Best Rockford, Illinois Auto Insurance in 2026

The cheapest auto insurance in Rockford, Illinois, is Liberty Mutual. However, auto insurance rates will vary for each person depending on your age and ZIP code. Rockford, IL auto insurance must meet the state minimum requirements with coverage levels of 25/50/20 for liability. We recommend higher coverage limits to cut possible out-of-pocket costs, but you can save money by asking about car insurance discounts.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated September 2024

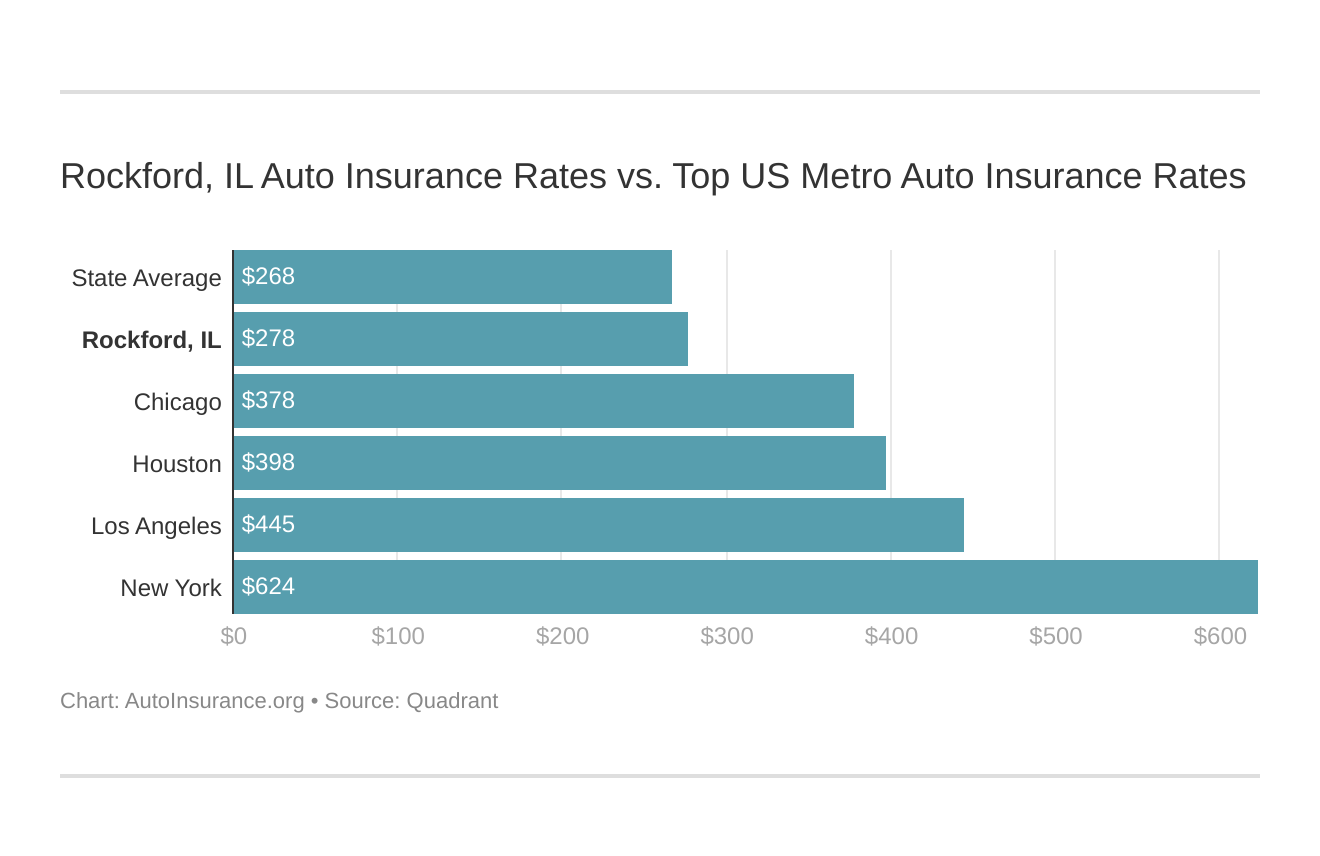

- Rockford, Illinois auto insurance rates are $3,341/yr or $278/mo

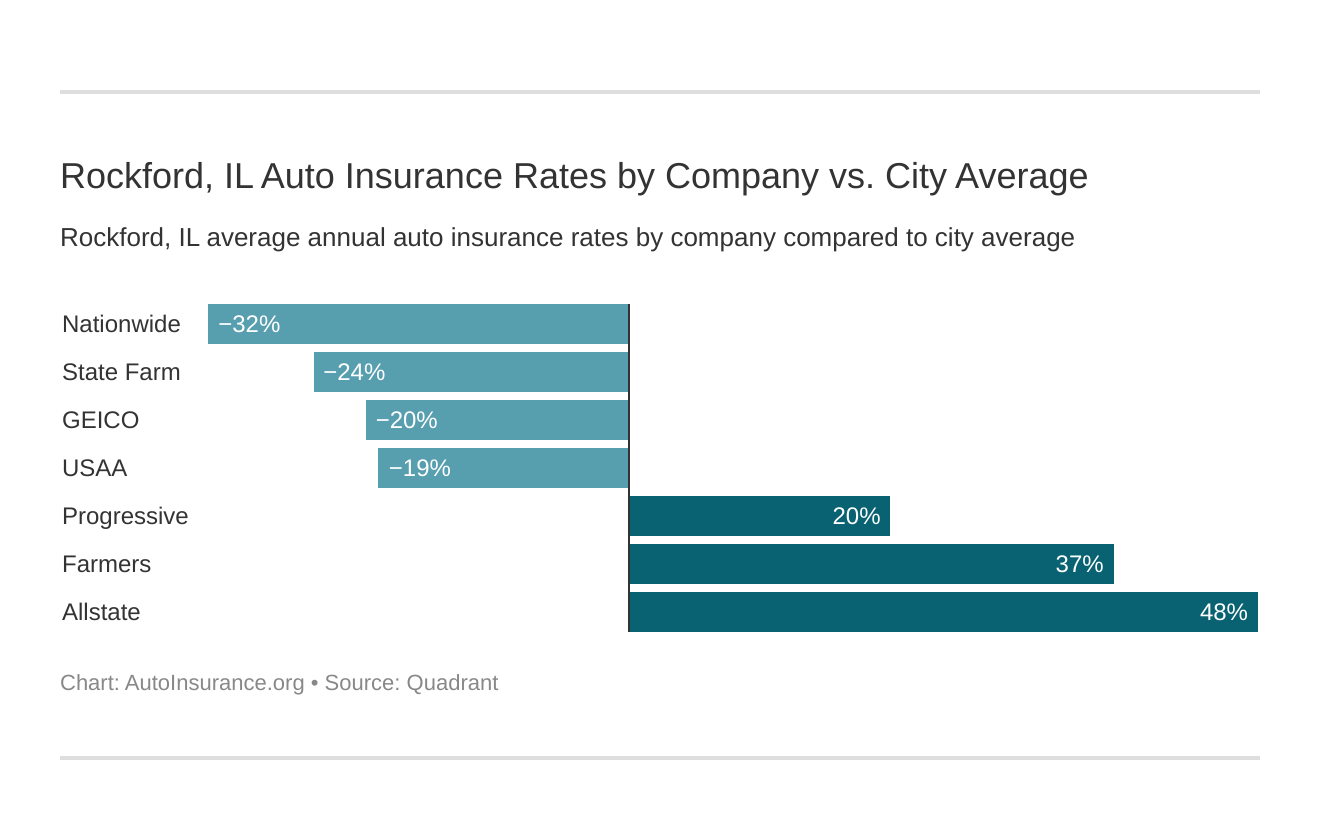

- Six of the nation’s top companies have cheaper than average auto insurance quotes in Rockford

- Auto insurance requirements in Illinois are 25/50/20

Rockford, IL auto insurance rates are $36 less than the Illinois average and $591 less than the national average. However, Rockford, Illinois auto insurance rates depend on the company and other factors that affect auto insurance.

Those factors include age, driving record, credit history, and even marital status. Our guide explains how you can buy cheap auto insurance in Rockford, IL.

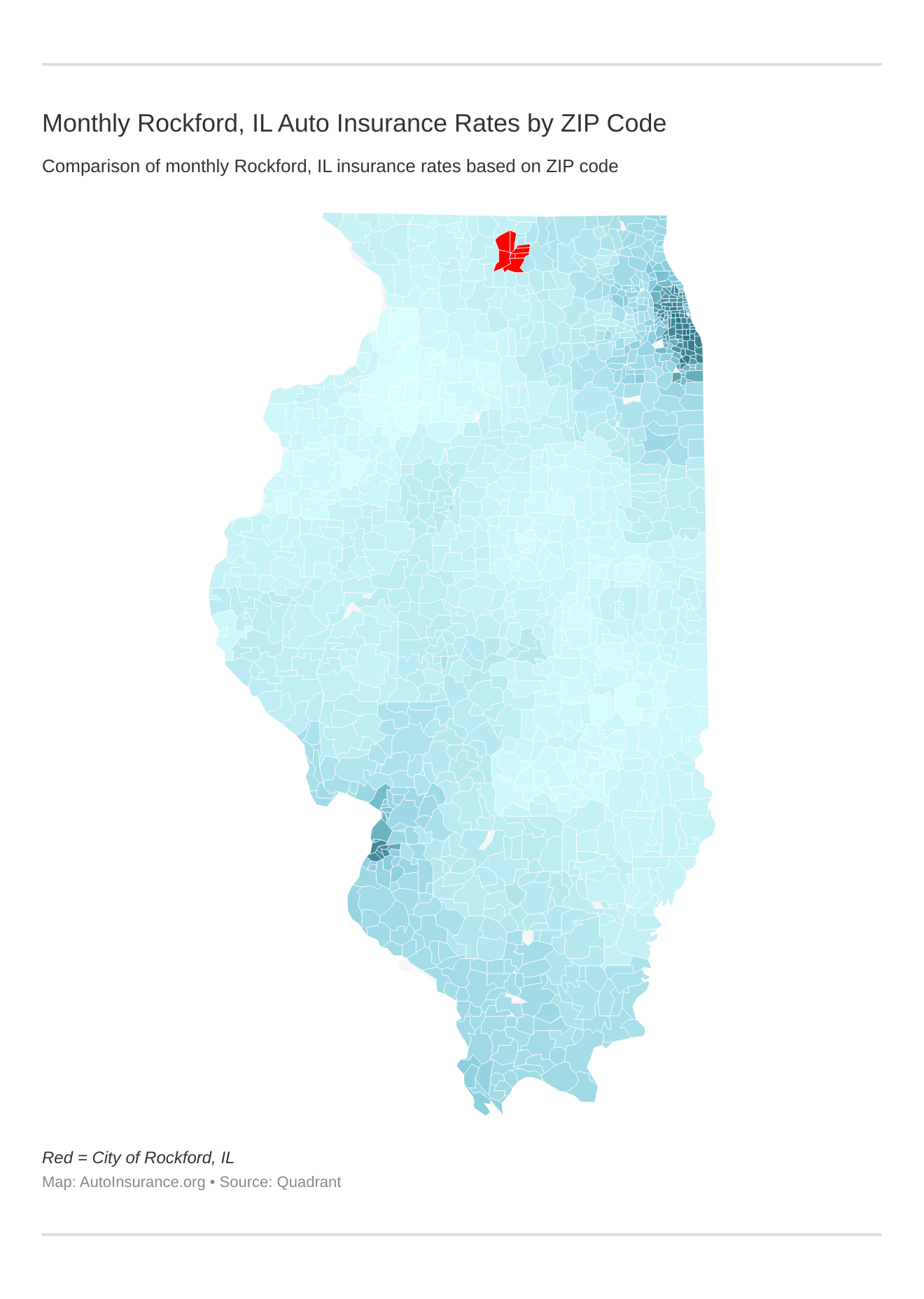

Monthly Rockford, IL Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Rockford, IL auto insurance rates by ZIP Code below:

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Rockford, IL Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Rockford, IL against other top US metro areas’ auto insurance costs.

Ready to find affordable Rockford, IL auto insurance? Enter your ZIP code above to get started.

What is the cheapest auto insurance company in Rockford, IL?

The cheapest auto insurance company in Rockford, IL, is Liberty Mutual. The following most affordable companies are Nationwide and Travelers.

The cheapest Rockford, IL car insurance providers can be found below. You also might be wondering, “How do those Rockford, IL rates compare against the average Illinois car insurance company rates?” We uncover that too.

Here are the best auto insurance companies in Rockford, Illinois, ranked from cheapest to most expensive:

- Liberty Mutual – $2,251

- Nationwide – $2,416

- Travelers – $2,529

- State Farm – $2,631

- Geico – $2,733

- USAA – $2,764

- American Family – $3,717

- Progressive – $4,093

- Farmers – $4,860

- Allstate – $5,418

Liberty Mutual, Nationwide, Travelers, State Farm, Geico, and USAA are the only companies in Rockford that provide cheaper than average auto insurance rates. With the right discounts, you can lower your annual costs.

Before you get any discount, auto insurance providers will inspect specific factors that determine your auto insurance rates, such as age, gender, marital status, driving record, and credit history.

The most important factor is your driving history. Some auto insurance companies provide up to 40% off if you have a clean driving record. In addition to no traffic violations or accidents, a good credit score can lower your auto insurance rates even more.

Even your location is a factor. Did you know your neighborhood ZIP code can save you hundreds more if you live in a safer address? The cheapest ZIP code in Rockford, IL, is 61104, and its average auto insurance cost is $293/mo.

If you’re a single driver under 25 years old, you could face auto insurance quotes up to $7,636 per year. On the other hand, married drivers over 24 years old may have auto insurance rates that cost $1,800 per year.

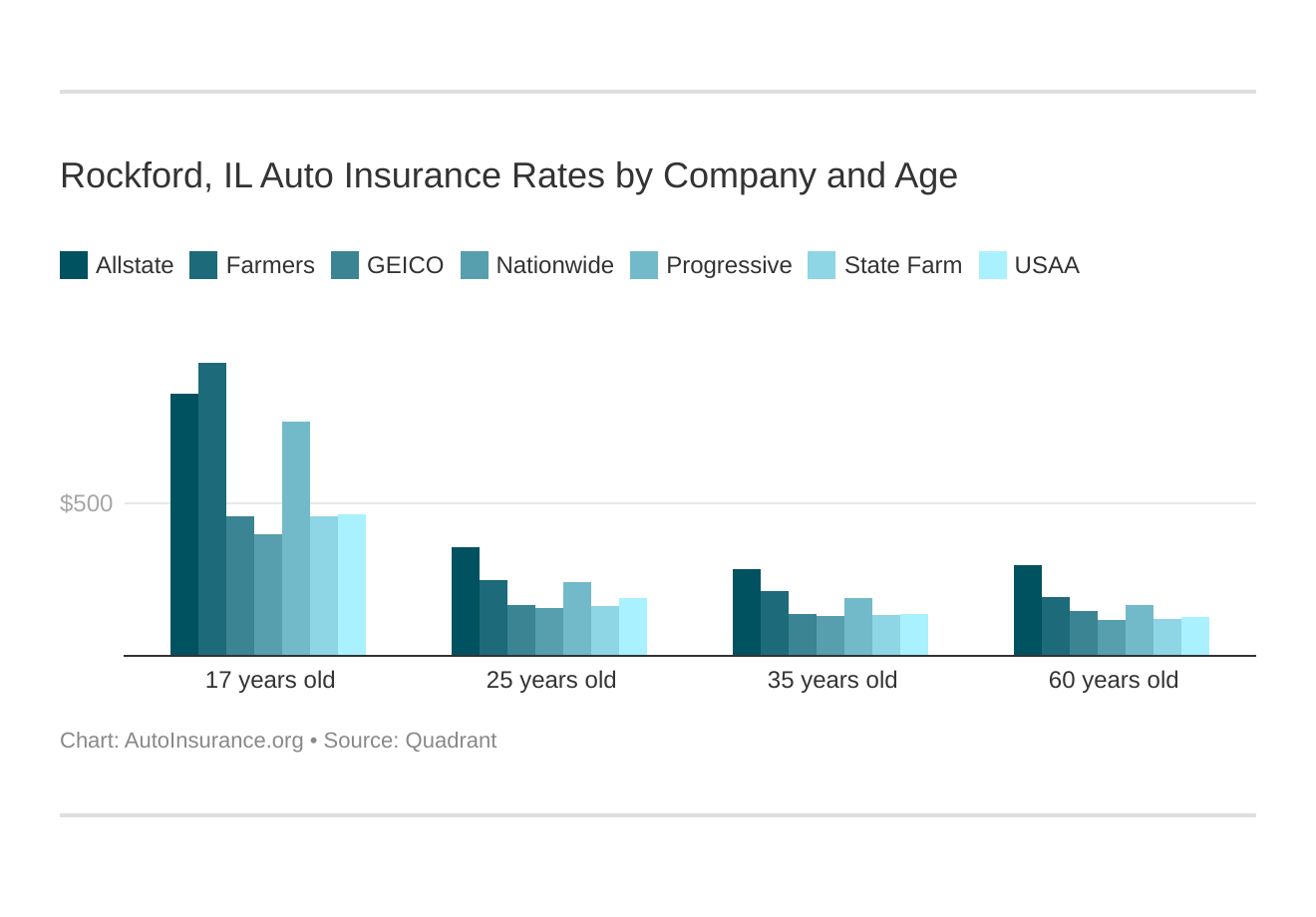

Rockford, Illinois car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

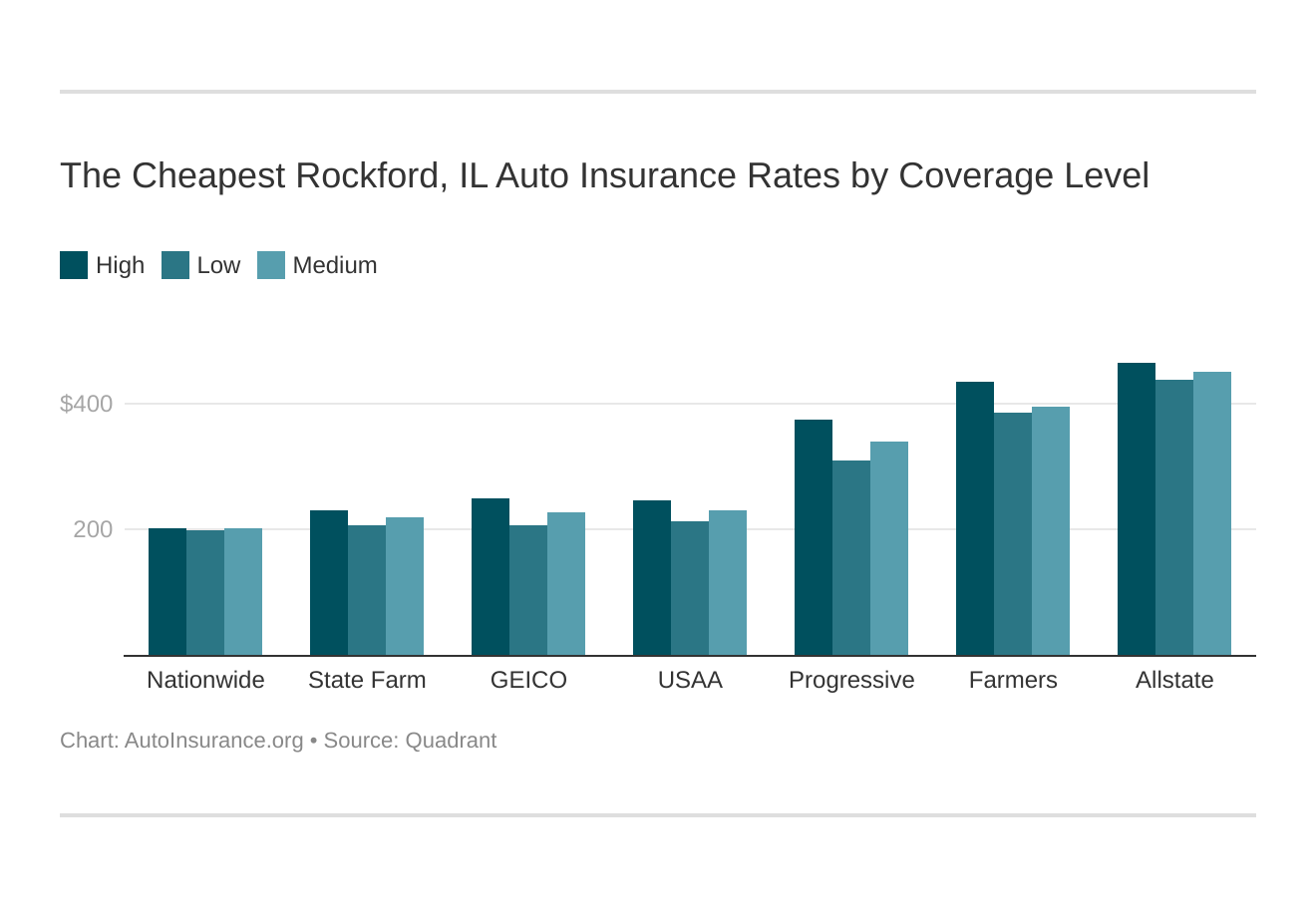

Your coverage level will play a major role in your Rockford, IL car insurance costs. Find the cheapest Rockford, Illinois car insurance costs by coverage level below:

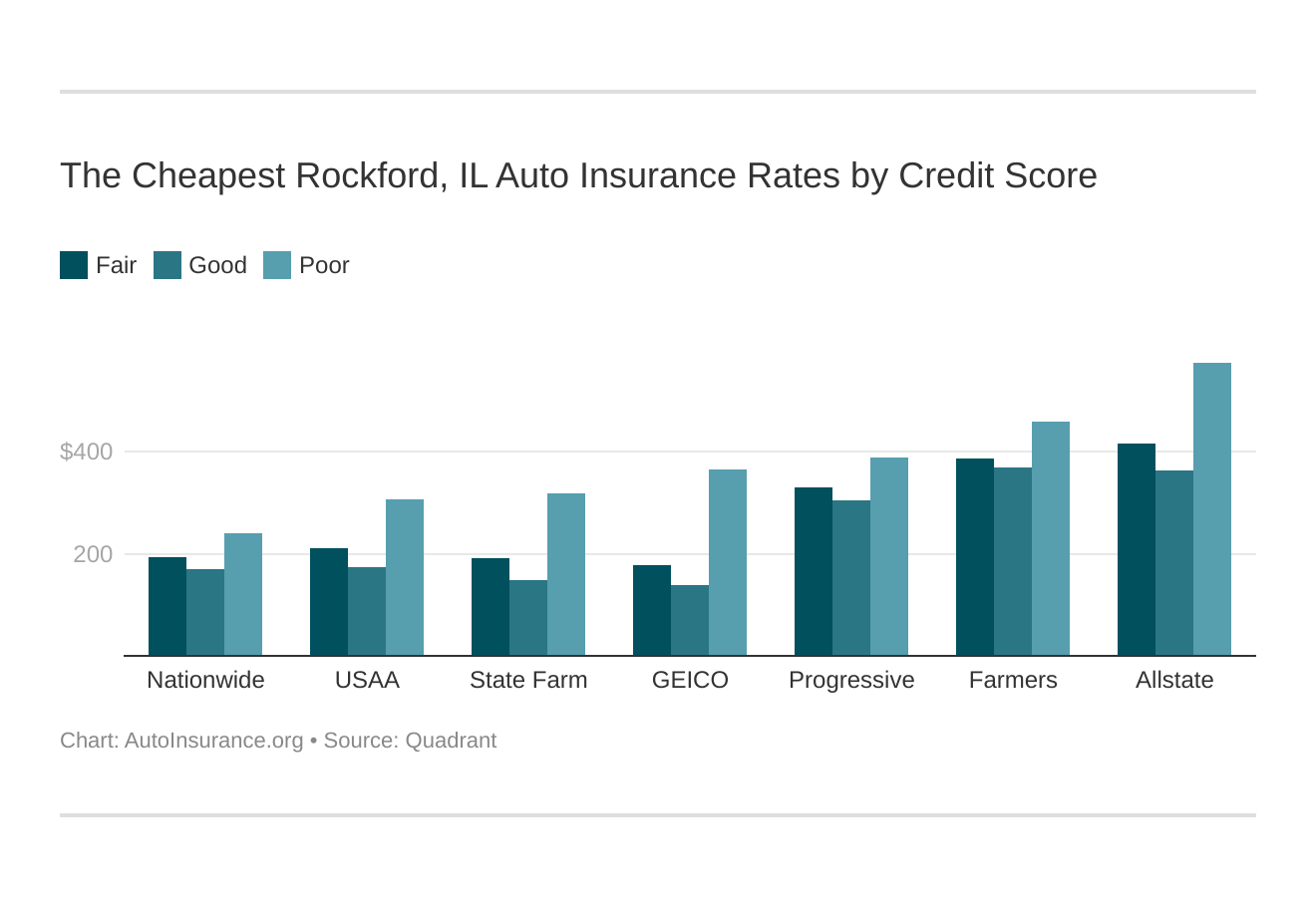

Your credit score will play a major role in your Rockford, IL car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Rockford, Illinois car insurance costs by credit score below.

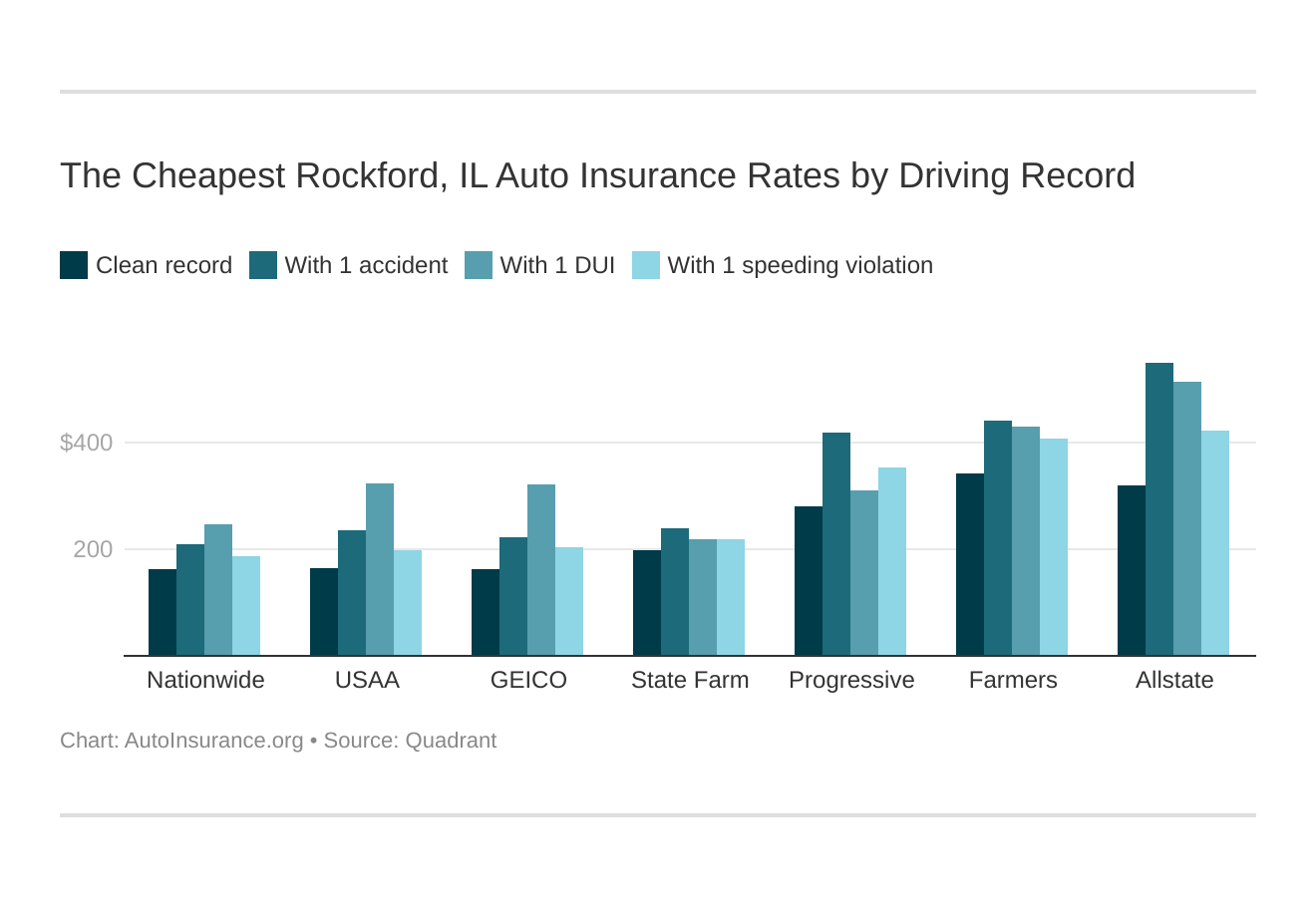

Your driving record will affect your Rockford, IL car insurance costs. For example, a Rockford, Illinois DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Rockford, Illinois car insurance costs by driving record.

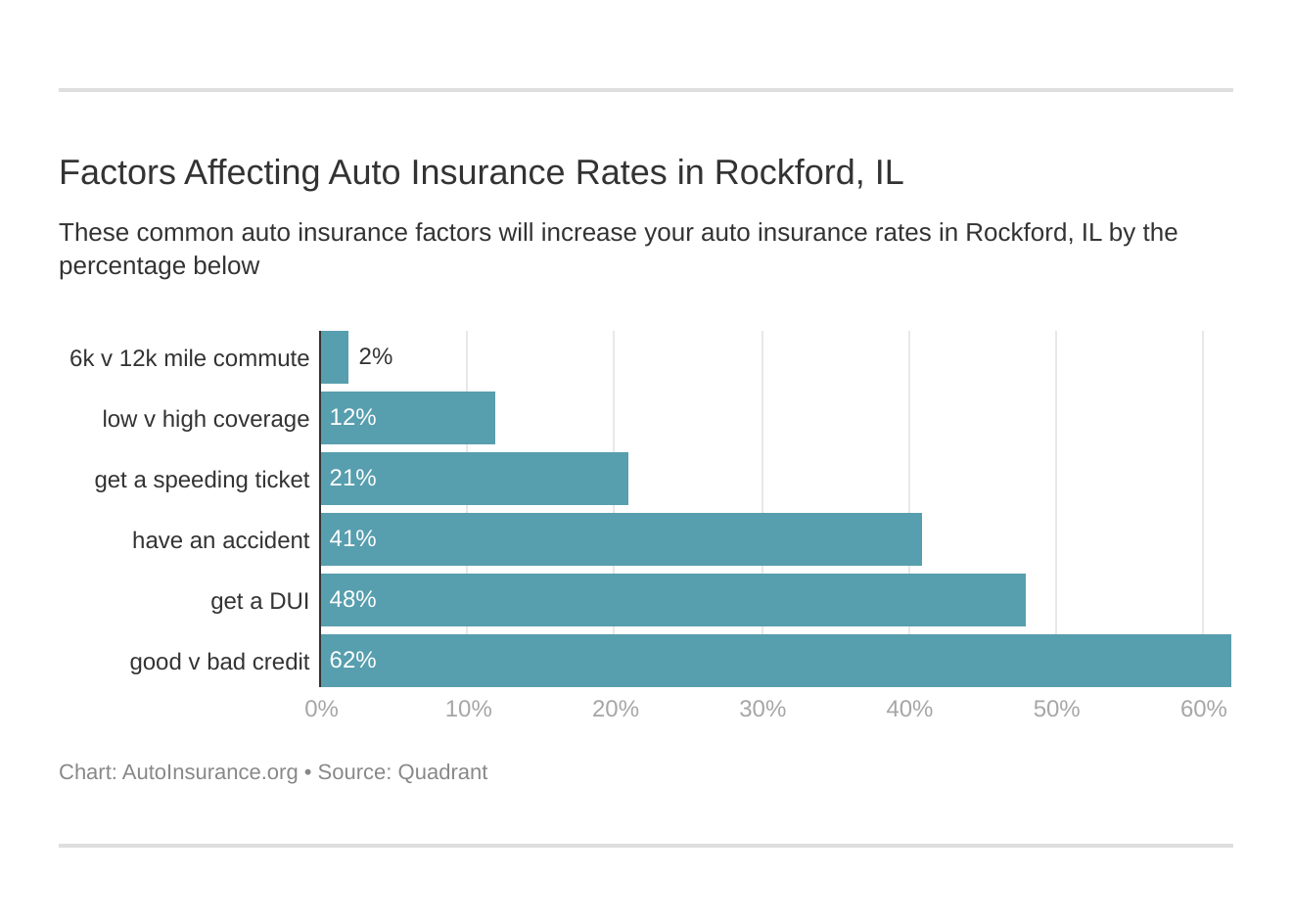

Controlling these risk factors will ensure you have the cheapest Rockford, Illinois car insurance. Factors affecting car insurance rates in Rockford, IL may include your commute, coverage level, tickets, DUIs, and credit.

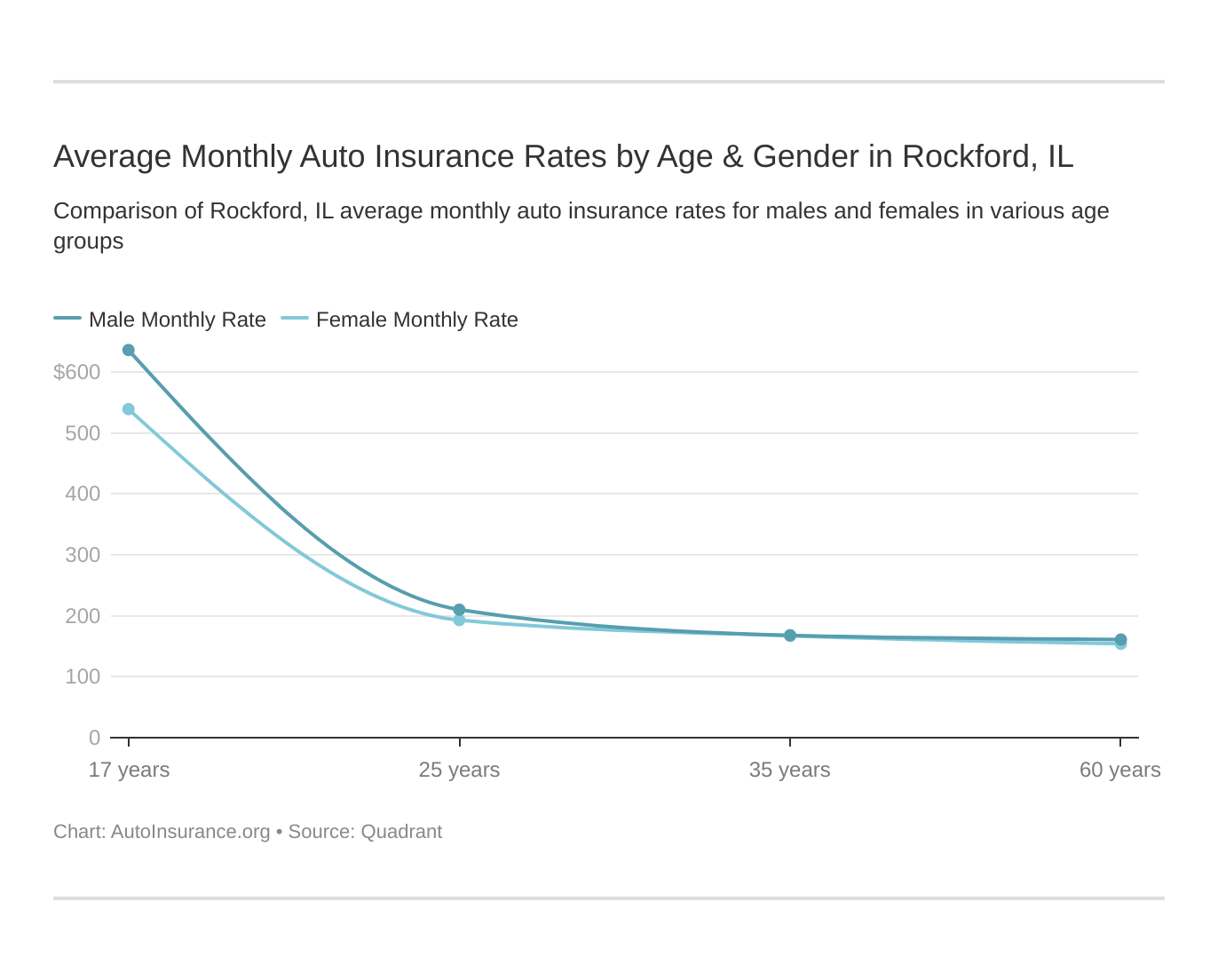

Age is a significant factor for Rockford, IL car insurance rates. Young drivers are often considered high-risk. This Rockford, Illinois does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Rockford, IL.

What are the minimum auto insurance coverage requirements in Rockford, IL?

All Rockford drivers must have the minimum Illinois auto insurance requirements, which are:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $20,000 per incident for property damage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist

Some auto insurance agents may recommend higher coverage limits to cut possible out-of-pocket costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Rockford, IL?

Did you know that your daily commute affects your auto insurance? Even a city’s motor vehicle thefts affect auto insurance quotes.

And more residents means more drivers on the road. According to INRIX, Rockford is ranked 227th in the most congested cities in the United States.

What about the daily drive to work? How long does it usually take to get to work in Rockford? According to Data USA, it takes the average Rockford driver 20 minutes to get to work – that’s five minutes faster than the national average.

However, vehicle theft has a significant impact on comprehensive auto insurance. Higher rates of motor vehicle theft will certainly increase auto insurance costs. The FBI annual statistics reported that Rockford had 389 car thefts in 2019.

Having adequate comprehensive auto insurance coverage can also come in handy when your car is damaged because of Rockford, IL weather.

Rockford, IL Auto Insurance: The Bottom Line

Rockford, IL auto insurance rates are more affordable than most cities in the United States. You can save hundreds on auto insurance if you maintain a clean driving record and a good credit score. Also, married drivers that are 25 and older can save thousands.

Before you buy auto insurance in Rockford, Illinois, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Rockford, IL auto insurance quotes.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a contract between you and an insurance company that provides financial protection in case of accidents, theft, or other damages to your vehicle. It typically covers both property damage and liability for bodily injury.

Is auto insurance mandatory in Rockford, IL?

Yes, auto insurance is mandatory in Rockford, IL, as it is in most states. Illinois law requires drivers to carry liability insurance with minimum coverage limits.

What are the minimum auto insurance requirements in Rockford, IL?

In Rockford, IL, the minimum liability insurance requirements are as follows:

- $25,000 for bodily injury or death per person

- $50,000 for bodily injury or death per accident

- $20,000 for property damage per accident

Are there any additional auto insurance coverages I should consider?

While the minimum liability coverage is mandatory, you may want to consider additional coverages such as:

- Collision coverage: Covers damage to your vehicle in case of an accident, regardless of fault.

- Comprehensive coverage: Covers non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you’re in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Medical payments coverage: Covers medical expenses for you and your passengers, regardless of fault.

How are auto insurance premiums determined in Rockford, IL?

Auto insurance premiums are influenced by various factors, including:

- Your driving record

- Age and gender

- Type of vehicle you drive

- Your credit score

- Annual mileage

- Deductible amounts

- Coverage limits

Insurers assess these factors to determine the level of risk you represent and calculate your premium accordingly.

How can I find affordable auto insurance in Rockford, IL?

To find affordable auto insurance in Rockford, IL, consider the following tips:

- Shop around and compare quotes from multiple insurance providers.

- Maintain a clean driving record.

- Increase your deductibles if you can afford to pay more out of pocket.

- Take advantage of available discounts (e.g., multi-policy, safe driver, good student, etc.).

- Consider bundling your auto insurance with other policies.

What should I do after an accident in Rockford, IL?

After an accident in Rockford, IL, follow these steps:

- Ensure everyone’s safety and call emergency services if necessary.

- Exchange information with the other driver(s) involved.

- Take pictures of the accident scene and any damages.

- Notify your insurance company as soon as possible and provide them with accurate details of the accident.

- Cooperate with the insurance company’s investigation and claims process.

Can my auto insurance policy be canceled in Rockford, IL?

Yes, your auto insurance policy can be canceled in Rockford, IL, under certain circumstances. Insurance companies may cancel a policy for reasons such as non-payment, fraud, or if your driver’s license is suspended or revoked. Maintain a good driving record and pay your premiums on time to avoid policy cancellation.

Are there any discounts available for auto insurance in Rockford, IL?

Yes, many insurance companies offer various discounts on auto insurance in Rockford, IL. Common discounts include:

- Multi-policy discount: Insuring multiple vehicles or bundling auto insurance with other policies.

- Safe driver discount: Having a clean driving record without accidents or violations.

- Good student discount: Maintaining good grades if you’re a high school or college student.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.