Best Jeep Grand Cherokee Auto Insurance in 2026 (Find the Top 10 Companies Here)

Amica, Erie, and Auto-owners are the top providers for the best Jeep Grand Cherokee auto insurance starting at $45 per month. These companies offer competitive rates and comprehensive coverage, making them top choices for Jeep Cherokee insurance. Compare their rates to find the best deal.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2025

Company Facts

Full Coverage for Jeep Grand Cherokee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jeep Grand Cherokee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jeep Grand Cherokee

A.M. Best

Complaint Level

Pros & Cons

The best Jeep Grand Cherokee auto insurance providers are Amica, Erie, and Auto-Owners, with rates starting at $45 per month. These companies offer competitive pricing and comprehensive coverage options. For the lowest Jeep Cherokee insurance cost and optimal protection, Amica stands out as the top pick overall.

This article also covers factors affecting Jeep Cherokee insurance rates and how much insurance for a Jeep Cherokee can vary. It explains What does proper auto insurance cover, ensuring you understand the essentials of a well-rounded policy.

Our Top 10 Company Picks: Best Jeep Grand Cherokee Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Customer Service Amica

#2 10% A+ Personalized Policies Erie

#3 10% A++ Coverage Flexibility Auto-Owners

#4 20% B Reliable Service State Farm

#5 12% A+ Usage Based Progressive

#6 25% A+ Comprehensive Coverage Allstate

#7 20% A+ Policy Discounts Nationwide

#8 25% A Wide Coverage Liberty Mutual

#9 20% A Agent Network Farmers

#10 25% A++ Affordable Rates Geico

Enter your ZIP code above to explore which companies have the cheapest auto insurance rates for you.

- Best Jeep Grand Cherokee Auto Insurance starts at $50 per month

- Jeep Cherokee insurance cost varies by age, location, and record

- Amica offers top coverage for Jeep Cherokee at competitive rates

#1 – Amica: Top Overall Pick

Pros

- Competitive Monthly Rates: Amica offers a monthly rate of $120 for Jeep Grand Cherokee insurance, which is relatively affordable compared to many competitors, making it a solid choice for budget-conscious drivers.

- Excellent Customer Service: Known for high customer satisfaction, Amica provides outstanding support for Jeep Grand Cherokee owners, helping them navigate claims and coverage options efficiently.

- Discounts for Safe Driving: As outlined in our Amica auto insurance review, Amica offers substantial discounts for safe driving records, which can significantly lower insurance costs for Jeep Grand Cherokee drivers who maintain a clean driving history.

Cons

- Limited Coverage Options: While Amica offers competitive rates, their coverage options for Jeep Grand Cherokee owners may not be as extensive as some competitors, potentially limiting customization.

- Higher Deductibles: Amica’s deductibles might be higher compared to other insurers, which can result in higher out-of-pocket expenses for Jeep Grand Cherokee owners in the event of a claim.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Erie: Best for Personalized Policies

Pros

- Affordable Monthly Premiums: As mentioned in our Erie auto insurance review, Erie provides a monthly insurance rate of $110 for the Jeep Grand Cherokee, making it one of the more budget-friendly options available in the market.

- Comprehensive Coverage: Erie offers robust coverage options for the Jeep Grand Cherokee, including extensive comprehensive and collision coverage that can cater to various needs and preferences.

- Strong Regional Presence: With a solid reputation in various regions, Erie is well-regarded for offering reliable and personalized insurance services to Jeep Grand Cherokee owners.

Cons

- Limited National Availability: Erie’s insurance services are not available in all states, which may limit options for Jeep Grand Cherokee owners in regions where Erie is not an option.

- Fewer Discounts for New Drivers: Erie may offer fewer discounts for new or young drivers, which could lead to higher premiums for Jeep Grand Cherokee owners who are less experienced.

#3 – Auto-Owners: Best for Coverage Flexibility

Pros

- Reasonable Monthly Rates: Auto-Owners provides competitive monthly rates at $115 for Jeep Grand Cherokee insurance, balancing affordability with comprehensive coverage options.

- Flexible Coverage Options: Auto-Owners offers a range of customizable coverage options, allowing Jeep Grand Cherokee drivers to tailor their policy to meet specific needs and preferences.

- Strong Customer Support: As mentioned in our Auto-Owners auto insurance review, the company is known for reliable customer service, Auto-Owners helps Jeep Grand Cherokee owners with responsive support for claims and policy inquiries.

Cons

- Average Discount Opportunities: Auto-Owners may not offer as many discount opportunities compared to competitors, which could result in higher overall insurance costs for Jeep Grand Cherokee drivers.

- Mixed Reviews on Claims Processing: Some customers report mixed experiences with claims processing, potentially leading to delays or challenges for Jeep Grand Cherokee owners when filing claims.

#4 – State Farm: Best for Reliable Service

Pros

- Top Pick for Rates: State Farm offers a monthly rate of $130 for Jeep Grand Cherokee insurance, making it a top choice for comprehensive coverage and competitive pricing in the market.

- Extensive Coverage Options: State Farm provides a broad range of coverage options, including extensive add-ons for Jeep Grand Cherokee owners seeking more comprehensive protection.

- Multiple Discounts Available: State Farm auto insurance review highlights the numerous discount opportunities, such as multi-policy and safe driver discounts, which can significantly reduce insurance costs for Jeep Grand Cherokee owners.

Cons

- Higher Monthly Premiums: Despite its comprehensive coverage, State Farm’s monthly premiums are higher compared to some competitors, which may not be ideal for budget-conscious Jeep Grand Cherokee owners.

- Inconsistent Customer Service: Customer service experiences can vary, with some Jeep Grand Cherokee owners reporting less consistent support compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Usage Based

Pros

- Affordable Insurance Rates: As mentioned in our Progressive auto insurance review, Progressive provides a monthly rate of $125 for Jeep Grand Cherokee insurance, offering a good balance of affordability and coverage options.

- Usage-Based Insurance: Progressive offers a usage-based insurance program, which can potentially lower rates for Jeep Grand Cherokee drivers who drive less frequently or safely.

- Extensive Coverage Options: Progressive offers a wide range of coverage options, including add-ons for enhanced protection tailored to the needs of Jeep Grand Cherokee owners.

Cons

- Higher Deductibles: Progressive may have higher deductibles compared to some competitors, which could lead to increased out-of-pocket costs for Jeep Grand Cherokee owners in the event of a claim.

- Variable Customer Service: Customer service experiences with Progressive can be inconsistent, with some Jeep Grand Cherokee owners reporting issues with responsiveness and claims handling.

#6 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate provides extensive coverage options for the Jeep Grand Cherokee, including robust comprehensive and collision coverage tailored to various needs.

- Numerous Discounts Available: Allstate offers a wide range of discounts, such as safe driver and multi-car discounts, which can help reduce insurance costs for Jeep Grand Cherokee owners. Learn more about their discounts in our Allstate auto insurance review.

- Strong Regional Presence: With a strong presence in many regions, Allstate is known for providing reliable insurance services and support for Jeep Grand Cherokee drivers across various states.

Cons

- Higher Premiums: Allstate’s monthly premium of $140 is higher than many competitors, which may not be ideal for Jeep Grand Cherokee owners looking for more budget-friendly options.

- Mixed Customer Feedback: Customer feedback for Allstate can be mixed, with some Jeep Grand Cherokee owners reporting issues with claims processing and customer service.

#7 – Nationwide: Best for Policy Discounts

Pros

- Competitive Monthly Rate: Nationwide offers a monthly insurance rate of $128 for the Jeep Grand Cherokee, balancing affordability with comprehensive coverage.

- Diverse Coverage Options: Nationwide provides a wide range of coverage options, allowing Jeep Grand Cherokee owners to customize their policy to fit their specific needs.

- Discounts for Safety Features: Nationwide offers discounts for advanced safety features in the Jeep Grand Cherokee, which can help reduce overall insurance costs. For more information, read our Nationwide auto insurance review.

Cons

- Less Extensive Discount Program: Nationwide’s discount program may not be as extensive as some competitors, potentially leading to higher premiums for certain Jeep Grand Cherokee drivers.

- Inconsistent Claims Service: There have been reports of inconsistent claims service, which could affect the overall experience for Jeep Grand Cherokee owners when filing claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Wide Coverage

Pros

- Affordable Insurance Options: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers competitive monthly rates at $135 for Jeep Grand Cherokee insurance, providing a good balance of coverage and cost.

- Customizable Coverage Plans: Liberty Mutual offers a variety of customizable coverage options, allowing Jeep Grand Cherokee owners to tailor their insurance to their specific needs.

- Various Discount Opportunities: Liberty Mutual provides multiple discount options, including for safe driving and bundling policies, which can help reduce insurance costs.

Cons

- Higher Monthly Premiums: With a monthly premium of $135, Liberty Mutual may be more expensive compared to some competitors, which could be a drawback for budget-conscious Jeep Grand Cherokee owners.

- Mixed Customer Reviews: Customer reviews for Liberty Mutual can be mixed, with some Jeep Grand Cherokee owners reporting issues with customer service and claims handling.

#9 – Farmers: Best for Agent Network

Pros

- Comprehensive Coverage Options: Farmers offers extensive coverage options for the Jeep Grand Cherokee, including robust comprehensive and collision coverage tailored to various needs.

- Discounts for Safety Features: Farmers provides discounts for safety features installed in the Jeep Grand Cherokee, potentially lowering insurance costs for drivers.

- Multiple Coverage Discounts: Farmers offers a range of discounts for bundling policies and maintaining a good driving record, which can help reduce overall premiums. Check out this page Farmers auto insurance review to know more details.

Cons

- Higher Premiums: Farmers’ monthly premium of $132 is on the higher side compared to some competitors, which may not be ideal for those seeking lower insurance costs.

- Inconsistent Claims Experience: Some customers report inconsistent experiences with claims processing, which could be a concern for Jeep Grand Cherokee owners when filing claims.

#10 – Geico: Best for Affordable Rates

Pros

- Affordable Monthly Premiums: Geico offers a monthly rate of $112 for Jeep Grand Cherokee insurance, making it one of the more affordable options available in the market.

- Discounts for Safe Driving: Geico provides significant discounts for safe driving and good driving records, which can help lower insurance costs for Jeep Grand Cherokee owners.

- Comprehensive Coverage Options: Geico auto insurance review highlights the variety of coverage options, including comprehensive and collision coverage, to meet the diverse needs of Jeep Grand Cherokee drivers.

Cons

- Limited Local Presence: Geico’s local presence may be less extensive compared to some competitors, potentially impacting the level of personalized service available to Jeep Grand Cherokee owners.

- Average Customer Service: Geico’s customer service experiences can be hit or miss, with some Jeep Grand Cherokee drivers reporting challenges with responsiveness and claims handling.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeep Grand Cherokee Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Jeep Grand Cherokee from various providers.

Jeep Grand Cherokee Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $140

Amica $50 $120

Auto-Owners $48 $115

Erie $45 $110

Farmers $57 $132

Geico $47 $112

Liberty Mutual $58 $135

Nationwide $53 $128

Progressive $52 $125

State Farm $55 $130

When selecting insurance for your Jeep Grand Cherokee, it’s essential to compare rates across different providers to find the best coverage for your needs. The table above highlights the monthly costs for both minimum and full coverage, helping you make an informed decision.

Jeep Grand Cherokee Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $118 |

| Discount Rate | $69 |

| High Deductibles | $102 |

| High Risk Driver | $251 |

| Low Deductibles | $148 |

| Teen Driver | $431 |

Choosing the right deductible and discount options significantly impacts your Jeep Grand Cherokee insurance rates. The comparison above shows how different choices affect your auto insurance premium, helping you find the most cost-effective coverage.

Why Jeep Grand Cherokees Insurance is Expensive

The chart below details how Jeep Grand Cherokee insurance rates compare to other SUVs like the Mercedes-Benz GLE 350, Cadillac XT5, and Lexus RX 350.

Jeep Grand Cherokee Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi Q7 | $32 | $52 | $40 | $128 |

| Buick Enclave | $27 | $45 | $32 | $105 |

| Cadillac XT5 | $29 | $48 | $38 | $120 |

| Chevrolet Suburban | $33 | $55 | $38 | $131 |

| Jeep Grand Cherokee | $28 | $50 | $30 | $120 |

| Lexus RX 350 | $30 | $47 | $36 | $116 |

| Mercedes-Benz GLE 350 | $36 | $75 | $35 | $146 |

Jeep Grand Cherokee insurance rates are generally lower compared to luxury SUVs like the Mercedes-Benz GLE 350 and Lexus RX 350. Despite being cost-effective, rates can still vary based on coverage levels and specific vehicle features.

Read More: Cheap Buick Auto Insurance

Factors Impacting Jeep Grand Cherokee Insurance Cost

The cost of insurance for your Jeep Grand Cherokee is influenced by several key factors. The age of the vehicle plays a significant role; newer models generally incur higher premiums due to their higher value and advanced features.

The driver's age affects rates, with younger drivers, especially teens and those in their early twenties, facing higher costs due to increased risk.Heidi Mertlich LICENSED INSURANCE AGENT

Location and driving history also impact insurance rates. Urban areas with higher traffic and crime rates, such as New York City, tend to have higher premiums compared to less risky areas like Seattle.

Read More: What age group has the most fatal crashes?

A clean driving record with no violations or accidents typically results in lower insurance costs, whereas a history of infractions can lead to increased rates. Lastly, the type of coverage you choose—whether comprehensive, collision, or liability—affects your premium, with higher coverage levels increasing the overall cost.

Age of the Vehicle

Older Jeep Grand Cherokee models generally cost less to insure. For example, insurance rates for a 2020 Jeep Grand Cherokee are higher compared to those for a 2010 Jeep Grand Cherokee, reflecting a significant difference in cost.

Jeep Grand Cherokee Auto Insurance Monthly Rates by Model Year

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Jeep Grand Cherokee | $29 | $50 | $32 | $119 |

| 2023 Jeep Grand Cherokee | $28 | $49 | $32 | $117 |

| 2022 Jeep Grand Cherokee | $28 | $48 | $31 | $116 |

| 2021 Jeep Grand Cherokee | $27 | $48 | $31 | $114 |

| 2020 Jeep Grand Cherokee | $27 | $47 | $31 | $118 |

| 2019 Jeep Grand Cherokee | $26 | $45 | $33 | $116 |

| 2018 Jeep Grand Cherokee | $25 | $45 | $33 | $116 |

| 2017 Jeep Grand Cherokee | $24 | $44 | $35 | $115 |

| 2016 Jeep Grand Cherokee | $23 | $42 | $36 | $114 |

| 2015 Jeep Grand Cherokee | $22 | $40 | $37 | $112 |

| 2014 Jeep Grand Cherokee | $21 | $38 | $38 | $109 |

| 2013 Jeep Grand Cherokee | $20 | $35 | $38 | $107 |

| 2012 Jeep Grand Cherokee | $19 | $32 | $38 | $102 |

| 2011 Jeep Grand Cherokee | $18 | $29 | $38 | $99 |

| 2010 Jeep Grand Cherokee | $17 | $27 | $39 | $96 |

Insurance rates for the Jeep Grand Cherokee decrease with older model years, reflecting lower overall costs for insuring these vehicles. For example, a 2020 model is more expensive to insure than a 2010 model.

Driver Age

Driver age can have a significant effect on the cost of Jeep Grand Cherokee car insurance. For example, a 20-year-old driver could pay around $144 more each month for their Jeep Grand Cherokee car insurance than a 30-year-old driver.

Jeep Grand Cherokee Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $550 |

| Age: 18 | $450 |

| Age: 20 | $380 |

| Age: 30 | $250 |

| Age: 40 | $220 |

| Age: 45 | $210 |

| Age: 50 | $200 |

| Age: 60 | $190 |

Insurance rates for the Jeep Grand Cherokee vary significantly by driver age, with teens facing the highest costs and seniors benefiting from lower rates. Drivers in their 30s and 40s generally see more manageable insurance expenses.

Driver Location

Where you live can significantly impact Jeep Grand Cherokee insurance rates. For example, drivers in New York may pay $72 more each month than drivers in Seattle.

Jeep Grand Cherokee Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $202 |

| New York, NY | $186 |

| Houston, TX | $185 |

| Jacksonville, FL | $171 |

| Philadelphia, PA | $158 |

| Chicago, IL | $156 |

| Phoenix, AZ | $137 |

| Seattle, WA | $114 |

| Indianapolis, IN | $100 |

| Columbus, OH | $98 |

Your location significantly affects Jeep Grand Cherokee insurance rates, with substantial variations between cities. For instance, drivers in New York may pay significantly more compared to those in Seattle, highlighting the importance of considering regional differences in insurance costs.

Your Driving Record

Your driving record can have an impact on the cost of Jeep Grand Cherokee car insurance. Teens and drivers in their 20’s see the highest jump in their Jeep Grand Cherokee car insurance rates with violations on their driving record.

Jeep Grand Cherokee Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $570 | $750 | $800 | $670 |

| Age: 18 | $407 | $580 | $640 | $520 |

| Age: 20 | $345 | $490 | $560 | $450 |

| Age: 30 | $111 | $210 | $240 | $190 |

| Age: 40 | $102 | $200 | $220 | $170 |

| Age: 45 | $100 | $190 | $210 | $165 |

| Age: 50 | $95 | $180 | $200 | $160 |

| Age: 60 | $90 | $170 | $190 | $150 |

Accidents and violations can substantially increase Jeep Grand Cherokee insurance rates, especially for younger drivers. Maintaining a clean driving record is crucial for keeping insurance costs lower.

Jeep Grand Cherokee Safety Ratings

Your Jeep Grand Cherokee auto insurance rates are tied to the Jeep Grand Cherokee’s safety ratings. See the breakdown below:

Jeep Grand Cherokee Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Marginal |

| Small overlap front: passenger-side | Poor |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Jeep Grand Cherokee’s safety ratings vary significantly across different test types, with poor ratings in small overlap front tests. Overall, it performs well in moderate overlap front, side, roof strength, and head restraints evaluations.

Jeep Grand Cherokee Crash Test Ratings

Jeep Grand Cherokee crash test ratings can impact the cost of your Jeep Grand Cherokee car insurance. See Jeep Grand Cherokee crash test results below:

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Jeep Grand Cherokee Trackhawk SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Jeep Grand Cherokee SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Jeep Grand Cherokee SUV 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Jeep Grand Cherokee SRT SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Jeep Grand Cherokee Trackhawk SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Jeep Grand Cherokee SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Jeep Grand Cherokee SUV 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Jeep Grand Cherokee SRT SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Jeep Grand Cherokee Trackhawk SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Jeep Grand Cherokee SUV 4WD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Jeep Grand Cherokee SUV 2WD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Jeep Grand Cherokee SRT SUV 4WD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Jeep Grand Cherokee SUV 4WD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Jeep Grand Cherokee SUV 2WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2017 Jeep Grand Cherokee SRT SUV 4WD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Jeep Grand Cherokee SUV 4WD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Jeep Grand Cherokee SUV 2WD | 4 stars | 5 stars | 5 stars | 3 stars |

| 2016 Jeep Grand Cherokee SRT SUV 4WD | 5 stars | 5 stars | 5 stars | 4 stars |

The Jeep Grand Cherokee’s crash test ratings show strong performance, particularly in frontal and side impacts. However, the ratings vary by model and year, with some models not tested or rated.

Jeep Grand Cherokee Safety Features

The Jeep Grand Cherokee safety features can help lower insurance costs. According to AutoBlog, the 2020 Jeep Grand Cherokee has the following safety features:

- Comprehensive Airbag System: Includes driver, passenger, front head, rear head, and front side airbags for enhanced protection.

- Advanced Braking Features: Equipped with 4-wheel ABS, 4-wheel disc brakes, and brake assist.

- Stability and Traction Control: Features electronic stability control and traction control for better handling.

- Safety and Visibility Enhancements: Includes daytime running lights and a blind spot monitor for improved safety.

- Child Safety: Equipped with child safety locks for added protection for younger passengers.

The Jeep Grand Cherokee’s robust safety features contribute to lower insurance premiums by enhancing overall vehicle safety. These advanced systems not only protect occupants but also can help you save on insurance costs.

Jeep Grand Cherokee Insurance Loss Probability

Another contributing factor that plays a direct role in Jeep Grand Cherokee insurance rates is the loss probability for each type of coverage.

Jeep Grand Cherokee Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | -19% |

| Property Damage | 11% |

| Comprehensive | -29% |

| Personal Injury | -38% |

| Medical Payment | -40% |

| Bodily Injury | -6% |

The loss probability for different insurance coverage types significantly impacts Jeep Grand Cherokee insurance rates. Lower loss rates for comprehensive and medical payment coverages can help reduce overall insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeep Grand Cherokee Finance and Insurance Cost

If you are financing a Jeep Grand Cherokee, most lenders will require your carry higher Jeep Grand Cherokee coverage options including comprehensive coverage, so be sure to shop around and compare Jeep Grand Cherokee car insurance rates from the best companies using our free tool below.

Read More: Do you need medical payment coverage on auto insurance?

Ways to Save on Jeep Grand Cherokee Insurance

Drivers can end up saving more money on their Jeep Grand Cherokee car insurance rates by employing any one of the following strategies.

- Avoid the temptation to file a claim for minor incidents.

- Move to the countryside.

- Don’t assume your Jeep Grand Cherokee is cheaper to insure than another vehicle..

- Check the odometer on your Jeep Grand Cherokee.

- Pay your Jeep Grand Cherokee insurance upfront.

To save on Jeep Grand Cherokee insurance, avoid filing claims for minor incidents and consider relocating to a less populated area. Additionally, check your vehicle’s mileage regularly and pay your premium upfront to benefit from potential discounts.

Read More: Is it worth claiming a scratch on your auto insurance?

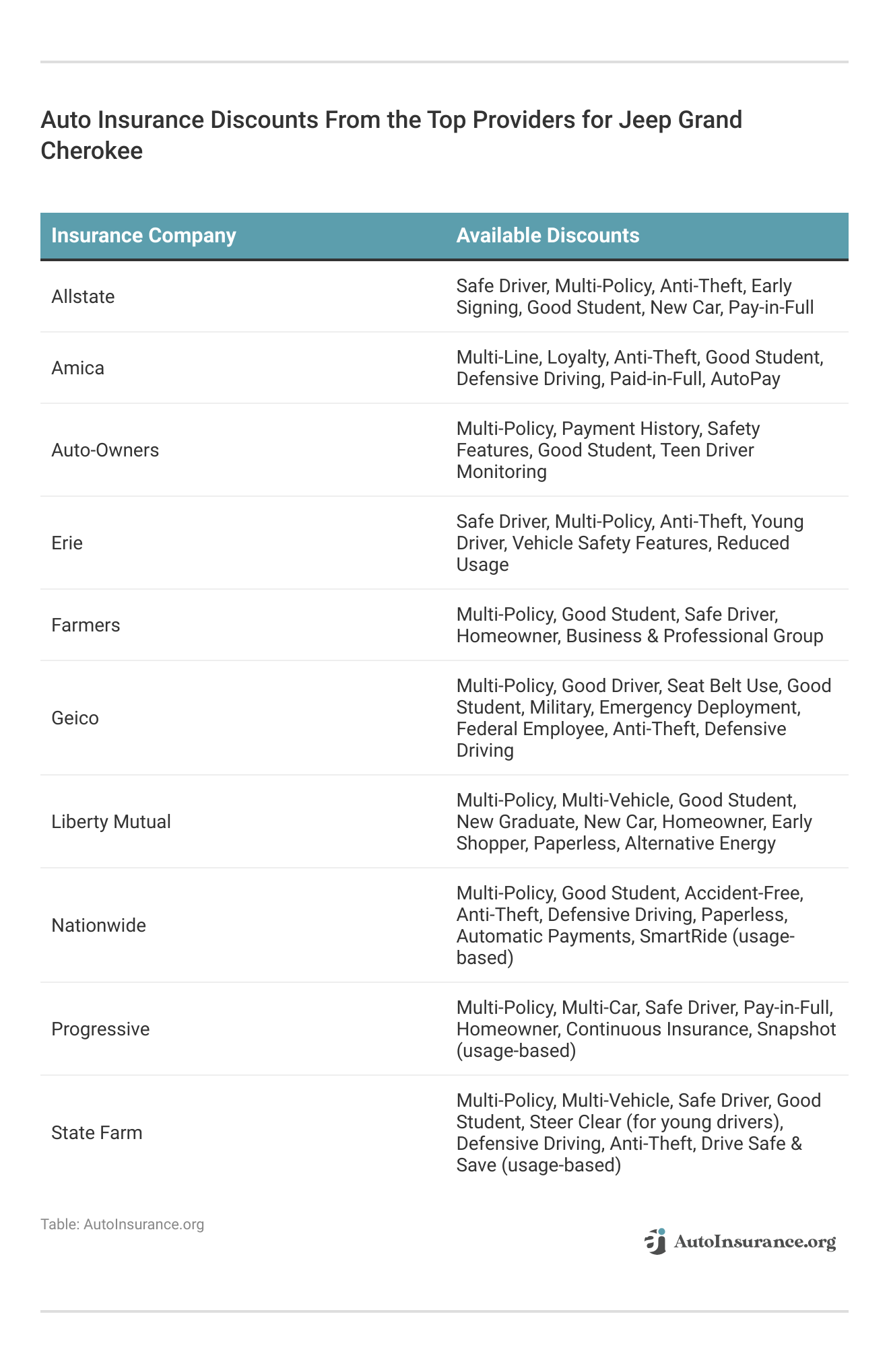

Discover the variety of auto insurance discounts offered by top providers for Jeep Grand Cherokee to help you save on your premiums.

These discounts from top insurance providers for Jeep Grand Cherokee offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Jeep Grand Cherokee Insurance Companies

Several insurance companies offer competitive rates for the Jeep Grand Cherokee based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Jeep Grand Cherokee drivers organized by market share.

Top Jeep Grand Cherokee Auto Insurance Companies by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

The data reveals that State Farm leads the market with a significant share of 9.3%, while Geico and Progressive follow as strong competitors. Companies like Liberty Mutual and Allstate also hold notable positions, reflecting a diverse range of options for Jeep Grand Cherokee insurance.Read More: Cheap Jeep Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Free Jeep Grand Cherokee Insurance Quotes Online

To find the best auto insurance for your Jeep Grand Cherokee, comparing quotes online is essential. Our free online tool allows you to easily obtain and compare rates from top insurance providers, ensuring you get the most competitive coverage options.

By evaluating auto insurance quotes, you can find the best coverage tailored to your needs, potentially saving you money while securing the protection your Jeep Grand Cherokee deserves.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

Why is Amica considered a top pick for Jeep Grand Cherokee insurance?

Amica is recognized for its competitive rates and comprehensive coverage options, making it a leading choice for affordable and reliable Jeep Grand Cherokee auto insurance.

Read More: Amica Auto Insurance Discounts

What factors impact the cost of Jeep Grand Cherokee insurance?

Several factors can influence the cost of insuring a Jeep Grand Cherokee. These include the age of the vehicle, driver age, driver location, and driving record. Older models and drivers with a clean record generally have lower insurance rates.

Are Jeep Grand Cherokees expensive to insure?

Jeep Grand Cherokees have insurance rates that are, on average, $105 less per year compared to the average vehicle. However, insurance costs can vary depending on factors such as your location, driving record, and model year.

What is the average insurance cost for Jeep Grand Cherokee?

The average monthly insurance cost for a Jeep Grand Cherokee is $118, with comprehensive coverage at approximately $29 per month, collision coverage at $42 per month, and liability coverage at $33 per month.

Read More: Cheapest Liability-Only Auto Insurance

How does the model year of my Jeep Grand Cherokee affect my insurance premium?

Older Jeep Grand Cherokee models typically cost less to insure compared to newer models due to lower repair costs and decreased likelihood of high-value claims.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What are the safety ratings of the Jeep Grand Cherokee?

The safety ratings of the Jeep Grand Cherokee are an important factor in determining insurance rates. The vehicle’s crash test ratings and safety features contribute to insurance costs. The 2020 Jeep Grand Cherokee, for example, offers various safety features that can potentially lower insurance premiums.

How do the safety ratings of the Jeep Grand Cherokee impact insurance costs?

The Jeep Grand Cherokee’s safety ratings can influence insurance premiums. Higher safety ratings may lead to lower costs due to reduced risk of injury and damage, while lower ratings could increase premiums as insurers account for greater potential claims.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

How can I save on Jeep Grand Cherokee insurance?

There are several ways to save on Jeep Grand Cherokee insurance. These include practicing safe driving habits, maintaining a clean driving record, taking advantage of discounts offered by insurance companies, and comparing quotes from different insurance providers to find the best rates.

What additional coverage options should I consider for the Best Jeep Grand Cherokee Auto Insurance?

Consider adding options like roadside assistance and rental reimbursement to enhance your coverage, ensuring comprehensive protection tailored to your Jeep Grand Cherokee.

How does financing a Jeep Grand Cherokee affect my insurance rates?

Financing a Jeep Grand Cherokee typically increases insurance costs, as lenders usually require comprehensive and collision coverage. This added protection safeguards the lender’s investment, potentially raising your monthly premium compared to a vehicle without a loan.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.