OCHO Review for 2026 (Legit Insurance Quotes?)

Our OCHO review highlights how OCHO.co stands out as a licensed insurance agency, not just a quote aggregator. It offers no-down-payment auto insurance with 0% APR and flexible grace periods. Despite slower quote times, it holds a 3.7/5 Trustpilot rating for affordability and user-friendly tools.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated May 2025

In this OCHO review, we take an honest look at how OCHO sets itself apart from traditional insurance comparison sites.

OCHO Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.8 |

| Customer Support | 2.4 |

| Discount Clarity | 2.8 |

| Ease of Use | 2.8 |

| Educational Resources | 2.3 |

| Provider Network | 3.8 |

| Quote Accuracy | 2.5 |

| Quote Speed | 2.7 |

| Savings Potential | 2.7 |

OCHO operates as a licensed insurance agency, giving it the ability to not only compare real-time quotes from top-rated providers but also directly facilitate policy purchases.

- OCHO review notes a 3.7/5 Trustpilot rating for affordability and ease of use

- Offers 0% APR and average down payments as low as $62 for eligible users

- Provides up to 58% savings potential with a 96% customer satisfaction rate

AutoInsurance.org is where to compare auto insurance rates, offering access to trusted providers with industry-leading quote speed and average yearly savings of $540.

AutoInsurance.org helps you find the lowest rates and offers 25% more coverage options per request when you enter your ZIP code to compare.

Pros and Cons of OCHO

| Pros/Cons | |

|---|---|

| ✅ Pros | • $0 down payment options with 0% APR financing. • Flexible biweekly payment plans aligned with paydays. • On-time payments may help build credit. |

| ❌ Cons | • Available only in select states. • Quote process may take up to 10 minutes. • Limited to auto insurance offerings. |

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Insurance Quotes on OCHO.co

OCHO offers a consumer-friendly auto insurance financing solution with many attractive features. It provides $0 down payment options and 0% APR financing, making it easier for customers to begin coverage without immediate out-of-pocket costs. Customers can also get free online auto insurance quotes, making the process simple, accessible, and budget-friendly right from the start.

Getting a quote through OCHO.co is quick, simple, and built to fit your budget. It connects you with top providers and streamlines the process of comparing online auto insurance companies.

OCHO Platform Overview

| Details | |

|---|---|

| Real-Time Quotes | Yes |

| Average Quote Time | 2–10 minutes |

| Insurance Types Compared | Car (Liability, Comprehensive, Collision) |

| Providers Compared | 15–20+ |

| Shares Contact Info | Yes |

| Customer Support | Phone, email, and live chat support |

| Platform Focus | Car insurance with flexible financing options |

Shoppers can buy auto insurance online instantly through the OCHO.co website, and it also provides 0% APR financing for the down payment, so drivers can find quality coverage without a hefty starting fee.

OCHO Pay offers flexible, interest-free payments, but users should check state availability since eligibility details aren’t clearly listed in the content.Tonya Sisler Insurance Content Team Lead

The flexible bi-weekly payment plans correspond to the usual payday dates to make budgeting easier. Also, on-time payments could help some customers establish or improve their credit history. But the service is currently only offered in a handful of states, limiting use for some customers.

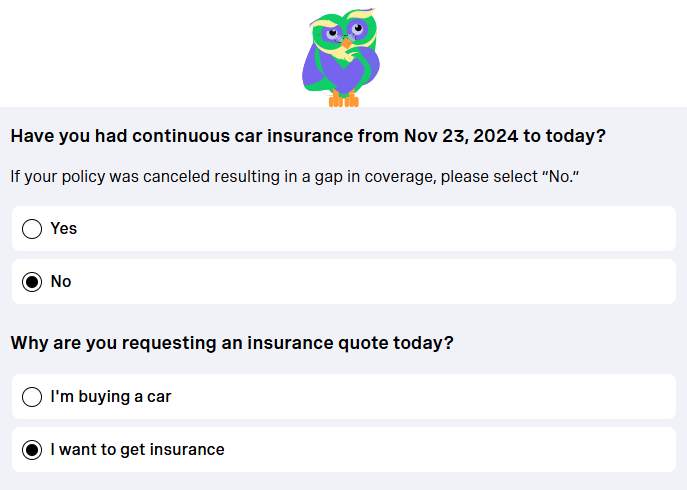

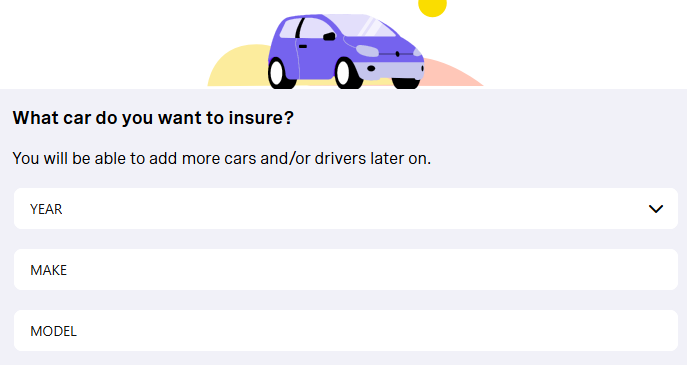

The OCHO quote tool delivers a streamlined and visually engaging experience designed to make shopping for auto insurance simple and accessible.

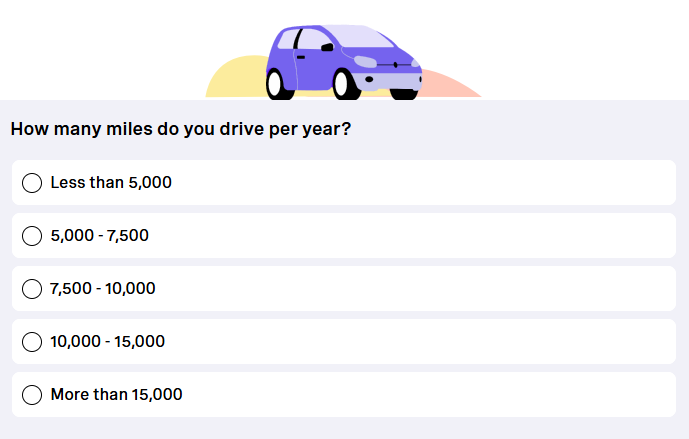

Users start by entering their ZIP code and are then guided through a series of easy-to-understand questions, including whether they’ve had continuous coverage, their reason for requesting a quote, and basic vehicle details such as year, make, and model.

The tool also requests an approximation of annual mileage to further tailor the quote. Its clean interface, bright illustrations, and animated owl mascot create a friendly, conversational feel, while secure SHA-256 encryption ensures data protection.

With the ability to add more drivers or vehicles later, and a design that caters to both first-time users and returning customers, OCHO’s quote tool stands out as an efficient and user-centric option for finding affordable, tailored auto insurance coverage.

OCHO Holdings Co. acts as an insurance broker and delivers instant quotes from leading insurance companies via its quote tool.

It compares 15–20+ providers at once, but it can take up to 10 minutes to get quotes. The process does speed up a little with the OCHO app, but other online insurance comparison sites find quotes much faster.

OCHO Insurance Reviews

When comparing third-party customer ratings, OCHO holds its own against more established platforms like Insurify and NerdWallet, particularly on Trustpilot, where it boasts an impressive 3.7/5 rating. However, that is from just one review compared to the thousands of users on other sites.

OCHO vs. Insurify vs. NerdWallet: Third-Party Customer Ratings

| Review Platform | |||

|---|---|---|---|

| 4.7 / 5 500+ reviews | 3.4 / 5 141 reviews | 4.8 / 5 115k+ reviews |

|

| A+ | A+ | A+ | |

| NA | 3.8 / 5 130+ reviews | NA | |

| 4.2 / 5 150+ reviews | 3.4 / 5 141 reviews | 3.7 / 5 2k+ reviews |

|

| 3.7 / 5 1 review | 4.7 / 5 2,000+ reviews | 1.5 / 5 10+ reviews |

Despite fewer review sources, OCHO’s strong Trustpilot score indicates high customer satisfaction, especially for a newer platform focused on affordability and financing.

A Facebook user, Sylvester Rosario, recommends OCHO as an auto insurance broker that makes it easy to get insured with no down payment and helps build credit.

He found an affordable policy and suggests OCHO is a great option for those looking for the best companies for credit-based auto insurance.

OCHO.co vs. Insurify vs. NerdWallet Insurance Comparison

OCHO, Insurify, and NerdWallet each offer distinct advantages, but OCHO stands out with a 58% savings potential and a high 96% customer satisfaction rate.

OCHO vs. Insurify vs. NerdWallet: Compare Top Insurance Sites

| Feature | |||

|---|---|---|---|

| Savings Potential | 58% | 30% | 20% |

| Monthly Savings | $50 | $420 | $300 |

| Fastest Quote Time | 2 minutes | 2 minutes | 5 minutes |

| Providers Compared | 15–20+ | 120+ | 700+ |

| Customer Satisfaction | 96% | 94% | 89% |

The OCHO Financial 0% APR down payment financing also adds unique value for budget-conscious users. Insurify delivers the highest average monthly savings at $85 and access to over 100 providers.

NerdWallet offers the broadest network with 700+ providers, but lags with a 20% savings potential, $25 monthly savings, and an 89% satisfaction rate. Learn more in our NerdWallet review.

AutoInsurance.org Saves You 40% More on Car Insurance

AutoInsurance.org is a website that finds and shares the best car insurance products from top providers. Known for its efficiency and reliability, the platform consistently outperforms other comparison sites by delivering 40% more savings, helping drivers find better rates without compromising coverage.

AutoInsurance.org makes comparing different types of auto insurance more manageable, helping drivers maximize value and minimize effort.

AutoInsurance.org has a simple user interface and fast quoting process. It was created to help the average shopper find cheap and full coverage auto insurance in just a few clicks.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get Instant Insurance Quotes and Deals With OCHO.co

In this OCHO review, the platform is a strong choice for self-employed individuals and cost-conscious drivers. Users can compare quotes for cheap auto insurance with no down payment, and free tools like OCHO Pay and PriceCheck help users save money and avoid price hike surprises.

While it lacks broad financial products and may not suit traditional employees, the OCHO Company General Partnership stands out for those looking to find affordable auto insurance rates online with flexible, user-focused solutions.

AutoInsurance.org lets you compare quotes from top insurers and maintains a 98% user satisfaction rate. Enter your ZIP code to check for better auto insurance deals.

Frequently Asked Questions

Who are the founders of OCHO.co?

The founders of OCHO are Lulu Luchaire, Akshay Buradkar, and Jaime Gutierrez.

What do customers say about OCHO insurance quote accuracy?

Users frequently praise OCHO.co for providing accurate, final quotes with minimal price surprises. Tools like PriceCheck allow them to compare real-time rates and avoid the bait-and-switch common with other platforms.

Still searching for the best rate? Use our free comparison tool, AutoInsurance.org helps users save an average of $540 per year on full coverage.

How does OCHO work with insurance providers?

OCHO is a licensed insurance agency that partners with multiple top-rated carriers to provide auto insurance for different types of drivers. It searches real-time quotes and presents policy options so users can compare and choose what fits best.

Does OCHO offer support for non-traditional workers?

OCHO was built with freelancers, gig workers, and self-employed individuals in mind, offering flexible payment plans and financial tools designed for independent earners, but it can help anyone find cheaper auto insurance.

How does AutoInsurance.org help me find the best car insurance rates?

AutoInsurance.org simplifies the comparison process by giving you access to over 50 top-rated insurers, allowing you to quickly review and choose from a wide range of competitive quotes—all in one place.

How do you use OCHO Pay for flexible payments?

OCHO Pay makes it easy to pay my auto insurance online in 12 equal, interest-free installments. Payments sync with your paycheck schedule, offering better budget control and avoiding large upfront costs.

Is there a minimum down payment required for OCHO auto insurance?

OCHO car insurance specializes in lowering or eliminating upfront costs. While eligibility varies, many users qualify for $0 down, and others pay an average of just $62, significantly less than the typical 50% down required elsewhere.

What are the most common OCHO complaints from users?

Most OCHO complaints relate to limited provider availability in certain states, delays in processing payments, and occasional miscommunication during the sign-up process. However, many users also note that the company responds quickly to resolve issues.

Does OCHO help build credit?

Yes, along with OCHO affordable car insurance, drivers have tools like OCHO Pay to help them pay on time and build credit. That positive history will lower auto insurance rates over time.

Can I build credit using OCHO Financial services?

Absolutely. When you make on-time payments through OCHO Pay, OCHO Financial reports them to credit bureaus, giving you a chance to improve your credit score while maintaining accident coverage.

Is the OCHO Insurance phone number the best way to change my payment date?

Are there any complaints mentioned in OCHO.co reviews on Reddit?

How reliable are OCHO.co reviews on BBB compared to other platforms?

Can I get auto insurance through the OCHO agency with no down payment?

Is the OCHO available in all states?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.