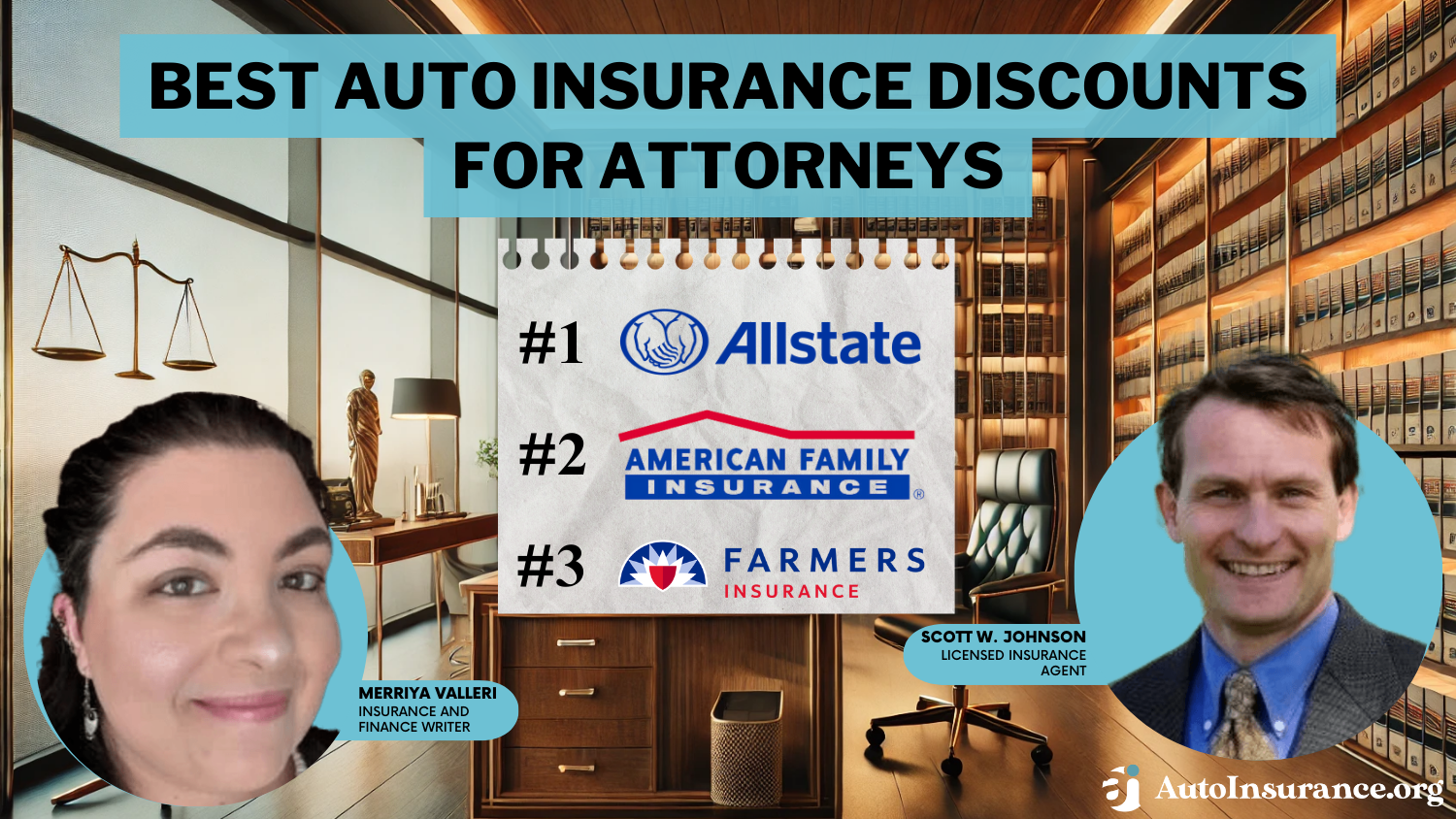

Best Auto Insurance Discounts for Attorneys in 2026 (Save up to 30% With These Companies)

The best auto insurance discounts for attorneys are accident-free, bundling, and multi-vehicle discounts, discounting up to 30%. State Farm is offering the highest discounts followed closely by Geico and Progressive. Attorneys can maximize their savings by combining several of these discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

State Farm offers the highest savings, with tailored discounts specifically for attorneys. Companies like Geico and Progressive also provide competitive rates and extra benefits like roadside assistance.

Our Top 10 Picks: Best Auto Insurance Discounts for Attorneys

| Discount | Rank | Savings Potential | Who Qualifies? |

|---|---|---|---|

| Accident-Free | #1 | 30% | Attorneys with no recent accidents |

| Bundling | #2 | 25% | Attorneys combining multiple policies (e.g., auto and home) |

| Multi-Car | #3 | 24% | Attorneys insuring multiple vehicles |

| Low Mileage | #4 | 20% | Attorneys with below-average mileage annually |

| Alumni | #7 | 19% | Attorneys with clean driving records |

| Safe Driver | #5 | 18% | Attorneys completing a defensive driving course |

| Defensive Driving | #6 | 15% | Attorneys who are alumni of specific institutions |

| Loyalty | #8 | 14% | Attorneys with long-term policies with the same insurer |

| Professional Association | #9 | 13% | Attorneys belonging to recognized professional associations |

| Good Student | #10 | 8% | Law students with good academic standing |

These discounts make insurance more affordable and provide essential benefits like liability coverage and roadside assistance. Knowing this is important when taking your auto insurance company to court, as it affects your coverage and rights as a policyholder.

Get quick and affordable auto insurance coverage now. Use our quote comparison tool above to find the best auto insurance discounts for attorneys.

- Best auto insurance discounts for attorneys meet their unique needs

- Legal professional insurance discounts lower overall premiums

- Attorneys can save up to 30% on tailored auto insurance options

Auto Insurance Discounts for Attorneys and Monthly Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leading Providers of Auto Insurance Discounts for Attorneys

Extra Benefits and Discounts for Attorneys

Elements Influencing Auto Insurance Rates for Attorneys

Frequently Asked Questions

What are the best auto insurance discounts for attorneys?

The best discounts typically come from State Farm, Geico, and Progressive, which offer up to 30% off premiums for legal professionals.

How can attorneys qualify for auto insurance discounts?

Attorneys can qualify by proving their professional status, often through bar association membership or providing their law license information.

Do all insurance companies offer discounts specifically for attorneys?

Not all insurance companies offer attorney-specific discounts, but many major providers like State Farm and Progressive do.

What factors influence the discounts available to attorneys?

How much can attorneys save with auto insurance discounts?

Attorneys can save between 10% and 30% on their premiums, depending on the insurer and specific discount programs.

Are there additional benefits included with attorney auto insurance discounts?

Yes, many providers offer benefits like roadside assistance, accident forgiveness, and bundling options for home or renters insurance. Discover budget-friendly auto insurance rates from leading providers by entering your ZIP code below for the best auto insurance discounts for attorneys.

Can attorneys combine discounts from different insurance providers?

Attorneys can often combine discounts from various providers, but the ability to do so varies by company policy.

Is it necessary to have a clean driving record to get discounts?

A clean driving record can enhance your chances of getting discounts, but some companies may still provide discounts even with minor infractions. This raises the question, “Can auto insurance companies check your phone records?” It’s crucial to understand how your driving history and phone usage could affect your premiums.

What types of coverage should attorneys consider to maximize discounts?

Attorneys should consider comprehensive and liability coverage, and those with higher deductibles may enjoy lower premiums.

Can attorneys negotiate their insurance premiums?

Yes, attorneys can negotiate their premiums by discussing available discounts, and coverage options, and comparing quotes from multiple insurers.

How do monthly rates for attorneys compare to the general population?

How can attorneys find the best auto insurance quotes?

What steps should attorneys take if they feel they aren’t receiving the discounts they deserve?

Are auto insurance discounts for attorneys available nationwide?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.