Liberty Mutual vs. Geico Auto Insurance in 2026 (Head-to-Head Review)

Comparing Liberty Mutual vs. Geico auto insurance shows that one provider is much cheaper – Geico car insurance quotes are as low as $43 per month, while Liberty Mutual starts at $96. However, Liberty Mutual receives higher customer service scores and a maximum UBI discount of 30% with RightTrack.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2026

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsWhen you compare Liberty Mutual vs. Geico auto insurance, you’ll find that customers are more satisfied with Liberty Mutual, but Geico is cheaper.

Geico is also the larger insurance company, and it has the better financial ratings to match.

Liberty Mutual vs. Geico Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.8 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.4 |

| Customer Satisfaction | 2.0 | 2.3 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 4.3 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.5 | 4.5 |

| Liberty Mutual Review | Geico Review |

However, Liberty Mutual maintains a base of loyal customers with excellent service and generous discounts on insurance.

- Geico typically has cheaper car insurance rates for most drivers

- Liberty Mutual provides more discounts and coverage variety

- Geico has higher financial ratings, but Liberty Mutual scores higher on service

You can compare Geico vs. Liberty Mutual auto insurance options, rates, and programs below to decide which company is best for you. Then, enter your ZIP code into our free comparison tool to see even more prices in your area.

Comparing Liberty Mutual vs. Geico Auto Insurance Cost

Many factors affect car insurance rates and determine whether Geico or Liberty Mutual is the cheapest for you. Your age, driving record, and credit score are just a few variables used to calculate Geico and Liberty Mutual car insurance rates. Your coverage level also makes a big difference.

For example, Geico’s full coverage costs around half the price offered by Liberty Mutual. So, Liberty Mutual is not cheaper than Geico. Before we delve into more specific costs, you can compare Geico and Liberty Mutual minimum and full coverage rates with other top providers below.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Since each driver’s personal factors differ, rates will vary. We compare average auto insurance by demographic below to give you an idea of what to expect.

Liberty Mutual vs. Geico Rates by Driving Record

One of the most significant factors affecting car insurance rates is your driving record. Auto insurance companies use your driving record to indicate if you’ll cost them money. As a result, risky drivers see much higher car insurance rates than drivers with clean records.

This table shows the average monthly Liberty Mutual and Geico auto insurance quotes based on your driving record.

Liberty Mutual vs. Geico Full Coverage Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $248 | $114 |

| Not-At-Fault Accident | $335 | $189 |

| Speeding Ticket | $302 | $151 |

| DUI/DWI | $447 | $309 |

Geico monthly car insurance costs are significantly lower for drivers with infractions on their driving record. Liberty Mutual may not be a good choice for high-risk drivers.

Liberty Mutual vs. Geico Rates by Age & Gender

Young drivers pay higher car insurance rates since they lack experience and are more likely to be in an accident. Conversely, older drivers typically see lower car insurance rates since they have more time behind the wheel.

This table shows the average Liberty Mutual and Geico monthly car insurance rates based on age.

Liberty Mutual vs. Geico Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $1,031 | $425 |

| 16-Year-Old Male | $1,121 | $445 |

| 30-Year-Old Female | $249 | $128 |

| 30-Year-Old Male | $285 | $124 |

| 45-Year-Old Female | $244 | $114 |

| 45-Year-Old Male | $248 | $114 |

| 60-Year-Old Female | $211 | $104 |

| 60-Year-Old Male | $227 | $106 |

Once again, Geico’s quotes are more affordable, especially for teen drivers. Teens can save around $250 a month by choosing Geico over Liberty Mutual.

Liberty Mutual vs. Geico Rates by Credit Score

You may not be aware that your credit score affects your Liberty Mutual and Geico insurance rates. However, Liberty Mutual and Geico calculate car insurance rates using your credit score in states where it’s legally permitted. Drivers with a higher credit score are less likely to file an insurance claim and will pay for damages out of pocket. Thus, rates are lower.

How much does Geico car insurance cost on average for drivers with bad credit? What’s Liberty Mutual’s average car insurance cost?

This table shows the average monthly car insurance rates based on credit scores from Liberty Mutual and Geico.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $90 | $105 | |

| $52 | $60 | $70 | |

| $56 | $64 | $76 |

| $74 | $85 | $100 | |

| $55 | $63 | $74 | |

| $82 | $94 | $111 |

| $64 | $74 | $86 | |

| $71 | $82 | $96 | |

| $59 | $68 | $80 | |

| $70 | $81 | $95 |

Geico provides the lowest car insurance rates regardless of credit score. However, keep in mind that some states, like California, don’t allow insurers to use credit scores to calculate rates. Check your state insurance laws as you compare Liberty Mutual vs. Geico auto insurance to get the best possible coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Mutual vs. Geico Auto Insurance Options

When you shop at either Liberty Mutual or Geico, you’ll have access to all the standard types of car insurance. This includes:

- Liability Insurance: Liability insurance covers your financial responsibilities after you cause an accident. It pays for damage to property and injuries you cause.

- Collision Insurance: If you want help paying for your car repairs after an accident, you need collision insurance.

- Comprehensive Insurance: Comprehensive coverage handles unexpected events that damage your vehicle, including fire, floods, theft, and vandalism.

- Personal Injury Protection/Medical Payments: Personal injury protection (PIP) insurance and medical payments (MedPay) coverage pay the health care costs of you and your passengers after an accident.

- Uninsured/Underinsured Motorist: Although most states require insurance before you can drive, not everyone follows the law. Uninsured/underinsured motorist coverage protects you against drivers with inadequate insurance.

These basic types of insurance make up most minimum and full coverage insurance policy needs. Like most major companies, Liberty Mutual and Geico offer add-ons so you can customize your policies.

Despite being one of the largest insurance companies in America, Geico lacks popular add-ons. For example, there is no Geico gap insurance.Kristen Gryglik Licensed Insurance Agent

With Geico, you can purchase rental reimbursement coverage and mechanical breakdown insurance.

Liberty Mutual’s selection is longer than Geico’s, making it a better choice for drivers looking to customize their coverage. When you buy a policy at Liberty Mutual, you can purchase the following add-ons:

- Rental car reimbursement

- New car replacement

- Gap coverage

- Original parts replacement

- Accident forgiveness

You can also purchase Mexico travel coverage if you’re planning a road trip south of the border. Whichever company you purchase insurance from, you should be careful about adding coverage. Add-ons increase the coverage in your policy, but they also increase your rates.

Liberty Mutual vs. Geico Roadside Assistance

The best roadside assistance plans help drivers with car trouble. However, the exact coverages vary by company. In addition, goods aren’t covered. So, for example, if you run out of gas, you still must pay for the gas, but delivery is free.

Liberty Mutual and Geico offer drivers peace of mind if they need help on the side of the road. Each company offers slightly different services and prices. Keep reading to learn more about roadside assistance from Geico and Liberty Mutual.

Liberty Mutual’s roadside assistance includes:

- Jump starts

- Towing to the nearest qualified repair shop

- Changing a flat tire

- Fuel delivery

- Locksmith services

These services are available 24/7 and can be accessed through the Liberty Mutual app or by calling 1-800-426-9898.

Geico roadside assistance covers a bit more than a Liberty Mutual plan. When you add roadside assistance to your Geico policy, you’ll get access to the following services:

- Towing to the nearest repair shop within 20 miles

- Jump starts

- Changing a flat tire

- Locksmith services up to $100

- Winching

- Fuel delivery

Geico also offers 24/7 assistance, which can be accessed through the Geico app or by calling the Geico roadside assistance number at 1-800-424-3426.

Auto Insurance Discounts for Liberty Mutual & Geico

Geico and Liberty Mutual both offer a variety of discounts to help drivers save, including discounts for things like being a safe driver and paying for your policy upfront.

Liberty Mutual has a few more discount options than Geico, but you'll need to check with a representative to see what's available in your area.Scott W. Johnson Licensed Insurance Agent

Check below to compare how much you can save with some of Liberty Mutual and Geico’s most popular auto insurance discounts.

Liberty Mutual vs. Geico Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Accident-Free | 20% | 22% |

| Anti-Theft | 35% | 25% |

| Bundling | 25% | 25% |

| Good Driver | 20% | 26% |

| Good Student | 12% | 15% |

| Military | 10% | 15% |

| Multi-Car | 25% | 25% |

| Safety Features | 12% | 15% |

Each company also offers exclusive discounts. For example, you can get the following discounts only at Liberty Mutual:

- Automatic Payments: Sign up for automatic payments from a bank account to earn this Liberty Mutual discount.

- Early Shopper: Sign up for a new Liberty Mutual policy before your old coverage with a different provider ends for this discount.

- Student Away at School: Full-time students attending a college 100 miles or more from home can earn significant savings by leaving their car at home.

If you purchase a policy from Geico, you’ll have other discount options. In fact, Geico is well-known for offering some of the best auto insurance for federal employees because of its government workers discount. Geico offers the following discounts you won’t find at Liberty Mutual:

- Federal Employee Discount: Geico offers a discount of up to 8% to government workers.

- Emergency Deployment: Military members can save up to 25% on their coverage when they’re called for an emergency deployment.

- Driver’s Education Discount: Drivers under 25 who complete a driver’s ed course will earn this discount as long as Geico approves the class.

- New Vehicle Discount: If your car is newer than three model years, you may qualify for a 15% discount.

Liberty Mutual may offer a few more discounts than Geico, but Geico is still the cheaper option for most drivers. However, that doesn’t mean you can’t get affordable rates with Liberty Mutual. Most discounts automatically apply to your account, but you can check with a representative if you’re worried.

Liberty Mutual vs. Geico Usage-Based Insurance

Liberty Mutual and Geico offer discounts for participating in their usage-based car insurance programs. Each company uses telematics to monitor driving habits and provides a discount based on how well you score.

While both insurers offer a discount based on safe driving, they differ when it comes to which habits they monitor and how much you can save.

Liberty Mutual’s RightTrack uses an app to monitor driving behaviors such as speeding, hard braking, and the time of day you drive. Drivers with safe driving habits can save up to 30%, and rates don’t increase for scoring poorly. If you want to learn more about this UBI program, check out our Liberty Mutual RightTrack review.

Our Geico DriveEasy review shows that this UBI program also uses an app to track driving habits, including distracted driving, hard braking, and the time of day you drive. Safe drivers earn up to a 25% discount. However, Geico may raise your rates if DriveEasy reports risky driving.

Liberty Mutual vs. Geico Auto Insurance Customer and Business Ratings

While rates are essential when choosing a car insurance company, consumer ratings are also important. You need to know that you can depend on your company when you need it. Cheap rates aren’t helpful when you can’t get good customer service, as you can see in this Reddit discussion.

GEICO or Liberty Mutual Auto insurance?

byu/randrae inInsurance

If you read through some of these Reddit comments, you’ll notice a trend. Many of the Reddit users agree that Geico is the cheaper option, but they also say that Liberty Mutual is the better company to work with.

Many users prefer to pay a little more at Liberty Mutual for a better experience. Often, customers at both companies look for either Geico similar companies or Liberty Mutual similar companies when they want to switch providers.

Of course, customer reviews aren’t the only thing you should look at. Third-party rating companies offer valuable insight to how well an insurance provider performs. check below to compare Liberty Mutual and Geico’s ratings.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual vs. Geico

| Agency |  | |

|---|---|---|

| Score: 717 / 1,000 Above Avg. Satisfaction | Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A- Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

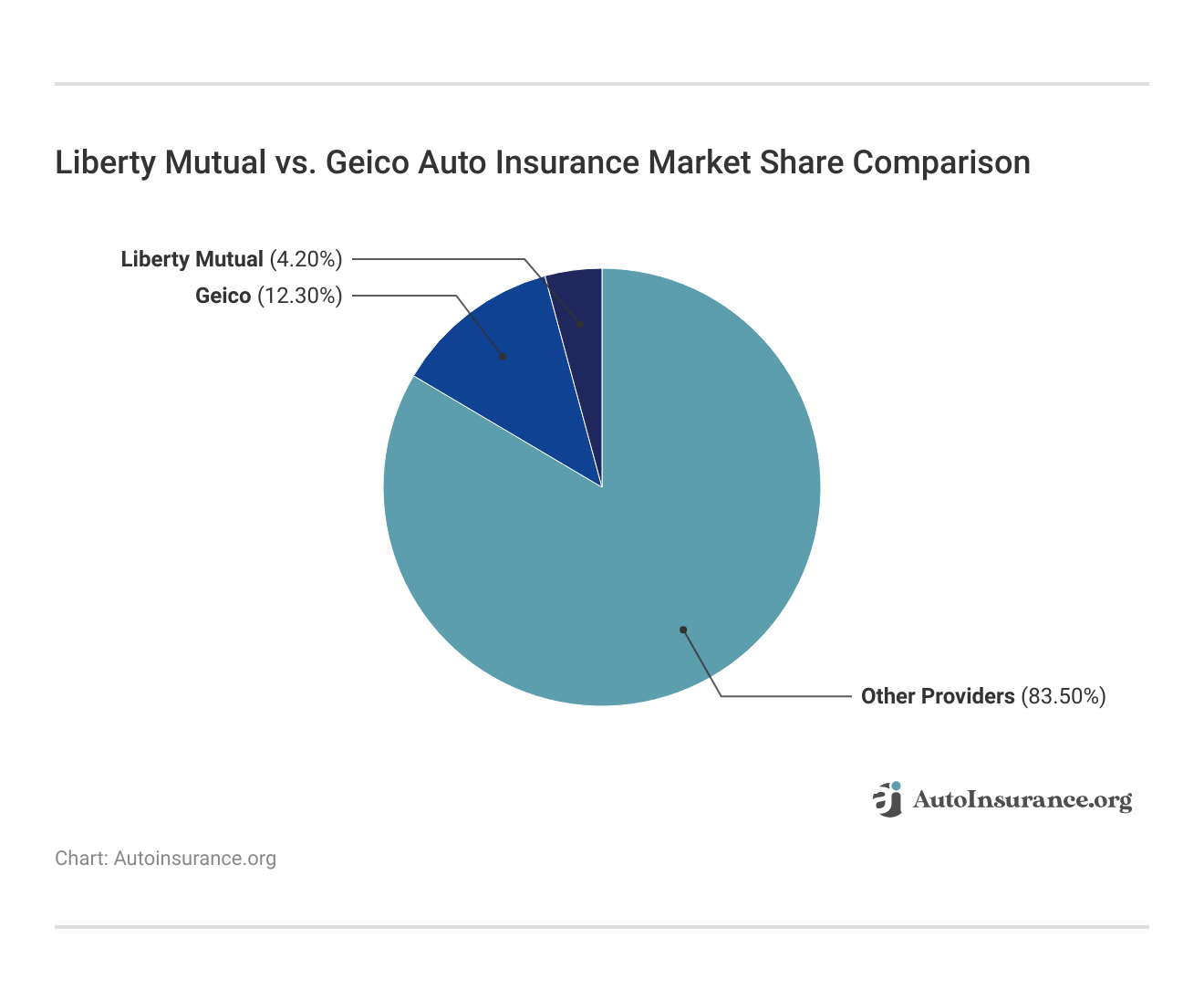

Although some of the best coverage comes from smaller providers, some drivers prefer to shop with larger companies. Geico isn’t the largest insurance provider in the U.S., but it definitely sells more policies than Liberty Mutual. You can see exactly how large Geico is by comparing both companies’ market shares.

Whichever company you decide is right for you, you’ll likely have a good experience. Where Geico lacks in customer service, it makes up for with affordability. On the other hand, Liberty Mutual might be a bit costlier, but most customers swear by its claims service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Liberty Mutual vs. Geico Auto Insurance Policies Today

Liberty Mutual and Geico are two of the top insurance companies in the nation. Both companies offer various types of auto insurance and have similar ratings. However, Geico tends to be the cheapest, and Liberty Mutual offers more discounts and specialty coverages.

Whether Liberty Mutual or Geico is the best insurance company depends on the driver. While some drivers may need specialty coverage like rideshare insurance, other drivers may need the cheapest rates available.

Auto insurance rates aren’t the same for everyone. Looking to find the right coverage for the best price? Use our free comparison tool to see Liberty Mutual and Geico quotes side by side and pick the policy that fits you best.

Frequently Asked Questions

Is Liberty Mutual or Geico better?

Whether Liberty Mutual or Geico is better depends on the driver. For example, high-risk drivers like teens and those with infractions on their driving records tend to find a lower auto insurance quote from Geico.

Who is cheaper, Geico or Liberty Mutual?

Again, this depends on the driver. Since many factors affect the cost of car insurance, each driver receives different rates from Liberty Mutual and Geico. However, Liberty Mutual quotes tend to be higher than Geico.

Enter your ZIP code to get started on finding the cheapest insurance provider for your needs.

Does Geico own Liberty Mutual?

No, Geico does not own Liberty Mutual. However, Geico does use Liberty Mutual to provide homeowners insurance in certain circumstances.

Is Liberty Mutual cheaper than Geico?

The car insurance rates offered by Liberty Mutual and Geico can vary depending on several factors, including your location, driving history, type of vehicle, and coverage needs. However, it can be difficult to find car insurance cheaper than Geico in many cases.

Learn More: Cheapest Auto Insurance Companies

What coverage options are available with Liberty Mutual and Geico?

Both Liberty Mutual and Geico offer a range of coverage options for car insurance, including liability coverage, collision coverage, comprehensive coverage, medical payments coverage, and uninsured/underinsured motorist coverage.

However, the specific coverage options, limits, and additional features may differ between the two companies. It’s important to review the details of each company’s policies to understand their offerings.

Do Liberty Mutual and Geico provide similar discounts?

Both Liberty Mutual and Geico offer various discounts to help policyholders save on their car insurance premiums. Common discounts may include safe driver discounts, multi-policy discounts, multi-vehicle discounts, good student discounts, and discounts for certain safety features installed in your vehicle.

However, the availability and specifics of these discounts can vary between the two companies.

How is the customer service of Liberty Mutual compared to Geico?

Evaluating customer service experiences can be subjective, as it can vary from person to person. Both Liberty Mutual and Geico have customer service departments that handle inquiries, claims, and policy management. It’s recommended to research customer reviews, ratings, and feedback about their customer service experiences to get a better understanding of how they compare.

Is Geico or Liberty Mutual better?

Whether Liberty Mutual is better than Geico or vice versa depends on an individual’s needs. Both companies have strengths and weaknesses. Liberty Mutual provides more customizable policies, while Geico is known for its competitive rates and strong customer service.

How do you obtain a quote for auto insurance with Geico?

To get insurance quotes from Geico, visit the Geico website, click on “Get a Quote”, and enter the required information, such as your vehicle details, personal information, and driving history.

Does car insurance go down at 25 with Geico?

Yes, Geico insurance quotes often decrease when drivers turn 25, as they are considered less risky than younger drivers.

How much is Geico auto insurance?

Does Liberty Mutual offer gap insurance?

Is Geico a good car insurance company?

Is Liberty Mutual a good auto insurance company?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.