Best Sarasota, Florida Auto Insurance in 2026 (Find the Top 10 Companies Here)

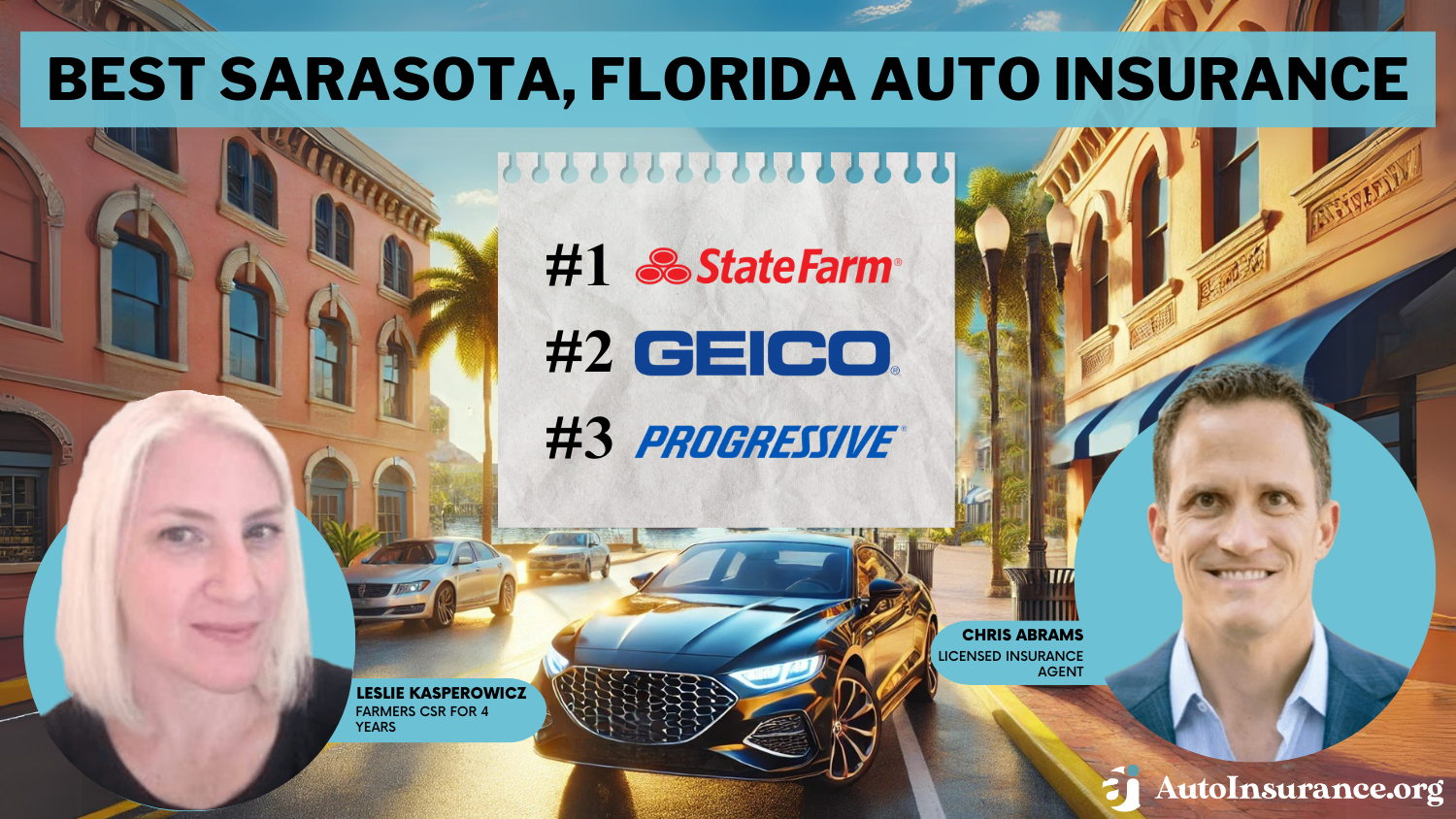

Get the best Sarasota, Florida auto insurance starting at just $45 per month with our best providers, State Farm, Geico, and Progressive. Renowned for their financial stability and tailored policies, these companies stand out as the best options for cheap and dependable coverage in the area of Sarasota, Florida.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

Company Facts

Full Coverage in Sarasota Florida

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Sarasota Florida

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage in Sarasota Florida

A.M. Best

Complaint Level

Pros & Cons

In the best Sarasota, Florida auto insurance, State Farm, Geico, and Progressive stand out as the leading auto insurance providers, offering competitive rates and comprehensive coverage options.

We’ll explore what impacts auto insurance rates in Sarasota, Florida, like your driving record, credit, and commute.

Our Top 10 Company Picks: Best Sarasota, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 25% A++ Affordable Rates Geico

#3 20% A+ Customizable Plans Progressive

#4 10% A+ High-Risk Drivers Allstate

#5 10% A++ Military Families USAA

#6 12% A Young Drivers Liberty Mutual

#7 15% A Local Agents Farmers

#8 10% A+ Bundling Options Nationwide

#9 13% A++ Hybrid Vehicles Travelers

#10 15% A+ Customer Satisfaction Amica

Before buying auto insurance in Sarasota, Florida, compare rates by entering your ZIP code above to get free quotes.

- State Farm is the best auto insurance from $45/month in Sarasota, FL

- Geico and Progressive both offer competitive rates

- Compare quotes for your personalized coverage

Affordable Auto Insurance Rates in Sarasota, Florida Based on Commute

In Sarasota, Florida, the length of your daily commute and your annual mileage significantly impact your auto insurance rates.

These are among the key factors that affect auto insurance rates, as insurance providers view longer commutes and higher mileage as indicators of increased risk, which can lead to higher premiums.

Conversely, if you have a shorter commute or drive fewer miles annually, you may qualify for lower insurance rates. This is because less time on the road reduces the likelihood of accidents, making you a less risky driver in the eyes of insurers.

Consequently, it’s essential to accurately report your driving habits when seeking cheap auto insurance in Sarasota, Florida, as it can directly influence the cost of your coverage. Enter your ZIP code now to begin.

Best By Category: Cheapest Auto Insurance in Sarasota, Florida

When searching for the cheapest auto insurance in Sarasota, Florida, it’s essential to compare auto insurance rates by age across different categories to find the best fit for your unique needs.

By evaluating the top insurance companies in categories such as minimum coverage, full coverage, and high-risk drivers, you can identify the provider that offers the most affordable rates tailored to your specific situation.

This approach ensures that you not only find the cheapest auto insurance but also secure a policy that meets your coverage requirements, offering both cost savings and peace of mind.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Sarasota, Florida Auto Insurance Quotes

Frequently Asked Questions

How does commute length affect auto insurance rates in Sarasota, FL?

Commute length and annual mileage can impact auto insurance rates in Sarasota, FL.

Longer commutes may result in higher insurance rates compared to shorter commutes.

How does coverage level affect auto insurance rates in Sarasota, FL?

The coverage level you select can affect the cost of auto insurance in Sarasota, FL. Higher coverage levels typically come with higher insurance rates. Enter your ZIP code now to begin.

What are the average auto insurance rates in Sarasota, FL?

In Sarasota, FL, the average auto insurance rate is $342 per month. Auto insurance for men vs. women can differ, with men often facing higher premiums due to higher risk factors. It’s important to compare quotes to find the best rate for your specific situation.

What is the minimum auto insurance coverage required in Sarasota, FL?

The minimum auto insurance coverage required in Sarasota, FL is 10/20/10, which means $10,000 bodily injury liability coverage per person, $20,000 bodily injury liability coverage per accident, and $10,000 property damage liability coverage.

Which company offers the most expensive auto insurance for teen drivers in Sarasota, FL?

The most expensive auto insurance company for teen drivers in Sarasota, FL is Allstate. Enter your ZIP code now to begin.

How does credit history affect auto insurance rates in Sarasota, FL

Credit score affecting auto insurance rates is crucial in Sarasota, FL. A poor credit score can lead to higher insurance premiums, whereas a good credit score can help lower rates.

Which auto insurance provider offers the highest bundling discount in Sarasota, Florida?

Geico offers the highest bundling discount at 25%. This significant discount makes it a strong contender for affordable auto insurance in Sarasota, Florida.

What is the financial rating of Geico, and how does it impact its standing as a top auto insurance provider in Sarasota, Florida?

Geico has an A++ rating from A.M. Best, indicating exceptional financial stability.

This high rating reinforces its reliability and attractiveness as a top auto insurance provider in Sarasota, Florida. Enter your ZIP code now to begin.

How does Progressive’s Snapshot program benefit drivers seeking the best auto insurance in Sarasota, Florida?

Progressive’s Snapshot program rewards safe driving with potential discounts, making it a cost-effective choice for those who drive cautiously.

By participating in this program, you can access cheap online auto insurance quotes that reflect your safe driving habits. This can help you find competitive rates for the best Sarasota, Florida auto insurance.

What makes USAA a standout option for military families looking for the best Sarasota, Florida auto insurance?

USAA is known for its tailored coverage and discounts specifically designed for military families. Its exceptional customer service and financial stability make it a top choice for military families in Sarasota, Florida.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.