Axa Auto Insurance Review for 2026 [Hidden Gem?]

Choose Axa auto insurance for coverage starting at $84 monthly, offering personalized plans tailored to your needs. This Axa auto insurance review details 24/7 claims support and access to over 4,000 agents across Canada, providing reliable service and guidance whenever needed.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

Explore this Axa auto insurance review to discover various personalized coverage options, including auto, home, and life insurance.

With 24/7 claims support and over 4,000 agents across Canada, Axa ensures reliable assistance (For more information, read our “How to File an Auto Insurance Claim“).

Axa Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claim Processing | 4.0 |

| Company Reputation | 3.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 1.3 |

| Insurance Cost | 3.1 |

| Plan Personalization | 3.5 |

| Policy Options | 3.5 |

| Savings Potential | 2.5 |

Connect with agents using Axa’s online tool or phone service, making your insurance experience seamless.

This review highlights Axa’s commitment to delivering customer-focused solutions tailored to your needs. Enter your ZIP code now for online auto insurance quotes in your area.

- Axa has an “A” rating from A.M. Best for financial strength

- Offers 24/7 claims support and over 4,000 agents in Canada

- Personalized coverage options for auto, home, and life insurance

Key Axa Auto Insurance Rates Overview

The table below showcases Axa auto insurance monthly rates, broken down by coverage level, age, and gender. It compares minimum and full coverage options based on these factors, helping drivers better understand potential costs.

Axa Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $237 | $432 |

| Age: 16 Male | $248 | $456 |

| Age: 18 Female | $215 | $389 |

| Age: 18 Male | $229 | $407 |

| Age: 25 Female | $126 | $218 |

| Age: 25 Male | $134 | $233 |

| Age: 30 Female | $112 | $197 |

| Age: 30 Male | $119 | $208 |

| Age: 45 Female | $84 | $172 |

| Age: 45 Male | $91 | $181 |

| Age: 60 Female | $72 | $158 |

| Age: 60 Male | $76 | $166 |

| Age: 65 Female | $83 | $171 |

| Age: 65 Male | $88 | $178 |

In the body, the table reveals that younger drivers face significantly higher rates, with 16-year-old males paying the most for full coverage at $456 per month. As drivers age, rates decrease, with 45-year-old females seeing the lowest minimum coverage cost of $84.

Gender also plays a role, as males pay slightly more than females across all ages. The difference in cost between minimum and full coverage is also substantial, highlighting the importance of selecting the right coverage level based on your needs.

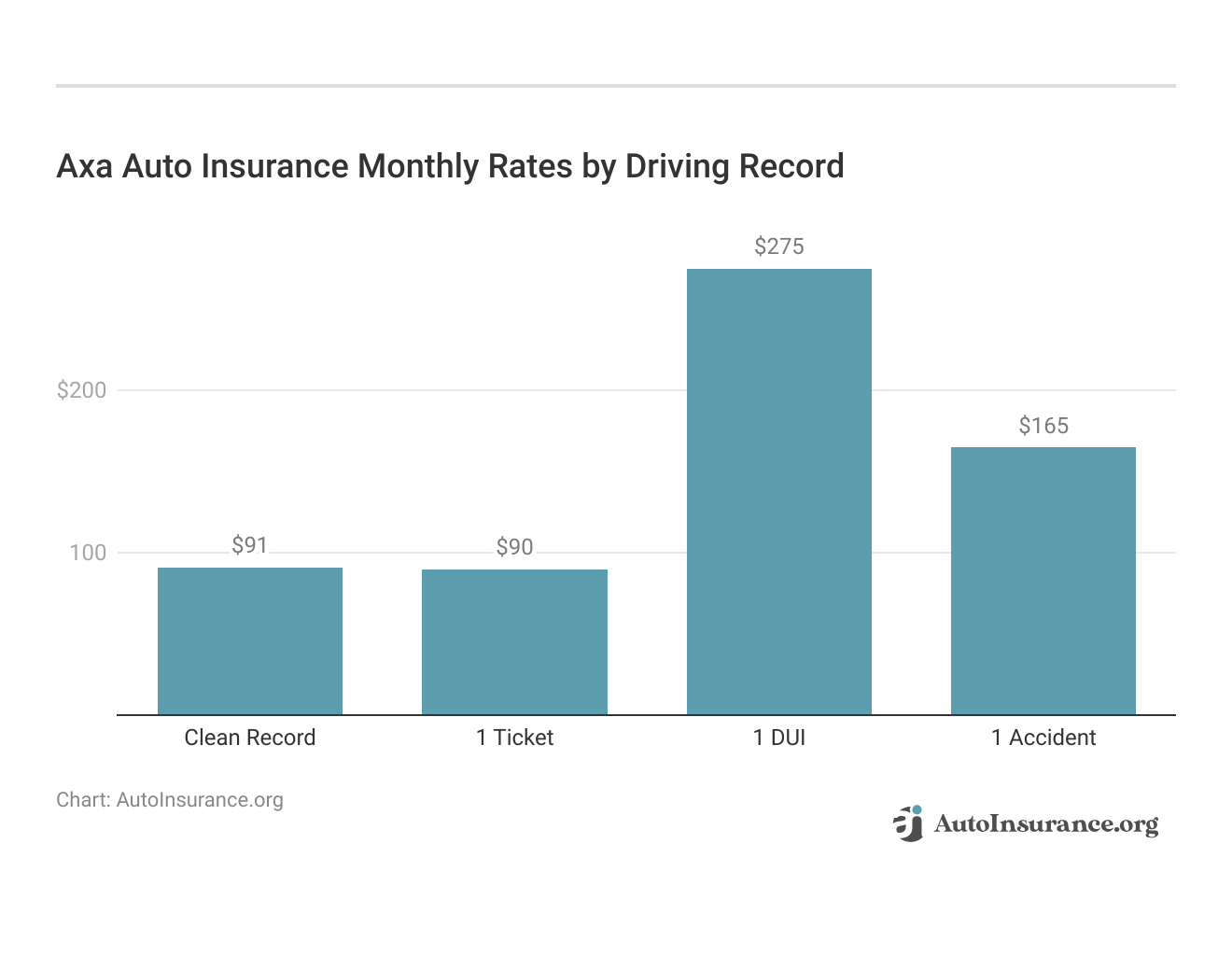

This section breaks down the monthly rates for Axa auto insurance based on different driving records. The table explains how driving history impacts minimum and total coverage premiums.

Read more: When to Buy More Than Minimum Auto Insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What You Should Know About Axa

Axa Insurance Company has three corporate offices – one in Quebec, Ontario, and British Columbia.

- The Quebec office is at 2020 University Street, Suite 700, in Montreal.

- The Ontario office is at 5700 Yonge Street, Suite 1400, North York.

- The British Columbia office is located at 999 Hastings West Street in Vancouver.

In addition, there are 11 regional offices throughout Canada, and, as mentioned previously, more than 4,000 individual agents and insurance brokers can assist customers. The Axa website has a convenient search tool where customers can enter their postal code, address, and nearest intersection or province to locate a nearby agent.

In addition, customers can call the toll-free number to contact an independent agent. The website also offers detailed driving directions and a map to all agent offices. See more details on how to get free online auto insurance quotes.

Axa Insurance Quotes

At this time, Axa Insurance does not offer online auto insurance quotes. Customers are encouraged to search for an agent close to their home or business by using the online search tool or calling the main toll-free number. Each agent can provide an auto insurance quote.

Axa Insurance Claims

Axa Insurance accepts claims 24 hours a day and seven days a week; however, it is impossible to file a claim online. Get detailed insights about how to dispute an auto insurance claim.

Customers are encouraged to contact their individual broker or agent in order to file a claim.

If the accident occurs after traditional business hours or the individual agent cannot be reached, Axa Insurance customers can call 1-800-268-8865. Axa does have information on the website detailing the information customers should have on hand before filing a claim, such as the policy number, details of the accident, and the drivers involved.

How Axa Ranks Among Providers

According to the Better Business Bureau, Axa Insurance Company is not accredited by the Better Business Bureau (BBB), although businesses have no obligation to seek or obtain accreditation.

Drivers aged 18, both male and female, face significantly higher premiums, with males paying $407 for full coverage.Kristen Gryglik Licensed Insurance Agent

Because of a lack of information on Axa Insurance Company, the Better Business Bureau has not assigned a rating. Axa Insurance is rated “A” (Excellent) by the A.M. Best Company. In addition, Axa Insurance has a long-term issuer credit rating of “a+.” Explore our review of “Where to Compare Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Customer Satisfaction Insights for Axa

Axa auto insurance consistently receives strong ratings for its financial strength, customer satisfaction, and complaint handling. While customer feedback is mixed, the company maintains a solid reputation across multiple rating agencies.

Axa Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 830/1000 Above Avg. Satisfaction |

|

| Score: A- Excellent Business Practices |

|

| Score: 78/100 Mixed Customer Feedback |

|

| Score: 1.5 Avg. Complaints |

|

| Score: A+ Excellent Financial Strength |

Axa’s ratings reflect high financial security and areas where customer satisfaction could improve, particularly in service-related aspects. Despite some average complaint levels, Axa remains a reliable choice for many. Learn more by reading our guide about how to file a complaint against your auto insurance company.

Axa Auto Insurance: Strengths and Weaknesses

Axa Auto Insurance stands out for its broad range of products and strong financial ratings. With thousands of agents and brokers across Canada, customers can easily access personalized service.

- Broad Product Offering: With life, home, liability, and vehicle insurance, Axa can meet various needs.

- Robust Financial Grade: A.M. has given Axa an A+ grade. Best, demonstrating outstanding financial stability.

- Tailored Coverage: Axa lets clients customize their vehicle insurance plans to meet specific requirements.

- Broad Agent Network: Axa guarantees simple access to help with more than 4,000 agents and brokers across Canada.

These pros showcase Axa’s commitment to reliability and flexibility in coverage options, backed by a solid financial foundation.

You may have heard 👂that comparing car🚗 insurance quotes can lead to savings🤑, but are you intimidated by the process? It’s time to figure it out so you can save. We have the step-by-step guide for you right here👉:https://t.co/7c2R2bodbp pic.twitter.com/8vc6ZXcmhX

— AutoInsurance.org (@AutoInsurance) October 1, 2024

Despite Axa’s strengths, its service delivery has limitations, particularly regarding online functionalities and geographical coverage. These shortcomings may inconvenience customers seeking more modern or widespread solutions.

- No Online Quotations: Axa forces clients to get insurance quotations directly from an agent, which might need to be more convenient.

- Canada-Only Service: Only Canadian citizens are eligible for Axa’s insurance products; Americans are not.

- No Online Claim Filing: Policyholders must speak with an agent rather than submitting a claim online to begin the claims process.

While Axa excels in personalized service and financial security, the lack of online tools may deter those seeking more convenience.

Check out our guide: Can you view your auto insurance policy online?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Axa Insurance Coverage Highlights

Axa auto insurance is a dependable alternative for Canadian consumers since it offers a broad range of coverage options, a solid financial base, and individualized attention through its vast agent network. Learn more about the best auto insurance for drivers with a Canadian license.

Comment

byu/Mevmaximus from discussion

injapanlife

Those outside Canada or those looking for more digital convenience could find its narrow service area and lack of internet resources disadvantageous. Encumbered with a strong reputation for customer service and adaptable policies, Axa is a strong competitor in the insurance space.

If you want coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Frequently Asked Questions

What is Axa Auto Insurance?

Axa Auto Insurance is an insurance provider that offers vehicle insurance coverage. They provide policies designed to protect drivers and their cars against potential risks. For additional details, explore our comprehensive resource, “Vehicle Registration Fees by State.”

What types of auto insurance coverage does Axa Auto Insurance offer?

Axa Auto Insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and more. The specific coverage options may vary based on the policy and state regulations.

How can I contact Axa Auto Insurance?

To contact Axa Auto Insurance, you can contact their customer service department through phone, email, or other contact methods provided on their official website or policy documents. Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

How can I file a claim with Axa Auto Insurance?

You can contact their claims department directly to file a claim with Axa Auto Insurance. They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It’s important to report accidents or incidents promptly to initiate the claims process.

Does Axa Auto Insurance offer roadside assistance?

Axa Auto Insurance may offer optional roadside assistance plan coverage as an add-on to their policies. Roadside assistance can provide services such as towing, jump-starts, fuel delivery, and lockout assistance in case of emergencies or breakdowns while on the road. The availability of this coverage may vary based on the policy and state regulations.

What do Axa insurance reviews say about their coverage and service?

Axa reviews often mention their solid financial stability, personalized customer service, and wide range of insurance products, though some find their digital services lacking.

How does Axa Assistance fare in reviews for emergency services?

Axa Assistance review comments frequently highlight their fast response times and reliable global emergency support, making them a top choice for travel and medical assistance.

Where can I find the Axa car insurance phone number for claims or inquiries?

You can easily find the Axa car insurance phone number on their official website or your policy documents for direct assistance.

Can I manage my Axa online car insurance policy through their website?

Axa online car insurance services allow you to manage payments, view policy details, and access digital ID cards from home. To find out more, explore how to buy auto insurance online instantly.

Is it possible to get an Axa car insurance online quote quickly?

Online quotes for Axa car insurance are unavailable; you can contact a local agent for personalized pricing options.

What do customers mention in Axa home insurance review feedback?

Can I purchase Axa policies through an Axa independent agent?

Are Axa online quotes available for car insurance?

What is the process for handling Axa car insurance claims?

What does Axa comprehensive car insurance cover?

What services does Axa direct insurance provide to customers?

Does Axa uninsured motorist coverage protect me from uninsured drivers?

How do I reach Axa car insurance customer service for assistance?

When can I contact Axa to file a claim?

What options are available for Axa first time car insurance buyers?

How does Axa multi car insurance work for multiple vehicles?

Does Axa provide roadside assistance with its car insurance plans?

Where can I find the Axa car insurance email address for inquiries?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.