Cheap Auto Insurance for High-Risk Drivers in Kentucky (10 Most Affordable Companies for 2026)

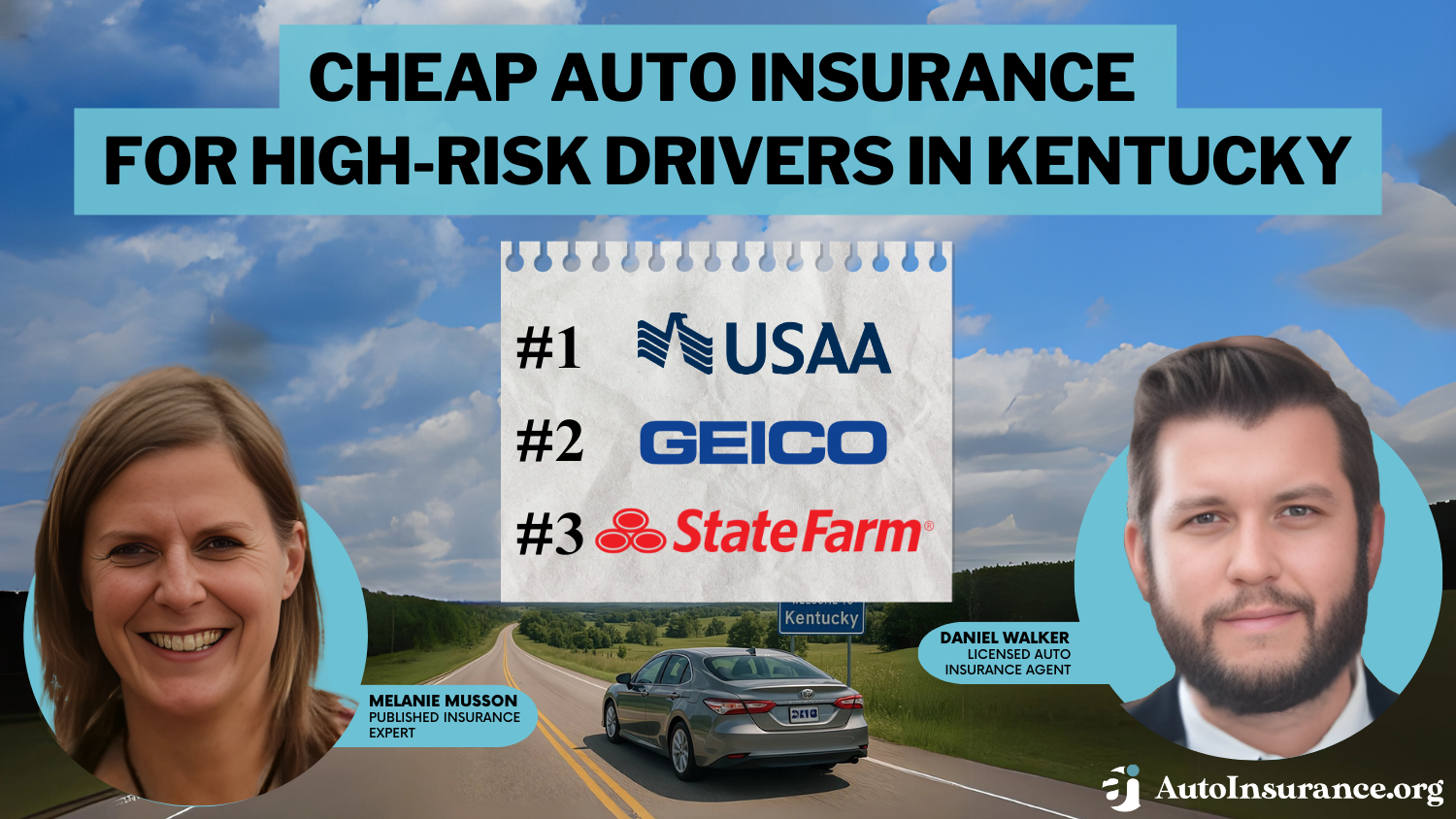

USAA, Geico, and State Farm offer cheap auto insurance for high-risk drivers in Kentucky, with rates starting at $32 per month. They provide excellent support for military members and suitable coverage for KY drivers, helping you budget with the average auto insurance cost in Kentucky.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated March 2025

6,590 reviews

6,590 reviewsCompany Facts

KY High-Risk Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

KY High-Risk Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

KY High-Risk Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top picks for cheap auto insurance for high-risk drivers in Kentucky are USAA, Geico, and State Farm, with rates starting as low as $32 per month.

Kentucky minimum auto insurance requirements offer the cheapest auto insurance in KY for bad drivers, with ten companies providing cheap, comprehensive options tailored to their needs.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Kentucky

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A++ | Military Members | USAA | |

| #2 | $35 | A++ | Online Service | Geico | |

| #3 | $43 | A++ | Customer Service | State Farm | |

| #4 | $49 | A+ | Qualifying Coverage | Progressive | |

| #5 | $62 | A++ | Insurance Discounts | Travelers | |

| #6 | $81 | A+ | Vanishing Deductible | Nationwide |

| #7 | $104 | A+ | Infrequent Drivers | Allstate | |

| #8 | $115 | A | Multiple Violations | The General | |

| #9 | $120 | A+ | Foreign Diplomats | Dairyland | |

| #10 | $130 | A+ | Minimum Coverage | Safe Auto |

KY drivers can secure reliable coverage that aligns with their budget and specific circumstances by choosing cheap insurance companies for high-risk drivers.

You can find affordable Kentucky auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote comparison tool.

- USAA offers the cheapest insurance in Kentucky at $32 per month

- Specialized coverage options meet the unique needs of KY’s high-risk motorists

- High-risk drivers in Kentucky might need to file SR-22 insurance to get coverage

#1 – USAA: Top Overall Pick

Pros

- Benefits for High-Risk Military Drivers: USAA offers specialized insurance and exclusive benefits for high-risk military drivers in Kentucky.

- Financial Support: The company offers banking and other financial services for Kentucky high-risk drivers who are active or retired military personnel.

- Competitive Coverage: USAA is owned by and serves the military community, including Kentucky’s high-risk drivers who are military or veterans. Read our USAA insurance review for a full list.

Cons

- Restrictions on Membership: USAA sells insurance exclusively to military members and their families.

- Potentially Higher Costs: High-risk drivers in Kentucky might still have high quotes depending on their record.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Online Service

Pros

- Low-Cost Coverage: Geico offers some of the most competitive rates on auto insurance for high-risk drivers, starting at $86 a month for high-risk drivers in Kentucky.

- Easy Online Management: Geico’s efficient online platform allows high-risk drivers in Kentucky to manage their policies and make changes quickly.

- Basic Coverage Options: Geico has affordable basic coverage plans for high-risk drivers in Kentucky. Read our Geico insurance review to learn what else is offered.

Cons

- Fewer Customizable Coverages: Geico has fewer options for the specific needs of high-risk drivers in Kentucky.

- Potential Service Gaps: The focus on cost savings may lead to less comprehensive customer service for high-risk drivers in Kentucky.

#3 – State Farm: Best for Customer Service

Pros

- Top-Notch Assistance: Customers of State Farm quote great support for Kentucky high-risk drivers. Discover more in our State Farm auto insurance review.

- Efficient Claims Handling: The company is known for its prompt and efficient claims processing, which is particularly beneficial for high-risk drivers in KY who might face more frequent claims.

- Cheapest Rates: State Farm has some of the cheapest KY high-risk insurance rates for drivers with accidents or DUIs.

Cons

- Limited Online Tools: High-risk drivers in Kentucky may find State Farm’s customer service less accessible due to limited online tools.

- Availability Issues: In some areas, Kentucky’s high-risk drivers might find State Farm’s high-risk insurance products limitedly available.

#4 – Progressive: Best for Qualifying Coverage

Pros

- Customizable Plans: Progressive provides a number of customizable coverage options tailored to the needs of Kentucky high-risk drivers, which means tailored insurance solutions.

- Affordable Options: This Kentucky insurer has cost-efficient coverage plans that can be useful for high-risk drivers who want to control expenses. Read more in our Progressive insurance review.

- Multiple Discounts: Progressive has numerous discounts that can help lower the cost of coverage for high-risk drivers in KY.

Cons

- Customer Service Ratings: Progressive has lower customer service ratings than other cheap Kentucky high-risk insurance companies.

- Complex Policy Options: The different coverage types in Kentucky can overwhelm high-risk drivers with information, complicating their decision on which plans to get.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Insurance Discounts

Pros

- Significant Savings: Travelers offers a 13% discount on the bundling policy for KY high-risk insurance. Check out more auto insurance discounts in our Travelers review.

- Streamlined Insurance Management: High-risk drivers in Kentucky can get double benefits after combining policies, as they can easily manage their policies.

- Savings for Young Drivers: Teens in Kentucky are considered high-risk drivers, but Travelers offers 25% student discounts for young drivers who can maintain a B average or better.

Cons

- Poor Customer Service: Other Kentucky car insurance companies provide better customer service and claims processing to high-risk drivers.

- Smaller Discounts: Despite an extensive list of Kentucky auto insurance discounts, the savings amounts are smaller than those from other Kentucky high-risk companies on this list.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Deductible Reduction: Nationwide’s vanishing deductible program helps reduce deductibles over time, benefiting high-risk drivers in Kentucky who maintain a clean driving record.

- Incentives for Safe Driving: Nationwide rewards safe driving behavior with additional discounts and usage-based driving plans for high-risk drivers in Kentucky.

- Long-Term Savings: High-risk drivers in KY who work to maintain a clean driving record can enjoy long-term savings on their premiums. Learn how in our Nationwide insurance review.

Cons

- Slow Deductible Reduction: Reducing the deductible might be slow, which could be a drawback for high-risk drivers in Kentucky seeking immediate relief.

- Eligibility Criteria: Drivers in Kentucky who are considered high-risk may not be scored to benefit from a vanishing deductible program.

#7 – Allstate: Best for Infrequent Drivers

Pros

- Cost-Efficient Coverage for Infrequent Drivers: Allstate Milewise is a tailored plan for high-risk Kentucky drivers who drive less often. Learn more in our Allstate Milewise review.

- High-Mileage Discounts: High-mileage drivers in Kentucky who sign up for Milewise Unlimited can get up to 30% off.

- Specialized Plans: Allstate’s coverage options are designed to meet the needs of infrequent high-risk drivers in KY. Find out more in our Allstate auto insurance review.

Cons

- Higher Rates for Frequent Drivers: High-risk drivers in Kentucky who drive more frequently may find more expensive auto insurance quotes with Allstate.

- Variable Customer Service: Allstate is highly rated for claims service but receives poor customer service reviews from local high-risk drivers in Kentucky.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The General: Best for Multiple Traffic Violations

Pros

- Specialized Insurance: The General focuses on providing insurance solutions for high-risk drivers in Kentucky with multiple offenses.

- SR-22 Filings: The company will file SR-22 insurance for high-risk drivers in Kentucky who have multiple traffic violations or accidents.

- Customizable High-Risk: The General provides customization for its insureds at a higher risk than average, which you can learn about in our review of The General.

Cons

- Higher Premiums: The specialized nature of The General’s coverage often leads to higher premiums for high-risk drivers in Kentucky.

- Limited Additional Benefits: Compared to other insurers, it may offer fewer additional perks or benefits to high-risk drivers in Kentucky.

#9 – Dairyland: Best for Foreign Diplomats

Pros

- Tailored Coverage: Dairyland offers insurance products that cover high-risk drivers in Kentucky, and those with special status, such as foreign diplomats.

- Adaptable Coverage Options: This insurer offers customized coverage options to Kentucky’s high-risk drivers. Read more in our review of Dairyland.

- Expertise in Unique Insurance Needs: Dairyland knows foreign diplomats, which turns into unique insurance knowledge for the special needs of high-risk drivers in Kentucky.

Cons

- Expensive Rates: Dairyland’s niche insurance focus means rates are slightly higher than other Kentucky high-risk providers on this list.

- Limited Add-Ons: Dairyland doesn’t offer as many customizable policy options as other high-risk auto insurance companies in KY.

#10 – SafeAuto: Best for Minimum Coverage

Pros

- Budget-Friendly Minimum Coverage: SafeAuto’s affordable minimum coverage options make it a good choice for Kentucky’s high-risk drivers seeking savings.

- Simple Coverage Solutions: SafeAuto offers basic insurance plans, which might be helpful for Kentucky drivers who are confused about insurance options.

- Flexible Payment Options: Some insurance providers offer this, enabling high-risk drivers to pay more easily. For a complete list, read our SafeAuto insurance review.

Cons

- Basic Coverage Limits: Kentucky high-risk drivers may be underinsured on Safe Auto’s minimum coverage focus.

- Potential Gaps in Protection: The minimal coverage offered may leave high-risk drivers in Kentucky exposed to coverage gaps.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kentucky High-Risk Auto Insurance Rates

This table compares the average car insurance cost in Kentucky for high-risk drivers. USAA offers the cheapest Kentucky auto insurance rates at $32 a month for minimum and $87 a month for full coverage, while Allstate has the highest monthly costs at $104 for minimum and $287 for full coverage.

Kentucky High-Risk Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $104 | $287 | |

| $120 | $265 | |

| $35 | $97 | |

| $81 | $224 |

| $49 | $135 | |

| $130 | $275 |

| $43 | $119 | |

| $115 | $250 | |

| $62 | $169 | |

| $32 | $87 |

What is the average auto insurance cost per month? While most drivers pay around $62 a month for car insurance in Kentucky, high-risk drivers will see higher rates due to their driving history.

Factors Affecting Auto Insurance Costs for High-Risk Drivers in Kentucky

Navigating auto insurance as a high-risk driver in Kentucky can be complex, with various factors influencing your premium. For instance, safe drivers with clean records will find it much easier to get cheap KY auto insurance.

To learn more about cheap car insurance in Kentucky for good drivers, check out the best auto insurance discounts for good drivers.

Accidents, speeding tickets, and DUI charges will increase your rates for up to 10 years in Kentucky, but State Farm is least likely to raise your rates as high as other companies on this list, making it one of the better choices for cheap Kentucky auto insurance.

Your driving record impacts insurance rates. Maintain a clean record to lower costs. For example, defensive driving courses reduce premiums.Michelle Robbins Licensed Insurance Agent

By considering how your driving history, vehicle information, personal factors, coverage type, and location impact your auto insurance costs, you can make more informed decisions and find ways to get the cheapest insurance in KY possible:

- Vehicle Information: Insurance costs vary based on the make and model, age, safety features, and usage, with luxury, high-mileage, and new vehicles generally costing more to insure.

- Coverage Type: Liability, collision, and comprehensive coverage affect your premium, with higher limits and add-ons increasing monthly high-risk car insurance rates.

- Location: High-risk insurance costs vary based on ZIP code, driving conditions, and local risk factors like crime rates, weather, and accident frequency.

This method will help identify areas where your coverage may be edited or discounts you may be eligible for, and get you one step closer to landing the best price for high-risk auto insurance available.

By becoming educated and taking action, you can get cheap full coverage car insurance in Kentucky while still having the important protection that you need.

Read More: Does a criminal record affect auto insurance rates?

Smart Approaches to Reducing High-Risk Auto Insurance Expenses

Securing cheap auto insurance for Kentucky high-risk drivers involves thoroughly comparing rates and discounts from various providers.

Comparing different insurance plans is crucial so you get the best cheap insurance for high-risk drivers that meets your needs. From there, make sure to find the best deal for your driving profile and risk factors.

Auto Insurance Discounts from the Top Providers for Kentucky High-Risk Drivers

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Bonus, Accident Forgiveness, Multi-policy Discount, Anti-theft Discount, Good Student Discount | |

| Multi-car Discount, Homeowner Discount, Advanced Quote Discount, Defensive Driving Course Discount | |

| Good Driver Discount, Multi-policy Discount, Anti-theft Discount, Good Student Discount, Military Discount | |

| Vanishing Deductible, Accident Forgiveness, Multi-policy Discount, Safe Driver Discount, Anti-theft Discount |

| Snapshot Program, Multi-policy Discount, Homeowner Discount, Continuous Insurance Discount, Good Student Discount | |

| Multi-car Discount, Safe Driver Discount, Paid-in-Full Discount, Homeowner Discount, Defensive Driving Discount |

| Steer Clear Program, Safe Driver Discount, Multi-policy Discount, Good Student Discount, Anti-theft Discount | |

| Multi-car Discount, Paid-in-Full Discount, Safe Driver Discount, Defensive Driving Course Discount | |

| IntelliDrive Program, Multi-policy Discount, Safe Driver Discount, New Car Discount, Homeowner Discount | |

| Safe Driver Discount, Multi-policy Discount, Military Discount, New Vehicle Discount, Good Student Discount |

One of the most straightforward methods of getting the cheapest car insurance in KY is to compare quotes from a number of providers to snag the lowest rates. Think about raising your deductible too, because a bigger deductible usually lowers your premium.

As a feature writer, I found that comparing rates and using discounts, especially after an accident, significantly lowered my insurance costs.Tonya Sisler Insurance Content Team Lead

Regularly review your coverages in order to avoid unnecessary extras and score cheap car insurance for high-risk drivers. You should also look into how credit scores affect auto insurance rates, as improving your credit score can lower premiums. Picking a vehicle with good safety ratings can also help you get cheap high-risk car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Budget-Friendly Auto Insurance for Kentucky’s High-Risk Drivers

Some of the best auto insurance companies for high-risk drivers are USAA, Geico, and State Farm. They each offer cheap auto insurance for high-risk drivers in Kentucky. In addition to offering cheap auto insurance in KY for high-risk drivers, USAA and Geico also excel in coverage and customer service.

To get cheap full coverage auto insurance for high-risk drivers, shop around to see quotes from different companies, raise your deductible, and take advantage of discounts. Understand the factors that compress insurance costs and use cost-saving strategies to secure the best Kentucky high-risk coverage for less.

Enter your ZIP code into our free quote tool to compare prices from different companies in your area and find out if you could save on KY auto insurance rates.

Frequently Asked Questions

Who has the cheapest auto insurance in Kentucky?

The cheapest auto insurance in KY generally comes from companies like USAA, Geico, and State Farm; minimum coverage rates can be as low as $32 per month. Comparison shopping among multiple providers is key to finding the right price for your personal circumstances.

What is the best auto insurance for DUI in Kentucky?

Companies such as State Farm and Progressive are usually good options. They both offer competitive rates on auto insurance for bad drivers. However, rates can vary widely based several factors, so it’s essential to compare quotes to find cheap auto insurance in Kentucky.

Find KY cheap auto insurance by entering your ZIP code into our free comparison tool. It will compare quotes from cheap Kentucky car insurance companies to help you find the best deal.

Who typically has the cheapest Kentucky auto insurance?

Insurance rates change based on location, driving record, and vehicle type. Generally, providers like Geico and State Farm are known for offering high-risk auto insurance cheaply. High-risk drivers might need to shop around for cheap auto insurance quotes for high-risk drivers to find the best deal (Read More: Cheap Auto Insurance for a Bad Driving Record).

Does the choice of vehicle impact the average car insurance cost in Kentucky?

Yes, choosing vehicles with high safety ratings and lower repair costs can help you save on Kentucky’s average car insurance cost.

How does increasing my deductible affect my chances of getting the cheapest car insurance in Kentucky?

Choosing a higher deductible can significantly reduce your premium, which is one of the strategies for finding cheaper car insurance costs in Kentucky.

Why is auto insurance in Kentucky so expensive?

Kentucky auto insurance is on the higher side, owing to a high number of car accidents, costly repairs, and strict regulations. However, high-risk drivers, particularly those with DUIs, typically receive higher premiums. Finding cheap auto insurance after a DUI involves comparing policies tailored for such drivers.

What is the best insurance in Kentucky?

The best insurance in Kentucky depends on your needs. State Farm, USAA, and Progressive are highly recommended for affordable car insurance for high-risk drivers. Each has several coverage options for high-risk drivers and has strong customer service.

Why might cheap auto insurance for high-risk drivers be more expensive than standard policies?

Insurers deploy higher premiums even on less expensive policies to help make up for the increased likelihood of high-risk drivers filing claims.

What is the minimum auto insurance in Kentucky?

Kentucky minimum auto insurance requirements include liability auto insurance coverage of $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage. This ensures essential protection in an accident but may not be sufficient for all drivers.

Can high-risk insurance costs decrease over time, and if so, how?

A high-risk insurance cost can lower over time if the driver maintains a clean driving record, avoids new infractions, and continuously monitors and adjusts their coverage levels as their risk profile improves.

How much is auto insurance per month in Kentucky?

Can you get auto insurance with a suspended license in Kentucky?

How long does a DUI stay on your insurance in Kentucky?

How does credit score affect rates for cheap auto insurance in Kentucky?

How much liability insurance do I need in Kentucky?

Can low-income car insurance in Kentucky cover all family vehicles?

How does improving my credit score affect the cost of cheap full coverage car insurance in Kentucky?

How can improving my driving record affect rates for cheap full coverage car insurance for high-risk drivers?

Are there specific discounts for young drivers on auto insurance in Louisville, KY?

How do loyalty and renewal affect Kentucky auto insurance discounts?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.