AAA vs. Farm Bureau Mutual Auto Insurance 2026 (Head-to-Head Review)

AAA car insurance starts at $65 per month, and Farm Bureau Insurance begins at just $50. AAA offers strong roadside assistance and a top-rated mobile app, while Farm Bureau focuses more on in-person agent support. Compare AAA vs. Farm Bureau auto insurance perks to find the right fit for your needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated June 2025

3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 682 reviews

682 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

682 reviews

682 reviewsAAA vs. Farm Bureau Mutual auto insurance offers two very different experiences, from membership benefits to personalized agent support.

AAA vs. Farm Bureau Auto Insurance Rating

| Rating Criteria |  |  |

|---|---|---|

| Overall Score | 4.1 | 3.7 |

| Business Reviews | 4.5 | 4.0 |

| Claims Processing | 3.3 | 4.0 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 3.2 |

| Coverage Value | 4.1 | 3.6 |

| Customer Satisfaction | 2.1 | 4.5 |

| Digital Experience | 4.0 | 4.0 |

| Discounts Available | 5.0 | 4.0 |

| Insurance Cost | 4.1 | 3.4 |

| Plan Personalization | 4.0 | 4.0 |

| Policy Options | 4.4 | 3.1 |

| Savings Potential | 4.4 | 3.6 |

| AAA Review | Farm Bureau Review |

AAA scores higher for its digital tools, like the Auto Club App, identity protection through ProtectMyID, and optional programs like AAA OnBoard for safe driving rewards. See more in our AAA Insurance review.

Farm Bureau Insurance focuses more on one-on-one support through local agents and offers standout programs, like the Young Driver Safety Program and its Preferred Auto Repair network. However, coverage varies by state, where AAA auto insurance is available everywhere.

- Compare AAA vs. Farm Bureau auto insurance membership perks

- AAA offers $65 per month with roadside help and multi-car discounts

- Farm Bureau starts at $50 a month with Driveology UBI and local agents

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

AAA vs. Farm Bureau Mutual Auto Insurance Cost Comparison

Looking at this rate comparison for AAA vs. Farm Bureau auto insurance, it’s clear that Farm Bureau consistently offers lower monthly premiums across every age and gender group. For example, a 16-year-old male pays around $269 a month with AAA but $210 monthly with Farm Bureau.

AAA vs. Farm Bureau Auto Insurance Monthly Rates

| Age & Gender |  |  |

|---|---|---|

| 16-Year-Old Female | $246 | $198 |

| 16-Year-Old Male | $269 | $210 |

| 30-Year-Old Female | $53 | $45 |

| 30-Year-Old Male | $55 | $47 |

| 45-Year-Old Female | $47 | $42 |

| 45-Year-Old Male | $65 | $50 |

| 60-Year-Old Female | $42 | $38 |

| 60-Year-Old Male | $43 | $39 |

Even older drivers, who usually enjoy lower premiums, see a wide gap. A 60-year-old female pays $42 per month with AAA versus just $38 a month with Farm Bureau. If pricing is a top concern, especially for families with young drivers, compare more quotes in our Farm Bureau Financial Services review to see if it’s the more budget-friendly choice.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA vs. Farm Bureau Insurance Rates by Driving Record

This AAA vs. Farm Bureau Financial Services auto insurance rate comparison by violation reveal a clear price difference — even after a not-at-fault accident, Farm Bureau holds steady at $95 while AAA jumps to $189.

AAA vs. Farm Bureau Auto Insurance Monthly Rates by Driving Record

| Violation |  |  |

|---|---|---|

| Clean Record | $65 | $50 |

| Not-At-Fault Accident | $71 | $62 |

| Speeding Ticket | $58 | $54 |

| DUI/DWI | $81 | $76 |

If you’ve had a speeding ticket or DUI, Farm Bureau still offers lower rates at $160 compared to AAA’s $211. These numbers make it clear that Farm Bureau is often the more affordable option among auto insurance companies for drivers with speeding tickets or other violations.

AAA vs. Farm Bureau Insurance Rates by Credit Score

Farm Bureau consistently offers lower premiums across all credit tiers. With good credit, AAA charges $110 per month while Farm Bureau charges $95 monthly. Even for fair or poor credit, Farm Bureau monthly rates remain cheaper at $115 and $142 compared to AAA’s $138 and $175 per month.

AAA vs. Farm Bureau Auto Insurance Monthly Rates by Credit Score

| Credit History |  |  |

|---|---|---|

| Good Credit | $110 | $95 |

| Fair Credit | $138 | $115 |

| Bad Credit | $175 | $142 |

So, if your credit score is less than perfect, Farm Bureau may be the better option for keeping costs low without sacrificing full coverage. Learn how credit scores affect auto insurance rates because it’s essential to consider your financial profile when choosing a provider.

When compared to AAA auto insurance, Farm Bureau remains the more affordable choice across all credit tiers, especially for drivers with fair or poor credit.

AAA vs. Farm Bureau Mutual Auto Insurance Discounts

The best auto insurance discounts for Farm Bureau members are for anti-theft devices and low mileage, while AAA delivers bigger rewards for telematics and multi-vehicle policies. Farm Bureau edges ahead with bigger savings for anti-theft systems at 20% vs. AAA’s 8% and low-mileage drivers (20% vs. 10%).

AAA vs. Farm Bureau Auto Insurance Discounts

| Discount |  |  |

|---|---|---|

| Anti-Theft | 8% | 20% |

| Bundling | 15% | 15% |

| Defensive Driving | 14% | 10% |

| Farm Vehicle | NA | 7% |

| Good Student | 14% | 10% |

| Low Mileage | 10% | 20% |

| Loyalty | 12% | 5% |

| Multi-Vehicle | 25% | 15% |

| New Vehicle | 3% | 10% |

| Paperless Billing | 2% | NA |

| Safe Driver | 10% | 10% |

| Usage-Based | 30% | 10% |

AAA auto insurance discounts win big with a 30% telematics discount and 25% off for multi-vehicle policies. Farm Bureau offers cheap farm vehicle auto insurance with additional discounts of 7%, while AAA doesn’t offer farm vehicle discounts. If you’re focused on usage-based savings, AAA has the advantage, but for rural drivers or those with short commutes, Farm Bureau might be the better fit.

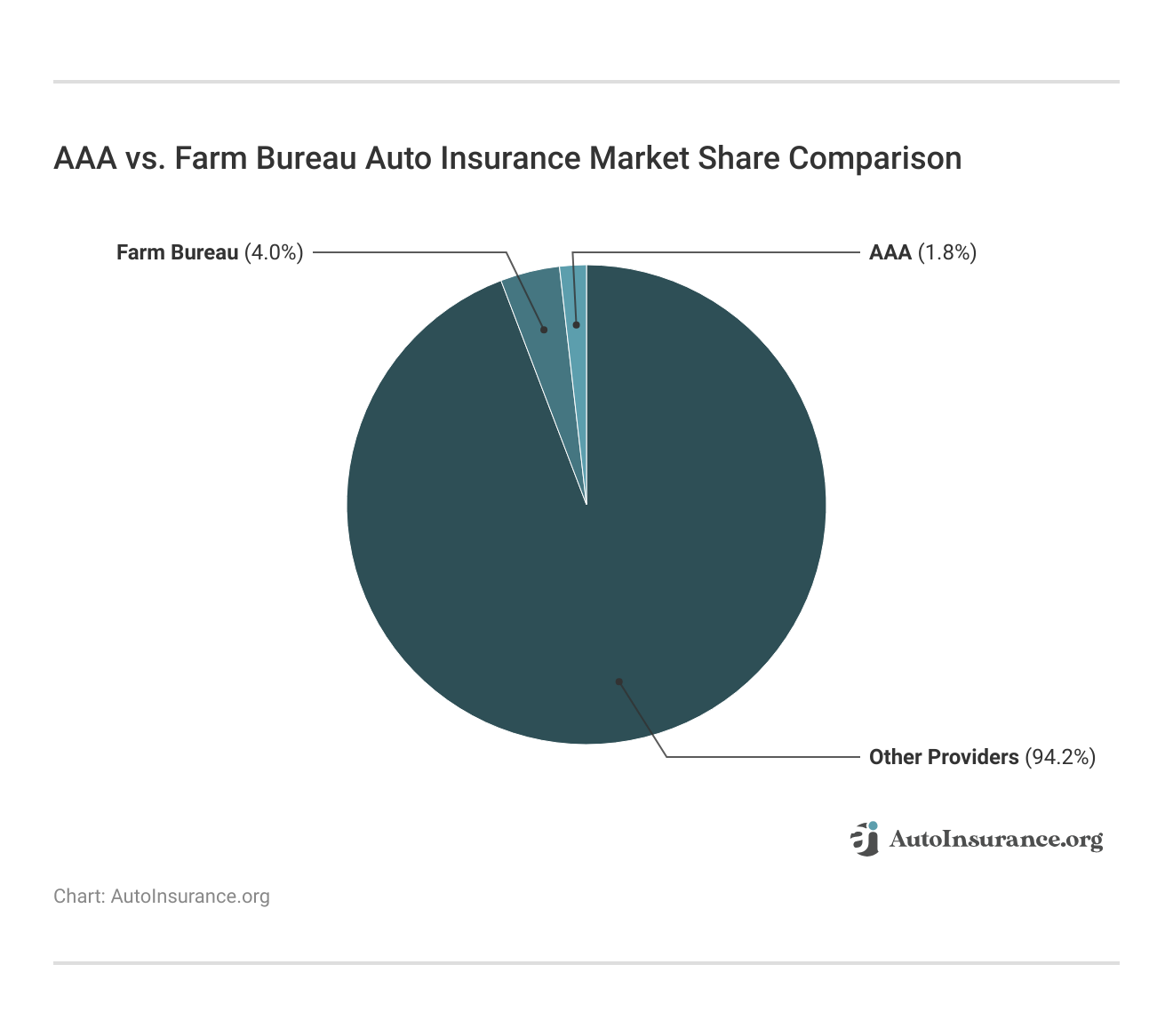

Looking at market presence, some insight into the differences between AAA and Farm Bureau Financial Services auto insurance. Farm Bureau accounts for a slight 4.0% of the auto insurance market, and AAA is way behind at only 1.8%. One might be surprised at that gap, considering AAA’s far-reaching brand recognition and national reach.

Farm Bureau’s stronger share reflects its foothold in the Midwest and Western regions, where local agents and tailored usage-based programs like Driveology connect more directly with drivers.

If market presence matters in your decision, Farm Bureau clearly edges out AAA in terms of customer reach. However, to make an informed choice, it’s important to evaluate auto insurance quotes from both companies based on your location and coverage needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA vs. Farm Bureau Mutual Auto Insurance Reviews

When you compare the business ratings and customer reviews for AAA vs. Farm Bureau auto insurance, Farm Bureau pulls slightly ahead in customer satisfaction. J.D. Power gives Farm Bureau a score of 849 out of 1,000 — well above average — while AAA reflects average satisfaction with a 706 out of 1,000.

Insurance Business Ratings & Consumer Reviews: AAA vs. Farm Bureau

| Agency |  |  |

|---|---|---|

| Score: 706 / 1,000 Avg. Satisfaction | Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback | Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. | Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

They don’t rank among the top auto insurance companies with the best customer service, but both providers earn high marks from the Better Business Bureau with an A+ rating. According to Consumer Reports, both Farm Bureau and AAA scored 74 out of 100, showing solid but not standout customer feedback.

Looking at complaint data from the NAIC, both providers land at a 0.58 complaint index, which is better than the national average. They also match in financial stability, each receiving an “A” rating from A.M. Best, which reflects strong claims-paying ability.

Pick AAA for digital perks and travel tools, or Farm Bureau if you prefer personal agent support. Your driving habits should shape your coverage.Laura Berry Former Licensed Insurance Producer

If you’re weighing customer satisfaction more heavily, Farm Bureau may give you a better experience overall. But if your priority is consistency across financials and complaints, both hold their own well.

Pros and Cons of AAA Auto Insurance

When you’re sizing up AAA auto insurance, it’s not just about the brand name. AAA shines if you want strong digital tools and dependable roadside help. Here’s what really stands out behind the wheel:

- Strong Roadside Assistance: AAA pioneered roadside assistance in 1915 and still leads with fast, reliable 24/7 service across the U.S. and Canada.

- Telematics Rewards with AAA OnBoard: Safe drivers can earn policy discounts by using the OnBoard program, which tracks habits like braking and speed.

- Digital Tools Built for Daily Use: The Auto Club App helps manage claims, policy documents, and roadside requests without calling an agent.

A Reddit reviewer also noted AAA’s helpful claims process and member perks like travel discounts and free maps, adding that while rates may vary, the overall experience was worth it.

Comment

byu/MShorter02 from discussion

inInsurance

But if personal agent support or consistent offerings are key for you, check the specifics in your region before signing up. Other things to look out for before buying AAA car insurance are:

- Coverage Varies by Club Location: Benefits and policy options aren’t consistent nationwide—what you get depends heavily on your local AAA club.

- Limited Agent Availability in Rural Areas: Some regions lack the same in-person support you’d find with more locally rooted insurers.

Remember the AAA requires an annual membership fee, so compare AAA vs. Geico auto insurance for more quotes and coverage details to see if it’s the best company for you.

Pros and Cons of Farm Bureau Mutual

Farm Bureau Insurance leans heavily on personal agent relationships and programs designed for everyday drivers in rural communities. Here’s a closer look at what works:

- Driveology Rewards Good Habits: Their usage-based Driveology program tracks speeding, braking, and phone use, offering performance-based savings and real-time feedback.

- Young Driver Safety Program: Drivers under 25 can earn a discount after completing Farm Bureau’s in-house safety course, which builds long-term habits.

- Preferred Auto Repair Network: After an accident, policyholders can use pre-screened repair shops with guaranteed work for as long as they own the car.

One Reddit user praised their experience as low-cost and hassle-free, sharing that their accident claim was handled smoothly and their premium didn’t increase afterward.

If hands-on support and locally focused programs matter more to you than high-tech extras, Farm Bureau may be the better fit, especially for families and rural drivers. However, it falls short for some drivers in these ways:

- Limited Availability: Farm Bureau only operates in 14 states, so it’s not an option if you live outside its regional footprint.

- Few Digital Features: Compared to national carriers, tools like online claims tracking or app-based account management are more limited.

The major downside to Farm Bureau is its lack of national coverage. However, if you live in Texas, Texas Farm Bureau auto insurance reviews rank it as one of the most popular providers for farm vehicle coverage and customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Between AAA and Farm Bureau Mutual Auto Insurance

When comparing AAA and Farm Bureau Financial Services, it’s important to consider how each handles auto insurance for different types of drivers. AAA suits those who value high-tech features like the Auto Club App and extra perks, including travel discounts and identity theft protection. Its nationwide service is also better-rated than Farm Bureau roadside assistance.

On the other hand, Farm Bureau caters more to drivers who prefer in-person service, want steady pricing across age groups, and appreciate programs like Driveology and guaranteed repairs through trusted repair shops.

Farm Bureau often offers better rates than AAA for rural drivers, those with lower credit, and parents insuring high-risk teen drivers.Chris Abrams Licensed Insurance Agent

If you’re looking for digital convenience and broad non-insurance benefits, AAA offers an edge, while Farm Bureau may be a better fit for drivers focused on affordability and personal agent support. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

Which company is best for auto insurance, Farm Bureau Financial Services or the American Automobile Association (AAA)?

AAA is best for drivers who want strong roadside assistance and travel perks, while Farm Bureau Mutual may be better for rural drivers seeking local agents and farming-related discounts. Your choice depends on whether you prioritize convenience or community-based service.

Is AAA a reliable company for auto insurance?

Yes, AAA is widely considered reliable with strong financial backing, typically receiving A or A+ ratings from A.M. Best. It also maintains high claims satisfaction scores, particularly in the areas of emergency services and roadside support.

Which offers better rates by age group, Farm Bureau or AAA auto insurance?

AAA generally offers lower premiums for drivers under 25 and over 65, while Farm Bureau car insurance tends to have more consistent pricing for teens and young drivers under 21. Comparing companies based on your age can help you lower your auto insurance rates

What is the rating of AAA auto insurance?

AAA auto insurance generally receives strong ratings, such as A or A+ from A.M. Best for financial stability, and scores around 4.2 out of 5 on customer satisfaction from independent review platforms, depending on the regional club.

What is the number one risk factor for AAA auto insurance rates increasing?

The top risk factor is accident history. AAA rates can rise 30%–60% after a single at-fault accident. Other significant risk factors include DUI convictions and multiple speeding violations within 36 months.

What is the best AAA insurance coverage option?

AAA’s best coverage typically includes full coverage with roadside assistance, rental reimbursement, and accident forgiveness. Many members opt for its “Plus” or “Premier” tier, which includes extended towing (up to 200 miles) and lockout services. Decide how much car insurance you need based on your driving habits and travel needs to get the best price.

Why is AAA considered good for auto insurance?

AAA car insurance is best known for its bundled benefits, which include roadside assistance, travel discounts, DMV services, and responsive customer support. It’s especially helpful for people who spend a lot of time on the road or are in need of emergency roadside assistance.

How much does AAA auto insurance screening or membership cost?

AAA membership fees typically start at around $60 per year for the Basic plan, but can reach $120 or more for Premier plans. These fees are separate from insurance premiums and are required for policyholders to access full AAA services.

Why is AAA auto insurance considered cheap for some drivers?

AAA can be cheaper for members who bundle policies or maintain safe driving records. Its discount structure, including multi-policy, good student, and loyalty discounts, helps reduce rates, especially for families and older drivers. Since pricing often depends on how auto insurance companies check driving records, maintaining a clean history can make a significant difference in what you pay.

What are the restrictions after an AAA auto repair?

After an approved AAA repair, the shop must guarantee work for at least 24 months or 24,000 miles. You may be restricted to using certified AAA repair facilities to maintain warranty protection on parts and labor.

What is the rating of Texas Farm Bureau auto insurance?

Does Farm Bureau auto insurance include roadside assistance?

Is Farm Bureau Financial Services a good company?

Is Farm Bureau auto insurance considered expensive?

How much does Farm Bureau car insurance cost per month?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.