Usage-Based Insurance in 2026 (Breaking Down the Facts)

Drivers who sign up for usage-based insurance can save up to 40%. Usage-based auto insurance tracks behaviors like speeding and hard braking. Drivers with the safest habits earn better discounts, but most companies guarantee that your usage-based insurance rates won’t increase for bad driving habits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated August 2025

Usage-based insurance discounts can help you save up to 40% on your car insurance, but only safe drivers get the full discount.

Most insurance providers offer a UBI discount to help their customers save, but the maximum amount you can save depends on your company and where you live. Usage-based car insurance is not available everywhere.

Read on to learn how usage-based insurance works and where to find cheap usage-based auto insurance companies. Then, enter your ZIP code into our free comparison tool to find the best deals in your area.

- Usage-based insurance tracks your driving habits to offer a discount

- UBI discount amounts depend on your insurance company

- Allstate and Nationwide offer the largest UBI discount at 40%

How Usage-Based Insurance Works

Usage-based insurance (UBI) is a type of auto insurance discount based on your driving habits. UBI typically relies on telematics technology, which uses a mobile app or a device installed in the vehicle to monitor driving behavior. As long as you drive safely, a UBI program is one of the easiest ways to get the best auto insurance for good drivers.

To help drivers save, most companies offer some form of usage-based insurance program. You can compare some of the top UBI programs below.

Top Usage-Based Auto Insurance (UBI) Programs

| Company | Program Name | Sign-up Discount | Savings Potential | How It's Tracked |

|---|---|---|---|---|

| Drivewise | 10% | 40% | Mobile App | |

| KnowYourDrive | 10% | 20% | Mobile App or Device |

| DriveEasy | 20% | 25% | Mobile App | |

| RightTrack | 5% | 30% | Mobile App or Device |

| Mile Auto | 20% | 40% | Mileage-Based | |

| SmartRide | 10% | 40% | Mobile App or Device | |

| Snapshot | $25 | $231/yr | Mobile App or Device | |

| RightTrack (Liberty) | 5% | 30% | Mobile App | |

| Drive Safe & Save | 5% | 30% | Mobile App or Device | |

| IntelliDrive | 10% | 30% | Mobile App |

Signing up for one of these UBI programs is usually easy, but you’ll need to be comfortable with your driving being tracked. In order to determine your discount, companies track some or all of the following:

- When you drive

- Speeding and acceleration

- Hard braking

- Phone use

- How much you drive

Depending on the company, you’ll either need to install an app on your phone or insert a tracking device into your car’s OBD port.

Less common methods of tracking include using your car’s 12V power outlet or a preinstalled in-car system.Scott W. Johnson Licensed Insurance Agent

It’s important to compare your options before you sign up for a UBI program. For example, most UBI programs guarantee your rates won’t go up if you’re not a safe driver, but that’s not true of every company. Also, some companies penalize phone use while driving while others do not.

Getting started with usage-based insurance is typically easy. Simply visit your provider’s website to start the sign up process.

If you’re looking for new insurance, you’ll fill out a quote request form for a normal policy. Most companies offer new customers the option to sign up for UBI when they purchase a new policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Usage-Based Insurance Rates

When you sign up for usage-based car insurance, you might qualify for a significant discount. Check below to see usage-based insurance costs for the average driver.

Usage-Based Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Program | Minimum Coverage | Full Coverage |

|---|---|---|---|

| Drivewise | $75 | $140 | |

| MilesMyWay | $80 | $150 | |

| DriveSense | $85 | $160 | |

| Signal | $78 | $145 | |

| DriveEasy | $80 | $150 | |

| Hugo Flex | $70 | $130 | |

| RightTrack | $82 | $155 |

| Pulse | $85 | $160 | |

| Mile | $78 | $145 | |

| SmartRide | $82 | $155 |

| Snapshot | $88 | $165 | |

| Drive Safe & Save | $83 | $158 | |

| IntelliDrive | $84 | $160 | |

| SafePilot | $80 | $150 |

Usage-based insurance benefits include being able to combine other discounts to further increase your savings. For example, many drivers who earn a UBI discount also qualify for a good driver discount.

Depending on how many discounts you qualify for, you can cut your normal insurance rates by a significant amount. Make sure to check with an insurance representative from your provider to ensure you’re getting all the auto insurance discounts you qualify for.

Usage-Based Insurance Pros and Cons

Like most things in life, usage-based insurance comes with pros and cons. Understanding these pros and cons can help you make the best choice for your driving situation. First, take a look at the benefits of usage-based insurance:

- Lower Rates: The best reason to sign up for a UBI program is that you’ll have the opportunity to lower your insurance rates.

- Encourages Safe Habits: For many drivers, knowing their driving habits are being tracked encourages them to drive safer.

- Driving Tips: Many UBI programs offer personalized tips based on previous trips to help you boost your driving score and earn a larger discount.

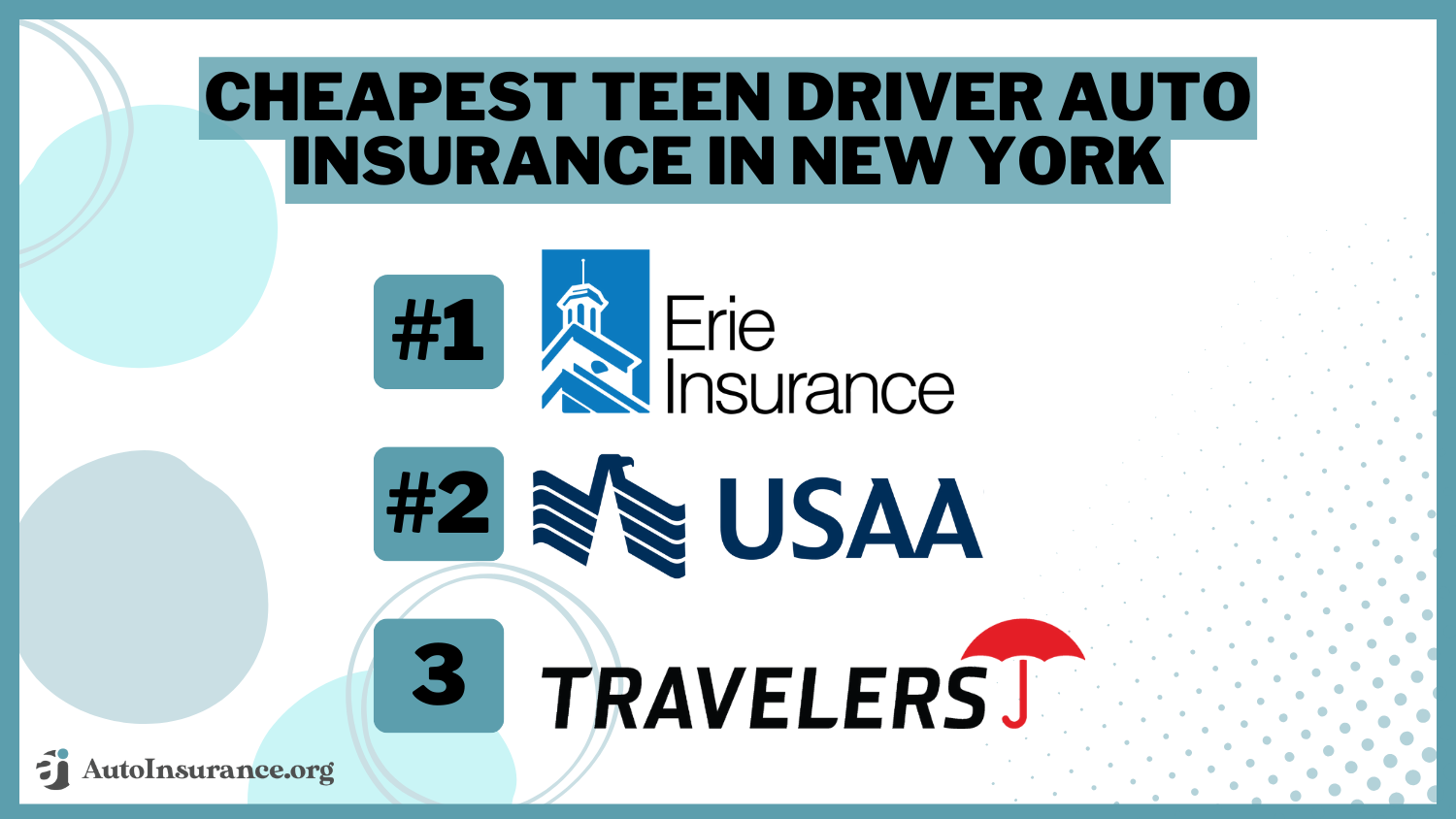

The driving improvement tips that are often included in UBI apps make these programs appealing to parents and guardians with teenage drivers.

Shout out to Allstate customers who use our Drivewise app! A national survey found, on average, Drivewise customers:

📞 handle their phones 44% less while driving

🚀 spend 23% less time driving at high speeds

🚙 have an 11% lower rate of hard braking https://t.co/5GeR2nydjm— Allstate (@Allstate) April 19, 2024

While many drivers enjoy affordable usage-based insurance, it’s not for everyone. The disadvantages of signing up for a UBI program include:

- Privacy Concerns: You’ll need to agree to have your driving tracked to enroll in UBI, which includes where you go. Some drivers simply aren’t comfortable sharing this information, even when their provider has one of the best auto insurance apps.

- Increased Rates: While most companies don’t raise your rates, some providers charge more if you sign up for UBI and drive recklessly.

The good news is that you’ll likely have a trial phase to decide if you like the UBI program your provider offers. If you don’t, you can cancel your enrollment without your rates changing.

Usage-Based Insurance vs. Pay-Per-Mile Insurance

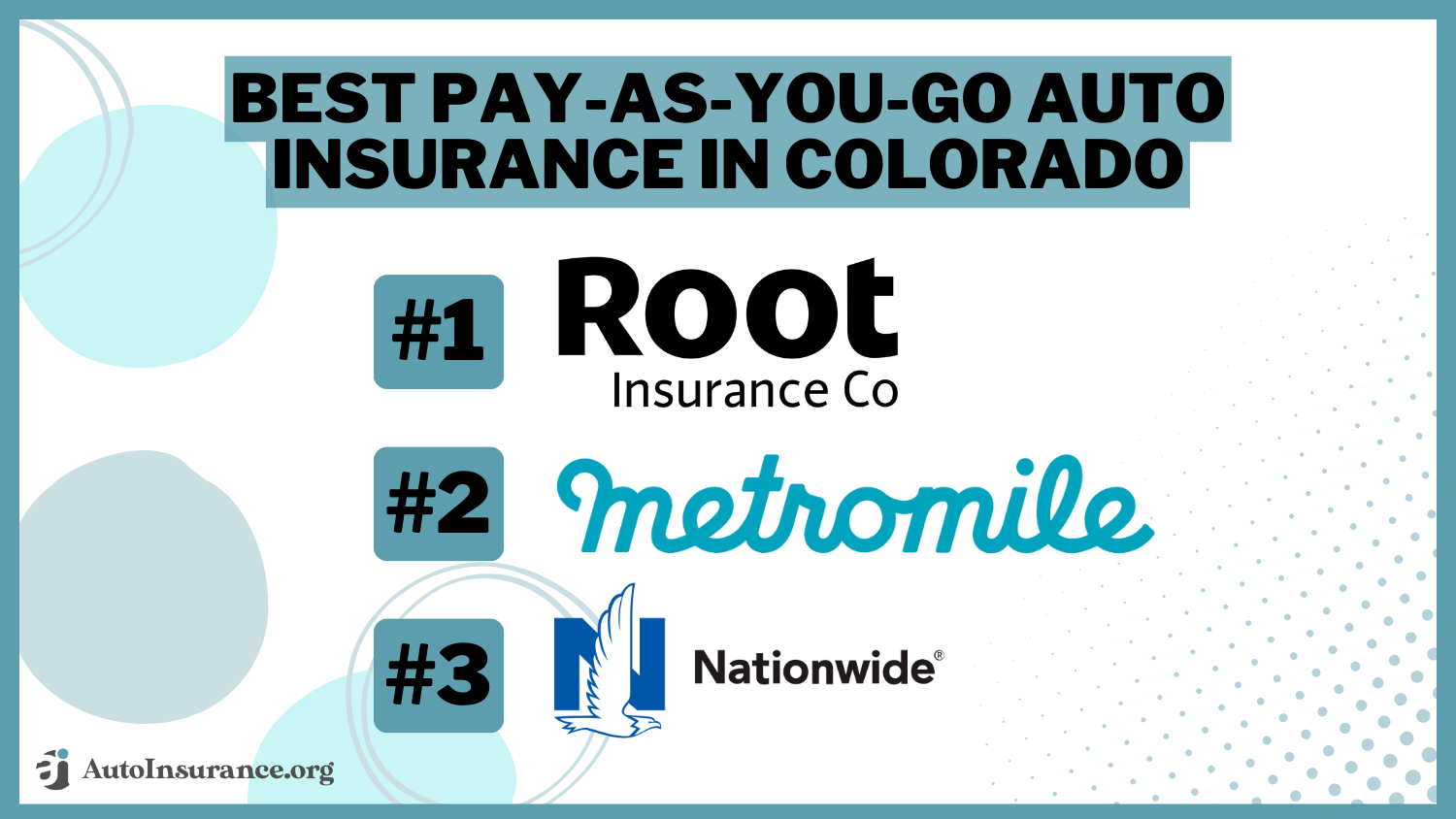

Although they’re a type of usage-based insurance, pay-per-mile insurance policies are different than the discount. While the best low-mileage discounts can help you save a bit, a pay-as-you-go plan offers much better savings.

With pay-per-mile insurance (also known as pay-as-you-go insurance), your rates are determined strictly by how much you drive. What you pay monthly for your insurance is a combination of two prices. The first is a flat fee you pay no matter what. The second is a per-mile fee, usually just a few cents.

For example, if your flat fee is $35 per month and you’re charged $.05 per mile, your insurance bill would be $60 for a month you drove 500 miles.

Pay-per-mile insurance policies don’t usually offer many discounts since you’ll be paying much less already.Michelle Robbins Licensed Insurance Agent

Usage-based insurance tracks annual mileage but also considers a host of other driving behaviors. Additionally, UBI programs offer a discount on a traditional policy, while pay-per-mile plans are standalone policies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Usage-Based Insurance Companies Today

A usage-based insurance discount can help you lower your car insurance rates, but you’ll need to regularly practice safe driving habits to qualify for the best discount. Companies like Nationwide and Allstate have the best UBI discounts, but most providers offer at least a small UBI discount.

Now that you know how usage-based insurance works, your next step should be to compare rates with the cheapest auto insurance companies. Use our free comparison tool to find affordable coverage in your area by entering your ZIP code.

Frequently Asked Questions

What is usage-based insurance?

Usage-based insurance (UBI) is a discount many insurance providers offer to help safe drivers save. UBI programs track things like how often you drive, when you drive, hard braking, and speeding. After an evaluation period, you’ll earn a usage-based insurance discount based on your driving habits.

Is usage-based insurance worth it?

A UBI program is worth it if you regularly practice safe driving habits and don’t mind being tracked. However, usage-based insurance probably isn’t the best for high-risk drivers. If you have speeding tickets, at-fault accidents, or DUIs on your record, shopping for the best auto insurance for high-risk drivers is a safer bet.

Does Progressive offer a UBI program?

Yes, the Progressive usage-based insurance program is called Snapshot. You can save up to 20% with Snapshot, but it’s one of the few UBI programs that can cause your rates to increase if you don’t drive safely enough. See if Snapshot is right for you in our Progressive car insurance review.

How much does usage-based insurance cost?

While many factors affect auto insurance rates, average UBI rates start at $70 per month. Rates vary significantly by a variety of factors, however, so make sure to enter your ZIP code into our free comparison tool to find affordable prices.

Is the State Farm UBI program worth it?

The State Farm usage-based insurance program Drive Safe & Save is considered one of the best UBI programs available. Check out our State Farm auto insurance review to learn more.

How much can you save with a UBI discount?

The largest discount opportunity through UBI programs comes from Nationwide and Allstate, which offer up to 40%. Every company has a different maximum discount, however.

Does Allstate have usage-based insurance?

There are two Allstate usage-based insurance programs — Milewise and Drivewise. Drivewise is Allstate’s UBI discount program, while Milewise is a pay-per-mile option. To see which is right for you, check out our Allstate auto insurance review.

What is pay-per-mile insurance?

Pay-per-mile insurance is a type of car insurance policy that doesn’t use traditional factors to determine your rates. Instead, your monthly premium is determined by how many miles you drive in a month. If you’re a low-mileage driver, shopping at the best pay-as-you-go auto insurance companies can help you save.

Can your rates go up with usage-based insurance?

Most UBI programs guarantee that your rates won’t increase if you sign up. However, some can increase your rates if you don’t have safe driving habits. For example, Snapshot by Progressive can lead to higher rates.

Does phone use affect usage-based insurance rates?

Many UBI programs don’t hold phone use against you simply because it’s too hard to track. However, a few usage-based insurance programs — like Geico’s DriveEasy — track phone use (Learn More: Geico DriveEasy Review).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.