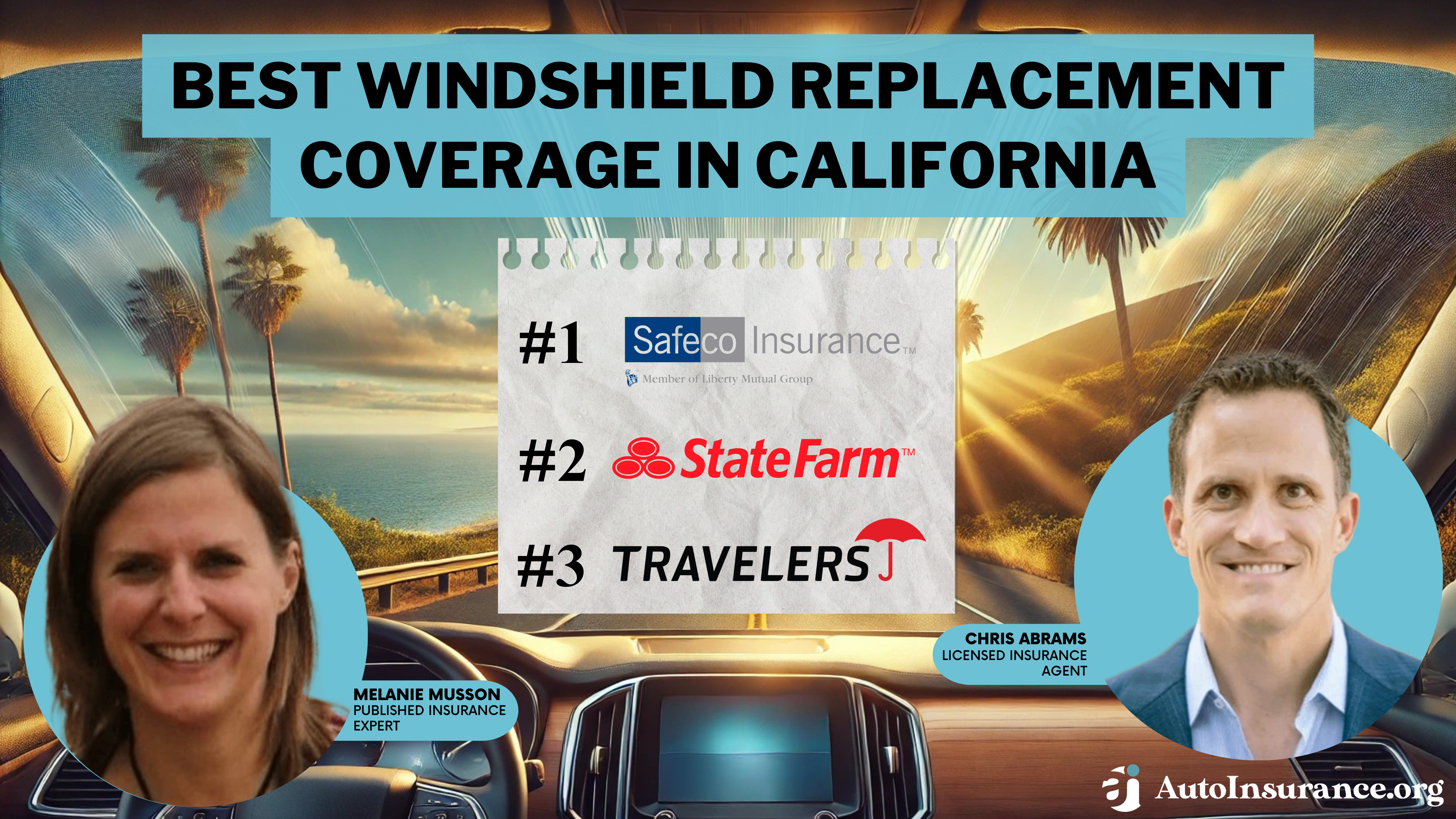

Best Windshield Replacement Coverage in California (Top 10 Companies in 2026)

Safeco, State Farm, and Travelers offer the best windshield replacement coverage in California, beginning at just $55 per month. We're committed to assisting you in comparing quotes from these trusted insurers, so you can secure the ideal coverage and enjoy tailored discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated March 2025

Company Facts

Full Coverage Windshield Replacement in CA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in CA

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in CA

A.M. Best

Complaint Level

Pros & Cons

- Safeco offers competitive rates beginning at $55 per month

- Top-tier insurance providers offer chances to save on windshield replacements

- There are multiple discount options available for windshield replacement coverage

#1 – Safeco: Top Overall Pick

Pros

- Competitive Rates: Safeco offers competitive rates for windshield replacement coverage in California, starting from just $55 per month. Read more with our Safeco auto insurance review for your guide.

- Comprehensive Coverage Options: Safeco provides a wide array of comprehensive coverage options tailored to meet specific driving needs.

- Trusted Insurer: Safeco is a trusted insurer with a reputation for reliability and customer satisfaction.

Cons

- Limited Availability: Safeco’s coverage may not be available in all areas of California, potentially limiting options for some drivers.

- Claim Process: Some customers may find the claims process with Safeco to be less streamlined compared to other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Student Savings

Pros

- Strong Financial Stability: State Farm boasts a high financial strength rating, providing reassurance to policyholders.

- Student Savings: State Farm offers discounts and savings opportunities specifically geared towards student drivers.

- Excellent Customer Service: State Farm is known for its excellent customer service, providing personalized support and assistance.

Cons

- Potentially Higher Rates: While State Farm offers quality coverage, some drivers may find their rates to be slightly higher compared to other providers. Find out more in our State Farm auto insurance review.

- Limited Coverage Options: State Farm’s coverage options may be somewhat limited compared to other insurers, potentially restricting customization for some drivers.

#3 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers offers comprehensive coverage options, ensuring drivers have adequate protection for various situations.

- Affordable Rates: Our Travelers auto insurance review reveals that Travelers provides affordable rates for windshield replacement coverage, making it accessible to a wide range of drivers.

- Flexible Policies: Travelers offers flexible policy options, allowing drivers to tailor coverage to their specific needs and budget.

Cons

- Mixed Customer Reviews: While Travelers has many satisfied customers, some have reported issues with claims processing and customer service.

- Limited Availability: Travelers’ coverage may not be available in all areas of California, potentially limiting options for some drivers.

#4 – Progressive: Best for Biggest Discount

Pros

- Biggest Discount: In our Progressive auto insurance review, Progressive offers some of the largest discounts in the industry, potentially saving policyholders significant money on their premiums.

- Innovative Technology: Progressive is known for its innovative technology, offering features like Snapshot® that can lead to additional savings based on driving habits.

- Easy Online Tools: Progressive provides user-friendly online tools and resources for managing policies, making it convenient for customers to access information and make changes.

Cons

- Varied Customer Service: While some customers praise Progressive’s customer service, others have reported issues with responsiveness and claims handling.

- Limited Coverage Options: Progressive’s coverage options may be more limited compared to some other providers, potentially restricting customization for certain drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits for policyholders, including perks like roadside assistance and recovery care. Read more with out The Hartford auto insurance review for guidance.

- Strong Reputation: The Hartford has a strong reputation for reliability and stability, providing peace of mind to customers.

- Personalized Coverage: The Hartford offers personalized coverage options, allowing drivers to tailor policies to their unique needs and preferences.

Cons

- Higher Rates for Some: While The Hartford offers quality coverage, some drivers may find their rates to be slightly higher compared to other providers.

- Limited Availability: The Hartford’s coverage may not be as widely available in all areas of California, potentially limiting options for some drivers.

#6 – Nationwide: Best for Commercial Insurance

Pros

- Commercial Insurance Expertise: Nationwide is known for its expertise in commercial insurance, offering comprehensive coverage options for business vehicles.

- Family Plans: Nationwide, as mentioned in our Nationwide insurance review, provides attractive family plans, allowing policyholders to bundle multiple vehicles and save on premiums.

- Wide Network: Nationwide has a wide network of agents and service centers, making it convenient for customers to access support and assistance.

Cons

- Mixed Customer Reviews: While many customers are satisfied with Nationwide’s service, some have reported issues with claims processing and communication.

- Limited Discounts: Nationwide’s discount offerings may be more limited compared to some other providers, potentially resulting in higher premiums for certain drivers.

#7 – Farmers: Best for Family Plans

Pros

- Family-Oriented Coverage: Farmers offers family-oriented coverage options, including discounts for multiple policies and safe driving incentives.

- Personalized Service: Farmers provides personalized service through its network of local agents, offering tailored advice and support to customers.

- Innovative Features: Farmers offers innovative features like Signal® app, which rewards safe driving behavior with potential discounts on premiums.

Cons

- Potentially Higher Rates: Farmers, as mentioned in our Farmers auto insurance review, while Farmers offers quality coverage, some drivers may find their rates to be slightly higher compared to other providers.

- Coverage Restrictions: Farmers’ coverage options may come with more restrictions and limitations compared to some competitors, potentially impacting flexibility for certain drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Multi-Policies

Pros

- Multi-Policy Discounts: Allstate offers significant discounts for bundling multiple policies, such as auto and home insurance.

- Nationwide Availability: Allstate’s coverage is widely available across California and the United States, ensuring accessibility for drivers. Use our Allstate auto insurance review as your guide.

- Quick Claims: Allstate is known for its efficient claims processing, providing prompt resolution and reimbursement for covered damages.

Cons

- Higher Premiums: Some drivers may find Allstate’s premiums to be higher compared to other providers, particularly for certain coverage options.

- Limited Specialty Coverage: Allstate’s specialty coverage options may be more limited compared to some competitors, potentially requiring additional policies for specific needs.

#9 – Geico: Best for Young Drivers

Pros

- Affordable Rates: Geico is renowned for its competitive rates, offering some of the most affordable premiums in the industry.

- Young Driver Discounts: Geico provides attractive discounts for young drivers, making it an appealing option for students and young professionals. Read more in our Geico auto insurance review.

- Online Convenience: Geico offers convenient online tools and resources for managing policies, allowing customers to handle tasks efficiently from anywhere.

Cons

- Limited Personalized Service: Geico’s direct-to-consumer model may result in less personalized service compared to traditional insurers with local agents.

- Varied Claims Experience: While many customers report positive experiences with Geico’s claims process, some have encountered delays or challenges in resolving claims.

#10 – Liberty Mutual: Best for Quick Claims

Pros

- Quick Claims Processing: Liberty Mutual is known for its quick and efficient claims processing, ensuring timely resolution for policyholders. For further insights, refer to our Liberty Mutual auto insurance review.

- Discount Opportunities: Liberty Mutual offers various discount opportunities, such as bundling policies, which can help policyholders save on premiums.

- Strong Financial Stability: Liberty Mutual boasts strong financial stability, providing reassurance to customers about the insurer’s ability to fulfill claims obligations.

Cons

- Higher Premiums for Some: While Liberty Mutual offers quality coverage, some drivers may find their premiums to be slightly higher compared to other providers.

- Complex Policy Options: Liberty Mutual’s policy options may be more complex compared to some competitors, potentially making it challenging for customers to understand their coverage fully.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Filing a Claim for a Cracked Windshield in California

Comprehensive Auto Insurance

Windshield Repair and Replacement Regulations in California

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Cheap Auto Insurance With Glass Coverage in California

Frequently Asked Questions

Does auto insurance in California cover windshield replacement?

Yes, auto insurance in California may cover windshield replacement under certain circumstances. Comprehensive insurance coverage typically includes coverage for windshield damage caused by incidents such as rock chips, cracks, or vandalism. However, the specific coverage and deductible amount can vary depending on your insurance policy.

What is comprehensive insurance coverage?

Comprehensive insurance coverage is an optional auto insurance coverage that helps protect against damage to your vehicle that is not caused by a collision with another vehicle. It typically covers incidents such as theft, vandalism, fire, hail, and certain types of windshield damage. Comprehensive coverage is subject to a deductible, which is the amount you must pay out of pocket before the insurance coverage applies. Enter your ZIP code now.

How do I know if my auto insurance policy includes windshield replacement coverage?

To determine if your auto insurance policy includes windshield replacement coverage, you should review your policy documents or contact your insurance provider directly. Look for the section that outlines comprehensive coverage or liability auto insurance and check if it specifically mentions coverage for windshield damage or glass replacement.

Will filing a windshield replacement claim affect my insurance rates in California?

Generally, filing a windshield replacement claim in California does not affect your insurance rates. Windshield replacement claims are typically considered no-fault claims and are not considered an indicator of increased risk or negligence. However, it’s always a good idea to review your policy and contact your insurance provider to understand how a claim might impact your specific policy.

Are there any limitations or restrictions on windshield replacement coverage in California?

While windshield replacement coverage is available in California, there may be certain limitations or restrictions depending on your insurance policy. These can include restrictions on the number of claims allowed within a specific period, limitations on the types of damage covered, and requirements to use approved repair facilities. It’s important to review your policy or contact your insurance provider for details on any specific limitations or restrictions that may apply. Enter your ZIP code now to begin.

What should I do if my windshield is damaged and needs replacement?

If your windshield is damaged and needs replacement, follow these steps for collision insurance:

- Contact your insurance provider. Report the damage to your insurance provider and inquire about the coverage for windshield replacement. They will guide you through the claims process and provide instructions on filing a claim.

- Schedule windshield replacement. If your policy covers windshield replacement, your insurance provider may recommend approved repair facilities or provide you with a list of preferred vendors. Schedule an appointment with a reputable windshield replacement service.

- Pay the deductible. Depending on your policy, you may need to pay a deductible before your insurance coverage applies. Pay the deductible to the repair facility when the service is completed.

- Provide necessary information. Ensure you provide all necessary information, including your insurance policy details, to the repair facility. They will handle the paperwork and billing with your insurance provider.

Can I choose any windshield replacement service in California?

While you have the option to choose any windshield replacement service in California, some insurance policies may have preferred vendors or approved repair facilities. Working with these preferred vendors can streamline the claims process and ensure that the service provider meets the insurance company’s quality and pricing standards. It’s advisable to check with your insurance provider for any specific recommendations or requirements.

How do California’s regulations affect windshield replacement coverage options?

California mandates no-deductible coverage for windshield replacement, ensuring minimal out-of-pocket expenses for policyholders. Enter your ZIP code now.

What sets Safeco, State Farm, and Travelers apart as top choices for windshield replacement coverage?

How do Progressive and Geico differ from traditional insurers like State Farm and Allstate in windshield replacement coverage?

Progressive and Geico provide optional windshield coverage, differing from traditional insurers like State Farm and Allstate in pricing and claims processes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.