Best Orlando, Florida Auto Insurance in 2025 (Find the Top 10 Companies Here)

The leading providers of best Orlando, Florida auto insurance are State Farm, Geico, and Progressive, with rates starting at $68 per month. These companies offer affordable rates, comprehensive coverage, and high customer satisfaction, making them the best choices for drivers in Orlando, Florida.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Orlando FL

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Orlando FL

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Orlando FL

A.M. Best

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Orlando, Florida auto insurance comes from State Farm, with Geico and Progressive also offering top coverage.

State Farm stands out with rates starting at $68 per month, while Geico is known for affordability and Progressive provides flexible, customizable options. These providers excel in value and customer satisfaction, making them top choices for Orlando drivers. Comparing quotes from these leading companies will help you find the best coverage for your needs and budget.

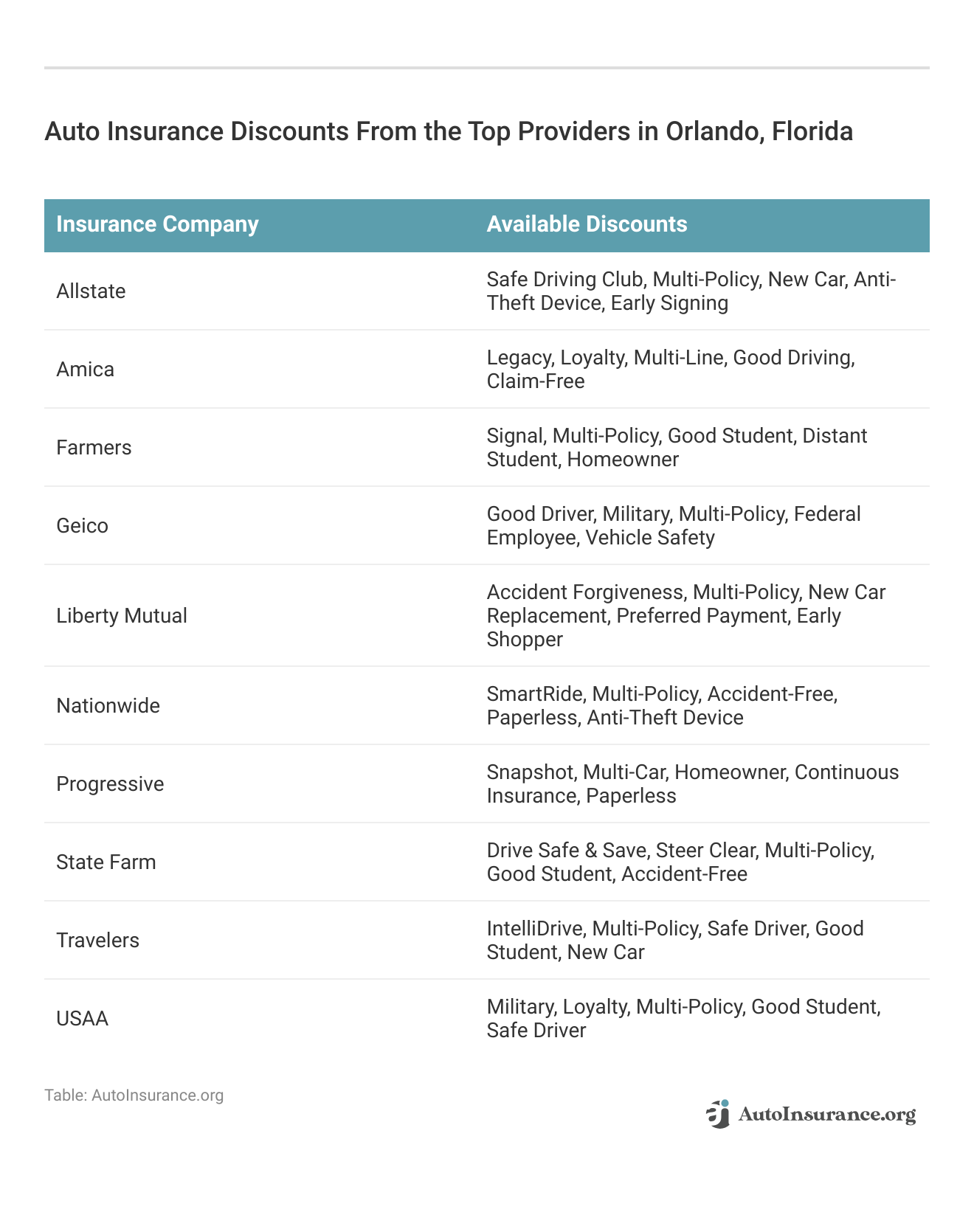

Our Top 10 Company Picks: Best Orlando, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Roadside Assistance State Farm

#2 18% A++ Affordable Rates Geico

#3 14% A+ Comprehensive Coverage Progressive

#4 16% A+ Local Agent Allstate

#5 22% A++ Military Families USAA

#6 21% A+ Customer Satisfaction Nationwide

#7 16% A Customizable Coverage Liberty Mutual

#8 12% A+ Multiple Discounts Farmers

#9 10% A++ Extensive Coverage Travelers

#10 11% A+ Claims Service Amica

By comparing these top providers, you can find the most suitable auto insurance to meet your needs and budget. For further details, consult our article called, “8 Best Pay-As-You-Go Auto Insurance Companies.” Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- State Farm offers the best Orlando, Florida auto insurance at $68

- Geico and Progressive provide top coverage in Orlando

- Compare quotes for affordable auto insurance in Orlando

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

Pros

- Roadside Assistance: State Farm offers comprehensive roadside assistance for Orlando, Florida drivers, providing peace of mind and support in case of emergencies on the road, which is a significant benefit for those frequently driving in the area.

- Strong Reputation: Known for reliability, State Farm has a long-standing presence, making it a trusted choice for Orlando, Florida policyholders seeking dependable and consistent insurance services.

- Wide Range of Coverage Options: State Farm provides a variety of coverage options tailored to the needs of Orlando, Florida owners, ensuring that drivers can find policies suited to their individual requirements.

- Discounts for Safe Drivers: State Farm offers a 17% bundling discount for safe drivers, which helps Orlando, Florida drivers lower their premiums and save on their insurance costs. Get the full story by checking out our article called, “State Farm Auto Insurance Review.”

Cons

- Limited Digital Tools: State Farm’s online tools and mobile apps are less advanced, which might be a drawback for tech-savvy Orlando, Florida enthusiasts who prefer more sophisticated digital features.

- Average Claims Process: Some Orlando, Florida drivers report slower claims processing times compared to top competitors, potentially leading to delays in receiving claim settlements.

- Higher Premiums: State Farm’s premiums can be higher for Orlando, Florida policyholders, especially those who are younger or high-risk drivers, potentially impacting their affordability.

#2 – Geico: Best for Affordable Rates

Pros

Pros

- Affordable Rates: Geico is known for offering competitive rates, making it a cost-effective option for Orlando, Florida drivers looking to save money on their auto insurance premiums.

- Strong Financial Rating: With an A++ rating from A.M. Best, Geico provides strong financial security, assuring Orlando, Florida policyholders of the company’s ability to meet its financial obligations.

- User-Friendly Digital Experience: Geico’s mobile app and website are top-rated for ease of use, providing a seamless and convenient experience for Orlando, Florida insurance enthusiasts.

- Quick Claims Process: Geico’s efficient claims process is highly rated by Orlando, Florida drivers, who appreciate the speedy settlements and prompt resolution of their claims. They also offer an 18% bundling discount, which further reduces insurance costs.

Cons

- Limited Local Agents: Geico operates primarily online, which might not appeal to Orlando, Florida owners who prefer in-person interactions with local insurance agents. Elevate your knowledge with our article entitled, “Geico Auto Insurance Review.”

- Fewer Discounts for High-Risk Drivers: Geico’s discounts are less generous for high-risk Orlando, Florida drivers compared to other providers, potentially limiting savings for those with less favorable driving records.

- No Customizable Coverage: Geico provides fewer options for customizing coverage, which may not meet the specific needs of all Orlando, Florida policyholders seeking tailored insurance solutions.

#3 – Progressive: Best for Comprehensive Coverage

Pros

Pros

- Comprehensive Coverage: Progressive offers a broad range of coverage options, including unique add-ons like pet injury protection, catering to the diverse needs of Orlando, Florida enthusiasts.

- Strong Digital Tools: Progressive’s mobile app and website deliver a seamless experience for Orlando, Florida drivers, making it easy to manage policies and file claims online.

- Name Your Price Tool: This tool allows Orlando, Florida drivers to set their budget and find suitable coverage options, helping them stay within their financial limits. Explore further details in our article entitled, “Progressive Auto Insurance Review.”

- Snapshot Program: Progressive’s telematics program offers discounts based on safe driving habits, providing a 14% bundling discount for Orlando, Florida insurance policyholders, rewarding them for responsible driving.

Cons

- Mixed Customer Service Reviews: Some Orlando, Florida policyholders report difficulties with Progressive’s customer service, which can impact the overall customer experience and support.

- Potentially Higher Rates for Full Coverage: Orlando, Florida drivers may find Progressive’s rates higher for comprehensive coverage options, which might affect their budget.

- Limited Discounts for Certain Situations: Discounts may be less available or have more restrictions for Orlando, Florida owners, potentially limiting savings on their policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Local Agent

Pros

Pros

- Local Agent Network: Allstate’s extensive network of local agents provides personalized service for Orlando, Florida policyholders, offering face-to-face assistance and tailored insurance advice.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate is a financially secure choice for Orlando, Florida drivers, ensuring reliable coverage and stability.

- Extensive Coverage Options: Allstate offers a wide range of coverage options and add-ons, catering to the diverse needs of Orlando, Florida enthusiasts and ensuring comprehensive protection.

- Discounts for New Cars: Orlando, Florida policyholders who insure newer vehicles can benefit from significant discounts, making it a cost-effective option for those with recently purchased cars.

Cons

- Higher Average Premiums: Allstate’s premiums tend to be higher for Orlando, Florida drivers compared to some competitors, which may impact affordability for some policyholders.

- Mixed Claims Satisfaction: Some Orlando, Florida insurance enthusiasts report issues with the claims process, including delays and difficulties in obtaining timely resolutions. Uncover additional insights in our article called, “Allstate Auto Insurance Review.”

- Complex Discount Structure: Understanding and qualifying for Allstate’s discounts can be challenging for Orlando, Florida owners, potentially making it harder to maximize savings.

#5 – USAA: Best for Military Families

Pros

Pros

- Best for Military Families: USAA provides exceptional service tailored for military families, making it a top choice for Orlando, Florida policyholders with military connections seeking specialized insurance.

- Top Financial Ratings: With an A++ rating from A.M. Best, USAA offers strong financial stability for Orlando, Florida drivers, ensuring dependable coverage and reliability.

- Comprehensive Coverage Options: USAA provides extensive coverage options and benefits designed for Orlando, Florida insurance enthusiasts, including unique military-focused features.

- Highly Rated Customer Service: USAA is renowned for its excellent customer service, making it a preferred choice for Orlando, Florida policyholders who value responsive and supportive service.

Cons

- Restricted Eligibility: USAA is available only to military members, veterans, and their families, limiting its accessibility for general Orlando, Florida drivers who do not meet these criteria.

- Limited Local Offices: USAA has fewer local offices, which might be inconvenient for Orlando, Florida owners who prefer in-person interactions with insurance representatives.

- Potentially Higher Rates for Non-Military Drivers: Orlando, Florida policyholders without military affiliations may face higher premiums, which could affect affordability. Get a better grasp by reading our article titled, “USAA Auto Insurance Review.”

#6 – Nationwide: Best for Customer Satisfaction

Pros

Pros

- High Customer Satisfaction: Nationwide is praised for its strong focus on customer service, making it a reliable choice for Orlando, Florida insurance enthusiasts who prioritize positive customer experiences.

- Wide Range of Discounts: Nationwide offers various discounts, including bundling options, benefiting Orlando, Florida drivers by providing opportunities to lower insurance costs.

- On Your Side Review: This personalized review helps Orlando, Florida policyholders ensure they have the right coverage, offering tailored advice and adjustments as needed.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide is a financially secure choice for Orlando, Florida drivers, providing dependable coverage and stability. Discover more by delving into our article entitled, “Nationwide Auto Insurance Review.”

Cons

- Average Digital Experience: Nationwide’s digital tools and mobile apps are functional but less advanced compared to competitors, which might be a drawback for tech-savvy Orlando, Florida enthusiasts.

- Higher Rates for Young Drivers: Younger Orlando, Florida drivers may find Nationwide’s rates higher compared to other insurers, which can impact their affordability.

- Limited Availability of Certain Discounts: Some discounts may not be available in all states or for all Orlando, Florida policyholders, potentially limiting opportunities for savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

Pros

- Customizable Coverage: Liberty Mutual offers a wide range of customizable coverage options for Orlando, Florida drivers, allowing them to tailor their policies to their specific needs.

- Solid Financial Ratings: With an A rating from A.M. Best, Liberty Mutual provides financial stability for Orlando, Florida policyholders, ensuring reliable coverage.

- New Car Replacement: Liberty Mutual includes new car replacement coverage, a valuable benefit for Orlando, Florida enthusiasts who own recently purchased vehicles.

- Roadside Assistance: The company provides extensive roadside assistance, enhancing security for Orlando, Florida drivers in case of emergencies on the road. For further details, consult our article entitled, “Liberty Mutual Auto Insurance Review.”

Cons

- Higher Premiums for Full Coverage: Liberty Mutual can be more expensive for full coverage policies, which might be a concern for Orlando, Florida owners looking to manage their insurance costs.

- Mixed Customer Service Reviews: Some Orlando, Florida drivers report varying experiences with Liberty Mutual’s customer service, which can affect the overall satisfaction with the insurer.

- Limited Discount Availability: Certain discounts may be less accessible or have more restrictions for Orlando, Florida policyholders, potentially reducing savings opportunities.

#8 – Farmers: Best for Multiple Discounts

Pros

Pros

- Multiple Discounts: Farmers offers a variety of discounts, including bundling options, which can benefit Orlando, Florida drivers by lowering their insurance premiums.

- Personalized Service: With a large network of local agents, Farmers provides personalized service to Orlando, Florida policyholders, ensuring tailored insurance solutions.

- Strong Financial Ratings: Farmers holds an A+ rating from A.M. Best, indicating strong financial stability for Orlando, Florida insurance enthusiasts. Deepen your understanding with our article called, “Farmers Auto Insurance Review.”

- Specialty Coverage Options: Farmers offers unique coverage options, such as rideshare insurance, catering to the specific needs of Orlando, Florida drivers.

Cons

- Higher Premiums: Farmers generally have higher premiums compared to other insurers, which may be a drawback for Orlando, Florida policyholders seeking more affordable options.

- Average Claims Process: The claims process is rated as average, with some Orlando, Florida drivers experiencing delays or issues with claim resolutions.

- Limited Online Tools: Farmers’ online and mobile tools are less advanced compared to competitors, which might affect the convenience for Orlando, Florida insurance enthusiasts.

#9 – Travelers: Best for Extensive Coverage

Pros

Pros

- Extensive Coverage Options: Travelers offers a broad range of coverage options, including unique add-ons like gap insurance, making it a comprehensive choice for Orlando, Florida drivers.

- Strong Financial Ratings: With an A++ rating from A.M. Best, Travelers ensures financial stability and dependable coverage for Orlando, Florida policyholders.

- Experienced Insurer: Travelers bring a wealth of experience and expertise to Orlando, Florida drivers, ensuring knowledgeable service and reliable insurance solutions.

- Convenient Digital Tools: Travelers offers user-friendly online tools and a mobile app, making it easy for Orlando, Florida drivers to manage their policies and file claims.

Cons

- Potentially Higher Rates: Travelers’ rates may be higher for some Orlando, Florida drivers, which could impact affordability compared to other insurers. Gain insights by reading our article titled, “Travelers Auto Insurance Review.”

- Complex Policy Options: The range of policy options can be complex, potentially making it challenging for Orlando, Florida policyholders to select the best coverage for their needs.

- Mixed Customer Service Reviews: Some Orlando, Florida drivers report mixed experiences with Travelers’ customer service, which could affect overall satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Claims Service

Pros

- Best for Claims Service: Amica is highly rated for its claims service, providing prompt and fair claim settlements for Orlando, Florida policyholders, ensuring a hassle-free experience during stressful times.

- Strong Financial Ratings: With an A+ rating from A.M. Best, Amica offers financial stability and reliable coverage for Orlando, Florida drivers, making it a secure choice.

- Dividend Policies Available: Amica offers dividend policies that return a portion of premiums to Orlando, Florida insurance enthusiasts, providing an additional financial benefit.

- Comprehensive Coverage Options: Amica provides a wide range of coverage options, ensuring that Orlando, Florida drivers can find policies that meet their specific needs.

Cons

- Limited Availability: Amica’s availability may be limited in certain areas, which could restrict access for some Orlando, Florida drivers. Explore further with our article entitled, “Amica Auto Insurance Review.”

- Higher Premiums: Amica’s premiums are often higher than average, which might be a concern for Orlando, Florida policyholders seeking more affordable options.

- Fewer Discounts: Amica offers fewer discounts compared to some competitors, which may limit savings opportunities for Orlando, Florida insurance enthusiasts.

Cheap Orlando, Florida Auto Insurance Rates by ZIP Code

Cheap Orlando, Florida Auto Insurance Rates by Commute

In Orlando, Florida, the length of your daily commute and your total annual mileage play a crucial role in determining your auto insurance rates. Insurance providers often use these factors to assess risk, with longer commutes and higher mileage typically leading to higher premiums.

State Farm stands out as the top choice in Orlando with its excellent coverage and competitive rates starting at just $68 per month.Jeff Root Licensed Insurance Agent

Understanding how your commute impacts your insurance costs can help you find more budget-friendly options. By evaluating insurance rates based on different commute lengths, you can better navigate your choices and secure the most affordable coverage for your driving habits.

Explore how your specific commute affects your annual auto insurance rates and discover strategies to lower your costs in Orlando. Dive into the details with our article entitled, “High-Risk Auto Insurance Defined.“

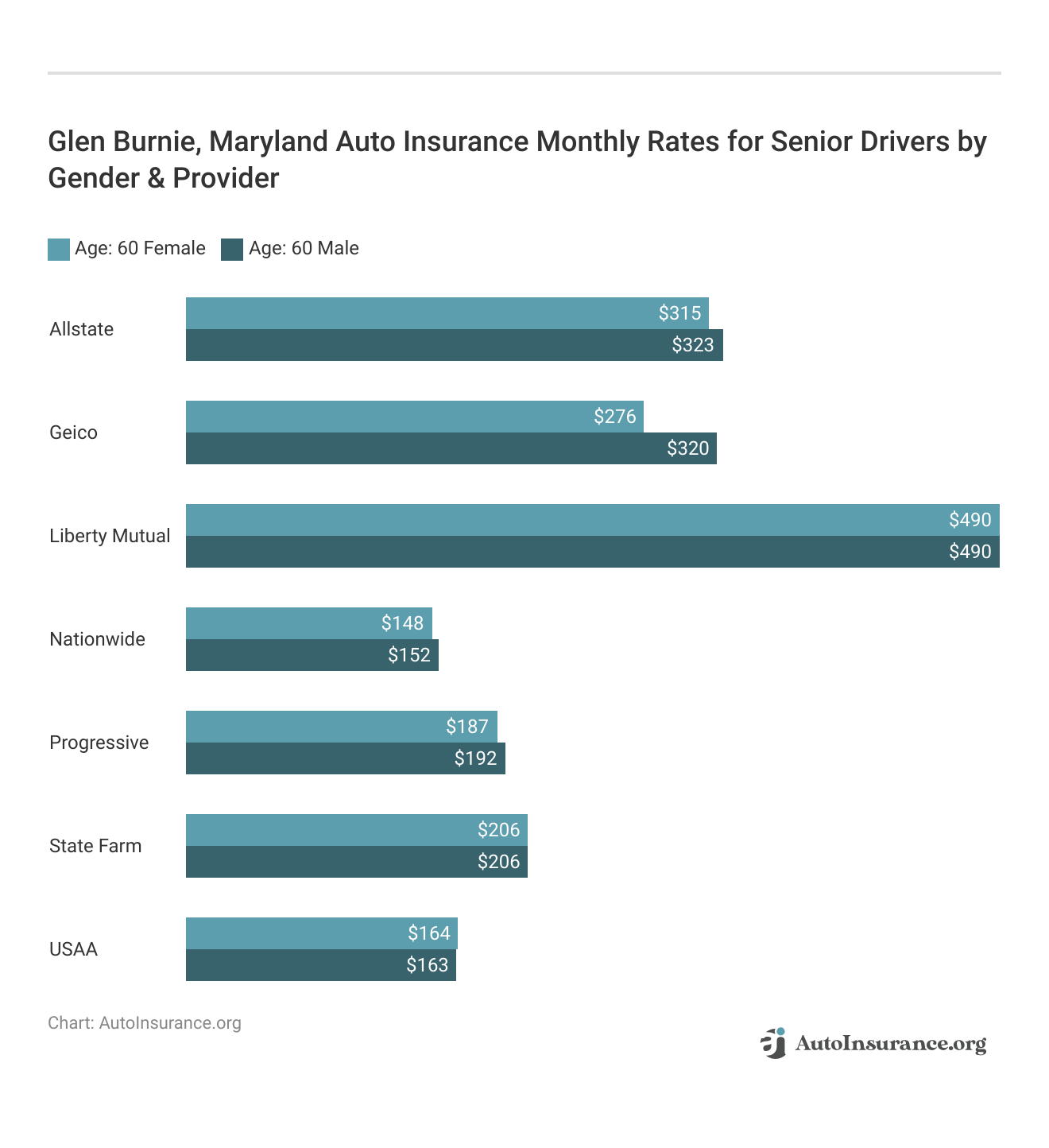

Cheap Orlando, Florida Auto Insurance for Seniors

Auto insurance rates for seniors in Orlando, Florida, can vary based on factors like driving history and vehicle type. To find the best rates, older drivers should compare auto insurance quotes in Orlando FL and take advantage of available discounts, such as those for safe driving or low mileage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Auto Insurance in Orlando, Florida

Driving in Orlando, Florida, comes with the responsibility of meeting state insurance requirements. Florida law mandates that all drivers maintain a minimum level of auto insurance to ensure they can cover costs associated with accidents and protect both themselves and others on the road.

Adhering to these requirements is crucial not only for legal compliance but also for your financial security. Here’s a step-by-step guide to understanding the minimum auto insurance coverage you need in Orlando:

- Understand the Requirement: In Orlando, Florida, state laws mandate that drivers carry auto insurance to comply with financial responsibility regulations.

- Know the Minimum Coverage: The minimum required auto insurance coverage includes specific limits for both bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage addresses expenses for injuries you might cause to others in an accident. Florida sets minimum coverage amounts for this liability.

- Property Damage Liability: This coverage handles the costs associated with damage to others’ property that you might cause in an accident. Minimum coverage limits are specified by the state.

- Verify Your Insurance: Ensure your policy meets or exceeds these minimum requirements to comply with Florida’s laws and provide adequate financial protection in the event of an accident.

By understanding and adhering to these requirements, you can ensure that you’re driving legally and are financially protected on the road. For additional insights, refer to our article called, “Does auto insurance cover passengers in an accident?“

Summary: Best Auto Insurance Options in Orlando, Florida

Finding the best auto insurance in Orlando, Florida, involves comparing top providers like State Farm, Geico, and Progressive, which offer competitive rates starting at $68 per month. These companies are praised for their comprehensive coverage and high customer satisfaction.

Factors such as your ZIP code, driving record, credit history, and demographics significantly influence insurance rates. To get the best deal, it’s essential to compare quotes from multiple insurers and consider how factors like Auto Insurance Rates by ZIP Code impact your premium. Instantly compare quotes by entering your ZIP code (below/above).

Frequently Asked Questions

What are the best auto insurance companies in Orlando, Florida?

The best auto insurance companies in Orlando include State Farm, Geico, and Progressive, known for their competitive rates and strong coverage options. Explore further in our article titled, “Best Commercial General Liability Insurance.“

What are the average auto insurance rates for teen drivers in Orlando, Florida?

Finding cheap auto insurance for teen drivers in Orlando, Florida can be challenging. On average, teen drivers in Orlando may face higher insurance rates due to their lack of driving experience and higher risk profile. Use our free quote comparison tool below to find the cheapest coverage in your area.

What are the minimum auto insurance requirements in Orlando, Florida?

The minimum auto insurance requirements in Orlando, Florida, according to Florida auto insurance laws, are 10/20/10 coverage. This means you must have at least $10,000 in bodily injury liability per person, $20,000 in bodily injury liability per accident, and $10,000 in property damage liability.

How do driving records affect auto insurance rates in Orlando, Florida?

Your driving record plays a significant role in determining your auto insurance rates in Orlando, Florida. A clean driving record with no accidents or traffic violations can result in lower insurance premiums, while a bad driving record may lead to higher rates. Enhance your knowledge by reading our article named, “What is auto insurance?“

How does credit history impact auto insurance rates in Orlando, Florida?

Credit history can have a significant impact on auto insurance rates in Orlando, Florida. Insurance companies often consider credit scores when determining premiums. A higher credit score generally indicates a lower risk profile, which can result in lower insurance rates.

What is the minimum coverage required by law in Orlando, Florida?

In Orlando, the minimum coverage required is $10,000 for bodily injury liability per person, $20,000 per accident, and $10,000 for property damage liability.

What is the starting rate for the top auto insurance in Orlando, Florida?

The top auto insurance in Orlando starts at about $68 per month with providers like State Farm, Geico, and Progressive. For additional insights, refer to our article called, “Where can I compare online auto insurance companies?“

How Does My ZIP Code Affect Auto Insurance Rates in Orlando, Florida?

ZIP code impacts insurance rates from top providers such as State Farm, Geico, and Progressive due to variations in local risk factors.

How do top auto insurance companies in Orlando handle rates for teen drivers?

Top providers in Orlando, including State Farm, often charge higher rates for teen drivers due to increased risk, but comparing quotes can help find the best options. Enter your ZIP code below to compare quotes instantly and find the cheapest insurance available.

Are the Best Auto Insurance Options for Seniors in Orlando?

Seniors can find favorable rates and discounts with top Orlando insurers like State Farm and Geico by exploring age-related benefits and comparing quotes. Find out more by reading our article titled, “Comprehensive Auto Insurance Defined.“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros