Kansas Minimum Auto Insurance Requirements in 2025 (KS Coverage Details)

Kansas minimum auto insurance requirements ensure drivers carry at least 25/50/25 coverage for bodily injury and property damage. At $22/mo, this coverage protects you from financial strain after an accident. Kansas minimum auto insurance offers essential protection that every driver must maintain.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2025

Kansas minimum auto insurance requirements mandate that drivers carry at least 25/50/25 coverage for bodily injury and property damage.

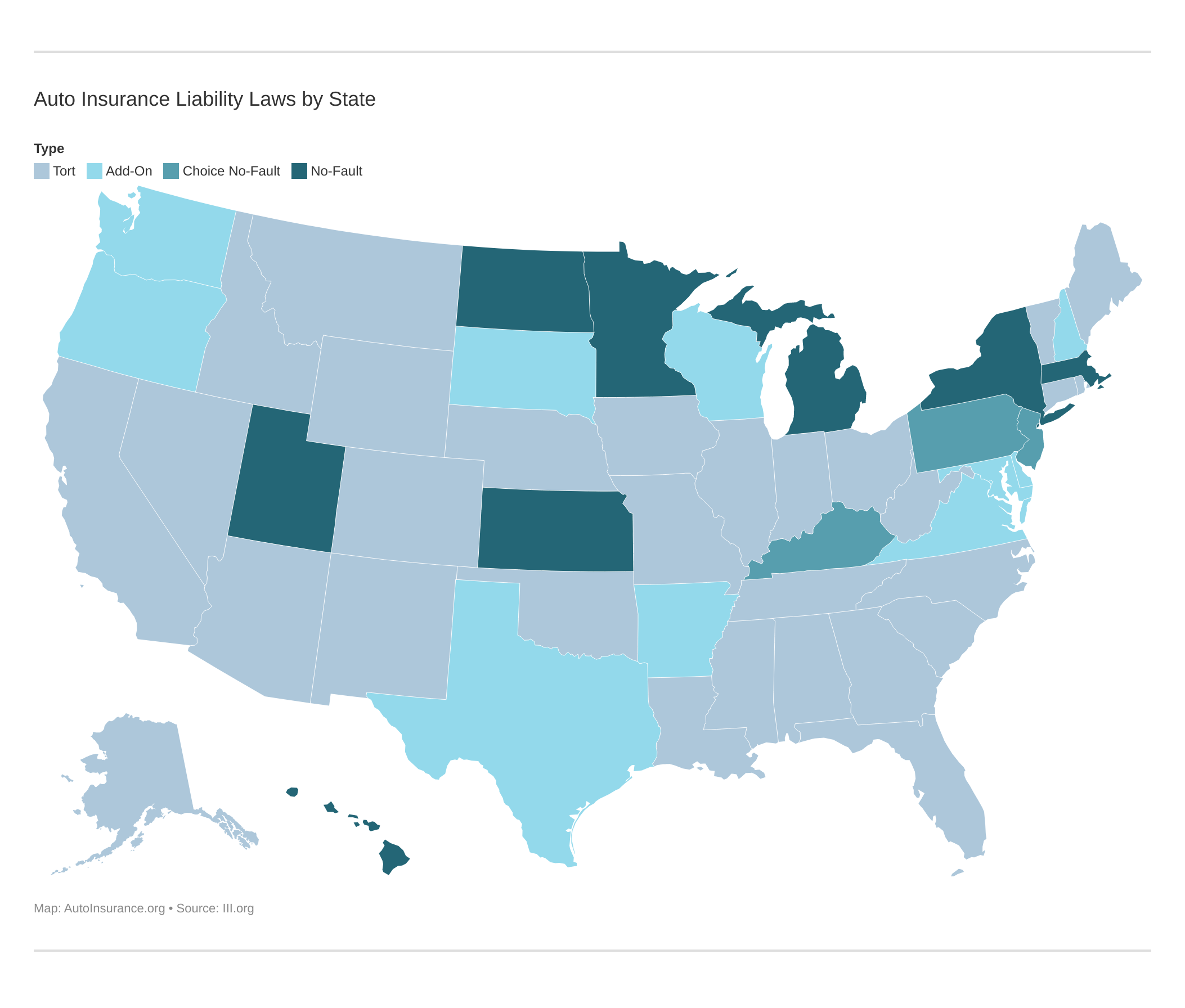

Accident victims and their possessions are protected by these limitations. Drivers can lower their financial burden and stay out of trouble with the law by following Kansas’ minimum auto insurance requirements. Discover how minimum auto insurance requirements vary by state to ensure you’re fully covered.

Kansas Minimum Auto Insurance Coverage Requirements & Limits| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Following state rules helps protect your assets in case of an accident and keeps you covered on the road. Knowing the minimums is key to picking the right coverage for you. Compare car insurance quotes today by using our free rate tool above.

- Kansas mandates 25/50/25 coverage for bodily injury/property damage

- High ratings come from reliable claims and competitive rates

- Low complaints highlight strong customer satisfaction and service

How to Read Kansas Car Insurance Requirements

Before you can buy a new car insurance policy that complies with this state’s guidelines and requirements, you need to learn how to read car insurance requirements. There are descriptions of the more common types of auto insurance coverages that you may need or want to buy:

- Bodily Injury Liability: If you cause an injury accident in Kansas, you are financially responsible for paying all medical expenses for other parties.

- Personal Injury Protection (PIP) / Medical Payments: Personal injury protection coverage pays for any medical bills for you and others in your car.

- Property Damage Liability: If you cause vehicle damage or other types of property damage for other people while driving in this state, property damage liability coverage can pay for those expenses.

- Uninsured and Underinsured Motorist Coverage: This is another type of required coverage for drivers in Kansas.

- Collision: Collision insurance pays for your own vehicle repairs or for a complete vehicle replacement in some cases, but it only covers collision events.

- Comprehensive: This type of auto insurance pays for your vehicle-related expenses for a collision, theft, weather damage, and more.

Car insurance requirements usually list a coverage type and a numerical coverage limit next to it. The coverage limit is the maximum dollar amount of benefits that the insurance company will pay out for that accident or event.

Minimum Auto Insurance Coverage in Kansas

USAA gives the least expensive car insurance in Kansas, known for its excellent customer reviews and low-cost plans. Geico is also a good option with good prices and wide accessibility, so many people like it too. State Farm ranks third, known for solid coverage options and reliable service.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Kansas

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe table below shows the three most affordable car insurance providers in Kansas, with attention to cost-effectiveness, customer happiness, and dependability of coverage. Each company has special advantages that appeal to drivers looking for budget-friendly choices without giving up good service.

Kansas Min. Coverage Auto Insurance Monthly Rates by City| City | Rates |

|---|---|

| Dodge City | $72 |

| Emporia | $68 |

| Garden City | $71 |

| Hutchinson | $69 |

| Junction City | $70 |

| Kansas City | $80 |

| Lawrence | $74 |

| Leavenworth | $73 |

| Leawood | $76 |

| Lenexa | $75 |

| Manhattan | $67 |

| Olathe | $78 |

| Overland Park | $79 |

| Pittsburg | $65 |

| Salina | $66 |

| Shawnee | $77 |

| Topeka | $81 |

| Wichita | $82 |

| Winfield | $64 |

In Kansas, how much you pay for car insurance can vary a lot based on your location. In Emporia, it is the least expensive at $68 each month. But in Kansas City, it costs more – about $80 monthly. These price differences often are because of factors like traffic and accident rates in each place. The table above has the rates for different cities, so you can easily compare them to see what fits your budget best.

Kansas City drivers face higher insurance premiums, averaging around $80 monthly due to increased traffic risks.Michelle Robbins Licensed Insurance Agent

If you plan to shop around for new car insurance in Kansas, you first need to determine how much you want to buy.

The state’s minimum insurance requirements should be considered as a first step in this process.

If you plan to drive legally in this state, your insurance policy should at least include:

- $25,000 for bodily injury per person or $50,000 for bodily injury per accident

- $25,000 for property damage liability coverage

These car insurance requirements for drivers in Kansas are only relevant for private-use vehicles. If you use your vehicle for commercial purposes, rarely or never drive your vehicle, or if there are other exceptional circumstances, explore the unique car insurance requirements relevant to your situation before you buy new insurance. Explore the benefits of Bodily Injury Liability (BIL) auto insurance for full protection.

Consequences for Violating Kansas Car Insurance Laws

All drivers in Kansas must maintain at least the minimum coverages listed above, and you may face legal consequences if you do not comply with the law.

In many cases, auto insurance policyholders who do not purchase and maintain this coverage will face a driver’s license suspension, but other penalties could also be assessed in different situations. Additional penalties may be assessed in the case of car insurance fraud. See how a suspended license can impact your auto insurance rates.

Kansas Minimum Requirement vs. Recommended Coverage

Kansas drivers’ car insurance requirements are relatively robust compared to minimum insurance requirements in other states. However, some drivers still opt to buy more than the minimum amount of insurance required by law, and you may wonder why they would willingly pay more than they need to for car insurance.

85% of drivers can benefit from comparing🔎 car insurance quotes. Get started✅ being part of the majority saving money 👉https://t.co/DqnZmfyEAG pic.twitter.com/pu0vl5QBip

— AutoInsurance.org (@AutoInsurance) September 30, 2024

The primary reason for taking these steps is to reduce the money you may have to pay out of your funds if you are involved in an accident or are affected by another damaging event.

Remember that any expenses your insurance policy does not cover are your responsibility, and other parties can sue you for damages if you fail to pay money that you legally owe them per financial responsibility laws in this state. Uncover ways how to lower your auto insurance rates without hassle.

Understanding Kansas Auto Insurance

Shopping for new auto insurance rates in Kansas can seem stressful and time-consuming, but it requires minimal time and effort. Discover the best Kansas auto insurance providers for reliable coverage.

The first step to take is to determine if you want to buy the minimum amount of auto insurance that is required by Kansas law and if you have any lender auto insurance requirements to comply with.

If you decide to purchase more coverage than what is required by law and by your lender, you need to determine how much coverage you want and which types to buy. Buying Kansas auto insurance is most quickly and easily done through online quotes. Identify a few leading car insurance providers to request quotes from, and focus your attention on their reputation and financial rating.

By taking these steps, you can quickly identify the best deal available on the type of auto insurance you want to buy. Compare car insurance quotes side-by-side by using our free rate tool below. Just enter your ZIP code to get started.

Frequently Asked Questions

What do Kansas auto insurance laws require drivers to have?

Kansas insurance laws require that all drivers carry a minimum of 25/50/10 liability coverage for bodily injury and property damage. Learn about auto insurance laws to ensure you’re adequately covered.

What information does a Kansas auto insurance guide provide?

A Kansas auto insurance guide includes details on required coverages, optional add-ons, and strategies for selecting the best policy for individual needs.

What are the minimum car insurance requirements in Kansas for drivers?

Kansas minimum car insurance requirements specify 25/50/10 coverage—$25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

What do Kansas liability insurance requirements include?

Kansas liability insurance requirements include 25/50/10 coverage, providing financial protection for bodily injury and property damage to others if you cause an accident.

What should I know about buying auto insurance in Kansas?

When purchasing auto insurance in Kansas, drivers need at least the minimum liability coverage, with options to add Personal Injury Protection (PIP) and other coverages for enhanced protection. Explore options for the cheapest liability-only auto insurance to save on premiums.

What is the minimum car insurance required in Kansas?

Kansas requires drivers to hold a minimum car insurance policy with liability limits of 25/50/10 to meet state law requirements.

How much does car insurance cost per month in Kansas?

Car insurance in Kansas averages around $29.85 per month, though rates can vary based on age, driving history, and location.

Does Progressive Insurance offer coverage in Wichita, KS?

Yes, Progressive Insurance offers coverage in Wichita, KS, and provides a variety of auto insurance policies, including liability, collision, and comprehensive options.

Can I get Progressive auto insurance coverage in Topeka, KS?

Yes, Progressive offers auto insurance in Topeka, KS, with customizable plans and competitive rates for local drivers. Discover key insights in our Progressive auto insurance review for informed choices.

What are the coverage requirements under Kansas auto insurance laws?

Kansas auto insurance requirements mandate minimum liability coverage of 25/50/10, along with Personal Injury Protection (PIP) for added medical and income protection.

Is Geico available for auto insurance in Kansas?

Can I purchase Geico auto insurance in Wichita, KS?

What is the state minimum auto insurance requirement?

What does liability insurance exclude in an accident?

What minimum auto insurance is required by law?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.