Best Nissan Altima Auto Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, Nationwide, and AAA offer the best Nissan Altima auto insurance rates, with starting rates for as low as at $47/month. These companies have specific factors that make them the top choices for insuring your Nissan Altima, providing reliability, savings, and convenience.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated March 2025

18,157 reviews

18,157 reviewsCompany Facts

Nissan Altima Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Nissan Altima Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,027 reviews

3,027 reviewsCompany Facts

Nissan Altima Full Coverage

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe top pick overall for the best Nissan Altima auto insurance are State Farm, Nationwide, and AAA, offering rates as low as $47/month. State Farm stands out for its comprehensive coverage and exceptional customer service (Read more: Nissan Auto Insurance).

Nationwide is ideal for those seeking usage-based discounts, while AAA provides unparalleled convenience with its user-friendly mobile app.

Our Top 10 Company Picks: Best Nissan Altima Auto Insurance| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | Usage Discount | Nationwide |

| #3 | 12% | A | Online App | AAA |

| #4 | 5% | A++ | Custom Plan | Geico | |

| #5 | 18% | A+ | Add-on Coverages | Allstate | |

| #6 | 7% | A+ | Online Convenience | Progressive | |

| #7 | 20% | A++ | Military Savings | USAA | |

| #8 | 6% | A | Customizable Polices | Liberty Mutual |

| #9 | 13% | A | Local Agents | Farmers | |

| #10 | 9% | A++ | Accident Forgiveness | Travelers |

Explore Nissan Altima insurance rates and why these providers are the best choices for affordable and reliable Nissan Altima insurance.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Discover the best Nissan Altima auto insurance rates starting at $123/month

- State Farm is the top pick for the best Nissan Altima auto insurance

- Save usage-based discounts and enjoy user-friendly mobile app from top providers

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm auto insurance review provides variety of discounts, which can help Nissan Altima owners significantly reduce their insurance expenses.

- Affordable Monthly Premiums: State Farm provides competitive monthly premiums, starting at $49 for minimum coverage on the Nissan Altima.

- Policy Bundling: Nissan Altima owners can achieve additional savings by bundling multiple insurance policies with State Farm.

Cons

- Limited Multi-Policy Savings: The discounts for bundling multiple policies may not be as substantial as those offered by some competitors.

- Potentially Higher Premiums: Even with available discounts, State Farm’s premiums could be relatively high for certain coverage levels, which might impact Nissan Altima owners.

#2 – Nationwide: Best for Usage Discount

Pros

- Significant Usage-Based Savings: Nationwide provides attractive discounts based on usage, which can be particularly beneficial for Nissan Altima drivers.

- Affordable Monthly Rates: Nationwide auto insurance review provides low monthly premiums, starting at $57 for minimum coverage on the Nissan Altima.

- Multi-Vehicle Discount: Nissan Altima owners with multiple vehicles can benefit from a 15% discount when insuring more than one car with Nationwide.

Cons

- Complex Discount Eligibility: Qualifying for certain discounts may require meeting specific and sometimes complex criteria, which could be challenging for Nissan Altima owners.

- Average Customer Service: Nationwide’s customer service may not be as responsive or efficient as that of other leading insurers, which could affect Nissan Altima policyholders.

#3 – AAA: Best for Online App

Pros

- Convenient Online App: AAA’s online app makes it easy for Nissan Altima owners to manage their insurance policies.

- Competitive Monthly Rates: AAA offers competitive monthly premiums, starting at $71 for minimum coverage on the Nissan Altima.

- Additional Membership Benefits: Along with insurance, AAA auto insurance review provides the members to receive extra benefits that add value for Nissan Altima owners.

Cons

- Membership Requirement: AAA requires a membership to access their insurance services, which could be an added expense for Nissan Altima owners.

- Availability Limitations: AAA’s insurance services might not be available in all regions, limiting access for some Nissan Altima drivers.

#4 – Geico: Best for Custom Plan

Pros

- Highly Customizable Plans: As mention in Geico auto insurance review, Geico offers flexible insurance plans that can be tailored to meet the specific needs of Nissan Altima drivers.

- Low Monthly Rates: Geico provides competitive monthly premiums, starting at $39 for minimum coverage on the Nissan Altima.

- Multiple Discount Options: Geico offers numerous discounts, enabling Nissan Altima owners to reduce their insurance costs.

Cons

- Higher Rates for High-Risk Drivers: Geico’s premiums may be higher for drivers deemed high-risk, which could affect some Nissan Altima owners.

- Customer Service Concerns: Geico’s customer service has received mixed reviews, which could impact the overall satisfaction of Nissan Altima policyholders.

#5 – Allstate: Best for Add-On Coverages

Pros

- Wide Range of Add-On Coverages: Allstate auto insurance review provides an extensive selection of add-on coverages, providing comprehensive protection for Nissan Altima owners.

- Competitive Monthly Rates: Allstate’s monthly premiums start at $69 for minimum coverage on the Nissan Altima.

- Multi-Policy Discount: Nissan Altima drivers can benefit from an 18% discount when bundling multiple policies with Allstate.

Cons

- Higher Premium Costs: Allstate’s premiums may be higher compared to some competitors, potentially affecting affordability for Nissan Altima owners.

- Limited Availability of Discounts: Certain discounts may not be available in all states, which could limit potential savings for Nissan Altima drivers.

#6 – Progressive: Best for Online Convenience

Pros

- Online Management Tools: Progressive offers an excellent array of online tools and services for managing Nissan Altima insurance policies.

- Competitive Monthly Rates: Progressive auto insurance review provides competitive monthly premiums, starting at $59 for minimum coverage on the Nissan Altima.

- Snapshot Program: Nissan Altima owners can save on premiums through Progressive’s Snapshot program, which offers usage-based discounts.

Cons

- High Premiums for Young Drivers: Premiums for young drivers may be higher with Progressive, potentially affecting Nissan Altima owners with teen drivers.

- Inconsistent Customer Service: The quality of Progressive’s customer service can vary, which could impact the experience of Nissan Altima policyholders.

#7 – USAA: Best for Military Savings

Pros

- Significant Military Savings: USAA offers substantial savings and benefits tailored for military members and their families who own Nissan Altimas.

- Affordable Monthly Rates: USAA auto insurance review provides competitive monthly premiums, starting at $62 for minimum coverage on the Nissan Altima.

- Outstanding Customer Service: USAA is renowned for its excellent customer service, which benefits Nissan Altima policyholders.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, excluding other Nissan Altima owners.

- Fewer Physical Locations: The limited number of physical branches might be inconvenient for some Nissan Altima drivers.

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Insurance Plans: Liberty Mutual offers highly customizable policies that cater to the unique needs of Nissan Altima owners.

- Competitive Monthly Rates: Liberty Mutual auto insurance review provides monthly premiums start at $93 for minimum coverage on the Nissan Altima.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness feature prevents rate increases after the first accident, benefiting Nissan Altima drivers.

Cons

- Higher Rates for High-Risk Drivers: Liberty Mutual’s premiums might be higher for drivers classified as high-risk, which could affect some Nissan Altima owners.

- Fewer Discount Options: Liberty Mutual may offer fewer discounts compared to other insurers, potentially impacting savings for Nissan Altima policyholders.

#9 – Farmers: Best for Local Agents

Pros

- Personalized Service from Local Agents: Farmers auto insurance review provides access to local agents, offering a personalized experience for Nissan Altima insurance.

- Competitive Monthly Rates: Farmers’ monthly premiums start at $71 for minimum coverage on the Nissan Altima.

- Multi-Policy Discount: Nissan Altima drivers can save 13% by bundling multiple policies with Farmers.

Cons

- Higher Premium Costs: Farmers’ premiums might be higher than those of some competitors, potentially impacting affordability for Nissan Altima owners.

- Mixed Reviews on Customer Service: Farmers’ customer service has received mixed reviews, which could affect the satisfaction of Nissan Altima policyholders.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Travelers offers accident forgiveness, which prevents rate hikes after the first accident for Nissan Altima drivers.

- Affordable Monthly Rates: Travelers Auto insurance review provides monthly premiums start at $57 for minimum coverage on the Nissan Altima.

- Multi-Policy Discount: Travelers offers a 9% discount when bundling multiple policies, providing additional savings for Nissan Altima owners.

Cons

- Limited Regional Availability: Travelers’ insurance might not be available in all areas, limiting access for some Nissan Altima drivers.

- Complicated Claims Process: Some customers have reported a complex claims process, which could be challenging for Nissan Altima policyholders.

Nissan Altima Insurance Cost

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $87 | $228 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

When it comes to full coverage auto insurance, the variation in rates is also notable. Geico again offers the most affordable option at $125 per month, while Liberty Mutual charges the highest at $296. Providers like Allstate, Farmers, and USAA fall in the middle range, with full coverage rates between $191 and $217.

Nissan Altima Auto Insurance Monthly Rates by Coverage Type| Category | Rates |

|---|---|

| Average Rate | $121 |

| Discount Rate | $71 |

| High Deductibles | $104 |

| High Risk Driver | $257 |

| Low Deductibles | $152 |

| Teen Driver | $440 |

Overall, selecting the right insurance provider can result in considerable savings. Geico tends to offer the lowest rates for both minimum and full coverage, whereas Liberty Mutual is generally more expensive for insuring a Nissan Altima.

Expensiveness of Nissan Altimas to Insure

Nissan Altimas are generally more expensive to insure than other sedans like the MINI Hardtop 4 Door, Chrysler 300, and Lincoln MKZ. This higher cost can be attributed to several factors, such as the Altima’s repair costs, the frequency of claims made by Altima owners, and the vehicle’s safety ratings.

Nissan Altima Auto Insurance Monthly Rates vs. Other Vehicles| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Nissan Altima | $27 | $50 | $31 | $121 |

| MINI Hardtop 4 Door | $25 | $47 | $33 | $118 |

| Chrysler 300 | $28 | $52 | $33 | $126 |

| Lincoln MKZ | $27 | $57 | $38 | $136 |

| Ford Focus | $20 | $45 | $33 | $111 |

| Subaru Legacy | $31 | $42 | $28 | $113 |

| Toyota Corolla | $25 | $45 | $33 | $115 |

Although the Altima is recognized for its reliability and performance, these factors contribute to its insurance rates, making it important for potential buyers to consider these costs when selecting a vehicle. The comparison chart emphasizes the rate differences, highlighting the significance of understanding how different models influence auto insurance premiums.

Factors That Impacts the Cost of Nissan Altima Insurance

Several factors influence the cost of insuring a Nissan Altima. The specific trim and model you choose can significantly affect your insurance premium.

Higher trims, which often include advanced features and luxury upgrades, typically result in higher insurance costs due to the increased expense of repairs and replacements. You can explore more in our analysis of “Factors That Affect Auto Insurance Rates.”

Furthermore, the vehicle’s safety ratings, theft susceptibility, part costs, and overall value are critical in determining insurance expenses. The driver’s age, driving record, location, and selected coverage options also play important roles. Collectively, these factors determine the overall cost of insuring a Nissan Altima.

Vehicle Age and Insurance Costs

Frequently Asked Questions

What is Nissan Altima auto insurance?

Nissan Altima auto insurance is coverage specifically designed for Nissan Altima vehicles, protecting you financially in case of accidents or damages. See our comprehensive guide titled “Motorcycle vs. Car Accident Statistics.”

What factors can affect the cost of Nissan Altima auto insurance?

Costs can be influenced by your age, driving record, location, vehicle usage, coverage options, and the vehicle’s value and safety features. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

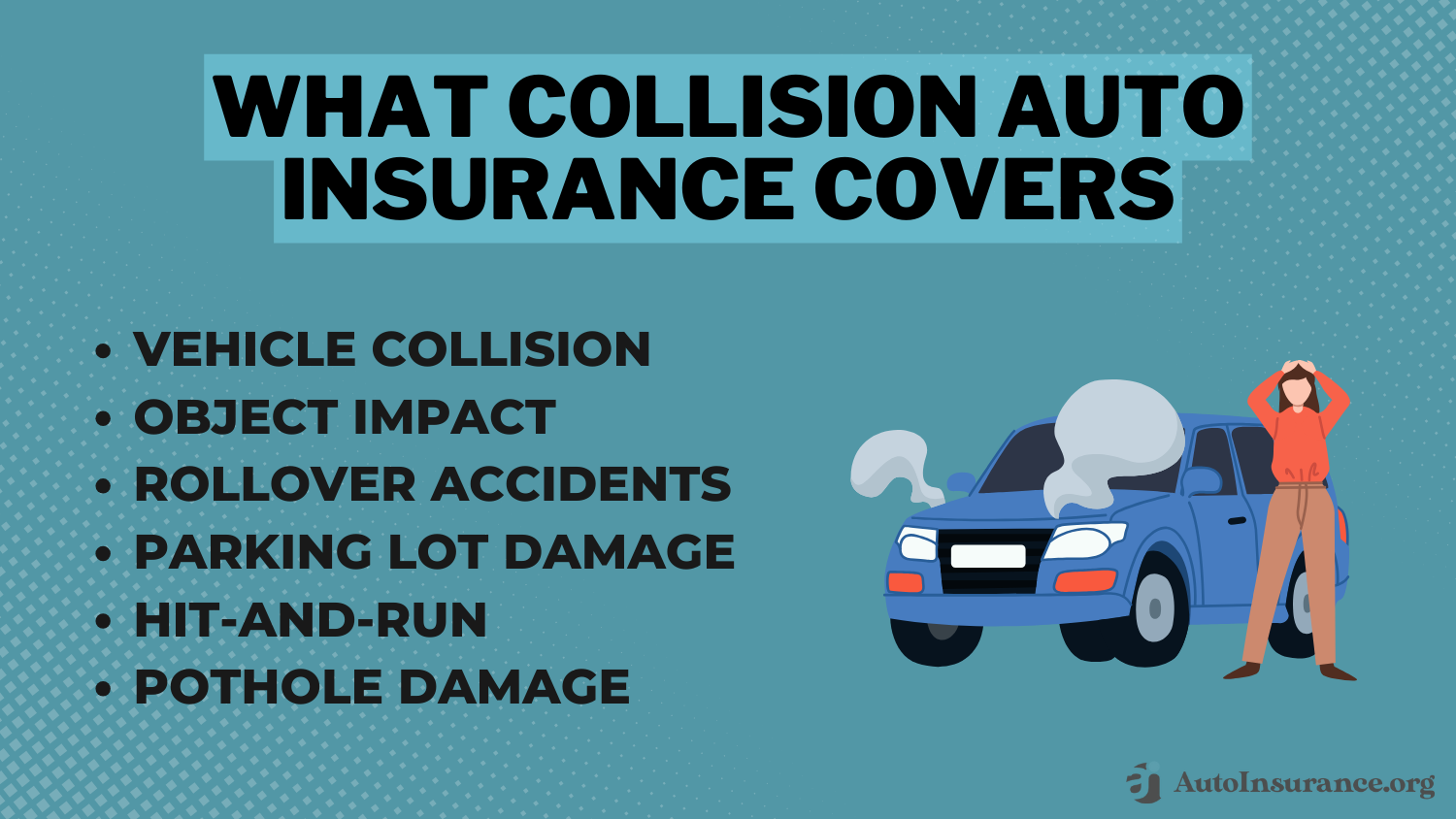

What types of coverage are available for Nissan Altima auto insurance?

You can get liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection (PIP), and other optional coverages.

Are there any specific insurance considerations for a Nissan Altima?

Consider the vehicle’s age, condition, trim level, safety features, and how often Nissan Altimas are stolen or involved in accidents. Discover more insights in our guide “What are the benefits of auto insurance?”

How can I find affordable Nissan Altima auto insurance?

Shop around, compare quotes, and look for discounts like safe driver, good student, or multi-policy insurance discount.

Are there any specialized insurance providers for Nissan Altima owners?

No specific providers cater only to Nissan Altima owners, but many insurers cover sedans and midsize vehicles well.

What is the average cost of Nissan Altima auto insurance?

The average cost is about $121 per month, but it can vary based on your profile and coverage choices.

How do safety features of the Nissan Altima affect insurance rates?

Safety features like anti-lock brakes and airbags can lower your insurance rates by reducing accident risks. Check out our guide “How to Get an Anti-Lock Brakes Auto Insurance Discount.”

Can I get discounts on Nissan Altima auto insurance?

Yes, you can get discounts for safe driving, good grades, having multiple policies, and installing safety features.

What should I consider when choosing an insurance provider for my Nissan Altima?

Look at the provider’s reputation, customer service, coverage options, discounts, and the total cost of premiums. Compare quotes to get the best deal. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.