discount Options: While Nationwide offers bundle discounts, it may not have as many other discount opportunities as some competitors, potentially limiting savings for certain customers.

#6 – American Family: Best for Family Protection

Pros

- Family Protection: American Family offers comprehensive coverage options designed to protect families, including windshield replacement coverage, providing peace of mind for drivers with loved ones.

- Personalized Service: American Family prides itself on its personalized approach to customer service, with dedicated agents who can help customers find the right coverage options for their needs and budget. Read more through our American Family auto insurance review.

- Discount Opportunities: American Family offers various discount opportunities, such as those for safe driving, bundling policies, and loyalty, helping customers save money on their premiums.

Cons

- Limited Availability: American Family may not be available in all areas, limiting choice for some drivers who are seeking coverage options.

- Potentially Higher Premiums: Some customers may find that American Family’s premiums are higher compared to other insurers, particularly for certain coverage options or demographic groups.

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers Insurance offers personalized service through its network of local agents, who can provide tailored guidance and support to customers, ensuring they have the coverage they need.

- Claims Satisfaction: Farmers Insurance has a strong reputation for claims satisfaction, with many customers reporting positive experiences and efficient resolutions when filing claims for windshield replacement.

- Educational Resources: Farmers Insurance provides educational resources and tools to help customers understand their coverage options and make informed decisions about their insurance needs.

Cons

- Potentially Higher Premiums: Some drivers may find that Farmers Insurance’s premiums are higher compared to other insurers, particularly for certain coverage options or demographic groups.

- Limited Online Features: While Farmers Insurance has made improvements to its online platform, some customers may find that its digital offerings are not as robust or user-friendly as those of other insurers. Read more through our Farmers auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customized Options

Pros

- Customized Options: Liberty Mutual offers a variety of coverage options and customizable policies, allowing customers to tailor their insurance plans to meet their specific needs and budget.

- Discount Programs: Liberty Mutual provides various discount programs, including those for safe driving, bundling policies, and insuring multiple vehicles, helping customers save money on their premiums. Read more through our Liberty Mutual auto insurance review.

- Digital Tools: Liberty Mutual offers user-friendly digital tools and resources, such as online quotes, policy management, and claims filing, making it convenient for customers to access and manage their insurance policies.

Cons

- Mixed Customer Reviews: Liberty Mutual has received mixed reviews from customers regarding its customer service and claims handling, with some policyholders reporting dissatisfaction with their experiences.

- Potential for Rate Increases: While Liberty Mutual initially offers competitive rates, some customers have reported experiencing rate increases over time, which can lead to higher premiums in the long run.

#9 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Travelers is known for its strong financial stability and reliability, providing customers with confidence that their claims will be paid promptly and reliably. Read more through our Travelers auto insurance review.

- Flexible Coverage Options: Travelers offers flexible coverage options and customizable policies, allowing customers to tailor their insurance plans to meet their specific needs and preferences.

- Discount Opportunities: Travelers provides various discount opportunities for policyholders, such as those for safe driving, bundling policies, and insuring multiple vehicles, helping customers save money on their premiums.

Cons

- Limited Availability: Travelers may not be available in all areas, limiting choice for some drivers who are seeking coverage options.

- Potentially Higher Premiums: Some drivers may find that Travelers’ premiums are higher compared to other insurers, particularly for certain coverage options or demographic groups.

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in providing coverage for high-risk drivers, including those with poor driving records or prior accidents, offering options for drivers who may have difficulty obtaining coverage elsewhere.

- Quick Quotes: The General offers quick and easy online quotes, allowing customers to get an estimate of their premiums without the need for lengthy application processes. Read more through our The General auto insurance review.

- Accessible Coverage: The General aims to make insurance accessible to a wide range of drivers, offering options for those who may have difficulty obtaining coverage from traditional insurers.

Cons

- Limited Coverage Options: The General may have limited coverage options compared to traditional insurers, potentially excluding certain types of coverage or add-ons that customers may desire.

- Higher Premiums for Some: While The General provides coverage options for high-risk drivers, some customers may find that premiums are higher compared to what they would pay with other insurers if they have a clean driving record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Damage in Louisiana

Louisiana Cracked Windshield Laws say About Driving with Cracks

Driving with a Cracked Windshield in Louisiana

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Louisiana Windshield Insurance: The Bottom Line

Frequently Asked Questions

Does auto insurance in Louisiana cover windshield replacement?

Yes, auto insurance in Louisiana typically covers windshield replacement. Comprehensive coverage, an optional insurance coverage, usually includes coverage for windshield damage caused by events other than a collision, such as flying debris, rocks, or vandalism. However, it’s important to review your specific insurance policy to understand the coverage details and any deductibles that may apply.

How do I know if my auto insurance policy in Louisiana includes windshield replacement coverage?

To determine if your auto insurance policy in Louisiana includes windshield replacement coverage, review your policy documents or contact your insurance provider directly. Look for the terms “comprehensive coverage” or “glass coverage” within your policy, as these provisions often extend to windshield replacement. Enter your ZIP code now to begin.

Are there any specific requirements or conditions for windshield replacement coverage in Louisiana?

Is windshield replacement covered by my auto insurance without a deductible in Louisiana?

Whether windshield replacement is covered without a deductible depends on the terms of your auto insurance policy. Some insurance policies in Louisiana may offer full or partial coverage for windshield replacement without requiring a deductible payment. However, many policies include a deductible that policyholders are responsible for paying before coverage applies. Review your policy or contact your insurance provider to determine the deductible requirements for windshield replacement coverage.

Can I choose any windshield replacement service provider in Louisiana?

The choice of windshield replacement service provider may vary depending on your insurance policy and provider. Some insurance companies have preferred or approved vendors for windshield replacement, while others may allow you to choose your own provider. It’s recommended to check with your insurance company to understand their guidelines and any restrictions on the choice of service provider for windshield replacement. Enter your ZIP code now to begin.

How do I file a windshield replacement claim with my auto insurance in Louisiana?

To file a windshield replacement claim with your auto or collision insurance in Louisiana, follow these general steps:

- Contact your Insurance Provider: Inform them about the windshield damage and initiate the claims process.

- Provide Necessary Information: Be prepared to provide details about the incident, your policy information, and any supporting documentation or photos of the damaged windshield.

- Follow the Claims Process: Follow the instructions provided by your insurance provider. They may require you to obtain estimates or provide additional documentation.

- Coordinate with an Approved Vendor: If your insurance company requires the use of an approved vendor, they will guide you through the process of scheduling the windshield replacement with them.

Use above information as you guide in filing a claim.

Will filing a windshield replacement claim affect my insurance rates in Louisiana?

In general, filing a windshield replacement claim should not have a significant impact on your insurance rates in Louisiana. Windshield claims are often considered a non-fault claim and may not result in an increase in premiums. However, insurance companies have different policies, so it’s advisable to consult your insurance provider to understand their specific guidelines and the potential impact on your rates.

What are the average monthly rates for windshield replacement coverage offered by Progressive, Geico, and Allstate in Louisiana?

The average monthly rates for windshield replacement coverage offered by Progressive, Geico, and Allstate in Louisiana start as low as $50 per month. Enter your ZIP code now to begin.

How do Louisiana’s cracked windshield laws impact drivers and their insurance coverage?

Which insurance companies listed in the article offer the best overall coverage options and customer satisfaction for windshield replacement in Louisiana?

Based on the article, Progressive, Geico, and Allstate are highlighted as the top providers offering the best overall coverage options and customer satisfaction for windshield replacement in Louisiana.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.