Markel Auto Insurance Review for 2026 (See if They’re a Good Fit)

Markel auto insurance covers classic and high-value vehicles, starting at $54 monthly. This Markel auto insurance review details their unique classic car insurance program, which safeguards restored or collector vehicles with specialized protection unavailable from standard insurers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated December 2024

This Markel auto insurance review shines a light on the company’s unique services, such as particular coverage for classic and high-value cars.

Markel is recognized for offering protection to collector cars and rare valuables, providing full safeguards that typical insurance companies may not consider.

They maintain a strong A+ rating from BBB by addressing distinctive requirements through tailored programs and specialized underwriting.

Markel Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 5.0 |

| Claim Processing | 4.6 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.8 |

| Customer Satisfaction | 1.8 |

| Digital Experience | 3.5 |

| Discounts Available | 4.3 |

| Insurance Cost | 4.5 |

| Plan Personalization | 4.0 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Their traditional car insurance plan is very noticeable, offering protection specially designed for reclaimed and collector’s cars. Markel’s dependability and emphasis on unique insurance make it a dependable alternative for particular markets. You can start comparing auto insurance rates side-by-side by entering your ZIP code above.

- Markel auto insurance earns a solid 4.4 rating for coverage

- Specialized programs for classic and high-value vehicles

- Reliable protection with tailored options for unique needs

What You Should Know About Markel Auto Insurance Company

As a general rule, Markel Service, Inc. receives fairly good reviews from customers who are willing to post to independent review sites. Those who like the company tend to remark that Markel was the only place to find specialty insurance for their niche needs.

Most notable were those searching for coverage for their scooters in areas where standard auto insurance was inadequate. Common complaints include things like poor billing practices and less-than-desirable customer service. Explore the specifics of what standard auto insurance covers in your policy.

Markel Corp. is a member of the Virginia Better Business Bureau and currently has a rating of A+.

According to the BBB, they have received a total of six complaints within the last three years; two of them occurred within the last 12 months. All complaints were closed after Markel Assurance demonstrated that they were addressed to the customer’s satisfaction. Of the six complaints, two were in relation to advertising and sales while the other four were concerned a product or service the company provides.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Markel Insurance Company Insurance Rates Breakdown

Customers will not find a quote tool, or any references to quotes for that matter, on the Markel Corporation website. However, the individual subsidiary sites do offer online quote tools. Markel American, for example, allows you to begin the quote process by clicking a button located strategically in the right column of their main page.

Markel Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $280 | $620 |

| Age: 16 Male | $315 | $680 |

| Age: 18 Female | $220 | $520 |

| Age: 18 Male | $250 | $580 |

| Age: 25 Female | $140 | $310 |

| Age: 25 Male | $160 | $350 |

| Age: 30 Female | $95 | $220 |

| Age: 30 Male | $105 | $240 |

| Age: 45 Female | $55 | $125 |

| Age: 45 Male | $54 | $121 |

| Age: 60 Female | $60 | $140 |

| Age: 60 Male | $65 | $145 |

| Age: 65 Female | $70 | $160 |

| Age: 65 Male | $75 | $170 |

Like with any quote tool, it is assumed users will need to provide their address and zip code along with pertinent information about the vehicles they want to cover. Quotes for their other insurance covers work similarly on subsidiary sites with embedded quote tools. Of course, interested consumers can always contact the individual subsidiary directly and speak to a representative.

The company also utilizes independent auto insurance agents you can contact for quotes. In some instances, such as classic car insurance, an agent will most likely have to visit your location and do a personal inspection before a quote can be rendered.

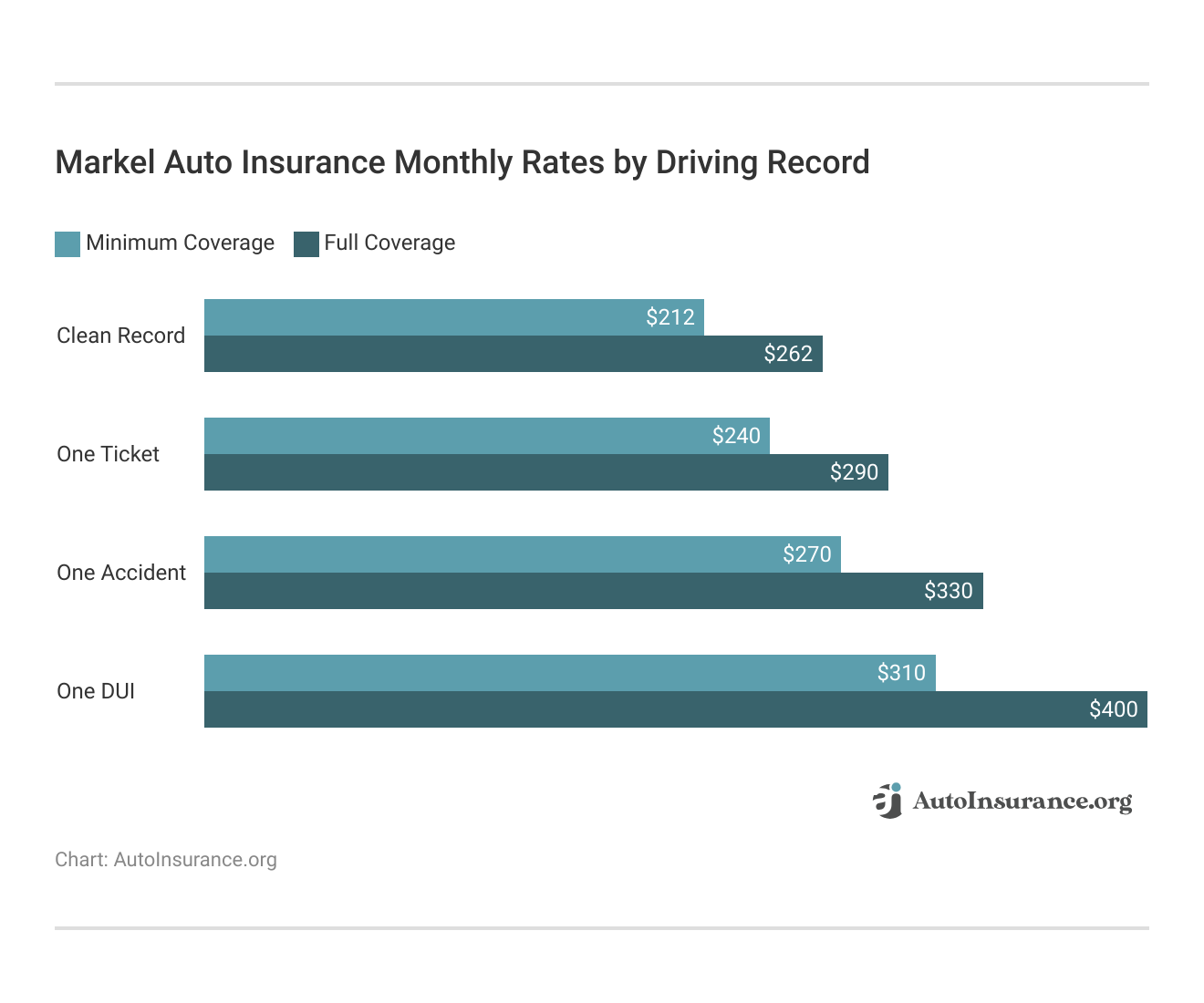

The car insurance costs from Markel significantly change depending on the driving record, and they offer reduced premiums for drivers with good records. For those with a clean history, the prices can go as low as $54 for limited coverage, while events such as DUIs could increase full cover rates to $200. The table below shows how much monthly costs vary at different coverage levels based on your driving background.

Markel Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $54 | $121 | |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 |

Examining monthly insurance rates side-by-side helps drivers pinpoint the best options for their budget and coverage needs. This table breaks down minimum and full coverage costs across major providers, showcasing Markel’s position among its competitors.

Read more: What are the recommended auto insurance coverage levels?

Markel Auto Insurance Agents and Locations

Markel Corp. maintains its Virginia headquarters, four regional offices, the Markel American office, and an international office. All these offices’ contact information is freely available on the corporate website. Through their acquisitions over the years, they may also have some local offices scattered around the country, even though their website doesn’t list any.

While Markel works directly with customers regarding selling and servicing policies, it also has a network of independent brokers nationwide.

There are brokers in every state, so you should be able to find one in your area.

Markel’s website makes finding a local broker easy with an interactive map showing all 50 states. Customers click on their state and wait a few seconds for the website to return a complete list of names and contact information. In more rural areas, you may not find a local broker in your immediate vicinity, but you should be able to find one within a reasonable distance.

Don’t let your car🚗 insurance lapse. Did you realize that continuous coverage can help you save 12% or more 💰on your premiums? Check out our tips for managing your policy👉: https://t.co/pJPWidaV8K pic.twitter.com/Ou2OFsytvb

— AutoInsurance.org (@AutoInsurance) November 16, 2024

Markel Insurance is a reputable insurance provider known for its strong financial stability and customer service. Here is some basic information about them:

- Markel Insurance Company Address: 4521 Highwoods Parkway Glen Allen, VA 23060

- Markel Insurance Company Phone Number: 1-800-431-1927

- Markel Insurance Customer Service Phone Number: 1-800-431-1927; choose the option for customer service

- Markel Motorcycle Insurance Phone Number: 1-800-236-2353

- Markel Insurance Company A.M. Best Rating: A+

- Markel Insurance Locations: Markel Insurance operates in multiple locations across the United States

Markel’s offices are located in America and internationally. Markel Insurance even operates in Hawaii. Markel’s Corporate Headquarters, located in Richmond, Virginia, oversees its diverse insurance offerings. Markel has offices across the United States and globally, supporting their wide-ranging clientele.

Markel Insurance Company Insurance Coverage Options

Markel Corp. doesn’t provide standard auto insurance in the same vein as some national auto insurance companies you see on television. Being a specialty and niche provider, their auto insurance is for classic and highly high-value vehicles. Learn how classic car insurance protects restored collector cars.

For example, if you had restored a classic Ford Hudson to the point where it became extremely valuable on the collector’s market, your standard auto policy wouldn’t do you much good. But Markel will write a policy that covers not only accidents and deaths but also any other possible circumstance that can result in the loss of the vehicle.

A Reddit user talked about Markel Specialty, saying it has been in the insurance business for a long time, at least since the 1970s. They pointed out that there is lots of information on the company’s website, which makes it very helpful to learn more about what Markel offers.

Comment

byu/Jeebus_FTW from discussion

inadjusters

The user pointed out that handling claims could be especially interesting because the company focuses on specialty markets. They also gave positive words, hoping for success to anyone looking for a job with Markel.

Drivers with clean records can secure Markel auto insurance for as low as $54 monthly, making it highly competitive.Jeff Root Licensed Insurance Agent

Markel auto insurance provides many kinds of coverage to fit drivers’ and car owners’ needs. Each choice is made for particular risks, so you get protection from usual problems and surprising events.

Markel Auto Insurance Coverage Options

| Coverage Name | What it Covers |

|---|---|

| Collision | Repairs your car post-collision |

| Comprehensive | Covers non-collision incidents |

| Custom Equipment | Protects vehicle modifications |

| Gap | Pays off vehicle loans |

| Liability | Covers damages to others |

| Medical Payments | Pays for medical expenses |

| Rental Reimbursement | Covers rental car costs |

| Roadside Assistance | Helps during breakdowns |

| Uninsured Motorist | Protects against uninsured drivers |

The table shows what Markel offers, such as collision coverage that helps fix vehicles after crashes and comprehensive protection for things like theft or weather damage. For people with special modifications to their vehicles, the custom equipment coverage protects these changes from loss or damage.

GAP coverage is very helpful for drivers who still owe money on their car loans, as it pays the remaining amount if the car gets totaled. Other choices like rental reimbursement, roadside assistance, and uninsured motorist protection make things easier and give peace of mind by dealing with various problems that might happen while driving.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Markel Auto Insurance: Weighing the Benefits and Drawbacks

Markel Auto Insurance is different because it has many kinds of insurance plans and special coverages that fit various needs. The company offers strong personal and business insurance choices, which makes it a good option for people who want flexible protection.

Pros

- Wide Coverage Options: Provides liability, full coverage, collision, and comprehensive plans.

- Added Protections: Includes uninsured motorist and personal injury coverage.

- Enhanced Services: Roadside assistance is available as an optional add-on.

- Business Insurance: Offers several of personal and business policy types.

Markel’s variety in coverage options and extra advantages make it attractive for both personal as well as business policyholders.

Cons

- Accreditation Issues: The company is not accredited by J.D. Power.

- Limited Information: Few details are available online about auto insurance policies.

- Feedback Gaps: Lacks substantial customer reviews or public feedback on services.

Markel has a lot of different coverage options, which is good. But sometimes it can be hard to find information or read public reviews about them. This might make some people not want to choose Markel. Explore steps on how to check if an auto insurance company is legitimate online.

Assessing Markel’s Unique Insurance Programs

Markel Auto Insurance is a good choice for special markets, especially for people who own classic or high-value cars and need specific coverage. Even though it has many different coverage choices, like liability and uninsured motorist property damage coverage, which make it interesting to lots of people, the less clear details and not much customer feedback might worry some.

Markel Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A+ Excellent Business Practices |

|

| Score: 80/100 Positive Customer Feedback |

|

| Score: 0.41 Fewer Complaints Than Avg. |

|

| Score: A+ Excellent Financial Strength |

But for drivers who need special insurance types, Markel’s custom-made plans and strong financial status give it a solid position in the unique insurance market. If you’re just looking for coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

Frequently Asked Questions

What does Markel car insurance offer?

Markel car insurance provides specialized coverage for classic, collector, and high-value vehicles with tailored protection unavailable from standard policies. Find out how this Markel auto insurance review rates its comprehensive coverage.

What do Markel American Insurance Company reviews say?

Markel American Insurance Company reviews highlight positive feedback for niche coverage but point to issues with billing and customer service in some cases. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What are Markel insurance’s pros and cons?

• Pros: Customizable policies for specialty vehicles and strong financial ratings.

• Cons: Limited online information and occasional complaints about customer service.

What do Markel umbrella insurance reviews reveal?

Markel umbrella insurance reviews highlight its affordability and extensive liability coverage, catering to individuals needing extra protection.

What does an ETT Markel insurance charge on a credit card mean?

An ETT Markel insurance charge on your credit card is likely a payment for a Markel policy. Contact their billing department for confirmation. Understand the essential types of auto insurance and their benefits.

What do Evanston Insurance Company reviews indicate?

Evanston Insurance Company reviews show strong expertise in niche markets but varying satisfaction levels with claims handling and customer support.

Is Markel a good insurance company?

Markel is considered a good insurance company with an A+ financial strength rating and tailored specialty policies, particularly for niche markets.

Is Markel Insurance Company admitted in all states?

Markel Insurance Company operates as both an admitted and non-admitted insurer, depending on the policy type and the state regulations.

What is the Markel AM Best rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

What does Markel American Insurance Company boat coverage include?

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

Markel car insurance provides specialized coverage for classic, collector, and high-value vehicles with tailored protection unavailable from standard policies. Find out how this Markel auto insurance review rates its comprehensive coverage.

Markel American Insurance Company reviews highlight positive feedback for niche coverage but point to issues with billing and customer service in some cases. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What are Markel insurance’s pros and cons?

• Pros: Customizable policies for specialty vehicles and strong financial ratings.

• Cons: Limited online information and occasional complaints about customer service.

What do Markel umbrella insurance reviews reveal?

Markel umbrella insurance reviews highlight its affordability and extensive liability coverage, catering to individuals needing extra protection.

What does an ETT Markel insurance charge on a credit card mean?

An ETT Markel insurance charge on your credit card is likely a payment for a Markel policy. Contact their billing department for confirmation. Understand the essential types of auto insurance and their benefits.

What do Evanston Insurance Company reviews indicate?

Evanston Insurance Company reviews show strong expertise in niche markets but varying satisfaction levels with claims handling and customer support.

Is Markel a good insurance company?

Markel is considered a good insurance company with an A+ financial strength rating and tailored specialty policies, particularly for niche markets.

Is Markel Insurance Company admitted in all states?

Markel Insurance Company operates as both an admitted and non-admitted insurer, depending on the policy type and the state regulations.

What is the Markel AM Best rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

What does Markel American Insurance Company boat coverage include?

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

• Pros: Customizable policies for specialty vehicles and strong financial ratings.

• Cons: Limited online information and occasional complaints about customer service.

Markel umbrella insurance reviews highlight its affordability and extensive liability coverage, catering to individuals needing extra protection.

What does an ETT Markel insurance charge on a credit card mean?

An ETT Markel insurance charge on your credit card is likely a payment for a Markel policy. Contact their billing department for confirmation. Understand the essential types of auto insurance and their benefits.

What do Evanston Insurance Company reviews indicate?

Evanston Insurance Company reviews show strong expertise in niche markets but varying satisfaction levels with claims handling and customer support.

Is Markel a good insurance company?

Markel is considered a good insurance company with an A+ financial strength rating and tailored specialty policies, particularly for niche markets.

Is Markel Insurance Company admitted in all states?

Markel Insurance Company operates as both an admitted and non-admitted insurer, depending on the policy type and the state regulations.

What is the Markel AM Best rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

What does Markel American Insurance Company boat coverage include?

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

An ETT Markel insurance charge on your credit card is likely a payment for a Markel policy. Contact their billing department for confirmation. Understand the essential types of auto insurance and their benefits.

Evanston Insurance Company reviews show strong expertise in niche markets but varying satisfaction levels with claims handling and customer support.

Is Markel a good insurance company?

Markel is considered a good insurance company with an A+ financial strength rating and tailored specialty policies, particularly for niche markets.

Is Markel Insurance Company admitted in all states?

Markel Insurance Company operates as both an admitted and non-admitted insurer, depending on the policy type and the state regulations.

What is the Markel AM Best rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

What does Markel American Insurance Company boat coverage include?

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

Markel is considered a good insurance company with an A+ financial strength rating and tailored specialty policies, particularly for niche markets.

Markel Insurance Company operates as both an admitted and non-admitted insurer, depending on the policy type and the state regulations.

What is the Markel AM Best rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

What does Markel American Insurance Company boat coverage include?

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

The Markel AM Best rating is A+ (Excellent), reflecting strong financial stability and reliability. Explore options on where to buy auto insurance online securely.

Markel American Insurance Company boat coverage includes liability, physical damage, and optional add-ons like towing and fuel spill liability for a wide range of watercraft.

What is the Markel American Insurance Company phone number?

What does Markel American motorcycle insurance offer?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

What does Markel ATV insurance cover?

What do Markel bike insurance reviews highlight?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

How do I make a Markel boat insurance payment?

What do Markel boat insurance reviews reveal?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

What does Markel business insurance include?

How do I file a Markel claims request?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

What does Markel commercial insurance provide?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What is the Markel American Insurance Company rating?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.