Best Auto Insurance for Diplomats in 2026 (Top 8 Companies)

Geico, State Farm, and AAA have the best auto insurance for diplomats, with rates starting at $50 per month. Geico offers 15% off on premiums for federal employees, including overseas coverage. State Farm adds $116 a year in safe driver savings. AAA provides IDPs, plus foreign license support for visiting diplomats.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Shawn Laib

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated August 2025

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Diplomats

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Diplomats

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Diplomats

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe top providers of the best auto insurance for diplomats are Geico, State Farm, and AAA. Geico earns the top spot for its comprehensive overseas coverage and offers a 15% discount to federal employees.

Our Top 8 Company Picks: Best Auto Insurance for Diplomats

| Company | Rank | A.M. Best | Federal Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 8% | Low Rates | Geico | |

| #2 | B | 10% | Customer Service | State Farm | |

| #3 | A | 6% | Roadside Assistance | AAA |

| #4 | A+ | 11% | Foreign Diplomats | Dairyland | |

| #5 | A+ | 12% | Biggest Discount | Progressive | |

| #6 | A | 7% | Available Discounts | Farmers | |

| #7 | A+ | 9% | Usage-Based Savings | Nationwide | |

| #8 | A++ | 5% | Safe Drivers | Travelers |

State Farm stands out with safe driver savings of up to $116 annually, while AAA offers unmatched value by issuing International Driving Permits to U.S. and foreign diplomats.

These top providers meet the OFM’s 100/300/100 liability limits and support foreign licenses, with Geico and State Farm also offering the best auto insurance for federal employees, as well.

- Geico gives 15% off to diplomats and covers them when abroad

- OFM sets 100/300/100 minimum liability for diplomats’ cars

- AAA issues IDPs required for diplomats with foreign licenses

Dairyland offers the best car insurance for foreign drivers in the U.S., but Geico has the best rates on overseas coverage for U.S. diplomats going abroad. Enter your ZIP code to compare quotes from these top providers and more.

Best Auto Insurance Rates for Diplomats

Diplomats seeking the most affordable coverage can find suitable options at Geico and Dairyland, both of which start around $50 per month. However, if they want full coverage with Nationwide or Farmers, it may cost more than $200 per month.

Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $180 |

| $50 | $160 | |

| $65 | $200 | |

| $50 | $150 | |

| $75 | $220 | |

| $60 | $180 | |

| $55 | $170 | |

| $70 | $210 |

State Farm gives a decent compromise for diplomats who need to balance protection and price. These rate levels illustrate how selecting the right insurance company can significantly impact monthly premium costs for diplomatic drivers with varying responsibilities.

How Occupation Affects Auto Insurance Rates for Diplomats

Does a job affect auto insurance rates? Yes, your occupation can change your car insurance price, even if you aren’t aware of it. It all comes down to risk drivers: in some occupations, individuals are more likely to file a claim, which raises their rates. For example, diplomats are sometimes subject to targeted attacks, so insurers assume an additional risk when insuring them.

Commute and education level also impact how much you pay for auto insurance. So, don’t be surprised when your insurer asks about your occupation. Companies are using it to determine the risk of insuring you, since data shows that certain job fields are more likely to file claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Discounts for Diplomats

Diplomat drivers are eligible for all the same discounts as regular drivers, plus exclusive savings based on their career. Progressive, Geico, State Farm, and Dairyland offer the largest savings for federal employees, including those in diplomatic roles.

However, diplomats can lower their rates even more with vehicle discounts, safe driving discounts, policyholder discounts, and personal status discounts:

- Vehicle Discounts: Safety features on your car include anti-lock brakes, anti-theft devices, and passive restraint discounts

- Safe driver Discounts: Good driving savings for being claim-free, low-mileage, or having usage-based insurance

- Policyholder Discounts: Include early signing, multi-policy, multi-vehicle, auto-pay, and bundling discounts

- Personal Status Discounts: Savings based on age, marital status, education, and occupation

Several insurers offer occupation discounts, but fewer offer discounts for federal employees. Therefore, always remember to ask for all available discounts before purchasing car insurance.

Learn More: How to Get a Membership Discount

Liability Auto Insurance Requirements for Diplomats

The table below compares the required liability amounts for a diplomat with those for a normal driver in the District of Columbia. Diplomats’ car insurance typically has higher liability amounts because they often lack a driving record, particularly when new to a country.

Diplomatic Liability Limits Compared to District of Columbia

| Required Liability Amounts | Diplomats | Regular Drivers in the District of Columbia |

|---|---|---|

| For all people injured in an accident | $300,000 | $50,000 |

| For one person injured in an accident | $100,000 | $25,000 |

| For property damage | $100,000 | $10,000 |

Most companies require drivers to demonstrate at least a few years of consistent, safe driving without accidents or tickets before they can lower rates and offer discounts. During the purchase process, it’s important to inform the insurance provider about the minimum limits that are acceptable for a diplomat to carry.

Any diplomat operating a motor vehicle in the United States is bound by the same insurance requirements that any other motorist is required to follow. However, diplomats must carry the specific limits of coverage listed in the Foreign Missions Act as an additional interest in the policy.

The Office of Foreign Missions (OFM) outlines the minimum acceptable limits for any diplomat’s car insurance: 100/300/100. This amount is the minimum level of coverage that a diplomat must purchase, which means they would carry $100,000 coverage for bodily injuries per person, $300,000 coverage for bodily injuries per incident, and $100,000 coverage for property damage per incident.

Additional Auto Insurance Considerations for Diplomats

Car insurance for diplomatic individuals comes with a host of requirements that must be followed to maintain their privileges within the United States.

If a driver’s diplomatic insurance is about to end, the OFM will send out reminders to renew the auto insurance policy, but diplomats are required to notify the OFM of the following:

- Policy Changes

- Insurance Cancellations

- Tickets and Auto Accidents

The OFM has a complete program in place to help manage and follow up on moving violations and parking tickets that may occur. It includes payable violations and “must appear” violations. This office also handles situations where an individual drives under the influence of drugs or alcohol.

Most insurers don’t auto-file the OFM’s 100/300/100 liability limits. In particular, diplomats should verify that required coverage is manually requested.Daniel Walker Licensed Auto Insurance Agent

Additionally, there are regional offices that work with each Foreign Mission to make sure that the proper requirements are being followed. For example, if you have concerns or questions about coverage, such as before renting a non-owned vehicle, contact your regional office.

Best Auto Insurance for Drivers With a Foreign License

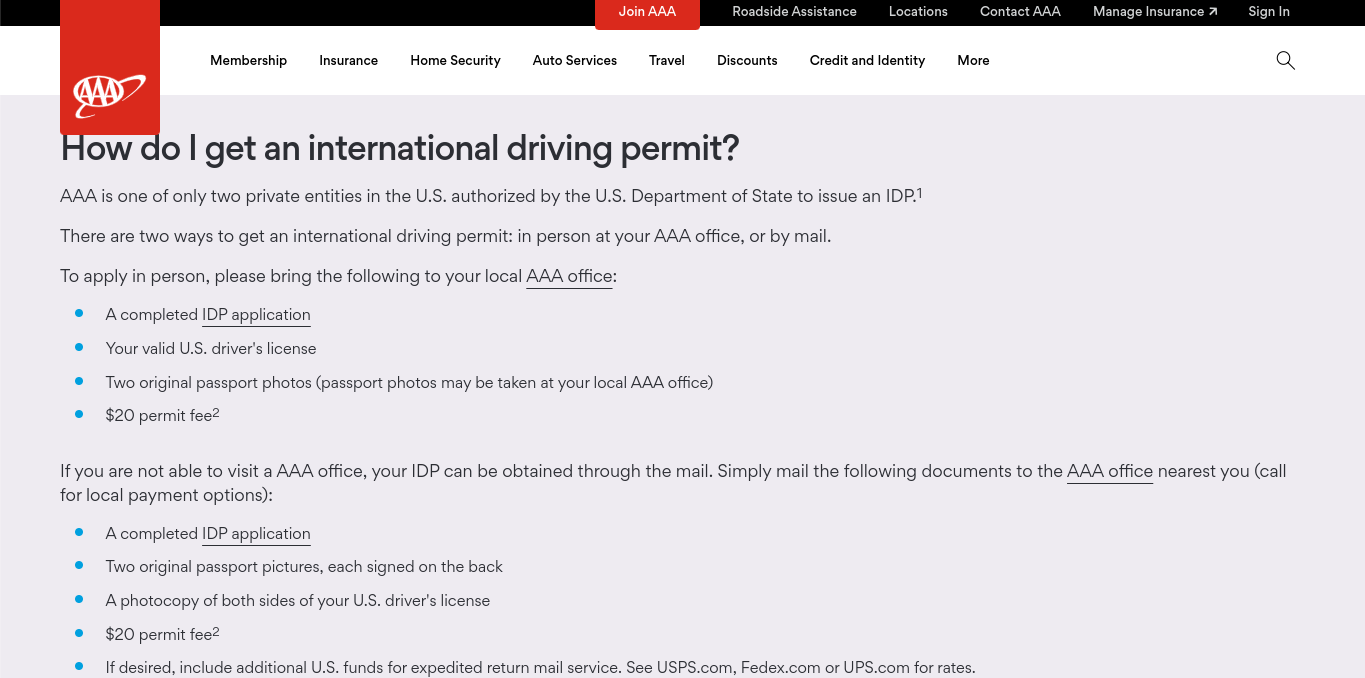

If you’re a diplomat visiting the United States, be aware that not all insurers offer auto insurance for foreign drivers. You will need to shop with companies that sell policies to drivers holding an International Driving Permit (IDP) or a foreign license. AAA is the best auto insurance company for diplomats, offering IDP.

Fortunately, Geico and State Farm also offer foreign car insurance as well as affordable auto insurance for government employees living and working in the U.S.

Temporary Auto Insurance for Foreign Drivers

Most visiting diplomats and other international drivers do not need a U.S. license or insurance policy for up to six months. You can get temporary car insurance from a rental car company or purchase short-term coverage from the providers on this list. Unfortunately, foreign diplomats are not eligible for coverage through Nationwide, Farmers, or Travelers.

If you are a U.S. diplomat traveling abroad, you can also buy temporary car insurance from a rental car company. Your personal policy may already provide coverage when traveling to Mexico, Canada, and other countries, so confirm with your provider before purchasing additional coverage.

Long-Term Auto Insurance for International Drivers

If you plan to be in the country for longer than 180 days, you will need to purchase auto insurance for non-U.S. citizens. While Dairyland offers the best auto insurance for international diplomats, shop around with multiple companies in the state where you will be living to find the cheapest quotes.

Read More: Best Auto Insurance For International Drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Coverage Available for Diplomats

Diplomats require specialized insurance that accommodates their unique travel lifestyles, international driving requirements, and higher liability standards. These six types of coverage are very important to make sure they follow laws and have enough protection when working either abroad or in the U.S.:

- Liability Coverage: The Office of Foreign Missions (OFM) says this coverage is necessary. It makes sure diplomats follow the 100/300/100 liability limits.

- Comprehensive Coverage: It covers damages not resulting from collisions, such as theft, vandalism, fire, or natural disasters. These things might happen more often when working abroad.

- Collision Coverage: Provides diplomats with peace of mind by covering the cost of repairs or replacement of their car in the event of an at-fault accident.

- Uninsured/Underinsured Motorist Coverage: This is particularly important for diplomats who drive in areas where few people have insurance.

- Foreign License Acceptance Coverage: This coverage is specifically designed for diplomats who use a valid foreign driver’s license or an International Driving Permit (IDP).

- Temporary Coverage: This is ideal for diplomats on short-term assignments or official trips. It provides important protection for up to 180 days, typically through rental or short-term policies.

These primary coverages enable diplomats to remain compliant with U.S. and international laws while providing dependable financial and legal protection, regardless of their location.

8 Best Auto Insurance Companies for Diplomats

Diplomats working in different countries need car insurance that follows them. Here is a list of the top 8 companies offering flexible policies good for IDP, international coverage, low-mileage benefits, and smart discounts to save money while on assignment:

#1 – Geico: Top Overall Pick

Pros

- Global Policy Access: Geico supports diplomats with international assignments by offering coverage options valid in over 30 countries (See More: Geico Auto Insurance Review).

- Federal Employee Discount: Diplomats employed by the U.S. government receive up to 15% off their premiums under Geico’s federal program.

- Top-Rated Claims Handling: Diplomats benefit from Geico’s A++ A.M. Best rating, ensuring superior financial stability and claim support abroad.

Cons

- Limited High-Risk Flexibility: Diplomats with prior violations may face restricted underwriting acceptance in certain states.

- No In-House IDP Issuance: Geico does not issue International Driving Permits, which limits convenience for diplomats transitioning with foreign licenses.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Safe Driver Savings: Diplomats can earn up to $116 per year in discounts through State Farm’s Drive Safe & Save program. Compare quotes in our State Farm auto insurance review.

- Extensive Agent Network: Diplomats moving between U.S. assignments benefit from State Farm’s 19,000+ agent offices for seamless policy transfers.

- Accident Forgiveness Option: Eligible diplomats may avoid surcharges on their first at-fault incident, maintaining stable rates after minor collisions.

Cons

- Slower Quote Process: Diplomats may experience delays when customizing policy limits above the OFM-required 100/300/100 coverage threshold.

- Less Flexibility for Foreign Licenses: Diplomats using non-U.S. licenses may be required to convert earlier compared to other providers.

#3 – AAA: Best for Diplomats Who Need an IDP

Pros

- IDP Issuance: AAA stands out for issuing International Driving Permits, a critical document for diplomats arriving from abroad. Learn more in our AAA Car Insurance Review.

- New Arrival Accessibility: Diplomats without a U.S. driving history can secure policies using valid foreign credentials and International Driving Permits (IDPs).

- Bundling Savings: Diplomats can save up to 17% when combining auto insurance with AAA membership and travel products.

Cons

- Membership Requirement: Diplomats must maintain an active AAA membership to access most auto policy benefits.

- Limited Overseas Coverage: AAA’s international auto support is limited to partner networks, which may restrict use for diplomats who frequently relocate.

#4 – Dairyland: Best for Foreign Diplomats Visiting the U.S.

Pros

- No U.S. License Required: Diplomats entering the U.S. temporarily can obtain Dairyland coverage using only an International Driving Permit.

- Flexible Payment Options: Dairyland allows diplomats to split payments into as many as 12 installments, easing upfront costs. Explore more in our Dairyland auto insurance review.

- SR-22 Availability: Diplomats needing state-filed forms can access Dairyland’s SR-22 service without added eligibility barriers.

Cons

- Higher Base Premiums: Diplomats may face average rates 10–15% higher than national competitors for basic liability packages.

- Lower Financial Strength: Dairyland holds a B++ A.M. Best rating, offering less claim-time confidence compared to top-tier providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Auto Insurance Discounts

Pros

- Federal Affiliation Savings: Diplomats qualify for Progressive’s specialized discount tiers designed for government employees.

- Snapshot Program: Diplomats using telematics can save an average of $146 per year based on their real-time driving habits, according to our Progressive auto insurance review.

- Non-Owner Coverage Option: Progressive supports diplomats who drive fleet or embassy vehicles with non-owner liability policies.

Cons

- No IDP Support: Progressive does not accept IDPs for policy setup, making it difficult for newly arriving diplomats.

- Telematics Not for All: Diplomats concerned with data sharing may find the Snapshot system too invasive for comfort.

#6 – Farmers: Best for Additional Discounts

Pros

- Multi-Line Discounts: Diplomats who bundle auto insurance with homeowners’ or renters’ insurance may save up to 20%, making it an ideal option for long-term foreign service housing.

- Signal App Rewards: Our Farmers auto insurance review reveals that Farmers’ telematics app offers discounts of up to 15% after 90 days of safe, monitored driving.

- Flexible Deductibles: Diplomats can adjust deductibles in $50 increments, allowing precise premium control across postings.

Cons

- Limited International Accommodation: Farmers lacks direct services for diplomats with overseas assignments or multi-country relocations.

- Higher Entry Premiums: Diplomats new to the U.S. may face rates above $80 per month due to a lack of domestic driving history.

#7 – Nationwide: Best for Low-Mileage Savings

Pros

- SmartMiles Program: Diplomats with minimal daily driving can reduce their premiums by up to 40%, making it an ideal option for city-based embassy staff.

- Accident-Free Rewards: Diplomats receive decreasing deductibles of $100 per year, without claims, up to a maximum of $500. Explore our review of Nationwide auto insurance.

- On Your Side Review: Annual policy reviews enable diplomats to adjust their coverage and rates to new assignments or locations.

Cons

- Foreign License Limitation: Diplomats must secure a U.S. license early, as Nationwide doesn’t accept foreign credentials or IDPs for policy issues.

- Limited Short-Term Flexibility: Diplomats needing less than 6 months of coverage will find Nationwide’s standard term structure restrictive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best Perks for Safe Drivers

Pros

- IntelliDrive Discounts: Diplomats who practice safe driving habits can earn up to 30% off through Travelers’ 90-day monitoring program.

- Premier New Car Package: Diplomats with newer vehicles benefit from full car replacement and gap coverage in the first five years. Read our full review of Travelers auto insurance.

- Broad Optional Add-ons: Travelers offers diplomats extras, such as accident forgiveness and decreasing deductible features, based on tenure.

Cons

- Foreign License Exclusion: Diplomats without a U.S. license must seek initial coverage elsewhere, as Travelers doesn’t insure drivers with IDPs.

- Less Competitive Base Rates: Diplomats without telematics or bundling may find Travelers’ standalone rates higher than tier-one carriers.

How to Get the Best Auto Insurance for Diplomats

Not all insurers offer diplomatic car insurance. However, you can apply for diplomatic car insurance at almost any provider. You simply need to inform them that you are purchasing diplomatic car insurance. Why? The insurer will raise the liability limits on your car insurance policy.

Remember, you need to meet the OFM’s requirements for minimum liability coverage, which is much higher than liability coverage for a regular driver. The OFM will also monitor your insurance to ensure it covers both you and your vehicle properly.

Insurers offering 15%–20% federal discounts require proof of status. For example, Geico applies it once federal employment is verified during setup.Michelle Robbins Licensed Insurance Agent

If a diplomat is found to be lacking the proper coverage, they may face surcharges or fees if they cause an accident or injury. Additionally, if the coverage is not in place, the Department of State may request to waive your immunity, which could leave you open to legal action as well as fines and the loss of any privilege to drive in the United States.

While you have to have the minimum liability amount required by the OFM, this doesn’t mean you need to go with the first insurer that offers diplomatic insurance. Compare rates to find the best fit for your budget. You can use our free quote comparison tool to find affordable diplomat insurance rates near you.

Frequently Asked Questions

Do diplomats have car insurance?

Yes, diplomats typically require auto insurance, although they may be exempt from certain requirements. Requirements can vary by country and insurer.

Do diplomats get discounts on cars?

Yes, as a diplomat, you often qualify for duty-free car purchases and manufacturer discounts. Some programs also bundle insurance starting from around $45 per month.

What privileges do diplomats have when living or working abroad?

As a diplomat, you may receive immunity from certain local laws, tax exemptions, and access to exclusive insurance or vehicle registration programs tailored to foreign service staff. Shop the best auto insurance for diplomats by entering your ZIP code and comparing quotes.

Do diplomats have to pay tolls when driving in the U.S.?

Generally, you’re expected to pay tolls like any other driver, unless you’re using a government vehicle with specific exemptions granted under international or federal agreements.

What is the best car insurance company for foreigners?

The best car insurance companies for foreigners typically offer low monthly rates, starting around $35, and accept international licenses or passports. Find out how much international auto insurance will cost for your stay.

Does Progressive accept foreign drivers’ licenses?

Yes, Progressive accepts foreign drivers’ licenses, especially when paired with a passport or international driving permit.

Does Geico have international car insurance?

Geico doesn’t directly provide international car insurance, but it can connect you with partners that offer coverage abroad.

Do diplomats have to pay parking tickets?

Yes, diplomats are generally expected to pay parking tickets, though some may be dismissed due to diplomatic immunity.

Can you get car insurance with a passport?

Yes, many insurers allow you to obtain car insurance with just a passport, although some may require additional documents, such as a visa or proof of residency. Explore the best auto insurance for undocumented immigrants with no U.S. license.

What is the highest-rated car insurance?

Top-rated car insurance options, such as USAA and Amica Mutual, receive excellent customer reviews and offer monthly rates starting at approximately $29.

Who qualifies for USAA insurance?

Who are the top 5 insurance companies?

Does Geico accept an international driver’s license?

What should you know from Diplomat America insurance reviews?

Is a long-term diplomat’s insurance right for your extended visit?

Can you get insurance for embassies or diplomatic missions?

How do you get car insurance in the USA for foreigners like yourself?

What is a diplomatic car brokerage, and do you need one?

Do you need insurance for foreign cars brought into the U.S.?

How do you get car insurance for international drivers like you?

Can you buy foreign auto insurance while traveling or relocating?

Can you get temporary international auto insurance while traveling abroad?

What is the cheapest car insurance for international drivers like you?

Do you need temporary car insurance for foreign drivers in the USA when visiting?

Should you consider Clements insurance as a foreign national or diplomat?

Can you get car insurance with a foreign license in the U.S.?

Is Geico car insurance approved for foreign license holders who are new to the country?

What’s the best car insurance for expats settling in the U.S.?

Can you buy Progressive car insurance for foreigners in the USA with a passport?

Which international car insurance companies can you rely on abroad?

Can you get car insurance for diplomatic cars registered under your mission?

Can you drive in the U.S. with a diplomat’s driver’s license?

Do you need diplomatic insurance as part of your foreign service role?

What does Diplomat Motors Inc. offer if you’re shopping for a car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.