Farmers vs. Travelers Auto Insurance in 2026 (Head-to-Head Review)

Our Farmers vs. Travelers auto insurance comparison found Travelers is cheaper at $53 per month, while Farmers starts at $76 a month. Farmers has a larger national network of local agents for in-person support, while Travelers holds a stronger A rating from A.M. Best, reflecting superior financial strength.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated July 2025

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsFarmers vs. Travelers auto insurance compares a company focused on personalized agent support and niche coverages with one offering lower rates, built-in accident forgiveness, and strong digital tools.

Farmers vs. Travelers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.3 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 2.0 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.1 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.5 | 4.4 |

| Farmers Review | Travelers Review |

Travelers stand out for lower premiums, built-in gap insurance, and accident forgiveness that benefit budget-conscious and newer car owners, while Farmers focuses on in-person support, rideshare and custom parts coverage, and its Signal app that rewards safe driving habits.

This Travelers vs. Farmers comparison breaks down policy structures, discount availability, claims processes, and digital tools to help you decide which insurer better fits your needs.

- Farmers offer smart home discounts and new car replacement coverage options

- Travelers provide IntelliDrive tracking and 20% low-mileage driver savings

- Farmers have fewer auto insurance complaints than Travelers

If you’re just looking for coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

Travelers vs. Farmers Auto Insurance Costs

When comparing auto insurance rates by age between Travelers and Farmers, Travelers consistently offers lower monthly rates across most age brackets, especially for younger drivers. For example, 16-year-olds pay around $50 less per month with Travelers.

Farmers vs. Travelers Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $452 | $392 |

| 16-Year-Old Male | $452 | $517 |

| 25-Year-Old Female | $94 | $57 |

| 25-Year-Old Male | $98 | $62 |

| 35-Year-Old Female | $87 | $53 |

| 35-Year-Old Male | $91 | $58 |

| 45-Year-Old Female | $76 | $53 |

| 45-Year-Old Male | $76 | $53 |

| 55-Year-Old Female | $72 | $50 |

| 55-Year-Old Male | $72 | $50 |

| 65-Year-Old Female | $75 | $52 |

| 65-Year-Old Male | $75 | $53 |

The gap shrinks with older drivers, with 60-year-old drivers paying $68 per month with Farmers but just $49 a month with Travelers, but Travelers is still more affordable.

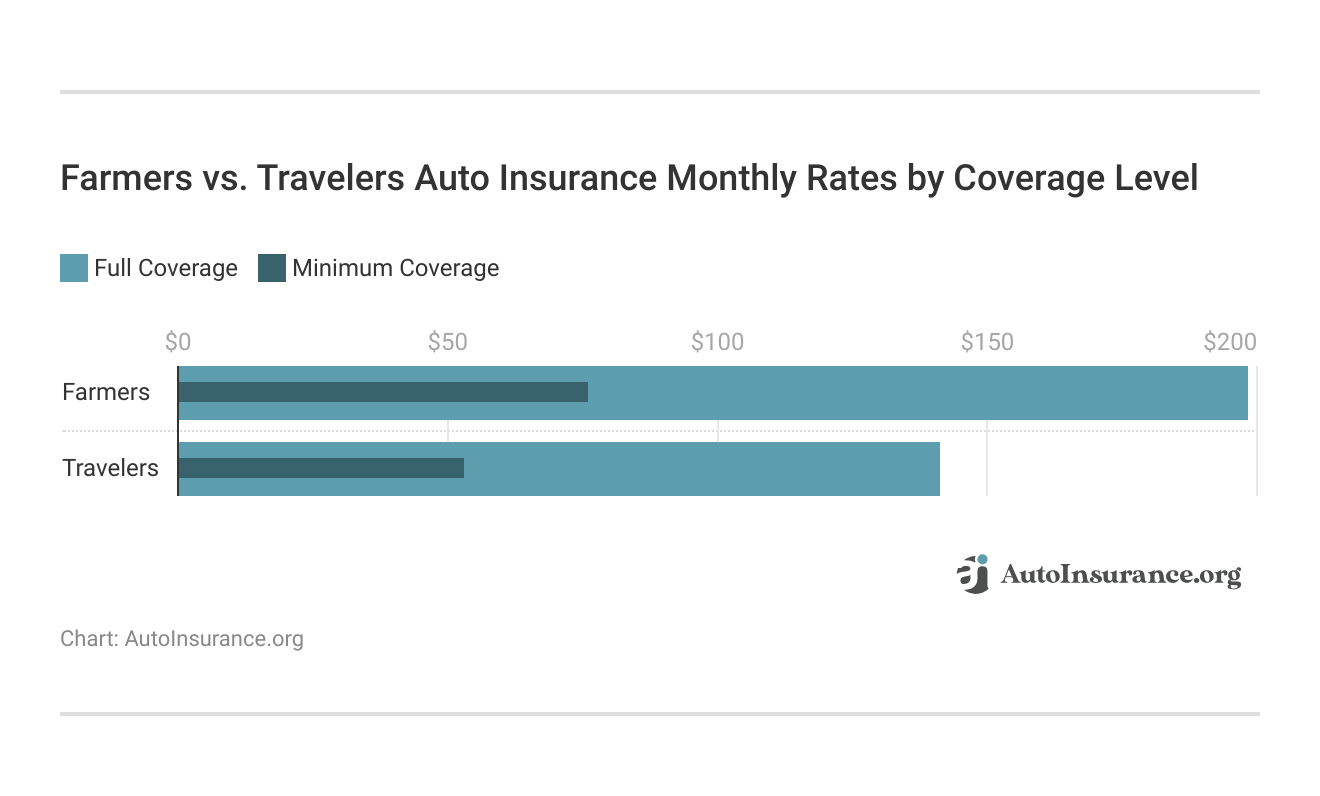

This shows that Farmers charges about $198 for full coverage, nearly double its $76 minimum coverage rate. Travelers is more affordable overall, with full coverage at $141 and minimum coverage at $53. Full coverage costs more because it includes collision, comprehensive, and higher liability limits. Among the many factors that affect auto insurance rates, your chosen coverage level has one of the biggest impacts on monthly costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cost by Driving Record

Travelers tend to offer lower rates for most driving records, but not across the board. If you have a clean record, Travelers comes in cheaper at $53 per month versus $76 per month with Farmers.

Farmers vs. Travelers Auto Insurance Monthly Rates by Driving Record

| Violation | ||

|---|---|---|

| Clean Record | $76 | $53 |

| Not-At-Fault Accident | $109 | $76 |

| Speeding Ticket | $95 | $72 |

| DUI/DWI | $105 | $112 |

That trend continues if you’ve had a not-at-fault accident or a speeding ticket, with Travelers offering monthly rates of $76 and $72, respectively, while Farmers charges $109 and $95 per month. But things flip if you have a DUI vs. DWI. Travelers charge $112 a month compared to Farmers’ $105 monthly.

So if you’ve had a violation like a speeding ticket or a minor accident, Travelers will likely save you money. On the other hand, if you’re dealing with a DUI on your record, Farmers may offer a better deal. It really comes down to your specific driving history.

Cost by Credit Score

Auto insurance and your credit score are major pricing factors. Farmers generally give you a better deal than Travelers across the board. Farmers charge drivers with excellent credit $102 per month, compared to $120 with Travelers.

Farmers vs. Travelers Auto Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Excellent Credit (800-850) | $102 | $120 |

| Very Good Credit (740-799) | $116 | $120 |

| Good Credit (670-739) | $130 | $145 |

| Fair Credit (580-669) | $145 | $178 |

| Bad Credit (300-579) | $160 | $210 |

The Farmers vs. Travelers pricing by credit score shows that even as credit drops to good or fair, Farmers remains ahead with $116 and $130 per month compared to Travelers at $120 and $145 a month.

The biggest difference shows up for drivers with poor credit. Farmers charges $160, while Travelers jumps to $210. If your score is less than perfect, you’ll likely save more with Farmers, which offers better pricing across all credit tiers.

Farmers vs. Travelers Auto Insurance Discounts

The Farmers and Travelers discount comparison shows that Travelers offers broader savings across more categories. For instance, Travelers gives drivers a 15% discount for anti-theft devices, compared to Farmers’ 10%, and offers 20% off for low-mileage drivers, double what Farmers provides.

Farmers vs. Travelers Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Anti-Theft | 10% | 15% |

| Auto-Pay | 5% | 6% |

| Bundling | 20% | 13% |

| Good Driver | 30% | 10% |

| Good Student | 15% | 8% |

| Loyalty | 12% | 9% |

| Low Mileage | 10% | 20% |

| Multi-Car | 20% | 8% |

| Paperless | 3% | 3% |

| Pay-in-Full | 10% | 15% |

| Safe Driver | 20% | 17% |

The best Farmers auto insurance discounts are for safe drivers, with its standout 30% good driver discount (versus Travelers’ 10%), which is one of the few areas where it outperforms.

Across most other common auto insurance discounts, such as pay-in-full, safe driver, auto-pay, and bundling, Travelers continues to lead the competition with broader savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers vs. Travelers: Coverage Option Comparison

When choosing between Farmers and Travelers auto insurance, it helps to understand not only the price differences but also the coverage options each company offers. Beyond basic protections, both insurers provide add-ons that can fill important gaps in your policy—but they don’t offer exactly the same extras. Every auto insurance policy starts with a few essential coverages:

- Liability Coverage: Covers injury and property damage to others when you’re at fault. Required in most states.

- Collision Coverage: Pays for damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision damage like theft, fire, vandalism, and weather.

- Personal Injury Protection (PIP): Covers your medical bills and lost wages after an accident, regardless of fault. Availability varies by state.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance.

Farmers Insurance and Travelers compare when it comes to add-on coverage, which could help you decide which company fits your needs. Both companies include popular options like accident forgiveness, gap insurance, OEM parts coverage, and roadside assistance.

Farmers vs. Travelers Add-On Insurance Coverage Options

| Coverage | ||

|---|---|---|

| Accident Forgiveness | ✅ | ✅ |

| Custom Equipment | ✅ | ❌ |

| Gap Insurance | ✅ | ✅ |

| $0 Glass Deductible | ✅ | ✅ |

| New Car Replacement | ✅ | ✅ |

| OEM Parts | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Coverage | ✅ | ❌ |

| Roadside Assistance | ✅ | ✅ |

| Vanishing Deductible | ❌ | ✅ |

But there are some key differences. Farmers Insurance stands out for offering custom equipment coverage and rideshare insurance, making it a strong choice if you drive for a rideshare company or have aftermarket parts on your car. Travelers, on the other hand, includes a vanishing deductible program—great if you want your deductible to decrease over time with safe driving.

So, if you’re a driver who wants specialty protections or covers more unique risks, Farmers could be the better fit. But if you’re focused on lowering your out-of-pocket costs long term, Travelers might be worth a look.

Farmers vs. Travelers Auto Insurance Ratings & Reviews

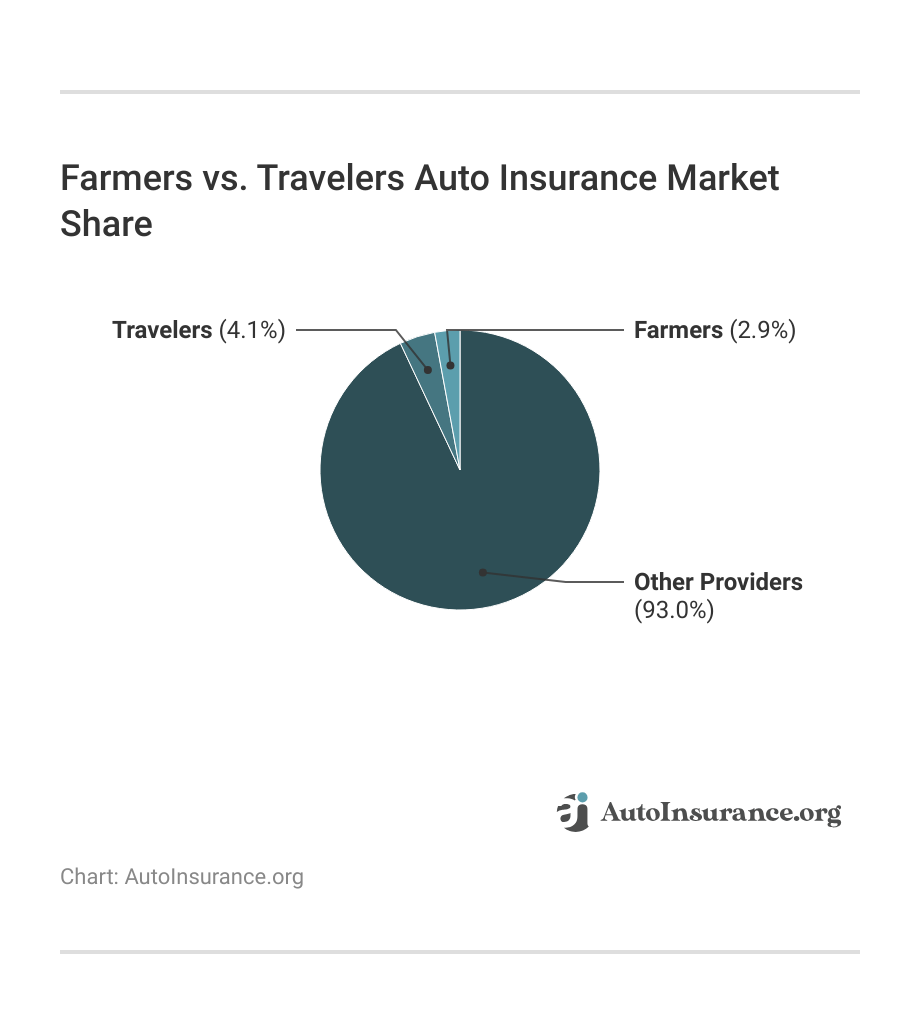

This market share shows Travelers holds 4.1% of the U.S. auto insurance market, while Farmers Insurance accounts for 2.9%. That means Travelers ensures a larger share of drivers, possibly due to its lower rates and broader discount options. Most of the market—93%—belongs to other providers like State Farm, Geico, and Progressive.

Despite their smaller share, both Travelers and Farmers remain recognizable brands with distinct customer bases. Travelers lead in financial strength as well, with an A++ rating from A.M. Best, compared to Farmers’ A. So, if you’re comparing strictly on potential for long-term discounts and customer reach, Travelers looks like the stronger pick.

Insurance Business Ratings & Consumer Reviews: Farmers vs. Travelers

| Agency | ||

|---|---|---|

| Score: 706 / 1,000 Avg. Satisfaction | Score: 684 / 1,000 Below Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A Good Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 76/100 Good Customer Feedback |

|

| Score: 1.32 More Complaints Than Avg. | Score: 3.96 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

However, when you stack up Farmers and Travelers based on business ratings and customer feedback, Farmers comes out slightly ahead in overall satisfaction and is often listed among the top-rated insurance companies for home and auto.

Choose Travelers for lower rates and digital tools. Pick Farmers for agent help and specialty coverages like rideshare or custom parts.Kristen Gryglik Licensed Insurance Agent

J.D. Power gives Farmers a 706 out of 1,000, which signals average satisfaction, while Travelers scores lower at 684, below average. Farmers also scores 82 out of 100 on Consumer Reports, outperforming Travelers at 76. See more ratings in our Farmers vs. USAA auto insurance review.

Complaint data from NAIC shows a clearer divide. Farmers score 1.32, which is above average but manageable, while Travelers hit 3.96, meaning it see nearly four times the complaints expected for its size. If customer satisfaction and fewer complaints matter more to you, Farmers might be the safer bet. But if you’re focused on financial stability alone, Travelers holds the edge.

Pros and Cons of Farmers Auto Insurance

Farmers auto insurance reviews praise its hands-on approach and local expertise. It’s not built for everyone, but it works well if you have a layered insurance setup or prefer talking to someone when it comes to policy changes and filing claims.

- Great for Complex Portfolios: Farmers agents are skilled at building multi-property and multi-vehicle policies, which makes them ideal for clients with layered insurance needs.

- Agent-Led Support: Policyholders who want real-time advice from a dedicated local agent will appreciate Farmers’ in-person service model.

- Uncommon Coverage Options: Farmers provides policies for rideshare drivers, OEM and custom parts, and new car replacements.

If you’re the kind of driver who values strong local support over digital tools, Farmers delivers. A Yelp review user in Mill Valley, CA, stated that Farmers handled a challenging case involving three homes, two VRBOs, and four cars.

The agent listened closely, worked with underwriting, and found a policy that tackled fire zone issues in Utah without overcharging. That kind of service is what Farmers leans on.

But if you want a tech-forward experience or plan to adjust your policy frequently on your phone, there are more streamlined options out there.

- Slower for Self-Service Users: If you prefer managing your policy entirely online, the agent-first setup may feel outdated and inconvenient.

- Limited Tech Features: Farmers lack the advanced mobile tools or usage-based apps that competitors like Travelers offer for tracking and saving.

Farmers may have better customer service ratings and fewer complaints, but it isn’t as digitally streamlined as Travelers or other competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Travelers Auto Insurance

Travelers car insurance reviews rate it as a great option for drivers who prioritize quick claims support and want to manage insurance online. It’s designed for convenience, with quick claims and user-friendly tools.

- Quick Claims Response: Travelers is known for handling claims efficiently online despite its high number of complaints.

- User-Friendly Tools: The MyTravelers app and IntelliDrive program let you track driving behavior, access policy info, and adjust coverage (Learn More: Travelers IntelliDrive review).

- Strong Nationwide Availability: Travelers operates in most states and works with independent agents, giving you more flexibility in how you buy coverage.

If you want a carrier that makes everything easier after an accident and doesn’t slow you down with paperwork or long calls, Travelers fits the bill. A Yelp reviewer shared that Travelers was consistently helpful, especially after an accident.

They praised the company’s fast feedback and service, saying it helped ease a tough situation, exactly the kind of interaction that shows what Travelers does best when it counts. But if you’re after relationship-based service or ongoing support from one agent, it might feel too hands-off.

- Lower Satisfaction on Review Platforms: Despite solid service, Yelp reviews are mixed overall, and some customers report inconsistent follow-through.

- Less Personalized Service: Travelers lean on digital tools and phone support, which may not work as well if you want a local agent who knows your situation.

A Farmers vs. Travelers car insurance comparison comes down to how you like to manage your policy and what features matter most.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing Between Farmers or Travelers Auto Insurance

If you’ve narrowed it down to Farmers vs. Travelers auto insurance, we found that Farmers focuses on in-person support, offering a broad agent network and solid options for drivers who want detailed, hands-on help with their coverage. It has higher customer satisfaction and fewer complaints than Travelers.

If you have poor credit or a DUI, Farmers may cost less. But for low-mileage drivers or those using digital tools, Travelers is often the smarter pick.Travis Thompson Licensed Insurance Agent

Travelers, by contrast, stands out for its lower average rates and digital perks that streamline policy access. Compare Progressive vs. Travelers auto insurance to see how it compares to another digital-first provider. But if you’d rather work with a local agent who can walk you through every step, Farmers delivers better on that front.

Find the best auto insurance company, no matter how much coverage you need, by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

Which auto insurance is better, Travelers or Farmers?

Travelers is a better fit if you’re looking for lower rates and digital tools like IntelliDrive, which rewards safe driving. Farmers is a better choice if you value strong local agent support and unique coverage options such as rideshare and custom equipment protection.

What is Travelers Insurance ranked in terms of market share?

Travelers holds 4.1% of the auto insurance market, ranking it above Farmers, which has 2.9%. This shows that more policyholders choose Travelers over Farmers.

Who offers cheaper auto insurance than Travelers?

Several companies offer lower starting rates than Travelers, which averages $53 per month for minimum coverage. Geico auto insurance averages $43 per month, State Farm starts at $47, and Progressive offers rates from $50 per month. These companies typically provide broader low-mileage and bundling discounts, making them competitive for budget-focused drivers.

Is Travelers Insurance a good insurance company for car coverage?

Yes, Travelers offers strong financial backing with an A++ A.M. Best rating and lower-than-average rates for most drivers, especially those with clean records or low annual mileage.

Why should you get Travelers Insurance instead of Farmers Insurance?

Travelers provides more competitive pricing across age and violation profiles, faster digital claims handling, and more available discounts for features like anti-theft devices and low mileage.

Is Travelers auto insurance good for drivers with no prior coverage?

Travelers is ideal for drivers without prior coverage who want to lower premiums with usage-based insurance. The Travelers IntelliDrive program offers additional savings by tracking driving habits like speeding and braking.

Why is Farmers auto insurance so high?

Farmers Insurance rates are higher because it offers personalized agent service, rideshare coverage, and specialty options like custom parts protection. Its minimum coverage averages $76 per month, reflecting hands-on support and flexible policy choices not found with cheaper, digital-first insurers like Travelers.

Is Travelers good at paying claims?

Yes, Travelers is known for fast claims through its MyTravelers app and 24/7 support. Despite a higher complaint index of 3.96, many drivers report quick settlements and responsive service, especially for common claims. It also offers accident forgiveness to help keep premiums stable after your first accident.

How does Travelers Insurance vs. Farmers compare for teen drivers?

Travelers offers lower monthly rates for female drivers under 21 at $392 compared to $453 a month with Farmers. Male teen rates are higher across the board, but Travelers still provides more affordability in most cases. Find the cheapest teen auto insurance here.

Is Travelers auto insurance any good?

Yes, Travelers auto insurance is a solid option, especially for drivers seeking digital claims support and discount opportunities. Travelers holds an A++ rating from A.M. Best, reflecting superior financial strength. Its NAIC complaint index is 3.96, meaning it receives more complaints than expected for its size, but many drivers still report fast claims processing and helpful service.

Do Farmers or Travelers offer better roadside assistance coverage?

Is Farmers auto insurance good?

What are the rates by violation for Travelers & Farmers auto insurance?

Is Travelers owned by Geico?

How does Farmers Insurance vs. Nationwide compare for hands-on service?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.