Salvage Titles Explained (2026 Detailed Guide)

Salvage titles are simply titles that applies to a vehicle deemed total loss by insurance companies, often following an accident. This article explains how salvage title cars, while 20-40% cheaper, pose challenges for insurance. Rebuilt title insurance rates start at $62 per month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated August 2025

Salvage titles are titles for vehicles that have been deemed total losses by insurance companies, typically after severe damage, making them legally unfit to drive without extensive repairs.

These vehicles can be 20-40% cheaper, but they impact what insurance options you have, as you’ll have to repair the vehicle and then obtain rebuilt title auto insurance.

- A salvage title applies to any vehicle declared a total loss by an insurance company

- No insurance company will provide coverage to salvaged vehicles unless repaired

- To insure a salvage vehicle, it must be repaired and pass a state inspection

This guide covers the pros, cons, and legal requirements of buying a salvage vehicle or securing insurance. Discover how rebuilt titles make damaged vehicles insurable and road-ready. Get fast and cheap auto insurance coverage for a salvage title car today with our free quote comparison tool.

Salvage Title Defined

There are different types of vehicle title brands. The title to your car is proof that you own it. As long as it’s in your name, your state DMV recognizes that the car belongs to you. Usually, you get a clean title when you buy a car, especially if it’s a new vehicle. However, there are other types of titles to look out for if you’re on the hunt for a new vehicle.

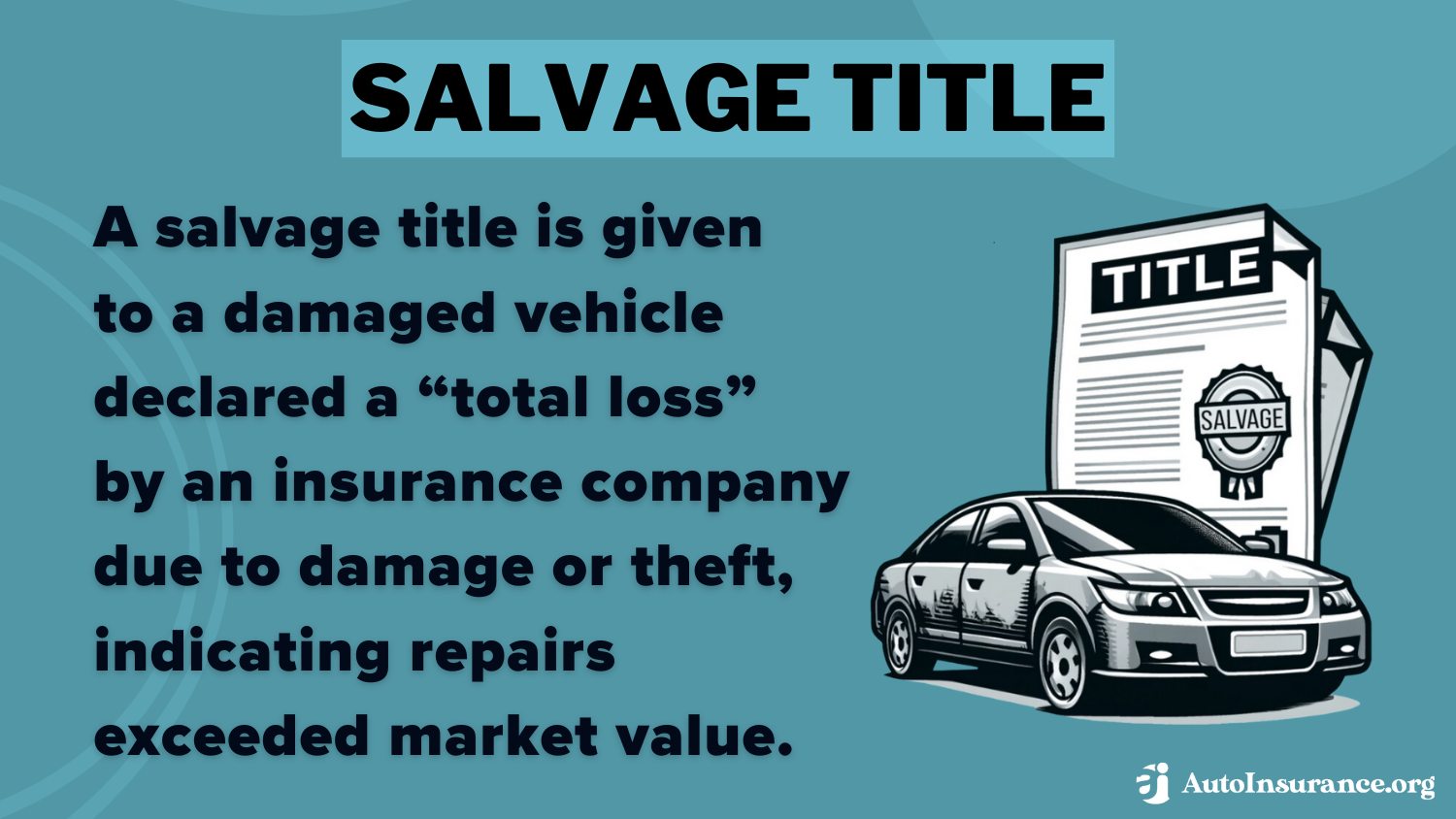

What is a salvage title on a car? The salvage title definition is a title that is issued to cars that have sustained enough damage that they had to be declared a total loss.

Salvage titles let potential buyers know that repairs will have to be made to the vehicle before driving it or putting a liability auto insurance policy on it.

This table explains the salvage title meaning and the meanings of other types of titles:

Minimum Coverage Auto Insurance Cost for a Salvage Car

| Insurance Company | Monthly Rates |

|---|---|

| $90 | |

| $68 | |

| $78 | |

| $110 | |

| $62 | |

| $114 | |

| $84 | |

| $72 | |

| $95 |

| $98 |

The title salvage meaning applies to damaged vehicles that were declared a total loss by the insurance company. A salvage vehicle meaning is a vehicle that an insurance company declared totaled because the cost to repair it outweighed its total value. If a salvage title car is repaired and inspected, it will be issued a rebuilt title.

The salvage title’s meaning and color are meant to alert buyers and insurance companies that the vehicle was previously damaged.

Types of Vehicle Titles

| Title Type | Description | Use Case |

|---|---|---|

| Clean | No major damage or claims | Standard new or used cars |

| Salvage | Declared total loss by insurer | Repair, resale, or parts |

| Rebuilt | Salvage car repaired and approved for road use | Driving after inspection |

| Flood | Water-damaged vehicle | Risky resale or parts |

| Junk | Not drivable, sold for scrap | Dismantling or recycling |

| Bonded | No title proof, backed by a surety bond | Ownership disputes |

| Lien | Still under loan or financing | Financed vehicles |

| Export | Meant for shipment abroad | International sales |

| Reconstructed | Repaired after major damage (state-specific term) | Similar to rebuilt |

Cars can be declared a total loss for a variety of reasons. The most obvious example that comes to mind is a car accident, but salvaged status can also come from floods, fire, vandalism, and theft.

In fact, it doesn’t matter how a car is damaged. As long as repairs cost too much, the vehicle will become salvaged and require a salvage title. Take a look below to see which states require salvage titles for stolen vehicles.

What criteria do insurance companies use to total a car? It depends on the company, but it’s usually when repairs cost more than a large percentage of the car’s worth.

Read More: How Insurance Companies Determine if a Car is Totaled

Most companies set the damage threshold between 75% and 90% of the car’s total value. What do auto insurance companies do with totaled cars? Once a car has crossed that threshold, the insurance provider sells the vehicle to mechanics or auction sites. If your car has been declared totaled, you can keep your vehicle and try to repair it on your own time.

Typically, a salvage title vehicle was involved in a major accident or collision, and the repair costs surpassed the car’s value.

You may encounter salvage titles on vehicles with flood or water damage, as well as heavily used taxi cabs and patrol vehicles.Laura Berry Former Licensed Insurance Producer

If you own a salvage vehicle, you must register it with your state. In general, you will register it through your local DMV, but each state will have a different process and registration costs. For more, see our article on vehicle registration fees by state.

Understanding the Impact of a Salvage Title

If you’re looking for a road-ready vehicle, then a salvage title isn’t in your best interest. You can’t buy insurance for a car with a salvage title, so you can’t drive that car until it’s repaired and deemed eligible for coverage. A salvage vehicle is not suited for registration.

But this doesn’t mean a salvage title is bad. Salvage titles aren’t lost causes, and you may find a salvage title that isn’t too costly to repair.

Remember, a total loss means that repairs cost more than what the insurance company thinks a vehicle is worth. Your budget may be more flexible than the insurance companies’. So, it’s important to weigh your options and compare auto insurance rates before you decide to buy a salvage title car.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Restoring a Salvaged Vehicle for the Road

It’s not always possible, but you can sometimes repair a salvaged car. You can tell a salvaged car has been adequately repaired when it has a rebuilt title. Laws vary by state, but a salvaged car usually has to pass a rigorous examination before it’s eligible for a rebuilt title.

Before you buy a car with a salvage or rebuilt title, make sure to check your state’s laws. Salvage titles are not eligible for auto insurance until they are repaired. If you’re looking to buy auto insurance for salvage vehicles, you will have to make all the necessary repairs and apply for rebuilt titles.

For example, what does a salvage title mean in Texas? Regarding insuring salvage title cars in Texas, it’s easier for a salvage title to get a rebuilt title in Texas than in California. Once a salvaged car has passed an examination and receives a rebuilt title, you can safely and legally drive it on the street again.

The Process of Clearing a Salvage Title

Clearing a salvage title requires extensive repairs and passing a state inspection. Where you live will determine how you clear a salvage title since each state has different laws regarding vehicle inspections.

Once your vehicle is repaired and passes inspection, you will have to apply for a rebuilt title and new vehicle registration with your state’s DMV. Application processes will vary by state.

For example, in Texas, drivers must fill out two forms: 1) an application for a Texas certificate of title, and 2) a rebuilt vehicle statement. Once the applications are processed, the salvaged title meaning in Texas will change to “Rebuilt Salvage – Damage.” With this new title, drivers can now buy liability-only auto insurance.

To learn the specifics of how to clear a salvage title in your state, contact your local DMV.

Obtaining Insurance for Rebuilt Title Vehicles

What does a salvage title mean for insurance? Since it’s illegal to drive a salvage car, you won’t find a reputable insurance provider that will offer you a policy. However, rebuilt titles are street-legal. Most insurance companies will work with a rebuilt title (though there are a few exceptions). Insurance companies that sell to rebuilt car owners are usually not willing to give you more than liability coverage.

Insurance for vehicles with rebuilt titles may cost less, as you can only buy liability insurance. Insurance companies consider rebuilt cars riskier because there could be underlying damage that no one knows about.

However, some companies may be willing to provide you with full coverage. Finding full coverage on a rebuilt title is more challenging than liability-only, but it can be done. It’s challenging to buy full coverage for a rebuilt title because it’s hard to determine the car’s value.

However, you may be able to add collision and comprehensive insurance for full coverage.

- Collision: Pays for your rebuilt car’s repairs if you are in an accident with another car or object, like a fence.

- Comprehensive: Pays for your rebuilt car’s repairs if you collide with an animal or your car is damaged by weather, vandalism, or theft.

Since the salvage title value of a vehicle often loses up to 20% after it is rebuilt, you’ll also receive a smaller payout if you file an auto insurance claim (Learn More: How to File an Auto Insurance Claim). Rebuilt cars aren’t valued as highly as clean-titled models, and insurers aim to minimize their financial risk.

Your provider will have difficulty determining what damage was already present if you ever need to make a claim. Even cars that are certified safe to drive after a thorough mechanic exam could have undiscovered damage.

Undiscovered damage usually shows up down the road when you least expect it. This danger is why insurance companies are hesitant to fully insure rebuilt cars.

Insurance companies assume that a rebuilt car is more likely to make a claim. You need a minimum amount of liability coverage in most states, and you can find that. It’s full coverage that can be tricky.

Best Auto Insurance Providers for Rebuilt Title Vehicles

No auto insurance company will offer coverage to a salvage title vehicle. There is no such thing as salvage title insurance. Any place selling you a salvage title policy is committing auto insurance fraud.

If you need salvage title insurance, you need to repair your vehicle and apply for a rebuilt title. Insurance companies are more likely to insure a rebuilt title. The table below shows what you could pay for auto insurance with a rebuilt title:

Salvage Title Auto Insurance Rates

| Insurance Company | Liability-Only Coverage | Full Coverage |

|---|---|---|

| $162 | $318 | |

| $91 | $179 | |

| $135 | $275 | |

| $125 | $249 | |

| $117 | $229 | |

| $144 | $283 | |

| $110 | $210 | |

| $120 | $235 | |

| $130 | $260 |

| $82 | $161 |

Most of the best auto insurance companies provide liability-only policies for rebuilt titles. Still, you may have difficulty finding a company willing to provide full coverage.

State Farm, Progressive, Allstate, Geico…These and more made our list of the top 10 🏆auto insurance companies. Check out 👀our review to see which might be a good fit for you👉: https://t.co/RS6zOyxEnY pic.twitter.com/XUC6Loksx1

— AutoInsurance.org (@AutoInsurance) September 25, 2024

Even though rebuilt titles are legal to drive, some insurance companies won’t cover them. If you already have an insurance policy, you can ask your agent if your rebuilt car can be added to it. If you don’t have insurance (or they won’t cover your new car), consider the following companies:

- State Farm Auto Insurance Review

- Allstate Auto Insurance Review

- Geico Auto Insurance Review (additional inspections are required before your insurance goes into effect)

- MetLife Auto Insurance Review (liability only)

- Farmers Auto Insurance Review

- Progressive Auto Insurance Review (full coverage offered for specific models)

Most companies have specific requirements that you’ll have to meet before they sell you coverage for your rebuilt car. You’ll probably face limitations on your policy as well. It’s vital that you compare insurance quotes to get the best deal possible.

Read more: Best Auto Insurance Companies That Cover Salvage Titles

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Insurance Coverage for a Salvage Car

Getting auto insurance with a rebuilt title might seem confusing, but the process doesn’t have to be stressful. Rebuilt cars require more work to be street-legal, but the effort is worthwhile once you can drive.

Read More: What is needed for adequate auto insurance coverage?

Take the following steps to secure insurance for your rebuilt car:

- Make Sure You Have the Correct Title: If your car has a salvage title, you can’t drive it, and insurance companies won’t insure it. Save yourself a headache and make sure you have the right title before looking at insurance.

- Get a Certified Mechanic’s Statement: This statement assures your insurance company that a mechanic has gone over the entire car looking for potential problems.

- Shop for Coverage: Normally, you’d consider what type of coverage you want on your car. Most companies only offer liability, so you’ll have to do a little searching to find a company that will give you more than that.

- Compare Quotes: It’s always important to compare quotes when you’re looking for new insurance, and this is especially true when you have a rebuilt car. Prices tend to be higher on rebuilt cars, this step can help you save money.

These four steps are the basis for getting the best insurance policy to protect your new car. When you have an idea of what insurance company you want to buy from, one of their agents can help you make the most of your coverage.

Evaluating the Value of Purchasing a Salvage Title Vehicle

Deciding to buy a car with a salvage title is nothing to walk into lightly. Salvage titles come with cheaper price tags, often less than a used vehicle with a clear title. Most people who buy salvage titles use them for parts (Read More: Should I buy a car that was totaled?).

Look for companies that take salvage titles and qualify you for full coverage pending a vehicle inspection, or, at the very least, comprehensive.Brandon Frady Licensed Insurance Producer

Now that you know the definition of a salvage title, you should be ready to find insurance if you plan on fixing a salvage car. Enter your ZIP code into our free tool to see what quotes might look like for you.

Frequently Asked Questions

What is a salvage title?

The definition of a salvage title means a vehicle that has been declared a total loss by an insurance company due to severe damage from an accident, collision, flood, or other causes. It indicates that the vehicle has significant damage and may not be legally fit to be driven.

Can you drive a vehicle with a salvage title?

No, salvage title vehicles are not eligible for auto insurance, and therefore, they cannot be legally driven on the road. The necessary repairs must be made, and the vehicle needs to pass inspection to obtain a rebuilt title before it can be driven.

Can you register a salvage title?

Is a salvage title bad?

Salvage titles indicate that a vehicle has sustained significant damage and was deemed a total loss by an insurance company. While salvage titles may not be suitable for road-ready vehicles, they are not necessarily bad.

Depending on the extent of the damage and your budget for repairs, buying a salvage title vehicle at a lower cost can be an option worth considering.

How do I clear a salvage title?

Clearing a salvage title involves repairing the vehicle and passing a state inspection. The process varies by state, and you will need to follow your state’s specific requirements. Once the repairs are completed and the inspection is passed, you can apply for a rebuilt title and new vehicle registration through your local DMV.

What is the salvage insurance definition?

Regarding insurance salvage meaning, most reputable insurance providers do not offer coverage for salvage cars since it is illegal to drive them. However, once a salvaged car has been repaired and inspected, it can be issued a rebuilt title, and insurance coverage may be available for it. Find out if auto insurance covers transmission repair.

What is the difference between salvage and rebuilt titles?

A salvage title is given to a car that has been declared a total loss by an insurance company. On the other hand, a rebuilt title is issued to a previously salvaged car that has been repaired and passed a rigorous examination to meet the necessary safety standards.

Can you get full coverage insurance for a rebuilt title car?

Obtaining full coverage insurance for a rebuilt title car can be challenging. Insurance companies are often hesitant to provide full coverage due to difficulties in determining the car’s value and the potential for undiscovered damage. Liability coverage is generally more readily available for rebuilt titles.

Is it worth buying a car with a salvage title?

The value of buying a salvage title car depends on its intended use. It can be a good deal for parts or personal repair, but insurance coverage is often limited, and the car’s value is lower than a clean-titled vehicle. You may also need to adjust your recommended auto insurance coverage levels.

Does Allstate insure rebuilt titles?

Allstate may insure vehicles with a rebuilt title, but coverage options are typically limited to liability insurance.

Are salvage cars insurable?

What is the best insurance for a rebuilt title?

Does Allstate insure salvage titles?

Does Geico insure salvage titles?

Does Progressive insure rebuilt titles?

Does State Farm cover salvage titles?

How does a salvage title affect insurance?

How do you get a salvage title cleared in Georgia?

What are the requirements for insuring salvage title cars in Texas?

Is insurance cheaper for salvage title cars?

Does Progressive insure salvage titles?

What is the meaning of a salvage title in California?

What does a salvage title mean in Texas?

What does a Utah salvage title not suitable for registration mean?

What are the disadvantages of a salvage title?

What does a salvage title mean in Colorado?

What does a salvage title mean in South Carolina?

What insurance companies cover rebuilt titles with full coverage?

What does a salvage title look like?

Should I buy a car with a salvage title?

What does blue title mean?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.