Founders Auto Insurance Review for 2026 (See Ratings & Cost Here!)

Our Founders auto insurance review shows it’s a solid high-risk insurer for drivers who need SR-22 or FR Bond coverage. Founders rates start at $80 per month, but good drivers may find better deals at companies that don't specialize in high-risk customers. Founders has an A financial rating from A.M. Best.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated April 2025

Our Founders auto insurance review found it offers good insurance options for those needing high-risk auto insurance coverage, with add-ons like gap.

Founders Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.7 |

| Business Reviews | 3.0 |

| Claim Processing | 2.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 2.4 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.7 |

| Digital Experience | 3.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 2.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.2 |

| Savings Potential | 2.9 |

While the Founders Insurance Company has strong financial ratings, the company does have some negative customer reviews regarding claims processing.

The company’s rates also tend to be higher for good drivers, so it may not be the best choice cost-wise for all drivers.

- Founders offers SR-22 insurance to higher-risk drivers

- Founders only sells coverage in four states

- Good drivers will find better deals at other companies

Before making a decision, make sure to compare quotes from multiple auto insurance companies in your area. Whether you are a high-risk driver or a driver with a great driving record, our free quote tool will help you find the best deal.

Cost of Founders Auto Insurance

Cost is often one of the most important factors to car insurance shoppers. While rates vary greatly for customers due to differences in driving record, location, age, and other insurance rate factors, you can get an idea of what the Founders Insurance Company will charge based on the averages below.

Founders Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $220 | $550 |

| 16-Year-Old Male | $250 | $600 |

| 18-Year-Old Female | $180 | $450 |

| 18-Year-Old Male | $200 | $500 |

| 25-Year-Old Female | $120 | $300 |

| 25-Year-Old Male | $130 | $320 |

| 30-Year-Old Female | $110 | $280 |

| 30-Year-Old Male | $115 | $290 |

| 45-Year-Old Female | $100 | $260 |

| 45-Year-Old Male | $105 | $270 |

| 60-Year-Old Female | $110 | $280 |

| 60-Year-Old Male | $120 | $290 |

| 65-Year-Old Female | $125 | $310 |

| 65-Year-Old Male | $135 | $330 |

Teenage drivers will pay the most at the Founders Insurance Company if they are purchasing their own policy. Rates will be more affordable if they join a parent’s existing Founders policy, however.

Read More: Should I add my teenager to my auto insurance policy?

For more insight into Founders’ car insurance rates, take a look at the average cost of insurance by driving record below.

A DUI raises auto insurance rates the highest at the Founders Insurance Company, which is typical at most insurance companies. Rates are often increased for at least a few years following any driving incident, whether a ticket or an accident.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Founders Insurance Rates Compare to Top Providers

The Founders Insurance Company is not the only auto insurance provider out there, which is why we want to evaluate its affordability in comparison to other major companies. Below, you can see Founders’ average rates versus other competitors like Geico based on minimum and full coverage policies.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $80 | $220 |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Founders Insurance is the second most expensive company on average, besides Allstate (Read More: Allstate Auto Insurance Review). If you are looking for affordability, Founders may be out of your price range.

However, when looking at average rates by driving record, Founders car insurance is more affordable than other companies.

Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $100 | $120 | $130 | $170 |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

Based on these rate averages, Founders might be best for those with poor driving records, but drivers with clean records looking for full coverage will likely find cheaper insurance elsewhere.

Coverage Options at Founders

Founders provides all the coverages needed to meet state requirements, as well as some optional add-ons. We’ve listed all the types of auto insurance coverage the Founders Insurance Company offers below.

Founders Auto Insurance Coverages

| Coverage Type | Description |

|---|---|

| Liability | Covers injury and damage to others |

| Collision | Pays for your car’s damage from crashes |

| Comprehensive | Covers theft, vandalism, and disasters |

| PIP | Covers medical bills and lost wages |

| Uninsured/Underinsured | Protects if the other driver lacks coverage |

| MedPay | Helps with medical costs |

| Roadside Assistance | Covers towing, lockouts, and fuel |

| Rental Reimbursement | Pays for a rental car after an accident |

| Gap Insurance | Covers loan balance if totaled |

| Custom Parts | Protects aftermarket upgrades |

New car owners may want to take advantage of gap coverage, which will help cover the loan amount if a new car is totaled. Founders also offers SR-22 insurance and Financial Responsibility (FR) Bond insurance.

SR-22 insurance from the Founders Insurance Company is for high-risk drivers who must provide proof of coverage to reinstate their driver’s license. FR Bond insurance is similar to SR-22 insurance, but it provides less coverage than SR-22.

Founders Auto Insurance Discount Options

Our Founders car insurance review finds that it can be a bit pricier than other companies, but discounts can bring down the cost and make coverage more affordable.

Founders Auto Insurance Discounts

| Discount Name | Savings | Description |

|---|---|---|

| Multi-Policy | 25% | Bundle auto with home or renters insurance |

| Safe Driver | 30% | Reward for a clean driving record |

| Good Student | 15% | Available for students with a B average or higher |

| Defensive Driving | 10% | Complete an approved safety course |

| Low Mileage | 20% | Save for driving below a mileage limit |

| Pay-in-Full | 10% | Discount for paying the premium in full |

| Paperless Billing | 5% | Enroll in electronic statements and autopay |

| New Customer | 10% | Savings for switching to Founder Auto |

| Loyalty | 15% | Reward for long-term policyholders |

| Anti-Theft Device | 10% | Discount for having an alarm or GPS tracker |

Founders’ biggest discount is for bundling (Read More: How to Save Money by Bundling Insurance Policies). Discount availability may vary depending on your state, so make sure to ask a Founders Insurance Company agent which discounts are available in your state.

Most discounts should be widely available, such as the Founders Insurance Company bundling discount. The more discounts you can qualify for, the better your Founders auto insurance rates will be.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Reviews of Founders Insurance

Like all auto insurance companies, Founders has mixed reviews from customers. Negative reviews on sites like Reddit and Yelp are mainly due to denied claims or delays in communication with Founders insurance customer service, such as in the Yelp review below.

The majority of the Founders Insurance Company reviews on rating sites are negative, as the Founders Insurance Company has one star overall on Yelp and two on Google reviews. Customers complain about poor customer service from agents, as well as low claim amounts and claim disputes.

Read More: How to Dispute an Auto Insurance Claim

Founders Insurance Company Ratings

Because customer reviews usually tend to be negative, it’s important to also consider the business ratings of a company for a more complete picture of customer satisfaction, as well as financial health and business practices. Below, see what the Founders Insurance Company has been rated by companies like J.D. Power and A.M. Best.

Founders Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 769/1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 High Customer Satisfaction |

|

| Score: 0.85 Avg. Complaints |

|

| Score: A Excellent Financial Strength |

The Founders Insurance Company has just average customer satisfaction ratings on J.D. Power (Learn More: Auto Insurance Companies With the Best Customer Service). However, the Founders insurance BBB rating for business practices is excellent, and it has a strong A.M. Best rating for financial strength.

A.M. Best evaluates an auto insurance company's ability to financially meet its obligations, such as paying out claims.Brandon Frady Licensed Insurance Producer

So, while Founders may not have the highest customer satisfaction score, its financial health and business practices are in good standing.

Pros and Cons of Founders Auto Insurance

The Founders Insurance Company will not be the right choice for all drivers, but there are some pros that make it right for some customers.

- High-Risk Coverage: Founders insures drivers who may have trouble getting insured due to poor driving records.

- Add-On Coverages: The Founders Insurance Company has extras like gap insurance that can be added onto a policy (Learn More: Best Gap Insurance).

- Financial Strength: Founders has an A rating from A.M. Best, meaning it is in good financial standing.

Of course, there are some downsides to choosing this company. The most common cons in Founders Insurance reviews include:

- Higher Rates: Because Founders offers higher-risk coverage like SR-22 insurance, its rates are going to be higher.

- State Availability: The Founders Insurance Company is only available in Illinois, Indiana, Ohio, and Wisconsin.

If the Founders Insurance Company isn’t in your state, you will have to look elsewhere for insurance. Luckily, there are plenty of other great companies available, whether you are looking for non-name brand car insurance or well-known insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

See if Founders is the Best Fit for You

Our Founders auto insurance review found that drivers with high-risk driving records may find its SR-22 auto insurance coverage and add-ons like gap insurance beneficial. However, the company’s customer service reviews and limited state availability mean that it is not suitable for all drivers.

If you need help finding an affordable auto insurance option in your state, compare rates with our free tool. It will collect quotes from companies in your area to help you find the best deal.

Frequently Asked Questions

Is Founders auto insurance good?

The Founders Insurance Company is one of the lesser-known auto insurance companies on the market, but it has an A+ rating from BBB and an A rating from A.M. Best.

Who owns Founders Insurance?

The Founders Insurance Company is part of the Utica National Insurance Group.

Does Founders insurance cover rental cars?

The Founders Insurance Company will cover a rental car during a covered claim if you have rental car reimbursement coverage.

Does Founders offer auto insurance?

Yes, the Founders Insurance Company sells car insurance, as well as renters, homeowners, liquor liability, and commercial auto insurance. You can bundle some coverages for a discount, such as home and auto insurance (Learn More: Best Home and Auto Insurance Bundling Discounts).

What are the hours for the Founders Insurance Company?

Founders’ billing and claims numbers can be reached from 8:00 a.m. to 5:00 p.m. CT, Monday through Friday. There is no Founders insurance 24-hour phone number.

What is the Founders insurance phone number?

The Founders Insurance Company’s main number is (847) 768-0040.

How do you pay for Founders insurance?

You can pay with a credit or debit card or set up direct bank withdrawals. You can also set up autopay to avoid any insurance lapses (Read More: How do auto insurance payments work?).

Is there Founders Insurance mobile pay?

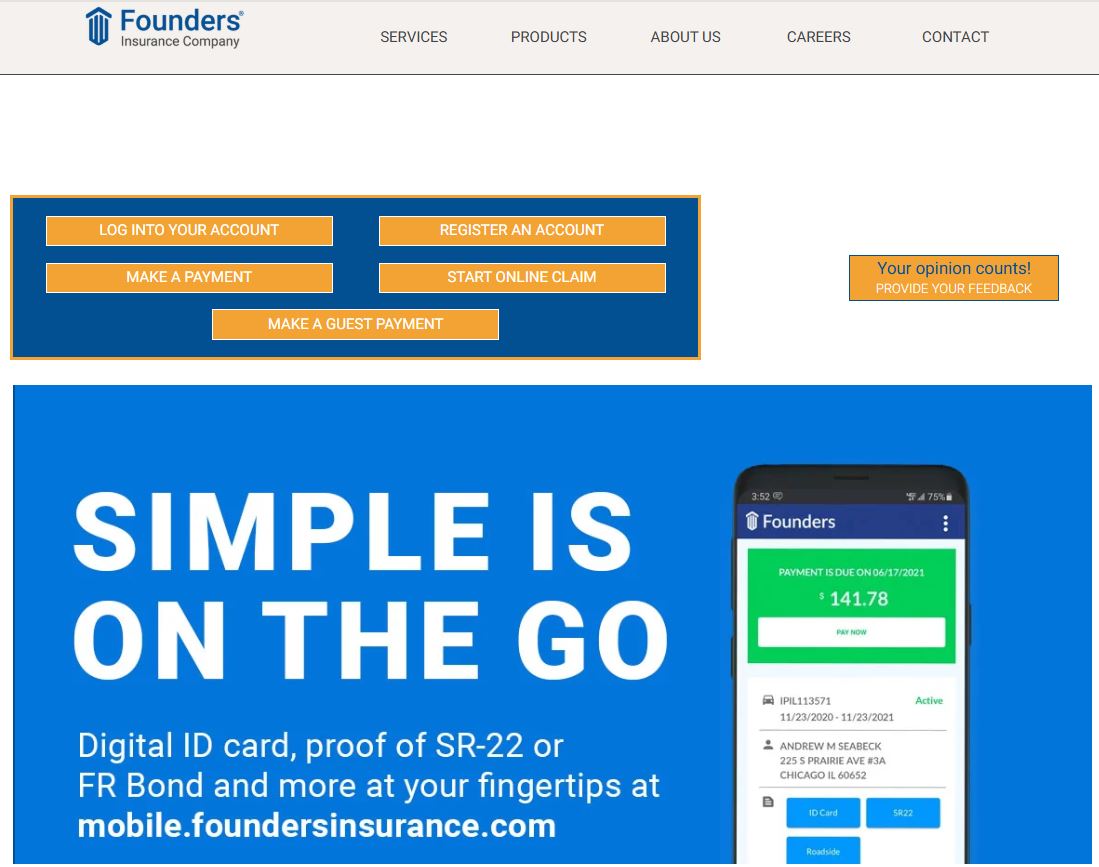

There is no Founders Insurance mobile app download, but you can visit mobile.foundersinsurance.com to pay online.

Does Founders Insurance have renters insurance?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Is Progressive a nonstandard insurance company?

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

The Founders Insurance Company is one of the lesser-known auto insurance companies on the market, but it has an A+ rating from BBB and an A rating from A.M. Best.

The Founders Insurance Company is part of the Utica National Insurance Group.

Does Founders insurance cover rental cars?

The Founders Insurance Company will cover a rental car during a covered claim if you have rental car reimbursement coverage.

Does Founders offer auto insurance?

Yes, the Founders Insurance Company sells car insurance, as well as renters, homeowners, liquor liability, and commercial auto insurance. You can bundle some coverages for a discount, such as home and auto insurance (Learn More: Best Home and Auto Insurance Bundling Discounts).

What are the hours for the Founders Insurance Company?

Founders’ billing and claims numbers can be reached from 8:00 a.m. to 5:00 p.m. CT, Monday through Friday. There is no Founders insurance 24-hour phone number.

What is the Founders insurance phone number?

The Founders Insurance Company’s main number is (847) 768-0040.

How do you pay for Founders insurance?

You can pay with a credit or debit card or set up direct bank withdrawals. You can also set up autopay to avoid any insurance lapses (Read More: How do auto insurance payments work?).

Is there Founders Insurance mobile pay?

There is no Founders Insurance mobile app download, but you can visit mobile.foundersinsurance.com to pay online.

Does Founders Insurance have renters insurance?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Is Progressive a nonstandard insurance company?

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

The Founders Insurance Company will cover a rental car during a covered claim if you have rental car reimbursement coverage.

Yes, the Founders Insurance Company sells car insurance, as well as renters, homeowners, liquor liability, and commercial auto insurance. You can bundle some coverages for a discount, such as home and auto insurance (Learn More: Best Home and Auto Insurance Bundling Discounts).

What are the hours for the Founders Insurance Company?

Founders’ billing and claims numbers can be reached from 8:00 a.m. to 5:00 p.m. CT, Monday through Friday. There is no Founders insurance 24-hour phone number.

What is the Founders insurance phone number?

The Founders Insurance Company’s main number is (847) 768-0040.

How do you pay for Founders insurance?

You can pay with a credit or debit card or set up direct bank withdrawals. You can also set up autopay to avoid any insurance lapses (Read More: How do auto insurance payments work?).

Is there Founders Insurance mobile pay?

There is no Founders Insurance mobile app download, but you can visit mobile.foundersinsurance.com to pay online.

Does Founders Insurance have renters insurance?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Is Progressive a nonstandard insurance company?

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

Founders’ billing and claims numbers can be reached from 8:00 a.m. to 5:00 p.m. CT, Monday through Friday. There is no Founders insurance 24-hour phone number.

The Founders Insurance Company’s main number is (847) 768-0040.

How do you pay for Founders insurance?

You can pay with a credit or debit card or set up direct bank withdrawals. You can also set up autopay to avoid any insurance lapses (Read More: How do auto insurance payments work?).

Is there Founders Insurance mobile pay?

There is no Founders Insurance mobile app download, but you can visit mobile.foundersinsurance.com to pay online.

Does Founders Insurance have renters insurance?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Is Progressive a nonstandard insurance company?

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

You can pay with a credit or debit card or set up direct bank withdrawals. You can also set up autopay to avoid any insurance lapses (Read More: How do auto insurance payments work?).

There is no Founders Insurance mobile app download, but you can visit mobile.foundersinsurance.com to pay online.

Does Founders Insurance have renters insurance?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Is Progressive a nonstandard insurance company?

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

Yes, the Founders Insurance Company offers renters insurance. Find affordable insurance coverage today by entering your ZIP in our free quote finder.

Progressive is a standard insurance company, but it does offer nonstandard SR-22 insurance. Curious what are the top 10 nonstandard auto insurance companies? Read our article on the best nonstandard insurance companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Founders insurance have a grace period?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.