Best Windshield Replacement Coverage in Maryland (Top 10 Companies Ranked for 2026)

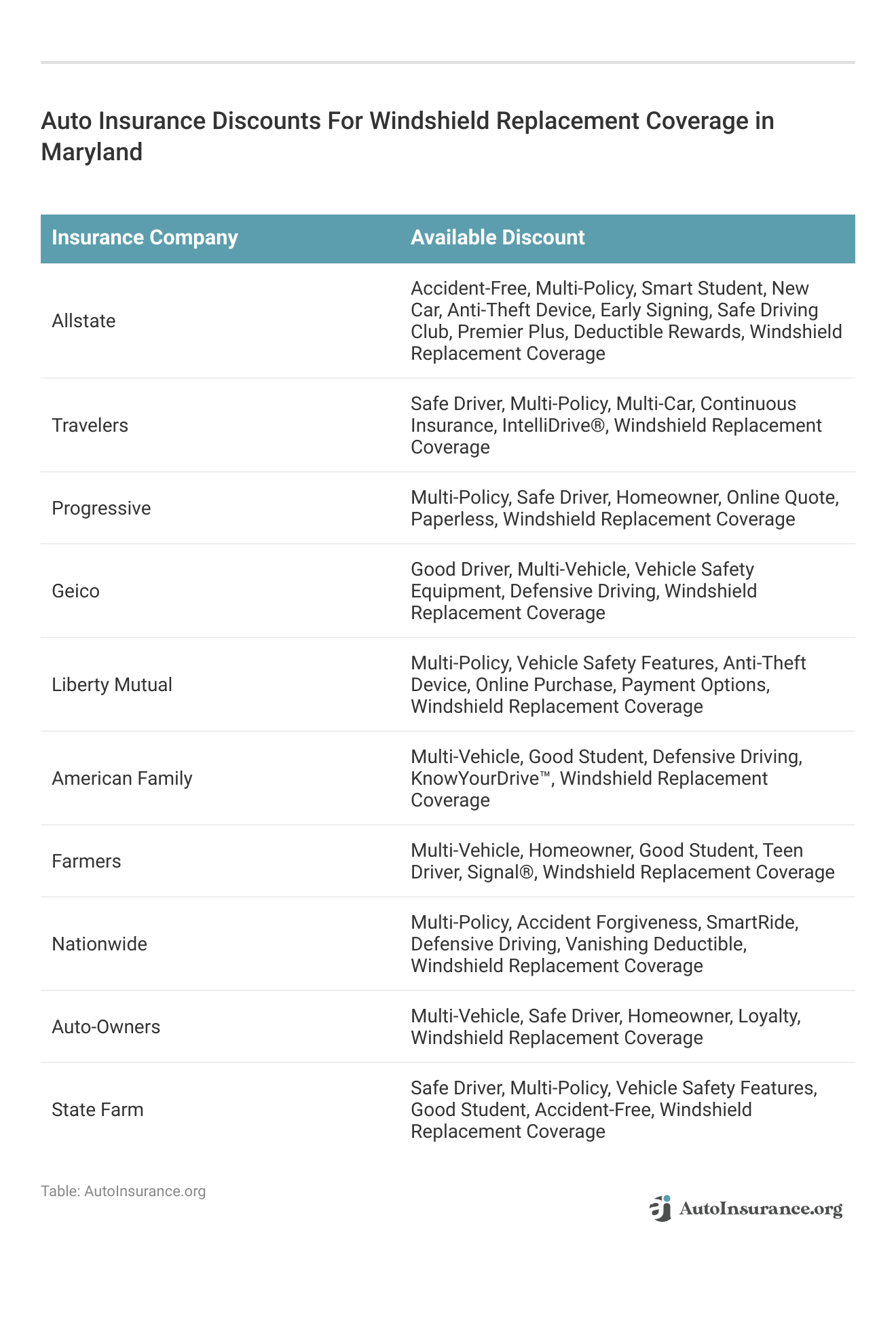

Allstate, Travelers, and Progressive offer the best windshield replacement coverage in Maryland, starting at a monthly premium of $125. Our objective is to assist you in comparing quotes from these reputable insurers, guaranteeing you receive optimal coverage and personalized discounts tailored to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated October 2024

Company Facts

Full Coverage Windshield Replacement in Maryland

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Maryland

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Maryland

A.M. Best

Complaint Level

Pros & Cons

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including comprehensive coverage that often includes windshield replacement, providing peace of mind for policyholders. Use our Allstate auto insurance review as your guide.

- Strong Financial Stability: Allstate has a strong financial standing, as evidenced by its high ratings from agencies like A.M. Best, ensuring that policyholders can rely on the company’s stability and ability to fulfill claims.

- Discount Opportunities: Allstate provides various discount opportunities for policyholders, such as safe driving discounts and bundling discounts, helping customers save on their premiums.

Cons

- Higher Premiums: While Allstate offers comprehensive coverage, its premiums may be relatively higher compared to some other insurance providers, potentially making it less affordable for budget-conscious individuals.

- Customer Service Concerns: Some customers have reported dissatisfaction with Allstate’s customer service, citing issues with claim processing and communication, which could impact overall satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Unique Coverage

Pros

- Flexible Coverage Options: Our Travelers auto insurance review reveals that Travelers offers flexible coverage options, allowing policyholders to tailor their insurance plans to their specific needs, including options for windshield replacement coverage.

- Strong Reputation: Travelers has a strong reputation for customer service and claims satisfaction, with many policyholders praising the company’s responsiveness and efficiency in handling claims.

- Discount Programs: Travelers provides various discount programs, such as multi-policy discounts and safe driver discounts, helping customers save money on their premiums.

Cons

- Limited Availability: Travelers’ coverage may not be available in all areas, limiting options for potential policyholders who reside in regions where the company does not operate.

- Potentially Higher Rates: While Travelers offers quality coverage and service, its premiums may be higher compared to some other insurers, making it less competitive in terms of pricing.

#3 – Progressive: Best for Biggest Discount

Pros

- Innovative Technology: Progressive is known for its innovative use of technology, offering tools like Snapshot, which tracks driving behavior to potentially lower premiums for safe drivers.

- Extensive Discounts: Progressive offers a wide range of discounts, including multi-policy discounts and discounts for using their Name Your Price® tool, making it possible for customers to find savings opportunities.

- Convenient Claims Process: Progressive’s claims process is known for its convenience and efficiency, with options for online claims filing and 24/7 customer support.

Cons

- Limited Agent Interaction: In our Progressive auto insurance review, Progressive primarily operates online and through phone channels, which may not be ideal for customers who prefer face-to-face interaction with agents for insurance inquiries and assistance.

- Rate Increases After Accidents: Some customers have reported experiencing significant rate increases after filing claims for accidents, potentially resulting in higher premiums over time.

#4 – Geico: Best for Low Deductibles

Pros

- Affordability: Geico is often praised for its competitive rates and affordability, making it a popular choice for budget-conscious drivers seeking quality coverage at lower premiums.

- Ease of Use: Geico’s user-friendly website and mobile app make it easy for customers to manage their policies, make payments, and file claims conveniently. Read more through our Geico auto insurance review.

- Strong Financial Standing: Geico is backed by the financial strength of Berkshire Hathaway, providing reassurance to policyholders regarding the company’s ability to fulfill claims and obligations.

Cons

- Limited Coverage Options: Geico may have fewer coverage options compared to some other insurers, potentially limiting customization for policyholders with specific needs or preferences.

- Less Personalized Service: Due to its direct-to-consumer business model, Geico may offer less personalized service compared to companies with extensive agent networks, which could be a drawback for customers who prefer more hands-on assistance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Affinity Discounts

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to their individual needs and preferences, including options for windshield replacement coverage.

- Wide Network of Agents: With a vast network of agents across the country, Liberty Mutual provides personalized assistance and support to policyholders, ensuring they have access to professional guidance when needed.

- Additional Benefits: Liberty Mutual offers additional benefits and features, such as accident forgiveness and new car replacement coverage, enhancing the value of their insurance products for customers.

Cons

- Potentially Higher Premiums: Liberty Mutual’s premiums may be higher compared to some other insurers, particularly for drivers with less-than-perfect driving records or credit histories, potentially making it less affordable for some individuals. For further insights, refer to our Liberty Mutual auto insurance review.

- Mixed Customer Service Reviews: While Liberty Mutual has received positive feedback for its claims handling, some customers have reported mixed experiences with customer service, citing issues with responsiveness and communication.

#6 – American Family: Best for Discount Availability

Pros

- Personalized Service: American Family is known for its personalized service, with a network of local agents who provide tailored assistance and guidance to customers, ensuring their insurance needs are met.

- Discount Opportunities: American Family offers various discount programs, such as bundling discounts and loyalty rewards, helping customers save on their premiums and maximize value.

- Community Involvement: American Family is actively involved in supporting local communities through charitable initiatives and sponsorships, resonating with customers who value companies with strong social responsibility. Read more through our American Family auto insurance review.

Cons

- Limited Availability: American Family’s coverage may be limited to certain regions, restricting options for potential policyholders who reside outside of the company’s service area.

- Potentially Complex Claims Process: Some customers have reported experiencing challenges with American Family’s claims process, citing difficulties in navigating procedures and obtaining timely resolution, which could impact overall satisfaction.

#7 – Farmers: Best for Discount Selection

Pros

- Extensive Coverage Options: Farmers Insurance offers a wide range of coverage options, including comprehensive coverage that may include windshield replacement, providing comprehensive protection for policyholders.

- Strong Financial Stability: Farmers Insurance has a strong financial standing and is well-regarded for its ability to fulfill claims, providing policyholders with confidence in the company’s stability and reliability.

- Dedicated Agents: Farmers Insurance employs a network of dedicated agents who provide personalized assistance and support to customers, ensuring that they have access to expert guidance when selecting and managing their policies.

Cons

- Higher Premiums for Certain Profiles: While Farmers Insurance offers comprehensive coverage, its premiums may be higher for certain profiles, such as younger drivers or individuals with less-than-perfect driving records, potentially making it less affordable for some customers.

- Limited Online Tools: Farmers Insurance’s online tools and digital capabilities may be less robust compared to some other insurers, which could be a drawback for customers who prefer to manage their policies online or via mobile app. Read more through our Farmers auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Nationwide Network: Nationwide Insurance operates nationwide, providing coverage to customers across the country, offering convenience and accessibility to potential policyholders regardless of their location.

- Flexible Policy Options: Nationwide offers flexible policy options, allowing customers to customize their coverage to suit their individual needs and preferences, including options for windshield replacement coverage. Read more through our Nationwide auto insurance review.

- Multi-Policy Discounts: Nationwide provides multi-policy discounts for customers who bundle their auto insurance with other policies, such as home or renters insurance, helping them save on their premiums.

Cons

- Potentially Complex Claims Process: Some customers have reported experiencing challenges with Nationwide’s claims process, citing delays and difficulties in obtaining resolution, which could impact overall satisfaction.

- Mixed Customer Service Reviews: While Nationwide has received positive feedback for its customer service in some areas, others have reported mixed experiences, highlighting inconsistencies in responsiveness and communication.

#9 – Auto-Owners: Best for Accidents

Pros

- High Customer Satisfaction: Auto-Owners Insurance consistently receives high marks for customer satisfaction, with many policyholders praising the company’s personalized service and claims handling. Read more through our Auto-Owners auto insurance review.

- Strong Financial Ratings: Auto-Owners Insurance boasts strong financial ratings from agencies like A.M. Best, indicating its stability and ability to meet financial obligations, providing reassurance to policyholders.

- Customized Coverage Options: Auto-Owners Insurance offers customized coverage options, allowing customers to tailor their policies to their specific needs and preferences, ensuring they have adequate protection.

Cons

- Limited Availability: Auto-Owners Insurance may have limited availability in certain regions, restricting options for potential policyholders who reside outside of the company’s service area.

- Potentially Higher Premiums: While Auto-Owners Insurance offers quality coverage and service, its premiums may be higher compared to some other insurers, making it less competitive in terms of pricing for some individuals.

#10 – State Farm: Best for Business Owners

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents who provide personalized assistance and guidance to customers, ensuring they have access to expert advice and support when managing their policies.

- Variety of Discounts: State Farm offers a variety of discounts, including multi-policy discounts, safe driver discounts, and vehicle safety feature discounts, helping customers save on their premiums and maximize value.

- Financial Stability: State Farm has a strong financial standing and is well-established in the insurance industry, providing policyholders with confidence in the company’s stability and ability to fulfill claims. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: While State Farm offers comprehensive coverage and personalized service, its premiums may be higher compared to some other insurers, particularly for certain demographics or coverage profiles.

- Limited Online Tools: State Farm’s online tools and digital capabilities may be less robust compared to some other insurers, which could be a drawback for customers who prefer to manage their policies online or via mobile app.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Replacement Insurance in Maryland

Insurance Coverage for Glass Replacement in Maryland

Glass Options for Windshield Replacement in Maryland

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maryland Windshield Replacement Insurance: The Bottom Line

Frequently Asked Questions

Does auto insurance in Maryland cover windshield replacement?

Yes, auto insurance in Maryland typically covers windshield replacement under certain conditions. Comprehensive coverage, which is an optional coverage, often includes windshield replacement as part of its coverage. However, it’s important to review your specific policy to understand the terms, conditions, and deductible associated with windshield replacement.

What is comprehensive coverage in auto insurance?

Comprehensive coverage is an optional coverage in auto insurance that helps protect your vehicle against damage that is not caused by a collision with another vehicle. It typically covers incidents such as theft, vandalism, fire, falling objects, and certain types of natural disasters. In many cases, comprehensive coverage also includes windshield replacement if the damage is due to non-collision incidents. Enter your ZIP code now to begin.

Do I need comprehensive coverage to have windshield replacement coverage in Maryland?

What factors should I consider when making a windshield replacement claim in Maryland?

When making a windshield replacement claim in Maryland, consider the following factors:

- Deductible: Check your policy to see if you have a deductible for comprehensive coverage. You will usually be responsible for paying this amount before the insurance coverage kicks in.

- Repair or Replacement: Determine if the damage to your windshield requires repair or full replacement. Insurance coverage may vary depending on the severity of the damage.

- Preferred Providers: Check if your insurance company has a list of preferred providers for windshield replacement. Using a preferred provider may simplify the claims process and ensure quality service.

- Claim Process: Contact your insurance company to initiate the claim. They will guide you through the necessary steps, which may involve providing documentation, photos, or arranging an inspection.

- Coverage Limits: Review your policy to understand any limits or exclusions that may apply to windshield replacement coverage. Ensure that the cost of the replacement falls within the coverage limits.

These factors will be your guide in filing a claim for windshield replacement.

Will filing a windshield replacement claim affect my insurance rates in Maryland?

Generally, filing a windshield replacement claim in Maryland does not typically affect your insurance rates. Windshield replacement claims are often considered “no-fault” claims and may not result in premium increases. However, it’s advisable to check with your insurance provider to understand their specific policies and any potential impacts on your rates. Enter your ZIP code now.

Are there any limitations or exclusions to windshield replacement coverage in Maryland?

What are the average monthly rates for windshield replacement coverage offered by the top insurance providers in Maryland?

The article mentions that the average monthly rates for windshield replacement coverage start at $125, with Allstate, Travelers, and Progressive being highlighted as the top providers in Maryland.

How do Maryland’s insurance laws affect coverage for windshield replacement costs?

Maryland’s insurance laws do not mandate coverage for windshield replacement costs under standard liability insurance. However, some insurers offer full glass replacement, often under comprehensive coverage, but policyholders may still be responsible for deductibles. Enter your ZIP code now to start.

What factors should drivers consider when making a windshield replacement claim in Maryland?

How do insurance companies like Allstate, Travelers, and Progressive compare in terms of coverage options and customer satisfaction ratings for windshield replacement?

Allstate, Travelers, and Progressive are mentioned as the top insurance providers for windshield replacement coverage in Maryland, offering comprehensive protection at affordable rates starting from $125 per month. These insurers also partner with each other to provide budget-friendly rates and various coverage options tailored to individual driving needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.