Best Mercedes-Benz Sprinter Auto Insurance in 2026 (Check Out These 10 Companies)

Explore Geico, USAA, and Erie as the top picks for the best Mercedes-Benz Sprinter auto insurance, with excellent rates beginning at $90 monthly. These industry leaders are renowned for their competitive rates, comprehensive policies, and superior customer service, making them the best choices for Sprinter owners.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated April 2025

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsThe best Mercedes-Benz Sprinter auto insurance picks are Geico, USAA, and Erie, known for their exceptional coverage and customer service.

These companies stand out in the competitive auto insurance market by offering robust policies tailored to the unique needs of Mercedes-Benz Sprinter owners. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

Our Top 10 Company Picks: Best Mercedes-Benz Sprinter Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Affordable Rates Geico

#2 10% A++ Military Benefits USAA

#3 10% A+ Customer Service Erie

#4 25% A+ Wide Coverage Allstate

#5 12% A+ Flexible Options Progressive

#6 20% A++ Comprehensive Coverage State Farm

#7 20% A Personalized Service American Family

#8 20% A+ Multi-Policy Discounts Nationwide

#9 25% A Customizable Coverage Liberty Mutual

#10 8% A++ Extensive Network Travelers

With a focus on affordability, comprehensive coverage, and responsive customer support, they ensure that drivers receive value and peace of mind. Choosing the right insurer is crucial, as it affects not only the cost but also the extent and effectiveness of coverage in case of an incident. Enter your ZIP code for free Mercedes-Benz Sprinter car insurance quotes from top companies.

- Geico is the top pick for the best Mercedes-Benz Sprinter auto insurance

- Tailored coverage options cater to the specific needs of Sprinter owners

- Focus on comprehensive protection for Mercedes-Benz Sprinter vehicles

#1 – Geico: Top Overall Pick

Pros

- Competitive Premiums: Geico offers some of the most affordable Mercedes-Benz Sprinter auto insurance rates, thanks to their 25% multi-vehicle discount.

- Superior Financial Strength: With an A++ rating from A.M. Best, Geico promises robust financial reliability for claims on Mercedes-Benz Sprinters.

- Extensive Discounts: Geico provides a range of discounts that benefit Mercedes-Benz Sprinter owners, enhancing overall affordability. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

Cons

- Coverage Limitations: Some Mercedes-Benz Sprinter owners may find Geico’s coverage options less extensive compared to other insurers.

- Customer Service Variability: Geico’s customer service quality can vary, potentially affecting the insurance experience for Mercedes-Benz Sprinter owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Tailored to Service Members: USAA offers specialized auto insurance benefits for military personnel who own Mercedes-Benz Sprinters. Unlock details in our guide titled, USAA auto insurance review.

- High Financial Rating: USAA’s A++ rating from A.M. Best ensures excellent financial stability for handling claims on Mercedes-Benz Sprinters.

- Low Multi-Vehicle Discount Impact: Despite a lower 10% multi-vehicle discount, USAA’s overall rates remain competitive for Mercedes-Benz Sprinter owners.

Cons

- Membership Restrictions: USAA’s services are only available to military members and their families, limiting access to the Mercedes-Benz Sprinter owners.

- Less Flexibility: Compared to others, USAA might offer fewer options for customizing Mercedes-Benz Sprinter insurance policies.

#3 – Erie: Best for Customer Service

Pros

- Customer Support Excellence: Erie is renowned for exceptional customer service, providing personalized attention to Mercedes-Benz Sprinter owners.

- Consistent Coverage Options: Erie offers comprehensive insurance coverage that meets the unique needs of Mercedes-Benz Sprinter drivers.

- A+ Financial Stability: Erie’s A+ rating from A.M. Best assures strong backing for insurance claims of Mercedes-Benz Sprinter customers. Delve into our evaluation of “Erie Auto Insurance Review.”

Cons

- Higher Premiums for Some Policies: Erie’s premiums may be higher for certain Mercedes-Benz Sprinter insurance policies, depending on the coverage.

- Limited Geographical Availability: Erie’s services are not available nationwide, which could restrict options for some Mercedes-Benz Sprinter owners.

#4 – Allstate: Best for Wide Coverage

Pros

- Diverse Policy Options: Allstate offers a variety of coverage options that cater to the specific needs of Mercedes-Benz Sprinter owners. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Strong Multi-Vehicle Discount: With a 25% discount for multi-vehicle policies, Allstate enhances affordability for owners of multiple Mercedes-Benz Sprinters.

- Excellent Financial Rating: Allstate’s A+ rating from A.M. Best ensures reliability and capacity to handle claims effectively for Mercedes-Benz Sprinter insurance.

Cons

- Higher Rate Tendency: Despite strong discounts, Allstate’s rates can still be on the higher side for some Mercedes-Benz Sprinter coverage levels.

- Complex Policy Management: Some customers may find managing their Mercedes-Benz Sprinter insurance policies with Allstate more complex due to the extensive options available.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Flexible Options

Pros

- Customization at Its Best: Progressive offers highly flexible policy options, allowing Mercedes-Benz Sprinter owners to tailor their coverage extensively. Delve into our evaluation of Progressive auto insurance review.

- Discounts for Responsiveness: Progressive’s 12% discount for multi-vehicle setups benefits Mercedes-Benz Sprinter owners, especially those prioritizing flexible terms.

- Strong Online Tools: Progressive is known for its superior online management tools, making insurance handling smoother for Mercedes-Benz Sprinter owners.

Cons

- Variable Customer Feedback: Customer satisfaction can vary, with some Mercedes-Benz Sprinter owners experiencing less favorable interactions.

- Premium Fluctuations: Progressive’s premiums might fluctuate more than some competitors, affecting budget planning for Mercedes-Benz Sprinter insurance.

#6 – State Farm: Best for Comprehensive Coverage

Pros

- Broad Coverage Spectrum: State Farm excels in offering extensive coverage options that benefit Mercedes-Benz Sprinter owners significantly. Discover insights in our guide titled, State Farm auto insurance review.

- Good Multi-Vehicle Discounts: With a 20% discount on multi-vehicle policies, State Farm offers considerable savings for Mercedes-Benz Sprinter owners.

- Strong Support Network: State Farm’s nationwide network of agents provides accessible support and assistance for Mercedes-Benz Sprinter insurance.

Cons

- Higher Premiums Possible: Even with discounts, State Farm’s premiums can be relatively higher for some coverage levels of Mercedes-Benz Sprinter insurance.

- Limited Discount Scope: The benefits of multi-policy discounts with State Farm are not as pronounced as with some competitors, affecting overall savings for Mercedes-Benz Sprinter owners.

#7 – American Family: Best for Personalized Service

Pros

- Custom-Tailored Policies: American Family offers personalized service, ensuring that each Mercedes-Benz Sprinter insurance policy is suited to the owner’s specific needs.

- Strong Multi-Vehicle Discount: A 20% discount on multi-vehicle policies helps reduce costs for Mercedes-Benz Sprinter owners managing several vehicles. See more details in our guide titled, “American Family Auto Insurance Review.”

- Consistently Positive Customer Experiences: American Family is known for its customer-oriented approach, often resulting in high satisfaction rates for Mercedes-Benz Sprinter insurance.

Cons

- Limited Availability: American Family’s coverage options and availability can vary by region, which might restrict access for some Mercedes-Benz Sprinter owners.

- Pricing Variability: While offering personalized services, American Family’s rates can sometimes be inconsistent, affecting budget planning for Mercedes-Benz Sprinter clients.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Multi-Policy Discounts

Pros

- Exceptional Multi-Policy Benefits: Nationwide offers significant savings through its multi-policy discounts, greatly benefiting Mercedes-Benz Sprinter owners with multiple insurance needs.

- Comprehensive Coverage Options: Nationwide provides a wide range of coverage choices, ensuring that all aspects of Mercedes-Benz Sprinter insurance are addressed. Read up on the Nationwide auto insurance review for more information.

- High Customer Satisfaction: Known for its customer service, Nationwide maintains strong relations with its clients, enhancing the insurance experience for Mercedes-Benz Sprinter owners.

Cons

- Costly Premiums Without Discounts: Without qualifying for discounts, Nationwide’s premiums can be higher compared to other insurers for Mercedes-Benz Sprinter insurance.

- Complexity in Policy Customization: Some Mercedes-Benz Sprinter owners may find the policy customization process with Nationwide to be intricate and time-consuming.

#9 – Liberty Mutual: Best for Customizable Coverage

Pros

- Highly Customizable Plans: Liberty Mutual offers extensive customization options for Mercedes-Benz Sprinter insurance, catering to diverse needs and preferences.

- Strong Financial Backing: With an A rating from A.M. Best, Liberty Mutual is well-equipped to handle claims reliably for Mercedes-Benz Sprinters. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Generous Multi-Vehicle Discount: A 25% discount on multi-vehicle policies aids in reducing insurance costs for owners of multiple Mercedes-Benz Sprinters.

Cons

- Higher-End Pricing: Despite discounts, Liberty Mutual’s pricing can still be on the higher end for some Mercedes-Benz Sprinter insurance policies.

- Varied Customer Service Quality: Customer service quality at Liberty Mutual can vary, potentially impacting the satisfaction of Mercedes-Benz Sprinter insurance holders.

#10 – Travelers: Best for Extensive Network

Pros

- Widespread Service Network: Travelers boast an extensive network that provides dependable service across many regions for Mercedes-Benz Sprinter insurance.

- Robust Policy Offerings: The company offers a broad range of policies that effectively cater to the complex needs of Mercedes-Benz Sprinter owners. See more details in our guide titled, “Travelers Auto Insurance Review.”

- Top-Tier Financial Stability: With an A++ rating from A.M. Best, Travelers demonstrates exceptional financial strength, ensuring reliability in the claim handling of Mercedes-Benz Sprinter owners.

Cons

- Lower Multi-Vehicle Discount: With an 8% discount, Travelers offers a less competitive multi-vehicle discount rate for Mercedes-Benz Sprinter owners compared to other insurers.

- Premium Costs: Travelers’ premiums, while justifiable by their services, can be relatively high, impacting cost-effectiveness for some Mercedes-Benz Sprinter owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Sprinter Insurance Rate Breakdown

For those considering auto insurance for a Mercedes-Benz Sprinter, understanding how monthly rates vary by coverage level and provider is crucial. This detailed comparison will help you navigate your choices more effectively.

Mercedes-Benz Sprinter Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$105 $240

$101 $235

$100 $230

$95 $220

$110 $250

$96 $220

$98 $225

$93 $215

$102 $240

$90 $210

The table below presents the monthly rates for both minimum and full coverage across various insurance providers. State Farm and USAA offer the most competitive rates, with State Farm’s minimum coverage starting at $93 and USAA’s full coverage at $210.

On the higher end, Liberty Mutual charges $110 for minimum and $250 for full coverage, representing the most expensive option. Geico and Nationwide also stand out for their affordability, with minimum coverage rates at $95 and $96 respectively, and both offering full coverage at $220.

This range of prices showcases the significant differences in potential costs, enabling Mercedes-Benz Sprinter owners to choose insurance that fits their budget and coverage needs optimally. For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

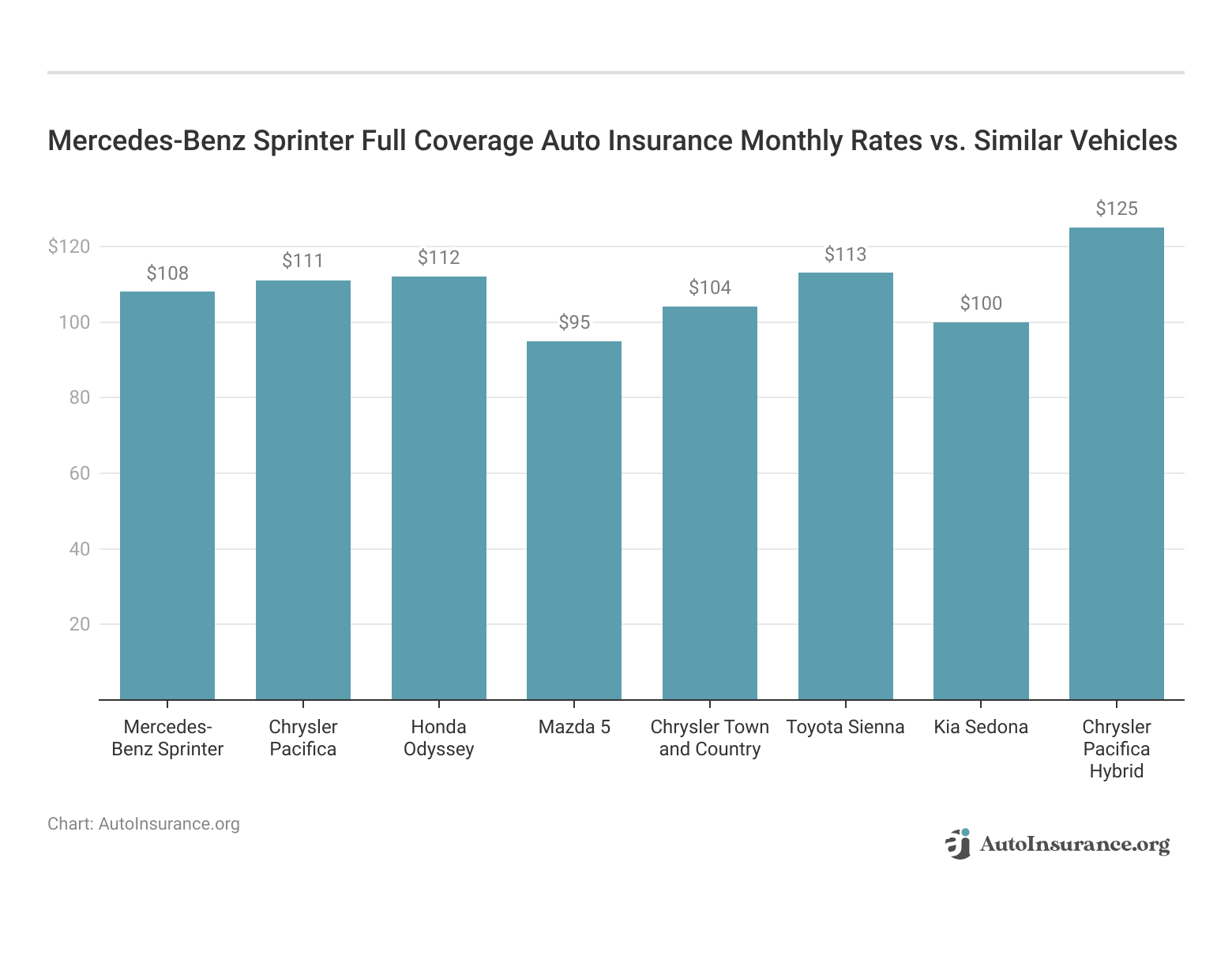

Are Vehicles Like the Mercedes-Benz Sprinter Expensive to Insure

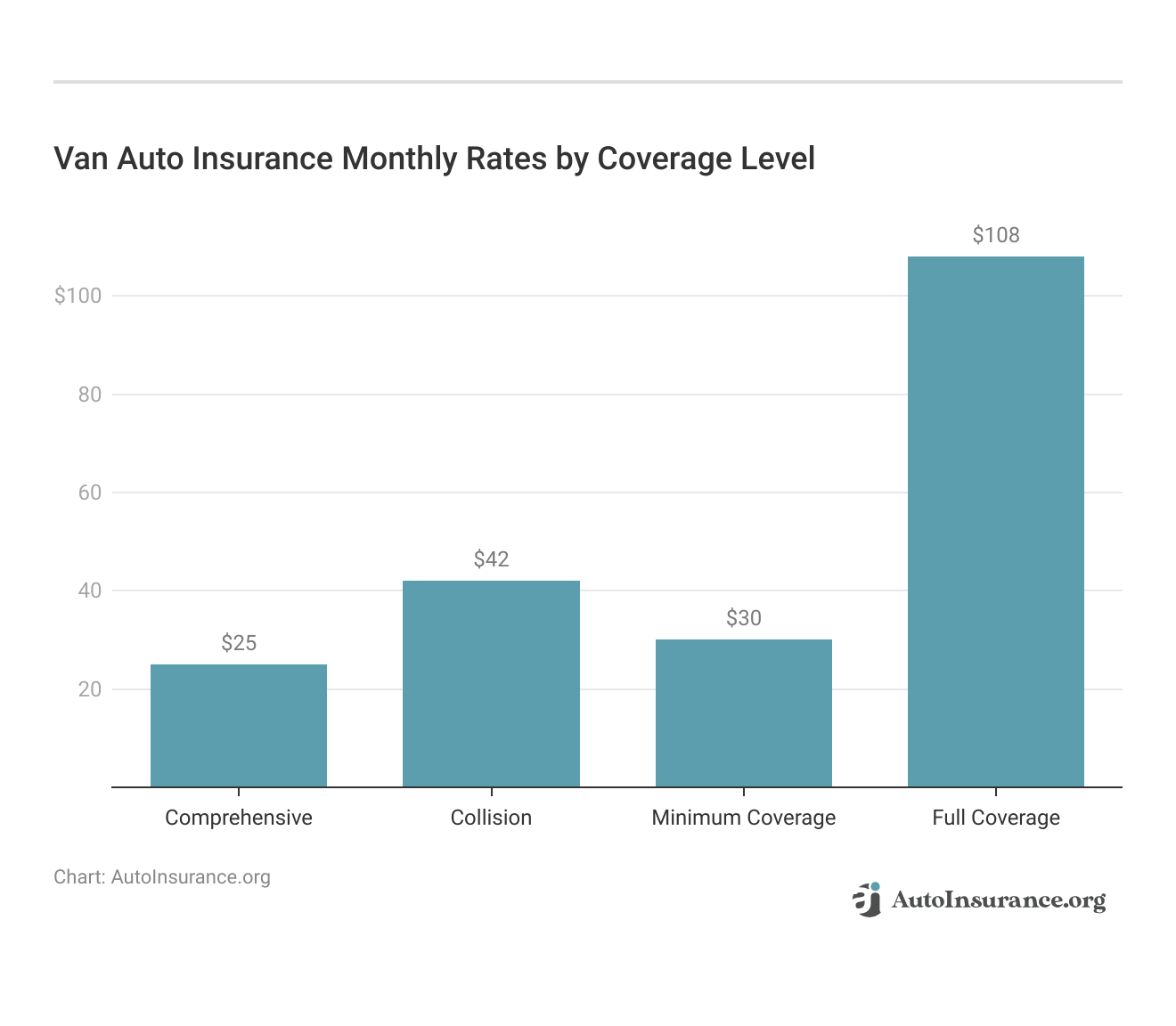

Understanding the insurance costs for large vehicles like the Mercedes-Benz Sprinter and its competitors is essential for making an informed decision. Here, we compare the Sprinter’s insurance rates with those of other similar vans to provide a clear financial perspective.

The provided data illustrates that insurance costs can vary significantly among similar types of vans, with the Mercedes-Benz Sprinter’s insurance rates aligning closely with industry averages for comprehensive, collision, and full coverage.

This information is crucial for potential owners to budget effectively and select an insurance plan that best suits their needs.

This comparison of insurance rates reveals that costs can vary significantly among vehicles similar to the Mercedes-Benz Sprinter, highlighting the importance of considering insurance expenses when evaluating different vehicle options. Access comprehensive insights into our guide titled, “What is the average auto insurance cost per month?“

Insurance Rates for Vehicles Similar to the Mercedes-Benz Sprinter

Understanding how insurance costs for the Mercedes-Benz Sprinter compare to similar vehicles can help owners make more informed decisions. Here’s a breakdown of insurance rates for vehicles like the Kia Sedona, Toyota Sienna, and others, encompassing comprehensive, collision, and liability coverage.

Mercedes-Benz Sprinter Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Mercedes-Benz Sprinter | $25 | $42 | $30 | $108 |

| Kia Sedona | $24 | $37 | $28 | $100 |

| Toyota Sienna | $25 | $44 | $31 | $113 |

| Chrysler Pacifica | $29 | $44 | $26 | $111 |

| Mazda 5 | $19 | $34 | $31 | $95 |

| Chrysler Town and Country | $25 | $39 | $30 | $104 |

| Chrysler Pacifica Hybrid | $31 | $55 | $28 | $125 |

| Honda Odyssey | $23 | $44 | $31 | $112 |

| Dodge Grand Caravan | $26 | $37 | $31 | $106 |

This comparison highlights the variety in insurance costs among vehicles comparable to the Mercedes-Benz Sprinter. Whether considering a Honda Odyssey or a Chrysler Pacifica Hybrid, potential insurance expenses play a critical role in the total cost of ownership, assisting buyers in choosing a vehicle that aligns with their budget and coverage needs.

What Impacts the Cost of Mercedes-Benz Sprinter Insurance

As with any car, your Mercedes-Benz Sprinter car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits. The Mercedes-Benz Sprinter trim level you buy will also impact the total price you will pay for Mercedes-Benz Sprinter insurance coverage.

Read more: Top 7 Factors That Affect Auto Insurance Rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Mercedes-Benz Sprinter Insurance

Securing affordable insurance for your Mercedes-Benz Sprinter doesn’t mean you have to compromise on quality. By adopting strategic approaches and leveraging specific discounts, you can significantly lower your insurance costs without sacrificing coverage.

- Don’t always pick the cheapest Mercedes-Benz Sprinter insurance policy.

- Make sure you use an accredited driver safety program.

- Ask about discounts for people with disabilities.

- Ask for a Mercedes-Benz Sprinter discount if you have a college degree.

- Take a refresher course as an older driver.

Implementing these strategies can lead to significant savings on your Mercedes-Benz Sprinter insurance. By focusing on accredited programs, taking advantage of specific discounts, and enhancing your driving skills, you can enjoy both reduced rates and improved safety. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

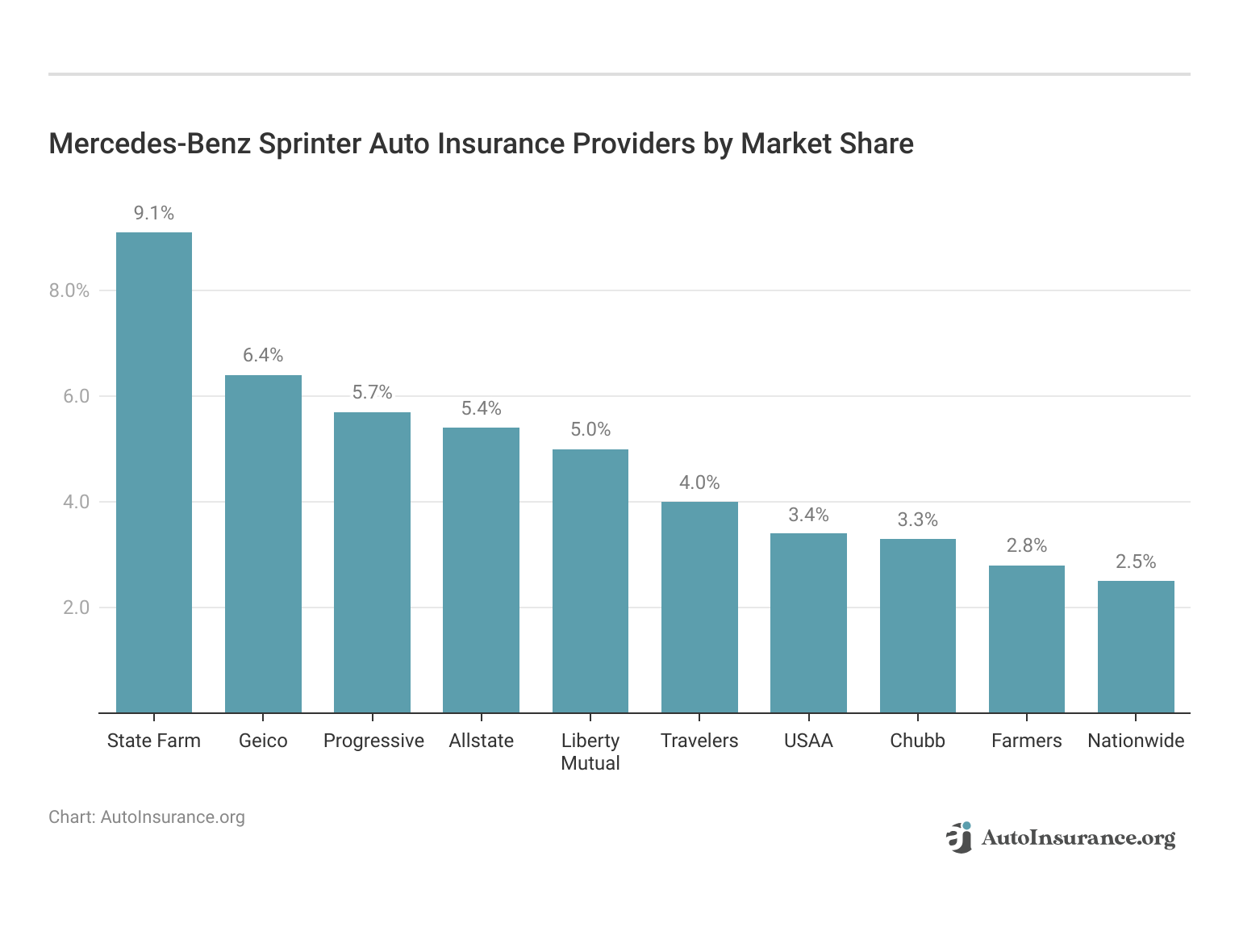

Top Mercedes-Benz Sprinter Insurance Companies

When it comes to insuring a Mercedes-Benz Sprinter, choosing the right insurance provider is crucial. Below is a list of leading auto insurers, ranked by market share, known for offering competitive rates and discounts for Sprinter owners. See more details in our guide titled, “Types of Auto Insurance.”

The data on the largest auto insurers by market share illustrates the diverse options available for Mercedes-Benz Sprinter insurance.

This information aids drivers in selecting a company that not only offers favorable rates but also aligns with their specific coverage needs and preferences.

Largest Auto Insurers by Market Share

Market share is a critical indicator of an insurer’s prominence and influence in the industry. This list details the largest auto insurers by market share, showcasing the leading companies and their respective volumes.

Top Mercedes-Benz Sprinter Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $66,153,063 | 9.10% | |

| #2 | $46,358,896 | 6.40% | |

| #3 | $41,737,283 | 5.70% | |

| #4 | $39,210,020 | 5.40% | |

| #5 |  | $36,172,570 | 5% |

| #6 | $28,786,741 | 4% | |

| #7 | $24,621,246 | 3.40% | |

| #8 | $24,199,582 | 3.30% | |

| #9 | $20,083,339 | 2.80% | |

| #10 |  | $18,499,967 | 2.50% |

This snapshot of the largest auto insurers by market share illustrates the competitive landscape of the industry. Companies like State Farm, Geico, and Progressive lead, indicating their significant role in shaping auto insurance policies and practices nationwide.

Geico excels in blending extensive coverage with remarkable customer service for Mercedes-Benz Sprinter insurance.Justin Wright Licensed Insurance Agent

You can compare quotes for Mercedes-Benz Sprinter auto insurance rates from some of the best auto insurance companies by using our free online tool below now.

Frequently Asked Questions

How can I find the best insurance coverage for my Mercedes-Benz Sprinter?

Compare quotes from multiple providers online or consult with an insurance agent specializing in auto insurance.

Is it necessary to notify my insurance company if I modify my Mercedes-Benz Sprinter?

Yes, it’s important to inform your insurance company about modifications to ensure proper coverage.

Can I insure multiple Mercedes-Benz Sprinters under the same insurance policy?

Indeed, several insurance companies provide fleet or multi-vehicle insurance options specifically designed for covering multiple Sprinters under one policy, known as sprinters insurance. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Are there specialized insurance providers for Mercedes-Benz Sprinter conversions?

Indeed, some insurance providers specialize in offering coverage for Mercedes-Benz Sprinter conversions, such as those adapted into camper vans. These providers are experienced in handling both insurance on a Mercedes and Mercedes insurance requirements.

How can I lower my Mercedes-Benz Sprinter insurance rates?

Maintain a clean driving record, bundle policies, increase deductibles, and qualify for eligible discounts. To find out more, explore our guide titled, “Auto Insurance Discounts.”

What is the typical monthly cost of insurance for a Mercedes Sprinter van?

Monthly insurance rates for a Mercedes Sprinter van vary by location and coverage but typically start around $100.

How does Mercedes Sprinter van insurance differ from standard auto insurance?

Mercedes Sprinter van insurance often includes additional coverage for commercial use and higher liability limits compared to standard auto insurance.

What factors influence Sprinter van commercial insurance cost?

Factors include the van’s use, the driver’s history, coverage levels, and whether additional equipment is insured.

What is the average 15 passenger van insurance cost?

The cost can vary widely but generally starts at about $120 monthly, depending on the extent of coverage and usage. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

How much does cargo van insurance cost typically?

Monthly premiums for cargo van insurance usually begin around $75, influenced by the van’s value, usage, and the owner’s driving record.

What determines the cost of Chrysler Town and Country car insurance?

What should I consider when looking for commercial insurance for a Sprinter van?

What are common coverage options for insurance for a Sprinter van?

How is the Mercedes Sprinter insurance cost calculated?

What should I know about Mercedes van insurance?

What specific considerations are there for Mercedes-Benz Sprinter cargo car insurance?

What is unique about passenger van insurance in Georgia?

What services does a Sprinter insurance agency typically provide?

What factors affect Sprinter van insurance cost?

What are the legal Sprinter van insurance requirements?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.