Best Auto Insurance Discounts for EBT Recipients in 2026 (Save up to 8% With These Companies)

State Farm, Travelers, and USAA offer top auto insurance discounts for EBT recipients, including discounts for safe driving, low mileage, bundling, and auto-pay, EBT users can save up to 8%. State Farm offers low rates, Travelers has flexible payments, and USAA fits military families for affordable coverage.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated June 2025

The top picks for the best auto insurance discounts for EBT recipients are State Farm, with Travelers and USAA standing out with some of the cheapest and most flexible coverage options.

Our Top 10 Company Picks: Best Auto Insurance Discounts for EBT Recipients

| Company | Rank | A.M. Best | Savings Potential | Discount Requirement |

|---|---|---|---|---|

| #1 | A++ | 8% | May require proof of government aid | |

| #2 | A++ | 7% | Nonprofit or assistance programs | |

| #3 | A++ | 7% | Available to military families with aid | |

| #4 | A | 7% | Group membership or aid verification needed |

| #5 | A++ | 6% | Must be enrolled in a qualifying program | |

| #6 | A+ | 6% | Snapshot/bundle or proof of assistance | |

| #7 | A | 6% | Government assistance documentation | |

| #8 | A | 6% | Assistance proof or policy bundling |

| #9 | A+ | 5% | May offer savings with aid verification | |

| #10 | A | 5% | Aid documentation |

If you’re an EBT (Electronic Benefit Transfer) recipient, you can save with top insurers. State Farm offers low premiums, Travelers has flexible payments, and USAA provides military discounts.

- State Farm is the top pick for affordable and reliable coverage with EBT savings

- Average EBT auto insurance discounts save drivers about 8% on premiums

- Learn how safe driving, low mileage, and full payment options can lower rates

These providers offer affordable coverage, great service, and real value for budget-conscious drivers. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Companies With Auto Insurance Discounts for EBT Recipients

Choosing a cheap auto insurance policy can be difficult, primarily for drivers and families who are living on tight budgets. Luckily, a few of the top insurance companies can provide you with a special savings opportunity if you are an EBT recipient, whether directly or via government assistance programs for low-income drivers.

Auto Insurance Discounts for EBT Recipients by Provider

| Company | Bundling | Defensive Driving | Safe Driver | Low Mileage | Auto-Pay |

|---|---|---|---|---|---|

| 25% | 10% | 18% | 30% | 5% | |

| 25% | 10% | 18% | 20% | 5% | |

| 20% | 10% | 20% | 10% | 4% | |

| 25% | 15% | 15% | 30% | 3% | |

| 25% | 10% | 20% | 30% | 5% |

| 20% | 10% | 10% | 20% | 5% |

| 10% | 31% | 10% | 30% | 5% | |

| 17% | 15% | 8% | 30% | 4% | |

| 13% | 20% | 17% | 20% | 4% | |

| 10% | 5% | 10% | 20% | 5% |

This table shows how much EBT recipients can save with major auto insurance providers by using available discount programs. It includes savings for combining policies, completing defensive driving courses, maintaining a clean record, driving fewer miles, and setting up automatic payments to help lower monthly insurance costs.

If you receive EBT or other aid like SNAP, TANF, or Medicaid, you may qualify for car insurance discounts. Even without listed offers, showing proof of benefits can unlock savings.

Using discounts is key to lowering auto insurance costs. For example, enrolling in autopay can reduce your premium and ensure on-time payments.Michelle Robbins Licensed Insurance Agent

EBT recipients may also benefit from free government assistance for car insurance, which can help reduce costs further, especially for those with clean driving records or minor infractions.

Read More: Cheap Auto Insurance For Low-Income Families

Defensive Driving Discount

Take a defensive driver auto insurance discount by completing an approved course. Most insurers cut safe driver premiums, while some states provide courses for free or at a reduced cost for low-income individuals, including EBT recipients. If they can reduce their costs, they can save money and become a better, safer driver.

Multi-Policy Discount

Whether bundling all your auto insurance together with renters or homeowners insurance, or saving with the best multi-vehicle auto insurance discounts, you can reduce the total cost of coverage and make it easier to manage.

It’s a widely available option, often offered to low-income drivers and EBT recipients. It also provides extra convenience by having policies under one roof, which makes it much easier to manage coverage and payments.

Safe Driver Discount

A safe driver discount reduces your insurance cost if you have a clean record with no accidents or traffic violations. Most insurance companies also offer usage-based auto insurance, including State Farm Drive Safe & Save, which can help lower your premium even more (Learn More: State Farm Drive Safe & Save Review).

Drive Safe & Save® is triggered with movement of the beacon recording a trip. The app is designed to run in the background, so you don’t have to open the app for trips to record. Specific phone settings are required for the app and location to allow for this functionality. -CB https://t.co/YfhiqoZYaW

— State Farm (@StateFarm) August 25, 2024

Making safe driving a habit is the easiest way for EBT beneficiaries to find cheap auto insurance after an accident.

Auto-Pay Discounts

Some auto insurance companies offer discounts if you pay your auto insurance premium in full or establish automatic payments online through the provider’s website or mobile app.

Paying in full can reduce overall costs by avoiding installment fees, while automatic payments ensure on-time billing and may qualify for extra savings. The best auto-pay insurance discounts make budgeting easier for EBT recipients by offering lower premiums and hassle-free payment management.

Low Mileage Discount

EBT recipients who drive occasionally for errands, appointments, or short commutes may qualify for the best low-mileage auto insurance discounts. Insurance companies typically offer lower rates to those who drive fewer miles in a year because they are less likely to get into accidents.

You may need to confirm your mileage through odometer readings or a monitoring program. This is a simple way for EBT recipients with limited driving needs to reduce their auto insurance costs.

Learn More: Pay-Per-Mile Insurance

Saving on auto insurance is possible, even with a limited income. EBT recipients can reduce premiums by taking advantage of discounts like safe driver, low mileage, and pay-in-full options. Compare rates and ask about eligible discounts to find the best fit for your budget and coverage needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

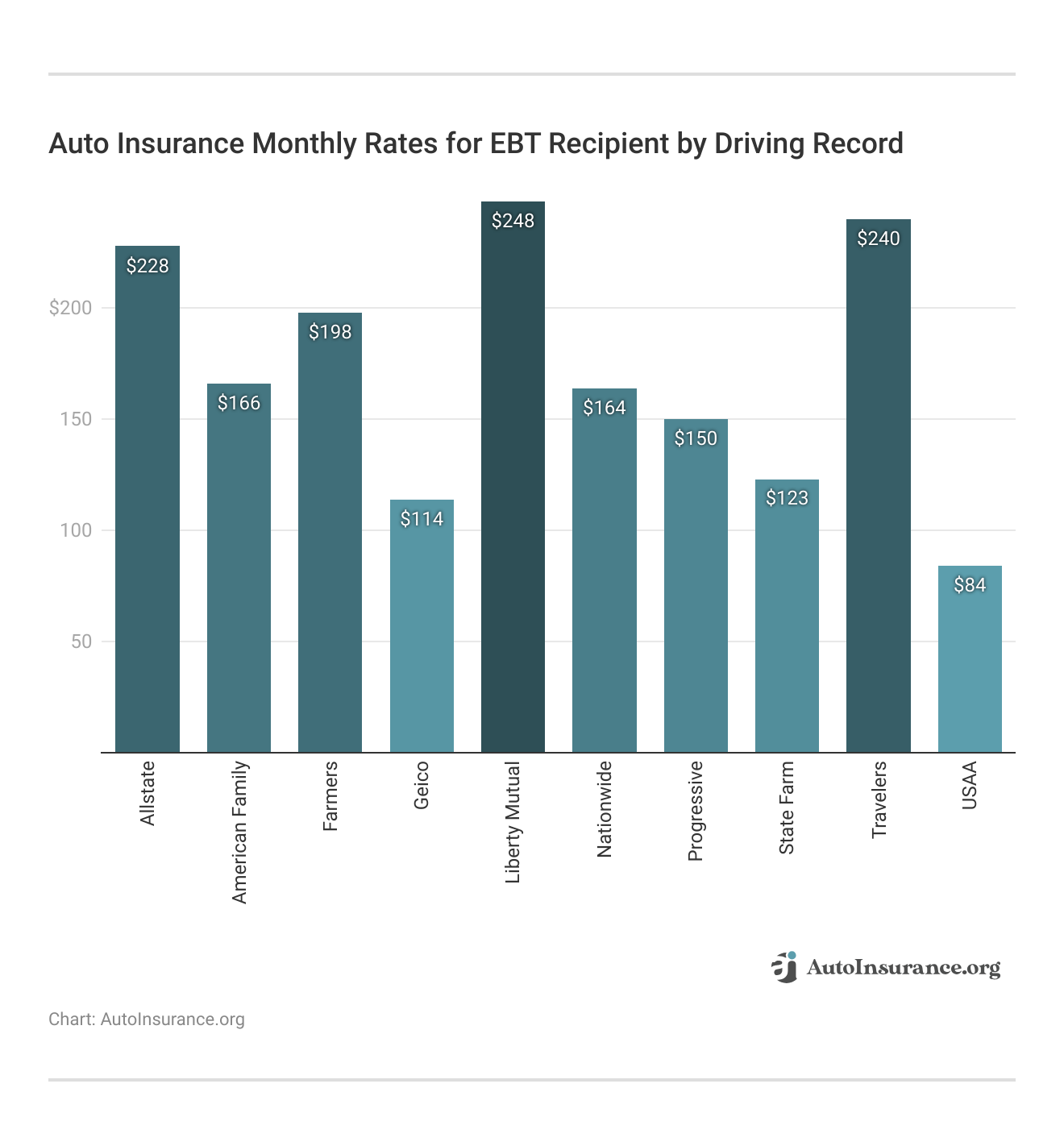

How Much Auto Insurance Costs for EBT Recipients

EBT recipients see a wide variation of rates based on their driving record, from a low premium for clean drivers to a high premium for DUIs.

This table compares full coverage rates before and after applying the EBT car insurance discount offered by major providers. Geico and State Farm also have relatively low monthly premiums, and USAA comes in as the cheapest, at $76.

EBT Recipient Auto Insurance Full Coverage Monthly Rates Before & After Discount

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $178 | $160 | |

| $115 | $103 | |

| $173 | $155 | |

| $104 | $93 | |

| $255 | $230 |

| $123 | $110 |

| $128 | $115 | |

| $107 | $96 | |

| $113 | $101 | |

| $85 | $76 |

Whether you are looking for flexible payment options, strong customer service, or simply a lower auto insurance premium, this comparison highlights how much you can save by choosing the right provider.

Watch this video for more ways to save money on auto insurance. Comparing multiple companies with these savings can benefit individuals and families managing tight budgets while still needing reliable coverage.

Where to Find The Best Auto Insurance Discounts for EBT Recipients

The best auto insurance discounts for EBT recipients can help eligible drivers save an average of 8% on monthly payments, making coverage more affordable for those on a fixed income. Companies such as State Farm, Travelers, and USAA provide car insurance for low-income individuals at affordable rates (Read More: State Farm vs. Travelers Auto Insurance).

These companies offer affordable base rates along with perks like flexible payments, bundling, and safe driver rewards. These options help EBT recipients access cheaper car insurance with a low income while maintaining quality coverage.

Enter your ZIP code and use the free quote tool to compare full coverage rates in your area and maximize your savings.

Frequently Asked Questions

Do all insurers offer defensive driving discounts, and how do I get it?

Most insurers offer this, but eligibility and savings vary by state and company. Take a state approved defensive driving course, then send the certificate to your insurer for a 5 to 10% discount. Some states offer the course free or at a discount for low income drivers or EBT users.

Is a low-mileage discount really worth it?

Yes, if you drive under 7,500 to 10,000 miles a year, you may save up to 15%. Insurers consider low mileage drivers less risky. You might need to verify your mileage with odometer readings or a tracking app.

Start saving on your auto insurance right now by entering your ZIP code and comparing quotes.

Are there any coverage limitations on government auto insurance for low-income drivers near me?

Yes, these programs often provide basic liability coverage only, which meets legal requirements but may not include collision or comprehensive auto insurance. Additional coverage may require out-of-pocket payment or private insurance.

What is the easiest discount to qualify for?

The Auto-Pay Discount is one of the easiest to get. Set up automatic payments through your insurer’s website or app. Some also give a 3–5% discount for paying your full premium upfront.

How much can I save with a safe driver discount?

Safe driver discounts offer big savings, usually between 10 and 30%. You need a clean record with no recent accidents or tickets. Some insurers use apps or devices to track your driving and reward safe habits.

Is the EBT car insurance discount in California available for full coverage?

While most discounts apply to liability auto insurance coverage, some insurers may extend savings to full coverage if you qualify through low-income assistance or bundling options.

Read More: Best California Auto Insurance

Can renters qualify for multi-policy discounts too?

Yes. The Multi Policy Discount applies when you bundle car insurance with renters or homeowners insurance. It can save you 5 to 25% and makes payments and claims easier to manage.

How can I get car insurance with no money down if I have a low income or receive government assistance?

Some insurers offer no-down-payment options or low upfront costs for low-income drivers or those receiving benefits like EBT. You may need to show proof of assistance and compare quotes from multiple providers to find one that offers flexible payment plans.

What does government car insurance for low-income in NJ typically cover?

While the New Jersey Personal Automobile Insurance Plan (NJ PAIP) helps high-risk drivers find coverage, programs like SAIP mainly cover emergency medical treatment after an accident. They do not include liability, collision, or comprehensive coverage, so they’re best suited for basic legal compliance.

Do EBT cardholders get discounts on car insurance automatically when applying?

No, EBT cardholders usually need to ask their insurance provider about available discounts and may need to provide documentation to qualify.

Is EBT auto insurance near me available for drivers with bad credit or past tickets?

How can I pay less for my auto insurance by adjusting my coverage?

What documents do I need to apply for an EBT car insurance discount in Texas?

Can I combine free government auto insurance for low-income with other discounts?

Is there car insurance for low-income drivers with poor credit?

Is Progressive low-income car insurance available in all states?

Are there specific insurers offering government auto insurance for low-income in Michigan?

Are government programs involved in providing the cheapest low-income car insurance?

Is cheap car insurance for EBT holders available in every state?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.