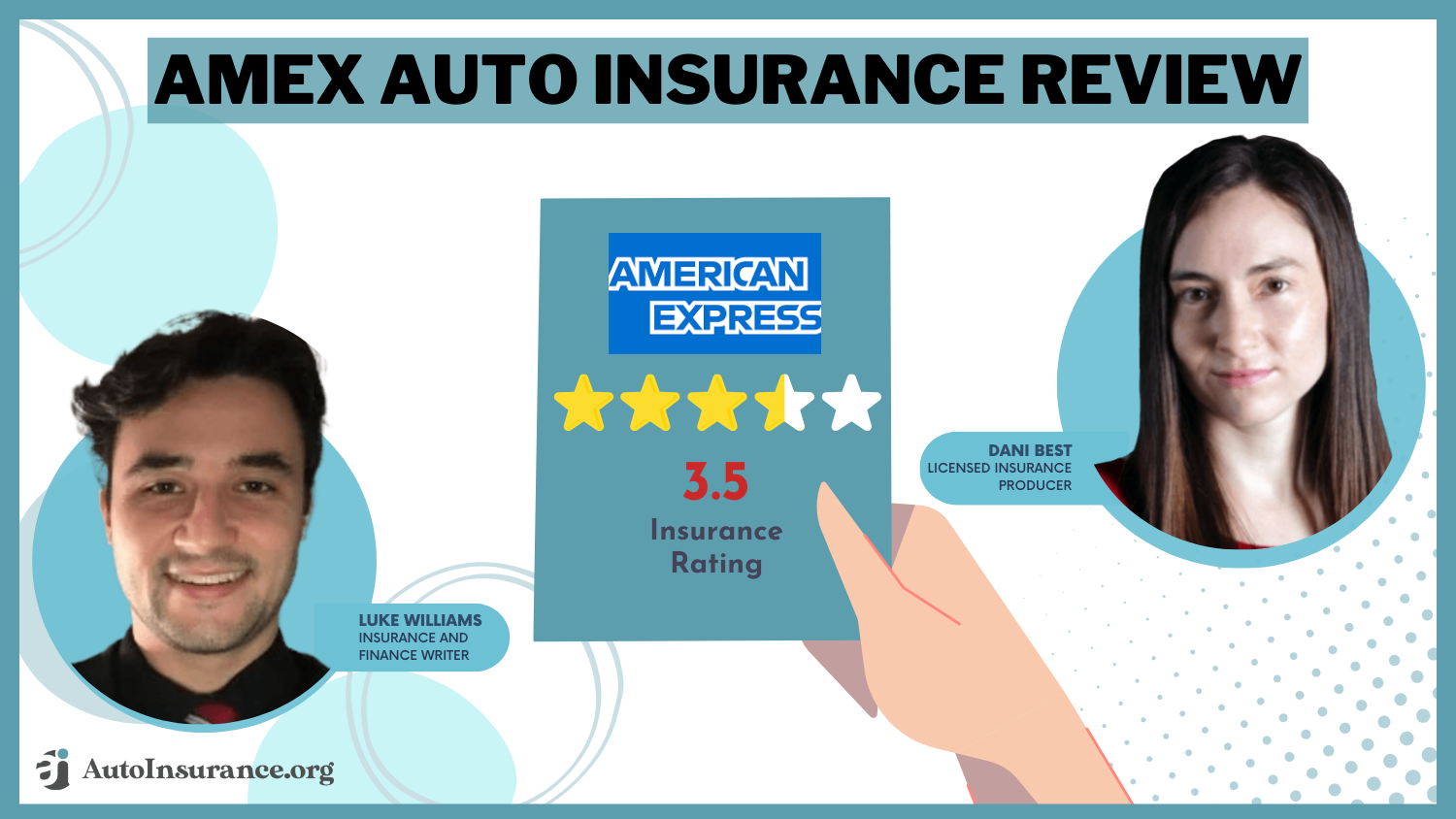

Amex Auto Insurance Review for 2026 [See Rates & Discounts Here]

Amex auto insurance provides affordable coverage starting at $97 per month, offering liability, full coverage, and PIP options. Amex auto insurance review highlights its comprehensive coverage across Texas, protecting drivers with flexible policies and additional offerings like roadside assistance.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2024

This Amex auto insurance review showcases Amex’s diverse offerings, including liability, full coverage, and PIP options for drivers in Texas.

Amex provides its own auto insurance policies, catering to both owners and non-owners. Additionally, Amex offers roadside assistance and business insurance, making it a versatile option.

Amex Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Insurance Rating | 3.5 |

| Business Reviews | 4.0 |

| Claim Processing | 4.0 |

| Company Reputation | 3.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.7 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 1.3 |

| Insurance Cost | 3.1 |

| Plan Personalization | 3.5 |

| Policy Options | 3.5 |

| Savings Potential | 2.5 |

This review delves into the details of these programs, allowing drivers to compare coverage and benefits. Find out more insights about what are the benefits of auto insurance.

You may wonder, “How do I get Amex car insurance near me?” While you can’t get an American Express auto insurance quote, you can enter your ZIP code into our free tool above to compare your Amex insurance auto quote to top competitors in your area.

What You Should Know About Amex

Information on Amex insurance for car owners is complex; the primary source of information is the company website. That would be the best place to find information about rates if you ask yourself, “How do I buy Amex insurance near me?” Find more information on how to buy auto insurance online instantly.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amex Insurance Rates by Age Group

The table highlights how Amex auto insurance rates vary based on coverage level, age, and gender. It shows the differences in minimum and full coverage premiums for drivers in different age groups.

Amex Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $178 | $354 |

| Age: 16 Male | $192 | $367 |

| Age: 18 Female | $162 | $339 |

| Age: 18 Male | $199 | $372 |

| Age: 25 Female | $134 | $299 |

| Age: 25 Male | $149 | $315 |

| Age: 30 Female | $123 | $287 |

| Age: 30 Male | $139 | $293 |

| Age: 45 Female | $97 | $228 |

| Age: 45 Male | $102 | $244 |

| Age: 60 Female | $88 | $215 |

| Age: 60 Male | $93 | $225 |

| Age: 65 Female | $81 | $203 |

| Age: 65 Male | $76 | $187 |

For 16-year-old drivers, both male and female, rates are significantly higher, with full coverage costing around $354 for females and $367 for males. As drivers age, their premiums decrease, with 45-year-old drivers seeing the lowest rates, with females paying $228 and males $244 for full coverage.

The gap between male and female rates remains consistent across age groups, with males paying slightly more than females for minimum and full coverage. Notably, 25-year-old and 30-year-old drivers experience a noticeable drop in costs compared to younger drivers. This table shows how age and gender affect auto insurance premiums under Amex policies.

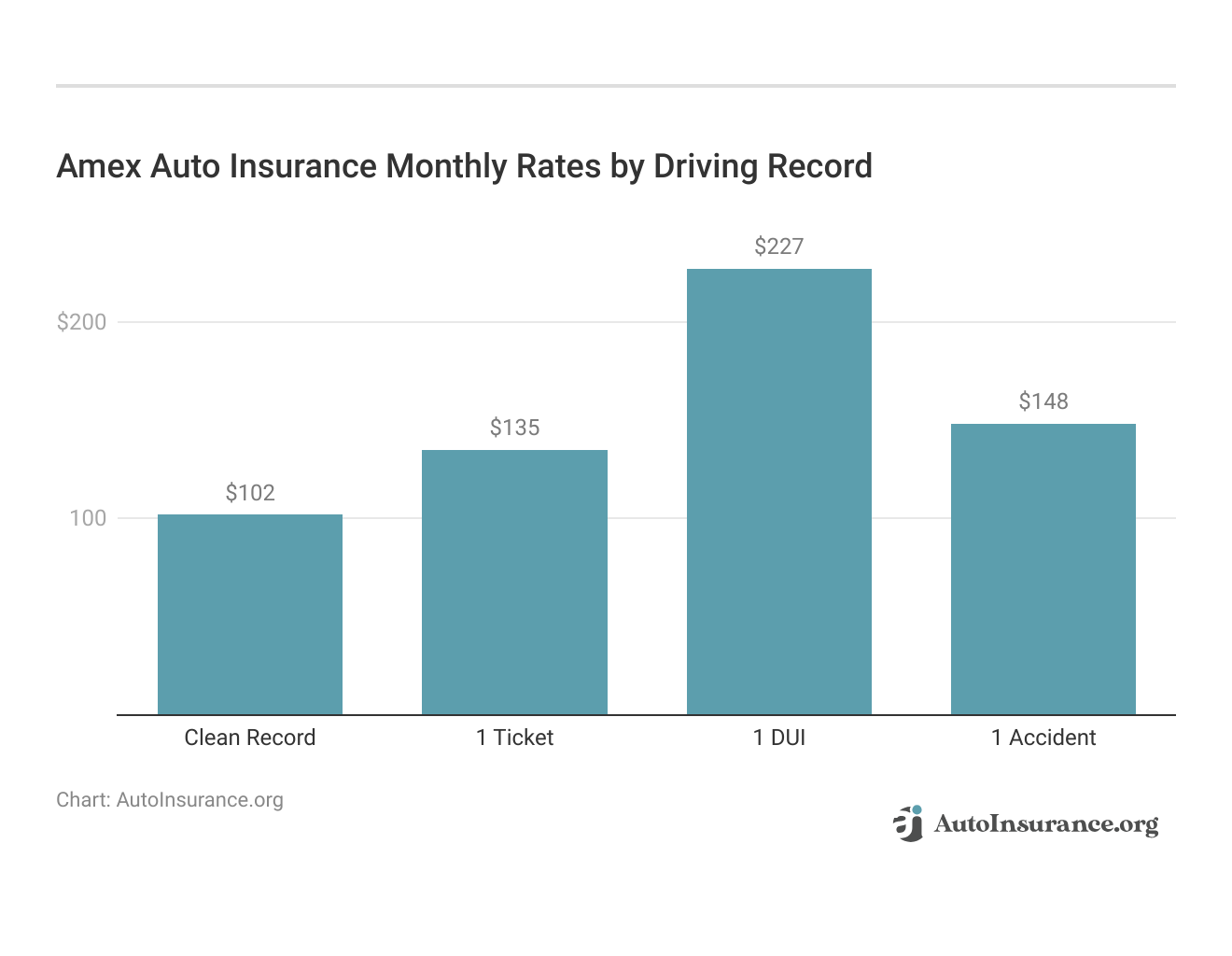

Amex auto insurance rates vary significantly based on your driving record. The table above outlines how different records, from clean to having a DUI, affect both minimum and total coverage rates.

Learn more by checking out our guide: Minimum Auto Insurance Requirements by State

Amex Insurance Coverage Options

There are many different types of auto insurance coverage. According to its website, Amex insurance offers owner and non-owner coverage, state-mandated liability, full coverage, collision, comprehensive, uninsured motorist, and PIP (personal injury protection). An explanation of these coverage options follows:

- Liability Coverage: Protects you when you cause an accident. Bodily injury liability covers any medical expenses when you are injured, while property damage liability covers any damage to physical property.

- Personal Injury Protection: Pays for medical expenses and will also cover the costs of lost earnings, rehabilitation, funeral expenses, and replacement costs for certain things like child care.

- Collision and Comprehensive Coverage: Collision coverage will be paid for when your car is damaged by a collision with another car or an object or if your vehicle is damaged by rolling over. Comprehensive coverage protects your car when it is damaged by theft, fire, hail, flood, wind, and vandalism.

- Uninsured and Underinsured Coverage: Even if you purchase adequate insurance for your car, if you are in an auto accident, the other person involved might not have sufficient auto insurance. This situation is where having uninsured and underinsured motorist coverage is helpful.

Curious if you can get Amex roadside assistance? Speak with an Amex automotive insurance representative to see if the coverage is available.

In addition, if you need travel coverage and find out Amex has it, check out Amex travel insurance reviews to see if it offers what you need.

Amex Auto Insurance and Other Coverage Types

Your home is typically the biggest purchase you will make. That is why homeowners insurance is so important. Amex home insurance typically covers acts of nature like lightning, hail, and windstorms or natural disasters like tornadoes and hurricanes.

Home insurance also covers things like theft and any major damage like when pipes freeze over in the winter.

Business insurance offers coverage for workers’ compensation, business property and business liability insurance, business auto insurance, surety and fidelity bonds, and even mobile property and inland marine insurance.

Commercial insurance is the best line of protection for business owners. Worker’s compensation insurance is another way for business owners to protect their business and employees. Lastly, Does American Express have car insurance? American Express offers car insurance options through partnerships with various insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance With American Express Doesn’t Exist

Does Amex have car insurance? If you’re wondering how to get American Express insurance for car owners, you’ll be disappointed to learn that American Express car insurance coverage isn’t available. However, you can get other American Express insurance coverage from Amex Assurance Company.

So, what is the Amex Assurance Co.? The American Express Assurance Company underwrites the company’s other insurance services, such as travel insurance, extended warranties, and Amex rental insurance coverage. The American Express Assurance Company’s phone number is 1-800-243-0198 to file an American Express insurance claim.

Do you need all the auto 🚗insurance coverage or just the bare minimum? Probably somewhere in between, but where❓? Check out our guide to help you make the best decision for you👉: https://t.co/PlHvBUHasO pic.twitter.com/y6wRKU7Xb1

— AutoInsurance.org (@AutoInsurance) June 24, 2024

Can I get American Express home insurance? American Express homeowners insurance is available in some regions through the American Express Home Plus Insurance plan, underwritten by Zurich Insurance. See our Zurich auto insurance review to learn more about the company.

You can also get term life insurance with the Amex Life Assurance Company, underwritten by MetLife. However, Amex Life Insurance Company coverage is only available in India (Read our “MetLife Auto Insurance Review” to learn more).

At $228 per month, Amex offers competitive full coverage for 45-year-old female drivers.Laura Berry Former Licensed Insurance Producer

While no “American Express Insurance Company” exists with auto insurance, you can still use the other American Express insurance services listed above. Check out American Express insurance reviews to see if Amex Assurance Company insurance coverage fits your needs.

Consumer Reports Insights on Amex Auto Insurance

Amex auto insurance received an impressive score of 840/1000 from J.D. Power, indicating above-average customer satisfaction. The BBB awarded it an A+ rating, reflecting excellent financial strength and business practices. Consumer Reports scored 75/100, mainly suggesting positive customer feedback.

Amex Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 840/1000 Above Avg. Satisfaction |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 0.75 Low Complaint Level |

|

| Score: A Excellent Financial Strength |

Amex also earned a low complaint score of 0.75 from the NAIC, demonstrating that it resolves issues effectively. A.M. Best was awarded an “A” for its strong financial stability, further reinforcing its reputation for reliability.

Amex Auto Insurance: Pros and Cons Overview

Amex auto insurance offers a variety of coverage options and flexibility, making it appealing to both personal and business customers. Their services include protections that suit various needs, from standard auto coverage to additional business-related insurance policies.

- Extensive Coverage Options: Amex liability insurance, full coverage, collision, and comprehensive plans.

- Uninsured Motorist and PIP Protection: Includes coverage for uninsured drivers and personal injury protection.

- Add-On Services: Offers roadside assistance as an optional add-on for added convenience.

- Business Insurance Variety: Also provides a range of personal and business insurance options.

Amex’s well-rounded selection of insurance options and added services like roadside assistance plans make it suitable for drivers looking for flexible, robust coverage.

However, Amex faces some notable issues, including poor customer service ratings. Additionally, limited online resources and a lack of customer feedback create transparency challenges for potential buyers.

- BBB Rating Issues: Amex received an “F” rating from the BBB for failing to address a customer complaint.

- Limited Online Info: The company’s auto insurance information is sparse and hard to find online.

- Lack of Customer Feedback: There is minimal public feedback or reviews on their auto insurance services.

While Amex provides versatile coverage, its customer service and lack of online transparency concern potential policyholders.

Read More: Auto Insurance Discount for American Express Employees

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Evaluating Amex Auto Insurance Coverage

Amex Auto Insurance offers various coverage options, including full coverage, liability, and personal injury protection, making it an appealing choice for those seeking flexibility in their insurance needs.

Where do you start when you need auto 🚗insurance? Start with deciding how much 📊coverage you need. Not sure what that is? Check out this guide and shop with confidence👉: https://t.co/F4he3XKI34 pic.twitter.com/d630yHVca5

— AutoInsurance.org (@AutoInsurance) June 23, 2024

While it provides valuable add-ons like roadside assistance and business insurance, the company faces challenges in customer service, which is evident in its “F” rating from the BBB and lack of available customer feedback online.

Amex’s NAIC score of 0.75 shows a low complaint rate, pointing to effective issue resolution.Justin Wright Licensed Insurance Agent

Amex presents a substantial selection of services for drivers in Texas and beyond, but potential customers should weigh its pros and cons carefully before deciding. Compare the auto insurance rates and get Amex auto insurance quotes and quotes from other companies in your area today. Enter your ZIP code below now.

Frequently Asked Questions

What is Amex auto insurance?

Amex Auto Insurance is an insurance provider that offers vehicle coverage. Its policies are designed to protect drivers and their vehicles against potential risks. Access comprehensive insights into our guide, “Best Auto Insurance by Vehicle Type.”

How can I contact Amex auto insurance?

To contact Amex auto insurance, you can contact their customer service department by phone, email, or other methods provided on their official website or policy documents.

How can I file a claim with Amex auto insurance?

You can contact their claims department directly to file an Amex car insurance claim. They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It’s important to report accidents or incidents promptly to initiate the Amex claims process. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

How are Amex auto insurance premiums determined?

Amex auto insurance calculates premiums based on several factors, including the driver’s age, driving history, location, type of vehicle, coverage options selected, and other relevant factors. Premiums can vary from person to person based on these factors.

Does Amex auto insurance offer discounts?

Amex car coverage may offer discounts to eligible policyholders. These discounts can vary but commonly include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in the vehicle. Read our “Best Auto Insurance Discounts” guide to learn more.

What options are available with Amex insurance car policies?

Amex insurance car policies provide comprehensive options, including full coverage, liability, and personal injury protection for drivers.

Where can I find American Express travel insurance reviews?

American Express travel insurance reviews can be found on platforms such as Consumer Reports or their official website.

Does American Express insurance car coverage exist?

American Express insurance car policies don’t exist, but Amex Assurance provides other insurance options like rental vehicle coverage.

How do I purchase auto insurance on American Express?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Can I use Geico American Express to pay my insurance premiums?

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Amex Auto Insurance is an insurance provider that offers vehicle coverage. Its policies are designed to protect drivers and their vehicles against potential risks. Access comprehensive insights into our guide, “Best Auto Insurance by Vehicle Type.”

To contact Amex auto insurance, you can contact their customer service department by phone, email, or other methods provided on their official website or policy documents.

How can I file a claim with Amex auto insurance?

You can contact their claims department directly to file an Amex car insurance claim. They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It’s important to report accidents or incidents promptly to initiate the Amex claims process. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

How are Amex auto insurance premiums determined?

Amex auto insurance calculates premiums based on several factors, including the driver’s age, driving history, location, type of vehicle, coverage options selected, and other relevant factors. Premiums can vary from person to person based on these factors.

Does Amex auto insurance offer discounts?

Amex car coverage may offer discounts to eligible policyholders. These discounts can vary but commonly include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in the vehicle. Read our “Best Auto Insurance Discounts” guide to learn more.

What options are available with Amex insurance car policies?

Amex insurance car policies provide comprehensive options, including full coverage, liability, and personal injury protection for drivers.

Where can I find American Express travel insurance reviews?

American Express travel insurance reviews can be found on platforms such as Consumer Reports or their official website.

Does American Express insurance car coverage exist?

American Express insurance car policies don’t exist, but Amex Assurance provides other insurance options like rental vehicle coverage.

How do I purchase auto insurance on American Express?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Can I use Geico American Express to pay my insurance premiums?

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

You can contact their claims department directly to file an Amex car insurance claim. They will guide you through the claims process, provide the necessary forms, and assist you in gathering any required information. It’s important to report accidents or incidents promptly to initiate the Amex claims process. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Amex auto insurance calculates premiums based on several factors, including the driver’s age, driving history, location, type of vehicle, coverage options selected, and other relevant factors. Premiums can vary from person to person based on these factors.

Does Amex auto insurance offer discounts?

Amex car coverage may offer discounts to eligible policyholders. These discounts can vary but commonly include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in the vehicle. Read our “Best Auto Insurance Discounts” guide to learn more.

What options are available with Amex insurance car policies?

Amex insurance car policies provide comprehensive options, including full coverage, liability, and personal injury protection for drivers.

Where can I find American Express travel insurance reviews?

American Express travel insurance reviews can be found on platforms such as Consumer Reports or their official website.

Does American Express insurance car coverage exist?

American Express insurance car policies don’t exist, but Amex Assurance provides other insurance options like rental vehicle coverage.

How do I purchase auto insurance on American Express?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Can I use Geico American Express to pay my insurance premiums?

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Amex car coverage may offer discounts to eligible policyholders. These discounts can vary but commonly include safe driver discounts, multi-policy discounts, good student discounts, and discounts for certain safety features installed in the vehicle. Read our “Best Auto Insurance Discounts” guide to learn more.

Amex insurance car policies provide comprehensive options, including full coverage, liability, and personal injury protection for drivers.

Where can I find American Express travel insurance reviews?

American Express travel insurance reviews can be found on platforms such as Consumer Reports or their official website.

Does American Express insurance car coverage exist?

American Express insurance car policies don’t exist, but Amex Assurance provides other insurance options like rental vehicle coverage.

How do I purchase auto insurance on American Express?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Can I use Geico American Express to pay my insurance premiums?

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

American Express travel insurance reviews can be found on platforms such as Consumer Reports or their official website.

American Express insurance car policies don’t exist, but Amex Assurance provides other insurance options like rental vehicle coverage.

How do I purchase auto insurance on American Express?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Can I use Geico American Express to pay my insurance premiums?

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Auto insurance through American Express is unavailable, but cardholders can access rental car insurance through specific American Express credit cards. Gain further insights by exploring our detailed resource on “Does my auto insurance cover rental cars?”

Yes, you can use your Geico American Express card to pay auto insurance premiums with Geico.

Does American Express auto insurance coverage exist?

What benefits does American Express car rental insurance offer?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

How does American Express vehicle insurance work?

Can I get American Express motor insurance?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Does Amex car buying service exist?

What services does the Amex insurance company offer?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Can I purchase insurance Amex coverage for my vehicle?

Does American Express provide auto loans?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

How can I contact the Amex Assurance Company phone number?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

What does American Express’s life insurance cover?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.